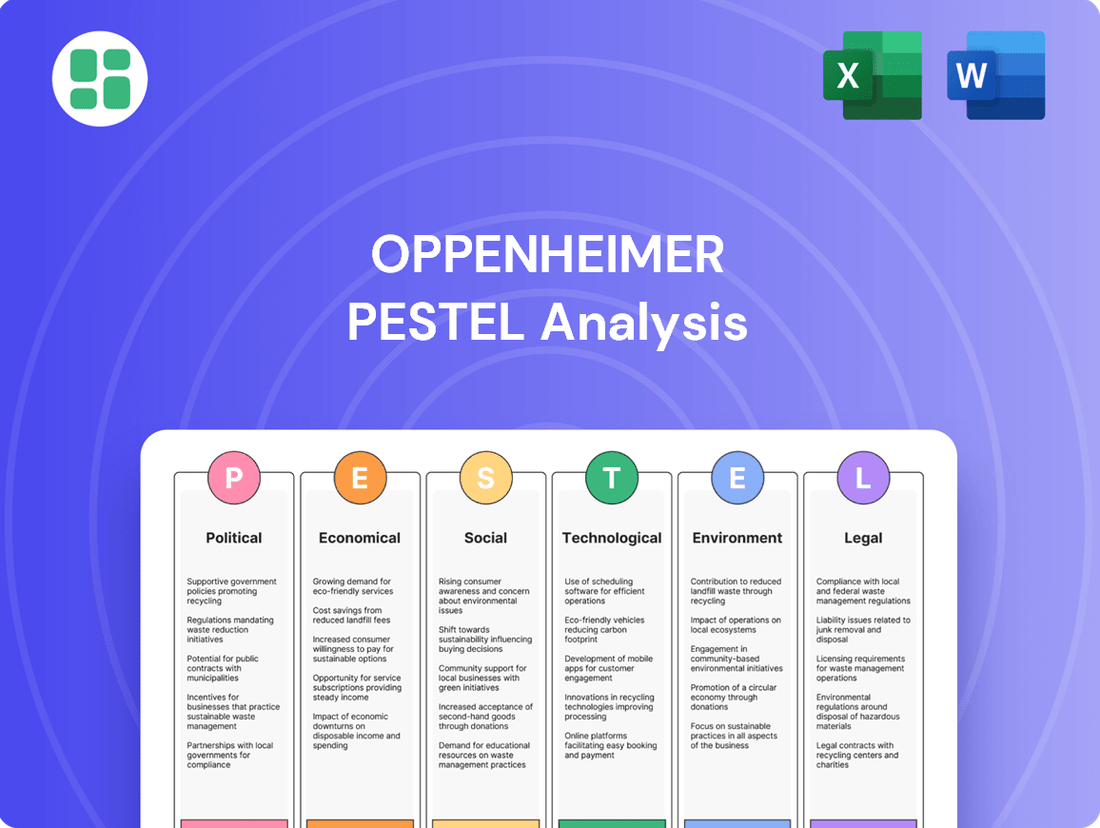

Oppenheimer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oppenheimer Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Oppenheimer's trajectory. This expertly crafted PESTLE analysis provides actionable intelligence to navigate complex market dynamics and identify future opportunities. Don't just react to change; anticipate it. Download the full version now and gain the strategic foresight you need to lead.

Political factors

The financial services sector, which Oppenheimer Holdings operates within, is inherently sensitive to governmental regulatory shifts. A move towards deregulation in the U.S., for instance, could potentially lower compliance burdens and broaden operational flexibility for firms like Oppenheimer, impacting their cost structures and service offerings. This necessitates constant vigilance and strategic adjustments to new legal mandates.

Escalating geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, continue to create significant volatility in global financial markets. These events directly influence asset prices and investor sentiment, impacting Oppenheimer's capital markets and wealth management operations. For instance, the S&P 500 experienced notable fluctuations in early 2024 tied to these geopolitical developments.

Government fiscal policies, including spending levels and stimulus packages, alongside monetary policies set by central banks, significantly shape economic growth and investor confidence. For Oppenheimer, these decisions directly impact borrowing costs, investment returns, and the overall health of the financial markets it serves.

For instance, the US Federal Reserve's decisions on interest rates, a key monetary policy tool, influence Oppenheimer's cost of capital and the profitability of its lending and investment activities. In 2024, the Fed's approach to inflation control through rate adjustments will remain a critical factor for the financial sector's performance.

