New Wave Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New Wave Group Bundle

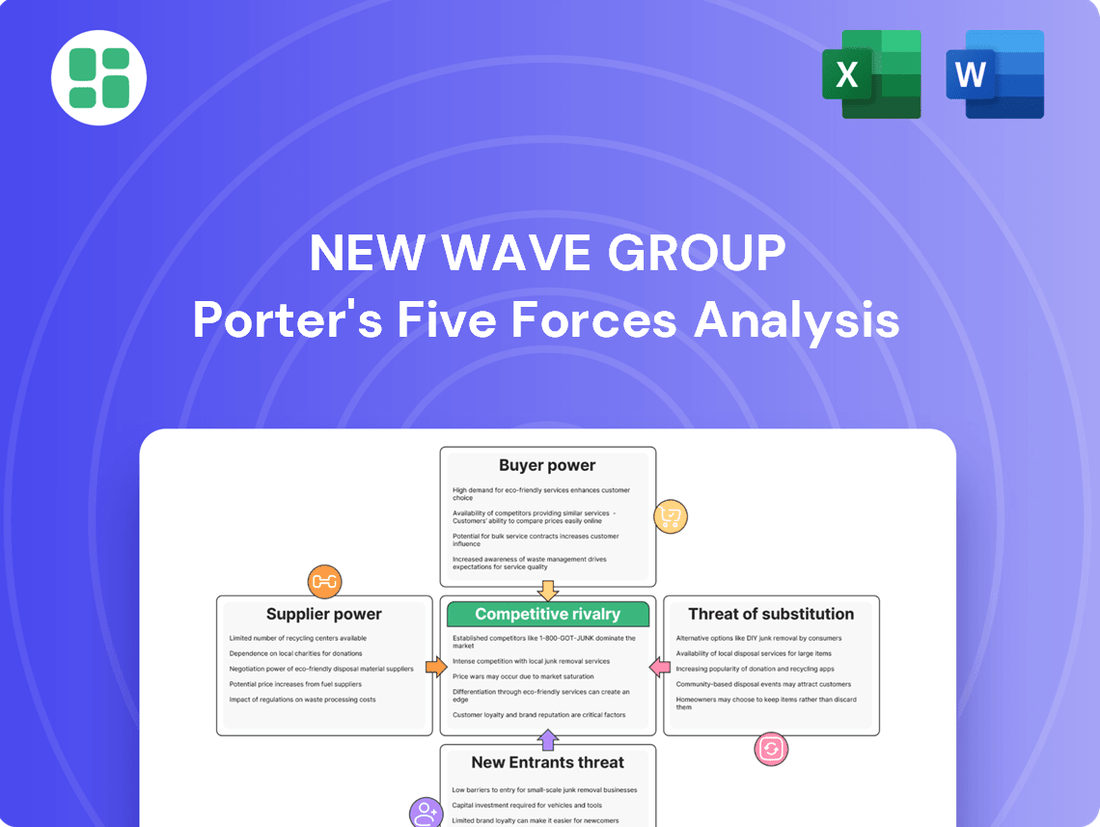

New Wave Group faces moderate buyer power and intense rivalry, but the threat of substitutes is low, suggesting a stable industry landscape. Understanding the nuances of supplier bargaining power and the potential for new entrants is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore New Wave Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

New Wave Group's broad product range, spanning corporate items, sports equipment, gifts, and home furnishings, likely indicates a diverse supplier network. This diversification generally dilutes the bargaining power of individual suppliers, as the company can shift its business to alternatives.

However, for specific, highly specialized components, proprietary materials, or exclusive brand collaborations, the supplier pool shrinks considerably. In these niche areas, suppliers possessing unique capabilities or intellectual property can exert greater influence, potentially dictating terms or pricing.

New Wave Group's commitment to maintaining high product quality and a strong brand image necessitates partnerships with suppliers who consistently meet stringent standards. This reliance on dependable, quality-focused suppliers can empower those suppliers, particularly if they are among the few capable of fulfilling these demands.

