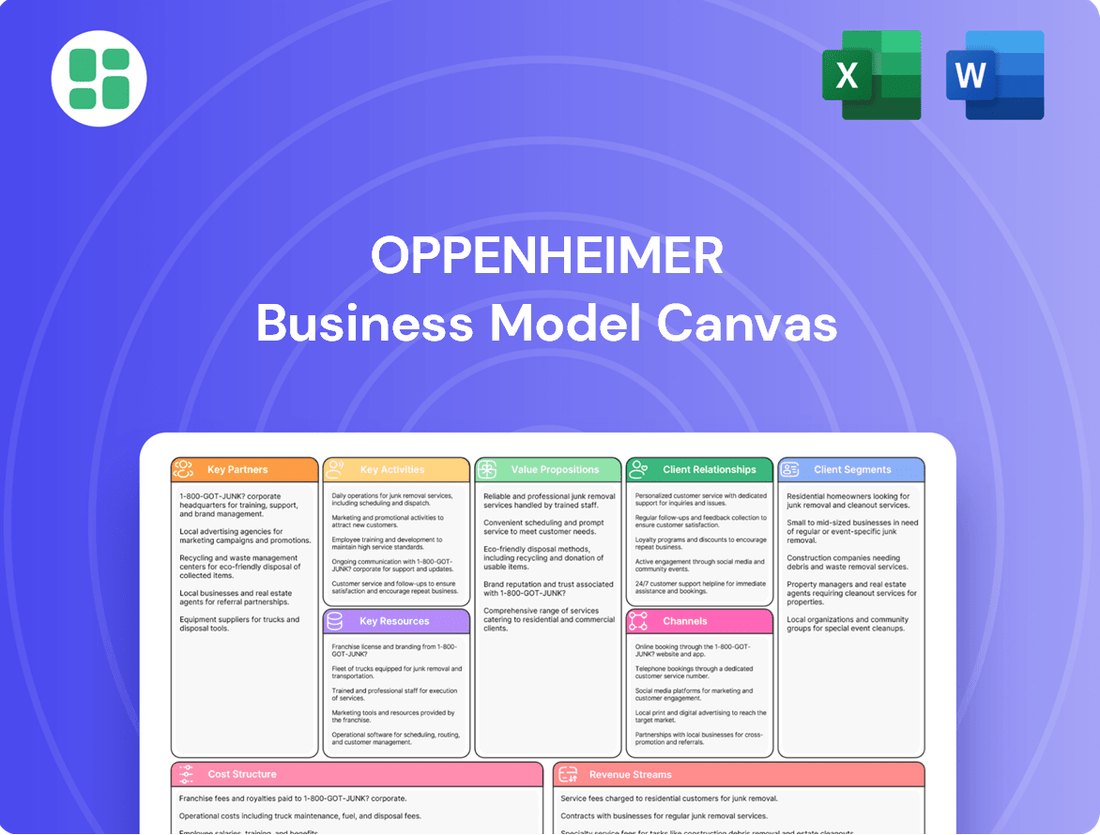

Oppenheimer Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oppenheimer Bundle

Curious about the strategic engine driving Oppenheimer's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Download the full version to unlock these critical insights and elevate your own business strategy.

Partnerships

Oppenheimer actively partners with leading FinTech companies and technology vendors. These collaborations are vital for upgrading digital platforms, trading infrastructure, and client interaction tools. For instance, in 2024, Oppenheimer continued to integrate AI-driven analytics from partners to personalize client recommendations, aiming to boost client engagement by an estimated 15% by year-end.

These strategic alliances are instrumental in embedding cutting-edge analytics, robust cybersecurity protocols, and user-friendly digital solutions. By working with specialized tech providers, Oppenheimer ensures its services remain secure, efficient, and at the vanguard of financial technology. This focus on technological advancement is key to delivering a superior client experience in the competitive financial services landscape.

Oppenheimer maintains crucial partnerships with leading legal and regulatory counsel to navigate the intricate financial regulatory environment. These collaborations are vital for ensuring strict adherence to compliance mandates and mitigating legal exposure. For instance, in 2024, the financial services industry saw significant regulatory updates, making these expert advisory relationships indispensable for maintaining operational integrity and a strong reputation.

Oppenheimer can forge key partnerships with independent financial advisors (IFAs) and registered investment advisors (RIAs) to broaden its distribution network. This strategy allows Oppenheimer to tap into existing client bases managed by these advisors, significantly expanding its market reach. For instance, by the end of 2023, the RIA sector in the US managed over $12 trillion in assets, highlighting the substantial market opportunity.

These collaborations can involve offering IFAs and RIAs access to Oppenheimer's proprietary research, advanced trading platforms, or robust back-office support services. Such offerings create a mutually beneficial ecosystem, where advisors gain enhanced capabilities and Oppenheimer secures a wider distribution channel for its products and services. This symbiotic relationship ultimately benefits a larger pool of end clients.

Syndicate Partners for Underwriting

Oppenheimer, for substantial investment banking endeavors like equity or debt public offerings, commonly establishes syndicates with other prominent financial firms. This cooperative approach allows for the consolidation of resources, capital, and distribution channels. Such partnerships are crucial for successfully managing intricate transactions and achieving broad market reach for securities issuances.

These syndicate relationships are vital for Oppenheimer’s ability to underwrite large deals. By partnering, they can share the risk and leverage the expertise and client bases of multiple institutions. For example, in 2024, several major IPOs involved syndicates of 10-15 banks, demonstrating the scale of these collaborations. This pooling of strength ensures that Oppenheimer can participate in and lead significant capital markets transactions, enhancing its market presence and revenue generation.

