OPmobility Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OPmobility Bundle

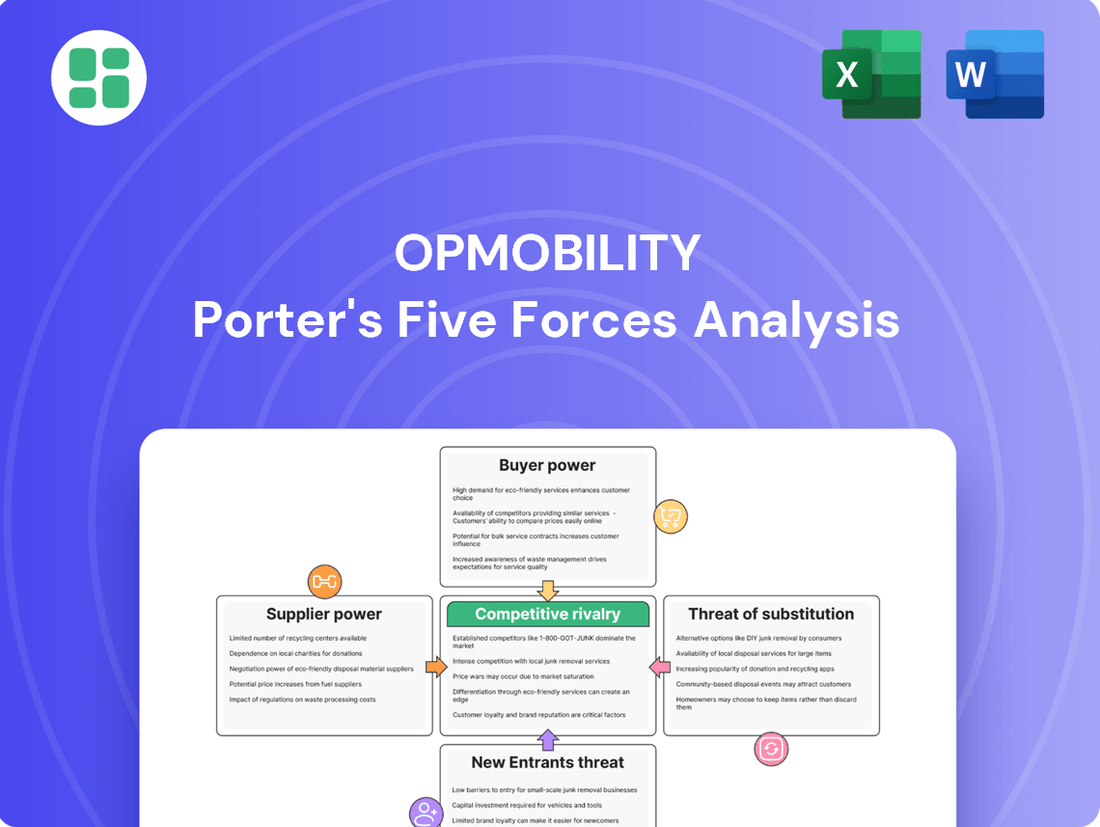

OPmobility faces a dynamic competitive landscape, with intense rivalry and significant buyer power shaping its market. The threat of substitutes and new entrants also presents challenges, while supplier power can influence operational costs.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore OPmobility’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for critical components significantly impacts OPmobility's bargaining power. For specialized inputs like advanced lightweighting materials or specific electronics for intelligent mobility solutions, having only a handful of dominant suppliers can empower them to dictate higher prices and less favorable terms. For instance, in 2024, the automotive sector continued to see consolidation among Tier 1 suppliers for advanced semiconductor components, a key area for OPmobility's intelligent systems.

The costs OPmobility incurs when switching suppliers for its specialized automotive components, such as retooling manufacturing lines or recertifying new parts, can be substantial. These switching costs directly influence the bargaining power of existing suppliers. For instance, if a new supplier requires extensive integration and validation processes, OPmobility might hesitate to make a change, thereby strengthening the position of its current partners.

