OPmobility SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPmobility Bundle

OPmobility's strategic positioning is clear, but are you ready to uncover the hidden opportunities and potential threats that lie beneath the surface? Our comprehensive SWOT analysis dives deep into their market dynamics, revealing critical insights for informed decision-making.

Want the full story behind OPmobility's competitive edge and potential challenges? Purchase our complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

OPmobility commands a strong global leadership position, particularly in intelligent exterior systems and clean energy systems. This broad offering caters to a diverse automotive landscape, encompassing internal combustion engine, hybrid, and electric vehicles, showcasing their adaptability to evolving market demands.

The company's strength lies in its diversified product portfolio, which spans exterior components, lighting, modules, and energy systems. This strategic diversification mitigates risks associated with reliance on any single product segment, enabling OPmobility to navigate market fluctuations effectively.

With an extensive global footprint, OPmobility operates 150 plants and 40 R&D centers across 28 countries. This widespread presence not only reinforces its market standing but also enhances its capacity to serve a global clientele and foster innovation through distributed research capabilities.

OPmobility showcased impressive financial strength in 2024, with revenues climbing 2.8% to €11.6 billion. This performance notably outpaced the broader automotive market by 4.0 percentage points, highlighting the company's competitive edge.

The company's growth was fueled by widespread sales increases across all geographical regions and particularly strong results in its Modules and Exterior business segments. This broad-based success underscores OPmobility's diversified market presence and product appeal.

Further demonstrating its operational efficiency, OPmobility achieved significant gains in its operating margin, net result, and free cash flow. These improvements reflect effective cost management strategies and robust execution of its business plan, solidifying its financial resilience.

OPmobility's dedication to innovation is a significant strength, underscored by substantial R&D investments aimed at creating cleaner, safer, and more connected mobility solutions. This focus drives the development of cutting-edge technologies such as hydrogen fuel cells, intelligent exterior systems equipped with integrated sensors, and advanced lightweight materials.

This strategic commitment positions OPmobility as a leader in automotive technological progress, ensuring they can effectively meet the dynamic demands of the industry. For instance, in 2023, OPmobility reported a notable increase in its R&D expenditure, reflecting its proactive approach to staying ahead in a rapidly evolving market.

Strategic Geographical Expansion, particularly in the US and India

OPmobility is strategically expanding its global reach, with a significant focus on the United States and India. The company has identified the US as its largest market and aims to double sales there by 2028, indicating strong growth potential. This aggressive expansion is supported by concrete plans, including the establishment of new manufacturing facilities and an R&D center in India by 2025.

This deliberate geographical diversification is a key strength, allowing OPmobility to tap into high-growth regions and reduce reliance on any single market. The investment in India, specifically, highlights the company's commitment to capturing emerging opportunities in a rapidly developing economy.

- US Market Focus: Aiming to double sales in the United States by 2028, solidifying its position as the largest market.

- Indian Expansion: Planning to open additional plants and an R&D center in India by 2025 to enhance its presence.

- Growth Opportunity Capture: Strategic expansion into key markets like the US and India allows OPmobility to capitalize on new business avenues.

- Global Footprint Strengthening: This diversification reinforces OPmobility's international presence and market penetration capabilities.

Strong Sustainability Initiatives and ESG Performance

OPmobility places sustainability at the core of its operations, with a defined strategy targeting carbon neutrality for scopes 1 and 2 emissions starting in 2025. This commitment is validated by its consistent 'A' rating from CDP Climate for two consecutive years, underscoring robust environmental, social, and governance (ESG) performance.

This dedication to sustainability not only positions OPmobility favorably within evolving global environmental standards but also significantly boosts its brand image and attractiveness to investors and consumers prioritizing eco-friendly practices.

- Carbon Neutrality Target: Aims for scope 1 and 2 carbon neutrality from 2025.

- CDP Climate Rating: Achieved an 'A' rating for two consecutive years, demonstrating strong ESG credentials.

- Stakeholder Appeal: Enhances reputation and attractiveness to environmentally conscious stakeholders.

