Oppenheimer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oppenheimer Bundle

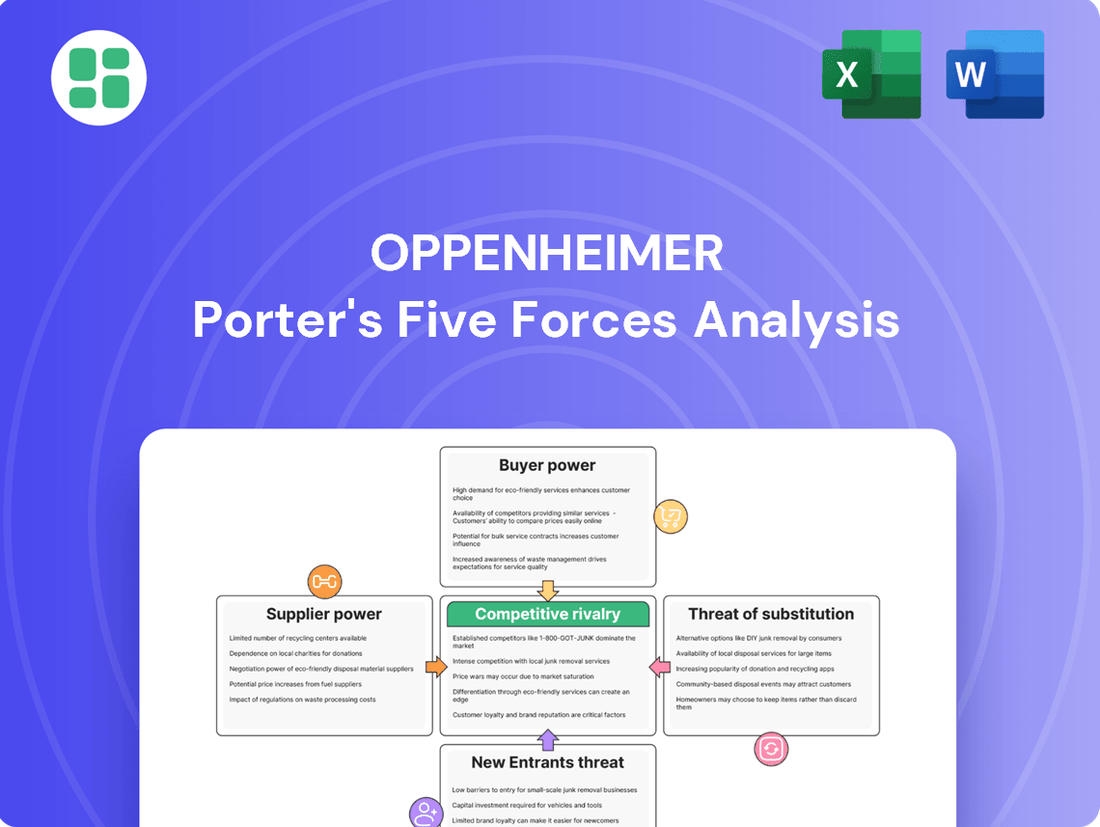

Oppenheimer's position within its industry is shaped by the interplay of five key forces, including the bargaining power of its customers and the threat of new entrants. Understanding these dynamics is crucial for any strategic evaluation of the company's competitive landscape.

The complete report reveals the real forces shaping Oppenheimer’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Oppenheimer Holdings' reliance on a specialized workforce, encompassing financial advisors, investment bankers, and analysts, underscores the significant bargaining power of highly skilled talent. The demand for professionals with expertise in emerging fields like AI and data analytics is particularly acute, creating a competitive landscape for talent acquisition.

In 2024, the financial services sector continues to grapple with a shortage of specialized skills, especially in areas driving technological innovation. This scarcity directly translates into increased bargaining power for these professionals, compelling firms like Oppenheimer to offer highly competitive compensation packages, robust benefits, and well-defined career progression opportunities to attract and retain them.

