Oppenheimer SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oppenheimer Bundle

The Oppenheimer SWOT analysis reveals a powerful narrative of scientific prowess and historical impact, but also hints at complex ethical considerations and the weight of responsibility. Understanding these internal strengths and potential weaknesses is crucial for grasping its multifaceted legacy.

Want the full story behind Oppenheimer's profound influence and the challenges he navigated? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to illuminate his strategic context and enduring impact.

Strengths

Oppenheimer Holdings boasts a diversified service portfolio, encompassing investment banking, wealth management, and capital markets. This broad spectrum of offerings shields the company from the volatility of any single financial sector, creating a more resilient business model. The firm's Q1 2025 results highlighted growth in advisory fees and transaction commissions, underscoring the strength and cross-selling potential within its varied business segments.

Oppenheimer's strength lies in its broad client base, serving corporations, institutions, and high-net-worth individuals. This diversity in clientele ensures a resilient and varied revenue stream, mitigating risks associated with over-reliance on a single market segment.

The company boasts a significant global reach, with operations established in key financial hubs like Hong Kong, London, Geneva, St. Helier, and Tel Aviv. This international presence is crucial for tapping into diverse market opportunities and providing comprehensive services to a worldwide clientele.

Oppenheimer's financial performance has been notably strong. For the first quarter of 2025, the company reported an increase in net income and revenue, building on a successful 2024. This consistent growth underscores the firm's operational efficiency and market positioning.

In 2024, Oppenheimer achieved record levels for stockholders' equity and book value per share. These metrics are key indicators of financial stability and the company's ability to generate value for its shareholders, demonstrating a robust capital base.

This solid financial footing acts as a significant advantage, offering resilience against economic downturns and market fluctuations. It also provides the necessary capital to invest in strategic growth opportunities and enhance its competitive edge.

Record Assets Under Management and Administration

Oppenheimer has demonstrated remarkable success in growing its client assets, reaching record levels. At the close of 2024, Assets Under Management (AUM) stood at an impressive $49.4 billion, while Assets Under Administration (AUA) reached $129.5 billion.

This substantial increase in client assets underscores a deep well of trust from clients and highlights the effectiveness of Oppenheimer's asset management strategies.

The growth in AUM is particularly impactful, directly boosting advisory fee revenue, which is a crucial component of the firm's overall profitability.

- Record AUM: $49.4 billion at year-end 2024.

- Record AUA: $129.5 billion at year-end 2024.

- Client Trust: Growth reflects strong client confidence.

- Revenue Driver: Increased AUM fuels advisory fee income and profitability.

Strategic Focus on Wealth Management and Capital Markets

Oppenheimer's strategic focus on Wealth Management and Capital Markets has been a significant strength. The Wealth Management division, in particular, has demonstrated consistent positive revenue growth, buoyed by favorable equity market performance and an increase in advisory fees. This segment's resilience highlights the firm's ability to capitalize on market conditions.

Looking ahead, Oppenheimer anticipates a positive outlook for its Capital Markets segment. The firm expects a resurgence in Mergers & Acquisitions (M&A) activity and a rise in private credit opportunities throughout 2025. These anticipated market trends are projected to further bolster revenue streams within this division.

- Wealth Management Revenue Growth: Benefited from strong equity markets and increased advisory fees.

- Capital Markets Outlook: Anticipates a rebound in M&A activity and growth in private credit for 2025.

- Strategic Alignment: Both key segments contribute positively to overall revenue.

Oppenheimer's diversified business model, spanning investment banking, wealth management, and capital markets, provides significant resilience against sector-specific downturns. The firm's Q1 2025 results showed robust growth in advisory fees and transaction commissions, demonstrating the strength of its cross-selling capabilities across these varied segments.

The company's substantial growth in client assets is a testament to its strong market position and client trust. At the close of 2024, Oppenheimer reported record Assets Under Management (AUM) of $49.4 billion and Assets Under Administration (AUA) of $129.5 billion, directly fueling advisory fee revenue and enhancing profitability.

Oppenheimer's financial health is underscored by its strong capital base, with record stockholders' equity and book value per share achieved in 2024. This financial stability provides a solid foundation for weathering economic fluctuations and pursuing strategic growth initiatives.