OPmobility's robust financial performance in 2024 is a significant strength, with revenues growing 2.8% to €11.6 billion, outperforming the automotive market by 4.0 percentage points. This growth was broad-based, with increases across all regions and strong contributions from the Modules and Exterior segments. The company also demonstrated operational excellence by improving its operating margin, net result, and free cash flow.

The company's commitment to innovation is a key differentiator, evident in its substantial R&D investments focused on clean energy and intelligent systems. This forward-looking approach ensures OPmobility remains at the forefront of automotive technology, catering to the evolving needs of the industry. Their strategic expansion into high-growth markets like the US and India, including planned investments in new facilities by 2025, further solidifies their competitive advantage and future growth potential.

OPmobility's strong emphasis on sustainability, targeting carbon neutrality for scopes 1 and 2 emissions from 2025 and maintaining a consistent 'A' rating from CDP Climate, enhances its brand reputation and appeal to environmentally conscious stakeholders. This strategic focus on ESG principles aligns with global trends and strengthens the company's long-term value proposition.

| Metric | 2024 Performance | Significance |

|---|---|---|

| Revenue Growth | 2.8% (€11.6 billion) | Outperformed automotive market by 4.0 pp, indicating strong market share gains. |

| R&D Investment | Substantial, focused on clean energy & intelligent systems | Drives technological leadership and future product development. |

| US Market Ambition | Double sales by 2028 | Capitalizes on largest market potential for significant revenue expansion. |

| India Expansion | New plants & R&D center by 2025 | Establishes strong foothold in a high-growth emerging market. |

| Sustainability Rating | 'A' CDP Climate rating (2 consecutive years) | Demonstrates strong ESG performance, enhancing brand and stakeholder appeal. |

What is included in the product

Analyzes OPmobility’s competitive position through key internal and external factors.

OPmobility's SWOT analysis offers a clear, visual representation of strategic factors, simplifying complex business landscapes for rapid decision-making.

Weaknesses

OPmobility's continued reliance on traditional internal combustion engine (ICE) components, such as fuel tanks and depollution systems, presents a significant weakness. This dependence becomes more pronounced as the automotive sector accelerates its transition to electric vehicles (EVs). For instance, the global EV market share for new passenger car sales reached approximately 14% in 2023, a figure projected to climb significantly in the coming years.

This strong tie to ICE technology could hinder OPmobility's adaptability in markets with aggressive EV adoption targets. If the company's transition to EV-specific technologies is not swift or comprehensive enough, it risks facing structural long-term decline. This could lead to considerable downward pressure on future revenue streams as demand for ICE components wanes.

While OPmobility's overall revenue shows growth, specific regional markets pose significant hurdles. For example, the European market experienced a notable downturn in electric battery vehicle sales during 2024, a key segment for the company.

North America's market faced headwinds in 2024 due to elevated vehicle inventories and postponed program launches, which directly affected OPmobility's module production activities in Mexico.

In China, despite the market's general expansion, the rise of local electric vehicle production has created competitive pressures, particularly impacting OPmobility's C-Power business unit.

OPmobility operates in the automotive supplier sector, which is currently experiencing significant headwinds. Declining vehicle production volumes and the ongoing transition from internal combustion engines (ICE) to battery electric vehicles (BEVs) create substantial uncertainty, impacting demand for traditional components. This environment puts pressure on profitability, as suppliers often have tighter margins than original equipment manufacturers (OEMs).

While OPmobility has shown some margin improvement, the broader industry trend of lower average profit margins persists. For instance, industry reports from 2024 indicate that automotive supplier operating margins typically range from 3% to 7%, a figure consistently below OEM margins. Intense competition, coupled with rapid technological advancements, can further erode earnings potential, creating an ongoing drag on profitability.

Risk Associated with Acquisitions and New Business Integration

The integration of new businesses, such as the acquisition of Varroc Lighting Systems, presents significant challenges that can impact OPmobility's financial health. The slow growth and delayed profitability in this recently acquired lighting division are creating an ongoing earnings drag, potentially reducing net margins. For instance, in the first half of 2024, the lighting segment's profitability was notably lower than anticipated, contributing to a broader pressure on the company's overall financial performance.

