Orano SA Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orano SA Bundle

Orano SA's marketing mix is a powerful engine driving its position in the global nuclear energy sector. This analysis delves into their product offerings, from uranium mining to waste management, and their strategic pricing that reflects value and market dynamics.

Discover how Orano SA leverages its extensive global network for optimal product placement, ensuring accessibility and reliability for their diverse clientele. This includes understanding their sophisticated distribution channels and the strategic advantage they provide.

Uncover the nuances of Orano SA's promotional strategies, examining how they build brand awareness and communicate their commitment to safety and sustainability. This full analysis provides actionable insights into their communication mix.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Orano SA's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Orano SA's product offering in uranium mining and conversion provides essential raw materials for global nuclear power. In 2023, Orano's mining activities contributed to a significant portion of global uranium supply, with production figures reaching approximately 7,000 tonnes of uranium. Their conversion services, transforming uranium into UF6, are crucial for enriching fuel, with the company processing substantial volumes annually to meet the demands of nuclear reactors worldwide, supporting energy security for many nations.

Orano SA's uranium enrichment services are a cornerstone of its product offering, providing a crucial step in preparing nuclear fuel. These advanced services concentrate fissile uranium isotopes, making them suitable for powering nuclear reactors worldwide. The Georges Besse II plant, a key facility for Orano, exemplifies their dedication to increasing enrichment capacity to meet rising global demand for nuclear energy.

Orano's nuclear fuel fabrication and recycling capabilities are central to its product offering, positioning the company as a key player in the nuclear lifecycle. They are a leading global supplier of fuel assemblies for various reactor types, ensuring reliable energy production for their clients. This expertise is complemented by their advanced recycling processes, such as those at La Hague, which are critical for waste reduction and resource recovery.

The company's commitment to a circular economy in nuclear energy is demonstrated through its recycling of used nuclear materials. This process not only minimizes the volume of high-level waste but also reclaims valuable fissile materials, contributing to resource efficiency. For instance, Orano's recycling operations recovered approximately 96% of the uranium and 99% of the plutonium from spent fuel in 2023, underscoring their technological prowess and environmental stewardship.

Nuclear Decommissioning and Waste Management

Orano SA provides comprehensive services for nuclear facility decommissioning and radioactive waste management, covering the entire lifecycle of nuclear assets. These solutions ensure the safe and responsible handling of materials post-operation, a critical aspect for long-term nuclear safety and environmental protection. In 2023, Orano's revenue from its Waste Management and Decommissioning segment was approximately €1.2 billion.

The company's expertise is vital for addressing the legacy of nuclear power generation. Orano's capabilities include dismantling retired nuclear power plants and managing various types of radioactive waste, from low-level to high-level. This commitment to safety and environmental stewardship underpins the sustainability of nuclear energy.

- Extensive Decommissioning Services: Orano handles the complete dismantling of nuclear facilities.

- Comprehensive Waste Management: The company offers solutions for all categories of radioactive waste.

- Lifecycle Responsibility: Orano ensures safe and responsible material handling from plant closure to final disposal.

- Environmental Protection Focus: These services are essential for mitigating the environmental impact of nuclear operations.

Nuclear Medicine and Strategic Metals

Orano SA is strategically expanding its business into nuclear medicine, focusing on the development and production of radioisotopes crucial for cancer therapies. This diversification leverages Orano's core nuclear competencies to address significant healthcare needs, showcasing an innovative approach to societal contribution beyond traditional energy sectors.

The company is also actively involved in the valuation of strategic metals, an area vital for various advanced industries, including renewable energy and defense. This dual focus on nuclear medicine and strategic metals reflects a sophisticated portfolio management strategy aimed at capturing growth opportunities in high-value markets.

Recent collaborations underscore this strategic push, with notable agreements such as those with Sanofi, a global pharmaceutical leader. These partnerships are designed to accelerate the development and commercialization of radiopharmaceutical products, positioning Orano as a key player in the burgeoning nuclear medicine landscape.

