OPmobility PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPmobility Bundle

Uncover the crucial political, economic, social, technological, legal, and environmental factors impacting OPmobility's trajectory. Our expertly crafted PESTLE analysis provides the essential context for understanding the company's current position and future opportunities. Don't get left behind; download the full version now to gain a competitive edge and make informed strategic decisions.

Political factors

Governments globally are actively pushing for greener and safer transportation, a trend that directly supports OPmobility. For instance, the European Union's Green Deal aims for significant emissions reductions, with substantial funding allocated to sustainable mobility projects. This includes direct subsidies for electric vehicle purchases, like those seen in Germany, where incentives can reach thousands of euros per vehicle, boosting demand for components like those OPmobility produces.

Further bolstering this shift, many nations are investing heavily in charging infrastructure. By 2025, the US is projected to have over 500,000 public charging ports installed, a key enabler for EV adoption. Tax incentives for manufacturers adopting sustainable practices also create a more favorable operating environment for companies like OPmobility, encouraging investment in cleaner production methods and advanced energy systems.

Changes in international trade policies, including tariffs, directly affect OPmobility's global supply chains and costs. For instance, the US imposed tariffs on steel and aluminum in 2018, impacting automotive manufacturing costs. In 2024, ongoing trade discussions between major economic blocs like the US, China, and the EU continue to create uncertainty regarding potential tariffs on automotive parts and finished vehicles.

The threat of tariffs can escalate prices for automotive components and vehicles, potentially reducing consumer demand. OPmobility's strategic approach includes localized production, with a significant portion of its revenue generated within regions like the United States, which helps to buffer against some of these international trade policy risks.

Global vehicle regulations are tightening, pushing automakers and suppliers like OPmobility to innovate. For instance, the European Union's CO2 emission targets are becoming increasingly stringent, with a goal of a 55% reduction for cars and 50% for vans by 2030 compared to 1990 levels, and aiming for carbon neutrality by 2035 for new cars and vans. These evolving standards directly impact product development cycles and increase compliance costs, but they also create opportunities for companies focused on sustainable mobility solutions.

OPmobility's strategic alignment with hydrogen and electrification technologies positions it favorably within this regulatory landscape. The increasing demand for zero and low-emission vehicles, driven by these global mandates, directly supports OPmobility's business model. For example, the global market for electric vehicles (EVs) is projected to reach over 30 million units annually by 2025, a significant jump from around 10 million in 2022, highlighting the market shift that OPmobility is poised to capitalize on.

Geopolitical Stability and Regional Conflicts

Geopolitical instability, particularly ongoing regional conflicts, poses a significant threat to OPmobility's operations. These situations can severely disrupt global automotive supply chains, impacting the availability and cost of essential raw materials and electronic components. For instance, the ongoing conflict in Eastern Europe has already led to price volatility in key metals like palladium, crucial for catalytic converters.

Such disruptions increase operational complexities, potentially delaying production timelines and forcing strategic adjustments in sourcing and manufacturing to ensure business continuity. OPmobility must remain agile, potentially diversifying its supplier base and exploring near-shoring options to mitigate these risks.

- Supply Chain Vulnerability: Conflicts can halt the flow of vital automotive parts, as seen with disruptions affecting semiconductor manufacturing hubs.

- Material Cost Volatility: Geopolitical tensions often drive up the prices of critical metals and rare earth elements used in vehicle production.

- Production Delays: Unforeseen geopolitical events can lead to extended lead times for components, impacting OPmobility's manufacturing schedules.

- Increased Operational Costs: Navigating these disruptions requires higher logistics expenses and investment in contingency planning.

Public Funding for R&D in Green Technologies

Government support and public funding for research and development in green mobility technologies are pivotal for fostering innovation. This includes significant investment in areas like hydrogen fuel cell technology and advanced materials crucial for lightweighting vehicles.

For instance, the European Union's Horizon Europe program allocated €95.5 billion for research and innovation from 2021 to 2027, with a substantial portion directed towards climate action and sustainable mobility solutions. Such public funding directly accelerates the development and industrialization of new technologies, bolstering companies like OPmobility in their pursuit of sustainable automotive components.

- Increased R&D Investment: Public funding initiatives, like those seen in the EU's Horizon Europe program, directly fuel innovation in green technologies.

- Accelerated Industrialization: Government support helps bridge the gap between research and market-ready products, speeding up the adoption of sustainable solutions.