Achieving the desired profitability from acquisitions is often a complex and time-consuming process. This can divert crucial resources and management attention away from core operations, potentially hindering OPmobility's ability to capitalize on existing market opportunities or innovate effectively. The financial strain from integrating these new entities can also impact the company's ability to invest in future growth initiatives.

- Earnings Drag: The lighting division's slow growth is negatively impacting OPmobility's overall profitability.

- Integration Complexity: Merging new businesses like Varroc Lighting Systems requires significant resources and time.

- Profitability Delays: Achieving expected returns from acquisitions can be a lengthy process, affecting financial performance.

Vulnerability to Supply Chain Disruptions and Raw Material Volatility

OPmobility, like many automotive suppliers, remains susceptible to ongoing supply chain snags. The industry has grappled with persistent shortages of essential components, notably semiconductor chips. This vulnerability directly impacts production schedules and can lead to delays in delivering finished products.

The cost of raw materials is another significant concern. For instance, fluctuations in the prices of metals crucial for automotive components can directly affect OPmobility's bottom line. Coupled with persistent labor shortages in manufacturing sectors, these rising costs can strain operational stability and make it harder to maintain competitive pricing in the market.

- Semiconductor Shortages: Continued impact on automotive production globally, with estimates suggesting the industry lost billions in revenue in 2023 due to chip scarcity.

- Raw Material Price Volatility: Prices for key metals like aluminum and copper have seen significant swings, impacting manufacturing input costs.

- Labor Market Tightness: Persistent shortages in skilled manufacturing labor contribute to increased operational expenses and potential production bottlenecks.

OPmobility's significant reliance on internal combustion engine (ICE) components, such as fuel tanks and depollution systems, is a key weakness. This dependence is amplified by the automotive industry's rapid shift towards electric vehicles (EVs). By 2023, EVs accounted for roughly 14% of new passenger car sales globally, a figure anticipated to grow substantially.

This entanglement with ICE technology could impede OPmobility's ability to adapt to markets prioritizing EV adoption. If the company's transition to EV-specific technologies isn't swift or comprehensive, it risks a long-term structural decline, leading to considerable downward pressure on future revenues as demand for ICE parts diminishes.

The company's financial performance is also hampered by specific regional market challenges and integration issues. For example, the lighting division, acquired through Varroc Lighting Systems, has shown slow growth and delayed profitability, creating an earnings drag. Furthermore, the automotive supplier sector faces headwinds from declining production volumes and the ICE-to-BEV transition, impacting demand for traditional components and compressing profit margins, which typically range from 3% to 7% in 2024.

| Weakness Category | Specific Issue | Impact/Data Point |

| Technology Dependence | Reliance on ICE Components | Global EV market share ~14% in 2023, projected to rise. |

| Market Adaptation | Slow EV Transition | Risk of long-term decline if EV tech integration lags. |

| Profitability & Integration | Lighting Division Performance | Slow growth and delayed profitability in acquired lighting segment. |

| Industry Headwinds | Sector Profit Margins | Automotive supplier margins typically 3-7% (2024), below OEMs. |