- Radioisotope Production: Orano is investing in facilities for producing isotopes like Lutetium-177, a key component in targeted radionuclide therapy for prostate and neuroendocrine cancers. The global market for radiopharmaceuticals was valued at over $5 billion in 2023 and is projected to grow significantly.

- Strategic Metals Valuation: The company's expertise extends to assessing the value of metals such as rare earths and lithium, essential for electric vehicle batteries and advanced electronics. Demand for lithium, for instance, is expected to more than double by 2030.

- Partnerships for Growth: Collaborations with pharmaceutical giants like Sanofi aim to streamline the supply chain for nuclear medicine treatments, ensuring timely access to life-saving therapies for patients.

Orano SA's product portfolio is diverse, encompassing the entire nuclear fuel cycle and extending into nuclear medicine and strategic metals. Their core offerings include uranium mining and conversion, enrichment, fuel fabrication, recycling, and waste management. In 2023, Orano's mining output was approximately 7,000 tonnes of uranium, and their recycling operations recovered 96% of uranium from spent fuel. The company also generated around €1.2 billion from its Waste Management and Decommissioning segment in 2023.

| Product Segment | Key Offerings | 2023/2024 Data Points |

| Uranium Mining & Conversion | Uranium ore extraction, milling, and conversion to UF6 | ~7,000 tonnes uranium produced (Mining); Significant volumes processed for conversion |

| Enrichment | Uranium isotope concentration for fuel | Georges Besse II plant capacity expansion |

| Fuel Fabrication & Recycling | Fuel assemblies, used fuel recycling | Leading global supplier; ~99% plutonium recovered from spent fuel (Recycling) |

| Decommissioning & Waste Management | Dismantling facilities, waste handling | ~€1.2 billion revenue (Waste Management); Comprehensive solutions for all waste types |

| Nuclear Medicine & Strategic Metals | Radioisotopes for therapy, valuation of critical metals | Partnerships with Sanofi; Lutetium-177 production; Valuing metals like lithium and rare earths |

What is included in the product

This analysis delves into Orano SA's marketing mix, examining its comprehensive product portfolio, pricing strategies within the nuclear fuel cycle, global distribution and service network, and promotional efforts focused on expertise and sustainability.

Simplifies Orano SA's marketing strategy by clearly outlining their 4Ps, alleviating the pain of complex market analysis for actionable insights.

Provides a concise, easy-to-understand overview of Orano SA's 4Ps, streamlining marketing discussions and ensuring alignment across teams.

Place

Orano SA boasts a substantial global operational footprint, crucial for its role in the nuclear fuel cycle. The company actively engages in uranium mining, processing, and waste management across key continents. This international network includes significant operations in Canada, a major uranium-producing nation, and France, its home base with extensive nuclear infrastructure.

Further extending its reach, Orano is involved in ongoing projects in Mongolia and Uzbekistan, tapping into emerging resource opportunities. This widespread presence ensures proximity to vital uranium resources and allows for efficient service delivery to a diverse international clientele within the nuclear energy sector. Their global operations are essential for maintaining a competitive edge and meeting the complex demands of the industry.

Orano SA's direct sales approach and long-term contracts are cornerstones of its marketing mix, especially given the specialized nature of its nuclear fuel cycle services. This strategy ensures a stable revenue stream by locking in business with major global utilities and government entities.

Securing multi-year agreements, like those with Japanese utilities and EDF, highlights the strategic importance and high value of Orano's offerings. These contracts, often spanning several years, provide significant revenue visibility and underpin the company's financial predictability.

As of early 2024, Orano's substantial order backlog, representing several years of future revenue, underscores the success of this direct sales and long-term contracting model. This backlog is a critical indicator of sustained demand for its specialized services.

Orano SA actively cultivates strategic partnerships and joint ventures, especially within uranium mining and the burgeoning fields of new technology development. These collaborations are vital for broadening market reach and facilitating the exchange of specialized knowledge. For instance, Orano has engaged in joint ventures for Canadian uranium projects, underscoring its commitment to global resource access.

