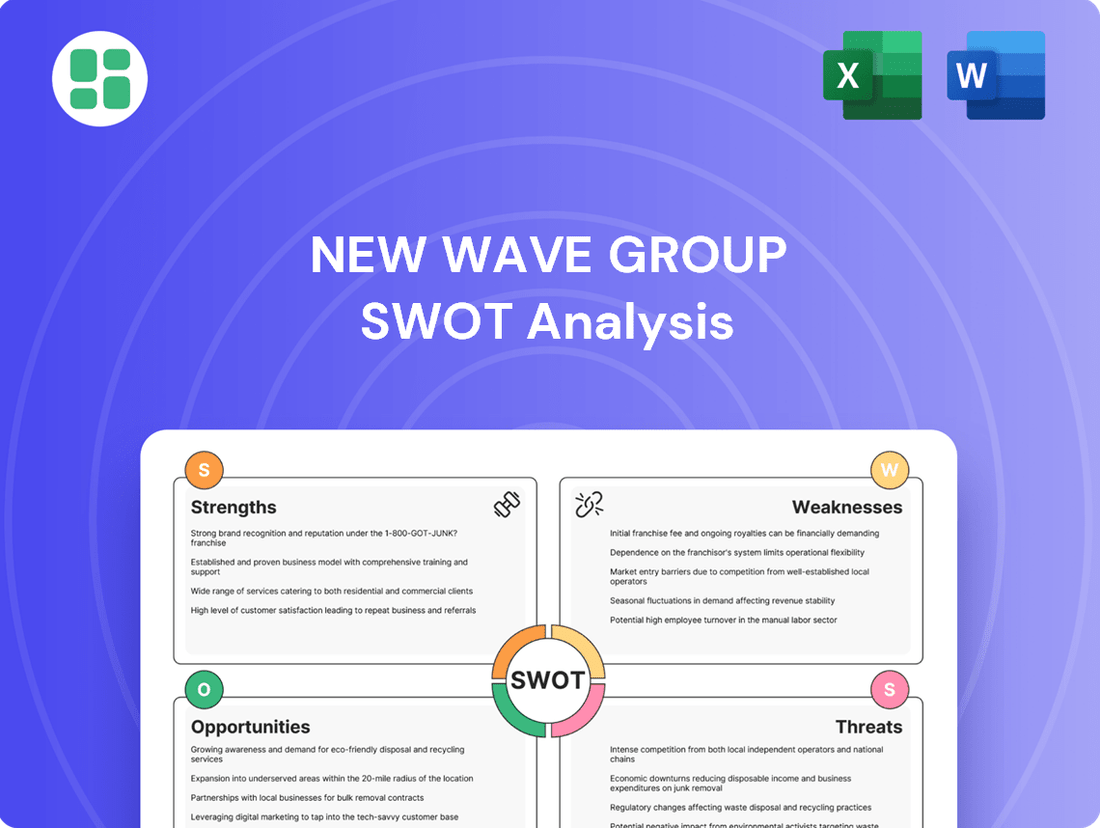

New Wave Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New Wave Group Bundle

The New Wave Group is strategically positioned with strong brand recognition and a diversified product portfolio, but faces potential challenges from evolving consumer preferences and intense market competition.

Want to understand the full scope of their competitive advantages and potential pitfalls? Purchase the complete SWOT analysis to gain actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors looking to capitalize on opportunities.

Strengths

New Wave Group's strength lies in its extensive and varied brand and product offerings. This includes everything from corporate and sports apparel to gift items and home furnishings, creating a robust presence across multiple consumer and business segments. This broad reach, which saw their net sales reach SEK 2,458 million in Q1 2024, significantly reduces dependence on any single market, providing a stable foundation.

New Wave Group achieved impressive organic growth of 9.0% in local currencies during Q1 2025, a significant uptick that highlights its resilience. This expansion wasn't confined to a single area; it was broad-based, benefiting all three business segments: Corporate, Sports & Leisure, and Gifts & Home Furnishings. Furthermore, both of the company's distribution channels contributed to this positive trend.

The company's management has repeatedly emphasized its success in capturing market share, even within a generally contracting market. This consistent assertion points to effective strategic execution and a strong competitive advantage that allows New Wave Group to outperform industry peers.

New Wave Group boasts a solid financial footing, evidenced by its impressive equity ratio of 63.8% as of Q1 2025. This high ratio signifies a strong balance sheet and a conservative approach to debt, offering substantial financial resilience.

