Orano SA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orano SA Bundle

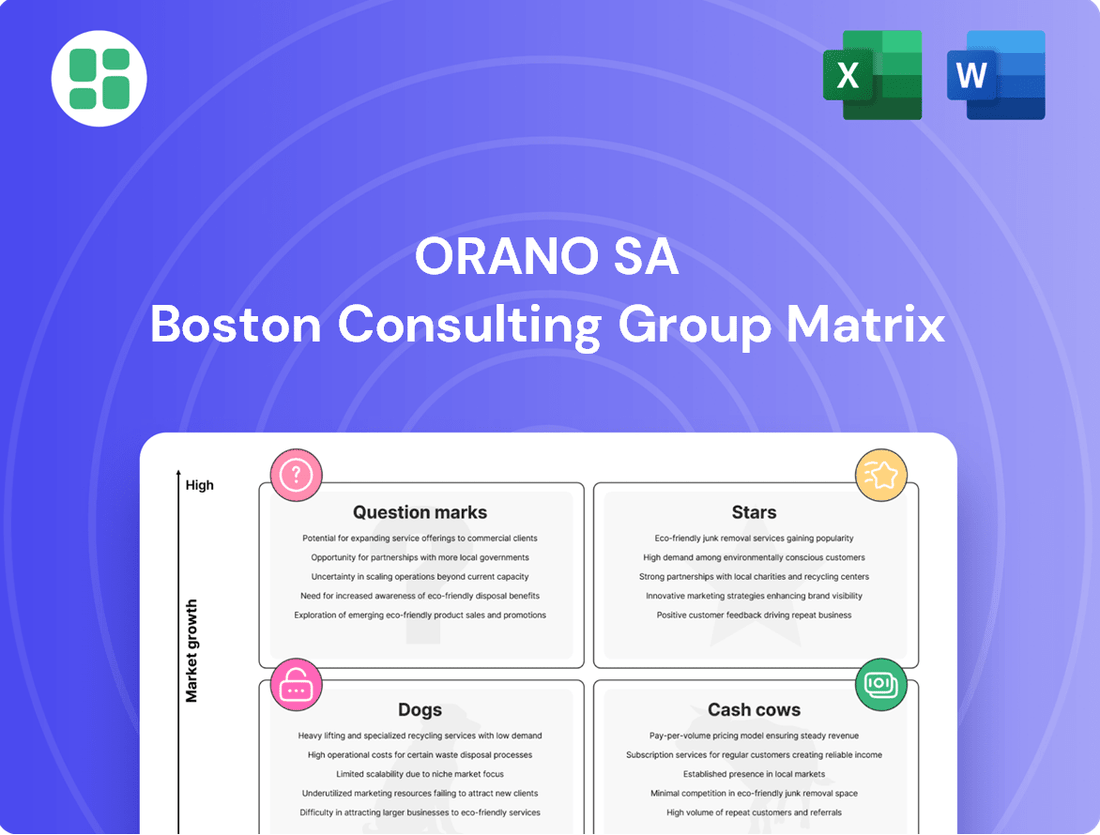

Uncover the strategic positioning of Orano SA's diverse portfolio with our comprehensive BCG Matrix analysis. See where their ventures fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth and resource allocation.

This snapshot offers a glimpse into Orano SA's market dynamics, but the full BCG Matrix report provides the granular detail and actionable insights needed to navigate the complexities of the nuclear energy sector. Purchase the complete analysis to unlock strategic clarity and drive informed investment decisions.

Stars

Orano's nuclear fuel recycling and treatment business is a star in its portfolio. It holds a strong position in a market that's expanding due to the global push for better nuclear waste management and making the most of resources. This segment is vital for making nuclear energy more sustainable by cutting down waste.

In 2024, Orano saw impressive performance in this area, largely thanks to major contracts, especially within the Back End of the fuel cycle. This success highlights Orano's leadership in a sector that's becoming increasingly important as countries focus on responsible nuclear energy practices and circular economy principles.

Orano is making a significant investment of €1.75 billion to boost its Georges Besse II enrichment plant's capacity. This expansion is set to increase production by more than 30% by 2028-2030.

This move highlights Orano's strong standing in a favorable Front End market. It's a strategic play to address the rising global demand for enriched uranium, reinforcing their leading role in a rapidly expanding segment of the nuclear fuel cycle.

