OPmobility Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPmobility Bundle

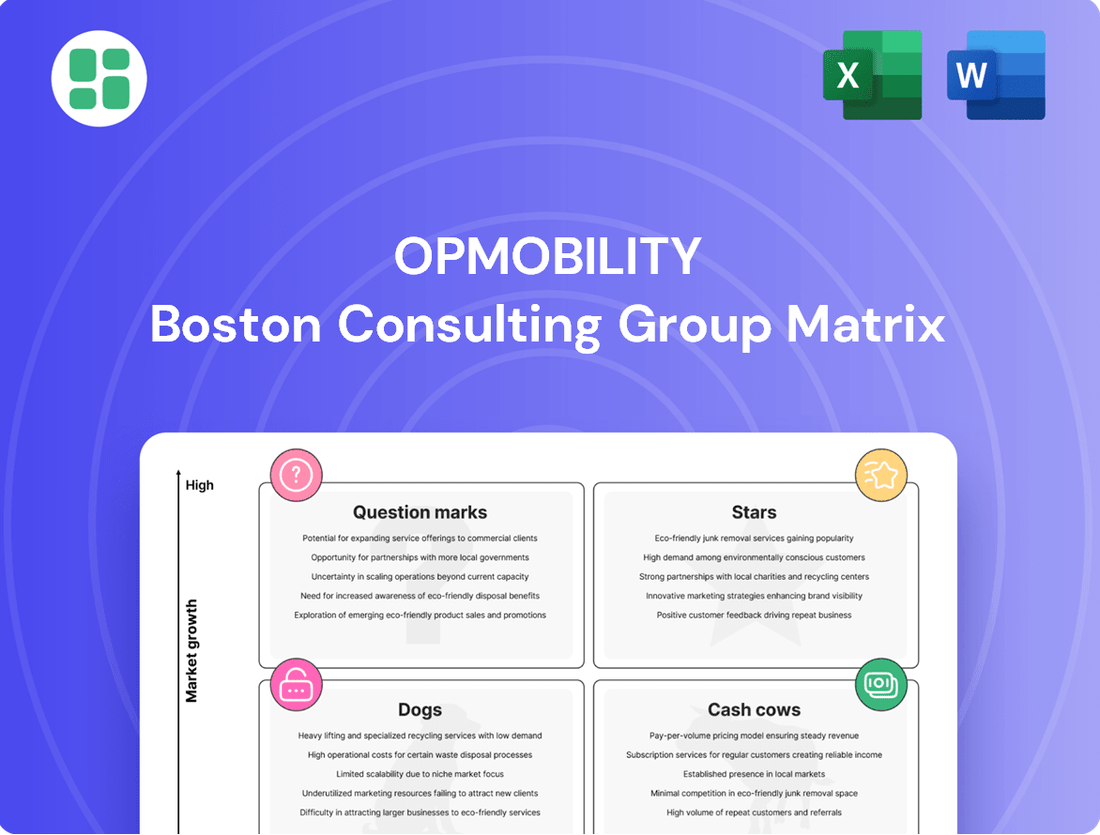

Curious about OPmobility's strategic product positioning? Our BCG Matrix preview offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks. To truly unlock OPmobility's competitive advantage and make informed investment decisions, dive into the full report for a comprehensive quadrant-by-quadrant analysis and actionable strategic insights.

Stars

OPmobility is a key player in hydrogen storage for heavy-duty vehicles, a segment poised for substantial growth due to global decarbonization mandates. The company has secured significant orders, signaling strong market demand for its high-pressure hydrogen tanks.

Their expansion into the US with new production facilities underscores their commitment to meeting this demand and solidifies their leadership in a high-growth sector. This strategic move positions OPmobility to capitalize on the increasing adoption of hydrogen fuel cell technology in commercial transportation.

The newly formed Exterior & Lighting business group, established in February 2025, is poised to capitalize on the increasing demand for sophisticated, integrated exterior vehicle systems. This segment is designed to incorporate advanced lighting technologies, addressing a key trend in automotive design and functionality. The group's strategy focuses on delivering value-added solutions that combine aesthetic appeal with intelligent lighting features.