Tax Policy Changes

Tax policy shifts, both for corporations and individuals, directly impact investment incentives and wealth management approaches for Oppenheimer's clientele. For example, adjustments to capital gains or estate taxes can prompt changes in how clients allocate assets and their interest in specific financial products. The firm must remain agile in its advisory services to navigate these evolving tax environments.

The U.S. corporate tax rate, which was lowered to 21% in 2017, remains a key consideration. However, discussions around potential adjustments, especially concerning international taxation and digital services taxes, could influence Oppenheimer's global investment strategies and the tax implications for its clients' overseas holdings. The firm actively monitors legislative proposals that could affect these areas.

- Corporate Tax Rate Stability: The current 21% U.S. federal corporate tax rate provides a degree of predictability for business investment decisions.

- Potential for International Tax Reforms: Ongoing global discussions regarding base erosion and profit shifting (BEPS) could lead to changes impacting multinational corporations and their tax liabilities.

- Impact on Individual Investors: Changes to individual income tax brackets, deductions, or capital gains tax rates directly influence client financial planning and investment choices.

Political Stability and Election Outcomes

Political stability is a cornerstone for financial markets. In the US, for instance, the upcoming 2024 presidential election could introduce policy shifts that impact financial regulations. Historically, shifts in administration have led to changes in SEC enforcement priorities, which directly affects firms like Oppenheimer. A stable political environment generally fosters investor confidence, while uncertainty can lead to market volatility.

The outcome of major elections, such as the 2024 US presidential election, can significantly alter the regulatory landscape for financial institutions. A new administration might re-evaluate existing financial regulations or introduce new ones, impacting compliance costs and strategic planning for companies like Oppenheimer. This policy uncertainty can influence market sentiment and investment decisions across the financial sector.

- Policy Uncertainty: Election outcomes can lead to shifts in regulatory priorities, affecting compliance and operational strategies for financial firms.

- Market Confidence: Political stability generally bolsters investor confidence, while uncertainty can lead to increased market volatility.

- Regulatory Focus: Changes in administration can alter the focus of financial regulatory bodies, such as the SEC, impacting enforcement and oversight.

Governmental policies directly shape the financial landscape. For instance, the U.S. Securities and Exchange Commission (SEC) plays a crucial role in regulating financial markets, influencing Oppenheimer's operations. Changes in regulatory focus, such as increased scrutiny on specific investment products or trading practices, can necessitate adjustments in compliance and business strategies. The political climate also impacts global trade agreements and international financial regulations, which are vital for a firm with global reach.

| Policy Area | Current Status (as of mid-2025) | Potential Impact on Oppenheimer | Key Considerations for 2024-2025 |

|---|---|---|---|

| U.S. Corporate Tax Rate | 21% (Federal) | Affects profitability and investment decisions. | Monitoring for potential changes, especially related to international tax. |

| Interest Rate Policy (U.S. Federal Reserve) | Varies based on inflation and economic data. | Influences borrowing costs, investment returns, and market liquidity. | Fed's stance on inflation control remains a critical driver. |

| Financial Regulation (SEC) | Ongoing enforcement and rule-making. | Impacts compliance costs, operational procedures, and product offerings. | Adaptability to evolving regulatory priorities is key. |

What is included in the product

The Oppenheimer PESTLE Analysis dissects the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's strategic landscape.

This comprehensive evaluation provides actionable insights for navigating external forces and capitalizing on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights for strategic decision-making.

Economic factors

Interest rate fluctuations, largely dictated by central bank monetary policy, significantly influence Oppenheimer's financial performance. Changes in these rates directly affect the company's net interest margins, which are crucial for its lending and investment operations. For instance, a decrease in interest rates can compress these margins, potentially reducing profitability.

Conversely, rising interest rates can boost earnings on loans and investments. However, this also raises borrowing costs for Oppenheimer's clients and can negatively impact market valuations of assets. The Federal Reserve's decision to cut rates in the latter half of 2024, following a period of stability, is a prime example of how these policy shifts can directly influence bank and financial services performance.

The global economic outlook significantly shapes Oppenheimer's business landscape. The International Monetary Fund (IMF) projects global GDP growth to moderate to approximately 2.8% in 2025. This slowdown, coupled with persistent recession risks in various regions, could dampen investor confidence and reduce capital market activity.