Orano SA's global uranium mining diversification efforts are a strategic move to bolster its position in a growing market. The company is channeling investments into promising new projects like Zuuvch Ovoo in Mongolia, aiming to tap into new supply sources. This expansion is crucial for meeting the anticipated surge in uranium demand, driven by a renewed global focus on nuclear energy as a clean power solution.

Furthermore, Orano is pioneering innovative extraction techniques, such as the SABRE method at its McClean Lake site in Canada. This technological advancement not only enhances operational efficiency but also underscores Orano's commitment to sustainable and responsible mining practices. By diversifying its geographical footprint and embracing cutting-edge technology, Orano is positioning itself to maintain a significant market share and capitalize on the projected growth in the uranium sector.

Nuclear Decommissioning and Waste Management Solutions

Orano is significantly expanding its expertise in nuclear decommissioning and waste management, a sector gaining critical importance as aging nuclear power plants globally reach the end of their operational lives.

The company provides integrated, cradle-to-grave services, positioning it with a strong market share in an industry heavily influenced by regulatory requirements and the natural lifecycle of nuclear installations. This strategic focus guarantees a steady demand for Orano's specialized skills and services.

- Market Growth: The global nuclear decommissioning market is projected to grow substantially, with estimates suggesting it could reach over $100 billion by 2030, driven by the increasing number of reactors slated for retirement.

- Orano's Role: Orano's comprehensive solutions cover dismantling, waste treatment, and site remediation, offering a full spectrum of services to clients.

- Revenue Contribution: While specific figures for this segment are often embedded within broader financial reports, the increasing number of decommissioning projects worldwide indicates a growing revenue stream for companies like Orano. For instance, in 2023, Orano reported revenues of €2.3 billion, with its Waste Management and Decommissioning division playing a key role in its diversified portfolio.

- Strategic Importance: This segment aligns with Orano's overall strategy of managing the entire nuclear fuel cycle, ensuring long-term sustainability and a stable business base.

Development of Advanced Reactor Fuel Cycle Support

Orano is making significant investments in the fuel cycle support for advanced nuclear reactors, particularly Small Modular Reactors (SMRs). This strategic focus targets a high-growth segment within the nuclear energy sector, anticipating substantial future demand.

By concentrating on fuel supply and waste management solutions for these innovative reactor designs, Orano aims to secure a leading market position. This proactive approach aligns with the global push towards cleaner energy sources and advanced nuclear technologies.

- Strategic Investment in SMR Fuel Cycle: Orano is channeling resources into developing and securing the supply chain for advanced reactor fuels, a critical component for the burgeoning SMR market.

- High-Growth Market Potential: The SMR sector is projected for rapid expansion, and Orano's positioning in fuel provision and waste management is designed to capitalize on this anticipated growth.

- Capturing Emerging Market Share: By offering comprehensive fuel cycle support for next-generation nuclear technologies, Orano is setting itself up to become a key player in this evolving and expanding market.

Orano's nuclear fuel recycling and treatment business is a star in its portfolio. It holds a strong position in a market that's expanding due to the global push for better nuclear waste management and making the most of resources. This segment is vital for making nuclear energy more sustainable by cutting down waste.

In 2024, Orano saw impressive performance in this area, largely thanks to major contracts, especially within the Back End of the fuel cycle. This success highlights Orano's leadership in a sector that's becoming increasingly important as countries focus on responsible nuclear energy practices and circular economy principles.

Orano is making a significant investment of €1.75 billion to boost its Georges Besse II enrichment plant's capacity. This expansion is set to increase production by more than 30% by 2028-2030.

This move highlights Orano's strong standing in a favorable Front End market. It's a strategic play to address the rising global demand for enriched uranium, reinforcing their leading role in a rapidly expanding segment of the nuclear fuel cycle.

Orano SA's global uranium mining diversification efforts are a strategic move to bolster its position in a growing market. The company is channeling investments into promising new projects like Zuuvch Ovoo in Mongolia, aiming to tap into new supply sources. This expansion is crucial for meeting the anticipated surge in uranium demand, driven by a renewed global focus on nuclear energy as a clean power solution.

Furthermore, Orano is pioneering innovative extraction techniques, such as the SABRE method at its McClean Lake site in Canada. This technological advancement not only enhances operational efficiency but also underscores Orano's commitment to sustainable and responsible mining practices. By diversifying its geographical footprint and embracing cutting-edge technology, Orano is positioning itself to maintain a significant market share and capitalize on the projected growth in the uranium sector.