With a robust order book for lighting systems and ambitious plans for a significant expansion of new projects in 2025, this business unit is targeting a high-growth market. The synergy between exterior components and advanced lighting offers a distinct competitive advantage, allowing for more cohesive and innovative vehicle designs. Industry analysts project the global automotive lighting market to reach over $30 billion by 2027, underscoring the significant growth potential.

OPmobility's modules for new energy vehicles (NEVs) are a significant growth driver, particularly in the burgeoning battery electric vehicle (BEV) sector. The company's expansion, including a new assembly plant in Austin, Texas, to support a major American EV manufacturer, underscores its commitment to this high-potential market. This strategic move capitalizes on the global electrification trend.

OPmobility's module business demonstrates strong performance across key regions, with notable strength in Europe and Asia. This geographic diversification highlights their established market presence and ability to cater to diverse automotive manufacturing hubs. The company's focus on complex modules for BEVs positions them favorably within a rapidly expanding segment of the automotive industry.

AI-Driven Design & Software Solutions (OP'nSoft)

OPmobility's 'OP'nSoft' initiative is a significant push into AI-driven design and software solutions for the automotive sector. This strategic move aims to enhance vehicle performance, efficiency, and safety through advanced digital engineering. The company is actively forging partnerships, such as with Neural Concept, to accelerate this software innovation.

This focus on embedded software and digital capabilities positions OPmobility in a high-growth market segment. Early adoption and leadership in this transformative area can unlock substantial future returns. For instance, the automotive software market is projected to grow significantly, with some estimates suggesting it could reach hundreds of billions of dollars by the end of the decade, driven by increasing vehicle connectivity and autonomous features.

OPmobility's commitment to this domain is further highlighted by their participation in events like CES 2025, where they plan to showcase their advancements in AI-driven design and software. This demonstrates a clear strategy to capitalize on the evolving automotive landscape, where software is becoming as crucial as hardware.

- AI-Driven Design: OP'nSoft leverages AI for optimizing vehicle component design, potentially reducing development time and improving material usage.

- Software Innovation: Partnerships with entities like Neural Concept focus on developing cutting-edge embedded software for automotive applications.

- High-Growth Market: The automotive software sector is experiencing rapid expansion, driven by trends like electrification, connectivity, and autonomous driving.

- CES 2025 Showcase: OPmobility's presence at CES underscores their dedication to presenting their latest advancements in digital engineering and AI for vehicles.

Lightweight Composite Solutions for EVs

OPmobility is strategically positioned in the lightweight composite solutions for EVs segment, a key driver for future automotive growth. Their focus on advanced materials for battery casings directly addresses the industry's pressing need for enhanced EV range and performance. This specialization allows them to capitalize on the automotive sector's shift towards electrification, aiming for substantial market share.

The market for lightweight materials in EVs is experiencing robust expansion. For instance, the global electric vehicle battery market was valued at approximately USD 150 billion in 2023 and is projected to grow significantly, with lightweight components playing a crucial role in this expansion. OPmobility's expertise in composites positions them to capture a considerable portion of this burgeoning market.

- Market Growth: The demand for lightweight composites in EVs is projected to accelerate, driven by regulatory pressures and consumer preferences for longer range and improved efficiency.

- Technological Advancement: OPmobility's development of advanced materials for battery casings showcases their commitment to innovation in a critical EV component.

- Strategic Partnerships: Collaborations, such as the one with AIRY Automotive, underscore OPmobility's proactive approach to developing cutting-edge solutions and securing market presence.

- Competitive Advantage: Their specialized materials and manufacturing capabilities provide a distinct advantage in a market where weight reduction is paramount for electrification success.

OPmobility's hydrogen storage solutions for heavy-duty vehicles are a prime example of a Star in the BCG matrix. This segment benefits from strong market demand driven by global decarbonization efforts, as evidenced by significant order wins. Their expansion into the US with new production facilities further solidifies their leadership in this high-growth area, positioning them to capture substantial market share as hydrogen fuel cell technology gains traction in commercial transport.

What is included in the product

OPmobility's BCG Matrix analysis categorizes its offerings into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

OPmobility BCG Matrix provides a clear visual for strategic resource allocation, alleviating the pain of uncertainty in business unit investment.