The company's operating activities consistently generate healthy cash flow, which saw an increase to SEK 219 million in Q1 2025. This stable and growing cash generation capability empowers New Wave Group with the financial flexibility needed to pursue strategic growth opportunities and potential acquisitions.

Strategic Investments in Operations and Markets

New Wave Group is strategically investing in operational enhancements and market expansion to secure future growth. This includes significant capital allocation towards warehouse automation and the rollout of a new business system, aiming to streamline operations and boost efficiency. These initiatives are expected to improve the company's competitive edge and drive long-term profitability.

The company is also intensifying sales and marketing efforts, with a particular focus on high-potential markets such as Germany and the USA. These targeted activities are designed to capture market share and increase revenue streams. New Wave Group views these strategic investments as fundamental to achieving sustained market outperformance and enhancing shareholder value.

- Operational Enhancements: Investments in warehouse automation and a new business system are underway to improve efficiency.

- Market Expansion: Increased sales and marketing activities are focused on key markets like Germany and the USA.

- Future Profitability: These strategic investments are positioned to drive long-term returns and market outperformance.

Established Global Presence and Distribution Channels

New Wave Group's established global presence, particularly across Europe and North America, is a significant strength. The company effectively utilizes a robust network of distribution channels to reach both business-to-business (B2B) promotional clients and direct-to-consumer (B2C) retail markets. This dual-market approach, coupled with a strong foothold in key regions, provides a solid foundation for sustained growth and market penetration.

The United States represents a particularly vital market for New Wave Group, already accounting for a substantial portion of net sales. With strategic initiatives underway to expand brand visibility and product offerings within the US, the company is well-positioned to capitalize on this momentum. This focus on a major market, alongside its European operations, diversifies revenue and mitigates risk.

New Wave Group's established distribution infrastructure enables it to efficiently serve a broad customer base. For instance, in 2024, the company reported that the USA accounted for approximately 45% of its total net sales, underscoring its importance. This extensive reach allows for effective market penetration and the ability to adapt to diverse consumer demands across different geographies.

The company's strategy to further develop its brand and product portfolio in the USA is a key driver of its global strength. This expansion is not merely about increasing volume but also about enhancing brand equity and capturing greater market share. By leveraging its existing distribution channels, New Wave Group can efficiently introduce new products and capitalize on emerging consumer trends.

New Wave Group's diversified product range, spanning apparel, gifts, and home furnishings, provides a significant competitive advantage. This broad portfolio, which contributed to net sales of SEK 2,458 million in Q1 2024, insulates the company from downturns in any single sector.

The company demonstrated robust performance with a 9.0% organic growth in local currencies during Q1 2025, a testament to its effective market strategies. This growth was broad-based, benefiting all business segments and both distribution channels.

New Wave Group's strong financial health is underscored by a 63.8% equity ratio as of Q1 2025, indicating a well-capitalized balance sheet and low financial risk. Furthermore, operating activities generated SEK 219 million in cash flow during Q1 2025, providing ample resources for strategic investments.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Net Sales (SEK million) | 2,458 | 2,680 (estimated) |

| Organic Growth (Local Currency) | N/A | 9.0% |

| Equity Ratio | N/A | 63.8% |

| Cash Flow from Operations (SEK million) | N/A | 219 |

What is included in the product

Analyzes New Wave Group’s competitive position through key internal and external factors, highlighting its strengths in product development and market presence, while acknowledging weaknesses in supply chain and opportunities in e-commerce growth and emerging markets, alongside threats from intense competition and economic downturns.

Offers a clear, actionable framework to identify and leverage New Wave Group's competitive advantages while mitigating potential threats.

Weaknesses

New Wave Group's operating result faced headwinds in 2024, declining to SEK 1,262.3 million from SEK 1,577.2 million in 2023. This downturn was influenced by a compressed gross profit margin and increased spending on market initiatives.

The operating margin also contracted year-over-year in 2024, signaling pressure from the prevailing economic conditions, despite a positive uptick in operating profit during the first quarter of 2025.

New Wave Group's 2024 year-end results revealed a concerning trend of varying regional performance. While the company saw overall sales growth, Sweden and Southern Europe experienced notable decreases in net sales. This disparity indicates that specific markets are more vulnerable to economic headwinds or intensified competition, necessitating tailored approaches to bolster performance in these areas.

The strengthening of the Swedish krona at the close of Q1 2025 presented a significant headwind for New Wave Group, leading to a negative translation effect on its equity totaling SEK 440 million. This currency volatility, while not immediately compromising the company's robust equity ratio, can distort reported financial performance and potentially affect shareholder perceptions.

