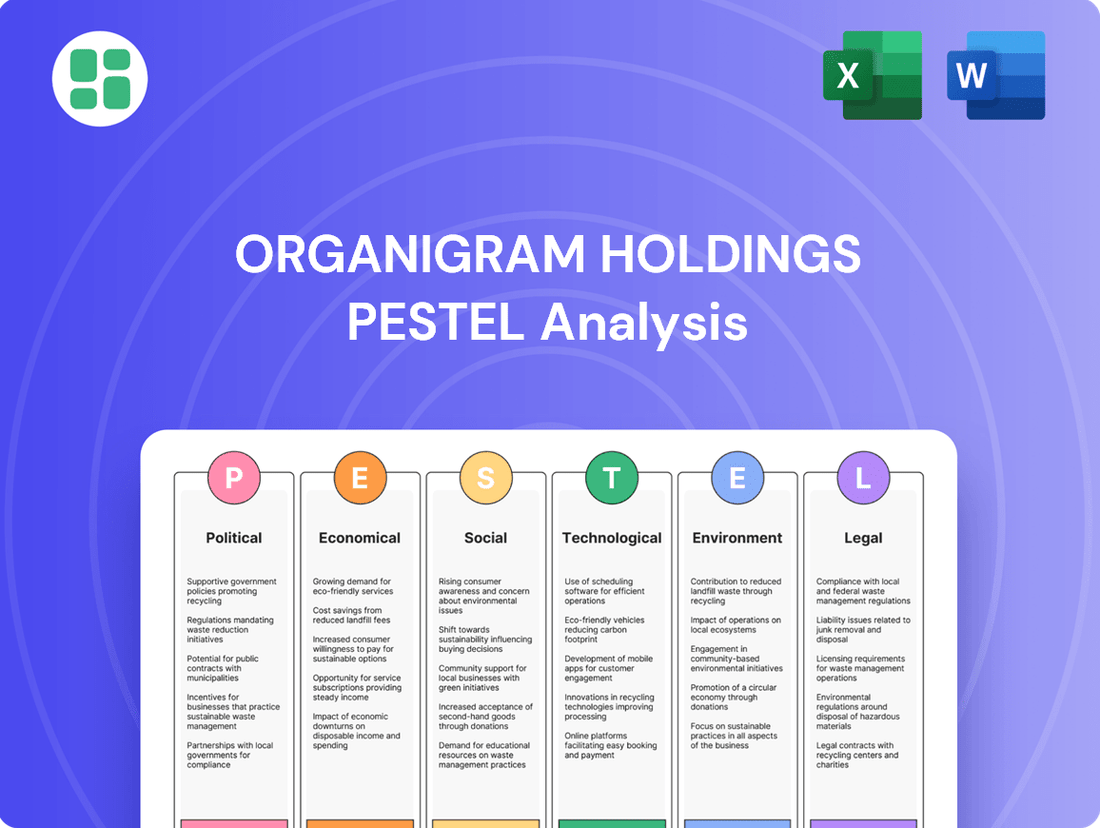

Organigram Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

Organigram Holdings operates within a dynamic cannabis industry, significantly influenced by evolving political landscapes and economic fluctuations. Understanding these external pressures is crucial for forecasting growth and mitigating risks. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable intelligence for strategic decision-making. Download the full version now to gain a competitive edge.

Political factors

Health Canada continues to refine the Canadian cannabis regulatory framework, balancing public health with industry growth. Recent changes, effective March 2025, are designed to ease burdens, particularly for smaller players. For instance, micro-cultivators and micro-processors will see increased cultivation limits, a move intended to foster market diversity.

These regulatory adjustments also extend to operational requirements, with eased stipulations for on-site security personnel. Such modifications aim to reduce administrative overhead and support the viability of smaller licensed producers within the competitive Canadian cannabis market.

The Canadian government's comprehensive review of the Cannabis Act, which wrapped up its final phase in 2024, signals a commitment to updating regulations for the evolving cannabis market. This review highlights a potential for policy adjustments aimed at fostering growth within the industry.