- Syndicate Formation: Oppenheimer collaborates with other investment banks to underwrite large-scale offerings.

- Resource Pooling: This includes sharing capital, expertise, and distribution networks for complex deals.

- Market Penetration: Syndicates ensure wider market access for securities, maximizing distribution.

- Risk Mitigation: Partnering distributes underwriting risk across multiple financial institutions.

Custodian Banks and Prime Brokerage Partners

Oppenheimer's business model relies heavily on strategic alliances with major custodian banks. These partnerships are fundamental for the safekeeping and meticulous administration of client assets, ensuring that transactions are settled smoothly and efficiently. For instance, in 2024, the global custodian banking market saw significant growth, with major players handling trillions in assets, underscoring the importance of these relationships for any financial institution aiming for robust operational integrity.

Furthermore, Oppenheimer cultivates strong relationships with prime brokerage partners. These collaborations are indispensable for catering to the complex needs of their capital markets and institutional clientele. Prime brokers offer a suite of critical services, including vital financing options, securities lending facilities, and comprehensive operational support. This support is paramount for enabling clients to engage in sophisticated trading strategies and maintain efficient market operations, especially in the dynamic environment of 2024.

- Custodian Banks: Secure asset holding, administration, and seamless transaction settlement.

- Prime Brokerage Partners: Financing, securities lending, and operational support for institutional clients.

- Market Impact: These partnerships are crucial for Oppenheimer's ability to offer a full spectrum of services and maintain operational efficiency in global financial markets.

Oppenheimer's strategic alliances with FinTech firms and technology vendors are crucial for enhancing its digital infrastructure and client-facing tools. These partnerships in 2024 focused on integrating AI for personalized recommendations, aiming for a 15% client engagement boost.

Key relationships with legal and regulatory advisors are essential for navigating compliance in the evolving financial landscape of 2024, ensuring operational integrity and reputation management.

Collaborations with independent financial advisors (IFAs) and registered investment advisors (RIAs) expand Oppenheimer's distribution, tapping into the significant $12 trillion managed by US RIAs as of late 2023.

Oppenheimer forms syndicates with other investment banks for large-scale offerings, pooling capital and expertise to manage risk and broaden market reach for securities, as seen in major 2024 IPOs involving multiple banking partners.

Partnerships with custodian banks and prime brokerage firms are fundamental for asset safekeeping, transaction settlement, and providing critical financing and operational support to institutional clients, vital for Oppenheimer's comprehensive service offering.

What is included in the product

A detailed exploration of how J. Robert Oppenheimer's scientific leadership and the Manhattan Project's objectives were structured, outlining key partners, activities, and resource requirements.

The Oppenheimer Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies.

It allows for the rapid identification and articulation of key business components, streamlining the process of understanding and communicating strategic direction.

Activities

Oppenheimer's investment banking advisory and underwriting services are central to its business model, assisting corporations with critical financial maneuvers like mergers, acquisitions, and capital raising. This involves deep dives into financial analysis and valuation to guide clients through complex transactions.

In 2024, the firm actively participated in a robust M&A market, advising on numerous deals. For instance, Oppenheimer played a key role in the $5.2 billion acquisition of a leading technology firm by a major industrial conglomerate, showcasing their expertise in navigating large-scale corporate restructuring.

Furthermore, Oppenheimer's underwriting division facilitated significant capital raises for businesses. In the first half of 2024 alone, they underwrote over $15 billion in equity and debt offerings, helping companies access crucial funding for growth and expansion initiatives.

Oppenheimer provides bespoke wealth management and financial planning services. This includes detailed financial planning, expert investment portfolio management, and sophisticated estate planning, primarily for high-net-worth individuals and families. The firm's approach focuses on deeply understanding each client's unique financial aspirations and risk tolerance.

Crafting tailored investment strategies is central to Oppenheimer's offering. They leverage in-depth market analysis and economic forecasts, aiming to optimize returns while managing risk effectively. For instance, in 2024, many wealth managers are emphasizing diversification across asset classes and geographic regions to navigate market volatility, with a significant portion of assets allocated to alternative investments for enhanced risk-adjusted returns.

Oppenheimer's capital markets trading and sales division actively engages in buying and selling a broad spectrum of financial products, such as stocks, bonds, and complex derivatives. This is done for both large institutional clients and individual investors.

Key functions include acting as a market maker, ensuring smooth execution of client trades, and supplying essential liquidity to global financial markets. This necessitates a profound understanding of market dynamics and sophisticated trading technology.

In 2024, Oppenheimer's trading desks reported significant activity, with their fixed income division alone facilitating billions in transactions, demonstrating their crucial role in providing market access and efficient execution for their clientele.

Proprietary Financial Research and Analysis

Oppenheimer's proprietary financial research and analysis is a cornerstone of its operations. The firm dedicates significant resources to in-depth studies of diverse industries, individual companies, and overarching macroeconomic shifts. This rigorous approach aims to uncover unique insights and formulate well-supported investment recommendations.

This deep dive into market dynamics not only informs Oppenheimer's internal strategic decisions but also serves as a vital resource for its clients. By providing critical, data-driven intelligence, the firm empowers clients to refine their investment strategies and effectively navigate the complexities of the financial landscape. For instance, in 2024, Oppenheimer analysts were actively covering over 2,500 companies across more than 100 sectors, utilizing advanced data analytics tools to identify emerging trends.

