Orano SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orano SA Bundle

Orano SA operates within a complex global landscape, significantly influenced by political stability in resource-rich nations, fluctuating economic conditions impacting energy demand, and evolving technological advancements in nuclear energy. Understanding these external forces is crucial for any stakeholder looking to navigate the future of nuclear fuel cycle services and mining. Gain a competitive advantage by delving into the detailed PESTLE analysis, equipping you with the foresight needed to anticipate challenges and capitalize on opportunities within this dynamic sector. Download the full version now for actionable intelligence.

Political factors

Governments globally, especially in Europe and Asia, are increasingly viewing nuclear energy as crucial for meeting decarbonization targets and strengthening energy independence. This political trend creates a supportive landscape for Orano, potentially unlocking new investments and securing long-term agreements for its nuclear fuel cycle expertise.

France, a significant stakeholder, remains committed to Orano's strategic initiatives and growth plans. This support is evidenced by capital injections, such as the €200 million capital increase announced in late 2023, aimed at reinforcing Orano's operational capabilities and infrastructure development.

Geopolitical events, such as the 2023 coup in Niger where Orano lost control of its subsidiaries, underscore the inherent risks in uranium supply chains. This situation directly impacted Orano's operations, forcing a re-evaluation of its reliance on specific regions.

To counter such vulnerabilities, Orano is strategically diversifying its mining sources and securing long-term contracts. This approach aims to mitigate the risks stemming from political instability in crucial uranium-producing territories.

The company's proactive strategy includes developing new mining projects in diverse locations like Mongolia, Namibia, and Uzbekistan. For instance, Orano's involvement in the uranium sector in Namibia, a significant global producer, is a key component of this diversification effort.

Orano SA's global operations are deeply intertwined with international regulations governing the nuclear sector, particularly those focused on non-proliferation. Treaties and organizations like the International Atomic Energy Agency (IAEA) are pivotal, ensuring nuclear materials are used solely for peaceful purposes. This oversight is critical for Orano, as its activities cover the entire nuclear fuel cycle, from mining to recycling.

Compliance with these stringent international safeguards and verification processes is non-negotiable for Orano. It underpins the company's ability to maintain its operating licenses worldwide and uphold its reputation. As more nations explore or expand their nuclear energy programs, adherence to these global frameworks becomes even more vital for Orano's continued market access and success.

Trade Policies and Export Controls

Trade policies, including sanctions and export controls on nuclear materials and technologies, directly impact Orano's ability to conduct international business. For instance, ongoing geopolitical tensions in 2024 and 2025 continue to shape regulations around the transfer of sensitive nuclear components, potentially affecting Orano's access to key markets or suppliers.

Orano must navigate complex geopolitical landscapes and adapt its strategies to ensure the secure and compliant transfer of nuclear materials and services across borders. The company's operational footprint, spanning countries like Niger and Kazakhstan, necessitates constant monitoring of evolving international trade agreements and sanctions regimes, which can shift based on global political stability.

Diversification of export markets and supply chain resilience are key considerations for Orano in this environment. As of early 2025, the global nuclear energy sector is experiencing renewed interest, but trade restrictions can limit growth opportunities. Orano's strategic planning must account for potential disruptions, ensuring it can maintain a stable supply of uranium and services.

- Impact of Sanctions: Trade sanctions imposed on certain nations can restrict Orano's access to raw materials or limit its ability to export finished nuclear fuel products, affecting revenue streams.

- Export Control Compliance: Strict export controls on nuclear technology and materials require Orano to maintain rigorous compliance protocols, adding operational complexity and cost.

- Geopolitical Risk Management: Orano's global operations expose it to varying political risks; for example, changes in French or international nuclear non-proliferation policies directly influence its business activities.

- Market Diversification: To mitigate trade policy risks, Orano actively seeks to diversify its customer base and supply sources across different geopolitical regions, aiming for greater supply chain security.

Public Policy on Nuclear Waste Management

Government policies on nuclear waste management are a critical factor for Orano. France's commitment to the Cigéo deep geological disposal project, expected to begin construction in 2027 and operational by 2035, directly shapes the landscape for Orano's back-end services. A stable and predictable regulatory environment is paramount for Orano to confidently invest in and deliver its recycling and waste management solutions.

These policies also have a substantial effect on public perception and the financial planning required for managing nuclear materials throughout their lifecycle. For instance, the ongoing debate and evolving regulations around spent fuel reprocessing and disposal can influence the long-term viability and cost-effectiveness of Orano's operations.