- Technological Leadership: Companies benefiting from this funding are better positioned to lead in the development of advanced materials and hydrogen-based mobility.

- Market Competitiveness: Enhanced technological capabilities resulting from public R&D support improve a company's competitive edge in the global automotive sector.

Government policies globally are increasingly prioritizing sustainability and safety in transportation, directly benefiting OPmobility's focus on green mobility solutions. For example, the EU's Green Deal and national incentives, such as those in Germany for electric vehicles, are driving demand for components like those OPmobility produces.

New regulations, like the EU's stringent CO2 emission targets for 2030 and 2035, necessitate innovation in zero and low-emission vehicles, a market OPmobility is well-positioned to serve. The projected growth of the EV market, with annual sales potentially exceeding 30 million units by 2025, underscores this favorable regulatory environment.

Trade policies and geopolitical stability also significantly influence OPmobility's operations. Tariffs on automotive parts, as seen with past US actions, can increase costs, while conflicts can disrupt supply chains, impacting material costs and production schedules. OPmobility's strategy of localized production helps mitigate some of these risks.

Public funding for R&D, such as the EU's Horizon Europe program, accelerates the development of technologies like hydrogen fuel cells, enhancing OPmobility's competitive edge. This support is crucial for bridging the gap between research and market adoption of sustainable mobility solutions.

What is included in the product

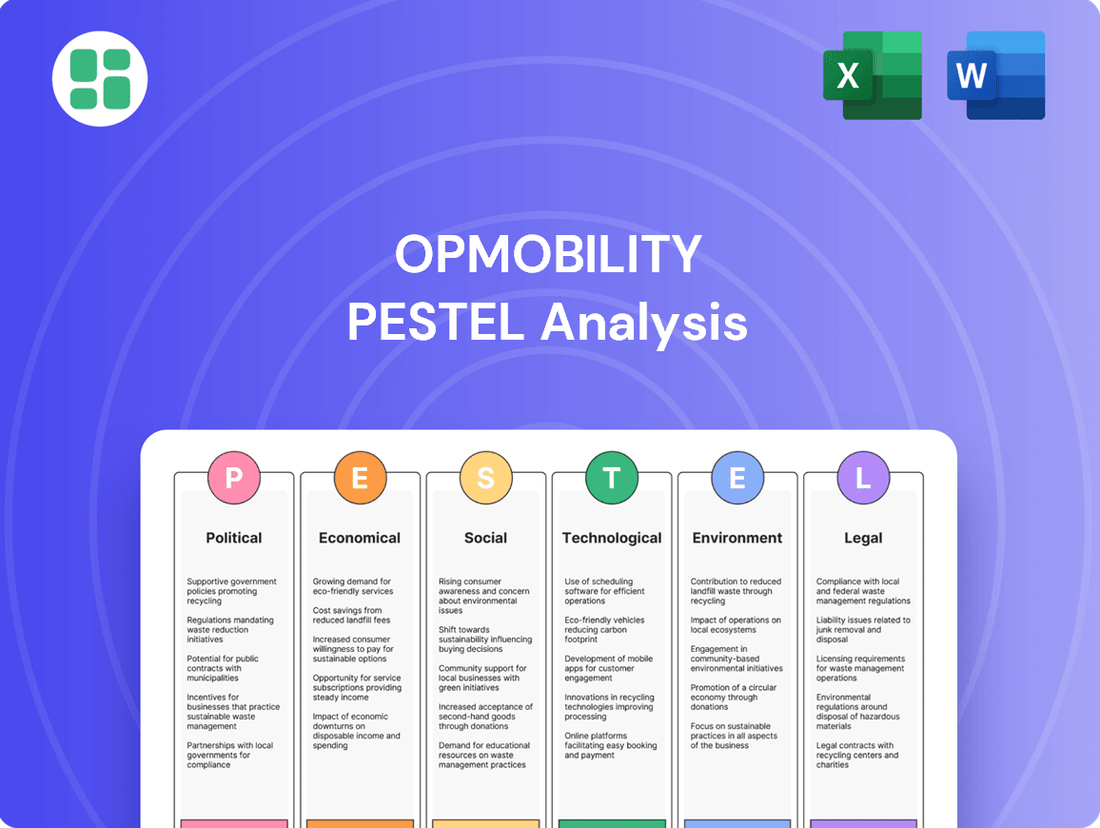

This OPmobility PESTLE analysis dissects the macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for OPmobility's future success.