Cash Cows

OPmobility's traditional exterior body parts, such as bumpers and body panels for ICE and hybrid vehicles, represent a significant Cash Cow. This segment benefits from OPmobility's high market share in a mature market, a testament to its established customer base and efficient manufacturing.

Despite potentially low overall market growth, this segment consistently generates substantial cash flow. For instance, in 2024, OPmobility's automotive components division, which heavily features these traditional parts, is projected to maintain robust profitability, driven by high-volume production and optimized supply chains.

The company's strategic joint ventures, like YFPO in China, further bolster this segment's contribution to OPmobility's stable revenue. These partnerships ensure continued market penetration and operational efficiency, solidifying the Cash Cow status of traditional exterior body parts.

The C-Power business group, a leader in fuel tanks and emission reduction systems, is a prime example of a Cash Cow for OPmobility. Despite the declining pure internal combustion engine (ICE) market, C-Power has maintained its strong market share in fuel tank production.

Crucially, C-Power has strategically expanded into the burgeoning hybrid vehicle sector, leveraging its established expertise. This dual approach allows OPmobility to generate steady profits from a mature yet resilient market, effectively milking consistent returns from C-Power's established capabilities.

OPmobility's Modules business, significantly bolstered by its HBPO joint venture, commands a robust market position in delivering front-end modules for numerous established vehicle platforms. These integrated systems, which include a variety of essential vehicle components, are typically secured by long-term supply agreements. This stability, coupled with efficient supply chain management, translates into reliable cash flow with minimal need for extensive marketing expenditures.

This segment is a cornerstone for OPmobility, generating consistent revenue streams and making a substantial contribution to the company's profitability. The predictable nature of these contracts allows for optimized production and resource allocation, further enhancing its status as a cash cow. For instance, in 2024, the automotive industry saw continued demand for modular solutions, with front-end modules remaining a critical component for vehicle assembly efficiency.

Automotive Painting Services

Automotive painting services represent a Cash Cow for OPmobility, leveraging their long-standing presence and expertise in a mature market. This segment likely generates substantial, consistent profits due to established infrastructure and operational efficiencies. For instance, the global automotive coatings market was valued at approximately $38.5 billion in 2023 and is projected to grow steadily, indicating the enduring demand for these services.

OPmobility's deep integration as a supplier means they benefit from high profit margins and predictable cash flow in this area. The need for significant new investment is minimal, allowing the company to harvest earnings from this established business.

- Strong Market Position: OPmobility's history as a supplier solidifies its standing in automotive painting.

- Mature Market Dynamics: The painting segment is essential yet stable, offering consistent revenue.

- Profitability: Established infrastructure and efficiency contribute to high profit margins.

- Cash Generation: This service provides a reliable source of steady cash flow for the company.

Aftermarket & Replacement Parts

OPmobility's aftermarket and replacement parts segment functions as a classic Cash Cow. Leveraging its substantial installed base of original equipment, the company benefits from a steady demand for replacement exterior and module parts. This segment, while typically experiencing lower growth rates, boasts high profit margins. This is largely due to the inherent need for compatible components and the strength of OPmobility's established distribution channels.

This segment offers a dependable and consistent revenue stream, demanding comparatively less capital investment than the development of entirely new product lines. For instance, in 2024, the automotive aftermarket industry alone was projected to reach over $500 billion globally, highlighting the significant financial potential of such segments.

- Stable Revenue: OPmobility's extensive installed base ensures consistent demand for replacement parts.

- High Margins: The necessity of compatible components and established distribution contribute to strong profitability.

- Low Investment: This segment requires less ongoing investment compared to new product development, freeing up capital.

- Cash Generation: It reliably generates cash, supporting other strategic initiatives within the company.

OPmobility's traditional exterior body parts, like bumpers and panels for ICE and hybrid vehicles, are a prime Cash Cow. This segment benefits from OPmobility's high market share in a mature market, generating substantial cash flow with minimal new investment. In 2024, the automotive components division, including these parts, is projected to maintain robust profitability due to high-volume production.

The C-Power business group, a leader in fuel tanks and emission reduction systems, also functions as a Cash Cow. Despite a declining ICE market, C-Power has maintained its strong market share in fuel tanks and strategically expanded into hybrids, ensuring steady profits from established capabilities.