Further demonstrating this strategy, Orano is involved in initiatives targeting nuclear medicine and the development of battery materials. These alliances are instrumental in navigating the complexities of international markets and fostering the creation of innovative solutions, positioning Orano at the forefront of technological advancement in its core sectors.

Secure Logistics and Transportation

Orano SA manages a highly specialized logistics and transportation network crucial for nuclear materials. This network prioritizes safety and strict adherence to international regulations, ensuring the secure movement of sensitive cargo. A key element is their development of advanced packaging solutions, such as the TN Eagle container, which exemplifies their commitment to secure handling.

The reliability of Orano's transportation services is fundamental to the entire nuclear fuel cycle. This includes everything from uranium mining and enrichment to the eventual recycling of spent fuel. Their logistical expertise underpins the operational continuity and safety assurance for their global clientele.

- Specialized Network: Operates a global, highly regulated logistics network for nuclear materials.

- Safety & Compliance: Adheres to stringent international safety and security standards.

- Advanced Packaging: Utilizes and develops cutting-edge packaging like the TN Eagle for enhanced security.

- Fuel Cycle Integration: Essential for the seamless operation of the entire nuclear fuel lifecycle.

Customer-Specific Project Delivery

Orano SA's 'place' strategy in customer-specific project delivery emphasizes direct engagement and tailored solutions. This approach is particularly crucial in the nuclear sector, where projects are inherently complex and require specialized on-site execution. For instance, Orano's decommissioning projects and on-site fuel management services are designed to meet the unique requirements of each client's facility, deploying expert teams directly to customer locations.

This direct delivery model ensures that Orano's specialized knowledge and capabilities are applied precisely where needed, fostering close collaboration throughout the project lifecycle. The long-term, high-stakes nature of nuclear operations mandates this customized approach, reinforcing Orano's role as a direct partner in managing critical aspects of the nuclear fuel cycle.

Key aspects of this customer-specific delivery include:

- On-site Expertise Deployment: Orano dispatches specialized teams and equipment directly to customer facilities for services like spent fuel management and dismantling operations.

- Tailored Project Planning: Each project's unique site conditions, regulatory environment, and client objectives dictate a customized delivery plan.

- Direct Client Collaboration: This model fosters continuous communication and partnership, ensuring alignment with customer needs throughout the project.

Orano SA's 'Place' strategy centers on its global operational presence and direct, on-site project execution. This ensures proximity to critical uranium resources and allows for specialized services delivered directly to client facilities, such as spent fuel management and dismantling operations. The company's extensive network, including operations in Canada and France, facilitates this tailored approach, reinforcing its role as a direct partner in the nuclear fuel cycle.

| Operational Area | Key Locations | Strategic Importance |

|---|---|---|

| Uranium Mining & Processing | Canada, Kazakhstan, Niger | Securing raw material supply, global resource access |

| Nuclear Fuel Manufacturing | France, USA | Serving key utility markets, technological expertise |

| Services (Decommissioning, Waste Management) | France, UK, USA | Direct client engagement, specialized project execution |

| Logistics & Transportation | Global network | Safe and compliant movement of nuclear materials |