Orano is significantly expanding its expertise in nuclear decommissioning and waste management, a sector gaining critical importance as aging nuclear power plants globally reach the end of their operational lives.

The company provides integrated, cradle-to-grave services, positioning it with a strong market share in an industry heavily influenced by regulatory requirements and the natural lifecycle of nuclear installations. This strategic focus guarantees a steady demand for Orano's specialized skills and services.

Orano is making significant investments in the fuel cycle support for advanced nuclear reactors, particularly Small Modular Reactors (SMRs). This strategic focus targets a high-growth segment within the nuclear energy sector, anticipating substantial future demand.

By concentrating on fuel supply and waste management solutions for these innovative reactor designs, Orano aims to secure a leading market position. This proactive approach aligns with the global push towards cleaner energy sources and advanced nuclear technologies.

| Segment | BCG Category | Key Drivers & Data (2024 Focus) | Strategic Importance |

| Nuclear Fuel Recycling & Treatment | Star | Growing demand for sustainable nuclear energy; strong performance in Back End contracts. | Vital for resource optimization and waste reduction in nuclear power. |

| Uranium Enrichment | Star | €1.75 billion investment in Georges Besse II plant for >30% capacity increase by 2028-2030; rising global demand for enriched uranium. | Reinforces leading role in the expanding Front End market. |

| Uranium Mining | Star | Investment in new projects (e.g., Zuuvch Ovoo, Mongolia); pioneering SABRE extraction method in Canada; global focus on nuclear as clean energy. | Diversifies supply and capitalizes on projected growth in the uranium sector. |

| Decommissioning & Waste Management | Star | Global market projected to exceed $100 billion by 2030; Orano's comprehensive services; 2023 revenue contribution of €2.3 billion (division impact). | Aligns with full nuclear lifecycle management and ensures stable business. |

| SMR Fuel Cycle Support | Star | Strategic investment in advanced reactor fuels; SMR sector projected for rapid expansion; capturing emerging market share. | Positions Orano as a key player in next-generation nuclear technologies. |

What is included in the product

Orano SA's BCG Matrix analysis categorizes its business units to guide strategic decisions on investment, divestment, and resource allocation.

A clear BCG Matrix visually identifies Orano's Stars and Cash Cows, alleviating the pain of resource allocation uncertainty.

Cash Cows

Orano SA's established uranium mining operations are clear cash cows, consistently generating substantial revenue and robust cash flow. These mature assets benefit from Orano's leading global position in uranium production, a sector that has shown bullish trends in both spot and term prices, with the average spot price for uranium oxide (U3O8) reaching approximately $70 per pound in early 2024, a significant increase from previous years. This segment is the bedrock of the nuclear fuel cycle, providing essential raw materials that underpin global energy needs.

Orano's nuclear fuel fabrication, including MOX fuel, is a cornerstone of its operations, leveraging decades of expertise and established infrastructure. This mature business segment holds a significant market share, consistently providing vital fuel for nuclear reactors worldwide. The stable demand for these essential components underscores its role as a reliable cash generator within the nuclear fuel cycle.

Orano SA's Nuclear Logistics and Transport Services are a classic Cash Cow. These specialized services, including nuclear packaging and international transport, boast high barriers to entry due to stringent regulations and safety requirements. Established long-term contracts provide a predictable and robust revenue stream, solidifying its strong market share in this mature but vital sector of the nuclear industry.

Conversion Services

Orano's conversion services, a critical step in preparing uranium for enrichment, represent a significant Cash Cow within its business portfolio. This segment benefits from a high market share, driven by the fundamental necessity of these services across the nuclear fuel cycle and Orano's well-established industrial capabilities.

The consistent demand for uranium conversion, coupled with Orano's strong market position, ensures a steady and reliable cash flow, characteristic of a Cash Cow. This segment operates in a mature market where established players like Orano dominate, making it difficult for new entrants to compete effectively.

Key aspects of Orano's conversion services include:

- Essential role in the nuclear fuel cycle: Transforming uranium ore into uranium hexafluoride (UF6) for enrichment.

- High market share: Orano is one of the few global leaders in uranium conversion.