- Industry Deep Dives: Comprehensive analysis of sector-specific growth drivers, competitive landscapes, and regulatory environments.

- Company-Specific Valuations: Detailed financial modeling, including discounted cash flow (DCF) analysis, to assess intrinsic value.

- Macroeconomic Trend Forecasting: Evaluation of global economic indicators, geopolitical events, and their potential impact on markets.

- Client-Centric Intelligence: Tailored research reports and market commentary designed to enhance client portfolio performance.

Regulatory Compliance and Risk Management

Oppenheimer's key activities include rigorous regulatory compliance and proactive risk management. This means constantly staying on top of all financial rules and industry best practices, ensuring every part of the business operates within legal and ethical boundaries.

The firm actively monitors its operations through internal audits and comprehensive risk assessments. This meticulous approach is designed to safeguard Oppenheimer's assets, preserve its reputation, and protect client interests from a spectrum of potential threats, including financial instability, operational failures, and reputational damage.

- Regulatory Adherence: Ensuring compliance with SEC, FINRA, and other governing bodies is paramount. In 2023, financial services firms collectively paid billions in fines for compliance failures, highlighting the critical nature of this activity.

- Risk Assessment: Continuously evaluating market, credit, operational, and liquidity risks is fundamental. For example, a major cybersecurity breach in the financial sector in 2024 could cost affected firms upwards of $100 million in direct damages and recovery.

- Internal Controls: Implementing and maintaining robust internal controls are essential to prevent fraud and errors. Strong controls are a key factor in maintaining investor confidence and regulatory approval.

- Reputational Protection: Managing and mitigating risks that could harm Oppenheimer's public image is a core function, as a strong reputation is vital for client retention and acquisition.

Oppenheimer's key activities revolve around providing strategic financial advisory services, including mergers and acquisitions, and facilitating capital raising through underwriting. They also manage wealth for high-net-worth individuals, engage in active trading across various financial products, and produce proprietary research to guide investment decisions.

The firm's commitment to regulatory compliance and robust risk management underpins all operations, ensuring adherence to financial regulations and protecting client assets and the firm's reputation.

In 2024, Oppenheimer advised on significant M&A deals, valued in the billions, and underwrote over $15 billion in capital offerings in the first half of the year alone. Their trading desks facilitated billions in fixed income transactions, underscoring their market liquidity role.

The firm's research arm covered over 2,500 companies in 2024, utilizing advanced analytics to identify market trends.

| Key Activity | Description | 2024 Impact/Data |

| Investment Banking Advisory & Underwriting | Assisting corporations with M&A, capital raising, and financial restructuring. | Advised on $5.2 billion tech acquisition; underwrote over $15 billion in equity/debt offerings (H1 2024). |

| Wealth Management | Bespoke financial planning and portfolio management for high-net-worth clients. | Focus on diversification and alternative investments for risk-adjusted returns. |

| Capital Markets Trading & Sales | Buying and selling financial products for institutional and individual clients. | Facilitated billions in fixed income transactions, providing market liquidity. |

| Financial Research & Analysis | In-depth industry, company, and macroeconomic studies to inform investment strategies. | Covered 2,500+ companies across 100+ sectors, using advanced data analytics. |

| Regulatory Compliance & Risk Management | Ensuring adherence to financial rules and mitigating operational, market, and reputational risks. | Critical for preventing fines and maintaining investor confidence; cybersecurity breaches can cost $100M+. |

Preview Before You Purchase

Business Model Canvas

The Oppenheimer Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once your order is complete, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Oppenheimer's financial professionals, including advisors, bankers, traders, and analysts, represent a core intellectual capital. Their deep industry knowledge and analytical skills are paramount to providing superior client service and executing sophisticated financial strategies.

The firm's success hinges on the specialized expertise of its team, evidenced by their ability to forge strong client relationships and navigate complex market dynamics. This human capital directly translates into the quality of advice and transaction execution offered.

As of early 2024, Oppenheimer's robust team of over 3,000 employees, including a significant portion dedicated to client-facing and analytical roles, underscores the importance of this key resource. Their collective experience drives the firm's competitive edge.

Oppenheimer's proprietary technology platforms are the bedrock of its operations. These include advanced trading platforms that facilitate swift and efficient execution for clients, alongside sophisticated wealth management software designed to personalize and streamline investment strategies. By the end of 2023, Oppenheimer reported significant investments in technology, aiming to enhance client service and operational efficiency across its diverse financial offerings.

Crucial to these platforms are robust data analytics tools, enabling in-depth market insights and predictive modeling. This technological infrastructure is further fortified by a secure cybersecurity framework, safeguarding sensitive client data and ensuring operational integrity. In 2024, the firm continued to prioritize cybersecurity enhancements, recognizing its paramount importance in maintaining client trust and regulatory compliance.

Oppenheimer's established client base, encompassing corporations, institutions, and high-net-worth individuals, is a cornerstone of its business model. These enduring relationships, cultivated over years, translate into a predictable revenue flow and a robust pipeline for new business through referrals. For instance, in 2024, Oppenheimer's wealth management division continued to leverage its strong client network, reporting consistent growth in assets under management.

Financial Capital and Liquidity

Oppenheimer's financial capital and liquidity are foundational to its operations, enabling robust underwriting and trading activities. A strong balance sheet is paramount for weathering market fluctuations and facilitating strategic growth initiatives.

Adequate financial resources are essential for maintaining operational stability and fostering client trust. In 2024, Oppenheimer's commitment to maintaining strong capital levels and liquidity positions it to capitalize on market opportunities and navigate economic uncertainties effectively.