The firm's strategic focus on Wealth Management and Capital Markets continues to yield positive results. Wealth Management saw consistent revenue growth, aided by favorable equity markets and increased advisory fees, while the Capital Markets segment anticipates a strong 2025 driven by expected increases in M&A activity and private credit opportunities.

| Metric | Year-End 2024 | Q1 2025 Highlight |

|---|---|---|

| Assets Under Management (AUM) | $49.4 billion | Growth in advisory fees |

| Assets Under Administration (AUA) | $129.5 billion | Continued client asset growth |

| Stockholders' Equity | Record levels | Financial stability indicator |

| Book Value Per Share | Record levels | Shareholder value generation |

What is included in the product

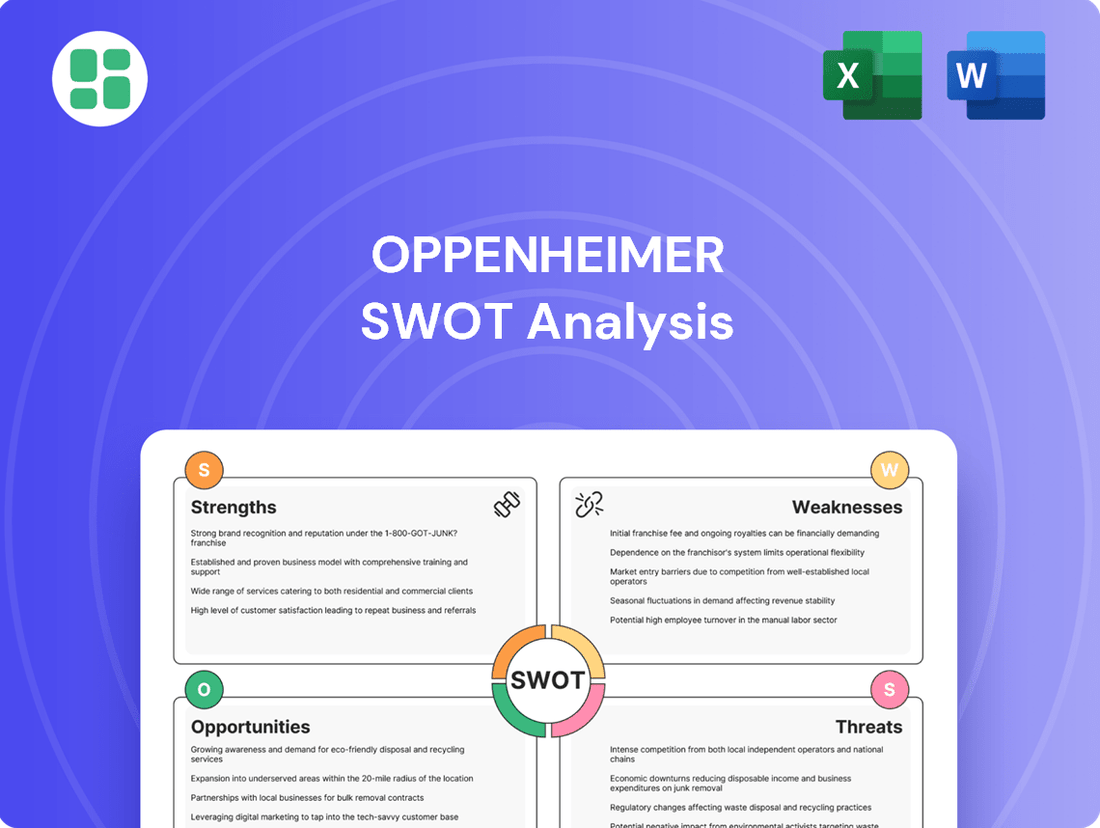

Delivers a strategic overview of Oppenheimer’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured approach to identifying and addressing the complex ethical and societal implications of scientific advancement.

Weaknesses

Oppenheimer's success is intrinsically linked to the broader economic climate. As a financial services company, its revenue streams from advisory, trading, and investment banking are highly sensitive to factors like interest rates, stock market performance, and overall economic stability. Even with diversification, a significant economic downturn or period of high market volatility can directly reduce earnings.

For example, Oppenheimer's Q1 2025 financial disclosures highlighted investor concerns regarding an increased probability of a recession and a dip in consumer confidence. This economic uncertainty poses a direct threat to the firm's ability to generate consistent revenue and profit.