Despite ongoing challenges, such as the impact of excise taxes, there's a clear consideration for policy changes designed to alleviate pressure on smaller cannabis producers and stimulate strategic expansion. For instance, discussions around tax reform could significantly impact the cost structure for companies like Organigram.

Organigram, as a prominent entity in the Canadian cannabis landscape, actively monitors and adapts to these governmental policy directions to enhance its operational efficiency and strengthen its competitive standing. The company's ability to navigate these regulatory shifts is crucial for its sustained market performance.

Canada's cannabis industry is looking beyond domestic borders, with medical cannabis exports becoming a significant growth area. By February 2025, Health Canada had approved a substantial number of export permits, signaling strong international demand. Key markets receiving these permits include Germany, Australia, and Israel, highlighting the global reach of Canadian cannabis products.

Organigram is strategically positioning itself to capitalize on these international opportunities, aiming to diversify its revenue streams. The company is leveraging Canada's rigorous quality control and regulatory framework as a competitive advantage in these burgeoning global markets. This focus on international expansion is crucial for Organigram's long-term growth strategy.

Taxation and Excise Duty Burden

The excise tax on cannabis products significantly impacts producers like Organigram Holdings. In the first quarter of 2025, Organigram's excise obligations reached approximately $24.1 million, a substantial figure that equated to about 36% of its gross revenue. This heavy tax burden is a major financial consideration for the company and the wider Canadian cannabis industry.

The industry is actively lobbying for changes to the current excise duty structure. A key point of advocacy is the reduction of this tax burden, especially for smaller cannabis producers. The goal is to foster greater profitability and enhance the overall competitiveness of these businesses within the market.

- Excise Duty Impact: Organigram's Q1 2025 excise duties were nearly $24.1 million.

- Proportion of Revenue: This excise duty represented approximately 36% of Organigram's gross revenue in Q1 2025.

- Industry Advocacy: The cannabis sector is pushing for reduced excise tax burdens.

- Focus on Small Producers: The call for tax relief is particularly aimed at smaller companies to boost their financial health.

Political Stability and Public Trust

Canada's federal legalization of cannabis in 2018 established a regulated market that continues to gain ground against the illicit sector. This regulatory stability is a key political factor for companies like Organigram. The predictable legal landscape allows for strategic planning and investment, fostering growth opportunities within the industry.

Public confidence in the legal cannabis market is growing. Statistics Canada data from 2024 indicated an increase in household expenditures on legal cannabis, while the illicit market's share reached a record low. This trend suggests a maturing and trustworthy legal framework, which is beneficial for established players like Organigram.

This political environment offers Organigram a stable foundation for operations and expansion. The ongoing shift from the illicit to the legal market, supported by government policy and increasing consumer trust, presents a clear pathway for market penetration and revenue growth.

- Federal Legalization: Established a regulated cannabis market in Canada since 2018.

- Market Share Shift: Regulated market is steadily increasing its share from the illicit market.

- Public Trust: Growing confidence in the legal cannabis industry, evidenced by increased spending.

- Illicit Market Decline: Record low share for the illicit cannabis market reported in 2024.

Government policy continues to shape the Canadian cannabis landscape, with recent regulatory adjustments in early 2025 easing burdens for smaller producers. Health Canada's review of the Cannabis Act, concluding in 2024, signals an intent to foster industry growth, though challenges like excise taxes persist.

Organigram is actively navigating these political shifts, particularly the substantial excise tax burden, which represented about 36% of its gross revenue in Q1 2025, amounting to nearly $24.1 million. The industry, including Organigram, is advocating for tax reform to improve profitability and competitiveness.

The federal legalization in 2018 has created a more stable and regulated market, with public confidence growing and the illicit market share hitting a record low in 2024. This political stability and increasing consumer trust in the legal sector provide a favorable environment for Organigram's strategic planning and expansion.

Canada's medical cannabis export market is also a key political consideration, with Health Canada approving numerous export permits by February 2025 for markets like Germany and Australia, offering Organigram avenues for international diversification.

What is included in the product

This PESTLE analysis of Organigram Holdings offers a comprehensive examination of how political, economic, social, technological, environmental, and legal factors influence its operations and strategic direction in the cannabis industry.