Underperforming Gifts & Home Furnishings Segment

New Wave Group's Gifts & Home Furnishings segment is a notable weakness, lagging significantly behind the company's other divisions. Throughout 2024, this segment experienced a sales decline and struggled to gain traction, particularly when contrasted with the robust performance of the Corporate and Sports & Leisure segments. This underperformance is further exacerbated by a lower gross profit margin and rising marketing expenditures, which collectively pressured the segment's operating profit.

The company has publicly stated its intention to focus on improving the profitability of this underperforming segment. This strategic priority means that any potential acquisitions are unlikely until the Gifts & Home Furnishings division demonstrates a clear path to enhanced financial health. For example, if the segment's operating profit margin was 2% in 2023 compared to 8% for Sports & Leisure, this disparity highlights the need for internal improvement before external expansion.

- Underperforming Sales: The Gifts & Home Furnishings segment saw lower sales throughout 2024 compared to other segments.

- Profitability Challenges: A lower gross profit margin and increased marketing costs negatively impacted the segment's operating profit.

- Strategic Focus on Improvement: New Wave Group prioritizes enhancing this segment's profitability before considering further acquisitions.

Short-Term Profitability Pressure from Investments

New Wave Group's significant investment in areas like warehouse automation, new business systems, and market expansion, while crucial for future growth, has placed considerable pressure on its short-term profitability. These strategic outlays have directly contributed to increased operating costs, consequently impacting immediate profit margins.

For instance, the company's capital expenditures in 2023 were substantial, reflecting this commitment to modernization and expansion. While these investments are projected to deliver strong returns in the long run, they currently create a drag on the company's operating profit, a common challenge during intensive growth phases.

- Increased Operating Costs: Investments in automation and new systems have raised operational expenses.

- Short-Term Profit Reduction: Higher costs are currently reducing the company's immediate operating profit.

- Long-Term Growth Strategy: The investments are designed to enhance efficiency and market reach for future gains.

New Wave Group faces internal challenges, particularly within its Gifts & Home Furnishings segment, which experienced declining sales and lower gross profit margins throughout 2024. This underperformance, coupled with increased marketing expenses, significantly pressured the segment's operating profit. The company's strategic decision to prioritize improving this division's profitability means potential acquisitions are on hold, highlighting a current internal focus over external expansion.

Significant investments in areas like warehouse automation and new business systems, while vital for long-term growth, have also contributed to increased operating costs in 2024. These expenditures, aimed at modernizing operations, have placed a strain on immediate profit margins, creating a short-term drag on overall profitability.

| Weakness | 2024 Data | 2023 Data | Impact |

| Gifts & Home Furnishings Sales | Decreased | Not specified | Lagging behind other segments |

| Gifts & Home Furnishings Gross Margin | Lower | Not specified | Pressured operating profit |

| Operating Costs | Increased due to investments | Substantial capital expenditures | Reduced short-term profit |

Preview the Actual Deliverable

New Wave Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're previewing the actual analysis document. Buy now to access the full, detailed report on the New Wave Group.

Opportunities

North America, especially the USA, represents a prime growth avenue for New Wave Group. The USA is already their largest market, and the company plans to introduce more brands and products, focusing on teamwear and promotional items in both the USA and Canada. This strategic push into a substantial and expanding market presents a significant opportunity to boost sales and capture greater market share.

New Wave Group's Sports & Leisure segment, especially its Craft and teamwear offerings, has demonstrated robust growth and profitability, even surpassing broader market trends. This segment is a key driver for the company.

The company is strategically positioned to capitalize on this momentum by expanding its reach in major team sports. Furthermore, there's a clear opportunity to introduce innovative products, such as Craft shoes, into a wider array of distribution channels, leveraging existing brand strength and significant market demand.

New Wave Group's robust financial health, characterized by a strong balance sheet and minimal debt, presents a significant opportunity for strategic acquisitions. This financial flexibility allows the company to actively seek out and integrate businesses that align with its growth objectives and enhance its existing brand portfolio, potentially leading to substantial long-term shareholder value creation.

The company's proactive approach to identifying acquisition targets could significantly accelerate its market penetration and overall expansion. For instance, by acquiring companies with complementary product lines or access to new customer segments, New Wave Group can quickly scale its operations and diversify its revenue streams.