Oppenheimer experienced a notable increase in pre-tax compensation expenses in 2024, driven by liability-based awards tied to its stock performance. This surge in costs directly weighed on the company's pre-tax earnings, presenting a significant hurdle to profitability even as revenues climbed.

Effectively controlling these compensation expenditures is paramount for Oppenheimer to achieve and maintain healthy profit margins moving forward. Spark, TipRanks' AI Analyst, specifically flagged these profitability concerns, alongside negative free cash flow, as critical areas requiring attention for the firm's financial health.

Oppenheimer's financial advisor headcount has shown minimal growth, standing at 933 in Q1 2025, a slight dip from 936 in Q1 2024. This stagnation, despite efforts to recruit and retain talent, could hinder the expansion of its wealth management business. In a sector where advisor numbers directly correlate with client acquisition and service capacity, this lack of growth presents a significant challenge.

Vulnerability to Regulatory Scrutiny and Policy Changes

Oppenheimer, like all financial services firms, navigates a complex and evolving regulatory landscape. Changes in regulations, such as those impacting capital requirements or client advisory services, can necessitate costly adjustments and potentially limit business activities. For instance, the Securities and Exchange Commission (SEC) continually updates its rules, and any new compliance burdens could affect Oppenheimer's operational efficiency and profitability.

The company's own disclosures highlight this vulnerability, with forward-looking statements often cautioning that actual results could differ materially due to factors including regulatory shifts. Policy decisions, even those seemingly unrelated to finance, can have ripple effects. For example, trade policy changes or new tariffs, as seen in recent years, can create uncertainty in capital markets and impact deal flow within Oppenheimer's investment banking division.

- Regulatory Compliance Costs: Financial firms must invest heavily in compliance infrastructure and personnel to adhere to evolving rules, potentially impacting margins.

- Policy Impact on Markets: Government policy changes, such as interest rate adjustments by the Federal Reserve or international trade agreements, can significantly influence market volatility and client investment strategies.

- Reputational Risk: Non-compliance or perceived missteps in navigating regulatory changes can lead to significant reputational damage and loss of client trust.

Competition in the Middle Market

Oppenheimer's position as a prominent middle-market investment bank and full-service broker-dealer places it in a fiercely competitive arena. This segment is characterized by a multitude of players, from nimble regional firms to established national and global financial institutions, all vying for the same client base. For instance, in 2024, the middle market M&A advisory space saw significant activity, with numerous firms actively participating, making it challenging to stand out.

The intensity of this competition necessitates a constant drive for innovation and the delivery of superior, differentiated services. Oppenheimer must continually adapt its offerings to meet evolving client needs and stay ahead of competitors who are also investing in technology and talent. Failing to do so could lead to erosion of market share and difficulty in acquiring new business, especially as other firms leverage their own strengths to capture opportunities.

- Intense Competition: The middle market is crowded with both specialized boutique firms and larger, diversified financial institutions, creating a challenging operating environment.

- Market Share Pressure: Oppenheimer faces constant pressure to maintain and grow its market share against aggressive rivals.

- Need for Differentiation: Continuous innovation in services, technology, and client relationships is crucial to stand out and attract new business.

- Regional and National Rivals: Competition comes from a broad spectrum of financial players, each with their own advantages and client networks.

Oppenheimer's profitability is significantly impacted by rising compensation expenses, particularly liability-based awards tied to stock performance, which rose notably in 2024. This increase directly pressured pre-tax earnings, even as revenues grew. Furthermore, the firm's financial advisor headcount has seen minimal growth, even a slight decline from 936 in Q1 2024 to 933 in Q1 2025, which could impede the expansion of its wealth management services and client acquisition capabilities.

Preview Before You Purchase

Oppenheimer SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Oppenheimer's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, offering detailed insights into Oppenheimer's strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

The wealth management sector presents a robust avenue for growth, fueled by an aging demographic increasingly needing financial guidance and a rising demand for tailored advisory solutions. Oppenheimer's commitment to this area, reflected in its substantial wealth management revenue, positions it favorably to expand its market presence.

The firm is well-placed to capitalize on this trend by deepening its advisory services and utilizing its extensive research capabilities to attract and retain high-net-worth individuals. For instance, Oppenheimer's wealth management segment saw significant revenue contributions in recent reporting periods, underscoring its strength in this market.

The rapid advancements in artificial intelligence and digital transformation offer Oppenheimer a significant avenue for growth. These technologies can streamline internal operations, leading to substantial efficiency gains. For instance, AI-powered analytics can process vast datasets, uncovering deeper investment insights that might otherwise be missed.

Furthermore, investing in technology can dramatically enhance the client experience. Digital platforms allow for more personalized interactions, faster service delivery, and easier access to information and investment tools. By developing sophisticated digital engagement channels, Oppenheimer can better meet the evolving expectations of its diverse client base, a trend strongly supported by the industry's move towards digital-first solutions.

These technological investments also unlock opportunities for new product development. AI can be instrumental in creating innovative financial products and services tailored to specific market needs or client segments. As of early 2024, the financial services sector is seeing increased adoption of AI in areas like fraud detection and personalized financial advice, with projections indicating continued substantial growth in AI spending within the industry through 2025.

Oppenheimer anticipates a significant rebound in capital markets activity, projecting increased M&A deals and a more robust IPO market for 2025, following a more challenging 2024. This expected upturn, coupled with a growing appetite for private credit, presents a substantial opportunity for the firm.

The company's strategic investment in experienced bankers over recent years is a key factor poised to capitalize on these improving market conditions. This positions Oppenheimer to capture increased transactional revenues across its investment banking and institutional trading divisions.

Strategic Acquisitions and Partnerships

Oppenheimer is actively exploring avenues for growth through strategic acquisitions and partnerships. The firm’s robust financial position, evidenced by its strong balance sheet, allows for significant flexibility in pursuing these opportunities.

While current market valuations present a challenge, judiciously selected acquisitions could significantly bolster Oppenheimer's service portfolio, broaden its geographical reach, and solidify its competitive standing. For instance, in the first quarter of 2024, Oppenheimer Holdings Inc. reported total revenue of $1.3 billion, showcasing a stable financial base from which to operate.

- Strategic Acquisitions: Potential to integrate complementary businesses to enhance service offerings and market share.

- Partnership Opportunities: Collaborations could unlock new markets or technological advancements.

- Financial Flexibility: A strong balance sheet supports the capital requirements for strategic expansion.

- Market Consolidation: Acquisitions can lead to greater efficiency and competitive advantage in a consolidating industry.

Growth in Specific Investment Areas

Oppenheimer is well-positioned to leverage growth in specialized investment sectors. Areas like asset-based lending and private credit are showing resilience and are anticipated to perform strongly through 2025, offering attractive opportunities for the firm.

The firm's market outlook for 2025 specifically points to robust potential in stock selection. This is particularly true for cyclical industries and across various market capitalizations, including small and mid-cap stocks, where skilled active management can genuinely enhance returns.

Key growth areas Oppenheimer can capitalize on include:

- Asset-based lending: This sector is expected to see continued demand as businesses seek flexible financing solutions.

- Private credit: The private credit market continues to expand, offering attractive yields and diversification benefits.

- Cyclical sectors: Oppenheimer's analysis suggests strong stock-picking opportunities in sectors that tend to perform well during economic upturns.

- Small- and mid-cap stocks: These segments of the market often present opportunities for alpha generation through active management, especially in 2025.

Oppenheimer can expand its reach by acquiring complementary businesses, enhancing its service portfolio and market share. Collaborations offer pathways to new markets and technological advancements, supported by a strong balance sheet for expansion. The firm is poised to benefit from market consolidation, increasing efficiency and competitive advantage.

Threats

Economic downturns and market volatility pose a significant threat to Oppenheimer. The financial services sector is inherently sensitive to macroeconomic shifts. Oppenheimer's Q1 2025 report highlighted a heightened probability of recession and ongoing market instability.

These conditions directly impact Oppenheimer by potentially reducing client engagement, devaluing assets under management, and dampening demand for crucial investment banking services. This can lead to a substantial decrease in the firm's revenue streams and overall profitability.

The financial sector is navigating an increasingly complex web of regulations. For Oppenheimer, this means potential hikes in compliance expenses and limitations on specific business operations. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to emphasize robust risk management and data privacy, potentially impacting how firms like Oppenheimer handle client information and conduct business.

Oppenheimer faces significant challenges in attracting and keeping top financial advisors and seasoned investment banking professionals, a common hurdle in the highly competitive financial services sector. The intense demand for skilled individuals means high compensation packages are often necessary, which directly affects profitability.