For OPmobility, dealing with intricate automotive systems means that components are often highly integrated and require specific expertise. This complexity means that finding and onboarding a new supplier for these specialized parts can be a significant undertaking, involving not just the cost of the new component but also the expense and time associated with testing and ensuring compatibility. This reliance on specialized knowledge and integrated systems increases the bargaining power of OPmobility's current suppliers.

Suppliers offering highly differentiated or proprietary technologies, such as specialized software for intelligent mobility systems or advanced materials for hydrogen storage, hold significant bargaining power. OPmobility’s strategic direction towards innovation and clean energy solutions inherently ties its success to the availability of these cutting-edge components.

When these technologies are unique and critical to OPmobility's product offerings, the suppliers are in a strong position to negotiate higher prices or impose more stringent contract terms. For instance, a supplier of a novel battery management system crucial for OPmobility's electric vehicle components could leverage its exclusivity to influence pricing and supply agreements.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into OPmobility's manufacturing processes is generally low in the specialized automotive sector. OEMs often prefer to maintain direct relationships with their component suppliers, limiting the likelihood of suppliers taking over OPmobility's core production.

However, very large, technologically advanced suppliers of raw materials or critical sub-components could theoretically pose this threat, especially if they possess unique manufacturing capabilities that OPmobility relies on.

- Supplier Forward Integration Threat: While not a dominant factor, the potential for major material or sub-component suppliers to integrate forward into OPmobility's manufacturing space exists.

- Industry Norms: The automotive industry typically favors dedicated supplier relationships, making widespread supplier forward integration less common.

- Key Supplier Capabilities: Suppliers with unique technological or manufacturing expertise are more likely to consider such a strategic move.

Importance of OPmobility to Supplier

The significance of OPmobility as a customer directly influences its suppliers' bargaining power. If OPmobility constitutes a substantial portion of a supplier's overall revenue, that supplier is likely more amenable to negotiating favorable terms and pricing. Conversely, if OPmobility is a minor client, the supplier holds greater leverage.

OPmobility's considerable revenue and extensive global operations position it as a key customer for a wide array of its suppliers. This strong customer status can translate into more favorable purchasing agreements for OPmobility.

- Customer Dependence: OPmobility's substantial revenue, estimated in the billions of Euros annually (e.g., reporting €5.5 billion in revenue for 2023), makes it a critical client for many component manufacturers and service providers.

- Negotiating Leverage: This significant customer dependency grants OPmobility considerable leverage to negotiate better pricing, payment terms, and supply chain conditions.

- Supplier Willingness: Suppliers who rely heavily on OPmobility's business are more inclined to offer competitive pricing and prioritize OPmobility's needs to maintain this valuable relationship.

- Global Scale Impact: OPmobility's global manufacturing footprint further amplifies its importance to suppliers, as it represents a consistent and large-volume demand across multiple regions.

OPmobility's bargaining power with its suppliers is influenced by the concentration of suppliers for critical components. For specialized inputs, a limited supplier base empowers those suppliers to dictate terms. For example, in 2024, the automotive sector saw continued consolidation among Tier 1 suppliers for advanced semiconductor components, a key area for OPmobility's intelligent systems.

The substantial costs OPmobility incurs when switching suppliers for specialized automotive components, such as retooling or recertification, strengthen the bargaining power of existing suppliers. This is particularly true for highly integrated systems requiring specific expertise, making supplier changes a significant undertaking.

Suppliers offering unique or proprietary technologies, like novel battery management systems for OPmobility's electric vehicle components, hold considerable leverage. This exclusivity allows them to negotiate higher prices and more stringent contract terms, directly impacting OPmobility's costs and product development.