OPmobility's PESTLE analysis offers a streamlined, actionable framework, simplifying complex external factors into easily digestible insights for strategic decision-making, thereby alleviating the burden of information overload during planning.

Economic factors

The global automotive market's overall health is a critical driver for OPmobility. Forecasts for vehicle sales directly impact the demand for OPmobility's offerings. While 2024 experienced modest expansion, the automotive sector in 2025 is anticipated to grapple with economic challenges. These include elevated vehicle prices and significant consumer debt levels, which could potentially temper demand.

Despite these market pressures, OPmobility has shown remarkable resilience. In the first quarter of 2025, the company managed to outpace the broader automotive market's performance. This suggests a strong underlying demand for OPmobility's specific product segments, even amidst broader economic constraints affecting the industry.

Inflationary pressures significantly impact OPmobility by driving up the costs of essential inputs like metals, plastics, and energy. For instance, the average price of steel, a key component in automotive manufacturing, saw substantial increases in 2024, with some benchmarks rising by over 15% year-over-year. This directly affects OPmobility's production expenses.

To counter these rising raw material and energy costs, OPmobility must prioritize operational efficiencies and robust supply chain management. Strategies such as bulk purchasing, long-term supplier contracts, and exploring alternative material sourcing become critical for maintaining profitability. Effective cost control is paramount in navigating a high-inflation economic landscape.

The company's ability to pass on increased costs to customers or absorb them through productivity gains will determine its financial performance. For example, if inflation continues to hover around 3-4% in key operating regions through 2025, OPmobility's margins could be squeezed if these cost increases are not effectively managed.

Interest rate fluctuations significantly impact OPmobility's operating environment. For instance, the US Federal Reserve's target federal funds rate, which influences broader borrowing costs, saw a series of hikes through 2023 and into early 2024, aiming to curb inflation. This trend directly affects consumer financing for vehicle purchases, potentially reducing demand for new cars, including electric vehicles that OPmobility supplies.

Higher borrowing costs also influence OPmobility's strategic investment decisions and its own cost of capital. If interest rates remain elevated in 2024 and 2025, it could make large capital expenditures for expanding production or developing new technologies more expensive, potentially slowing down growth initiatives.

Furthermore, the automotive industry's reliance on financing means that even modest increases in interest rates can have a pronounced effect on sales volumes. For example, a 1% increase in a car loan interest rate can add tens or even hundreds of dollars to monthly payments, deterring price-sensitive buyers and impacting OPmobility's order books.

Supply Chain Disruptions

Ongoing supply chain disruptions, particularly the lingering effects of semiconductor shortages and persistent logistical bottlenecks, continue to present significant risks to automotive production. These challenges directly impact operational costs for companies like OPmobility, potentially delaying manufacturing schedules and increasing the price of finished goods.

OPmobility's proactive strategy to diversify its supplier base and emphasize localized production is crucial for navigating these complexities. This approach aims to build resilience, reducing reliance on single sources and shortening lead times, thereby mitigating the impact on manufacturing and delivery timelines.

- Semiconductor Shortages: While easing, the automotive industry still faces component availability issues, with some projections indicating a full recovery in supply chains by late 2024 or early 2025.

- Logistical Bottlenecks: Shipping costs and transit times, though improving from peak 2022 levels, remain elevated compared to pre-pandemic norms, impacting inventory management and delivery efficiency.

- Supplier Diversification: Companies that have successfully diversified their supplier networks, especially into regions less prone to geopolitical or natural disaster disruptions, are better positioned to maintain production flow.

- Localization Benefits: Localizing production not only reduces transportation costs and lead times but also offers greater control over quality and production schedules, a key advantage in managing supply chain volatility.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for OPmobility, which operates in 28 countries. Fluctuations in exchange rates directly affect the value of its international revenues and expenses. For instance, if the Euro strengthens against other currencies where OPmobility generates revenue, those earnings translate into fewer Euros, potentially impacting reported profitability. Conversely, a weaker Euro could boost reported earnings from foreign operations.

Managing these foreign exchange risks is crucial for OPmobility's financial stability. The company's ability to maintain predictable profitability hinges on its strategies for hedging against adverse currency movements. As of early 2025, major currency pairs like EUR/USD and EUR/GBP have shown notable swings, underscoring the need for robust risk management frameworks.

- Global Operations Impact: OPmobility's presence in 28 countries means its financial results are exposed to a wide array of currency fluctuations.