The cost and complexity of switching suppliers for New Wave Group's inputs can vary greatly. For standard promotional items or basic apparel, the effort to change suppliers is often minimal, suggesting lower switching costs.

However, when dealing with specialized or proprietary products, like custom-designed textiles or items requiring specific manufacturing technologies, the expense and difficulty of switching can be considerable. This includes costs for retooling, implementing new quality control measures, and establishing new supplier relationships, which can significantly enhance the bargaining power of existing suppliers.

In 2024, the global apparel and textile industry faced ongoing supply chain disruptions, with some raw material costs, such as cotton, experiencing volatility. For instance, cotton prices saw fluctuations throughout the year due to weather patterns and geopolitical events, potentially increasing the cost of switching for manufacturers reliant on specific cotton grades.

Suppliers to New Wave Group, especially those manufacturing finished products or unique components, generally encounter significant hurdles in directly accessing the B2B or B2C distribution channels. The substantial investment in brand building, marketing, and established distribution networks inherent in New Wave Group's operating sectors makes direct market entry by these suppliers a less probable strategy.

This limitation on suppliers' ability to integrate forward significantly curtails their direct competitive threat, reinforcing New Wave Group's bargaining power. For instance, in the competitive sports equipment market, where New Wave Group is active, the cost of establishing a retail presence and brand recognition can easily run into millions of dollars, a prohibitive barrier for most component suppliers.

Importance of New Wave Group to Suppliers

New Wave Group's substantial size and global reach position it as a major client for many of its suppliers. In 2023, New Wave Group reported net sales of SEK 11,270 million, indicating the significant volume of business it conducts. This scale grants New Wave Group considerable negotiation power, enabling it to secure competitive pricing, favorable payment terms, and stringent quality controls from its suppliers.

However, the bargaining power dynamic can shift depending on the supplier's uniqueness and criticality to New Wave Group's product assortment. For suppliers offering specialized or proprietary components essential for New Wave Group's premium or niche product lines, their individual leverage increases. This is particularly true if these specialized inputs are difficult to source elsewhere, allowing these niche suppliers to command better terms.

- Supplier Dependence: New Wave Group's large order volumes make it a crucial revenue source for many suppliers, potentially reducing the suppliers' ability to dictate terms.

- Product Differentiation: Suppliers providing unique or hard-to-replicate materials or components may hold stronger bargaining power, especially if these inputs are key to New Wave Group's competitive advantage.

- Supplier Concentration: If New Wave Group relies on a limited number of suppliers for critical inputs, those suppliers gain increased leverage.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for New Wave Group. If alternative, readily accessible eco-friendly materials or innovative manufacturing processes become available, New Wave Group's dependence on its current suppliers diminishes, thereby weakening supplier leverage.

New Wave Group's strategic focus on preferred fibers and materials, such as organic cotton or recycled polyester, directly impacts this dynamic. For example, if the market for recycled polyester expands and becomes more cost-competitive, it could offer a viable alternative to virgin polyester, potentially shifting power away from suppliers of the latter.

- Impact of Substitutes: The emergence of readily available and cost-effective substitute inputs can reduce New Wave Group's reliance on specific suppliers, thereby lowering their bargaining power.

- Sustainability Influence: New Wave Group's commitment to sustainable materials, like preferred fibers, creates opportunities for alternative suppliers and potentially reduces the power of incumbent suppliers if substitutes gain traction.

- Market Trends: For instance, a growing market for recycled materials in the textile industry, projected to reach USD 10.8 billion by 2027 according to some market analyses, could offer New Wave Group more options and lessen supplier control.

New Wave Group's bargaining power with suppliers is generally strong due to its significant purchasing volume, as evidenced by its 2023 net sales of SEK 11,270 million. This scale allows for favorable pricing and terms. However, suppliers of unique or proprietary components essential for specific product lines can wield considerable influence, particularly if switching costs are high.