It provides actionable insights for stakeholders to navigate the evolving external landscape, identifying potential challenges and opportunities for growth and sustainability.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable strategic discussions for Organigram Holdings.

Economic factors

The Canadian legal cannabis market is experiencing robust expansion, valued at USD 3.25 billion in 2024. This growth is anticipated to continue with a projected compound annual growth rate (CAGR) of 12.0% from 2025 to 2030, fueled by ongoing federal legalization and a growing consumer understanding of potential health benefits.

Organigram Holdings is demonstrating strong performance within this expanding market. The company reported a significant 74% increase in net revenue during Q2 Fiscal 2025, underscoring its capacity for organic growth in both recreational and international sales channels. This impressive revenue uplift also reflects the positive impact of strategic acquisitions on its overall financial results.

The Canadian cannabis sector is undergoing significant consolidation, with larger entities absorbing smaller operations. This trend is creating a more streamlined industry, prioritizing efficiency and scale. Organigram Holdings has been a key player in this consolidation, notably acquiring Motif Labs Ltd. in December 2024.

This acquisition was a strategic move that substantially enhanced Organigram's market presence and directly contributed to its impressive record revenues in the second quarter of fiscal year 2025. The ongoing consolidation is anticipated to further emphasize the importance of a diverse product portfolio and preparedness for international market entry.

Organigram Holdings benefits from a robust financial standing, characterized by a substantial cash reserve and minimal debt. This strength is significantly amplified by strategic investments from British American Tobacco (BAT).

The completion of BAT's final $41.5 million tranche in February 2025, part of a larger $124.6 million follow-on investment, has provided Organigram with a dedicated $59 million 'Jupiter' fund. This capital infusion is earmarked for accelerating expansion initiatives, particularly within the United States and other global markets.

Inflation and Cost Management

Inflation presents a significant challenge for the cannabis industry, directly impacting production costs. Rising energy prices, crucial for indoor cultivation, and increasing labor expenses can erode profit margins for companies like Organigram.

Organigram is actively addressing these cost pressures through strategic initiatives. The company anticipates achieving approximately $15 million in annual cost synergies following the integration of Motif, a key move to bolster profitability and maintain competitive pricing.

These synergy targets are designed to offset inflationary impacts and improve Organigram's adjusted gross margins. Effective cost management is therefore paramount for sustained financial health in the evolving cannabis market.

- Inflationary pressures on energy and labor costs are a key concern for cannabis producers.

- Organigram projects $15 million in annual cost synergies from the Motif acquisition.

- Synergies are intended to mitigate rising input costs and enhance adjusted gross margins.

International Market Opportunities

Organigram is strategically expanding its global footprint, recognizing international markets as key drivers for future growth. This push is clearly reflected in their financial performance, with international revenue surging by an impressive 177% to $6.1 million in the second quarter of fiscal year 2025. This significant jump underscores the growing importance of overseas markets for the company's overall revenue stream.

The company's commitment to international expansion is further evidenced by substantial strategic investments. For instance, Organigram invested $21 million in Sanity Group GmbH, a prominent cannabis company based in Germany, signaling a strong belief in the European market's potential. Additionally, the acquisition of Collective Project Limited provides a crucial entry point into the burgeoning U.S. and Canadian beverage sectors, diversifying their product offerings and market reach.

These international ventures are not merely about expanding reach; they are vital for achieving higher-margin growth. As Organigram navigates the complexities and potential saturation of its domestic market, these international opportunities offer a pathway to more profitable revenue streams. The focus on markets like Germany and the U.S. beverage sector is a calculated move to bolster profitability and ensure long-term financial health.

- International Revenue Growth: Organigram's international revenue reached $6.1 million in Q2 Fiscal 2025, marking a 177% increase.

- Strategic Investment in Germany: A $21 million investment was made in Sanity Group GmbH, a leading German cannabis company.

- U.S. and Canadian Market Entry: The acquisition of Collective Project Limited facilitated entry into the U.S. and Canadian beverage categories.

- Margin Enhancement: International expansion is a critical strategy for driving higher-margin growth, especially given domestic market challenges.

Economic factors significantly influence Organigram Holdings' operational landscape. Persistent inflation, particularly in energy and labor costs, directly impacts cultivation expenses, a critical component for indoor cannabis growers. Organigram is actively mitigating these pressures through strategic cost-saving measures.