OPmobility's significant customer status, evidenced by its substantial revenue, estimated at €5.5 billion for 2023, grants it considerable negotiation leverage. This dependence makes suppliers more willing to offer competitive pricing and prioritize OPmobility's needs, especially given its global manufacturing footprint.

| Factor | Impact on OPmobility's Bargaining Power | Example/Data Point (2023-2024) |

|---|---|---|

| Supplier Concentration | Weakens OPmobility's power | Consolidation in semiconductor suppliers for intelligent systems. |

| Switching Costs | Weakens OPmobility's power | High costs for retooling and recertifying specialized automotive components. |

| Supplier Differentiation/Proprietary Tech | Weakens OPmobility's power | Exclusive suppliers of battery management systems for EVs. |

| OPmobility's Customer Importance | Strengthens OPmobility's power | €5.5 billion revenue in 2023 makes OPmobility a critical client. |

What is included in the product

This analysis dissects OPmobility's competitive environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry to inform strategic decision-making.

Instantly identify and quantify competitive pressures with a visual, interactive dashboard.

Customers Bargaining Power

The automotive sector is dominated by a few large vehicle manufacturers, or OEMs. This concentration means that suppliers like OPmobility face customers with considerable negotiating leverage. For instance, in 2023, the top five global automotive OEMs accounted for a significant portion of the industry's total sales, underscoring their market power.

This concentrated customer base grants OEMs substantial bargaining power. They can often dictate terms, pricing, and delivery schedules to their suppliers. OPmobility's ability to achieve revenue growth, even amidst market fluctuations, suggests it has successfully navigated these powerful customer relationships and secured vital contracts.

The significant purchase volumes by individual automotive original equipment manufacturers (OEMs) considerably strengthen their negotiating position with OPmobility. For instance, major vehicle platforms often involve substantial orders for OPmobility's exterior systems, clean energy components, and integrated modules, directly impacting OPmobility's sales volume and revenue streams.

This scale of commitment allows these OEMs to effectively negotiate for competitive pricing and more favorable contract terms. Their ability to place large orders for critical vehicle systems means they can exert considerable influence over OPmobility's production schedules and product development priorities, ensuring their specific requirements are met.

Switching costs for Original Equipment Manufacturers (OEMs) from an established supplier like OPmobility can be substantial. These costs arise from the deep integration of OPmobility's systems into the OEM's vehicle platforms, requiring extensive re-testing and validation of new components. For instance, in 2024, the automotive industry continued to see significant investment in supplier qualification processes, which can take many months and involve rigorous safety and performance checks.

Furthermore, OPmobility's long-term contracts with OEMs often include clauses that make early termination financially punitive. The complexity of reconfiguring supply chains to accommodate a new supplier, alongside the need for thorough qualification of new components, further entrenches existing relationships. This inherent stickiness in the supplier-OEM dynamic naturally limits the bargaining power of the customer.

Customer's Threat of Backward Integration

Automotive Original Equipment Manufacturers (OEMs) hold the potential to bring component manufacturing in-house, a move known as backward integration. This capability gives them significant bargaining power, as it presents a credible alternative to relying on external suppliers like OPmobility. For instance, in 2024, the automotive industry continued to explore vertical integration strategies to gain greater control over supply chains and costs, especially in light of ongoing geopolitical and economic uncertainties.

However, OPmobility's deep specialization in niche areas, such as advanced hydrogen storage systems and sophisticated intelligent exterior components, makes full backward integration by OEMs less feasible or economically attractive. Developing the necessary expertise, technology, and manufacturing infrastructure for these highly specialized products requires substantial investment and time. OPmobility's commitment to continuous innovation in these fields directly counters the OEM's threat of integration.

- OEMs' Backward Integration Threat: Automotive manufacturers can potentially produce components internally, increasing their leverage in supplier negotiations.

- Resource Intensity of Integration: The significant capital and technical expertise required for OEMs to manufacture specialized components in-house limits the practicality of this threat.

- OPmobility's Competitive Edge: OPmobility's focus on specialized technologies, like advanced hydrogen systems and intelligent exteriors, creates a barrier to OEM backward integration due to the high R&D and manufacturing complexity involved.

- Innovation as a Deterrent: OPmobility's ongoing investment in innovation and development of proprietary technologies reduces the incentive for OEMs to replicate these capabilities internally.