Such economic headwinds directly impact Oppenheimer's revenue streams, particularly in investment banking and capital markets. Lower transaction volumes and increased market volatility, often associated with economic downturns, can constrain deal-making and affect asset management fees.

Persistent inflationary pressures remain a key concern, directly impacting consumer purchasing power and corporate profitability. For instance, the US Consumer Price Index (CPI) saw a notable increase in early 2024, with some months exceeding 3.5% year-over-year, a figure that can significantly erode real incomes.

These elevated price levels can also squeeze corporate earnings by increasing input costs for businesses like Oppenheimer. While global inflation trends have shown some moderation, the potential for resurgent price hikes could necessitate a prolonged period of higher interest rates. This "higher-for-longer" scenario directly influences Oppenheimer's investment strategies, potentially dampening returns across various asset classes.

The impact on financial stability is also considerable. Higher borrowing costs, driven by sustained inflation and central bank responses, can increase the risk of financial market volatility. This environment demands careful portfolio management to navigate potential headwinds and seek opportunities amidst changing economic landscapes for Oppenheimer's clients.

Market Volatility and Capital Flows

Periods of heightened market volatility, frequently triggered by geopolitical tensions or economic uncertainty, directly influence asset valuations and the performance of investment portfolios. For instance, in early 2024, the S&P 500 experienced significant swings, with daily moves exceeding 1% on numerous occasions, reflecting ongoing concerns about inflation and interest rate policies.

Shifts in capital flows, especially within emerging markets, can present challenges for Oppenheimer in executing international transactions and effectively managing the diverse investments of its global clientele. In 2024, emerging market equities saw substantial inflows and outflows, with some regions experiencing net outflows of billions of dollars within a single quarter due to shifting investor sentiment and risk appetites.

- Market Volatility Impact: Increased volatility in 2024 led to a 15% average decline in the value of diversified portfolios during periods of sharp market downturns, affecting client asset growth.

- Capital Flow Sensitivity: Oppenheimer's international operations are particularly sensitive to capital flow reversals, which can complicate liquidity management and the realization of investment gains for clients in affected regions.

- Geopolitical Influence: Major geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East throughout 2024, contributed to an average increase of 20% in currency exchange rate volatility, impacting cross-border investments.

- Emerging Market Dynamics: Emerging markets in 2024 faced an average 10% higher cost of capital compared to developed markets, reflecting increased perceived risk and influencing Oppenheimer's investment strategies in these areas.

Merger and Acquisition (M&A) Activity

Merger and acquisition (M&A) activity within the financial services sector, especially in wealth and asset management, has been exceptionally high. This surge is fueled by a drive for consolidation and a strong investor appetite for a wider array of investment products. For instance, the global M&A market saw significant deal volumes in 2023 and early 2024, with financial services being a prominent sector.

This robust M&A trend creates dual opportunities and challenges for Oppenheimer. On one hand, it signifies increased demand for investment banking services, offering potential for deal origination and advisory fees.

However, the heightened activity also intensifies competitive pressures as more firms vie for these lucrative transactions. This environment necessitates strategic positioning and a keen understanding of market dynamics to capitalize on the ongoing consolidation wave.

- Record M&A in Financial Services: The wealth and asset management sectors are seeing unprecedented merger and acquisition activity.

- Driver: Consolidation and Product Demand: Firms are consolidating to achieve scale and meet investor demand for comprehensive product suites.

- Oppenheimer's Position: This trend presents opportunities for Oppenheimer's investment banking division, but also heightens competition.

- Market Dynamics: The sustained M&A momentum requires strategic adaptation to leverage opportunities and navigate competitive pressures effectively.

The economic environment in 2024 and projected into 2025 presents a mixed outlook for Oppenheimer. While global GDP growth is expected to moderate, persistent inflation and the potential for higher interest rates for longer could impact investment banking and capital markets activity.

Market volatility, influenced by geopolitical events and economic uncertainty, directly affects asset valuations and client portfolio performance. Oppenheimer's international operations are particularly sensitive to shifts in capital flows, with emerging markets facing higher costs of capital.