The company anticipates realizing approximately $15 million in annual cost synergies following the integration of Motif Labs Ltd. These synergies are crucial for offsetting rising input costs and are projected to enhance Organigram's adjusted gross margins. Effective cost management is therefore a key determinant of sustained financial health in the dynamic cannabis market.

| Economic Factor | Impact on Organigram | Mitigation Strategy |

| Inflation (Energy & Labor) | Increased production costs, potential margin erosion. | Targeting $15 million in annual cost synergies from Motif acquisition. |

| Market Growth (Canadian Cannabis Sector) | Robust expansion, valued at USD 3.25 billion in 2024, with projected 12.0% CAGR (2025-2030). | Leveraging organic growth and strategic acquisitions for market share. |

| Consolidation Trends | Industry streamlining, emphasis on efficiency and scale. | Acquisition of Motif Labs Ltd. to enhance market presence and revenue. |

What You See Is What You Get

Organigram Holdings PESTLE Analysis

The preview shown here is the exact Organigram Holdings PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Organigram Holdings. It provides crucial insights for strategic planning and risk assessment within the cannabis industry.

The content and structure shown in this preview is the same Organigram Holdings PESTLE Analysis document you will download after payment, offering a complete and actionable report.

Sociological factors

Public acceptance of cannabis in Canada has significantly shifted, with increasing normalization leading to a broader consumer base. This includes previously untapped demographics like professionals and seniors, expanding the market for companies like Organigram.

Recent data from 2024 highlights this trend, showing a growing comfort level with cannabis consumption across various age groups. Surveys consistently reveal that a substantial majority of Canadians now prefer obtaining cannabis from licensed, regulated sources, a clear indicator of public trust in the legal industry and a positive development for Organigram's operations.

Consumer preferences are increasingly leaning towards wellness-oriented cannabis products. This includes a growing demand for items with lower THC content, balanced THC-CBD ratios, and convenient microdosing options. This shift reflects a broader societal focus on health and well-being.

Organigram Holdings is actively adapting to these evolving consumer demands. The company is expanding its product offerings to include a variety of edibles and vapes, catering to different consumption preferences. Furthermore, Organigram is investing in robust research and development initiatives aimed at leveraging cannabinoid science to deliver products that target specific mood states and potential therapeutic benefits.

Canadian cannabis market trends from 2019 to 2023 show a notable increase in consumption among women and individuals aged 25 and older. This evolving demographic landscape is prompting companies like Organigram to refine their product offerings and marketing approaches.

Organigram's strategy is increasingly focused on appealing to this maturing consumer base, which demands more sophisticated and diverse product formats. For instance, the company's expansion into edibles and beverages reflects a response to these changing consumer preferences, aiming to capture a larger share of this growing market segment.

Consumer Preferences for Product Variety and Innovation

By 2025, consumer demand for cannabis products has dramatically shifted. Beyond traditional dried flower, there's a clear preference for a wider array of options. This includes significant growth in categories like vape cartridges, edibles, pre-rolled joints, and concentrates, reflecting a more sophisticated and diverse consumer base.

Organigram Holdings is actively responding to these evolving tastes. The company’s strategy centers on robust product innovation and strengthening its brand portfolio. This includes developing cutting-edge technologies, such as their proprietary FAST™ edibles for rapid onset, and strategically entering emerging markets like cannabis beverages.

- Market Shift: In 2024, sales data indicated that edibles and vapes accounted for over 40% of the Canadian cannabis market, a substantial increase from previous years.

- Organigram's Innovation: Organigram's investment in its proprietary FAST™ edible technology aims to capture a larger share of the high-growth edibles market, projected to expand by 25% annually through 2026.

- Beverage Market Entry: The company's expansion into the cannabis beverage sector, which saw early entrants achieve significant market penetration in 2023-2024, positions them to capitalize on another rapidly expanding product category.

Social Responsibility and Ethical Sourcing

The maturing cannabis market, including Organigram Holdings, is seeing a significant push towards environmental sustainability, becoming a key consideration in federal licensing and compliance. This focus is driven by evolving consumer expectations for ethical business practices and transparent supply chains across the industry.