Same Document Delivered

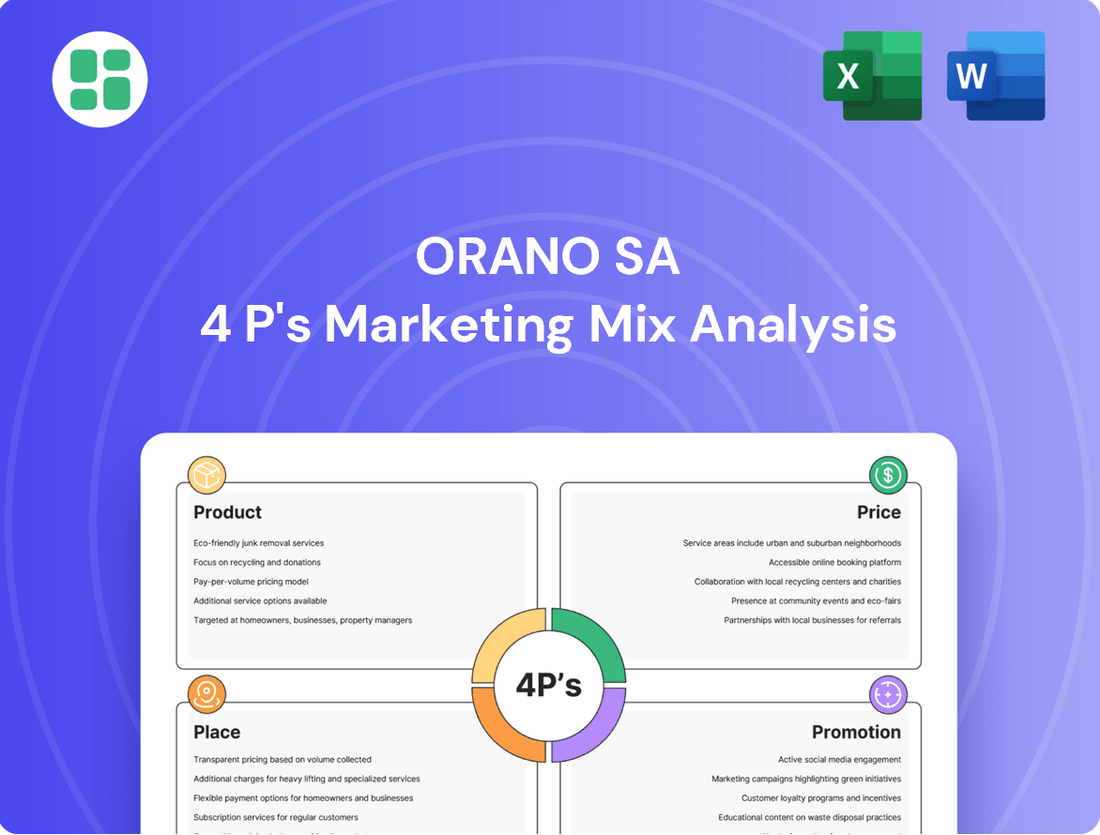

Orano SA 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Orano SA 4P's Marketing Mix Analysis covers all key aspects of their strategy, ensuring you have a complete understanding. You'll gain immediate access to the full report, ready for your review.

Promotion

Orano SA actively participates in and sponsors key international nuclear industry events, such as the World Nuclear Fuel Cycle (WNFC) conference and the Atoms for the Future forum. These engagements in 2024 and projected for 2025 provide platforms to highlight their innovations in areas like advanced reactor fuel and recycling technologies, reinforcing their leadership in the nuclear fuel cycle.

These forums are crucial for Orano to connect with industry peers, potential clients, and regulators, fostering valuable partnerships and influencing future industry standards. For instance, their presentations at the 2024 WNFC showcased their commitment to sustainable nuclear energy solutions, a key differentiator in the market.

Orano SA actively manages its government and regulatory relations, a critical component in the heavily regulated nuclear sector. In 2024, the company continued its engagement with key governmental bodies and international organizations like the IAEA, emphasizing compliance and contributing technical expertise to policy discussions. This proactive approach is vital for securing operational permits and fostering market expansion, especially as global energy policies evolve.

Orano SA's commitment to Corporate Social Responsibility (CSR) and sustainability is a cornerstone of its marketing strategy, fostering trust and addressing public perception. The company's annual activity reports, readily available, showcase their dedication to environmental stewardship, operational safety, and active community involvement. This transparency is crucial for a sector like nuclear energy, where public confidence is paramount.

In 2023, Orano reported a 10% reduction in greenhouse gas emissions intensity compared to 2022, demonstrating tangible progress in their low-carbon initiatives. Their sustainability reports also detail significant investments in local communities, with over €5 million allocated in 2023 for social and economic development projects near their operational sites, reinforcing their role as a responsible corporate citizen.

Technical Publications and Thought Leadership

Orano SA actively showcases its deep expertise through a consistent stream of technical publications, whitepapers, and contributions to scientific journals. This commitment to sharing knowledge positions them as a recognized thought leader within the nuclear science and technology sectors. Their R&D focus, particularly on areas like Small Modular Reactors (SMRs) and advanced fuel recycling, is frequently detailed in these outputs.