- Revenue and Expense Translation: Changes in exchange rates can alter the value of income earned and costs incurred in foreign currencies when translated back to OPmobility's reporting currency.

- Profitability Prediction: Effective management of currency risks is vital for ensuring consistent and predictable profitability across its diverse geographical markets.

- 2024-2025 Trends: Significant volatility observed in major currency pairs like EUR/USD and EUR/GBP during 2024 and early 2025 highlights the ongoing importance of FX risk mitigation strategies for global businesses like OPmobility.

Economic factors present a mixed outlook for OPmobility heading into 2025. While the overall automotive market is expected to face headwinds from elevated vehicle prices and consumer debt in 2025, OPmobility demonstrated resilience in Q1 2025, outperforming the broader sector. However, persistent inflation, with key input costs like steel seeing significant year-over-year increases in 2024, directly impacts OPmobility's production expenses, necessitating strong cost management strategies.

What You See Is What You Get

OPmobility PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This OPmobility PESTLE analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

Sociological factors

Consumers are increasingly favoring electric and hybrid vehicles, fueled by a heightened environmental consciousness and supportive government policies. This trend is a significant driver for OPmobility, particularly as the company focuses on clean energy systems and battery technologies.

While the rapid growth of pure electric vehicle (EV) sales has seen some moderation, hybrid vehicle adoption is on the rise. For instance, in 2024, hybrid sales in the US were up significantly year-over-year, capturing a larger market share. This resurgence in hybrids presents a prime opportunity for OPmobility to leverage its expertise in battery and clean energy solutions, catering to a broader segment of the eco-conscious automotive market.

Consumers are clearly prioritizing advanced vehicle features. Safety, comfort, and connectivity are no longer nice-to-haves; they're expected. This shift directly fuels demand for innovations like intelligent exterior systems and smart surfaces, which are key areas for OPmobility's development.

The desire for personalized driving experiences is a major trend. Think about how many people want their cars to adapt to their preferences, from seat settings to infotainment. This focus on tech-enabled interiors means companies like OPmobility, which provide integrated modules, are well-positioned to capitalize on this evolving consumer expectation.

The global population is getting older, with projections indicating that by 2050, one in six people worldwide will be 65 or older, up from one in 11 in 2015. This demographic shift significantly impacts mobility, potentially increasing demand for accessible, user-friendly vehicles and services tailored to seniors, such as autonomous shuttles or specialized ride-sharing options.

Simultaneously, urbanization continues its relentless march, with the UN estimating that 68% of the world's population will live in urban areas by 2050. This concentration of people in cities often leads to increased traffic congestion and a greater reliance on public transportation and shared mobility solutions, potentially decreasing individual car ownership in favor of more efficient, space-saving alternatives.

Increased Public Environmental Awareness

Growing public awareness of environmental issues is significantly influencing consumer choices, with a strong preference emerging for products and companies demonstrating genuine commitment to sustainability. This trend directly supports OPmobility's strategic direction, which emphasizes eco-design principles, the utilization of recycled materials, and ambitious carbon neutrality goals. For instance, a 2024 survey indicated that over 65% of European consumers consider a vehicle's environmental impact when making a purchase decision.

Consumers are increasingly seeking out environmentally friendly vehicles and showing a growing demand for remanufactured automotive parts. This shift in consumer behavior is a powerful driver for companies like OPmobility that are investing in circular economy models. By 2025, the global market for remanufactured automotive parts is projected to reach over $40 billion, reflecting this burgeoning consumer interest.

- Consumer Demand: Over 65% of European consumers prioritize environmental impact in vehicle purchasing (2024 data).

- Market Growth: The global remanufactured automotive parts market is expected to exceed $40 billion by 2025.

- Company Alignment: OPmobility's focus on eco-design and recycled materials directly addresses this growing consumer preference.

- Future Outlook: Continued public pressure will likely accelerate the adoption of sustainable practices across the automotive industry.

Workforce Availability and Skill Gaps

The automotive sector's swift technological advancement, especially in areas like electric vehicles (EVs) and autonomous driving systems, is significantly reshaping the demand for specialized labor. This means OPmobility must actively seek out and cultivate talent with expertise in areas such as battery technology, AI-driven software development, and advanced robotics for manufacturing.

Addressing potential workforce shortages and skill mismatches is crucial for OPmobility's continued success. For instance, a 2024 report indicated a projected shortage of over 100,000 skilled technicians in the EV repair and maintenance sector across Europe alone, highlighting the urgency for proactive reskilling and upskilling initiatives.