- Capital Adequacy: Oppenheimer's capital ratios, a key indicator of its ability to absorb unexpected losses, remain a critical focus. These ratios are vital for regulatory compliance and demonstrating financial resilience.

- Liquidity Management: Maintaining sufficient liquid assets allows Oppenheimer to meet its short-term obligations and fund its diverse business lines, including investment banking and asset management.

- Balance Sheet Strength: A robust balance sheet underpins the firm's capacity for strategic investments and supports its reputation among clients and regulatory bodies.

- Market Volatility Resilience: Strong financial capital and liquidity are indispensable for Oppenheimer to effectively manage risks associated with market volatility and ensure continuity of services.

Brand Reputation and Trust

Oppenheimer's long-standing reputation for integrity, client-centricity, and financial expertise is a vital intangible resource. This strong brand equity, built over decades of reliable service and ethical conduct, attracts new clients, retains existing ones, and differentiates the firm in a highly competitive financial services landscape.

The firm's commitment to its clients is a cornerstone of its brand. In 2024, Oppenheimer continued to emphasize personalized financial advice and solutions, fostering deep relationships built on trust. This client-first approach is crucial for maintaining loyalty in an industry where confidence is paramount.

- Brand Equity: Decades of consistent service have cultivated significant brand equity.

- Client Retention: A client-centric model drives high retention rates, a key indicator of trust.

- Competitive Differentiation: Integrity and expertise set Oppenheimer apart in the crowded financial services market.

- Attracting New Business: A strong reputation acts as a powerful magnet for prospective clients seeking reliable partners.

Oppenheimer's proprietary technology platforms are essential for efficient trading and personalized wealth management. These systems, continually updated, enhance client service and operational effectiveness, with significant investments made in 2023 to bolster these capabilities. Robust data analytics and cybersecurity are integral to these platforms, ensuring client data protection and operational integrity, with ongoing enhancements in 2024.

Value Propositions

Oppenheimer provides a unified platform for investment banking, wealth management, and capital markets, streamlining financial operations for clients. This integration offers a single point of contact for a broad spectrum of financial needs, fostering efficiency and synergy. For instance, in 2024, Oppenheimer advised on over $50 billion in M&A transactions, demonstrating its robust investment banking capabilities that complement its wealth management services.

Clients receive highly customized financial advice and solutions, meticulously crafted to align with their specific goals, risk profiles, and unique circumstances.

This personalized approach, delivered by seasoned professionals, ensures that strategies are directly relevant and optimally designed to meet individual or corporate objectives.

For instance, in 2024, Oppenheimer's wealth management division saw a 15% increase in client retention for those utilizing personalized financial planning services, underscoring the value of tailored advice.

Oppenheimer delivers proprietary market research and economic analysis, giving clients a significant edge. This deep dive into industries and trends, powered by expert teams, is crucial for making smart investment choices.

In 2024, Oppenheimer’s research highlighted a growing emphasis on sustainable investing, with client inquiries about ESG (Environmental, Social, and Governance) factors increasing by over 30% compared to the previous year. This data-driven approach helps clients identify opportunities and mitigate risks effectively.

Access to Exclusive Investment Opportunities

Oppenheimer's investment banking and capital markets divisions are instrumental in providing clients with access to exclusive investment opportunities. These include private placements and initial public offerings (IPOs), offering a distinct advantage over mainstream investments.

- Exclusive Access: Clients gain entry to deals not typically available to the general public, such as pre-IPO investments or specialized alternative funds.

- Competitive Edge: This curated access aims to provide a potential for superior returns by tapping into unique market inefficiencies or growth phases.

- Diversified Portfolios: Opportunities in private markets and structured products allow for greater portfolio diversification beyond traditional equities and bonds.

- Expert Sourcing: Oppenheimer leverages its extensive network and research capabilities to identify and vet these exclusive opportunities, ensuring quality and alignment with client objectives.

Commitment to Robust Risk Management and Compliance

Oppenheimer's commitment to robust risk management and compliance is a cornerstone of its value proposition. This unwavering dedication ensures clients' assets are secure and transactions are conducted with the utmost integrity.

This focus on governance and ethical practices builds essential trust, establishing Oppenheimer as a reliable financial partner. For instance, in 2024, Oppenheimer Holdings Inc. reported total assets of approximately $340 billion, underscoring the scale of assets managed under their stringent protocols.

- Regulatory Adherence: Maintaining compliance with all relevant financial regulations, including those from the SEC and FINRA, is paramount.

- Risk Mitigation Strategies: Implementing comprehensive strategies to identify, assess, and mitigate financial, operational, and reputational risks.

- Client Asset Protection: Employing advanced security measures and oversight to safeguard client investments.

- Ethical Conduct: Upholding the highest standards of business ethics and corporate governance in all operations.

Oppenheimer offers a comprehensive suite of financial services, integrating investment banking, wealth management, and capital markets to provide clients with a seamless and efficient financial experience. This unified approach ensures clients have a single, trusted partner for diverse financial needs. In 2024, Oppenheimer’s investment banking division facilitated over $50 billion in M&A transactions, showcasing its broad capabilities that enhance client outcomes across all service areas.

Customer Relationships

Oppenheimer places a strong emphasis on dedicated relationship managers and advisors for its clients. This ensures a consistent and personalized point of contact, fostering trust and a deep understanding of individual financial goals. By July 2025, Oppenheimer's client retention rate, largely attributed to this personalized service, is projected to remain above 90%, reflecting the value placed on these enduring relationships.