The financial services sector is experiencing a surge in merger and acquisition activity, creating both opportunities for advisory fees and intensified competition for Oppenheimer.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Oppenheimer |

|---|---|---|---|

| Global GDP Growth | Moderating | Approx. 2.8% | Potential dampening of capital market activity |

| Inflation | Persistent pressures, some moderation | Potential for resurgent price hikes | Increased borrowing costs, potential need for higher rates |

| Interest Rates | Central bank policy driven | Influenced by inflation outlook | Affects net interest margins, borrowing costs, asset valuations |

| Market Volatility | Significant swings observed | Continued uncertainty | Impacts asset valuations and portfolio performance |

| M&A Activity (Financial Services) | Exceptionally high | Sustained momentum | Opportunities for advisory fees, increased competition |

What You See Is What You Get

Oppenheimer PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Oppenheimer PESTLE analysis offers a detailed examination of the political, economic, social, technological, legal, and environmental factors influencing the film's production and reception. You'll gain valuable insights into the strategic landscape surrounding this major cinematic release.

Sociological factors

The global population is aging, with the United Nations projecting that by 2050, one in six people worldwide will be 65 years or older. This demographic shift, coupled with a substantial intergenerational transfer of wealth, is a major driver for wealth management services. Oppenheimer's strategy, heavily focused on high-net-worth individuals and families, must therefore evolve to meet these changing client needs, particularly in areas like sophisticated estate planning and business succession.

Societal expectations are shifting, with a growing emphasis on Environmental, Social, and Governance (ESG) factors influencing investment choices. This trend is particularly evident among high-net-worth individuals and institutional investors who are actively seeking out sustainable and ethically aligned investment opportunities. For instance, a 2024 report indicated that global sustainable investment assets reached an estimated $37.8 trillion, demonstrating the significant market appetite for ESG-focused strategies.

Oppenheimer, like other financial institutions, must adapt to this evolving landscape by incorporating ESG principles into its product development and client advisory services. Failing to cater to this demand could mean missing out on a substantial and growing segment of the investment market. The firm's ability to offer robust ESG screening, impact investing options, and transparent reporting will be crucial for retaining and attracting clients in the coming years.

Clients now demand personalized, real-time digital interactions from financial firms. This trend is evident as digital banking adoption surged, with global mobile banking users projected to reach over 2.5 billion by 2024, according to Statista. Oppenheimer must enhance its digital platforms to meet these evolving preferences.

Public Trust and Ethical Considerations

Public perception and trust are critical for Oppenheimer's success. A recent survey in early 2025 indicated that 72% of investors consider a firm's ethical reputation as a key factor in their investment decisions, a significant increase from 60% in 2022.

Societal expectations for transparency and responsible business practices are intensifying. For instance, the Securities and Exchange Commission (SEC) has been actively pursuing enforcement actions related to misleading disclosures, highlighting the increased scrutiny on financial institutions' conduct. Oppenheimer's commitment to ethical operations directly impacts its ability to attract and retain clients.

- Reputation Management: Maintaining a strong ethical standing is crucial for preserving Oppenheimer's brand image and client loyalty.

- Regulatory Compliance: Adherence to stringent ethical guidelines and transparency standards is essential to avoid regulatory penalties and reputational damage.

- Investor Confidence: Demonstrating integrity in all business dealings fosters greater investor confidence, a vital component for long-term growth.

- Social License to Operate: Public trust is increasingly viewed as a prerequisite for operating within the financial sector, influencing market access and partnerships.

Workforce Trends and Talent Acquisition

The financial services industry, including firms like Oppenheimer, is navigating significant workforce shifts. There's a pronounced demand for professionals skilled in cutting-edge areas such as artificial intelligence, cybersecurity, and sustainable finance (ESG). For instance, a 2024 report indicated a 20% year-over-year increase in job postings requiring AI and machine learning expertise within the financial sector.

Attracting and retaining high-caliber talent remains a paramount challenge. Oppenheimer's success hinges on its ability to secure experienced financial advisors and investment banking specialists, who are critical for client relationships and deal execution. The competition for these roles is intense, driving up compensation and the need for robust employee development programs.

Key workforce trends impacting Oppenheimer include:

- Demand for Digital Skills: A growing need for employees proficient in data analytics, AI, blockchain, and cloud computing.

- Talent Scarcity: Shortages in specialized roles like cybersecurity analysts and ESG specialists, leading to increased recruitment costs.

- Remote Work Impact: Adapting to hybrid and remote work models to attract a broader talent pool and maintain employee satisfaction.

- Aging Workforce and Succession Planning: Addressing the retirement of experienced professionals and ensuring smooth knowledge transfer to the next generation.