- Demand for EV Expertise: Growing EV production necessitates more engineers and technicians proficient in battery management systems and electric powertrains.

- Software Integration: The increasing complexity of vehicle software requires a larger pool of skilled software developers and cybersecurity experts.

- Advanced Manufacturing Skills: Automation and smart factory technologies require workers trained in operating and maintaining sophisticated machinery.

- Talent Acquisition Strategies: OPmobility may need to partner with educational institutions and implement robust internal training programs to bridge these skill gaps.

Societal shifts are profoundly influencing mobility preferences. A growing emphasis on sustainability means consumers increasingly favor electric and hybrid vehicles, with over 65% of European consumers in 2024 considering environmental impact. This aligns with OPmobility's focus on clean energy and battery tech. Furthermore, an aging global population, projected to see one in six people over 65 by 2050, may drive demand for accessible vehicle designs and specialized mobility services.

Technological factors

Continuous innovation in battery technology and hydrogen fuel cells is a game-changer for OPmobility's clean energy ambitions. The company is heavily invested in developing advanced energy storage solutions, including high-pressure hydrogen storage systems. This focus is essential as the mobility sector increasingly shifts towards decarbonization, with hydrogen fuel cells showing particular promise for heavier transport like trains.

The automotive industry, including companies like OPmobility, is seeing significant advancements in lightweight and sustainable materials. Progress in areas like advanced composites and recycled plastics is crucial for boosting vehicle fuel efficiency and achieving ambitious environmental goals. For instance, the use of carbon fiber composites, which can be up to 50% lighter than steel, is expanding, and the market for recycled plastics in automotive applications is projected to grow substantially. In 2024, the global automotive plastics market is valued at over $40 billion, with a growing segment dedicated to recycled materials.

OPmobility is actively integrating these trends by incorporating recycled materials into its product lines and emphasizing eco-design principles. This approach aims to minimize material consumption and improve the overall recyclability of their offerings. By focusing on reducing the environmental footprint of their components, OPmobility is aligning with both regulatory pressures and consumer demand for greener automotive solutions.

The manufacturing sector's embrace of AI and digitalization is a significant technological driver. These advancements boost efficiency, facilitate predictive maintenance, and accelerate product development cycles. For instance, in 2024, global spending on AI in manufacturing was projected to reach over $10 billion, highlighting its growing importance.

OPmobility is actively leveraging AI to enhance the functionality, efficiency, and cybersecurity of its mobility products. The company's adoption of advanced software solutions, such as Siemens' Teamcenter X PLM, underscores this commitment to digital transformation. AI's role in reducing development timelines and optimizing operational processes is crucial for competitive advantage.

Innovation in Intelligent Exterior Systems

Continued innovation in intelligent exterior systems, encompassing smart surfaces and integrated lighting, is paramount for shaping the future of vehicle design and functionality. These advancements are key to enhancing user experience and vehicle aesthetics.

OPmobility's Smart Tailgate 2024 serves as a prime example of this trend, showcasing advanced exterior body design and integrated lighting. This product highlights the company's commitment to merging complex functions with seamless connectivity, reflecting a significant technological leap in automotive exteriors.

The automotive industry is increasingly prioritizing these integrated systems, with investments in advanced lighting and smart surface technologies expected to grow. For instance, the global automotive lighting market was valued at approximately $28.5 billion in 2023 and is projected to reach over $40 billion by 2030, indicating a strong demand for such innovations.

- Smart Surfaces: Development of surfaces that can change appearance, display information, or even self-heal.

- Integrated Lighting: Moving beyond basic illumination to incorporate dynamic signaling, communication, and aesthetic elements.

- Connectivity: Embedding sensors and communication modules within exterior components for enhanced vehicle-to-everything (V2X) interaction.

- OPmobility's Focus: The Smart Tailgate 2024 demonstrates a strategic alignment with these technological drivers, integrating advanced design and lighting for improved functionality and user interaction.

Progress in Autonomous Driving and Connectivity

The steady advancement of autonomous driving capabilities and enhanced vehicle connectivity is opening up significant new avenues for component suppliers. These evolving technologies, from sophisticated driver-assistance systems to fully self-driving functionalities, demand specialized electronic components and integrated software solutions.

OPmobility, with its core expertise in embedded software systems and solutions designed for connected and safer mobility, is strategically positioned to leverage these burgeoning trends. The company's offerings directly address the increasing need for advanced electronics that power these sophisticated automotive functions.