OPmobility's Modules business, particularly through its HBPO joint venture, is a Cash Cow due to its robust market position in front-end modules. Secured by long-term supply agreements, this segment offers reliable cash flow with minimal marketing expenditure, contributing significantly to profitability.

Automotive painting services represent another Cash Cow, leveraging OPmobility's long-standing expertise and established infrastructure in a mature market. This segment generates consistent profits with high margins and minimal investment needs, contributing to steady cash flow.

The aftermarket and replacement parts segment is a classic Cash Cow for OPmobility. With a substantial installed base, it ensures steady demand for replacement parts, boasting high profit margins and requiring less capital investment than new product development.

| OPmobility Business Segment | BCG Matrix Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Traditional Exterior Body Parts | Cash Cow | High market share, mature market, consistent cash flow | Robust profitability projected in automotive components division |

| C-Power (Fuel Tanks & Emission Systems) | Cash Cow | Strong market share, expansion into hybrids, steady profits | Continued revenue from mature and growing hybrid sectors |

| Modules (Front-End Modules) | Cash Cow | Strong market position, long-term contracts, reliable cash flow | Critical component for assembly efficiency in 2024 |

| Automotive Painting Services | Cash Cow | Established infrastructure, high profit margins, minimal investment | Enduring demand in a growing global coatings market |

| Aftermarket & Replacement Parts | Cash Cow | Substantial installed base, high margins, low investment needs | Significant financial potential in a large global aftermarket industry |

Preview = Final Product

OPmobility BCG Matrix

The OPmobility BCG Matrix you are currently previewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures you get a complete and professionally designed strategic tool without any alterations or missing sections. The analysis and layout you see are precisely what will be delivered, ready for your immediate use in business planning and decision-making.

Dogs

Legacy ICE-Exclusive Powertrain Components fall into the Dogs category of the BCG matrix. These are products tied to older, declining internal combustion engine vehicle models that haven't adapted to hybrid or electric technologies.

This segment faces a structural long-term decline due to the accelerating shift towards electrification. Markets for these components are shrinking, and there's a significant risk of margin erosion for those that remain unadapted.

For instance, the Powertrain segment as a whole saw a slight decline in Q1 2025, underscoring the broader challenges faced by traditional ICE components. Companies with a significant reliance on these legacy parts need to strategize for their eventual phase-out or explore niche market opportunities.

Outdated emission reduction systems, particularly those tailored for older internal combustion engine (ICE) vehicles, are likely candidates for the question mark category in OPmobility's BCG Matrix. As environmental regulations tighten globally, demand for these legacy systems is shrinking. For instance, in 2024, many European countries are phasing out the sale of new ICE vehicles, directly impacting the market for these components.

OPmobility's market share in this specific niche is diminishing as manufacturers pivot to electrification and hydrogen technologies. This shift signifies low growth prospects for these particular product lines. The company's revenue from these outdated systems is expected to decline further as the automotive industry accelerates its transition towards zero-emission vehicles, a trend that gained significant momentum in 2024 with major automakers announcing accelerated EV production targets.

Some OPmobility operations might be classified as 'Dogs' within the BCG matrix. These are typically localized manufacturing sites facing significant headwinds. For example, regions with sharp, sustained drops in automotive production where OPmobility hasn't secured new business or diversified its offerings could fall into this category. A prime example is the 'lower modules activity in Mexico' which negatively impacted OPmobility's North American market performance in Q1 2025, indicating a potential 'Dog' scenario.

Generic Plastic Components with High Competition

Generic plastic components with high competition, often found in the automotive sector, represent OPmobility's potential 'Dogs' in the BCG matrix. These are high-volume parts where differentiation is minimal, leading to intense price competition from lower-cost manufacturers, particularly those in emerging markets.

These products typically operate within a low-growth, highly commoditized market. In 2024, the global automotive plastics market, while substantial, is characterized by mature segments where innovation cycles are long and cost is the primary purchasing driver. Achieving or maintaining a high market share in such segments is a significant challenge, often resulting in break-even or low profitability for suppliers like OPmobility.

- Market Saturation: Many segments for generic plastic components are mature with limited growth prospects.

- Price Sensitivity: Buyers prioritize cost, leading to margin compression.