- Regulatory Stability: Orano relies on consistent government policies for long-term waste management to plan its recycling and disposal services.

- Cigéo Project Impact: France's Cigéo project, a significant deep geological disposal initiative, directly influences Orano's back-end business activities and future investments.

- Public Acceptance & Financial Provisions: Government policies impact public trust in nuclear waste solutions and dictate the financial commitments required for end-of-lifecycle management.

Governments globally are increasingly prioritizing nuclear energy for energy security and climate goals, creating a favorable political climate for Orano. France's continued support, including a €200 million capital injection in late 2023, highlights its commitment to Orano's growth. However, geopolitical instability, as seen with the 2023 coup in Niger impacting operations, necessitates strategic diversification of mining sources to mitigate supply chain risks.

Orano must navigate complex international regulations and trade policies, including sanctions and export controls on nuclear materials, which directly influence its global business operations and market access. Compliance with non-proliferation treaties and IAEA safeguards is crucial for maintaining operating licenses and reputation.

Government policies on nuclear waste management, such as France's Cigéo project, significantly shape Orano's back-end services and require stable regulatory environments for investment. Public perception and financial provisions for lifecycle management are also influenced by these policies, impacting the long-term viability of Orano's operations.

| Political Factor | Description | Impact on Orano SA | Examples/Data (2024/2025 Focus) |

| Energy Policy & Decarbonization | Government push for nuclear energy to meet climate targets and energy independence. | Creates demand for Orano's nuclear fuel cycle services and potential for new contracts. | Increased nuclear investment plans announced by several European nations in 2024. |

| State Ownership & Support | Government as a key stakeholder in Orano. | Provides financial backing and strategic direction, ensuring operational stability. | France's €200 million capital increase in late 2023 to bolster Orano's capabilities. |

| Geopolitical Instability & Supply Chain Risk | Political events in uranium-producing countries affecting operations. | Requires diversification of mining sources and long-term contracts to ensure supply security. | Impact of the 2023 coup in Niger on Orano's subsidiaries; ongoing efforts to secure projects in Mongolia, Namibia, and Uzbekistan. |

| International Regulations & Non-Proliferation | Global oversight of nuclear materials for peaceful use (e.g., IAEA). | Mandates strict compliance, affecting operating licenses and market access. | Continued stringent verification processes by the IAEA for all Orano's fuel cycle activities. |

| Trade Policies & Sanctions | Export controls and sanctions impacting international trade of nuclear materials. | Can restrict market access or supplier relationships, necessitating careful navigation of geopolitical tensions. | Monitoring of evolving international trade agreements and sanctions regimes in 2024-2025 affecting sensitive nuclear component transfers. |

| Nuclear Waste Management Policies | Government regulations for managing nuclear waste. | Influences Orano's back-end services and requires stable regulatory frameworks for investment. | France's Cigéo deep geological disposal project, with construction planned from 2027, impacting Orano's waste management solutions. |