Technology providers hold significant bargaining power over Oppenheimer, especially as the financial services sector leans heavily into digital transformation. Oppenheimer's reliance on these vendors for essential infrastructure, software, and advanced data analytics tools means that changes in technology, like the widespread adoption of AI and cloud solutions, can allow specialized tech companies to dictate higher prices. For instance, the global market for AI in financial services was projected to reach over $10 billion in 2024, indicating a strong demand and pricing power for leading AI solution providers.

Oppenheimer's reliance on specialized data vendors for real-time market insights, crucial for capital markets and wealth management, grants these suppliers significant bargaining power. The sheer volume of market data, which has seen exponential growth, further solidifies the essential nature of these providers' offerings.

In 2024, the global financial data market was valued at over $35 billion, highlighting the substantial revenue streams for these information gatekeepers. The proprietary nature of many data sets and the high cost of switching vendors mean Oppenheimer has limited alternatives, increasing supplier leverage.

Regulatory Compliance Solutions

The increasing complexity of financial regulations, such as those stemming from Basel III reforms and evolving data privacy laws, significantly enhances the bargaining power of suppliers offering specialized regulatory compliance solutions. Firms are increasingly reliant on these RegTech providers to navigate a landscape where non-compliance can lead to substantial fines, as evidenced by the billions in penalties levied against financial institutions for various regulatory breaches in recent years. This reliance grants suppliers leverage, especially those with proven track records and comprehensive, integrated platforms that can adapt to new mandates.

Suppliers of advanced regulatory compliance solutions benefit from high switching costs for financial institutions. Once a firm integrates a particular RegTech platform, the effort and expense involved in migrating to a competitor are often prohibitive. This stickiness is amplified by the need for continuous updates and specialized expertise, which only a few providers can consistently deliver. For instance, the global RegTech market was projected to reach approximately $25 billion in 2024, indicating strong demand and the critical nature of these services.

- High Switching Costs: Implementing and integrating new compliance software is resource-intensive, making it difficult for financial firms to change providers.

- Specialized Expertise: Only a limited number of suppliers possess the deep knowledge required to interpret and implement complex global financial regulations.

- Critical Need for Accuracy: The severe penalties for non-compliance drive demand for reliable and proven compliance solutions, increasing supplier leverage.

- Market Growth: The expanding RegTech market, with significant projected growth through 2025, reflects the essential nature of these services and the power of their providers.

Funding and Liquidity Providers

Even though Oppenheimer is a financial services firm, it still needs access to funding and liquidity, often from larger financial institutions or capital markets. The terms and availability of this wholesale funding are crucial. For instance, during periods of market stress, like the regional banking turmoil experienced in early 2023, the cost of borrowing for financial firms can significantly increase, impacting their profitability and ability to offer competitive financial products.

The bargaining power of these funding and liquidity providers is amplified when capital is scarce or when Oppenheimer requires substantial amounts for specific transactions or ongoing operations. This reliance means that the pricing and conditions set by these external sources can directly affect Oppenheimer's operational capacity and the profitability of its offerings.

- Impact on Funding Costs: Providers can dictate higher interest rates or fees, especially during economic uncertainty.

- Availability of Capital: In tight credit markets, access to necessary liquidity might be restricted, limiting Oppenheimer's strategic moves.

- Influence on Product Development: The cost of wholesale funding can influence the pricing and viability of certain financial products Oppenheimer brings to market.

Suppliers of critical technology and data, particularly those offering AI and specialized analytics, wield considerable bargaining power over Oppenheimer. This is due to the high demand for these services, as seen in the projected over $10 billion market for AI in financial services in 2024, and the significant costs associated with switching vendors. Similarly, providers of regulatory compliance solutions (RegTech) benefit from high switching costs and specialized expertise, with the RegTech market expected to reach around $25 billion in 2024. Financial institutions' reliance on these essential services, coupled with limited alternatives and the severe penalties for non-compliance, significantly strengthens supplier leverage.

| Supplier Type | 2024 Market Projection | Key Bargaining Factors |

|---|---|---|

| AI in Financial Services | Over $10 billion | High demand, specialized expertise, critical need for innovation |

| Financial Data Providers | Over $35 billion | Proprietary data, high switching costs, essential for operations |

| RegTech Solutions | Approximately $25 billion | Specialized expertise, high switching costs, critical for compliance |