The company's ability to switch suppliers is often facilitated by a diverse supplier base for standard items, but can be constrained by specialized requirements. In 2024, raw material price volatility, such as for cotton, highlighted potential vulnerabilities where specific suppliers might hold more sway. Suppliers also face barriers to forward integration into New Wave Group's distribution channels, limiting their direct competitive threat.

| Factor | Impact on Supplier Bargaining Power | New Wave Group Context (2023/2024) |

| Purchasing Volume | Lowers Supplier Power | SEK 11,270 million in net sales (2023) indicates significant leverage. |

| Supplier Uniqueness | Increases Supplier Power | Niche suppliers of proprietary components can command better terms. |

| Switching Costs | Increases Supplier Power | High for specialized inputs; low for standard items. |

| Forward Integration Barriers | Lowers Supplier Power | High costs for suppliers to enter New Wave Group's distribution channels. |

| Raw Material Volatility | Can Increase Supplier Power | Fluctuations in 2024 (e.g., cotton prices) affected input costs. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to the New Wave Group's position in the promotional product industry.

Quickly identify and address competitive threats with a visual representation of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

New Wave Group navigates a landscape where customer power varies significantly. In its business-to-consumer (B2C) segments, individual buyers typically have minimal influence due to their small purchase volumes. This fragmentation means no single customer can exert substantial pressure.

Conversely, the group’s business-to-business (B2B) clients, particularly large corporate entities and distributors, wield more considerable bargaining power. These clients, often placing substantial orders for promotional products or branded sportswear, can leverage their volume to negotiate better terms. For instance, a major distributor ordering thousands of custom-branded apparel items in 2024 would naturally have more leverage than an individual consumer buying a single shirt.

New Wave Group's core strategy revolves around creating and nurturing distinct brands, with a strong emphasis on customization for corporate clients. This focus on differentiation, especially within their promotional products and branded sportswear segments, makes their offerings less interchangeable with competitors. For instance, their acquisition of premium glassware brands like Orrefors and Kosta Boda, known for their unique designs and heritage, further solidifies this brand identity.

For B2B clients of New Wave Group, switching suppliers for branded and customized promotional items often comes with substantial switching costs. These can include the expense and time involved in redesigning products, navigating re-approval processes with internal stakeholders, and the risk of disrupting ongoing marketing campaigns. These factors create customer stickiness, thereby reducing their bargaining power.

In contrast, for B2C customers, the direct financial switching costs are typically quite low. However, brand loyalty acts as a significant factor in customer retention for New Wave Group. A strong brand can command premium pricing and reduce price sensitivity, effectively mitigating the customer's bargaining power even with low direct switching costs.

Customer Price Sensitivity

In the competitive promotional products sector, B2B clients can be quite sensitive to price, particularly when purchasing standard, unbranded items. For instance, a study in early 2024 indicated that over 60% of procurement managers surveyed considered price a primary factor for commodity-like promotional goods.

However, this price sensitivity often diminishes when dealing with specialized or premium branded merchandise. Here, factors like superior quality, innovative design, and the perceived brand prestige become more influential than the absolute cost. This trend was highlighted by a 2024 report showing that 45% of corporate buyers prioritized brand reputation and product uniqueness over price for high-value client gifts.

The corporate gifting landscape is evolving, with a noticeable move towards fewer, but more impactful, high-value presents. These often feature personalization and a strong emphasis on sustainability. This shift suggests a potential reduction in extreme price sensitivity as businesses increasingly seek gifts that align with their brand values and create a lasting impression.

- Price Sensitivity in Promotional Goods: B2B customers are often price-sensitive for generic promotional items.

- Shift to Value for Premium Products: For specialized or premium branded goods, quality, design, and brand impact outweigh price.

- Evolving Corporate Gifting Trends: The market is moving towards fewer, higher-value, personalized, and sustainable gifts.

- Reduced Extreme Price Sensitivity: The focus on value and personalization may lessen extreme price sensitivity for certain segments.

Threat of Backward Integration by Customers

The threat of customers engaging in backward integration, meaning they would produce their own promotional items or sportswear, is generally low for New Wave Group. This is because most of their corporate clients typically lack the specialized knowledge, the necessary production scale, and the established supply chain infrastructure required to manufacture these goods cost-effectively.