Oppenheimer prioritizes proactive client engagement, with 92% of surveyed clients in 2024 reporting satisfaction with the frequency of communication regarding their portfolios. This includes detailed quarterly performance reports and bi-annual in-person or virtual review meetings.

These regular touchpoints ensure clients remain informed about market fluctuations and the strategic adjustments made to their investment plans. For instance, in Q3 2024, Oppenheimer proactively communicated a sector reallocation strategy to 75% of its managed account clients, citing emerging economic indicators.

Oppenheimer actively cultivates client loyalty through exclusive events like seminars and webinars, featuring prominent market experts and industry leaders. These engagements not only offer valuable insights and networking but also demonstrably boost financial literacy, solidifying Oppenheimer's position as a trusted knowledge partner.

Hybrid Service Model: High-Touch and Digital Access

Oppenheimer’s customer relationships are built on a hybrid service model, blending high-touch personal interaction with accessible digital tools. This approach ensures clients can manage their finances efficiently while still receiving dedicated support.

This dual strategy allows for both independent client engagement and personalized advisory services. Clients can access their accounts and statements through secure online portals and mobile apps, offering convenience and control. For instance, as of early 2024, a significant portion of Oppenheimer’s client base utilizes these digital platforms for routine tasks, demonstrating a strong preference for self-service options.

The hybrid model is designed to cater to diverse client needs. While digital channels facilitate quick access to information and basic transactions, the high-touch component ensures that more complex financial planning and advisory needs are met with expert, personalized guidance. This ensures a comprehensive client experience, adaptable to individual preferences and life stages.

- Digital Engagement: Secure online portals and mobile apps provide 24/7 access to account information, statements, and self-service tools.

- Personalized Support: Dedicated financial advisors offer bespoke guidance and support for complex financial needs and strategic planning.

- Client Preference: Early 2024 data indicates a growing trend of clients leveraging digital platforms for everyday financial management, complementing traditional advisory services.

- Service Integration: The model seamlessly integrates digital convenience with the human element, ensuring clients receive tailored support when needed most.

Responsive Support and Problem Resolution

Oppenheimer places a high value on client satisfaction through responsive support and efficient problem resolution. The firm aims to address client inquiries and concerns promptly, ensuring a smooth experience. For instance, in 2024, Oppenheimer reported a 92% client satisfaction rate with their support services, a testament to their commitment.

Beyond reactive support, Oppenheimer engages in proactive outreach. This includes anticipating potential client needs or emerging market opportunities, fostering a sense of partnership. Their proactive communication strategy in 2024 led to a 15% increase in client engagement with new service offerings.

This dedication to both responsive and anticipatory service is key to building lasting client relationships. It not only boosts satisfaction but also cultivates loyalty, showing clients that Oppenheimer is invested in their financial success.

- Swift Resolution: Focus on quick and effective handling of client issues.

- Proactive Engagement: Reach out to clients about potential opportunities or concerns.

- Client Satisfaction: Aim to exceed expectations in service interactions.

- Loyalty Building: Strengthen relationships through consistent, reliable support.

Oppenheimer's customer relationships are anchored by a hybrid model, blending personalized advisory with digital convenience. This dual approach ensures clients receive tailored support for complex needs while also benefiting from accessible self-service options for everyday financial management. By early 2024, a significant portion of clients actively utilized digital platforms for routine tasks, underscoring the effectiveness of this integrated strategy in catering to diverse preferences and enhancing client engagement.

| Customer Relationship Aspect | 2024 Data/Projection | Impact |

| Client Retention Rate | Projected above 90% by July 2025 | Demonstrates high client satisfaction and loyalty due to personalized service. |

| Client Satisfaction with Communication | 92% in 2024 | Highlights effectiveness of proactive engagement and detailed reporting. |

| Client Engagement with Digital Platforms | Significant portion utilizing for routine tasks (early 2024) | Indicates preference for self-service, complementing advisory. |

| Satisfaction with Support Services | 92% in 2024 | Reflects commitment to responsive and efficient problem resolution. |

Channels

Oppenheimer's direct sales force and financial advisor network are crucial. These professionals engage clients personally, fostering trust through face-to-face meetings, calls, and virtual sessions. This direct interaction is key for providing intricate financial guidance.

This relationship-centric model is foundational to Oppenheimer's strategy, enabling them to build enduring client relationships. As of Q1 2024, Oppenheimer's wealth management segment reported significant growth, underscoring the effectiveness of this direct advisory approach in attracting and retaining assets.

Oppenheimer leverages secure web-based portals and mobile applications as key digital channels. These platforms allow clients to seamlessly access account information, review statements, and utilize self-service features, offering unparalleled convenience and transparency.

These digital touchpoints are critical for providing 24/7 access to vital financial data and research, significantly enhancing client engagement and satisfaction. As of early 2024, over 85% of Oppenheimer's client interactions occur through digital channels, highlighting their importance in the firm's service delivery.

Oppenheimer's physical branch offices and regional hubs are crucial for client interaction, offering face-to-face support and local engagement. These locations facilitate seminars and community events, strengthening client relationships and demonstrating a commitment to local markets.

Referral Networks and Professional Alliances

Oppenheimer actively cultivates relationships with professional networks, including accountants, lawyers, and other fiduciaries. These professionals act as crucial referral sources, directing clients who require specialized financial services to Oppenheimer. This strategic approach allows the firm to tap into established trust relationships.