- Mature market dynamics: Stable demand with limited but significant competition.

- Consistent cash generation: Provides a reliable financial foundation for the company.

In 2023, the global uranium conversion market continued to show resilience, with demand underpinned by existing and planned nuclear power generation. Orano's conversion facilities, such as those in France and Canada, are crucial to supplying this demand, contributing significantly to the company's overall revenue and profitability.

Long-term Back End Contracts (excluding one-offs)

Orano SA's long-term Back End contracts, excluding one-off deals, represent a significant cash cow. These multi-year agreements, like the Treatment-Recycling contract with EDF, offer a highly predictable and substantial revenue stream.

This segment is characterized by a high market share in a mature industry, ensuring consistent and robust cash flow generation for Orano.

- Stable Revenue: Long-term contracts provide a reliable income base.

- Mature Segment: High market share in a well-established industry.

- Predictable Cash Flow: Consistent generation of significant cash for the company.

Orano's established uranium mining operations are clear cash cows, consistently generating substantial revenue and robust cash flow. These mature assets benefit from Orano's leading global position in uranium production, a sector that has shown bullish trends in both spot and term prices, with the average spot price for uranium oxide (U3O8) reaching approximately $70 per pound in early 2024, a significant increase from previous years. This segment is the bedrock of the nuclear fuel cycle, providing essential raw materials that underpin global energy needs.

Orano's nuclear fuel fabrication, including MOX fuel, is a cornerstone of its operations, leveraging decades of expertise and established infrastructure. This mature business segment holds a significant market share, consistently providing vital fuel for nuclear reactors worldwide. The stable demand for these essential components underscores its role as a reliable cash generator within the nuclear fuel cycle.

Orano SA's Nuclear Logistics and Transport Services are a classic Cash Cow. These specialized services, including nuclear packaging and international transport, boast high barriers to entry due to stringent regulations and safety requirements. Established long-term contracts provide a predictable and robust revenue stream, solidifying its strong market share in this mature but vital sector of the nuclear industry.

Orano's conversion services, a critical step in preparing uranium for enrichment, represent a significant Cash Cow within its business portfolio. This segment benefits from a high market share, driven by the fundamental necessity of these services across the nuclear fuel cycle and Orano's well-established industrial capabilities.

Delivered as Shown

Orano SA BCG Matrix

The Orano SA BCG Matrix preview you see is the definitive report you will receive upon purchase, offering a comprehensive strategic overview. This document is fully formatted and ready for immediate application, containing no watermarks or placeholder content, ensuring you get the complete, professional analysis. What you are viewing is the exact same BCG Matrix file that will be delivered to you, meticulously prepared for strategic decision-making and business planning. This preview accurately represents the final, unedited BCG Matrix report, providing you with a clear and actionable tool for evaluating Orano SA's business portfolio. Upon completing your purchase, you will gain instant access to this entire, professionally designed BCG Matrix, empowering your strategic insights without any further modifications required.

Dogs

Orano SA has officially confirmed the loss of control over its Niger operations, a move that has significantly impacted its mining segment's earnings. This situation directly affects the operating income, prompting the exclusion of these subsidiaries from Orano's consolidated financial reports.

The Niger mining segment, once a substantial investment, now faces a low to non-existent market share and a negative financial impact. This scenario aligns perfectly with the characteristics of a 'Dog' in the BCG matrix, as it consumes resources without yielding any returns.

For instance, prior to this disruption, Niger was a key uranium producer for Orano. However, following the political instability and the formal acknowledgment of lost control in 2024, the financial contribution from these assets has effectively ceased, underscoring their 'Dog' status.

Legacy site remediation without defined commercial value, while a necessary part of operations for companies like Orano SA, often falls into the 'Dog' category of the BCG matrix. These are projects that require significant investment to address historical environmental obligations, such as cleaning up former mining or processing sites. For instance, Orano's commitment to managing the environmental legacy of its past activities in regions like La Hague, France, involves substantial, ongoing expenditure.

These remediation efforts, though crucial for regulatory compliance and corporate responsibility, typically do not generate direct revenue or contribute to market share expansion. They are resource-intensive, demanding specialized expertise and long-term financial commitment without a clear return on investment in terms of new business growth. This classification highlights the strategic challenge of balancing essential environmental stewardship with the pursuit of profitable market opportunities.