What is included in the product

This analysis unpacks the competitive forces impacting Oppenheimer, detailing industry rivalry, buyer and supplier power, new entrant threats, and substitute products to inform strategic decision-making.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

High-net-worth individuals and institutional clients, such as pension funds and endowments, wield significant bargaining power with firms like Oppenheimer. Their substantial asset bases and transaction volumes mean that losing even a few of these clients can have a material impact on revenue. For instance, in 2024, the average high-net-worth individual globally controlled over $1 million in investable assets, and institutional investors often manage billions.

These sophisticated clients are well-informed and can easily compare service offerings and fee structures across multiple wealth management and investment banking providers. They often demand tailored solutions, preferential pricing, and a high level of personalized service, leveraging their financial clout to negotiate favorable terms. This ability to switch providers if their demands aren't met intensifies their bargaining power.

Customers today possess remarkable access to financial information and market data, significantly diminishing information asymmetry. Online platforms and comparison tools empower individuals to research investment options, fees, and performance metrics with ease, leveling the playing field.

The proliferation of digital wealth management and self-directed trading platforms has further amplified customer leverage. In 2024, the global robo-advisory market was projected to exceed $2.5 trillion in assets under management, a testament to clients' growing comfort and demand for digitally-enabled, cost-effective financial services, forcing traditional firms to adapt or risk losing market share.

For certain financial services, such as basic brokerage or standard asset management, the effort and expense involved in switching providers can be minimal. This low barrier to entry for customers means they can readily explore and move to competitors, directly influencing Oppenheimer's need to remain competitive on pricing and service quality. In 2023, the average cost for retail investors to transfer brokerage accounts was often negligible, especially for digital-first platforms.

Demand for Tailored and Integrated Solutions

Clients are increasingly seeking financial services that are not just standard products but highly personalized and integrated solutions. This demand for bespoke portfolios and comprehensive financial planning, tailored to individual goals and life stages, significantly enhances customer bargaining power. For instance, in 2024, a significant portion of high-net-worth individuals expressed a preference for advisors who could offer holistic wealth management, combining investment strategies with estate planning and tax advice.

Financial institutions that can deliver these customized, seamless digital experiences are better positioned to meet evolving client expectations. However, this very ability allows customers to negotiate more favorable terms or switch providers if their specific needs for integration and personalization are not met. The ability to demand and receive such tailored services directly impacts the pricing and service level agreements that firms can enforce, thereby increasing customer leverage.

- Personalization Demand: Reports from 2024 indicate over 70% of affluent investors prefer financial advisors who offer personalized, integrated wealth management.

- Digital Integration Expectation: A growing number of clients, particularly younger demographics, expect financial platforms to seamlessly integrate banking, investing, and financial planning tools.

- Switching Behavior: In 2024, the ease of switching between financial service providers, often facilitated by digital platforms, empowers customers to seek out firms offering superior customization.

Client Expectations for Technology and Transparency

Modern clients, particularly younger demographics, demand intuitive digital platforms and clear insights into their investments. A 2024 survey indicated that 75% of Gen Z investors prioritize user-friendly mobile apps and readily accessible performance data.

The expectation for transparency extends to fees and investment strategies. Clients are increasingly scrutinizing how their money is managed and what costs are involved, pushing firms to be more open about their operations. Failure to provide this level of clarity can lead to significant client attrition.

Firms failing to adapt to these technological and transparency demands face a heightened risk of losing business. For instance, a significant portion of clients surveyed in early 2024 expressed willingness to switch financial providers if their current one lacked advanced digital tools or comprehensive reporting.

- Digital Experience: 75% of Gen Z investors prioritize user-friendly mobile apps.

- Transparency Demand: Clients increasingly scrutinize fees and investment strategies.

- Competitive Pressure: Lack of advanced digital tools and reporting drives client switching.