What You See Is What You Get

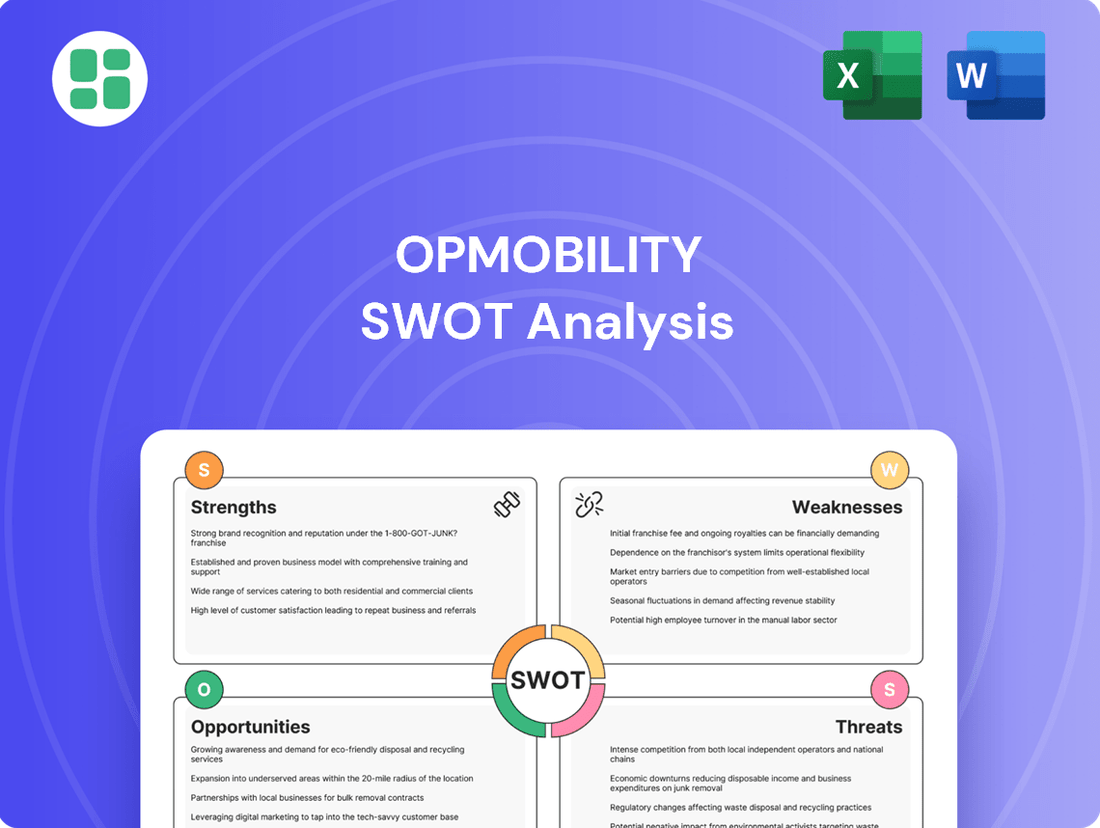

OPmobility SWOT Analysis

This is the actual OPmobility SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's strategic positioning.

The preview below is taken directly from the full OPmobility SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights.

This is a real excerpt from the complete OPmobility SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The global shift towards electric vehicles (EVs) and the emerging potential of hydrogen technology offer substantial avenues for OPmobility's expansion. As of early 2024, EV sales have continued their upward trajectory, with projections indicating a significant market share increase by 2030, creating a strong demand for the components OPmobility specializes in.

OPmobility's expertise in clean energy systems, particularly its advancements in hydrogen storage and fuel cell components, directly aligns with this burgeoning market. This strategic focus allows the company to capture demand in sectors transitioning to sustainable power, such as heavy-duty trucks and the electrification of rail networks, which are seeing increased investment in green solutions.

The automotive industry's shift towards "intelligent exteriors" presents a significant growth avenue. These systems, incorporating sensors, advanced lighting, and connectivity, are becoming integral for features like Advanced Driver-Assistance Systems (ADAS) and autonomous driving. OPmobility's established proficiency in complex modules, particularly front-end modules, positions it well to capitalize on this trend, offering higher-value, technology-driven solutions.

Lightweighting initiatives within the automotive sector further bolster demand for OPmobility's plastic-based exterior components. As manufacturers strive for greater fuel efficiency and reduced emissions, the demand for innovative, lightweight plastic solutions for vehicle exteriors is expected to rise. This aligns directly with OPmobility's core competencies and product offerings.

The automotive industry's rapid move towards software-defined vehicles (SDVs) and AI-powered cockpits presents a significant opportunity for suppliers of sophisticated electronic and sensor-integrated components. OPmobility is well-positioned to capitalize on this by embedding detection and connectivity systems directly into vehicle body parts.