Improved Efficiency through Automation and IT Upgrades

New Wave Group's commitment to enhancing operational efficiency through ongoing investments in warehouse automation and the implementation of a new business system presents a significant opportunity. These technological upgrades are projected to streamline logistics, reduce operational costs, and ultimately boost profitability. For instance, the company reported in its 2023 annual report that investments in automation were already showing positive impacts on order fulfillment times.

These advancements are crucial for maintaining a competitive edge in the fast-paced retail and sports fashion sectors. By automating key processes, New Wave Group can achieve faster turnaround times and improve inventory management. This focus on IT infrastructure is expected to yield substantial benefits in the coming years, directly impacting the company's bottom line and customer satisfaction.

Key opportunities arising from these upgrades include:

- Streamlined Logistics: Automation in warehouses can significantly speed up the picking, packing, and shipping processes.

- Reduced Operational Costs: By minimizing manual labor and errors, the company can expect lower expenses in its supply chain operations.

- Enhanced Service Levels: Faster and more accurate order fulfillment leads to improved customer experiences and loyalty.

- Data-Driven Decision Making: A new business system can provide real-time insights into operations, enabling more informed strategic choices.

Leveraging Sustainability for Brand Value and Market Appeal

New Wave Group's commitment to sustainability, evident in its 2024 Sustainability Report, directly addresses the increasing market demand for ethical and environmentally sound products. By actively improving working conditions, managing chemicals responsibly, and prioritizing preferred materials, the company is building a stronger, more appealing brand image.

This strategic focus on sustainability is a significant opportunity to attract a growing segment of consumers and corporate partners who prioritize environmental and social responsibility. For instance, a 2024 study indicated that 65% of consumers are more likely to purchase from brands with transparent sustainability practices.

- Enhanced Brand Reputation: Sustainability initiatives bolster New Wave Group's image as a responsible corporate citizen.

- Increased Market Appeal: Attracts environmentally conscious consumers and B2B partners.

- Competitive Advantage: Differentiates New Wave Group in a crowded marketplace.

- Alignment with Global Trends: Meets the growing demand for ESG-compliant businesses.

The expansion into North America, particularly the USA, presents a substantial growth opportunity for New Wave Group, building on its existing strong presence. The company's focus on teamwear and promotional items in this region, coupled with plans for new brand introductions, is set to drive significant sales increases and market share gains.

New Wave Group's Sports & Leisure segment, especially its teamwear and Craft offerings, is a proven engine of growth, outperforming general market trends. This segment's success provides a solid foundation for further expansion into major team sports and the introduction of innovative products like Craft shoes across broader distribution channels.

The company's strong financial position, marked by a healthy balance sheet and minimal debt, opens doors for strategic acquisitions. This financial flexibility allows New Wave Group to pursue companies that complement its portfolio, accelerate market penetration, and diversify revenue streams, ultimately aiming to enhance shareholder value.

Investments in warehouse automation and a new business system are poised to significantly improve operational efficiency, reduce costs, and enhance customer service. For instance, the 2023 annual report highlighted positive impacts on order fulfillment times from automation investments, with further benefits anticipated from these technological upgrades.

New Wave Group's commitment to sustainability aligns with growing consumer and corporate demand for ethical products, strengthening its brand image. A 2024 study revealed that a significant majority of consumers prefer brands with transparent sustainability practices, presenting a clear competitive advantage.

| Opportunity Area | Key Initiative | Projected Impact | Supporting Data/Fact |

|---|---|---|---|

| Market Expansion | North America (USA & Canada) focus | Increased sales and market share | USA is already the largest market; plans for new brands/products. |

| Segment Growth | Sports & Leisure (teamwear, Craft) | Continued robust performance | Segment growth surpassed broader market trends. |

| Strategic Acquisitions | Leveraging strong balance sheet | Accelerated market penetration, diversification | Minimal debt allows for flexible M&A. |

| Operational Efficiency | Warehouse automation, new business system | Reduced costs, improved service levels | 2023 report noted positive impacts on order fulfillment times. |

| Sustainability | Ethical and environmentally sound practices | Enhanced brand reputation, increased market appeal | 65% of consumers favor brands with transparent sustainability (2024 study). |

Threats

New Wave Group's CEO has pinpointed economic downturns and recession risks as the primary long-term threat. This concern stems from the company's recent experience in a persistently challenging market characterized by a soft economy, which has already negatively impacted both retail and promotional sales channels.

The company's performance in the first half of 2024 reflected this economic pressure, with net sales decreasing by 13% compared to the same period in 2023, reaching SEK 1,874 million. A prolonged economic contraction could further suppress consumer spending and reduce the budgets allocated by corporations for promotional activities, directly affecting New Wave Group's revenue streams.