Customers' bargaining power is amplified by their access to information and the ease with which they can switch providers. This forces firms like Oppenheimer to offer competitive pricing and superior service to retain clients. The demand for personalized solutions and seamless digital experiences further empowers customers, allowing them to negotiate better terms.

| Customer Segment | Bargaining Power Drivers | Impact on Firms |

|---|---|---|

| High-Net-Worth Individuals | Large asset base, demand for personalization | Pressure on fees, need for tailored services |

| Institutional Clients | Billions in assets, transaction volume | Significant revenue impact if lost, negotiation leverage |

| Retail Investors (Digital Savvy) | Access to data, low switching costs | Need for competitive digital platforms and transparent pricing |

Preview Before You Purchase

Oppenheimer Porter's Five Forces Analysis

This preview showcases the complete Oppenheimer Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. You are viewing the actual, professionally formatted report, ensuring no discrepancies or placeholder content. This comprehensive analysis is ready for your immediate use upon completion of your transaction.

Rivalry Among Competitors

Oppenheimer competes with massive, globally integrated financial institutions. These bulge-bracket banks, such as JPMorgan Chase and Goldman Sachs, possess vast resources, extensive client networks, and formidable brand equity, offering a full spectrum of services from investment banking to wealth management.

These larger competitors often leverage their scale to offer more competitive pricing and a wider array of integrated solutions. For instance, in 2023, the top five global investment banks generated hundreds of billions in revenue, demonstrating their significant market presence and capacity to outspend smaller firms on talent and technology.

Oppenheimer faces intense competition not only from major global players but also from a multitude of regional and boutique investment banks. These smaller firms often possess deep local market knowledge and specialized expertise, allowing them to effectively compete for mandates within niche and mid-market segments. This dynamic creates a crowded landscape where differentiation and client relationships are paramount for success.

The financial services sector is grappling with significant price and fee compression, especially in asset management and brokerage. This trend is fueled by a surge in competition and the growing popularity of cost-effective digital platforms. For instance, the average expense ratio for actively managed equity mutual funds in the U.S. dropped to 0.68% in 2023, down from 0.76% in 2022, reflecting this intense pricing pressure.

This downward pressure on fees directly escalates rivalry among firms. Companies are increasingly competing on price to win and keep clients, making it harder to maintain profit margins. The rise of robo-advisors, for example, has pushed traditional wealth managers to lower their advisory fees, with many now charging less than 1% for assets under management.

Talent Poaching and Retention Challenges

The financial services sector is experiencing intense competition for skilled professionals, often referred to as talent poaching. This rivalry significantly drives up compensation expenses as firms aggressively recruit experienced advisors and bankers.

This heightened competition for human capital directly impacts profitability by increasing operational costs. For instance, in 2024, the average base salary for a financial advisor in the US saw an increase, with bonuses and commissions further inflating total compensation packages. This upward pressure on wages intensifies the rivalry among financial institutions.

- Talent Poaching: Firms actively seek to hire employees from competitors, often offering lucrative packages.

- High Compensation: Increased demand for experienced professionals leads to higher base salaries, bonuses, and equity.

- Retention Challenges: Maintaining a stable workforce requires ongoing investment in competitive compensation and benefits.

- Impact on Profitability: Rising labor costs can squeeze profit margins if not offset by revenue growth or efficiency gains.

Technological Innovation and Digital Transformation

The financial services industry is locked in a fierce competition driven by rapid technological innovation. Firms are pouring resources into areas like artificial intelligence, automation, and advanced data analytics to differentiate themselves.

This technological arms race is crucial for enhancing customer experiences, streamlining operations, and securing a market advantage. Companies that fail to keep pace with these advancements, such as the widespread adoption of AI in wealth management, risk significant erosion of their competitive standing.

For instance, in 2024, global spending on AI in financial services was projected to reach over $30 billion, highlighting the scale of investment and the intensity of this rivalry. This push for digital transformation means that lagging firms face a real threat of being outmaneuvered by more agile, tech-forward competitors.

- AI Adoption: Leading firms are leveraging AI for personalized financial advice, fraud detection, and algorithmic trading.