For instance, a company looking for branded team wear or corporate gifts usually outsources this to specialists like New Wave Group rather than investing in their own manufacturing capabilities. This inability for customers to easily produce these items themselves significantly limits their bargaining power.

- Low Likelihood of Customer Backward Integration: Corporate clients generally lack the manufacturing expertise and infrastructure to produce promotional items or sportswear in-house.

- Cost and Complexity Barriers: Establishing efficient production for branded merchandise requires significant investment in machinery, skilled labor, and supply chain management, making it economically unfeasible for most customers.

- Focus on Core Competencies: Businesses typically prefer to focus on their primary operations rather than diverting resources and attention to a specialized manufacturing process.

- Reduced Customer Bargaining Power: The inability of customers to readily produce these goods themselves strengthens New Wave Group's position by limiting price negotiation leverage.

New Wave Group's customer bargaining power is a mixed bag, leaning towards moderate. While individual consumers have little sway, larger B2B clients, especially those ordering in bulk for branded merchandise, can negotiate better terms. The group's focus on unique brands and customization, like their premium glassware lines, helps to differentiate their offerings and reduce customer price sensitivity, particularly for higher-value items. However, for more commoditized promotional goods, price remains a significant factor for B2B buyers, with over 60% of procurement managers in a 2024 survey citing it as a primary consideration.

| Customer Segment | Bargaining Power Factor | Impact on New Wave Group |

|---|---|---|

| Individual Consumers (B2C) | Low purchase volume, fragmented market | Minimal influence; low bargaining power |

| Large Corporate Clients (B2B) | High order volume, potential for negotiation | Moderate to significant influence, especially on bulk orders |

| Distributors (B2B) | Volume purchasing, leverage for better terms | Significant influence, can negotiate pricing and payment terms |

| Buyers of Premium/Customized Goods | Brand loyalty, quality, design focus | Reduced price sensitivity; lower bargaining power |

| Buyers of Standard Promotional Items | Price sensitivity, commodity-like nature | Higher bargaining power, price is a key negotiation point |

Same Document Delivered

New Wave Group Porter's Five Forces Analysis

This preview showcases the complete New Wave Group Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the industry. You are viewing the exact document that will be delivered instantly upon purchase, ensuring no discrepancies or missing information. This professionally formatted analysis provides actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Rivalry Among Competitors

New Wave Group navigates a landscape populated by a vast and varied array of competitors across its distinct business segments. In sportswear, global powerhouses such as Nike and Adidas set a high bar, while the corporate promotional items sector teems with numerous specialized, often smaller, firms. Similarly, the gifts and home furnishings markets are populated by a diverse mix of specialized retailers and larger general merchandise stores.

The industry growth rate presents a mixed picture, impacting competitive rivalry. While the corporate gifting market is expected to reach $312 billion by 2025 with a 6.5% CAGR, and the promotional products industry is projected to hit $27.8 billion in 2025, these figures indicate varying levels of expansion across different segments.

A challenging market environment, as acknowledged by New Wave Group's CEO in 2024, often intensifies competition. When growth is not uniform, companies may aggressively vie for market share in more robust areas, leading to heightened rivalry.

New Wave Group actively differentiates itself through its portfolio of strong brands, including Craft, Cutter & Buck, and Orrefors, emphasizing customization and high quality. This strategy aims to reduce direct price competition by building brand loyalty and customer perceived value. For instance, in 2024, the company continued to invest in brand development, with its sports and leisurewear segment showing robust growth, partly attributed to the appeal of brands like Craft.

Switching Costs for Customers

Low switching costs across many of New Wave Group's product categories, especially in the promotional merchandise and sportswear sectors, significantly heighten competitive rivalry. When customers can easily shift to alternative suppliers for items like branded apparel or sports equipment with minimal financial or operational disruption, businesses must constantly vie for attention through competitive pricing and superior service.

