New Wave Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New Wave Group Bundle

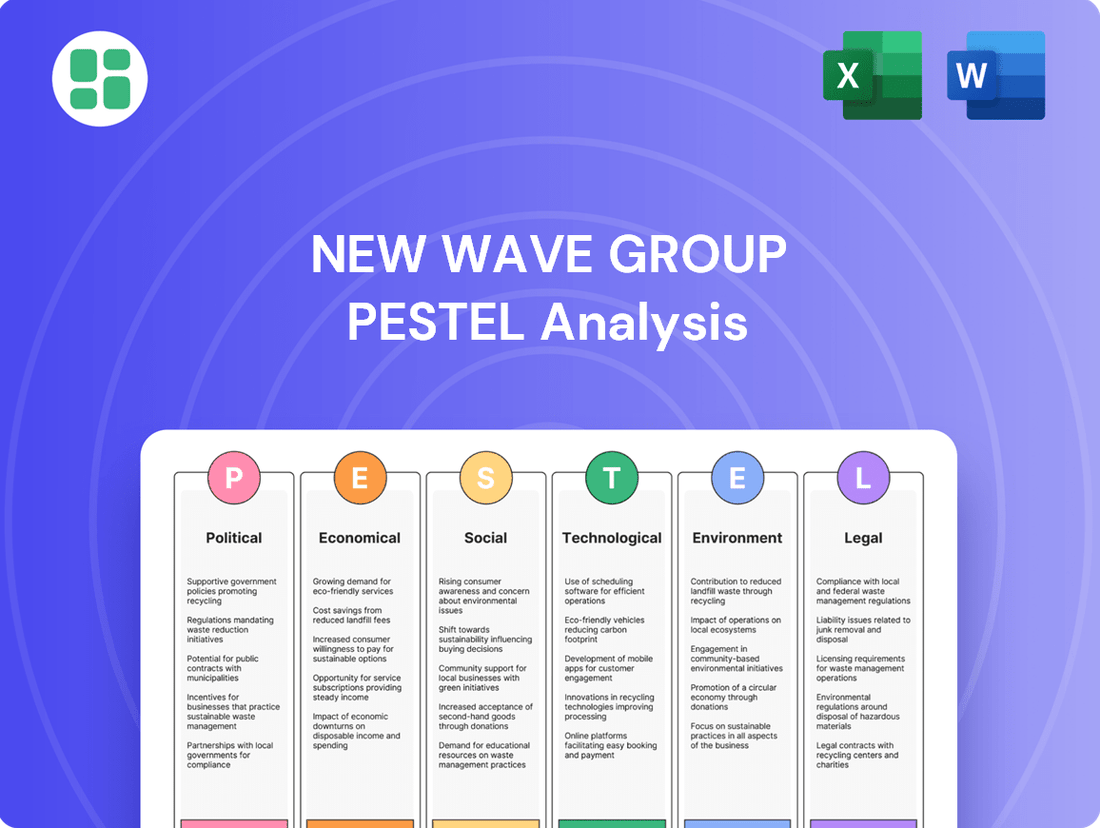

Navigate the complex external forces shaping New Wave Group's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. Understand the landscape to make informed strategic decisions.

Unlock critical insights into how global shifts affect New Wave Group. This comprehensive PESTLE analysis provides a deep dive into the external environment, empowering you to identify opportunities and mitigate risks. Purchase the full version for actionable intelligence to sharpen your competitive edge.

Political factors

New Wave Group's reliance on Asian manufacturing for products sold in Europe and North America makes it particularly vulnerable to shifts in global trade policies and tariffs. For instance, the US-China trade war, which saw significant tariff increases in 2019, demonstrated how quickly these policies can impact supply chains and profitability for companies with similar operational footprints. A sudden imposition of new tariffs could directly increase New Wave Group's cost of goods sold, potentially squeezing their gross profit margins and making their offerings less competitive in crucial markets.

The company is aware of the financial implications, estimating potential short-term cost hikes if tariffs are implemented rapidly. However, New Wave Group's strategic diversification of manufacturing facilities across multiple continents, including Europe and North America, provides a degree of resilience. This geographical spread allows for some flexibility in sourcing and production, potentially mitigating the full impact of tariffs concentrated on specific regions, a strategy increasingly adopted by global manufacturers to navigate trade uncertainties.

Governments worldwide are tightening regulations on corporate responsibility, pushing companies like New Wave Group to adopt more sustainable practices. This shift reflects a growing demand for transparency and accountability in how businesses operate.

New Wave Group demonstrated its commitment by incorporating detailed sustainability reporting into its 2024 annual report, aligning with new EU standards such as the European Sustainability Reporting Standards (ESRS) under the Corporate Sustainability Reporting Directive (CSRD). This proactive approach is vital for navigating the complex European market.

Adhering to these evolving environmental, social, and governance (ESG) mandates is not just a legal necessity but also a strategic imperative. Non-compliance could lead to significant penalties and damage New Wave Group's reputation among investors and consumers alike.

Political stability in New Wave Group's key operational and sourcing regions, including Europe, North America, and Asia, is a critical determinant of business continuity and supply chain integrity. Geopolitical events can introduce volatility, impacting everything from raw material access to consumer demand.

While New Wave Group has demonstrated adaptability in navigating complex environments, significant political instability can still pose risks. Disruptions to logistics, shifts in consumer sentiment, and direct impacts on sales performance are potential consequences, particularly in markets like Sweden and Southern Europe, which have recently experienced downturns attributed partly to these factors.