Underperforming or obsolete technologies within Orano SA's portfolio, such as older uranium enrichment or processing facilities that haven't undergone significant modernization, would fall into the Dogs category. These assets may still require operational expenses but contribute little to the company's overall market share or profitability in today's competitive nuclear fuel cycle landscape. For instance, if Orano has legacy enrichment plants with higher energy consumption or lower output efficiency compared to newer centrifuge technologies, they would represent a classic example.

Non-core, Divested Assets

Non-core, divested assets for Orano SA would represent business units or assets that the company has recently sold off or plans to sell. These are typically characterized by low market share and limited growth potential, making them less strategic for Orano's long-term objectives.

These divested assets often consume resources without generating significant returns, acting as cash traps. Their divestiture allows Orano to focus on more promising areas of its business. For instance, in 2023, Orano completed the divestment of its stake in the Trekkopje uranium mine in Namibia, a move aligned with optimizing its portfolio.

- Divested Assets: Businesses with low market share and minimal growth prospects.

- Cash Flow Impact: Typically generate little to no cash and are considered cash traps.

- Strategic Rationale: Divestiture allows for resource reallocation to core, high-growth areas.

- Example: Orano's 2023 divestment of its stake in the Trekkopje uranium mine in Namibia.

Unsuccessful Exploration Ventures

Unsuccessful exploration ventures for Orano SA, falling under the 'Dogs' category in a BCG matrix analysis, represent significant capital outlays that have not resulted in commercially viable uranium deposits. These projects, despite initial promise and investment, have failed to deliver the expected returns, becoming what are often termed sunk costs.

These ventures consume financial resources without generating any positive return on investment. Furthermore, they do not contribute to Orano's market share or competitive standing in the global mining sector. By 2024, the mining industry, including uranium, faced heightened scrutiny on capital efficiency, making such non-performing assets a drag on overall financial health.

- Capital Drain: Exploration projects that fail to identify commercially viable reserves represent a direct outflow of capital with no anticipated future revenue stream.

- Market Share Stagnation: These ventures do not enhance Orano's position in the uranium market, as they do not translate into new production or increased supply.

- Negative ROI: The return on investment for these unsuccessful ventures is inherently negative, as the initial expenditure is unrecoverable and no future profits are expected.

Orano SA's Niger operations, following the loss of control confirmed in 2024, now represent a classic 'Dog' in the BCG matrix. These assets, once a significant contributor to uranium production, now have a negligible market share and are a drain on resources without generating returns.

Legacy site remediation projects, essential but non-revenue generating, also fit the 'Dog' profile. These require ongoing investment for environmental stewardship, such as Orano's commitments in La Hague, France, without direct commercial upside.

Divested assets, like Orano's 2023 exit from the Trekkopje uranium mine in Namibia, are also categorized as 'Dogs'. These are non-core, low-growth units that consume capital, and their sale allows Orano to reallocate resources to more promising ventures.

Unsuccessful exploration ventures, which by 2024 represented a significant capital drain in the mining industry due to scrutiny on efficiency, are 'Dogs'. These ventures consume financial resources without yielding commercially viable deposits or enhancing market share.

| Category | Description | Orano SA Example | Market Share | Growth Potential | Cash Flow |

| Dogs | Low market share, low growth potential, often cash traps. | Niger Operations (post-2024), Legacy Site Remediation, Divested Assets (e.g., Trekkopje), Unsuccessful Exploration | Low to Non-existent | Low | Negative to Neutral |

Question Marks

Orano is actively investing in Small Modular Reactors (SMRs) and their associated supply chains, acknowledging the significant growth prospects these advanced nuclear technologies offer for meeting global energy demands. This strategic focus positions Orano to capitalize on a rapidly evolving market.

Despite the promising outlook, SMRs are still considered nascent technologies with an underdeveloped market. Consequently, Orano's current market share in this emerging sector is minimal, necessitating substantial investment to secure future market gains and establish a strong competitive position.

Orano Med is positioned as a Star within Orano SA's BCG Matrix. It represents a significant diversification into the high-growth nuclear medicine sector, particularly in radiotherapies for cancer treatment. The company has made unprecedented advances, signing new agreements in 2024 to further its development in this innovative market.

While the market for radiotherapies is expanding rapidly, Orano Med's market share is currently modest as it continues to establish its presence and bring its novel therapies to commercialization. This suggests a business with strong growth potential that requires continued investment to capture market share and solidify its position.