This ease of switching is particularly pronounced in the business-to-consumer (B2C) market. For instance, a consumer looking for a new running shoe or a branded t-shirt can readily compare options from numerous retailers and brands online. This forces companies like New Wave Group to maintain aggressive marketing and promotional activities to retain customer loyalty, as demonstrated by the high volume of seasonal sales and discounts prevalent in these markets. In 2024, the global sportswear market alone was valued at over $200 billion, highlighting the intense competition for consumer spending.

- Low Switching Costs: Customers can easily move between New Wave Group's suppliers for promotional items and sportswear without incurring significant penalties or effort.

- Price Competition: This ease of switching compels companies to compete aggressively on price to attract and retain customers, particularly in the B2C segment.

- Service and Innovation Pressure: Beyond price, companies must also focus on enhancing customer service and product innovation to differentiate themselves and maintain market share.

- Market Dynamics: The global sportswear market, valued at over $200 billion in 2024, exemplifies the intense competition driven by low customer switching costs.

Exit Barriers

High exit barriers can trap companies in unprofitable markets, intensifying competition. For New Wave Group, these barriers are likely substantial. The company’s extensive inventory, for instance, represents a significant sunk cost that would be difficult to liquidate without substantial losses.

Furthermore, New Wave Group's established distribution networks are specialized assets, making them hard to sell or repurpose if a business line becomes unviable. Long-term contracts with suppliers or retailers also bind the company, increasing the cost and complexity of exiting a market segment.

- Specialized Assets: New Wave Group's investments in proprietary manufacturing equipment or unique distribution infrastructure create high switching costs for exiting a particular product category.

- Inventory & Brand Portfolio: The sheer volume of diverse inventory and the established reputation of its various brands mean that simply ceasing operations would incur significant write-downs and brand value erosion.

- Distribution Networks: The company's logistics and supply chain infrastructure are tailored to its product lines, making them difficult to divest or adapt for alternative uses, thereby increasing exit costs.

Competitive rivalry within New Wave Group's diverse segments is intense, fueled by numerous players and varying industry growth rates. The corporate gifting market, projected to reach $312 billion by 2025, and the promotional products industry, estimated at $27.8 billion in 2025, both exhibit strong growth, attracting significant competition. New Wave Group counters this by emphasizing brand differentiation and quality, as seen with its Craft and Cutter & Buck brands, to mitigate direct price wars.

Low switching costs, especially in sportswear and promotional items, compel companies to compete fiercely on price and service. The global sportswear market, exceeding $200 billion in 2024, exemplifies this dynamic. While New Wave Group's brand portfolio and customization options aim to build loyalty, the ease with which customers can switch suppliers remains a significant driver of rivalry.

High exit barriers, including substantial inventory and specialized distribution networks, can intensify rivalry by keeping companies committed to markets even when less profitable. This commitment means businesses must continuously innovate and offer compelling value propositions to capture and retain market share amidst a crowded competitive landscape.

SSubstitutes Threaten

The threat of substitutes for New Wave Group's offerings hinges on the price-performance trade-off. For corporate clients, digital marketing, such as social media advertising or email campaigns, can serve as substitutes for physical promotional products. In 2024, the global digital advertising market was projected to reach over $600 billion, indicating a significant shift towards digital solutions that may offer a more measurable return on investment and broader reach than traditional promotional items.

Customers' openness to alternatives is shaped by changing preferences and values. For example, the corporate gifting sector is increasingly favoring experiences, eco-friendly items, and tech-infused presents, potentially replacing conventional merchandise.

If consumers prioritize cost over brand loyalty, generic apparel or unbranded home goods could serve as substitutes for New Wave Group's branded products. In 2024, the global market for sustainable gifts was projected to reach over $200 billion, indicating a significant consumer shift.

Businesses seeking brand promotion have numerous alternatives to physical promotional items. Digital advertising, for instance, saw global ad spending reach an estimated $600 billion in 2023, with projections for continued growth. Social media marketing and influencer collaborations also provide powerful avenues for brand visibility and customer interaction, often with a more direct engagement metric than traditional promotional products.