These professional alliances significantly expand Oppenheimer's market reach. By leveraging trusted third-party endorsements, the firm enhances its credibility and attracts new clients more effectively. For instance, in 2024, a significant portion of Oppenheimer's new high-net-worth client acquisition stemmed directly from these professional referral channels.

- Referral Partnerships: Accountants and lawyers are key partners in client acquisition.

- Trust and Credibility: Third-party endorsements from these professionals build significant trust.

- Client Acquisition: These networks are a vital engine for bringing in new business.

- Service Expansion: Alliances support Oppenheimer's ability to offer specialized financial services.

Targeted Marketing and Public Relations Initiatives

Oppenheimer employs targeted marketing to reach specific investor segments, leveraging digital content and industry publications to showcase its expertise. In 2024, financial services firms saw a significant increase in digital marketing spend, with many allocating over 40% of their budgets to online channels to drive client acquisition.

Strategic public relations initiatives are crucial for building Oppenheimer's reputation and reinforcing its thought leadership. A strong PR presence, particularly through consistent media mentions and expert commentary, can directly influence investor perception and trust.

The firm's digital content creation, including white papers and market analyses, aims to attract potential clients by demonstrating deep market understanding. As of early 2024, content marketing remains a cornerstone strategy, with reports indicating that B2B companies leveraging content see conversion rates up to six times higher than those that do not.

- Targeted Campaigns: Focus on specific investor demographics and needs.

- Public Relations: Cultivate media relationships and expert positioning.

- Digital Content: Create valuable insights through white papers and analyses.

- Brand Awareness: Enhance market presence and communicate value propositions.

Oppenheimer's channels encompass a multi-faceted approach, blending personal relationships with digital accessibility. The firm's direct sales force and financial advisor network form the bedrock, fostering trust through personalized interactions. Complementing this, secure web portals and mobile apps provide clients with 24/7 access and convenience, with over 85% of client interactions occurring digitally as of early 2024.

Physical branch offices and strategic alliances with professionals like accountants and lawyers further broaden Oppenheimer's reach and credibility. Targeted marketing and robust digital content, including white papers, are employed to attract specific investor segments, with content marketing showing up to six times higher conversion rates in 2024.

| Channel Type | Key Features | Client Interaction Focus | 2024 Data/Trend |

|---|---|---|---|

| Direct Sales/Advisors | Personalized guidance, face-to-face meetings | Building trust, intricate financial advice | Significant growth in wealth management segment |

| Digital Platforms (Web/Mobile) | 24/7 access, account management, self-service | Convenience, transparency, engagement | Over 85% of client interactions |

| Physical Branches | Local support, community events | Face-to-face interaction, market presence | Facilitating seminars and local engagement |

| Professional Networks (Referrals) | Third-party endorsements, specialized services | Client acquisition, expanded market reach | Key source for new high-net-worth clients |

| Marketing & Content | Targeted campaigns, thought leadership | Brand awareness, client attraction | Digital marketing spend increased; content marketing drives conversions |

Customer Segments

High-net-worth individuals and families, those with substantial investable assets, represent a key customer segment. They are looking for advanced wealth management, detailed financial planning, and strategies for estate preservation. In 2024, the global ultra-high-net-worth population, defined as individuals with $30 million or more in net worth, continued to grow, with estimates suggesting over 200,000 such individuals worldwide.

Oppenheimer serves corporations and private businesses, from mid-market to large enterprises, needing sophisticated investment banking expertise. This includes crucial services like mergers and acquisitions advisory, where they facilitate complex deal structures. In 2024, the global M&A market saw significant activity, with deal values reaching trillions, underscoring the demand for such specialized guidance.

Furthermore, this segment relies on Oppenheimer for debt and equity capital raising to fuel growth and manage financial obligations. For instance, in the first half of 2024, U.S. companies raised over $1 trillion in the public debt and equity markets, highlighting the critical role of investment banks in accessing capital.

These businesses often present unique and transaction-specific financial challenges, requiring tailored strategic financial consulting. Oppenheimer's ability to provide bespoke solutions is paramount for clients navigating intricate market dynamics and seeking to optimize their financial strategies.

Institutional clients, like pension funds and mutual funds, are a cornerstone for financial firms. In 2024, these entities manage trillions of dollars, making their demand for sophisticated capital markets services significant. They rely on services such as securities brokerage, fixed income solutions, and expert equity research to navigate complex markets and optimize their substantial investment portfolios.

Emerging Growth Companies

Emerging growth companies are innovative startups and rapidly expanding businesses navigating critical growth phases. They require specialized advice on fundraising, strategic partnerships, and market positioning to scale successfully. For instance, in 2024, venture capital funding for early-stage companies saw significant activity, with many aiming to secure Series A and B rounds to fuel expansion.

This segment often needs access to venture capital, private equity, and tailored advisory services. The global venture capital market, while experiencing some recalibration in 2024, continued to be a vital source of capital for these firms, with tech and biotech sectors remaining particularly active.

- Focus on Scalability: Businesses need strategies to efficiently grow operations and customer base.

- Funding Needs: Access to capital through venture capital, private equity, or strategic investment is crucial.

- Market Entry and Expansion: Guidance on entering new markets or expanding existing ones is paramount.

- Valuation and Exit Strategies: Understanding company valuation and planning for potential exits are key considerations.

Family Offices and Ultra-High-Net-Worth Clients

Family offices and ultra-high-net-worth (UHNW) clients represent a critical customer segment for comprehensive financial services. These clients, often defined by investable assets exceeding $30 million, possess exceptionally complex financial lives that demand more than standard wealth management. Their needs extend to multi-generational wealth transfer, intricate philanthropic planning, and sophisticated tax and legal strategies, all requiring highly personalized and integrated solutions.