For instance, in 2023, the average compensation for financial advisors in the US ranged from $60,000 to $100,000 annually, with top performers earning considerably more, according to industry reports. This pressure to offer competitive salaries can strain Oppenheimer's bottom line.

Should Oppenheimer falter in its recruitment or retention efforts for crucial talent, it could impede the firm's expansion plans and potentially compromise the caliber of services it provides to clients, impacting its market standing.

Cybersecurity Risks and Data Breaches

As a financial services firm, Oppenheimer faces significant cybersecurity risks. The increasing sophistication of cyberattacks means that breaches are a constant concern, potentially exposing sensitive client financial data and leading to substantial financial losses. For instance, the financial services sector globally saw an average cost of a data breach rise to $5.90 million in 2024, according to IBM's Cost of a Data Breach Report. A successful attack could cripple operations, damage Oppenheimer's hard-earned reputation, and erode client confidence, which is paramount in this industry.

The consequences of a data breach extend beyond immediate financial impact. Regulatory bodies worldwide are imposing stricter penalties for data protection failures. In 2024, fines under regulations like GDPR can reach millions of euros, directly impacting profitability.

- Cybersecurity Threats: Oppenheimer, like all financial institutions, is a prime target for cybercriminals seeking sensitive client information and financial assets.

- Financial and Reputational Impact: A successful breach could result in direct financial losses, significant operational disruption, and severe damage to client trust and brand image.

- Regulatory Scrutiny: Non-compliance with data protection laws can lead to substantial fines and increased regulatory oversight, adding to the cost of a breach.

- Ongoing Investment Need: Continuous and substantial investment in advanced cybersecurity infrastructure, threat detection, and employee training is essential to mitigate these evolving risks.

Disruptive Technologies and Fintech Competition

The financial services industry is experiencing a significant shift due to the rapid evolution of financial technology (FinTech). New digital platforms are emerging, offering services that are often more streamlined, cost-effective, and innovative than traditional offerings. This presents a direct competitive threat to established firms like Oppenheimer, as these FinTech companies can attract customers with superior user experiences and lower fees, potentially eroding market share.

For instance, the global FinTech market size was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, reaching an estimated $3.5 trillion by 2024 and continuing its upward trajectory through 2025. This growth underscores the increasing demand for digital financial solutions. Oppenheimer must actively integrate and develop its own digital capabilities to remain competitive and prevent a loss of market share to these agile disruptors.

The increasing adoption of artificial intelligence (AI) in finance further intensifies this competitive pressure. While AI offers opportunities for enhanced efficiency and personalized services, it also necessitates continuous innovation. Firms that fail to keep pace with AI advancements risk falling behind, as competitors leverage these technologies to offer superior products and gain a competitive edge in the market.

Key areas of FinTech disruption impacting Oppenheimer include:

- Digital Wealth Management: Robo-advisors and automated investment platforms offer lower fees and accessible portfolio management, challenging traditional advisory models.

- Payment Technologies: Innovations in digital payments and cross-border transactions are reshaping how consumers and businesses manage money.

- Blockchain and Digital Assets: While still evolving, these technologies have the potential to disrupt traditional financial infrastructure and asset management.

- AI-driven Analytics: Advanced analytics powered by AI are enabling more sophisticated risk assessment, fraud detection, and personalized customer service, creating a performance gap for those not adopting them.

Intensifying competition from FinTech firms poses a significant threat to Oppenheimer's market position. These agile companies often offer more streamlined, cost-effective, and innovative digital financial solutions, directly challenging traditional business models. The global FinTech market's substantial growth, projected to reach an estimated $3.5 trillion by 2024, underscores this trend and the need for Oppenheimer to adapt swiftly.

The rapid advancement and adoption of Artificial Intelligence (AI) in finance further exacerbate competitive pressures. Firms that do not embrace AI risk falling behind as competitors leverage these technologies for enhanced efficiency, superior risk assessment, and personalized customer services. This necessitates continuous innovation from Oppenheimer to maintain its edge.

Emerging digital wealth management platforms, innovative payment technologies, and the evolving landscape of blockchain and digital assets all represent areas where FinTech disruption could erode Oppenheimer's market share. Failure to integrate or counter these advancements could lead to a significant loss of clients and revenue.

SWOT Analysis Data Sources

This Oppenheimer SWOT analysis is built on a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.