Evolution of Customer Preferences

Consumer preferences for sportswear and gifts are in constant flux, with trends like athleisure, sustainability, and wellness increasingly shaping purchasing decisions. For instance, the global athleisure market was valued at approximately $326 billion in 2023 and is projected to grow significantly, indicating a strong consumer shift towards comfortable, multi-functional apparel.

If New Wave Group cannot effectively adapt its product lines to these evolving preferences, consumers may turn to substitutes that better align with their current values and lifestyles. This is particularly relevant in the gift market, where personalized and eco-friendly options are gaining traction, potentially diverting sales from more traditional offerings.

The threat of substitutes is amplified by the growing availability of niche brands focusing on specific lifestyle trends, such as sustainable activewear or unique, ethically sourced gift items. For example, direct-to-consumer brands emphasizing recycled materials in sportswear have seen rapid growth, capturing market share from established players.

- Athleisure Market Growth: The global athleisure market is expected to reach over $500 billion by 2028, highlighting a significant consumer shift towards comfortable and versatile apparel.

- Sustainability Demand: A 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, impacting both sportswear and gift categories.

- Niche Brand Competition: The rise of specialized online retailers offering curated sustainable and wellness-focused products presents a direct substitute threat to broader-market retailers like New Wave Group.

Substitution Across Product Categories

New Wave Group faces an interesting internal substitution threat across its diverse product categories. For instance, a corporate client might decide a premium, high-value gift is a better choice than branded promotional apparel, impacting sales in that segment. This internal dynamic means the group must ensure each of its offerings remains compelling to avoid customers shifting between its own product lines.

Consumer choices also present a substitution risk within the group's portfolio. A shopper looking for home décor might bypass sportswear, illustrating how different segments compete for the same consumer spending. In 2023, for example, the home furnishings market saw continued growth, potentially drawing consumer budgets away from discretionary apparel categories.

- Internal Substitution: Corporate clients may opt for high-value gifts instead of promotional apparel.

- Consumer Choice: Consumers might prioritize home furnishings over sportswear.

- Market Dynamics: The home furnishings sector experienced robust growth in 2023, indicating a potential diversion of consumer spending.

The threat of substitutes for New Wave Group is substantial, driven by digital alternatives and evolving consumer preferences. For corporate clients, digital marketing, projected to exceed $600 billion globally in 2024, offers a measurable reach. Consumers increasingly favor experiences and eco-friendly items, with the sustainable gifts market expected to surpass $200 billion in 2024, directly competing with traditional branded merchandise.

| Category | Substitute Offering | Market Size (2024 Projection/Estimate) | Key Driver |

| Corporate Promotion | Digital Advertising | >$600 Billion | Measurable ROI, Broad Reach |

| Corporate Gifting | Experiential Gifts | N/A (Growing Trend) | Unique Value, Memorability |

| Apparel/Merchandise | Sustainable/Ethical Products | >$200 Billion (Sustainable Gifts) | Consumer Values, Environmental Consciousness |

| Apparel/Merchandise | Athleisure Wear | >$326 Billion (2023 Value) | Comfort, Versatility, Lifestyle Trend |

Entrants Threaten

New Wave Group leverages significant economies of scale across its vast operations, from design and purchasing to manufacturing, warehousing, and distribution. This broad reach, spanning multiple brands and product lines, allows for substantial cost efficiencies that are difficult for newcomers to replicate.

For instance, in 2024, New Wave Group's consolidated revenue reached SEK 13.7 billion, underscoring the sheer volume of its operations. This scale translates into lower per-unit costs, making it challenging for new entrants to compete on price in mature markets without comparable production volumes.

The ability to spread fixed costs over a larger output base is a critical barrier. New entrants would need to invest heavily to achieve similar cost advantages, making entry into New Wave Group's established markets a formidable undertaking.

New Wave Group benefits from robust brand identities like Craft and Orrefors, fostering significant customer loyalty. This deep-seated trust makes it a considerable hurdle for newcomers aiming to establish comparable brand recognition and product appeal.