- Digital Client Experience: Investment in user-friendly mobile apps and online platforms is a key differentiator.

- Operational Efficiency: Automation of back-office processes through robotics and AI is a major focus for cost reduction.

- Data Analytics: Utilizing big data for risk management, customer segmentation, and product development is critical for competitive edge.

Oppenheimer faces intense rivalry from both global behemoths and specialized boutique firms. The sheer scale and resource advantage of bulge-bracket banks like JPMorgan Chase and Goldman Sachs, which generated hundreds of billions in revenue in 2023, allow them to offer integrated solutions and competitive pricing. Conversely, smaller, niche players leverage deep market knowledge to capture specific segments.

Fee compression is a significant driver of this rivalry, with average expense ratios for U.S. equity mutual funds falling to 0.68% in 2023. This pressure forces firms to compete on price, impacting profitability. The demand for skilled financial professionals also fuels competition, driving up compensation costs as firms engage in aggressive talent poaching, as evidenced by rising average base salaries for financial advisors in 2024.

| Competitor Type | Key Strengths | Competitive Tactics | Impact on Rivalry |

|---|---|---|---|

| Global Investment Banks | Vast resources, extensive networks, brand equity | Scale-based pricing, integrated solutions | Price pressure, market share dominance |

| Regional/Boutique Firms | Niche expertise, local market knowledge | Specialized services, client relationships | Market segmentation, differentiated offerings |

| Digital Platforms/Robo-Advisors | Cost-effectiveness, accessibility | Lower fees, user-friendly interfaces | Fee compression, disruption of traditional models |

SSubstitutes Threaten

The rise of direct-to-consumer digital platforms and robo-advisors presents a substantial threat of substitutes for traditional wealth management. These platforms offer automated, low-cost investment solutions, directly appealing to a growing segment of tech-savvy investors and those with less complex financial needs.

For instance, by early 2024, the assets under management for major robo-advisors continued to climb, with some platforms reporting double-digit percentage growth year-over-year. This accessibility and affordability challenge the value proposition of human advisors, particularly for clients with smaller portfolios who may find the fees associated with traditional services prohibitive.

Large corporations increasingly possess sophisticated in-house corporate finance teams capable of managing certain investment banking functions. For instance, companies like Berkshire Hathaway have historically demonstrated a strong capacity for internal deal-making and capital allocation, reducing reliance on external advisors for many transactions.

This internal expertise can handle routine mergers and acquisitions advisory or capital raising activities, especially for smaller or less complex deals. In 2024, the trend of companies building out internal M&A capabilities continued, with many larger entities aiming to control costs and gain deeper insights into their strategic transactions.

Private equity and alternative financing sources present a significant threat of substitution for traditional investment banking capital-raising services. Firms like Apollo Global Management and Blackstone have seen substantial growth in their private credit and direct lending arms, offering businesses alternatives to public markets or traditional bank loans. For instance, the global private debt market was estimated to be worth over $1.5 trillion by the end of 2023, demonstrating its increasing relevance.

Self-Directed Investing and Financial Planning Tools

The rise of accessible online platforms and sophisticated financial planning software presents a significant threat of substitutes for Oppenheimer's traditional wealth management services. Individuals and even smaller institutions can now manage their portfolios and plan their financial futures with minimal or no professional intervention, directly impacting the demand for human advisory services.

These self-directed tools empower users with features like automated rebalancing, robo-advisory capabilities, and comprehensive market data analysis. For instance, by mid-2024, the assets under management in robo-advisors were projected to reach over $2 trillion globally, demonstrating a clear shift towards digital, self-service financial management.

- Increased Accessibility: Online platforms have democratized access to investment tools, allowing a broader range of individuals to engage in financial planning.

- Cost-Effectiveness: Self-directed options are often significantly cheaper than traditional wealth management fees, making them an attractive alternative.

- Technological Advancement: Continuous innovation in fintech provides users with increasingly powerful and user-friendly tools, narrowing the gap in capabilities compared to professional services.

- Growing User Confidence: As more individuals successfully manage their finances independently, confidence in self-directed investing grows, further solidifying this as a viable substitute.