Orano SA is actively investing in advanced waste treatment and recycling technologies, focusing on R&D for innovative processes. This includes recovering radioactive liquids and metals for potential industrial reuse, aligning with a circular economy model. These cutting-edge solutions represent a significant future growth opportunity, though their current market presence is minimal as they remain in the research and development or early adoption phases, demanding substantial financial commitment.

New Geographical Market Entries for Reactor Construction

Orano SA is strategically focusing on new geographical markets for reactor construction, particularly in Central and Eastern Europe, Asia, and North America. These regions represent significant growth potential for nuclear energy, driven by energy security needs and decarbonization goals. For instance, Poland has ambitious plans to build its first nuclear power plants, with a target of 6,000 MW by 2033, and Orano is a key player in discussions. Similarly, countries like the Czech Republic and Slovakia are also exploring new reactor projects.

While these emerging markets offer substantial opportunities, Orano's current market share in securing *new* reactor construction contracts in these specific programs is still in its nascent stages. This necessitates considerable strategic investment and the formation of robust partnerships. For example, Orano has signed agreements with companies like GE Hitachi Nuclear Energy to collaborate on small modular reactor (SMR) projects, aiming to leverage these emerging technologies in new markets.

- Central and Eastern Europe: Orano is actively pursuing opportunities in countries like Poland, which aims to have its first nuclear power plant operational by 2030, with a second phase planned for the early 2030s.

- Asia: China continues to be a major market for new reactor construction, with ongoing projects and plans for future expansion. Orano is involved in the fuel cycle services for several Chinese reactors.

- North America: The United States is seeing renewed interest in nuclear power, including the development of SMRs. Orano is collaborating on SMR projects, such as the one with GE Hitachi, targeting deployment in the mid-2020s.

- Market Share Development: Orano's position in these *new* construction contracts is actively being built through strategic partnerships and technological offerings, requiring significant upfront investment to establish a competitive foothold.

Digital Solutions for Nuclear Operations (AI-Powered Maintenance)

Orano is leveraging AI-powered predictive maintenance to boost efficiency and minimize downtime in its nuclear operations. This initiative falls into the high-growth category of industrial digitalization, reflecting a significant market opportunity.

While Orano is actively implementing these advanced digital solutions internally, its market share in offering them as a distinct commercial product to external clients is likely still in its early stages. This suggests a need for further development and strategic market penetration to capitalize on this growth area.

- AI-Powered Maintenance: Orano's investment in AI for predictive maintenance aims to optimize asset performance and reduce unexpected outages.

- Market Potential: The industrial digitalization sector, particularly AI in maintenance, is experiencing robust growth, with the global AI in industrial market projected to reach significant figures by 2030. For instance, reports indicate the market could exceed $20 billion by then, with a substantial portion driven by predictive maintenance solutions.

- Orano's Position: Orano is building capabilities in this digital solutions space, positioning itself to potentially offer these services externally in the future.

- Strategic Focus: The company's efforts here align with a broader trend of digital transformation in heavy industries, where efficiency gains and cost reductions are paramount.

Orano's investments in Small Modular Reactors (SMRs) and their supply chains represent a significant future growth opportunity, though the market is still developing and Orano's current share is minimal. This positions SMRs as potential Question Marks within Orano's BCG Matrix, requiring substantial investment to capture future market gains and establish a strong competitive presence in this emerging sector.

Orano Med, focusing on radiotherapies, is currently a Star, demonstrating high growth potential in a rapidly expanding market. However, its market share remains modest, necessitating continued investment to solidify its position and commercialize its novel therapies.

The company's engagement in advanced waste treatment and recycling technologies also points to a Question Mark. While these areas offer substantial future growth, their current market presence is minimal, demanding significant financial commitment for research, development, and early adoption phases.

Similarly, Orano's push into new geographical markets for reactor construction, particularly in Central and Eastern Europe and Asia, presents a Question Mark. While these regions offer substantial opportunities, Orano's market share in securing new construction contracts is nascent, requiring considerable investment and strategic partnerships to build a competitive foothold.

BCG Matrix Data Sources

Our BCG Matrix leverages Orano SA's official annual reports and financial disclosures, alongside industry-specific market research and growth forecasts to accurately assess business unit performance and market share.