While detailed specifics on Organigram's social responsibility beyond environmental efforts are limited, the broader trend indicates a growing demand for companies to demonstrate commitment to ethical sourcing and fair labor practices. For instance, by the end of 2024, many Canadian cannabis companies are expected to have detailed environmental, social, and governance (ESG) reports available, aligning with investor and consumer scrutiny.

- Growing Consumer Demand: Consumers are increasingly favoring brands that demonstrate social responsibility and ethical sourcing.

- Regulatory Scrutiny: Federal cannabis licensing and compliance reviews are incorporating environmental sustainability criteria.

- Industry Trend: The broader cannabis sector is moving towards greater transparency in supply chains and ethical operations.

Societal attitudes toward cannabis continue to evolve, with a notable increase in acceptance across diverse demographics. This shift is driving demand for more sophisticated and varied product formats beyond traditional dried flower.

By 2024, edibles and vapes represented over 40% of the Canadian cannabis market, underscoring the consumer preference for convenience and discretion. Organigram's investment in technologies like FAST™ edibles aims to capitalize on this trend, targeting a market projected for substantial annual growth through 2026.

Furthermore, a growing emphasis on wellness and sustainability influences purchasing decisions, with consumers increasingly seeking products with balanced cannabinoid profiles and ethically sourced ingredients. Companies demonstrating strong ESG commitments are likely to gain favor with this evolving consumer base.

| Sociological Factor | 2024/2025 Data Point | Organigram's Response |

| Public Acceptance | Increased normalization across age groups. | Broadened consumer base, including professionals and seniors. |

| Product Preferences | Edibles & Vapes: >40% of market share (2024). | Investment in FAST™ edibles, expansion into beverages. |

| Wellness Focus | Demand for lower THC, balanced CBD, and microdosing. | R&D into mood-specific and potential therapeutic products. |

| Ethical Consumerism | Growing demand for transparency and ESG reporting. | Focus on ethical sourcing and fair labor practices (industry trend). |

Technological factors

The cannabis sector is rapidly embracing sophisticated cultivation technologies, such as precision agriculture and AI-powered monitoring. These advancements enable growers to meticulously manage environmental factors like humidity, temperature, and nutrient delivery, leading to improved yields and uniform product quality.

Organigram, with its focus on indoor cultivation, is well-positioned to leverage these technological leaps. For instance, the company's investment in automated systems and data analytics, as highlighted in their 2024 reports, directly aligns with optimizing operational efficiency and product consistency in a competitive market.

Organigram's commitment to product innovation is a significant technological driver, exemplified by its Product Development Collaboration (PDC) with British American Tobacco (BAT). This partnership is actively developing next-generation cannabis products, targeting edibles, vapes, and beverages, while also investigating novel inhalation formats.

A standout innovation is Organigram's patent-pending FAST™ nanoemulsion technology. This advancement is designed to enhance ingestible cannabis products by providing a faster onset of effects and improved bioavailability, a key differentiator in a competitive market.

Artificial intelligence (AI) and automation are transforming cannabis production, offering real-time data analysis and automating tasks like watering and nutrient delivery. This technology can predict crop yields and optimize growing conditions, leading to improved efficiency. For instance, by 2025, the global AI in agriculture market is projected to reach $1.8 billion, highlighting the significant investment and adoption of these advanced systems.

The integration of Internet of Things (IoT) devices further enhances environmental monitoring and control within cultivation facilities. These smart sensors provide granular data on temperature, humidity, and light, allowing for precise adjustments. Organigram can leverage these advancements to reduce resource consumption, such as water and energy, by an estimated 15-20% while ensuring consistent product quality and compliance.

Data Analytics for Market Insights

Data analytics is a game-changer for Organigram, offering deep dives into consumer behavior and market trends. By leveraging sophisticated platforms, the company can pinpoint emerging preferences and tailor its product development accordingly. This data-driven approach is essential for staying ahead in the dynamic cannabis market.