Price Sensitivity of Automotive OEMs

Automotive Original Equipment Manufacturers (OEMs) operate in a fiercely competitive landscape where price is a critical factor for consumers. This intense market pressure directly translates into significant cost-saving demands placed upon their suppliers, including OPmobility. In 2024, the automotive sector continued to grapple with economic uncertainties, further amplifying the need for cost efficiency throughout the supply chain.

OPmobility, therefore, faces persistent pressure from its OEM customers to deliver components at increasingly competitive price points. This dynamic is a direct consequence of the automotive OEMs' own sensitivity to market pricing and their efforts to maintain profitability in a challenging environment. For instance, reports from early 2024 indicated a slowdown in certain automotive markets, pushing OEMs to scrutinize every aspect of their cost structure.

- Price Sensitivity: Automotive OEMs are highly sensitive to the final price of vehicles, impacting their willingness to absorb supplier cost increases.

- Competitive Pressure: The global automotive market's competitiveness forces OEMs to seek cost reductions from their supply base to remain competitive.

- Margin Squeeze: Constant demands for lower prices directly impact OPmobility's profit margins and necessitate continuous improvements in operational efficiency.

- Market Conditions: Challenging economic conditions in 2024, such as inflation and fluctuating demand, intensified the price pressure on automotive suppliers.

The bargaining power of customers, specifically automotive OEMs, is significant due to market concentration and their substantial order volumes. OPmobility's success in securing contracts with major players, such as those supplying components for high-volume vehicle platforms, demonstrates its ability to manage these powerful relationships. For example, in 2024, major OEMs continued to consolidate their supplier base, increasing the leverage of larger, established suppliers.

OEMs' ability to negotiate favorable pricing and terms is amplified by the sheer scale of their purchases. The deep integration of OPmobility's specialized systems into OEM vehicle designs also creates high switching costs, making it difficult and expensive for OEMs to change suppliers. This is evident in the extensive qualification processes that can take many months, as observed in 2024's industry trends.

While OEMs possess the potential for backward integration, OPmobility's specialization in advanced technologies like hydrogen storage systems makes this a less viable threat. The considerable investment and expertise required for OEMs to replicate OPmobility's niche capabilities limit their ability to bring these specific components in-house. OPmobility's ongoing innovation in these specialized areas serves as a key differentiator.

| Factor | Impact on OPmobility | 2024 Context |

|---|---|---|

| Market Concentration | High customer leverage for large OEMs | Continued consolidation among top OEMs |

| Order Volume | Strong negotiating position for OEMs | Substantial orders for critical vehicle systems |

| Switching Costs | Supplier stickiness due to integration | Extended qualification periods for new components |

| Backward Integration Threat | Limited by OPmobility's specialization | OEMs exploring integration, but complex for niche tech |

Preview the Actual Deliverable

OPmobility Porter's Five Forces Analysis

This preview showcases the comprehensive OPmobility Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the automotive sector. The document displayed here is the exact, professionally formatted analysis you’ll receive immediately after purchase, providing you with actionable insights without any surprises or placeholders.

Rivalry Among Competitors

The automotive supplier industry is intensely competitive, with a multitude of global companies offering comparable products and services. OPmobility contends with a broad spectrum of rivals, including major, diversified automotive suppliers and niche, specialized manufacturers. This diversity, encompassing established parts makers and emerging technology-driven businesses, significantly heightens the competitive pressures OPmobility navigates.

The automotive industry's growth rate is a crucial factor influencing competitive rivalry. In 2024, many global automotive markets experienced subdued growth, with some even contracting. This challenging environment forces companies to fiercely compete for existing market share, intensifying rivalry.

While OPmobility has demonstrated resilience and outpaced the broader market, the overall slow growth trend globally means competitors are actively pursuing new business opportunities. This aggressive pursuit of growth by rivals can lead to price wars and increased marketing efforts, further escalating competitive pressures.

OPmobility actively pursues product differentiation through innovation in intelligent exterior systems, clean energy solutions, and front-end modules, complemented by its software development expertise. For instance, their advancements in lightweight materials and integrated sensor technologies aim to set their offerings apart in the automotive sector.