What is included in the product

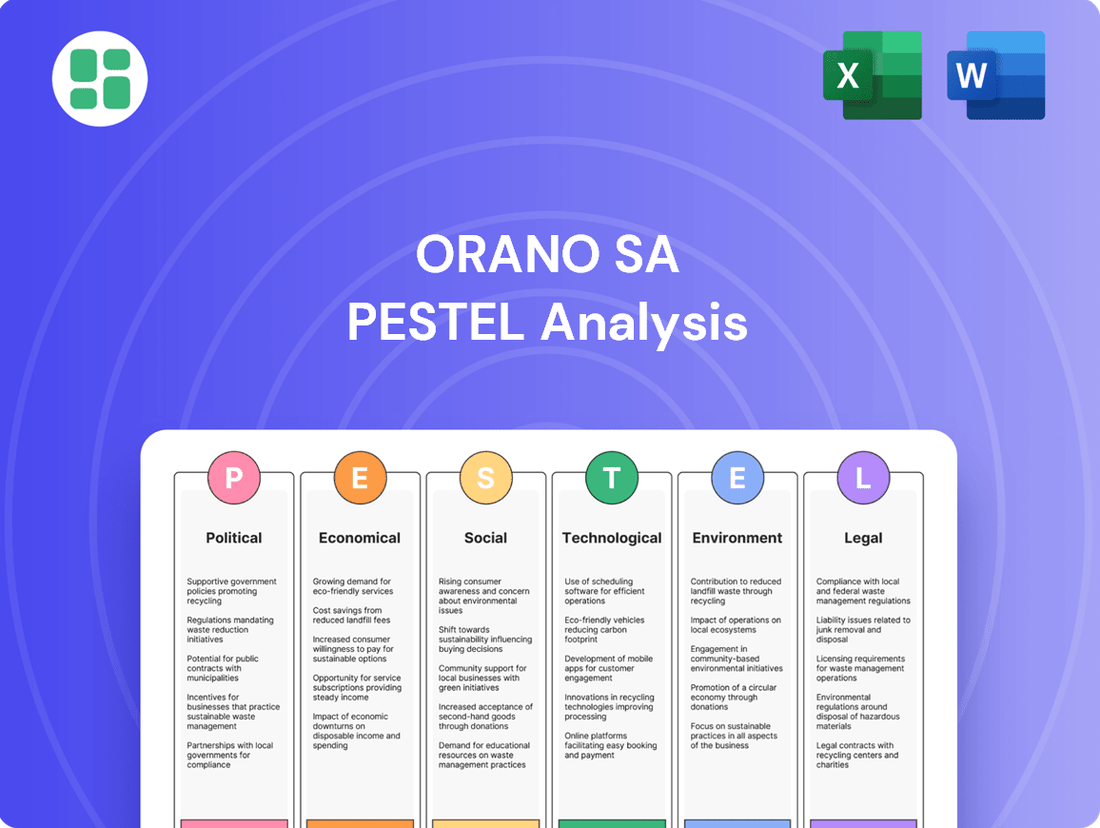

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Orano SA, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, highlighting key opportunities and threats relevant to Orano's global operations in the nuclear sector.

A PESTLE analysis of Orano SA offers a structured approach to identifying and mitigating external risks, acting as a pain point reliever by highlighting potential market shifts and regulatory challenges.

This analysis provides a clear, summarized version of Orano SA's external environment, simplifying complex factors for quick referencing during strategic planning and decision-making.

Economic factors

Global energy needs are shifting, with a growing emphasis on low-carbon sources due to climate change. This trend is revitalizing interest in nuclear power, directly influencing uranium prices. As of early 2025, benchmark uranium prices have seen significant increases, with spot prices trading around $90 per pound, a substantial jump from previous years.

Orano is well-positioned to capitalize on this bullish market, particularly in mining and front-end nuclear fuel cycle services. The company reported robust financial performance in 2024, with revenues exceeding €7 billion, partly attributed to these favorable market conditions.

Higher uranium prices are a strong incentive for reopening idled mines and exploring new uranium deposits. For instance, several projects in Canada and Australia, previously uneconomical, are now being reassessed for potential recommissioning in 2025 and 2026, signaling renewed investment in uranium extraction.

Nuclear infrastructure demands substantial, long-term capital investments for projects like new reactors and fuel cycle facilities. Orano is responding by increasing its investment program, notably expanding its Georges Besse II enrichment plant. This strategic move, alongside new mining ventures, is crucial for securing future supply and enhancing Orano's competitive standing in the global market.

As a global player in the nuclear fuel cycle, Orano SA's substantial international contracts expose it directly to the volatility of currency exchange rates. These fluctuations can significantly sway the reported value of its revenue and the ultimate profitability of its projects. For instance, a strengthening Euro against currencies where Orano generates substantial revenue could reduce its reported earnings when converted back.

Orano's substantial backlog, which stood at €35.9 billion by the close of 2024, is not immune to these currency effects. Changes in exchange rates can alter the value of future contracted revenues, impacting the company's financial outlook and planning. This underscores the importance of robust currency risk management strategies.

Effectively managing foreign exchange risk is therefore a critical component of Orano's financial strategy. It's essential for preserving the company's financial stability and ensuring a degree of predictability in its earnings, especially when dealing with long-term, multi-currency international agreements.

Cost of Raw Materials and Production Efficiency

The price of uranium, a key raw material for Orano, is a significant driver of operational costs. For instance, uranium spot prices have seen fluctuations, with averages around $30-$40 per pound in late 2023 and early 2024, impacting Orano's revenue and profitability. Improving production efficiency across conversion, enrichment, and recycling is therefore crucial for maintaining competitiveness in the global nuclear fuel market.

Orano actively pursues industrial performance enhancements and technological innovation to streamline its production processes and lower costs. This focus on optimization is essential given the capital-intensive nature of the nuclear fuel cycle.

Challenges in securing raw materials or disruptions in production, such as the political instability and subsequent suspension of operations in Niger in 2023, can have a material impact on Orano's output and financial performance.