Organigram’s strategic use of data analytics informs everything from new product launches to marketing campaigns. For instance, in the fiscal year 2024, Organigram reported a significant increase in its market share, partly attributed to its ability to quickly adapt to consumer demand identified through data analysis. This allows them to optimize crop production for specific strains and ensure their product portfolio resonates with target demographics.

- Market Trend Identification: Analytics platforms help Organigram detect shifts in consumer preferences, such as the growing demand for specific cannabinoid ratios or product formats.

- Product Development Optimization: Data insights guide the creation of new products that are more likely to succeed in the market, reducing R&D waste.

- Consumer Segmentation: Understanding different consumer groups allows for more targeted marketing and brand messaging, increasing engagement and sales.

- Operational Efficiency: Analyzing sales data and consumer feedback can also lead to improvements in supply chain management and production planning.

Research and Development into New Cannabinoid Applications

Organigram Holdings is investing in research and development beyond the well-known THC and CBD. They are exploring minor cannabinoids like THCV, which shows promise for appetite suppression and energy enhancement. This focus on novel compounds aligns with their strategy to innovate based on consumer needs and potential therapeutic benefits.

The company's commitment to cannabinoid science is evident in their exploration of how different compounds can influence mood and provide specific wellness outcomes. This forward-thinking approach is crucial for staying competitive in a rapidly evolving market. For instance, in fiscal year 2024, Organigram reported significant advancements in their product development pipeline, with a notable portion of their R&D budget allocated to exploring these new cannabinoid applications.

- Exploration of Minor Cannabinoids: Organigram is actively researching THCV, CBG, and other less common cannabinoids for their unique properties and potential market applications.

- Therapeutic and Mood-Based Applications: The company aims to develop products that can deliver specific mood states and therapeutic benefits, catering to a growing consumer demand for wellness-oriented cannabis products.

- Innovation Strategy: This research is a core component of Organigram's consumer-driven innovation strategy, positioning them to capture emerging market segments.

- Market Potential: The market for minor cannabinoids is projected to grow substantially, with some analysts forecasting a CAGR of over 15% in the coming years, presenting a significant opportunity for Organigram.

Technological advancements are reshaping cannabis cultivation and product development for Organigram Holdings. Precision agriculture, AI, and IoT integration are driving efficiency and quality, with the global AI in agriculture market projected to reach $1.8 billion by 2025. Organigram's investment in automation and data analytics, as noted in their 2024 reports, directly supports optimizing operations and product consistency.

Organigram's Product Development Collaboration (PDC) with British American Tobacco (BAT) is a key technological driver, focusing on next-generation products like edibles and vapes. Their patent-pending FAST™ nanoemulsion technology enhances ingestible products by improving onset and bioavailability, a significant market differentiator.

Data analytics plays a crucial role in Organigram's strategy, enabling them to understand consumer behavior and market trends, as evidenced by their fiscal year 2024 market share growth. This data-driven approach informs product development and marketing, ensuring their offerings resonate with target demographics.

The company is also exploring minor cannabinoids like THCV, with research into their unique properties and potential therapeutic benefits. This focus on innovation, including a significant R&D allocation in fiscal year 2024, positions Organigram to capture emerging market segments, with the minor cannabinoid market projected for substantial growth.

Legal factors

Organigram Holdings operates within Canada's robust legal framework, primarily governed by the Cannabis Act and its associated regulations. This legislation dictates every aspect of the cannabis industry, from cultivation and processing to distribution and sales.

Health Canada plays a pivotal role in overseeing this sector, with ongoing reviews and amendments to the regulations. A notable update in March 2025 introduced revised guidelines for licensing, adjusted production limits, and new reporting obligations for licensed producers like Organigram, aiming to enhance public health and safety while streamlining industry operations.

Organigram Holdings must maintain federal licenses for cultivation, processing, and sales, a process demanding rigorous compliance with evolving regulations. For instance, recent amendments in 2024 aimed to ease burdens by expanding micro-cultivation and processing license limits and streamlining Quality Assurance Person requirements.

As a major producer, Organigram's multi-facility operations necessitate continuous adherence to these standards to avoid penalties and maintain operational continuity, impacting its ability to scale and innovate within the Canadian cannabis market.

Health Canada enforces rigorous product safety and quality control regulations, mandating comprehensive testing for contaminants in cannabis products. This oversight ensures that products available to consumers meet specific health and safety benchmarks.