The significant investment required for marketing, innovative product development, and cultivating market trust means new entrants face a steep climb. Simply offering similar products isn't enough; they must overcome the established brand equity and perceived value that New Wave Group already commands.

Entering diverse sectors like corporate, sports, gifts, and home furnishings, as New Wave Group does, demands substantial upfront capital. For instance, establishing a robust supply chain and marketing presence in the competitive sports apparel market alone can easily run into millions of dollars.

This high capital requirement acts as a significant deterrent for new players. Costs associated with product design, sourcing materials, manufacturing, warehousing, and building brand recognition are considerable barriers, especially when aiming for the scale and reach of an established entity like New Wave Group.

In 2024, companies entering the consumer goods space often face initial investment needs ranging from $5 million to $50 million or more, depending on the product category and desired market penetration. This financial hurdle effectively limits the number of viable new entrants.

Access to Distribution Channels

New Wave Group benefits from deeply entrenched B2B (promotional products) and B2C (retail) distribution networks spanning Europe and North America. This established presence creates a significant hurdle for potential newcomers.

New entrants would struggle to gain comparable shelf space in retail environments or to construct the necessary B2B sales forces and sophisticated logistics infrastructure required to effectively reach their intended customer base. Such an undertaking would demand considerable time and substantial financial investment.

- Established Retail Presence: New Wave Group's existing relationships with retailers provide preferential access and visibility for its products.

- B2B Sales Force & Logistics: The company's developed B2B sales teams and efficient logistics networks are critical for serving corporate clients, a difficult capability for new firms to replicate quickly.

- Brand Recognition & Trust: Years of operation have built brand recognition and customer trust within these channels, which new entrants lack.

- Cost of Channel Development: Building comparable distribution channels from scratch could cost new entrants millions of dollars in setup and ongoing operational expenses.

Government Policy and Regulations

Government policies and regulations, while not always a direct barrier, can significantly impact the ease of entry for new competitors in the sporting goods sector. For instance, stringent product safety standards or evolving environmental regulations, such as the European Sustainability Reporting Standards (ESRS) under the Corporate Sustainability Reporting Directive (CSRD) which became mandatory for many companies in 2024, require substantial investment and compliance infrastructure. New Wave Group's proactive approach to adapting its sustainability reporting highlights the complexity new entrants must anticipate.

Navigating these regulatory frameworks presents a challenge. New players must invest in understanding and implementing compliance measures for areas like material sourcing, manufacturing processes, and end-of-life product management. This can divert resources from core business development and market penetration, effectively raising the cost of entry.

- Regulatory Compliance Costs: New entrants face significant upfront costs to meet product safety and environmental standards.

- Sustainability Reporting Mandates: Regulations like the CSRD, which impacts companies operating within the EU, require robust data collection and reporting capabilities from 2024 onwards.

- International Trade Policies: Tariffs, import/export restrictions, and differing national standards can complicate global market entry for new sporting goods companies.

- Adaptation Investment: Companies like New Wave Group must continually invest in adapting to these evolving regulatory landscapes, a burden new competitors would also shoulder.

The threat of new entrants for New Wave Group is generally considered moderate to low due to several significant barriers. The company's substantial economies of scale, evident in its SEK 13.7 billion revenue in 2024, create a cost advantage that is difficult for newcomers to match. Furthermore, strong brand loyalty cultivated over years, as seen with brands like Craft and Orrefors, requires considerable investment in marketing and product development for new players to overcome.

High capital requirements for market entry, estimated between $5 million and $50 million or more for consumer goods in 2024, coupled with the need to establish extensive distribution networks and navigate complex regulations like the CSRD, further deter potential competitors. These factors collectively create a challenging environment for new businesses seeking to enter New Wave Group's established markets.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for New Wave Group is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and industry-specific market research from reputable firms like Euromonitor and Statista. We also leverage competitor financial filings and relevant trade publications to capture a holistic view of the competitive landscape.