This intellectual capital not only highlights Orano's innovative drive but also plays a crucial role in advancing the global understanding and acceptance of nuclear energy solutions. For instance, their ongoing work in developing next-generation recycling technologies aims to enhance the sustainability of the nuclear fuel cycle.

- Thought Leadership: Orano consistently publishes research and analysis, reinforcing its position as a key influencer in nuclear technology discourse.

- Innovation Showcase: Technical papers often detail advancements in areas such as SMR design and waste management, demonstrating tangible R&D progress.

- Industry Advancement: By contributing to scientific understanding, Orano helps foster broader acceptance and development of nuclear solutions.

Digital Presence and Investor Relations

Orano actively manages its digital presence to foster robust investor relations, utilizing its official website, dedicated newsroom, and investor relations portals. These platforms serve as crucial channels for disseminating financial results, outlining strategic advancements, and sharing company updates with a worldwide audience of investors and key decision-makers.

The company prioritizes transparency by making regular financial reports and press releases readily available. For instance, following the close of the 2024 fiscal year, Orano is expected to publish its comprehensive financial reports in early 2025, offering stakeholders timely and accurate information.

This commitment to digital accessibility ensures that financial stakeholders have continuous access to the data needed for informed analysis and decision-making.

- Website & Newsroom: Centralized hub for company information and announcements.

- Investor Relations Portal: Direct access to financial reports, presentations, and shareholder information.

- Q1 2025 Updates: Anticipated release of 2024 financial results and strategic outlook.

- Global Reach: Facilitates communication with an international investor base.

Orano's promotional efforts center on showcasing its technological leadership and commitment to sustainability through participation in key industry events and thought leadership. Their engagement at forums like the World Nuclear Fuel Cycle conference in 2024 and planned 2025 activities highlights innovations in advanced reactor fuels and recycling. This strategic presence reinforces their market position and fosters crucial industry connections.

Price

Orano SA's pricing strategy for its nuclear fuel cycle services, including uranium supply, enrichment, and recycling, is predominantly anchored in long-term, multi-year contractual agreements. This approach ensures revenue predictability for Orano and stability for its clients in a highly capital-intensive industry.

These intricate negotiations often span decades, mirroring the long-term nature of nuclear power plant operations and fuel sourcing requirements. For instance, Orano's recent agreements with Japanese utilities for enriched uranium supply demonstrate this commitment to extended partnerships, securing a consistent revenue stream for the company.

Orano SA utilizes a project-based pricing model for its specialized services, such as nuclear decommissioning, waste management, and complex engineering projects. This approach acknowledges the inherent uniqueness of each undertaking, allowing for bespoke cost estimations that reflect the project's specific scope, intricate nature, stringent regulatory demands, and anticipated timeline.

This flexible pricing strategy enables Orano to create customized financial frameworks precisely aligned with the distinct requirements and challenges presented by each client's project. For instance, in 2024, Orano secured a significant contract for the decommissioning of a Magnox reactor in the UK, with pricing meticulously structured around the project's multi-year duration and the specialized expertise required.

Orano SA employs value-based pricing for its specialized services, particularly in nuclear medicine and advanced recycling. This strategy aligns pricing with the significant intellectual property, specialized infrastructure, and societal benefits delivered. For instance, Orano Med’s pioneering work in targeted alpha therapy reflects this approach, capturing the unique value and return on extensive R&D investments.

Regulatory and Market Influenced Pricing

Orano's pricing is deeply intertwined with the volatile global uranium market. Fluctuations in both spot and long-term uranium prices, driven by supply-demand imbalances and significant geopolitical events, directly shape the company's revenue streams and pricing strategies. For instance, anticipated increases in nuclear power generation globally, coupled with supply constraints from key producing nations, have been observed to push uranium prices higher.

The company's 2024 performance clearly demonstrated this sensitivity. As of mid-2024, uranium spot prices have shown upward momentum, with some reports indicating prices exceeding $30 per pound, a notable increase from previous years, directly impacting Orano's realized prices for its products.