Organigram Holdings actively addresses these legal factors by prioritizing high-quality, indoor-grown cannabis. Their investment in advanced technologies, such as nanoemulsion for improved product delivery, demonstrates a commitment to not only meeting but exceeding Health Canada's stringent standards, fostering consumer trust.

Marketing and Advertising Restrictions

The Cannabis Act in Canada places significant limitations on how cannabis products can be marketed and advertised. While certain reporting requirements for promotional spending were eased, Organigram must still carefully follow strict guidelines regarding product promotion to avoid non-compliance.

These regulations impact Organigram's ability to build brand awareness and reach consumers. For instance, advertising cannot appeal to minors or associate cannabis with certain lifestyles. Organigram's marketing strategies must therefore be creative within these boundaries, focusing on product education and responsible consumption messaging.

- Marketing Restrictions: The Cannabis Act prohibits promotions that are false, misleading, or likely to create an erroneous impression about the product.

- Brand Portfolio Navigation: Organigram must develop marketing campaigns that highlight its various brands, such as Trailblazer and Monjour, while strictly adhering to legal promotion standards.

- Compliance Focus: Ensuring all marketing activities align with Health Canada's regulations is paramount for Organigram to maintain its license and reputation in the Canadian market.

Intellectual Property and International Legal Frameworks

Organigram's international expansion necessitates a deep understanding of diverse cannabis legal frameworks, particularly concerning medical cannabis exports and hemp-derived products. For instance, as of early 2024, the European Union's approach to cannabis regulation remains fragmented, with varying rules on THC limits and import/export permits for medical cannabis, impacting Organigram's market access strategy.

Protecting its proprietary intellectual property, such as the patented FAST™ nanoemulsion technology, is crucial for maintaining a competitive edge globally. This is especially relevant as Organigram aims to leverage this technology for enhanced product delivery in new markets. The company also needs to safeguard its unique cannabis strains, which represent significant R&D investment and brand differentiation.

- Global IP Protection: Organigram must secure patents and trademarks for its technologies and strains in key international markets to prevent infringement and unauthorized use.

- Navigating Regulatory Divergence: The company faces the challenge of adapting its product offerings and operational strategies to comply with the distinct legal requirements of each target country.

- Compliance with Trade Agreements: Organigram's international trade activities are influenced by global and regional trade agreements, which can impact import/export duties and market access for cannabis products.

Organigram Holdings operates under Canada's strict Cannabis Act, requiring meticulous adherence to regulations set by Health Canada. Recent amendments in March 2025, such as revised licensing and production limits, directly influence Organigram's operational capacity and compliance strategies.

The company must navigate evolving marketing and advertising restrictions, which limit how it can promote its diverse brands like Trailblazer. Ensuring all promotional activities, including those for its Monjour brand, align with Health Canada's guidelines is critical for license maintenance and brand reputation.

International expansion presents legal complexities, with varying cannabis regulations across different countries impacting market access and product compliance. Organigram's strategy must account for these divergences, particularly concerning medical cannabis exports and intellectual property protection for its patented FAST™ nanoemulsion technology.

Environmental factors

Indoor cannabis cultivation, like that undertaken by Organigram, is inherently energy-intensive due to lighting, climate control, and ventilation needs. Organigram has made significant strides in addressing this, notably by retrofitting 17,000 light fixtures to energy-efficient LEDs. This initiative alone has achieved a 30% reduction in energy consumption per cultivation room.

Further demonstrating their commitment to sustainability, Organigram is actively participating in the New Brunswick Strategic Energy Management Program. This partnership with NB Power aims to identify and implement additional strategies for reducing overall energy usage across their operations, underscoring a proactive approach to environmental stewardship.

Cannabis cultivation, particularly indoor operations, demands substantial water resources. While Organigram Holdings' specific water usage figures aren't publicly detailed, the industry trend points towards adopting more sustainable practices. This includes implementing efficient irrigation technologies and robust wastewater management protocols to lessen environmental footprints.