Decentralized Finance (DeFi)

The burgeoning Decentralized Finance (DeFi) sector presents a notable threat of substitutes to traditional financial institutions. DeFi platforms, built on blockchain technology, offer services like peer-to-peer lending, decentralized exchanges, and blockchain-based asset management, directly challenging the role of intermediaries. By mid-2024, the total value locked (TVL) in DeFi protocols surpassed $100 billion, indicating significant user adoption and capital flow away from traditional channels for specific financial activities.

This ecosystem provides alternative avenues for capital deployment and borrowing, potentially siphoning off market share from incumbent banks and investment firms. For instance, DeFi lending protocols in early 2024 offered competitive interest rates, attracting borrowers seeking more favorable terms than those available through traditional credit markets. The accessibility and often lower fees associated with DeFi services make them an increasingly attractive substitute for a growing segment of users.

- DeFi's Growth: The total value locked in DeFi protocols reached over $100 billion by mid-2024.

- Alternative Services: DeFi offers peer-to-peer lending, decentralized exchanges, and blockchain-based asset management.

- Competitive Rates: DeFi lending protocols in early 2024 provided attractive interest rates, drawing in borrowers.

- Disruptive Potential: DeFi's accessibility and lower fees pose a significant threat to traditional financial intermediaries.

The threat of substitutes for Oppenheimer's services is multifaceted, encompassing digital platforms, in-house corporate capabilities, private finance, and decentralized finance (DeFi). These alternatives offer cost efficiencies, greater accessibility, and innovative solutions that directly challenge traditional financial models.

The increasing sophistication and adoption of self-directed financial tools, such as robo-advisors, represent a significant substitute. By mid-2024, global assets under management in robo-advisors were projected to exceed $2 trillion, demonstrating a clear trend towards automated, lower-cost investment management that appeals to a broad investor base.

Companies are also bolstering their internal financial expertise. For example, in 2024, many larger corporations continued to build out in-house mergers and acquisitions teams to manage transactions more cost-effectively and with greater strategic control, reducing reliance on external investment banks for certain activities.

Furthermore, the growth of private equity and alternative financing, with the global private debt market exceeding $1.5 trillion by the end of 2023, provides businesses with viable alternatives to traditional capital markets. The Decentralized Finance (DeFi) sector, with over $100 billion in total value locked by mid-2024, offers disruptive peer-to-peer lending and decentralized exchanges, presenting a compelling substitute for traditional financial intermediaries.

Entrants Threaten

The financial services sector presents formidable entry barriers due to extensive regulatory requirements. New entrants must navigate complex licensing, substantial capital requirements, and strict adherence to frameworks like the Digital Operational Resilience Act (DORA) and the Anti-Money Laundering and Counter-Terrorist Financing Directive (AMLA). For instance, in 2024, obtaining a full banking license in major jurisdictions can cost millions and involve years of scrutiny.

These stringent compliance demands, including robust data protection and consumer safeguarding measures, significantly deter potential new competitors, particularly in specialized areas like investment banking and securities brokerage. The ongoing evolution of regulations, such as those addressing digital assets and cybersecurity, further elevates the cost and complexity of market entry.

Establishing a full-service financial firm like Oppenheimer demands immense capital. Think about the costs for technology, compliance, and skilled personnel. For instance, in 2024, major financial institutions reported billions in operating expenses, a clear barrier to entry for smaller players.

These significant capital requirements act as a powerful deterrent. Newcomers would need to secure substantial funding to even begin competing, covering everything from sophisticated trading platforms to robust cybersecurity measures. This financial hurdle effectively limits the number of viable new entrants into the market.

Brand reputation and client trust are critical barriers to entry in financial services. Established firms like Oppenheimer have cultivated decades of client relationships and strong brand recognition, assets that new entrants simply cannot replicate overnight. For instance, in 2024, the financial advisory sector continued to see a premium placed on trust, with surveys indicating that over 70% of investors prioritize a firm's reputation and existing client relationships when choosing an advisor.