- Low Differentiation: Product features are often standardized, making it hard to command premium pricing.

- Intense Rivalry: Competition from low-cost producers is a constant threat.

Non-Core, Undiversified Legacy Acquisitions

Smaller, non-core acquisitions or legacy product lines that haven't integrated well into OPmobility's main strategy or diversified into growing areas could be considered Dogs. These might consume capital without delivering substantial returns, especially if they're in slow-moving markets where gaining more market share is difficult.

For instance, if OPmobility acquired a niche automotive component supplier in 2023 that operates in a declining segment of the internal combustion engine market, and this acquisition hasn't shown signs of adapting to EV trends or integrating with OPmobility's core EV battery solutions, it would fit the Dog profile. Such an asset might represent a drain on resources, potentially impacting OPmobility's ability to invest in its Stars and Cash Cows.

- Stagnant Market Presence: Acquisitions operating in industries with low growth projections, such as legacy automotive parts for older vehicle models, could be classified as Dogs.

- Low Return on Investment: If these non-core assets are consuming significant capital but generating minimal profits or negative cash flow, they exemplify the Dog category. For example, a legacy manufacturing facility with outdated technology might require substantial ongoing investment for minimal output.

- Lack of Strategic Fit: Businesses or product lines that do not align with OPmobility's forward-looking strategy, particularly its focus on mobility solutions and electrification, are candidates for the Dog quadrant.

- Integration Challenges: Acquisitions that have proven difficult to integrate operationally or culturally, leading to underperformance and a failure to achieve projected synergies, often fall into the Dog classification.

Legacy ICE-exclusive powertrain components are firmly in the Dogs category. These are parts for older vehicle models that haven't transitioned to hybrid or electric technologies, facing a shrinking market due to the industry's electrification push. For instance, OPmobility's Q1 2025 results showed a slight decline in its overall powertrain segment, highlighting the challenges for these unadapted components.

Generic plastic automotive components also fit the Dog profile. These are high-volume parts with little differentiation, leading to intense price competition, especially from emerging markets. In 2024, the global automotive plastics market is characterized by mature segments where cost is paramount, making it difficult for suppliers like OPmobility to maintain high market share or profitability.

Non-core acquisitions or legacy product lines that haven't integrated well or diversified into growing areas can also be Dogs. These might consume capital without significant returns, particularly in slow-moving markets. An example would be a niche supplier acquired in a declining ICE segment that hasn't adapted to EV trends, potentially draining resources needed for core EV battery solutions.

| Component Type | BCG Category | Market Trend | OPmobility Relevance | 2024 Outlook |

| Legacy ICE Powertrain Parts | Dog | Declining (Electrification) | Low market share, margin erosion risk | Continued decline |

| Generic Plastic Components | Dog | Mature, Low Growth (Commoditized) | High competition, price sensitivity | Stable but low profitability |

| Non-Core/Undiversified Acquisitions | Dog | Varies (often declining segments) | Potential capital drain, low ROI | Depends on divestment/restructuring |

Question Marks

Early-stage battery electrification components, like novel battery casing materials or specialized power electronics, often represent Stars or Question Marks in the OPmobility BCG Matrix. Despite the booming EV market, these specific offerings might hold a low market share initially, demanding substantial investment to mature and compete. For instance, while the global EV battery market was projected to reach over $400 billion by 2024, the market share for entirely new casing materials would likely be a fraction of that, reflecting their nascent stage.

OPmobility's exploration into new niche hydrogen applications beyond automotive, such as stationary power generation and industrial processes, represents a strategic move into potentially high-growth, albeit currently nascent, markets. These segments are crucial for diversifying revenue streams and leveraging their expertise in hydrogen storage and fuel cell technology.

The total addressable market for stationary fuel cells, for instance, was projected to reach approximately $10 billion by 2024, with significant growth anticipated in backup power and grid stabilization. OPmobility's involvement here could tap into this expanding sector.

While these non-automotive applications currently represent a small fraction of OPmobility's overall business, their strategic importance lies in future market penetration and technological leadership. For example, the industrial sector's demand for clean hydrogen for processes like ammonia production or refining is expected to surge, offering substantial opportunities.