- Uranium Price Volatility: Spot uranium prices averaged between $30 and $40 per pound in late 2023 and early 2024, directly influencing Orano's cost structure.

- Operational Efficiency Drive: Orano's commitment to technological advancements aims to reduce costs in conversion, enrichment, and recycling.

- Impact of Geopolitical Events: The suspension of operations in Niger in 2023 highlights the vulnerability of supply chains and the potential financial repercussions of geopolitical instability.

Competition in the Nuclear Fuel Cycle Market

Orano SA navigates a highly competitive global landscape for nuclear fuel cycle services, contending with both long-standing industry giants and emerging competitors. Its success in securing significant, multi-year agreements, like the treatment-recycling contract with EDF, underscores its robust market standing and the trust placed in its capabilities.

Maintaining and growing market share in this environment hinges on Orano's commitment to continuous innovation, forging strategic alliances, and broadening its service portfolio. For instance, the global nuclear fuel market was valued at approximately USD 30 billion in 2023 and is projected to grow, with key players investing heavily in advanced fuel technologies and recycling capabilities.

- Market Share Dynamics: Orano competes with major entities like Westinghouse Electric Company and Rosatom, each vying for contracts in uranium enrichment, fuel fabrication, and waste management.

- Contractual Strength: The EDF contract, valued in the billions of euros, highlights Orano's ability to secure long-term business, crucial for capital-intensive nuclear operations.

- Innovation and Diversification: Investments in areas like advanced reactor fuels and digital services are vital to staying ahead of competitors who are also expanding their offerings.

- Emerging Players: The rise of new entrants, particularly from Asia, adds pressure, necessitating agile strategies and technological leadership from established firms like Orano.

Government policies and international regulations significantly shape the nuclear industry, impacting Orano's operations and market access. Favorable governmental support for nuclear energy, including subsidies and streamlined permitting processes, directly benefits companies like Orano. Conversely, stricter environmental regulations or changes in nuclear non-proliferation treaties can introduce operational complexities and costs.

The global push for decarbonization is leading many governments to re-evaluate and expand their nuclear energy portfolios. For example, the United States Inflation Reduction Act of 2022 includes incentives for clean energy, which can indirectly benefit the nuclear fuel cycle. By early 2025, several countries, including the UK and Japan, have announced plans for new reactor builds or life extensions, signaling a supportive policy environment.

Orano's strategic investments, such as expanding its Georges Besse II enrichment plant, align with these governmental trends. The company's ability to adapt to evolving regulatory frameworks, such as those concerning waste management and safety standards, is crucial for its long-term success and market positioning.

Full Version Awaits

Orano SA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Orano SA covers all critical external factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain deep insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape relevant to Orano SA.

The content and structure shown in the preview is the same document you’ll download after payment. Equip yourself with a thorough understanding of the forces shaping Orano SA's future success.

Sociological factors

Public perception of nuclear safety is a critical sociological factor for Orano SA. Negative public sentiment, often fueled by past accidents like Chernobyl or Fukushima, can significantly hinder new project development and increase operational costs due to stricter regulations and community opposition. For instance, a 2024 survey indicated that while public acceptance of nuclear energy as a carbon-free source is growing in some regions, concerns about waste disposal and safety remain paramount, with only 45% of respondents expressing high confidence in nuclear plant security.

The nuclear sector, including companies like Orano, demands a highly specialized workforce. Attracting and keeping these skilled professionals is a hurdle, partly because it's a niche field and many experienced workers are nearing retirement. For instance, in 2024, the global nuclear workforce is projected to see continued demand for specialized engineers and technicians, with an estimated 70% of current nuclear professionals being over 40 years old.

Orano actively addresses this by investing in employee growth through training programs and fostering a diverse and inclusive workplace. Their efforts aim to create an environment that appeals to new talent, ensuring a steady pipeline of skilled individuals. This focus on professional development and an attractive work culture is crucial for maintaining operational expertise.

A significant ongoing challenge is the effective transfer of critical knowledge from experienced, retiring employees to newer generations of workers. This intergenerational knowledge sharing is vital for the long-term sustainability and safety of operations within Orano and the broader nuclear industry.

Orano SA's mining and waste management operations directly affect local populations, making community engagement vital. The company strives for 80% of residents in operational areas to hold a favorable view of its presence, achieved through transparent dialogue and local economic contributions.

Corporate Social Responsibility (CSR) and ESG Pressures

Societal expectations are increasingly shaping how companies like Orano operate, with a strong push for Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles. This means Orano's business decisions and how investors view the company are heavily influenced by its commitment to these areas.