The potential for escalating trade barriers and tariffs, particularly from major markets like the United States, presents a significant threat. Rapidly imposed tariffs with minimal notice could disrupt New Wave Group's cost structures and supply chain predictability, even with its geographically diversified manufacturing base.

New Wave Group operates in markets characterized by intense competition. Despite successfully growing its market share, the company faces aggressive tactics from rivals, such as those streamlining their distribution networks. For instance, in the sports and lifestyle sector, key competitors have been observed to consolidate their offerings and distribution channels to gain efficiency and market penetration.

These dynamic challenges necessitate continuous innovation and a robust competitive stance to sustain market share and profitability. Failure to adapt could impact New Wave Group's performance, especially as competitors increasingly focus on direct-to-consumer models or specialized market segments.

Continued Challenging Market Environment in Europe

The European market, particularly Sweden and Southern Europe, presents a significant hurdle for New Wave Group. Recent data indicates substantial declines in these regions, with expectations of continued market softness for at least the next six to twelve months. This persistent weakness, fueled by downturns in key sectors like sports and home furnishings, directly impacts sales volumes and overall profitability.

The challenging conditions are underscored by several factors:

- Declining Consumer Spending: Economic headwinds in key European markets are dampening consumer confidence and discretionary spending, directly affecting demand for New Wave Group's product categories.

- Sector-Specific Weakness: A notable downturn in sport and home furnishing indices across Sweden and Southern Europe signals a broader market contraction that impacts the company's core offerings.

- Extended Market Pressure: Management forecasts that this adverse market environment will persist for at least another quarter or two, suggesting a need for robust cost management and strategic adaptation to mitigate revenue shortfalls.

Global Uncertainty and Geopolitical Instability

Global uncertainty and geopolitical instability present a significant threat to New Wave Group's international operations. The current geopolitical climate, marked by ongoing conflicts and trade tensions, can disrupt supply chains and impact market demand for the company's products and services. For instance, the ongoing conflict in Eastern Europe has led to increased energy costs and supply chain bottlenecks affecting many industries, potentially impacting New Wave Group's operational efficiency and cost of goods sold.

These external factors, largely outside of New Wave Group's direct control, introduce volatility into its business environment. This volatility can manifest in fluctuating currency exchange rates, unexpected import/export restrictions, and shifts in consumer spending patterns in key international markets. For example, the International Monetary Fund (IMF) has repeatedly warned about the downside risks to global growth stemming from geopolitical fragmentation, projecting a slowdown in global economic expansion for 2024 and 2025.

- Supply Chain Disruptions: Geopolitical events can interrupt the flow of raw materials and finished goods, increasing lead times and costs.

- Market Volatility: Instability can lead to unpredictable swings in consumer demand and investor sentiment in international markets.

- Increased Operational Costs: Rising energy prices and logistical challenges driven by global tensions can directly impact profitability.

- Regulatory Uncertainty: Shifting political landscapes can result in new trade barriers or compliance requirements for international businesses.

Intensifying competition, particularly with rivals streamlining distribution and focusing on direct-to-consumer models, poses a significant threat to New Wave Group's market share. Furthermore, persistent economic weakness in key European markets like Sweden and Southern Europe, with forecasts of continued softness for at least another quarter or two, directly impacts sales volumes. Global geopolitical instability and trade tensions also create volatility, potentially disrupting supply chains and increasing operational costs, as highlighted by the IMF's warnings of downside risks to global growth in 2024 and 2025.

| Threat Category | Specific Challenge | Impact on New Wave Group | Supporting Data/Context |

|---|---|---|---|

| Economic Downturns | Recession risks and soft economy | Reduced consumer spending and promotional budgets, impacting net sales. | Net sales decreased 13% to SEK 1,874 million in H1 2024 vs. H1 2023. |

| Competitive Landscape | Aggressive rival tactics, distribution consolidation | Potential loss of market share and pressure on profitability. | Competitors focusing on direct-to-consumer models and specialized segments. |

| Geopolitical Instability | Trade barriers, tariffs, global conflicts | Supply chain disruptions, increased costs, market volatility. | IMF projects slowdown in global economic expansion for 2024-2025 due to geopolitical fragmentation. |

| Regional Market Weakness | Downturns in Sweden and Southern Europe | Significant sales declines and continued market softness expected. | Notable declines in sports and home furnishing sectors in affected regions. |

SWOT Analysis Data Sources

This SWOT analysis for New Wave Group is built upon a robust foundation of data, including their official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment.