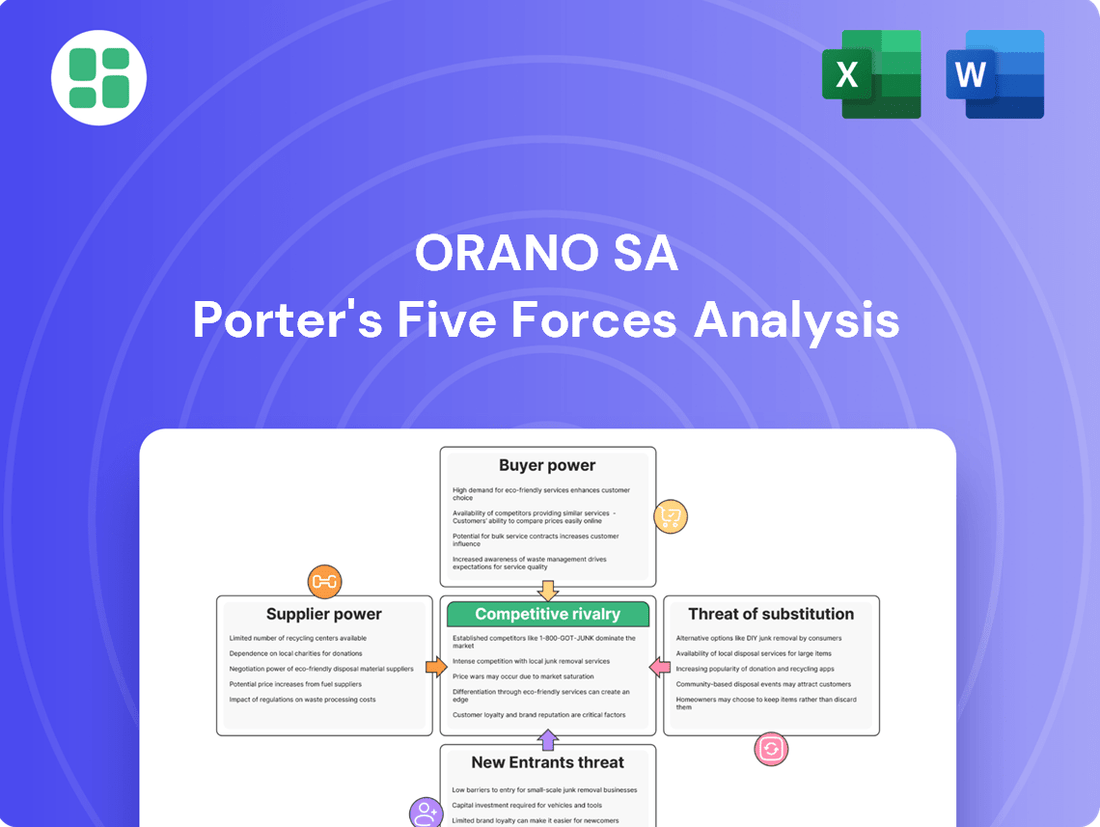

Orano SA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orano SA Bundle

Orano SA operates in a complex landscape shaped by intense rivalry and significant buyer power, particularly from major energy utilities. Understanding the nuanced interplay of these forces is crucial for navigating the nuclear fuel cycle. The full analysis reveals the real forces shaping Orano SA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Orano SA's reliance on a concentrated group of highly specialized suppliers for unique nuclear fuel cycle components and services significantly bolsters supplier bargaining power. This scarcity of alternatives, coupled with the substantial time and cost involved in qualifying new suppliers, grants existing providers considerable leverage over Orano.

High switching costs significantly bolster supplier power in the nuclear sector. For a company like Orano SA, transitioning to a new supplier for critical materials or services can involve immense expenditure and time. This includes the rigorous processes of requalifying new suppliers, obtaining necessary regulatory approvals, and managing the potential for significant project delays. These hurdles make it challenging for Orano to readily change its procurement partners, thereby increasing the leverage of existing suppliers.

The uniqueness of inputs significantly bolsters supplier bargaining power. Many critical components for nuclear fuel processing, like highly specialized enrichment machinery or specific chemicals for waste treatment, are proprietary or involve intricate, one-of-a-kind manufacturing. This means suppliers of these inputs face minimal direct competition, giving them a strong negotiating position when dealing with Orano SA.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while less prevalent, can still grant them leverage. Highly specialized technology or service providers within the nuclear fuel cycle might, in theory, integrate forward into certain operational stages. This possibility, however remote, underscores the indispensable nature of their expertise, bolstering their bargaining power during negotiations.

For Orano SA, this means that suppliers of critical, niche components or advanced processing technologies could potentially exert greater influence. For instance, a company providing unique enrichment or fabrication technologies might consider moving downstream. While Orano's 2024 financial reports do not explicitly detail supplier integration threats, the strategic importance of specialized inputs in the nuclear sector remains a constant consideration.

- Specialized Technology Providers: Suppliers of unique enrichment, fuel fabrication, or waste management technologies possess inherent leverage.

- Potential for Downstream Entry: The theoretical ability of these suppliers to move into Orano's operational areas increases their bargaining power.

- Strategic Value of Expertise: The critical nature of certain supplier expertise makes their potential forward integration a tangible, albeit often low-probability, threat.

Importance of Supplier Inputs to Orano's Operations

The quality and reliability of materials are critical for Orano, especially in the highly regulated nuclear sector where safety and performance are non-negotiable. Suppliers who can guarantee adherence to these strict standards possess significant leverage in price negotiations and contract terms. This is particularly true for specialized components and raw materials where few alternatives exist.

Disruptions in the supply chain can have immediate and substantial impacts on Orano's production capabilities and project timelines. For example, geopolitical instability in key uranium-producing regions, such as the reported coup in Niger in 2023 which affected uranium exports, highlights the vulnerability of relying on a limited number of sources. In response, Orano has been actively diversifying its sourcing, exploring new supply agreements with countries like Mongolia and Uzbekistan to mitigate these risks and strengthen its bargaining position.

- Criticality of Inputs: Orano's operations depend heavily on high-quality, reliable inputs, especially for nuclear fuel cycle activities.

- Supplier Leverage: Suppliers meeting stringent nuclear industry standards have considerable power over pricing and contract conditions.

- Supply Chain Vulnerabilities: Geopolitical events, like those in Niger in 2023, can disrupt supply and empower upstream producers.

- Diversification Strategy: Orano's efforts to secure uranium from new sources such as Mongolia and Uzbekistan aim to reduce supplier dependency and enhance supply chain resilience.

The bargaining power of suppliers for Orano SA is substantial due to the highly specialized nature of inputs and services required for the nuclear fuel cycle. This concentration of expertise means fewer suppliers can meet Orano's stringent quality and safety demands, granting them significant leverage in negotiations. For instance, the global uranium market, while having multiple producers, is characterized by a limited number of suppliers capable of meeting the specific enrichment and conversion requirements critical for nuclear power generation.

| Supplier Characteristic | Impact on Orano SA | Example/Data Point (Illustrative) |

|---|---|---|

| Specialized Inputs & Services | High Bargaining Power | Limited number of companies possess the technology for uranium enrichment or advanced fuel fabrication. |

| High Switching Costs | High Bargaining Power | Requalification of suppliers in the nuclear industry can take years and involve significant investment. |

| Uniqueness of Technology | High Bargaining Power | Proprietary technologies for waste management or reprocessing offer suppliers a strong negotiating position. |

| Supply Chain Vulnerabilities | Increased Supplier Leverage | Geopolitical events impacting key uranium-producing regions (e.g., Niger in 2023) can empower remaining suppliers. Orano's 2024 strategy includes diversifying sources from countries like Mongolia and Uzbekistan to mitigate this. |

What is included in the product

This analysis unpacks the competitive forces impacting Orano SA, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes within the nuclear energy sector.

Understand the competitive landscape of Orano SA's uranium and nuclear fuel cycle with a clear, one-sheet summary of all five forces—perfect for quick strategic decision-making.

Effortlessly adapt to shifting market dynamics by customizing pressure levels based on new data or evolving trends impacting Orano SA's operations.

Customers Bargaining Power

Orano SA's customer base is highly concentrated, primarily comprising national governments, state-owned utilities, and major private energy corporations. This limited number of large buyers means they collectively hold significant sway over pricing and contract negotiations.

The substantial purchasing power of these few customers allows them to exert considerable pressure on Orano. For instance, in 2024, major uranium procurement contracts often involve lengthy negotiations where buyer consortia can dictate terms, impacting Orano's profit margins.

The bargaining power of customers in the nuclear fuel cycle industry, particularly for a company like Orano SA, is significantly influenced by switching costs. For nuclear power plant operators, the process of changing fuel cycle service providers involves substantial hurdles. These include the need for extensive regulatory approvals for new fuel types, the significant expense associated with modifying existing plant infrastructure to accommodate different fuel specifications, and the presence of long-term, often multi-decade, contracts that lock in service providers.

These high switching costs effectively serve as a barrier, diminishing the leverage customers can exert. Orano benefits from this dynamic, as evidenced by its long-term contracts. For instance, Orano’s agreement with Ukraine's Energoatom for enrichment services, extending until 2040, highlights the commitment and difficulty in transitioning away from established suppliers in this specialized sector.

Orano's customers, primarily large utilities and government entities involved in nuclear power, are exceptionally well-informed. Their technical expertise in nuclear energy allows them to scrutinize Orano's proposals with a keen eye for detail, understanding the intricacies of fuel cycle services and reactor technologies.

This deep knowledge base empowers customers to negotiate more effectively on pricing and contract terms. For instance, a utility's ability to understand the cost drivers in uranium enrichment or fuel fabrication directly translates into greater leverage during contract discussions, potentially impacting Orano's profit margins.

Threat of Backward Integration by Customers

While complete backward integration across Orano SA's entire nuclear fuel cycle by its utility customers is highly improbable due to the complexity and capital intensity involved, some large power generators might explore integrating specific, less intricate stages. For instance, a major utility could potentially consider in-house fuel fabrication or certain waste management processes, especially if they possess the necessary technical expertise and scale. This theoretical capability, even if not fully realized, can subtly enhance their negotiating leverage when dealing with suppliers like Orano.

The threat of backward integration by customers, particularly large utilities, represents a significant factor in assessing their bargaining power. While the entire nuclear fuel cycle is capital-intensive and requires specialized knowledge, a large utility could theoretically bring certain less complex stages in-house. For example, a utility might explore backward integration into fuel fabrication or specific waste management activities. This potential, even if not fully actualized, grants them greater leverage in price negotiations with suppliers like Orano. In 2024, the global nuclear energy market continues to see significant investment, with countries like China and India expanding their nuclear fleets, potentially increasing the scale of individual utility operations and their capacity for such considerations.

- Customer Bargaining Power: The potential for large utility customers to integrate backward into less complex stages of the nuclear fuel cycle, such as fuel fabrication or waste management, can increase their negotiating power with suppliers like Orano.

- Complexity Barrier: Full backward integration across the entire nuclear fuel cycle is generally unfeasible for most utility customers due to the high capital investment and specialized technical expertise required.

- Market Context (2024): The ongoing expansion of nuclear energy globally, particularly in emerging markets, could lead to larger, more capable utility entities that might possess a greater theoretical capacity for backward integration in specific segments.

Strategic Importance of Nuclear Energy to Customers

Nuclear energy's role in national energy security and decarbonization efforts significantly strengthens the bargaining power of customers. Countries relying on nuclear power for stable, low-carbon electricity generation often prioritize supply continuity and reliability. This strategic imperative can lessen their immediate focus on marginal price differences, potentially benefiting suppliers like Orano.

Orano's substantial backlog of €35.9 billion at the close of 2024, which covers more than seven years of expected revenue, underscores the long-term, strategic nature of its customer commitments. This deep order book suggests that customers are making significant, multi-year commitments, indicating a reduced ability to easily switch suppliers based on short-term price fluctuations.

- Strategic Necessity: Nuclear energy is crucial for energy independence and meeting climate targets, making reliable supply a primary customer concern.

- Reduced Price Sensitivity: The critical nature of nuclear power can make customers less sensitive to minor price variations, favoring long-term supply agreements.

- Long-Term Commitments: Orano's extensive backlog of €35.9 billion as of year-end 2024 demonstrates customers' dedication to sustained relationships, limiting their immediate bargaining leverage.

Orano SA's customers, primarily large national utilities and government entities, possess considerable bargaining power due to the concentrated nature of the market and the critical importance of nuclear fuel supply. These buyers are highly informed, capable of scrutinizing technical details and cost drivers, which strengthens their negotiation position. While full backward integration is unlikely due to complexity and cost, the potential for partial integration into stages like fuel fabrication can enhance customer leverage.

The strategic imperative for energy security and decarbonization means customers prioritize supply continuity over marginal price differences, which can temper their aggressive price demands. Orano's substantial backlog of €35.9 billion at the end of 2024, representing over seven years of expected revenue, highlights the long-term commitments from these customers, thereby limiting their immediate ability to switch suppliers and reducing their overall bargaining power.

| Customer Characteristic | Impact on Bargaining Power | Supporting Data/Observation (2024 Context) |

| Market Concentration | High | Limited number of large state-owned utilities and government entities as primary buyers. |

| Customer Knowledge | High | Deep technical expertise in nuclear energy allows for informed price and term negotiations. |

| Switching Costs | Low for Customer | High regulatory hurdles, infrastructure modifications, and long-term contracts make switching difficult for customers. |

| Potential for Backward Integration | Moderate | Theoretical possibility for utilities to integrate into less complex stages like fuel fabrication. |

| Strategic Importance of Supply | Lowers Price Sensitivity | Nuclear energy's role in energy security and climate goals prioritizes reliability, reducing focus on minor price fluctuations. |

| Long-Term Commitments | Reduces Immediate Leverage | Orano's €35.9 billion backlog at year-end 2024 indicates multi-year customer commitments. |

Same Document Delivered

Orano SA Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis for Orano SA, detailing the competitive landscape and strategic implications within the nuclear fuel cycle industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately upon purchase. It covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, offering actionable insights for strategic planning.

Rivalry Among Competitors

The nuclear fuel cycle, where Orano operates, demands massive upfront investments in specialized facilities and technology. These substantial fixed costs mean companies must achieve significant economies of scale to be profitable, intensifying competition among existing players. For instance, building a new uranium enrichment facility can cost billions of dollars, making it nearly impossible for new entrants to compete and forcing established firms to maintain high utilization rates.

Exit barriers in this sector are exceptionally high. Beyond the sunk costs in specialized, often non-transferable assets, companies face long-term environmental remediation responsibilities and stringent regulatory compliance that extend for decades. These liabilities make it economically unviable for companies like Orano to simply shut down operations, compelling them to remain active and compete fiercely for market share to cover these ongoing obligations.

The nuclear energy sector, including companies like Orano SA, faces intense rivalry due to its slow industry growth. Building new nuclear reactors is a very long and expensive undertaking, meaning there aren't many new projects to go around. This scarcity forces established companies to fiercely compete for the limited new construction opportunities and for securing ongoing maintenance contracts for existing facilities.

As of early 2024, the world has around 394 GWe of nuclear capacity spread across 437 operational reactors. While there are 60 new reactors being built in 18 different countries, this signifies a market that is stable but not experiencing rapid expansion. This environment naturally heightens the competitive pressure among players like Orano SA, as they vie for market share in a relatively mature industry.

While the fundamental products in the nuclear sector, such as enriched uranium, are largely standardized, companies like Orano distinguish themselves through advanced technology, robust safety records, and the reliability of their geopolitical positioning. These factors are crucial for clients seeking secure and stable supply chains.

Orano's strategic advantage lies in its integrated approach, offering solutions that span the entire nuclear fuel cycle, from responsible mining and enrichment to the complex processes of recycling spent fuel and decommissioning old facilities. This end-to-end capability presents a significant differentiator in a market where comprehensive service is highly valued.

Further enhancing its competitive edge, Orano is actively expanding into new, high-growth sectors. Investments in nuclear medicine, providing essential radioisotopes for diagnostics and treatments, and pioneering battery recycling technologies demonstrate a forward-looking strategy that broadens its market appeal and diversifies revenue streams beyond traditional nuclear fuel.

Number and Size of Competitors

The uranium enrichment market is characterized by an oligopolistic structure, dominated by a handful of large, well-resourced multinational corporations, including state-owned entities. This concentration means that strategic moves by one major player, such as Orano's capacity expansions, have a pronounced effect on the competitive landscape.

Orano is actively increasing its production capabilities, notably with the expansion of its Georges Besse II enrichment plant. This initiative is set to boost its production capacity by more than 30% by the year 2030, a move designed to capitalize on increasing global demand for nuclear fuel.

- Market Structure: Oligopolistic, with a few dominant global players.

- Key Competitors: Includes major multinational corporations and state-owned enterprises.

- Impact of Actions: Competitive actions, like capacity increases, significantly influence rivals.

- Orano's Expansion: Georges Besse II plant to see over 30% capacity increase by 2030.

Geopolitical Influence and State Support

Geopolitical considerations and state backing significantly shape competition within the nuclear sector. Many key players are either state-owned enterprises or benefit from substantial government subsidies, creating an uneven playing field. This can result in competition that isn't solely driven by market forces, affecting how companies like Orano can access and operate in different global markets.

Orano's experience in Niger exemplifies these challenges. The company faced disruptions and political instability, prompting a strategic pivot towards diversification. For instance, in 2023, Orano announced plans to increase uranium production in Kazakhstan, a move partly influenced by the need to mitigate risks associated with its operations in other regions.

- State-Owned Competition: Companies like Rosatom (Russia) and CNNC (China) leverage state ownership for strategic market access and pricing advantages.

- Geopolitical Risk Mitigation: Orano's diversification strategy, including investments in Canada and Australia, aims to reduce reliance on single-source supply chains impacted by regional instability.

- Market Access Barriers: Sanctions or trade restrictions imposed due to geopolitical tensions can limit market access for companies operating in or sourcing from certain countries.

The competitive rivalry within the nuclear fuel cycle is intense, driven by an oligopolistic market structure dominated by a few large, well-resourced entities, including state-backed companies. Orano's strategic expansion, such as the over 30% capacity increase at its Georges Besse II plant by 2030, directly impacts this landscape. Geopolitical factors and state ownership create an uneven playing field, with companies like Rosatom and CNNC leveraging state backing for market advantages, while Orano mitigates risks through diversification into regions like Canada and Australia.

| Company | Primary Nuclear Fuel Services | Approximate Market Share (Enrichment) | Key Geopolitical Association |

|---|---|---|---|

| Orano SA | Mining, Enrichment, Recycling, Decommissioning | Estimated 10-15% | France |

| Urenco | Enrichment | Estimated 20-25% | UK, Germany, Netherlands |

| Rosatom | Mining, Enrichment, Fuel Fabrication, Construction | Estimated 30-40% | Russia |

| CNNC | Mining, Enrichment, Fuel Fabrication, Construction | Estimated 15-20% | China |

SSubstitutes Threaten

The most significant substitutes for nuclear energy are renewable sources like solar, wind, and hydropower. These alternatives are rapidly becoming more cost-competitive and are increasingly favored for their environmental benefits. For instance, the global renewable energy capacity saw a significant increase, with solar PV alone adding over 220 GW in 2023, demonstrating its growing viability as an energy source.

The declining costs of renewable technologies, coupled with growing public and political support for green energy initiatives, represent a substantial long-term threat to nuclear power's market share. By 2024, the levelized cost of electricity for utility-scale solar PV and onshore wind projects has fallen considerably, making them competitive with or even cheaper than new nuclear power plants in many regions.

Despite increasing environmental concerns, fossil fuels like coal and natural gas continue to present a significant threat of substitution for nuclear energy. In 2024, many regions still rely on these fuels for baseload power due to their perceived lower immediate cost and established infrastructure, particularly when energy security is a paramount consideration. For instance, global natural gas prices saw fluctuations throughout 2024, influenced by geopolitical tensions, which can make it a more or less attractive substitute compared to nuclear power depending on market conditions.

Improvements in energy efficiency and the adoption of demand-side management programs present a significant threat of substitution for nuclear power. These initiatives can directly curb electricity consumption, thereby lessening the demand for new power generation capacity, including nuclear facilities. For instance, in 2024, many countries continued to set ambitious energy efficiency targets, with the International Energy Agency reporting that efficiency improvements avoided the need for substantial new energy supply. This trend directly impacts the long-term growth prospects for nuclear fuel cycle services by reducing the overall market size.

Advancements in Energy Storage

The rapid development of energy storage technologies, like advanced battery systems, is a significant threat to traditional energy providers, including those focused on nuclear power like Orano SA. These advancements make intermittent renewable energy sources, such as solar and wind, more reliable and consistent, directly competing with baseload power generation. For instance, by mid-2024, global battery storage capacity is projected to reach substantial levels, with significant investments pouring into grid-scale solutions.

- Energy storage improvements make renewables more competitive.

- This directly challenges the need for constant power sources like nuclear.

- Investments in battery technology are rapidly increasing.

- The viability of renewables as a substitute is growing.

Public Perception and Policy Shifts

Public apprehension regarding nuclear safety and the long-term management of radioactive waste remains a significant factor. Growing concerns, amplified by high-profile incidents and ongoing debates about waste disposal solutions, can lead to increased public opposition. This sentiment directly impacts the perceived viability of nuclear energy as a reliable power source.

Evolving government energy policies play a crucial role in shaping the competitive landscape for nuclear power. As nations increasingly prioritize decarbonization and energy independence, policy shifts can either bolster or diminish the attractiveness of nuclear energy relative to other alternatives. For instance, substantial government subsidies or mandates for renewable energy sources like solar and wind can directly reduce the projected demand for nuclear power and, consequently, Orano's services.

- Public Sentiment: Surveys in 2024 continue to show a mixed but often cautious public view on nuclear power, with safety and waste disposal being primary concerns.

- Policy Trends: Many governments, particularly in Europe, are accelerating investments in renewables, with targets for renewable energy generation often increasing, potentially at the expense of new nuclear projects. For example, Germany's continued phase-out of nuclear power, completed in April 2023, illustrates a strong policy stance against nuclear energy.

- Substitute Competitiveness: The declining cost of renewable energy technologies, especially solar photovoltaic and battery storage, makes them increasingly competitive substitutes for nuclear power in many markets.

Renewable energy sources like solar and wind are increasingly cost-competitive substitutes for nuclear power, with global renewable capacity growing significantly. By 2024, the levelized cost of electricity for solar PV and onshore wind is often cheaper than new nuclear plants, making them a substantial long-term threat. Energy storage advancements further enhance the reliability of renewables, directly challenging the need for baseload nuclear generation.

| Substitute | Key Factor | 2024 Relevance |

|---|---|---|

| Renewables (Solar, Wind) | Declining Costs, Environmental Benefits | Levelized cost competitive with or cheaper than new nuclear. |

| Fossil Fuels (Gas, Coal) | Perceived Lower Immediate Cost, Established Infrastructure | Still used for baseload power, price fluctuations impact competitiveness. |

| Energy Efficiency & Demand Management | Reduced Electricity Consumption | Lessens demand for new power generation, impacting nuclear market size. |

| Energy Storage (Batteries) | Improved Reliability of Renewables | Makes intermittent renewables more viable substitutes for baseload power. |

Entrants Threaten

The nuclear fuel cycle industry demands staggering upfront capital, frequently reaching billions of euros for mining, conversion, enrichment, and recycling operations. These immense financial requirements create a substantial barrier, effectively discouraging many prospective new players from entering the market.

For instance, Orano SA's commitment to enhancing its Georges Besse II enrichment facility alone represents an investment of €1.75 billion. Such large-scale financial commitments are a significant deterrent for potential competitors aiming to establish a foothold in this capital-intensive sector.

The nuclear industry faces formidable barriers to entry, particularly stringent regulatory hurdles and licensing requirements. Global oversight bodies impose exceptionally strict safety, security, and environmental standards, making compliance a complex and costly endeavor. For instance, in 2024, the U.S. Nuclear Regulatory Commission (NRC) continued its rigorous review processes, with new reactor applications often taking years to navigate. These extensive licensing procedures represent a significant deterrent for potential new market participants, requiring substantial investment in expertise and time before operations can even commence.