The automotive industry is witnessing a pronounced shift towards software-defined vehicles, a trend that is accelerating the demand for cutting-edge electronics. For instance, by 2025, it's projected that the value of software in vehicles could reach hundreds of billions of dollars globally, underscoring the critical role of companies like OPmobility.

- Autonomous Driving Growth: The global market for Advanced Driver-Assistance Systems (ADAS), a precursor to full autonomy, was valued at approximately $30 billion in 2023 and is expected to grow significantly by 2025.

- Connectivity Demand: Vehicle connectivity services are becoming standard, with projections indicating that over 90% of new vehicles sold globally will feature some form of connectivity by 2025.

- Software-Defined Vehicle Market: The software-defined vehicle market is anticipated to reach over $200 billion by 2025, highlighting the increasing importance of software and electronics.

- OPmobility's Focus: OPmobility's investment in R&D for AI-powered driving assistance and secure communication protocols aligns with these market demands.

Technological advancements in battery and hydrogen fuel cell technology are critical for OPmobility's clean energy initiatives, especially for heavier transport like trains. The company is investing in advanced energy storage, including high-pressure hydrogen storage systems, to meet the mobility sector's decarbonization goals.

The increasing use of lightweight and sustainable materials, such as carbon fiber composites and recycled plastics, is vital for improving vehicle efficiency and environmental performance. The automotive plastics market, valued at over $40 billion in 2024, sees a growing segment dedicated to recycled materials.

OPmobility is leveraging AI and digitalization to boost manufacturing efficiency, enable predictive maintenance, and speed up product development. Global spending on AI in manufacturing is projected to exceed $10 billion in 2024, underscoring its growing importance.

Innovations in intelligent exterior systems, including smart surfaces and integrated lighting, are enhancing vehicle design and user experience. OPmobility's Smart Tailgate 2024 exemplifies this trend, integrating advanced design and lighting. The automotive lighting market, valued at approximately $28.5 billion in 2023, is expected to grow substantially.

The rise of autonomous driving and vehicle connectivity is driving demand for specialized electronic components and software. OPmobility's expertise in embedded software systems positions it well to capitalize on these trends, as the software-defined vehicle market is expected to surpass $200 billion by 2025.

Legal factors

OPmobility faces a critical need to comply with evolving global emissions regulations. For instance, the European Union's CO2 targets for new vehicles are becoming progressively stricter, impacting vehicle design and powertrain choices. Similarly, the U.S. Environmental Protection Agency (EPA) has introduced multi-pollutant emissions standards for 2027 and beyond, setting new benchmarks for air quality.

Failure to meet these mandates can lead to substantial financial penalties, estimated to be in the millions for non-compliant manufacturers. This regulatory pressure directly fuels OPmobility's drive for continuous innovation in clean energy systems and emissions reduction technologies.

Product liability laws are increasingly complex, especially concerning advanced automotive technologies. OPmobility must navigate evolving regulations for electric vehicles (EVs) and autonomous driving systems, which demand stringent safety validation. Failure to comply can lead to significant legal repercussions and reputational damage.

The automotive industry saw a notable increase in recall costs in 2023, with reports indicating billions spent globally on addressing safety concerns, particularly with newer technologies. OPmobility's commitment to rigorous testing and adherence to emerging safety standards, such as those being developed by NHTSA for advanced driver-assistance systems (ADAS) in 2024, is paramount to minimizing these risks and ensuring consumer trust.

OPmobility's competitive edge hinges on robust intellectual property (IP) protection for its innovations in hydrogen technology, advanced materials, and intelligent systems. Patents are crucial for safeguarding novel designs, efficient manufacturing processes, and proprietary software.

International Trade Laws and Customs

OPmobility, as a global automotive supplier, must meticulously adhere to international trade laws and customs regulations. Navigating these complex legal frameworks, including anti-dumping measures, is crucial for smooth operations and market access. For instance, the World Trade Organization (WTO) reported that in 2023, over 500 new trade-restrictive measures were implemented globally, highlighting the dynamic nature of these regulations.

Fluctuations in trade policies, such as the introduction of new tariffs or changes to existing trade agreements, can significantly influence OPmobility's logistics and overall operational expenses. For example, a sudden tariff increase on imported components could directly escalate production costs, impacting pricing strategies and competitiveness. The International Monetary Fund (IMF) projected in late 2024 that global trade growth could be dampened by ongoing geopolitical tensions and protectionist policies.