The intensity of competitive rivalry is directly influenced by how truly unique and difficult to replicate these innovations are. If competitors can easily mimic OPmobility's differentiated features, the advantage is short-lived, potentially leading to increased price competition.

In 2024, the automotive industry continues to see a strong push for electrification and advanced driver-assistance systems, areas where OPmobility's differentiation efforts are focused. Companies that successfully embed unique, value-adding technologies can command higher prices and secure a more robust market share, while those with more commoditized products face greater pressure on margins.

Exit Barriers

High exit barriers in the automotive supplier sector, including substantial fixed assets and specialized machinery, can intensify competitive rivalry. Companies might persist in operations even with low profits to recover investments, potentially causing overcapacity and price wars. OPmobility's extensive manufacturing presence is a notable exit barrier.

These barriers mean that firms like OPmobility may struggle to divest assets or exit markets easily, even when facing declining demand or profitability. This can lead to prolonged periods of intense competition as companies fight to maintain market share and cover their sunk costs.

- High Capital Intensity: The automotive supply chain demands significant investment in specialized production equipment and facilities, making it difficult and costly to exit.

- Long-Term Contracts: Many suppliers operate under long-term agreements with automakers, which can lock them into production and make immediate cessation of operations challenging.

- Workforce Commitments: Significant employee numbers and associated labor agreements can also present a hurdle to rapid downsizing or closure.

- Brand Reputation: A company's reputation within the automotive industry can be tarnished by a disorderly exit, impacting future business opportunities.

Strategic Stakes

The automotive sector, particularly in areas like electric vehicle (EV) components and hydrogen systems, is strategically vital for global players. This importance drives fierce competition as companies vie for dominance in these evolving markets. For instance, in 2024, investments in EV battery technology alone were projected to reach hundreds of billions of dollars globally, underscoring the immense strategic stakes involved.

Companies are aggressively investing in research and development for next-generation technologies and expanding their manufacturing and distribution footprints to gain a competitive edge. OPmobility's own strategic shift towards sustainable and connected mobility solutions directly reflects these high stakes, as securing a strong position in these future-oriented segments is critical for long-term success.

- Strategic Importance: The automotive industry, especially segments like EV components and hydrogen systems, holds significant strategic value for major global corporations.

- Investment Focus: Companies are channeling substantial capital into new technologies and geographic expansion to solidify their future market positions.

- Rivalry Fuel: The drive to secure future growth in the transforming mobility landscape intensifies competition among established and emerging players.

- OPmobility's Position: OPmobility's strategic pivot to sustainable and connected mobility underscores the high stakes and the need to adapt to industry shifts.

Competitive rivalry within the automotive supplier industry, where OPmobility operates, is characterized by a large number of global players offering similar products. The subdued growth in many automotive markets during 2024 intensified this rivalry, as companies aggressively fought for existing market share, sometimes leading to price pressures. OPmobility's efforts to differentiate through innovation in areas like intelligent exterior systems and clean energy solutions are crucial, but the ease with which competitors can replicate these innovations directly impacts the intensity of competition and margin sustainability.

| Competitor Type | Key Characteristics | Impact on Rivalry |

| Major Diversified Suppliers | Broad product portfolios, established global presence, significant R&D budgets | Intense competition across multiple product segments, price sensitivity |

| Niche/Specialized Manufacturers | Focus on specific technologies or components, agility, innovation in their domain | Disruptive potential, competition on technological superiority |

| Emerging Technology Firms | Focus on new mobility solutions (EV, ADAS), often venture-backed, rapid scaling | Rapidly shifting competitive landscape, competition on future-proofing |

SSubstitutes Threaten

The threat of substitute materials for vehicle exterior systems, like advanced lightweight metals or alternative composites, could certainly affect OPmobility's main business. While plastics are still widely used, the continuous exploration of new materials, driven by the need for lighter vehicles and cost savings, presents a real substitute threat.