Furthermore, national and international regulatory frameworks, including those related to nuclear safety, environmental standards, and non-proliferation, impose significant costs and influence the overall market structure. These regulations can affect production levels, transportation, and ultimately, the final price of uranium and related services.

Key factors influencing Orano's pricing include:

- Global Uranium Spot and Long-Term Prices: As of mid-2024, spot prices have seen a recovery, trading above $30/lb, influenced by supply concerns and increased demand forecasts.

- Supply-Demand Dynamics: The market anticipates a tightening supply as new projects face delays and existing mines operate at capacity, supporting higher pricing.

- Geopolitical Events: Tensions in major uranium-producing regions can disrupt supply chains, leading to price spikes and influencing Orano's strategic pricing decisions.

- Regulatory Landscape: Evolving nuclear energy policies and stringent environmental regulations in various countries add to operational costs, indirectly affecting pricing.

Capital Investment and Cost Recovery

Orano's pricing strategy must account for the immense capital required for its operations. Significant investments are channeled into developing and expanding facilities, such as the Georges Besse II enrichment plant, and into new mining ventures. These upfront costs are substantial, necessitating a pricing approach that ensures these investments are recovered over time.

The company's pricing structures are carefully calibrated to achieve long-term profitability. This profitability is crucial for reinvesting in ongoing research and development, a vital component in the competitive nuclear sector. For instance, as of early 2024, the global nuclear energy market is experiencing renewed interest, driving demand for Orano's services but also increasing the pressure to secure funding for future technological advancements and resource exploration.

- Capital Recovery: Pricing directly reflects the recovery of large-scale capital expenditures in new plants and mining operations.

- Long-Term Profitability: Structures are designed to ensure sustained financial health and fund future growth initiatives.

- R&D Investment: A portion of pricing supports continuous innovation in nuclear technologies and processes.

- Industry Context: Pricing must align with market dynamics and the capital-intensive nature of the nuclear fuel cycle.

Orano SA's pricing for its comprehensive nuclear fuel cycle services is a complex interplay of contractual stability, project-specific needs, and market realities. Long-term agreements, often spanning decades, provide revenue predictability, as seen in its ongoing supply contracts with Japanese utilities. For specialized projects like nuclear decommissioning, a bespoke, value-based pricing model is employed, reflecting unique scopes and regulatory demands, exemplified by the 2024 UK Magnox reactor decommissioning contract.

The company's pricing is significantly influenced by global uranium market volatility. As of mid-2024, uranium spot prices have shown an upward trend, exceeding $30 per pound, directly impacting Orano's revenue realization. Geopolitical events and evolving regulatory frameworks further shape these pricing strategies, adding layers of cost and market influence.

Capital recovery and long-term profitability are paramount in Orano's pricing calculus. Substantial investments in facilities like the Georges Besse II enrichment plant and new mining ventures necessitate pricing that ensures cost recovery and funds ongoing research and development, crucial for maintaining a competitive edge in the nuclear sector.

| Pricing Factor | Description | Mid-2024 Data/Trend |

|---|---|---|

| Long-Term Contracts | Secures predictable revenue for services like enriched uranium supply. | Ongoing agreements with major utilities, e.g., Japanese clients. |

| Project-Based Pricing | Tailored for unique projects like decommissioning and waste management. | Example: UK Magnox reactor decommissioning contract (2024). |

| Value-Based Pricing | Reflects R&D, IP, and societal benefits, particularly in specialized services. | Orano Med's targeted alpha therapy development. |

| Uranium Market Influence | Spot and long-term prices directly affect realized prices. | Spot prices > $30/lb as of mid-2024, indicating upward pressure. |

| Capital Investment Recovery | Pricing accounts for substantial upfront costs in facilities and exploration. | Investment in Georges Besse II enrichment plant. |

4P's Marketing Mix Analysis Data Sources

Our Orano SA 4P’s analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside industry-specific market research and competitive intelligence. We also incorporate data from Orano's official website and relevant trade publications to ensure a comprehensive understanding of their strategic positioning.