Talent Acquisition and Retention Challenges

New entrants in the financial services industry face significant hurdles in attracting and retaining top talent. Established firms often leverage their brand recognition, existing client relationships, and robust compensation packages, including bonuses and benefits, which are difficult for newer companies to replicate. This creates a substantial barrier, especially when competing for experienced financial advisors, investment bankers, and specialized tech professionals crucial for modern financial operations.

The difficulty in matching established compensation structures is a key deterrent. For instance, in 2024, the average total compensation for a senior investment banker in major financial hubs could easily exceed $500,000, a figure that startups struggle to offer consistently. Similarly, attracting skilled data scientists or cybersecurity experts, vital for fintech innovation, involves competing with high demand and lucrative offers from incumbent institutions.

- Talent Scarcity: High demand for specialized financial and technological skills exacerbates the challenge for new entrants.

- Compensation Gap: Startups often cannot match the comprehensive compensation and benefits offered by established financial institutions.

- Network Advantage: Existing firms benefit from established professional networks, making it easier to recruit experienced individuals.

- Retention Difficulty: High turnover rates can occur as new entrants struggle to provide the career progression and stability that experienced professionals seek.

Technological Infrastructure and Innovation Costs

The high cost of developing and maintaining advanced technological infrastructure presents a significant barrier for new entrants in the financial services sector. This includes investing in sophisticated AI platforms, robust cybersecurity measures, and efficient trading systems, all of which demand substantial capital outlay.

For instance, a major investment bank might spend billions annually on technology, a figure far beyond the reach of most startups. In 2024, the global spending on financial technology (FinTech) was projected to exceed $300 billion, highlighting the immense investment required to compete.

- High Capital Expenditure: Building state-of-the-art trading platforms and AI capabilities requires upfront investment often in the hundreds of millions of dollars.

- Ongoing Maintenance and Upgrades: Continuous investment is needed to keep technology current, secure, and compliant, adding to the operational burden.

- Talent Acquisition Costs: Specialized engineers and data scientists are in high demand and command significant salaries, increasing the cost of building and maintaining these systems.

- Cybersecurity Investment: Protecting sensitive financial data necessitates substantial and ongoing investment in advanced cybersecurity solutions, estimated to be tens of billions globally for the financial sector.

The threat of new entrants into the financial services sector, including firms like Oppenheimer, is significantly mitigated by substantial barriers. These include extensive regulatory compliance, requiring millions in licensing and years of scrutiny, as seen with directives like DORA and AMLA in 2024. Furthermore, the immense capital needed for technology, compliance, and skilled personnel, with major institutions reporting billions in operating expenses annually, deters smaller players.

Brand reputation and client trust are also critical deterrents; established firms benefit from decades of cultivated relationships, a factor that surveys in 2024 showed influenced over 70% of investor decisions. The difficulty in matching incumbent compensation packages, with senior investment banker salaries potentially exceeding $500,000 in 2024, and the high cost of advanced technology, with global FinTech spending projected over $300 billion in 2024, further solidify these barriers.

| Barrier Type | Description | Example Data (2024) |

|---|---|---|

| Regulatory Compliance | Navigating complex licensing, capital requirements, and directives. | Banking license costs in millions; DORA/AMLA compliance. |

| Capital Requirements | Funding technology, compliance, and skilled personnel. | Major financial institutions' billions in annual operating expenses. |

| Brand Reputation & Trust | Cultivated client relationships and long-standing recognition. | 70%+ of investors prioritize reputation and existing relationships. |

| Talent Acquisition & Compensation | Attracting and retaining skilled professionals. | Senior investment banker compensation >$500,000; high demand for data scientists. |

| Technological Infrastructure | Investing in advanced AI, cybersecurity, and trading systems. | Global FinTech spending projected >$300 billion. |

Porter's Five Forces Analysis Data Sources

Our Oppenheimer Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, SEC filings, and industry-specific market research reports to capture competitive dynamics.

We leverage financial statements, analyst reports, and trade publications to meticulously assess the bargaining power of suppliers and buyers, as well as the threat of new entrants and substitutes.