For instance, the automotive industry is increasingly looking at materials such as advanced high-strength steels and aluminum alloys, which offer improved fuel efficiency and crashworthiness. In 2024, the global automotive lightweight materials market was valued at over $200 billion, with composites and advanced metals making up a significant portion, indicating a growing adoption of alternatives to traditional plastics for exterior components.

However, OPmobility's deep knowledge in advanced composites and its ability to integrate these materials into complex designs helps to lessen this particular threat. Their focus on innovative solutions means they are not just subject to material shifts but can also be a part of driving them.

The threat of substitutes for OPmobility's core offerings, particularly in the clean energy sector, is significant. Alternative energy storage solutions beyond hydrogen fuel cells, such as advancements in solid-state batteries or more efficient electric vehicle (EV) battery architectures, pose a direct challenge. For instance, by mid-2024, the global EV battery market was projected to reach over $150 billion, with continuous innovation driving down costs and improving performance, making these alternatives increasingly competitive.

While OPmobility is strategically investing in hydrogen technology, the rapid pace of development in other electrification solutions could divert market demand. Companies are pouring billions into battery research; in 2024 alone, global investment in battery technology R&D was estimated to exceed $40 billion, aiming to overcome limitations of current lithium-ion technology. This intense innovation means that superior energy density, faster charging, and longer lifespans could be achieved by non-hydrogen storage methods, potentially eroding the market share for hydrogen-based systems.

OPmobility's diversification strategy, which includes investments in battery and broader electrification systems, is a crucial move to mitigate this substitute threat. By developing capabilities in these alternative areas, the company can adapt to evolving market preferences and technological shifts, ensuring it remains competitive regardless of which energy storage technology gains dominance. This proactive approach is vital as the energy transition continues to accelerate, with projections suggesting the global energy storage market could surpass $300 billion by 2030.

The automotive industry's move towards highly integrated vehicle architectures, where functions previously handled by separate modules are consolidated, presents a potential substitute threat to OPmobility's core business, particularly its front-end modules. This integration can reduce the demand for the distinct, complex components OPmobility specializes in.

However, the counter-trend of modular vehicle design, prioritizing ease of assembly, customization, and repair, remains a significant driver for OPmobility's product portfolio. This modularity allows for greater flexibility and potentially lower lifecycle costs, sustaining the relevance of OPmobility's offerings.

The ongoing evolution in vehicle design involves a delicate balance between these two architectural philosophies. For instance, in 2024, many manufacturers are exploring flexible skateboard platforms which inherently support modularity, while simultaneously pushing for software-defined vehicles that integrate more functions digitally, creating a dynamic competitive landscape for module suppliers.

Public Transportation and Shared Mobility

Broader societal shifts favoring public transportation and shared mobility services represent a significant threat of substitutes for traditional vehicle production, potentially impacting OPmobility's core business. As more individuals opt for ride-sharing, micro-mobility, or public transit, the overall demand for new, privately owned vehicles could decline. For instance, in 2024, many urban centers continued to invest heavily in public transit infrastructure, with cities like Paris aiming to expand their metro lines and bus networks to reduce reliance on private cars. This macro trend indirectly shrinks the total addressable market for automotive components.

OPmobility's strategic response to this threat involves expanding its focus into heavy and public mobility sectors. This diversification aims to capture demand from these growing segments, thereby mitigating the potential reduction in private vehicle component sales. By developing solutions for buses, trains, and other public transport systems, OPmobility can leverage its expertise in mobility technology to serve a different, yet related, market. This strategic pivot is crucial for maintaining relevance and growth in an evolving transportation landscape.

- Societal Shift: Increasing preference for public transit and shared mobility reduces demand for private vehicles.

- Market Impact: This trend indirectly shrinks the total addressable market for automotive components.

- OPmobility's Strategy: Expansion into heavy and public mobility aims to counter this threat.

- Example Data: Continued urban investment in public transit infrastructure in 2024 highlights this trend.