Orano's significant investment in proprietary technology and specialized expertise acts as a formidable barrier to new entrants. The company's decades of operational experience and highly skilled workforce are not easily replicated, making it difficult for newcomers to match its capabilities. In 2024 alone, Orano allocated €172 million to research and development, underscoring its commitment to maintaining a technological edge.

Control over Raw Materials and Existing Infrastructure

Established players like Orano SA benefit from significant control over crucial raw materials, primarily uranium mining assets. This deep integration into the supply chain, encompassing everything from extraction to processing, creates substantial barriers for newcomers. For instance, Orano's strategic diversification includes ongoing development of new uranium projects, such as those in Mongolia, ensuring a robust and reliable supply base.

The capital expenditure and regulatory hurdles required to establish competitive mining operations and processing facilities are immense. New entrants would struggle to replicate Orano's existing, extensive infrastructure, which is vital for efficient and cost-effective uranium fuel cycle management. This existing infrastructure provides a considerable competitive advantage, making it difficult for new companies to enter the market on equal footing.

- Control over Uranium Resources: Orano maintains long-term access to key uranium deposits, a critical input for nuclear fuel.

- Integrated Infrastructure: The company possesses a comprehensive network of mining, milling, conversion, and enrichment facilities, simplifying the entire fuel cycle.

- Supply Chain Dominance: New entrants face the daunting task of securing sufficient raw materials and building a competitive, compliant supply chain, a process that is both capital-intensive and time-consuming.

- Strategic Diversification: Orano's investment in new mining projects, like those in Mongolia, further solidifies its raw material control and competitive position against potential new market participants.

Long-Term Customer Relationships and Trust

The nuclear industry is characterized by deeply entrenched, long-term customer relationships built on a foundation of trust, reliability, and a demonstrable track record. New companies entering this space would face significant hurdles in replicating the established credibility that incumbents like Orano SA possess, particularly with government entities and major utility clients who prioritize stability and proven performance for their critical energy infrastructure.

Securing long-term commitments from these key customers is a formidable challenge for any new entrant. Orano SA's substantial backlog, which currently represents over seven years of revenue, underscores the sticky nature of these relationships and the difficulty for newcomers to displace established players.

- High barriers to entry due to established trust and long-term contracts in the nuclear sector.

- New entrants struggle to build credibility and secure commitments from government and utility clients.

- Orano SA benefits from a strong customer base and a backlog extending beyond seven years.

The threat of new entrants for Orano SA is significantly low due to several formidable barriers. The sheer scale of capital investment required for nuclear fuel cycle operations, often in the billions of euros, acts as a primary deterrent. Furthermore, the industry is heavily regulated, demanding extensive licensing and adherence to stringent safety and environmental standards, which can take years and substantial investment to navigate.

Orano's proprietary technology, decades of operational experience, and highly skilled workforce are difficult for newcomers to replicate. Combined with established long-term customer relationships built on trust and reliability, particularly with government and utility clients, displacing Orano becomes a monumental task for any emerging competitor. The company's substantial backlog further solidifies its market position.

| Barrier Type | Description | Orano's Advantage | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Billions of euros needed for mining, conversion, enrichment. | Orano's existing infrastructure and ongoing investments (e.g., €1.75 billion for Georges Besse II). | Extremely high barrier, discouraging entry. |

| Regulatory Hurdles | Strict safety, security, and environmental standards; lengthy licensing. | Orano's established compliance and expertise. | Time-consuming and costly for new players to achieve compliance. |

| Technology & Expertise | Proprietary processes and specialized workforce. | Orano's R&D investment (€172 million in 2024) and operational history. | Difficult to replicate Orano's capabilities. |

| Customer Relationships | Long-term contracts, trust, and reliability with utilities. | Orano's proven track record and backlog (over 7 years of revenue). | Challenging to gain credibility and secure initial contracts. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Orano SA is built upon a foundation of official company filings, including annual reports and sustainability disclosures. We supplement this with data from reputable industry analysis firms and relevant government regulatory bodies to ensure a comprehensive understanding of the competitive landscape.