- Compliance Burden: OPmobility faces the ongoing challenge of staying abreast of evolving international trade laws, customs procedures, and anti-dumping investigations across various operating regions.

- Tariff Impact: Changes in tariffs, such as those seen in automotive trade disputes in recent years, can directly increase the cost of raw materials and finished goods, affecting OPmobility's supply chain and profitability.

- Regulatory Alignment: Ensuring that product specifications and manufacturing processes meet the diverse regulatory requirements of different countries is essential to avoid import restrictions and penalties.

- Trade Agreements: The benefits or drawbacks of existing and potential new free trade agreements can significantly shape OPmobility's sourcing strategies and market access opportunities.

Data Privacy and Cybersecurity Regulations

The increasing prevalence of connected vehicles and sophisticated integrated software places significant emphasis on data privacy and cybersecurity regulations for OPmobility. Ensuring compliance with evolving data protection laws, such as the GDPR in Europe and similar frameworks globally, is critical. Failure to safeguard user data and protect against cyber threats can lead to substantial fines and reputational damage, impacting customer trust and market position.

OPmobility must proactively manage the security of its embedded software and connected solutions. For instance, the automotive industry is seeing a rise in data breaches, with reports in 2024 indicating increased targeting of vehicle systems. Adherence to standards like ISO 21434 for cybersecurity engineering in road vehicles is becoming a de facto requirement. This focus on robust data governance and cybersecurity measures is essential to avoid legal repercussions and maintain customer confidence in OPmobility's offerings.

- GDPR Fines: Non-compliance can result in fines of up to 4% of global annual revenue or €20 million, whichever is higher.

- Cybersecurity Standards: ISO 21434 adoption is becoming a benchmark for automotive cybersecurity.

- Data Breach Costs: The average cost of a data breach in the automotive sector is substantial, impacting profitability.

- Customer Trust: Strong data privacy practices are directly linked to customer loyalty and willingness to adopt connected services.

OPmobility must navigate stringent environmental regulations, such as the EU's tightening CO2 targets and the EPA's 2027 emission standards, to avoid significant financial penalties. Product liability laws are also a major concern, particularly for advanced technologies like EVs and autonomous driving, necessitating rigorous safety validation to prevent costly recalls and reputational damage, as evidenced by billions spent globally on recalls in 2023.

Protecting intellectual property, especially for innovations in hydrogen technology and intelligent systems, is vital for maintaining a competitive edge. Furthermore, OPmobility must comply with complex international trade laws and customs regulations, with over 500 new trade-restrictive measures implemented globally in 2023, impacting logistics and operational costs due to potential tariffs and trade policy shifts.

Data privacy and cybersecurity are paramount due to connected vehicles, requiring adherence to regulations like GDPR and standards such as ISO 21434 to prevent substantial fines and maintain customer trust. The automotive sector is experiencing an increase in data breaches, underscoring the need for robust data governance and security measures.

Environmental factors

The automotive sector is under immense pressure to cut CO2 emissions, impacting everything from how cars are made to how they're used. These aren't just suggestions; they are strict global targets that manufacturers must meet.

OPmobility is actively addressing this challenge. The company aims for carbon neutrality in its own operations, covering scopes 1 and 2, starting in 2025. Beyond that, they have a clear plan to extend this carbon neutrality across their entire value chain by 2050, demonstrating a long-term commitment to environmental responsibility.

The automotive industry, including players like OPmobility, is increasingly embracing circular economy principles. This shift emphasizes reusing, recycling, and remanufacturing materials and components to minimize waste and resource depletion. For instance, in 2024, the European Union continued to strengthen its commitment to the circular economy with updated directives aimed at boosting recycling rates and promoting sustainable product design across various sectors, including automotive.

OPmobility is actively integrating eco-design principles into its operations. This involves incorporating a growing proportion of recycled materials into its products and implementing strategies to reduce waste throughout its value chain. By 2025, many automotive manufacturers are targeting specific percentages of recycled content in key components, a trend OPmobility is aligning with to enhance its sustainability credentials and meet evolving regulatory and consumer demands.

Environmental regulations are tightening globally, pushing manufacturers like OPmobility to meticulously manage their operational impact. This includes a sharp focus on reducing energy consumption, minimizing waste, and optimizing water usage across all production facilities. For instance, OPmobility has reported efforts to enhance energy efficiency at its sites, a critical step in addressing this scrutiny.