Software-Defined Vehicle Functionality

The rise of software-defined vehicle (SDV) functionality presents a potential threat of substitutes by devaluing traditional hardware components. As innovation increasingly centers on software, the unique selling proposition of hardware-centric parts could diminish, making them less critical to a vehicle's overall value proposition. This shift could lead consumers and manufacturers to view software solutions as a viable substitute for advanced hardware features.

For OPmobility, this means that while its OP'nSoft division is positioned to capitalize on this trend, the core hardware business might face pressure. If the perceived value of a vehicle becomes predominantly tied to its software capabilities, the demand for and pricing power of specialized hardware components could weaken. For instance, advanced driver-assistance systems (ADAS) that were once reliant on complex sensor arrays might be partially replicated or enhanced through software algorithms, potentially reducing the need for the most sophisticated hardware.

- Software as a Substitute: Core vehicle functions, from infotainment to powertrain management, are increasingly being controlled and enhanced by software, potentially reducing reliance on specific hardware configurations.

- Value Proposition Shift: As innovation shifts to software, the intrinsic value of hardware components may decline if they don't offer unique, software-incompatible functionalities.

- Market Trends (2024): The automotive industry is investing heavily in SDV development, with projections suggesting that software-related revenue streams will significantly grow, impacting traditional hardware sales models. For example, by 2030, the value of software in vehicles is expected to reach hundreds of billions of dollars globally, highlighting the scale of this shift.

- OPmobility's Position: OPmobility's OP'nSoft unit is a direct response to this trend, but the broader threat lies in whether their hardware offerings remain indispensable in an increasingly software-centric automotive landscape.

The threat of substitutes for OPmobility's offerings is multifaceted, encompassing material science, energy storage technologies, vehicle architecture, and evolving mobility paradigms. In 2024, the automotive industry's pursuit of sustainability and efficiency intensifies the search for alternative materials and energy solutions, directly challenging established component suppliers.

| Threat Category | Substitute Examples | Impact on OPmobility | 2024 Market Data/Trend |

|---|---|---|---|

| Materials | Advanced high-strength steels, aluminum alloys, advanced composites | Potential reduction in demand for traditional plastic-based components. | Global lightweight materials market valued over $200 billion in 2024. |

| Energy Storage | Solid-state batteries, advanced EV battery architectures | Challenge to hydrogen fuel cell technology market share. | EV battery market projected over $150 billion in 2024; $40 billion+ invested in battery R&D in 2024. |

| Vehicle Architecture | Highly integrated vehicle designs | Reduced demand for distinct, complex modules like front-end modules. | Manufacturers exploring flexible platforms and software-defined vehicles. |

| Mobility Paradigms | Public transportation, shared mobility services | Decreased demand for new private vehicles, impacting component sales. | Continued urban investment in public transit infrastructure globally. |

| Technology Integration | Software-defined vehicle (SDV) functionalities | Devaluation of hardware-centric parts; software may substitute hardware features. | Projected significant growth in software-related automotive revenue streams by 2030. |

Entrants Threaten

The automotive supplier industry, especially for intricate systems like those OPmobility specializes in, demands significant capital for research and development, advanced manufacturing plants, and specialized machinery. These substantial upfront costs create a formidable barrier for any new company looking to enter the market, effectively limiting the threat of new entrants.

For instance, developing and producing advanced seating systems or mobility solutions requires millions in tooling, testing equipment, and sophisticated production lines. OPmobility's extensive global footprint, with numerous manufacturing sites and dedicated R&D facilities, underscores the scale of investment needed, a level that is difficult for newcomers to match.

Established players like OPmobility leverage significant economies of scale in production, procurement, and research and development. This allows them to achieve substantially lower costs per unit compared to potential newcomers.

New entrants would find it incredibly difficult to match OPmobility's cost efficiencies without achieving a comparable production volume, creating a substantial barrier to competing effectively on price.

OPmobility's extensive production volumes, a key factor in its market position, provide it with a considerable cost advantage, making it challenging for new companies to enter and gain market share.

New companies entering the automotive supply sector face significant hurdles in securing access to crucial distribution channels and building strong relationships with major Original Equipment Manufacturers (OEMs). Automakers typically favor suppliers who have a proven history of delivering high-quality, reliable components and possess the capacity for global production. OPmobility's established intimacy with key OEMs and its strategic alliances act as substantial deterrents to newcomers.