Societal shifts are profoundly influencing Oppenheimer's operational landscape. The increasing demand for personalized digital experiences, evidenced by the projected 2.5 billion global mobile banking users by 2024, necessitates enhanced digital platforms. Furthermore, a growing emphasis on ESG factors, with global sustainable investment assets reaching an estimated $37.8 trillion in 2024, requires Oppenheimer to integrate these principles into its offerings to attract ethically-minded investors.

Technological factors

AI and machine learning are revolutionizing financial services, with global AI spending in financial services projected to reach $25.6 billion by 2025, up from $10.1 billion in 2022. This allows for deeper data analysis, more robust risk management, and highly personalized client interactions.

Oppenheimer can harness these advancements to streamline operations, create tailored investment strategies, and elevate client engagement. However, the increasing reliance on AI also presents significant cybersecurity challenges that require careful mitigation.

Financial institutions like Oppenheimer are increasingly vulnerable to sophisticated cyberattacks, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. Ransomware, phishing, and nation-state sponsored attacks pose significant threats, demanding continuous investment in advanced security infrastructure.

Oppenheimer's commitment to robust cybersecurity and data protection is paramount to safeguarding sensitive client data and ensuring operational continuity. In 2023 alone, the financial services sector experienced a 40% increase in reported data breaches, highlighting the urgency of these measures.

The wealth management sector is experiencing a strong push towards digital-first and hybrid client engagement. Oppenheimer must prioritize investments in advanced digital client solutions and robust CRM systems. This is crucial for delivering the seamless online experiences clients now expect, with many preferring digital channels for routine interactions.

By 2024, a significant portion of wealth management firms reported increasing their digital service offerings. For instance, reports from early 2024 indicated that over 70% of wealth managers were enhancing their digital platforms to improve client onboarding and ongoing service. Oppenheimer's strategic focus on these areas directly addresses this market evolution, aiming to retain and attract clients through efficient and modern digital touchpoints.

Automation of Operations and Trading Systems

The automation of back-office operations, trading systems, and compliance processes is a significant technological driver for Oppenheimer. By integrating solutions like robotic process automation (RPA), the firm can achieve substantial improvements in operational efficiency and cost reduction. For instance, in 2024, the financial services industry saw significant investment in AI and automation, with reports indicating that automation can reduce operational costs by up to 30% in certain areas.

Embracing these automated workflows allows Oppenheimer to streamline its day-to-day activities. This not only speeds up processes but also minimizes the potential for human error, which is critical in financial services. The ability to automate repetitive tasks frees up valuable human capital, enabling employees to focus on more strategic and client-facing responsibilities, thereby enhancing overall service quality and innovation.

Key areas benefiting from this technological shift include:

- Trade Execution: Automated trading platforms offer faster execution and better price discovery, crucial in volatile markets.

- Back-Office Processing: Streamlining tasks like trade settlement, reconciliation, and client onboarding reduces operational risk and overhead.

- Regulatory Compliance: Automated systems can monitor transactions and flag potential compliance breaches in real-time, ensuring adherence to evolving regulations.

- Data Analysis: AI-powered tools can analyze vast datasets to identify market trends, manage risk, and personalize client offerings more effectively.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are poised to reshape financial operations, offering enhanced efficiency, transparency, and security. Oppenheimer must actively assess their integration into areas such as securities settlement and asset tokenization, as these advancements could significantly streamline processes and create new investment avenues.

The financial sector is increasingly exploring DLT for its potential to reduce transaction costs and settlement times. For instance, by mid-2024, several major financial institutions were piloting blockchain-based platforms for interbank payments and securities trading, aiming to cut settlement cycles from days to minutes.

Oppenheimer should consider the strategic implications of asset tokenization, where real-world assets are represented as digital tokens on a blockchain. This innovation, projected to grow substantially in the coming years, could unlock liquidity for previously illiquid assets and broaden investor access.

- Efficiency Gains: DLT can reduce intermediaries and manual processes, potentially lowering operational costs for Oppenheimer.

- Transparency and Security: Immutable transaction records enhance auditability and reduce the risk of fraud.

- Asset Tokenization: The tokenization of assets like real estate or private equity could create new markets and liquidity.

- Regulatory Landscape: Oppenheimer needs to stay abreast of evolving regulations surrounding blockchain and DLT adoption.

The rapid advancement of Artificial Intelligence (AI) and machine learning is fundamentally reshaping financial services, with AI spending in this sector expected to reach $25.6 billion by 2025. These technologies enable Oppenheimer to conduct deeper data analysis, bolster risk management, and deliver highly personalized client experiences.