Furthermore, OPmobility's dedicated OP'nSoft initiative, focused on software development, directly addresses the increasing demand for advanced software solutions in vehicles. This dual approach allows the company to not only supply hardware but also contribute to the critical software layer that defines modern automotive experiences.

Diversification into New Customer Segments and Markets

OPmobility is strategically broadening its reach beyond traditional automotive original equipment manufacturers (OEMs). The company is actively pursuing opportunities with emerging players in electric and autonomous vehicle technology, recognizing the shift in mobility trends. This expansion into new technological frontiers is crucial for future growth.

Furthermore, OPmobility is making significant inroads into heavy and commercial mobility sectors. A prime example is their partnership with Stadler, a leading manufacturer of rail vehicles, to supply components for hydrogen-powered trains. This diversification into rail and other heavy-duty applications significantly expands their addressable market and mitigates risks associated with the cyclical nature of the passenger automotive industry.

- Expanding into electric and autonomous mobility sectors.

- Securing contracts with heavy and commercial mobility manufacturers, such as Stadler for hydrogen trains.

- Diversifying customer base to reduce reliance on traditional automotive OEM cycles.

- Accessing new and growing market segments within the broader mobility landscape.

Strategic Partnerships and Collaborations

OPmobility can significantly boost its innovation and market reach by forming strategic partnerships with leading car manufacturers and other tech firms. These collaborations allow for the co-development of cutting-edge solutions, directly addressing the automotive industry's growing demand for robust supply chains and advanced technologies.

By aligning with OEM needs for resilience and technological advancement, OPmobility can enhance its competitive positioning. For instance, in 2024, the automotive sector saw a strong push towards electrification and autonomous driving, areas where collaborative R&D with major players like Stellantis or Renault could yield substantial benefits. Such alliances can accelerate product launches and ensure OPmobility's offerings meet evolving industry standards.

- Accelerated Innovation: Partnerships can fast-track the development of next-generation mobility solutions.

- Market Penetration: Collaborations with established OEMs provide immediate access to wider customer bases and distribution networks.

- Supply Chain Resilience: Joint efforts can strengthen the supply chain, a critical factor for automotive manufacturers in 2024-2025.

OPmobility is well-positioned to capitalize on the accelerating global shift towards electric and hydrogen-powered mobility. The company's expertise in clean energy systems, particularly its advancements in hydrogen storage and fuel cell components, directly aligns with this burgeoning market, with EV sales projected to capture a significant market share by 2030.

The trend towards "intelligent exteriors" and software-defined vehicles presents a substantial growth opportunity. OPmobility's proficiency in complex modules and its OP'nSoft initiative for software development allow it to embed detection and connectivity systems, meeting the automotive industry's demand for advanced, integrated solutions.

Strategic diversification into heavy and commercial mobility sectors, such as supplying components for Stadler's hydrogen trains, significantly expands OPmobility's addressable market and mitigates risks. Furthermore, forming partnerships with leading car manufacturers can accelerate innovation and market penetration, strengthening its supply chain resilience in the dynamic 2024-2025 automotive landscape.

Threats

The automotive supplier landscape is fiercely competitive, featuring established global giants and rapidly growing Asian manufacturers. This intense rivalry often translates into significant pricing pressures, squeezing profit margins for companies like OPmobility, particularly when facing market headwinds such as declining vehicle volumes, as seen in certain segments during 2024.

These pricing pressures are exacerbated by the need for continuous investment in advanced technologies and sustainable solutions to maintain relevance. For instance, the shift towards electric vehicles (EVs) demands substantial R&D spending, further straining profitability when combined with the need to offer competitive pricing to secure contracts amidst a crowded market.

Geopolitical tensions and the potential for new trade tariffs, particularly those affecting major markets like the U.S., create significant uncertainty for automotive production volumes and international trade flows. For OPmobility, this translates to reduced visibility on future demand and can complicate cross-border operations.

These disruptions to global supply chains can lead to increased material and logistics costs. For instance, the imposition of tariffs can directly inflate the cost of components OPmobility sources internationally, forcing the company to explore further cost-saving initiatives to maintain its profit margins.