Proprietary Technology and Patents

OPmobility's significant investment in innovation, particularly in areas like intelligent exterior systems and hydrogen technologies, results in a strong portfolio of proprietary technologies and patents. For instance, the company has actively pursued patents in advanced materials and manufacturing processes for its automotive components, creating a protective barrier. This technological edge makes it difficult and expensive for new players to replicate OPmobility's product offerings or achieve comparable performance levels without substantial upfront R&D expenditure or costly licensing agreements.

The high cost associated with developing cutting-edge technologies and securing intellectual property rights acts as a substantial barrier to entry. New companies would need to allocate considerable resources to research and development to even approach OPmobility's current technological capabilities. In 2023, OPmobility reported R&D expenses of €495 million, underscoring the significant investment required to maintain its innovative edge. This financial commitment deters potential entrants who may lack the capital or long-term vision to compete effectively in such a technologically driven market.

Furthermore, the need to license existing technologies from OPmobility or other established players adds another layer of cost and complexity. Licensing fees can be substantial, impacting the profitability of new entrants from the outset. This reliance on external technology also means that new companies may not have full control over their product development or innovation roadmap, further diminishing their competitive potential against a company like OPmobility that cultivates its own intellectual property.

- Proprietary Technology: OPmobility's focus on intelligent exterior systems and hydrogen technologies has yielded unique innovations protected by patents.

- High R&D Investment: New entrants face substantial costs to develop comparable technologies or license existing ones, as evidenced by OPmobility's €495 million R&D spend in 2023.

- Intellectual Property Barrier: Patents and trade secrets create a significant hurdle, requiring new companies to invest heavily in innovation or incur licensing fees.

Regulatory and Environmental Hurdles

The automotive sector faces substantial regulatory and environmental challenges. New companies must navigate complex compliance for safety, emissions, and sustainability, often requiring extensive testing and certification. For instance, by 2025, OPmobility aims for carbon neutrality, showcasing proactive engagement with these evolving industry benchmarks.

These stringent requirements act as a significant barrier to entry for potential new competitors. Meeting standards for vehicle safety, like crashworthiness and airbag deployment, involves costly development and validation. Similarly, environmental regulations, such as Euro 7 emission standards in Europe, demand advanced powertrain technologies and exhaust treatment systems, adding to the upfront investment needed to enter the market.

- Regulatory Compliance Costs: New entrants must invest heavily in research, development, and testing to meet diverse global safety and emissions regulations.

- Environmental Standards: Adherence to increasingly strict environmental mandates, including those related to CO2 emissions and material sourcing, presents a significant financial and technical challenge.

- Certification Processes: Obtaining necessary certifications for vehicles in different markets is time-consuming and expensive, requiring specialized expertise and rigorous documentation.

- OPmobility's Sustainability Focus: OPmobility's commitment to carbon neutrality by 2025 highlights its strategy to align with and potentially exceed these environmental expectations, differentiating itself from less prepared entrants.

The threat of new entrants for OPmobility is generally considered low due to substantial barriers. High capital requirements for R&D and manufacturing, coupled with established economies of scale, make it difficult for newcomers to compete on cost and quality. OPmobility’s significant investment in proprietary technology and patents, as demonstrated by its €495 million R&D expenditure in 2023, creates a strong technological moat.

Furthermore, the automotive industry's stringent regulatory landscape, encompassing safety and environmental standards, adds another layer of complexity and cost for potential entrants. OPmobility’s proactive stance on sustainability, aiming for carbon neutrality by 2025, positions it favorably against less prepared competitors.

Established relationships with OEMs and the need for extensive certifications further solidify OPmobility's market position, making the entry of new players a formidable challenge.

Porter's Five Forces Analysis Data Sources

Our OPmobility Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and relevant government regulatory filings. This comprehensive approach allows for a thorough examination of competitive intensity and strategic positioning.