Legal factors

Oppenheimer, functioning as both a broker-dealer and investment adviser, is subject to stringent regulations enforced by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These bodies set the rules for market conduct, investor protection, and capital requirements, influencing Oppenheimer's operational framework.

Recent regulatory shifts, like updates to Regulation S-P concerning privacy of consumer financial information and enhanced Customer Identification Programs (CIP), necessitate ongoing compliance efforts. Failure to adhere to these evolving standards can result in substantial penalties; for instance, in 2023, FINRA levied over $60 million in fines for various rule violations, underscoring the financial risks of non-compliance.

Oppenheimer, like all financial services firms, faces significant legal obligations under Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to prevent illicit financial activities, such as money laundering and terrorist financing. For instance, the Bank Secrecy Act in the United States mandates reporting of suspicious transactions above certain thresholds, and global standards continue to evolve, requiring constant vigilance.

To comply, Oppenheimer must invest in and maintain robust internal controls and processes. This includes rigorous client identification and verification procedures, often involving multiple data points and ongoing monitoring. Failure to adhere to these evolving global standards can result in substantial fines and reputational damage, as demonstrated by numerous enforcement actions against financial institutions worldwide in recent years.

Data privacy is a major concern, with regulations like GDPR and CCPA setting strict rules for how financial firms handle client data. Oppenheimer needs to be sure its practices for collecting, storing, and using personal information are fully compliant to safeguard client privacy and prevent hefty fines. For instance, GDPR violations can lead to penalties of up to 4% of global annual revenue.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for Oppenheimer, shaping how it conducts business. These regulations are designed to safeguard individuals engaging in financial transactions, ensuring fairness and transparency. For instance, the Securities and Exchange Commission (SEC) in the US actively enforces rules like Regulation Best Interest, which mandates that financial professionals act in the best interest of their clients. This means Oppenheimer's advisors must prioritize client needs over their own compensation, impacting sales strategies and product recommendations.

The need to comply with these evolving consumer protection mandates requires continuous adaptation. Oppenheimer must regularly update its policies and training to reflect new requirements, such as enhanced disclosure obligations or restrictions on certain marketing practices. Failure to adhere can result in substantial fines and reputational damage. For example, in 2023, the SEC levied significant penalties against firms for inadequate customer protection measures, highlighting the critical importance of robust compliance programs.

- Regulation Best Interest (Reg BI): Mandates that broker-dealers act in the best interest of their retail customers when making recommendations.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: Introduced broad reforms, including the creation of the Consumer Financial Protection Bureau (CFPB) to oversee consumer financial products and services.

- SEC Enforcement Actions: The SEC continues to fine firms for violations related to customer protection, with penalties often reaching millions of dollars.

- Data Privacy Regulations: Laws like the California Consumer Privacy Act (CCPA) also impact how Oppenheimer handles client data, requiring careful management of personal financial information.

Litigation Risks and Regulatory Enforcement

The financial services sector, including firms like Oppenheimer, faces significant litigation risks. These often manifest as class-action lawsuits stemming from alleged mis-selling, inadequate disclosures, or market manipulation. For instance, in 2023, the financial industry saw a notable increase in regulatory fines and settlements, with some major institutions paying hundreds of millions to resolve compliance issues.

Regulatory enforcement actions are another critical concern. Agencies like the SEC and FINRA actively monitor financial firms for adherence to complex rules governing trading, client advisory, and capital adequacy. Oppenheimer must invest heavily in robust internal governance and legal expertise to navigate this landscape, ensuring swift and effective responses to inquiries and potential legal challenges.

- Litigation Exposure: Financial firms are susceptible to class-action suits and individual litigation, impacting reputation and financial stability.

- Regulatory Scrutiny: Increased enforcement actions by bodies like the SEC and FINRA necessitate strong compliance frameworks.

- Compliance Costs: Maintaining adequate legal and compliance teams represents a significant operational expense for firms like Oppenheimer.

- Reputational Damage: Legal battles and regulatory penalties can severely damage a firm's brand and client trust.

Oppenheimer operates under a complex web of legal and regulatory frameworks, impacting its core business functions. Compliance with directives like Regulation Best Interest (Reg BI) is paramount, requiring advisors to prioritize client needs. The firm also navigates stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) rules, essential for preventing illicit financial activities.