Orano has actively responded to these pressures by renewing its Commitment roadmap for 2030. This plan details specific goals aimed at enhancing its social and societal contributions, tackling climate change adaptation, and championing a circular economy. These initiatives are crucial for maintaining stakeholder trust and ensuring long-term viability.

- Reduced Carbon Footprint: Orano aims to significantly decrease its greenhouse gas emissions, aligning with global climate targets.

- Resource Preservation: The company is investing in innovation to ensure the efficient use and preservation of natural resources.

- Societal Impact: Orano is focused on improving its positive contributions to the communities where it operates.

Anti-Nuclear Movements and Advocacy Groups

Anti-nuclear movements and environmental advocacy groups exert considerable influence, often manifesting as protests, legal battles, and public awareness campaigns targeting nuclear projects. Orano faces the challenge of actively engaging with these groups, presenting a clear case for nuclear energy's advantages and robust safety protocols to counter prevailing negative perceptions and foster wider public acceptance.

- Public Opinion Shifts: In 2024, polls indicated a growing segment of the public in several European nations expressing concerns over nuclear waste disposal, impacting government policy decisions.

- Advocacy Group Influence: Organizations like Greenpeace and the Nuclear Information and Resource Service (NIRS) actively lobby governments and engage in public discourse, influencing regulatory frameworks and project approvals.

- Legal Challenges: In 2024, several new legal challenges were filed against proposed uranium mining operations, citing environmental impact and community health concerns, demonstrating the ongoing legal scrutiny faced by the industry.

Societal expectations regarding Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles significantly influence Orano SA's operations and investor perception. The company's 2030 Commitment roadmap, detailing goals for social contribution, climate adaptation, and circular economy, reflects a proactive response to these evolving societal demands. This commitment is crucial for maintaining stakeholder trust and ensuring long-term viability in the nuclear sector.

Technological factors

The rise of Small Modular Reactors (SMRs) and Advanced Modular Reactors (AMRs) presents a significant technological avenue for Orano. These innovative designs promise enhanced flexibility and scalability, potentially broadening the market for nuclear energy and, consequently, Orano's comprehensive fuel cycle services.

Orano is proactively engaging with key stakeholders across the nuclear ecosystem to foster the growth of this emerging, forward-thinking sector. For instance, by 2024, several SMR designs are expected to reach advanced stages of development and licensing, with some aiming for deployment in the late 2020s, directly impacting Orano's future service demands.

Orano is heavily invested in advancing used nuclear fuel recycling and waste treatment, recognizing this as a core element of its business and its dedication to sustainable resource management. The company is actively upgrading its existing facilities and developing novel approaches to process decommissioned materials, aiming to substantially minimize the volume of final nuclear waste.

This commitment extends to exploring the recycling of valuable strategic materials beyond nuclear fuel, such as lithium-ion batteries, reflecting a broader circular economy approach. Such innovations are crucial for Orano's long-term viability and its role in managing the nuclear lifecycle responsibly.

Orano is increasingly integrating digitalization and AI into its operations, aiming to boost efficiency and safety. For instance, AI-powered predictive maintenance can anticipate equipment failures, reducing costly downtime. In 2023, Orano reported significant progress in digital transformation initiatives across its mining and nuclear fuel cycle activities, with a focus on optimizing production processes.

The strategic deployment of AI assists in minimizing operational interruptions and extending the service life of critical machinery, directly contributing to enhanced efficiency and substantial cost reductions. This technological advancement also plays a role in better assessing and managing the potential impacts of climate change on production schedules and resource management.

Development of Nuclear Medicine

Orano's strategic push into nuclear medicine, especially vectorized internal radiotherapies, represents a significant technological leap. This diversification leverages their deep-seated expertise in stable isotopes and the broader nuclear fuel cycle, redirecting these capabilities towards vital medical applications.

This move into nuclear medicine is not just about new products; it's about harnessing advanced technologies for therapeutic purposes. For instance, the development of targeted radiotherapies, which deliver radiation directly to cancer cells, is a prime example of this technological evolution. Such advancements aim to improve patient outcomes by minimizing damage to healthy tissues.

The company's engagement in this sector is bolstered by strategic alliances. These partnerships are instrumental in expediting the innovation process and ensuring swifter market penetration for their medical advancements. Orano's 2023 financial reports indicated continued investment in R&D, a portion of which is allocated to these burgeoning medical technology initiatives.

- Orano's focus on radiotherapies aligns with a growing global demand for targeted cancer treatments.

- The company's expertise in isotope production, a key component of nuclear medicine, provides a competitive advantage.

- Strategic partnerships are crucial for navigating the complex regulatory and scientific landscape of medical technology development.

- Investments in nuclear medicine are expected to contribute to Orano's long-term revenue diversification.

Uranium Enrichment Enhancements

Orano is heavily invested in refining uranium enrichment technologies to boost both efficiency and safety. This focus is critical for maintaining a competitive edge in the nuclear fuel supply chain.

A prime example of this commitment is the ongoing investment in expanding the Georges Besse II enrichment facility in France. This expansion is designed to increase production capacity, directly addressing the growing global demand for enriched uranium, particularly as many countries look to nuclear power for cleaner energy solutions.

These technological upgrades and capacity extensions are vital for Orano's strategic positioning. They solidify the company's role as a key player in the front-end of the nuclear fuel cycle, ensuring a reliable supply of essential materials for nuclear power generation worldwide.

- Technological Focus: Orano prioritizes enhancing the efficiency and safety of its uranium enrichment processes.

- Capacity Expansion: Investments are being made to extend the capacity of facilities like Georges Besse II, aiming to boost production.

- Market Responsiveness: These advancements are geared towards meeting the increasing global demand for enriched uranium.

- Strategic Advantage: The improvements strengthen Orano's position in the critical front-end of the nuclear fuel cycle.

Orano is actively developing and integrating advanced technologies, particularly in the areas of Small Modular Reactors (SMRs) and the recycling of nuclear materials, to enhance its service offerings. The company's strategic investments in digital transformation, including AI for predictive maintenance, aim to significantly improve operational efficiency and safety across its mining and nuclear fuel cycle activities. These technological advancements are crucial for Orano to maintain its competitive edge and meet evolving market demands for cleaner energy solutions and responsible resource management.

Legal factors

Orano SA navigates a complex web of national nuclear safety regulations across its global operations, including France, Canada, and Kazakhstan. These rules are critical for maintaining licenses and ensuring operational safety, with a significant focus on waste management and radiation protection. For instance, France's nuclear safety authority, the ASN, imposes strict oversight, and in 2023, it continued to emphasize enhanced safety measures following international reviews.

Adherence to these evolving regulatory frameworks is non-negotiable for Orano's continued operation and public confidence. Non-compliance can result in severe repercussions, including hefty fines, operational shutdowns, and the potential revocation of operating permits, directly impacting the company's financial performance and market standing.

Environmental protection laws, covering emissions, water discharge, and biodiversity, significantly shape Orano's operations in mining, conversion, and waste management. Adhering to these regulations is paramount for obtaining and maintaining necessary environmental permits, which involve detailed impact assessments. For instance, in 2024, Orano continued its efforts to comply with stringent EU regulations on radioactive waste management, a key aspect of its environmental stewardship.

Legislation governing radioactive waste management and nuclear decommissioning is paramount for Orano's back-end operations. These regulations define Orano's obligations, funding requirements, and the approved procedures for the secure, long-term storage or disposal of nuclear materials. For instance, French law mandates specific provisions for waste management, influencing the operational scope and financial planning for Orano's activities, including its participation in the Cigéo project.

International Trade and Export Control Laws

Orano SA's global business, particularly its trade in nuclear materials and services, operates under a complex web of international trade and export control laws. These regulations, including non-proliferation treaties, are critical for preventing the misuse of nuclear technology and materials. For instance, the Nuclear Suppliers Group (NSG) guidelines, which many countries adhere to, impose stringent controls on the export of nuclear-related items. Orano's compliance ensures its license to operate internationally and safeguards its reputation.

Geopolitical shifts can significantly impact Orano's cross-border activities. Evolving international relations and sanctions regimes can introduce new legal hurdles or alter existing trade agreements. In 2023, for example, ongoing geopolitical tensions led to increased scrutiny of supply chains involving sensitive materials, potentially affecting the logistics and contractual terms for Orano's international projects. Staying abreast of these dynamic legal landscapes is paramount for maintaining seamless global operations.

- Strict Adherence: Orano must comply with international agreements like the Treaty on the Non-Proliferation of Nuclear Weapons (NPT) and national export control regulations.

- Regulatory Landscape: The company navigates regulations from bodies such as the International Atomic Energy Agency (IAEA) and national export control agencies in countries where it operates or trades.

- Impact of Geopolitics: For example, in 2024, sanctions or trade restrictions imposed on certain nations could directly impact Orano's ability to source materials or deliver services in those regions.

- Reputational Risk: Non-compliance with export control laws can lead to severe penalties, including fines and the revocation of export licenses, significantly damaging Orano's global standing.

Corporate Governance and Compliance Requirements

As a global player in the nuclear energy sector, Orano SA faces rigorous corporate governance and compliance mandates. These include adherence to French legislation like the Sapin II law, which governs anti-corruption and transparency in business dealings. Ensuring ethical practices and transparent lobbying efforts are paramount to mitigating legal risks and protecting the company's reputation. For instance, Orano's 2023 annual report highlighted its commitment to these principles, detailing its compliance framework.

Orano's operations are subject to a complex web of international and national regulations governing nuclear safety, environmental protection, and trade. Failure to comply with these stringent requirements can result in significant penalties, operational disruptions, and damage to stakeholder trust. The company actively manages these legal factors through robust internal controls and regular audits.

- Regulatory Compliance: Orano must navigate and comply with diverse international regulations, including those from the International Atomic Energy Agency (IAEA) and national nuclear safety authorities.

- Anti-Corruption Laws: Adherence to laws such as the Sapin II law in France and similar legislation globally is critical to prevent bribery and ensure ethical business conduct.

- Corporate Governance Standards: Maintaining high standards of corporate governance, including board oversight and stakeholder engagement, is essential for long-term sustainability and investor confidence.

- Reporting and Transparency: Orano is obligated to provide transparent reporting on its activities, financial performance, and compliance with legal and ethical standards, as evidenced in its annual reports.

Orano SA operates under a stringent legal framework governing nuclear safety, environmental protection, and international trade. Compliance with regulations from bodies like the International Atomic Energy Agency (IAEA) and national authorities is paramount for its global operations, including those in France, Canada, and Kazakhstan. The company must also adhere to anti-corruption laws, such as France's Sapin II law, and maintain high corporate governance standards to ensure ethical conduct and transparency, as highlighted in its 2023 reporting.

Navigating international trade and export control laws, including non-proliferation treaties, is crucial for Orano's business. These regulations, influenced by geopolitical shifts and bodies like the Nuclear Suppliers Group, dictate the secure movement of nuclear materials and technology. For instance, in 2024, evolving sanctions could impact Orano's supply chains and international project agreements.

Legislation concerning radioactive waste management and nuclear decommissioning significantly shapes Orano's back-end operations, defining obligations and funding for long-term storage. In 2024, Orano continued its commitment to EU regulations on radioactive waste, a key aspect of its environmental stewardship and operational planning, including its involvement in projects like Cigéo.

Failure to comply with these diverse legal requirements can lead to severe penalties, including fines, operational shutdowns, and damage to Orano's reputation. The company actively manages these risks through robust internal controls and regular audits to maintain its license to operate and stakeholder trust.

Environmental factors

Global climate change policies and ambitious decarbonization goals are fueling a resurgence in nuclear energy's appeal as a low-carbon power source. This trend presents a substantial opportunity for Orano, given that its core operations directly contribute to reducing CO2 emissions. The company is actively aligning its strategic priorities with the Paris Agreement, a commitment that includes embedding climate considerations into its comprehensive risk management framework.

Orano SA's environmental strategy heavily focuses on the safe management of radioactive waste, a critical aspect of the nuclear lifecycle. This commitment translates into developing and deploying sophisticated treatment and recycling technologies aimed at minimizing waste volume and its inherent radiotoxicity.

The company is actively involved in creating long-term solutions for nuclear waste, with deep geological repositories being a key focus for safely containing this environmental burden. As of 2024, Orano continues to invest in research and development for advanced waste management techniques, reflecting the ongoing global need for secure nuclear waste disposal strategies.

Orano is actively championing resource preservation by embedding circular economy principles throughout the nuclear fuel cycle, notably by recycling spent nuclear materials. This strategy significantly curtails the need for virgin resources and lessens the overall environmental footprint.

The company is also broadening its capabilities to include the recycling of other critical materials, such as those essential for battery manufacturing, reflecting a commitment to broader resource efficiency. In 2024, Orano continued to invest in its recycling facilities, aiming to process an increased volume of spent fuel, thereby contributing to a more sustainable nuclear industry.

Environmental Impact of Mining Operations

Uranium mining, Orano's core business, presents significant environmental challenges. These include substantial land disturbance, considerable water consumption, and the risk of potential contamination of soil and water resources. Orano's commitment to mitigating these impacts is demonstrated through ongoing site remediation efforts and strict adherence to evolving environmental regulations.

The company's environmental stewardship is exemplified by projects like the Cluff Lake site, which has transitioned to an Institutional Control Program. This program ensures long-term management and monitoring of the site post-closure, reflecting a dedication to environmental rehabilitation. In 2023, Orano reported spending €163 million on environmental protection and remediation activities across its global operations.

- Land Disturbance: Mining activities can alter landscapes and ecosystems.

- Water Usage: Significant water resources are often required for mining processes.

- Contamination Risk: Potential for soil and water contamination from mining byproducts.

- Remediation Investment: Orano invested €163 million in environmental protection in 2023.

Water Management and Biodiversity Protection

Orano SA's operations, particularly its nuclear facilities and mining activities, place a significant demand on water resources. Effective water management is therefore a crucial environmental factor. The company must diligently manage its water footprint, ensuring compliance with an increasing array of environmental regulations aimed at safeguarding local water bodies. For instance, in 2023, Orano reported using approximately 10 million cubic meters of water across its global operations, with a focus on recycling and reducing consumption.

Biodiversity protection is also a key component of Orano's environmental strategy, especially when operating in ecologically sensitive regions. This integration into operational planning involves detailed impact assessments and mitigation strategies. For example, Orano's Namibian operations have implemented programs to protect the desert-adapted fauna, including monitoring and habitat preservation efforts. Their 2024 sustainability report highlighted a 5% reduction in water intensity per tonne of uranium processed compared to 2022 levels.

- Water Usage: Orano's global operations consumed roughly 10 million cubic meters of water in 2023, emphasizing recycling and reduction initiatives.

- Regulatory Compliance: Strict adherence to water management regulations is paramount to protect local aquatic ecosystems.

- Biodiversity Measures: Operational planning incorporates biodiversity protection, with specific programs in place for sensitive ecological areas.

- Efficiency Gains: In 2024, Orano achieved a 5% reduction in water intensity per tonne of uranium processed, showcasing progress in water management efficiency.

Global shifts towards decarbonization are making nuclear energy more attractive, a trend that benefits Orano as its activities reduce CO2 emissions. The company aligns its strategy with the Paris Agreement, integrating climate considerations into its risk management. Orano's environmental focus includes the safe management and recycling of radioactive waste, aiming to minimize volume and radiotoxicity, with ongoing R&D for advanced disposal solutions as of 2024.

Orano champions resource preservation through circular economy principles, recycling spent nuclear materials to reduce virgin resource reliance and environmental impact. This extends to recycling critical materials for battery manufacturing. In 2024, investments in recycling facilities aimed to increase processing volumes, supporting a more sustainable nuclear sector.

Uranium mining, Orano's core business, presents environmental challenges like land disturbance, water consumption, and contamination risks. The company addresses these through site remediation and regulatory compliance. For example, the Cluff Lake site is now under an Institutional Control Program for long-term management. Orano invested €163 million in environmental protection and remediation in 2023.

Water management is critical for Orano's operations, especially in mining and nuclear facilities. The company focuses on managing its water footprint and complying with evolving regulations. In 2023, Orano used approximately 10 million cubic meters of water globally, prioritizing recycling and reduction. Biodiversity protection is also key, with programs like those in Namibia for desert-adapted fauna. By 2024, Orano achieved a 5% reduction in water intensity per tonne of uranium processed compared to 2022.

| Environmental Factor | Description | Orano's Actions/Data |

|---|---|---|

| Climate Change & Decarbonization | Growing demand for low-carbon energy sources. | Orano's operations reduce CO2 emissions; alignment with Paris Agreement. |

| Waste Management | Safe handling and disposal of radioactive waste. | Developing advanced treatment, recycling, and deep geological repository solutions. |

| Resource Preservation | Minimizing virgin resource use and environmental footprint. | Circular economy principles, recycling spent nuclear materials and battery materials. |

| Mining Impacts | Land disturbance, water use, contamination risks. | Site remediation, regulatory compliance, €163M invested in environmental protection (2023). |

| Water Management | Efficient use and protection of water resources. | Used ~10M m³ water (2023); 5% reduction in water intensity per tonne uranium (2024). |

| Biodiversity | Protecting ecosystems in operational areas. | Impact assessments and mitigation strategies; programs for desert fauna in Namibia. |

PESTLE Analysis Data Sources

Our Orano SA PESTLE Analysis is built upon a robust foundation of data from official government publications, international economic organizations, and leading industry analysis firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors influencing Orano's operations.