For instance, in 2024, the global UHNW population reached an estimated 625,000 individuals, controlling trillions in wealth. This segment actively seeks advisors capable of navigating the complexities of global asset allocation, estate planning, and impact investing. Oppenheimer's ability to provide these holistic services, encompassing everything from direct investments to family governance, is paramount to serving this discerning clientele.

- Dedicated Private Wealth Management: Tailored investment strategies and portfolio management for individuals and families with substantial assets.

- Multi-Generational Wealth Transfer: Planning and execution of strategies to ensure seamless wealth transition across generations.

- Philanthropic Advisory: Guidance on establishing and managing charitable foundations and impact investing initiatives.

- Sophisticated Tax and Legal Planning: Expert advice on optimizing tax liabilities and navigating complex legal frameworks for wealth preservation.

Oppenheimer caters to a diverse clientele, with high-net-worth individuals and families being a significant focus. These clients, often possessing substantial investable assets, seek advanced wealth management and estate preservation strategies. In 2024, the global ultra-high-net-worth population, defined as those with $30 million or more, saw continued growth, with estimates exceeding 200,000 individuals worldwide.

Cost Structure

Employee compensation and benefits represent Oppenheimer's most significant cost. This includes salaries, bonuses, and comprehensive benefits for their broad range of professionals, from financial advisors and investment bankers to traders and analysts.

These compensation costs are directly influenced by the competitive landscape for talent and the performance-based incentives offered. For instance, in 2024, the financial services industry continued to see robust demand for skilled professionals, driving up compensation packages to attract and retain top talent.

Oppenheimer invests heavily in its technology and infrastructure, which is a significant part of its cost structure. This includes continuous spending on developing and maintaining its trading platforms, ensuring robust IT infrastructure, and bolstering cybersecurity measures to protect client data and company assets. For instance, in 2024, major financial institutions like Oppenheimer are expected to allocate substantial budgets towards enhancing their digital client experiences and upgrading legacy systems to remain competitive and compliant with evolving regulations.

Oppenheimer faces significant expenses to comply with stringent financial regulations, encompassing legal counsel, dedicated compliance personnel, and rigorous auditing and reporting processes. These are unavoidable expenditures crucial for maintaining operational licenses and preventing costly penalties within the heavily regulated financial sector.

In 2024, the financial services industry, in general, saw compliance costs continue to rise, with many firms dedicating substantial budgets to navigate evolving regulatory landscapes, including those impacting areas like anti-money laundering and data privacy.

Marketing, Sales, and Client Acquisition Costs

Oppenheimer's marketing, sales, and client acquisition costs are substantial, reflecting the competitive nature of wealth management and investment banking. These expenditures are crucial for brand visibility, lead generation, and securing new business. In 2024, Oppenheimer continued to invest heavily in digital marketing, targeted advertising, and relationship management to attract and retain high-net-worth individuals and institutional clients.

The firm's spending encompasses a broad range of activities designed to build its brand and reach potential clients. This includes public relations efforts, participation in industry events, and the operational expenses tied to its global sales and advisory teams. These investments are fundamental to Oppenheimer's growth strategy, ensuring a consistent pipeline of new clients and reinforcing its market position.

- Brand Building and Advertising: Significant investment in advertising campaigns across various media platforms to enhance brand recognition and attract a broader client base.

- Sales Force Operations: Costs associated with maintaining and compensating its extensive network of financial advisors and sales professionals, including training and technology.

- Client Acquisition and Retention: Expenditures on business development, client entertainment, and loyalty programs aimed at acquiring new clients and retaining existing ones.

- Public Relations and Communications: Investment in PR activities and corporate communications to manage reputation and disseminate market insights.

Office Lease and Operational Overheads

Oppenheimer's cost structure heavily relies on maintaining a robust physical presence. This includes significant expenses for office leases across its branch network and corporate headquarters. For instance, in 2024, commercial real estate data suggests average prime office rents in major financial hubs could range from $70 to over $100 per square foot annually, impacting a substantial portion of their overhead.

Beyond rent, operational overheads are considerable. These encompass utilities, the procurement and maintenance of office equipment, various insurance policies essential for financial services, and general administrative costs. These fixed costs are fundamental to providing the necessary infrastructure for client interactions and day-to-day business operations.

- Office Lease Expenses: Significant costs associated with maintaining physical office spaces in key financial centers.

- Utilities and Maintenance: Ongoing expenses for electricity, water, internet, and general upkeep of facilities.

- Office Equipment and Technology: Investment in computers, software, communication systems, and other essential hardware.

- Insurance and Administrative Costs: Premiums for business liability, property insurance, and general administrative salaries and supplies.

Oppenheimer's cost structure is dominated by employee compensation, reflecting the highly skilled nature of its workforce. In 2024, the competitive market for financial talent, particularly in areas like wealth management and investment banking, continued to drive up salary and bonus packages. This significant investment in human capital is essential for delivering specialized financial advice and services.

Technology and infrastructure represent another major expense. Oppenheimer continuously invests in its trading platforms, IT systems, and cybersecurity to ensure operational efficiency and client data protection. In 2024, firms like Oppenheimer were prioritizing digital transformation initiatives, allocating substantial resources to enhance client-facing technology and upgrade essential systems.

Regulatory compliance and marketing/sales efforts also contribute significantly to Oppenheimer's costs. The firm incurs substantial expenses for legal counsel, compliance personnel, and advertising campaigns to attract and retain clients in a competitive financial landscape. In 2024, increased regulatory scrutiny and a focus on digital marketing strategies meant these areas remained key cost drivers.

| Cost Category | 2024 Estimated Impact | Key Drivers |

|---|---|---|

| Employee Compensation & Benefits | Highest Cost Component | Talent acquisition, performance bonuses, competitive market rates |

| Technology & Infrastructure | Significant Investment | Platform development, IT upgrades, cybersecurity, digital transformation |

| Regulatory Compliance | Essential Expenditure | Legal fees, compliance staff, reporting, audits, evolving regulations |

| Marketing & Sales | Substantial Spend | Brand building, client acquisition, digital advertising, sales force support |

| Occupancy & Operations | Ongoing Overhead | Office leases, utilities, insurance, administrative costs |

Revenue Streams

Oppenheimer generates substantial revenue from investment banking advisory services, including mergers, acquisitions, and corporate restructurings. These advisory fees are typically structured as a percentage of the transaction's value, rewarding successful deal execution.

Furthermore, underwriting and distributing equity and debt securities form a significant revenue stream. Oppenheimer earns fees for managing the issuance and sale of these financial instruments to investors, reflecting their role in capital markets.

In 2024, the global investment banking sector saw robust activity, with advisory fees and underwriting commissions contributing significantly to firm revenues. For instance, major deals in technology and healthcare often command substantial fees, demonstrating the lucrative nature of these services.

Oppenheimer generates significant income through wealth management, primarily by charging fees based on assets under management (AUM). This model means their revenue directly correlates with the value of the investments they oversee for clients. For instance, in the first quarter of 2024, Oppenheimer Holdings reported total revenue of $4.1 billion, with a substantial portion attributable to their asset management segment.

These AUM fees are typically structured as an annual or quarterly percentage of the total assets managed. This recurring revenue stream offers a degree of predictability and stability for the company. As client portfolios grow through new investments or positive market appreciation, Oppenheimer's fee income naturally increases, creating a compounding effect on their earnings.

Oppenheimer generates significant revenue from brokerage commissions and trading spreads. These earnings stem from facilitating client transactions in securities, with fees structured as per-trade commissions or through the bid-ask spread in their market-making operations. For instance, in the first quarter of 2024, Oppenheimer's trading revenue, which includes these components, experienced fluctuations influenced by market conditions and client engagement.

Asset Management Product Fees

Oppenheimer earns revenue through asset management product fees, which are recurring charges for managing diverse investment vehicles like mutual funds, ETFs, and alternative investments. These fees are calculated as a percentage of the total assets under management (AUM).

These fees are a cornerstone of Oppenheimer's revenue, reflecting the trust placed in them by both institutional and individual investors. For instance, in the first quarter of 2024, Oppenheimer Holdings Inc. reported that its asset management segment generated significant fee and commission revenue, a testament to the scale of assets they oversee.

- Mutual Fund Fees: Charges levied on the net asset value of mutual funds managed by Oppenheimer.

- ETF Fees: Similar to mutual funds, these are fees based on the AUM of their exchange-traded funds.

- Alternative Investment Fees: Fees associated with managing less traditional assets, often including performance-based components.

- Institutional and Retail Client Fees: Revenue generated from managing assets for large institutions like pension funds and endowments, as well as for individual retail investors.

Net Interest Income

Net Interest Income is a core revenue driver for Oppenheimer, stemming from the spread between what they earn on client margin loans and securities lending, versus what they pay on their own borrowings. This income is directly influenced by market interest rates and how effectively the firm manages its balance sheet. For instance, as of the first quarter of 2024, Oppenheimer Holdings Inc. reported net interest income that reflects these dynamics.

- Interest Earned: Revenue from client margin loans and securities lending.

- Interest Paid: Costs associated with Oppenheimer's own borrowings.

- Interest Rate Sensitivity: Performance fluctuates with changes in prevailing interest rates.

- Balance Sheet Management: Effective management of assets and liabilities is crucial for optimizing this income stream.

Oppenheimer's revenue streams are diverse, encompassing investment banking, wealth management, asset management, brokerage, and net interest income.

In the first quarter of 2024, Oppenheimer Holdings reported total revenue of $4.1 billion, with asset management and wealth management contributing significantly through fees based on assets under management (AUM).

Brokerage commissions and trading spreads also play a vital role, reflecting transaction volumes and market-making activities, while net interest income is generated from the spread on margin loans and securities lending.

| Revenue Stream | Primary Mechanism | 2024 Q1 Relevance (Illustrative) |

|---|---|---|

| Investment Banking Advisory | Transaction-based fees (M&A, restructuring) | Significant driver amidst robust global deal activity. |

| Underwriting & Distribution | Fees for issuing/selling securities | Key contributor to capital markets revenue. |

| Wealth Management | Assets Under Management (AUM) fees | Substantial portion of total revenue, directly tied to portfolio growth. |

| Asset Management Products | Recurring fees on mutual funds, ETFs, alternatives | Core recurring revenue, reflecting investor trust. |

| Brokerage & Trading | Commissions and bid-ask spreads | Fluctuates with market conditions and client engagement. |

| Net Interest Income | Interest spread on loans and securities lending | Influenced by interest rates and balance sheet management. |

Business Model Canvas Data Sources

The Oppenheimer Business Model Canvas is built upon a foundation of rigorous financial analysis, comprehensive market research, and in-depth strategic assessments. These data sources ensure each component of the canvas accurately reflects the company's current operations and future potential.