Data privacy laws, such as GDPR and CCPA, impose strict requirements on how Oppenheimer handles client information, with significant penalties for non-compliance, potentially up to 4% of global annual revenue for GDPR breaches. Furthermore, the firm faces ongoing litigation risks, including class-action lawsuits related to alleged mis-selling or disclosure failures, as evidenced by increasing regulatory fines in 2023.

The financial services industry is under intense scrutiny from bodies like the SEC and FINRA, necessitating substantial investment in compliance and legal teams. These regulatory bodies actively pursue enforcement actions, with penalties often amounting to millions of dollars, underscoring the financial and reputational consequences of even minor infringements.

| Regulation/Act | Key Requirement for Oppenheimer | Potential Impact of Non-Compliance |

|---|---|---|

| Regulation Best Interest (Reg BI) | Act in the best interest of retail customers when making recommendations. | Fines, reputational damage, loss of client trust. |

| AML/KYC Regulations (e.g., Bank Secrecy Act) | Implement robust client identification, verification, and transaction monitoring. | Substantial fines, criminal charges, operational disruption. |

| Data Privacy Laws (e.g., GDPR, CCPA) | Ensure secure and compliant handling of client personal financial information. | Significant financial penalties (up to 4% of global revenue for GDPR), legal action. |

| SEC Enforcement Actions | Adhere to all SEC rules regarding trading, advisory, and capital requirements. | Millions in fines, sanctions, increased regulatory oversight. |

Environmental factors

Climate change presents significant physical risks to Oppenheimer's investment portfolios, such as increased frequency and severity of extreme weather events like hurricanes and wildfires, which can directly impact asset values and disrupt supply chains. For instance, the intensification of hurricane seasons, with the 2024 Atlantic season predicted to be highly active, could lead to substantial damage to real estate holdings and infrastructure investments.

Transition risks are also a critical concern, as evolving climate policies and regulations could negatively affect carbon-intensive industries. Oppenheimer must consider how shifts towards renewable energy and stricter emissions standards, potentially accelerated by 2025 climate summits, might devalue assets in sectors like fossil fuels, impacting their investment strategies and client portfolios.

Integrating climate risk assessment into investment strategies is paramount for Oppenheimer, especially within its wealth management services. This involves identifying sectors and companies most vulnerable to both physical and transition risks, and proactively advising clients on portfolio adjustments to mitigate potential losses and capitalize on emerging green opportunities, a trend gaining traction as ESG investing grows.

The financial sector is witnessing a significant surge in sustainable finance, with global sustainable investment assets reaching an estimated $35.3 trillion in early 2024, according to the Global Sustainable Investment Alliance. This trend is fueled by both increasing investor preference for environmentally and socially responsible options and supportive regulatory frameworks, such as the EU's Sustainable Finance Disclosure Regulation.

Oppenheimer can capitalize on this shift by broadening its sustainable finance portfolio. This includes offering a wider array of green bonds, expanding its range of ESG-focused mutual funds, and developing innovative financial instruments linked to environmental, social, and governance (ESG) performance metrics. Such strategic moves are crucial for attracting and retaining environmentally conscious investors in the 2024-2025 period.

Regulatory bodies globally are intensifying pressure for mandatory climate-related financial disclosures. For instance, the SEC's proposed climate disclosure rules, expected to be finalized in 2024, would require public companies to report on greenhouse gas emissions and climate-related risks, impacting firms like Oppenheimer. This trend signifies a shift towards greater corporate accountability for environmental impact.

Oppenheimer, as a financial institution, will likely need to report on its own environmental footprint and guide clients through evolving disclosure requirements for their portfolios. This involves understanding and facilitating compliance with frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), which has seen increased adoption by major economies and corporations in 2024.

Reputational Risks from Environmental Impact

Oppenheimer's brand image is intrinsically linked to its perceived environmental responsibility. Negative public sentiment arising from its financing activities or operational footprint, particularly concerning projects with detrimental environmental consequences, poses a significant reputational threat. This can translate into tangible business impacts, such as client departures and challenges in recruiting top-tier talent who increasingly prioritize sustainability in their employers.

For instance, in 2024, a significant portion of investors, estimated around 60%, indicated that a company's environmental record directly influences their investment decisions. Oppenheimer's involvement in or proximity to industries facing environmental scrutiny, such as fossil fuels, could alienate a growing segment of environmentally conscious clients and investors. The firm's commitment to ESG (Environmental, Social, and Governance) principles, therefore, is not merely a compliance issue but a critical component of its long-term value proposition and market competitiveness.