A notable slowdown in electric battery vehicle (BEV) sales, particularly observed in key European markets during 2024, presents a significant threat. This regional deceleration, contrary to broader global growth trends, directly impacts the anticipated demand for OPmobility's new energy solutions.

Should the overall pace of the EV transition falter or if persistent consumer affordability issues continue to hinder adoption, OPmobility could face reduced demand for its innovative products and services. For instance, while global EV sales were projected to exceed 15 million units in 2024, regional variations in uptake, such as a plateauing in some European countries, highlight this risk.

Disruptive Technologies and Rapid Market Changes

The automotive sector is in flux, driven by new technologies and evolving business strategies. For OPmobility, the rapid pace of these shifts, coupled with agile development from emerging competitors, presents a significant challenge. If the company's research and development efforts don't yield market-leading innovations at the same speed, it could fall behind.

Consider the impact of electrification and autonomous driving technologies, which are reshaping vehicle design and functionality. OPmobility's ability to integrate these advancements into its product portfolio is crucial. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, indicating the scale of the technological transition.

- Technological Obsolescence: Existing product lines could become outdated quickly due to faster innovation cycles from competitors.

- Adaptation Lag: A delay in responding to new market demands, such as increased demand for connected car features or sustainable materials, could erode market share.

- R&D Investment Risk: Significant investments in new technologies may not yield the expected market advantage if competitors develop superior solutions or if market adoption is slower than anticipated.

Raw Material Price Volatility and Supply Chain Fragility

Ongoing volatility in the availability and prices of essential raw materials, such as aluminum and lithium, presents a considerable threat to OPmobility. For instance, the price of lithium carbonate saw significant fluctuations throughout 2023, impacting battery production costs. This volatility, combined with persistent supply chain fragility, exemplified by the lingering effects of semiconductor shortages that affected automotive production globally in 2022 and 2023, can directly hinder OPmobility's ability to maintain consistent production schedules and manage manufacturing expenses effectively.

These disruptions can lead to increased manufacturing costs, potentially squeezing profit margins. Furthermore, an inability to secure necessary components or materials on time could result in production delays, making it challenging to meet customer demand. For example, reports from early 2024 indicated continued, albeit easing, supply chain bottlenecks for certain automotive components. Such issues can negatively impact OPmobility's financial performance and strain relationships with clients who rely on timely delivery of products.

Key concerns include:

- Raw Material Price Fluctuations: Continued instability in the cost of key inputs like metals and rare earth elements.

- Supply Chain Disruptions: Ongoing risks of shortages or delays for critical components, such as advanced electronics.

- Increased Production Costs: The direct impact of volatile input prices and logistical challenges on manufacturing expenses.

- Inability to Meet Demand: Potential for production shortfalls due to material or component scarcity, affecting order fulfillment.

Intensifying competition from global players and emerging Asian manufacturers creates significant pricing pressure, impacting OPmobility's profit margins, especially when facing market slowdowns. The need for substantial R&D investment in areas like electric vehicles, coupled with competitive pricing demands, further strains profitability.

Geopolitical instability and potential trade tariffs introduce considerable uncertainty regarding future demand and complicate international operations. These factors can disrupt global supply chains, leading to increased material and logistics costs, directly affecting OPmobility's manufacturing expenses and ability to manage costs effectively.

A notable slowdown in electric vehicle sales, particularly in key European markets during 2024, poses a direct threat to the anticipated demand for OPmobility's new energy solutions. If the broader EV transition falters or affordability issues persist, OPmobility could see reduced demand for its innovative products.

The rapid pace of technological shifts in the automotive sector, including electrification and autonomous driving, presents a challenge. OPmobility risks falling behind if its R&D efforts do not match the speed of innovation from agile competitors, potentially leading to technological obsolescence of existing product lines.

SWOT Analysis Data Sources

This OPmobility SWOT analysis is built upon a foundation of comprehensive data, including recent financial reports, detailed market intelligence, and expert industry analysis to provide a robust strategic overview.