In line with these environmental pressures, OPmobility is actively increasing its investment in and purchase of renewable energy sources. This strategic shift aims to decarbonize its manufacturing processes and align with growing stakeholder expectations for sustainable operations. By prioritizing renewables, the company is directly responding to the demand for a reduced carbon footprint in its supply chain.

Resource Scarcity and Sustainable Sourcing

Concerns over resource scarcity, especially for materials vital to electric vehicle batteries and lightweight automotive components, are intensifying. This drives a critical need for OPmobility to prioritize sustainable raw material sourcing and robust recycling programs.

OPmobility's commitment to utilizing recycled materials and advancing circular economy principles directly tackles these scarcity challenges. For instance, the automotive industry's reliance on lithium and cobalt, with global demand for lithium-ion batteries projected to grow significantly, underscores the importance of these strategies. By 2030, the demand for lithium is expected to reach over 1.5 million metric tons annually, highlighting the urgency for alternative sourcing and recycling solutions.

- Growing Demand for Critical Minerals: The automotive sector's electrification is projected to increase demand for key battery materials like lithium and nickel, creating supply chain pressures.

- Recycling as a Solution: OPmobility's focus on recycled content in its lightweight solutions helps mitigate reliance on virgin resources and reduces environmental impact.

- Circular Economy Initiatives: Investments in and adoption of circular economy models are crucial for long-term sustainability and cost-effectiveness in material procurement.

Climate Change Adaptation Strategies

Climate change presents significant challenges for the automotive supply chain, with events like extreme weather increasingly disrupting operations. For instance, the European Environment Agency reported that in 2023, floods and storms caused an estimated €50 billion in economic losses across Europe, impacting manufacturing and logistics. OPmobility's strategy of maintaining a global manufacturing footprint, with localized production facilities, offers a degree of resilience by diversifying operational risk and potentially mitigating the impact of region-specific climate events.

To address these vulnerabilities, OPmobility is likely focusing on adaptation strategies. These could include:

- Diversifying supplier bases to reduce reliance on single regions prone to climate disruptions.

- Investing in resilient infrastructure at manufacturing sites, such as enhanced flood defenses or backup power systems.

- Developing robust business continuity plans that account for a range of climate-related scenarios.

- Exploring alternative transportation routes and modes to circumvent areas affected by extreme weather.

OPmobility is navigating a landscape increasingly shaped by environmental concerns, from stringent emissions targets to resource scarcity. The company's strategic pivot towards carbon neutrality by 2025 for its own operations and a broader value chain commitment by 2050 demonstrates a proactive response to these pressures. This includes a significant push towards incorporating recycled materials, aligning with the European Union's strengthened circular economy directives and addressing the growing demand for critical minerals essential for vehicle electrification.

The company's focus on eco-design and circular economy principles is crucial for mitigating the impact of resource scarcity, particularly for materials like lithium and cobalt, where global demand is projected to surge. By 2030, lithium demand alone is expected to exceed 1.5 million metric tons annually, underscoring the need for sustainable sourcing and robust recycling programs. OPmobility's efforts in this area directly address these market dynamics.

Climate change also presents operational risks, as seen in the €50 billion economic losses from extreme weather events in Europe during 2023. OPmobility's global manufacturing footprint and localized production strategy are designed to build resilience against such disruptions, ensuring business continuity and supply chain stability.

| Environmental Factor | OPmobility's Response/Strategy | Key Data/Trend |

|---|---|---|

| Emissions Reduction & Carbon Neutrality | Aiming for carbon neutrality in scopes 1 & 2 by 2025, and entire value chain by 2050. | Automotive sector pressure to cut CO2 emissions. |

| Circular Economy & Recycled Materials | Integrating eco-design, increasing recycled content in products. | EU directives boosting recycling rates; 2025 targets for recycled content in components. |

| Resource Scarcity (Critical Minerals) | Prioritizing sustainable sourcing and recycling programs. | Lithium demand projected to exceed 1.5 million metric tons annually by 2030. |

| Climate Change Impact & Resilience | Global manufacturing footprint with localized facilities. | €50 billion economic losses from European extreme weather in 2023. |

PESTLE Analysis Data Sources

Our OPmobility PESTLE Analysis is built on a robust foundation of data sourced from official government publications, reputable international organizations, and leading industry research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and societal trends to ensure a comprehensive and accurate assessment.