OPmobility's exploration into advanced smart surface technologies, such as integrated sensors and interactive exterior displays, positions them at the forefront of automotive innovation. These are currently nascent technologies with significant growth potential, representing the question mark quadrant of the BCG matrix.

While these intelligent exterior systems are still in early development and have limited market adoption, their potential to redefine vehicle aesthetics and functionality is substantial. For instance, the global smart surfaces market is projected to reach $22.2 billion by 2027, indicating a strong future demand.

These high-growth potential technologies require considerable research and development investment to mature and achieve widespread market penetration. OPmobility's strategic focus here suggests a long-term vision for next-generation vehicle exteriors.

Emerging Market Entry Products (e.g., India specific)

In India's dynamic automotive sector, OPmobility's strategy for emerging market entry products, particularly those targeting the high-growth but competitive segments, aligns with the 'Question Mark' quadrant of the BCG matrix. These new offerings, despite the overall market expansion, might initially capture a modest market share. For instance, the Indian automotive market is projected to grow significantly, with passenger vehicle sales in FY2024 reaching approximately 4.2 million units, a testament to the high growth prospects.

- New product launches in India, like advanced driver-assistance systems (ADAS) for the burgeoning mid-size car segment, represent a strategic investment in a high-growth market.

- Despite the overall market's robust expansion, these specific products may initially command a low market share due to intense competition from established players and the need for consumer education.

- Significant marketing expenditure and R&D investment are crucial to rapidly increase market penetration and shift these products towards a 'Star' position.

- The Indian automotive market, valued at over $100 billion in 2023, offers substantial long-term potential, making these 'Question Mark' products vital for future market leadership.

New Digital Services and Connectivity Solutions

OPmobility's foray into new digital services and connectivity solutions, including advanced infotainment and ADAS integrations via software, taps into a burgeoning market. While this segment offers significant growth potential, OPmobility's current market share is relatively nascent, reflecting the early stage of its penetration.

These digital offerings operate within a highly competitive landscape, demanding considerable investment to build a substantial user base and achieve robust revenue streams. By 2024, the automotive software market alone was projected to exceed $60 billion globally, underscoring the scale of opportunity and the intensity of competition.

- High Growth Potential: The automotive digital services market is experiencing rapid expansion, driven by consumer demand for connected experiences and advanced vehicle features.

- Low Initial Market Share: OPmobility's current position in this segment is characterized by a relatively small footprint, indicating room for significant growth and market capture.

- Substantial Investment Required: Success in this competitive arena necessitates considerable R&D and marketing expenditure to develop compelling offerings and acquire users.

- Competitive Landscape: Established tech players and other automotive suppliers are also heavily investing in digital and connectivity solutions, intensifying competition.

Question Marks in OPmobility's BCG Matrix represent emerging technologies and market entries with high growth potential but currently low market share. These ventures demand significant investment to develop and gain traction. For instance, OPmobility's work on advanced smart surfaces, like interactive exterior displays, falls into this category. While the global smart surfaces market is projected to reach $22.2 billion by 2027, these specific applications are still in early development with limited adoption.

These 'Question Mark' products are crucial for OPmobility's future growth, necessitating substantial R&D and marketing to increase their market share. An example is their entry into India's mid-size car segment with ADAS, a market projected for robust growth, with passenger vehicle sales in FY2024 reaching approximately 4.2 million units. However, these new offerings face intense competition, requiring strategic investment to transition them into 'Stars'.

OPmobility's expansion into new digital services and connectivity solutions, such as advanced infotainment and ADAS integrations via software, also fits the 'Question Mark' profile. The automotive software market was expected to exceed $60 billion globally by 2024, indicating immense opportunity. Yet, OPmobility's current footprint in this segment is small, requiring considerable investment to capture a larger share in this competitive space.

| Category | OPmobility Example | Market Growth Potential | Current Market Share | Investment Needs |

| Emerging Tech | Smart Surfaces (Interactive Displays) | High (Global market $22.2B by 2027) | Low | High R&D, Marketing |

| New Market Entry | ADAS in India (Mid-size segment) | High (India PV sales ~4.2M in FY24) | Low | High Marketing, Product Development |

| Digital Services | Connected Infotainment Software | High (Global Auto Software $60B+ by 2024) | Low | High R&D, User Acquisition |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth projections, to accurately position each business unit.