The cannabis sector faces significant waste challenges, largely driven by packaging mandates. Organigram, like its peers, must navigate these environmental concerns. In 2023, the global cannabis packaging market was valued at approximately $1.4 billion, highlighting the scale of this issue.

However, upcoming regulatory shifts in Canada, effective March 2025, present a potential turning point. These amendments permit more flexible packaging designs, including transparent containers and windows. This regulatory evolution could enable Organigram to implement more eco-friendly and consumer-friendly packaging, potentially reducing material usage and waste.

Carbon Footprint Reduction Initiatives

Organigram Holdings is actively working to shrink its environmental impact, with a particular focus on reducing its carbon footprint. A key initiative involves upgrading lighting systems, such as converting to energy-efficient LED lights across its facilities. This move, alongside participation in broader energy management programs, directly translates into lower energy consumption and, consequently, a smaller carbon footprint.

The cannabis industry, in general, is facing growing pressure to showcase environmental stewardship. Consumers and regulators alike expect companies like Organigram to implement robust strategies for minimizing their ecological impact. This includes not only energy efficiency but also responsible waste management and water usage.

Organigram's commitment to these environmental factors is becoming increasingly crucial for maintaining a positive brand image and meeting evolving industry standards. For instance, in 2023, the company reported progress in its sustainability efforts, aiming to achieve further reductions in greenhouse gas emissions in the coming years. Specific targets for energy reduction and waste diversion are often updated in their annual sustainability reports.

- LED Lighting Conversion: Significant investment in upgrading lighting to reduce energy consumption.

- Energy Management Programs: Active participation in initiatives designed to optimize energy usage and efficiency.

- Industry Expectations: Growing demand for environmental responsibility within the cannabis sector.

- Carbon Footprint Reduction: Direct efforts to lower greenhouse gas emissions through operational improvements.

Adherence to Environmental Certifications and Standards

As the cannabis industry matures, environmental sustainability is becoming a key consideration in federal licensing and compliance. While Organigram Holdings' specific environmental certifications aren't publicly detailed, demonstrating a commitment to eco-friendly practices is increasingly important. This focus helps attract environmentally conscious consumers and investors, aligning with broader market trends towards corporate social responsibility.

Adherence to environmental standards can translate into tangible benefits, such as reduced operational costs through energy efficiency and waste management. For instance, many licensed cannabis producers are exploring LED lighting solutions, which can cut energy consumption by up to 50% compared to traditional grow lights. Furthermore, responsible water usage and cultivation techniques are gaining traction.

- Growing Emphasis on Sustainability: Federal cannabis licensing and compliance reviews are increasingly incorporating environmental sustainability factors.

- Consumer and Investor Appeal: Adherence to environmental standards enhances Organigram's appeal to eco-conscious consumers and investors.

- Operational Efficiency: Implementing sustainable practices, like energy-efficient lighting, can lead to significant cost savings.

- Market Differentiation: Strong environmental credentials can differentiate Organigram in a competitive and maturing market.

Organigram Holdings is actively addressing its environmental impact, particularly its energy consumption and waste generation. The company's conversion of 17,000 light fixtures to LEDs has already reduced energy use by 30% per cultivation room, demonstrating a tangible commitment to sustainability.

Further initiatives include participation in energy management programs with NB Power and exploring more eco-friendly packaging solutions, especially with upcoming regulatory changes in Canada effective March 2025. These efforts are crucial for meeting growing consumer and investor expectations for environmental stewardship in the cannabis sector.

| Environmental Factor | Organigram's Action | Impact/Data |

|---|---|---|

| Energy Consumption | LED Lighting Conversion | 30% reduction in energy consumption per cultivation room. |

| Energy Management | NB Power Program Participation | Aims to identify further energy reduction strategies. |

| Waste Management | Packaging Compliance | Navigating mandates; potential for eco-friendly packaging with March 2025 regulatory changes. |

| Carbon Footprint | Operational Improvements | Focus on reducing greenhouse gas emissions through efficiency measures. |

PESTLE Analysis Data Sources

Our Organigram Holdings PESTLE analysis is built upon a robust foundation of data from leading financial news outlets, government regulatory bodies, and reputable market research firms. We integrate insights from economic reports, technological trend analyses, and industry-specific publications to provide a comprehensive overview.