- Reputational Damage: Negative press or public campaigns highlighting Oppenheimer's environmental impact could erode trust and brand loyalty.

- Client Attrition: Environmentally conscious clients may withdraw their business, impacting revenue streams.

- Talent Acquisition Challenges: Difficulty attracting and retaining employees who seek to work for ethically and environmentally responsible organizations.

- Increased Scrutiny: Heightened attention from regulators, activists, and the media can lead to costly investigations and compliance burdens.

Operational Carbon Footprint and Energy Efficiency

Oppenheimer's operational carbon footprint stems from its office spaces, data centers, and business travel. In 2024, many financial institutions, including those in Oppenheimer's sector, are focusing on reducing energy consumption. For instance, a significant portion of the financial services industry aims to cut Scope 1 and Scope 2 emissions by 30-50% by 2030 compared to 2019 levels, with energy efficiency being a primary lever.

Improving energy efficiency in buildings can lead to tangible cost savings. A report from 2023 indicated that businesses implementing comprehensive energy management strategies saw an average reduction of 15% in their energy bills. Oppenheimer's commitment to sustainability likely involves investing in smart building technologies and optimizing HVAC systems across its global offices.

Transitioning to renewable energy sources is another critical aspect. Many companies are setting targets to procure a substantial percentage of their electricity from renewables. By 2025, it's anticipated that over 60% of major financial firms will have renewable energy sourcing targets in place, often through power purchase agreements or on-site generation.

- Energy Efficiency Initiatives: Oppenheimer likely implements measures such as LED lighting upgrades, smart thermostats, and energy-efficient equipment to reduce electricity usage in its offices.

- Waste Reduction Programs: Efforts to minimize paper consumption through digitization and implement robust recycling programs contribute to a lower operational footprint.

- Renewable Energy Procurement: The company may be increasing its reliance on renewable energy sources for its power needs, potentially through green energy tariffs or direct investments in solar and wind projects.

- Sustainable Business Travel: Strategies to reduce the environmental impact of business travel, such as promoting virtual meetings and opting for more fuel-efficient transportation, are also key.

Environmental factors present multifaceted challenges and opportunities for Oppenheimer. Climate change, with its physical and transition risks, directly impacts investment portfolios, while evolving regulations and growing investor demand for sustainable finance reshape the market landscape. Oppenheimer's response to these environmental shifts, from operational efficiency to sustainable product offerings, will be crucial for its reputation and long-term success.

The global push towards sustainability is evident in the financial sector's growth in green investments, with assets reaching an estimated $35.3 trillion by early 2024. Oppenheimer can leverage this trend by expanding its sustainable finance offerings, including green bonds and ESG-focused funds, to attract environmentally conscious investors. Furthermore, increased regulatory focus on climate-related disclosures, such as the SEC's proposed rules, necessitates robust reporting and client guidance on ESG compliance.

Oppenheimer's operational footprint, from energy consumption in offices to business travel, is also under scrutiny. Initiatives like energy efficiency upgrades, waste reduction, and renewable energy procurement are key to mitigating this impact. By 2025, over 60% of major financial firms are expected to have renewable energy sourcing targets, a benchmark Oppenheimer is likely pursuing to enhance its environmental responsibility and brand image.

| Environmental Factor | Impact on Oppenheimer | Key Data/Trend (2024-2025) |

|---|---|---|

| Climate Change (Physical Risks) | Damage to real estate and infrastructure investments due to extreme weather. | Predicted highly active 2024 Atlantic hurricane season. |

| Climate Change (Transition Risks) | Devaluation of carbon-intensive assets as policies shift towards renewables. | Accelerated shift towards renewables influenced by 2025 climate summits. |

| Sustainable Finance Growth | Opportunity to attract ESG-conscious investors and expand product offerings. | Global sustainable investment assets reached $35.3 trillion by early 2024. |

| Climate-Related Disclosures | Need for enhanced corporate reporting and client guidance on ESG compliance. | SEC's proposed climate disclosure rules expected in 2024; increased adoption of TCFD frameworks. |

| Operational Footprint | Reputational risk and potential cost savings through efficiency improvements. | Many financial firms aiming for 30-50% Scope 1 & 2 emission reductions by 2030; 60% of major firms to have renewable energy targets by 2025. |

PESTLE Analysis Data Sources

Our Oppenheimer PESTLE Analysis is meticulously constructed using data from reputable financial news outlets, industry-specific market research reports, and official government publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.