Government Procurement and Public Sector Demand

Government and public sector demand for promotional items, workwear, and sports apparel is directly tied to public spending policies and budget allocations. For New Wave Group, a significant portion of their business is B2B, meaning changes in how governments purchase these goods can have a substantial impact. For instance, if a government prioritizes local suppliers, New Wave Group's ability to adapt its sourcing and production will be crucial.

Shifts in government procurement trends, such as a move towards sustainability or ethical sourcing, could create new avenues for growth. Conversely, a reduction in public sector budgets for non-essential items would likely dampen demand. In 2023, for example, many European governments increased spending on public services, but also faced fiscal pressures that could lead to tighter controls on discretionary spending in 2024 and 2025.

- Government procurement policies directly influence demand for promotional products and apparel.

- New Wave Group's B2B model makes it sensitive to changes in public sector spending and sourcing preferences.

- A focus on local sourcing by governments presents both opportunities and challenges for international suppliers.

- Budgetary constraints in the public sector could lead to reduced orders for workwear and promotional items.

Intellectual Property Protection Policies

New Wave Group's global operations mean navigating a patchwork of intellectual property (IP) protection policies. The strength and enforcement of these laws directly influence the company's capacity to shield its diverse brands and innovative designs from infringement.

As New Wave Group continues to grow its brand portfolio and expand into new international markets, strong IP protection becomes even more critical. Effective legal frameworks are vital to combatting counterfeiting and preventing the unauthorized use of their valuable brand assets, ensuring market integrity and brand value.

For instance, in 2024, the World Intellectual Property Organization (WIPO) reported that global IP filings continued to rise, indicating a growing emphasis on IP as a business asset. However, enforcement remains a challenge in many regions, with varying penalties for infringement.

- Global IP Landscape: The effectiveness of IP protection varies significantly across countries, impacting New Wave Group's ability to safeguard its brands.

- Counterfeiting Risks: Robust legal frameworks are essential to prevent counterfeiting, which can dilute brand value and revenue.

- Brand Expansion: As New Wave Group expands its brand portfolio globally, consistent and strong IP enforcement is paramount.

- WIPO Data: WIPO's 2024 report highlights increased IP filings but persistent challenges in enforcement globally.

Political stability across New Wave Group's key markets and sourcing regions is paramount for uninterrupted operations and supply chain reliability. Geopolitical shifts can introduce significant volatility, affecting everything from raw material availability to consumer purchasing power. For example, recent regional conflicts in Eastern Europe have indirectly impacted logistics networks, potentially increasing shipping times and costs for goods moving through those corridors.

Government procurement policies directly shape demand for New Wave Group's product categories like promotional items and workwear. Changes in public sector spending priorities and sourcing preferences, such as a move towards favoring domestic suppliers, can significantly alter market dynamics. Many European governments, while increasing spending on essential services in 2023, also faced fiscal pressures that could lead to tighter controls on discretionary public sector purchases in 2024 and 2025.

Regulatory environments concerning corporate responsibility are becoming increasingly stringent globally, compelling companies like New Wave Group to integrate more sustainable and ethical practices. Adherence to evolving ESG mandates is crucial not only for legal compliance but also for maintaining investor confidence and consumer trust, with non-compliance potentially leading to substantial penalties and reputational damage.

The effectiveness of intellectual property (IP) protection varies considerably across different countries, directly impacting New Wave Group's ability to safeguard its brand assets and designs. As the company expands its global footprint and brand portfolio, robust IP enforcement mechanisms are vital to combat counterfeiting and protect brand value, a challenge highlighted by WIPO's 2024 report indicating continued growth in IP filings alongside persistent enforcement difficulties in many regions.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the New Wave Group, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities arising from these critical dimensions.

The New Wave Group's PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by offering easily digestible insights for strategic decision-making during meetings.

Economic factors

High inflation rates, particularly in Sweden and Southern Europe, have created a difficult economic climate, leading to reduced consumer spending. This trend directly impacts New Wave Group's retail and promotional sales channels.

The decline observed in the home furnishing index and the broader promo market underscores a significant squeeze on discretionary spending. For instance, in Q1 2024, Sweden's inflation rate was 4.1%, a substantial figure that erodes purchasing power.

This economic pressure affects both business-to-business clients, who may scale back budgets for promotional items, and business-to-consumer customers, who are less inclined to purchase non-essential sports and home furnishing products.

New Wave Group's extensive international operations mean that fluctuations in currency exchange rates directly affect its financial performance. When foreign earnings are converted back into Swedish Kronor (SEK), a weaker foreign currency reduces the SEK value of those sales and profits, impacting the company's net sales and overall profitability.

For instance, during the first quarter of 2025, a strengthening Swedish krona presented a challenge. Even with positive organic growth, this currency movement led to unfavorable translation effects on New Wave Group's equity, as reported in their financial statements. This highlights the sensitivity of their balance sheet to currency shifts.

Effectively managing these currency risks is therefore a critical component of New Wave Group's strategy to ensure financial stability and predictable earnings. Hedging strategies and careful monitoring of global currency markets are essential to mitigate potential negative impacts.

New Wave Group's performance is closely linked to broader economic trends. For instance, overall economic growth in key markets like Europe and North America directly impacts demand across its diverse sectors, including corporate, sports, gifts, and home furnishings. A robust economy typically translates to higher consumer and business spending in these areas.

Despite demonstrating resilience and successfully gaining market share, the company's operating results have been affected by a generally soft economic environment. This has been particularly evident in the continued decline observed in both the retail and promotional merchandise channels, which are sensitive to economic downturns.

Looking ahead, New Wave Group's future performance hinges on an anticipated improvement in the overall market. Positive signs have already been noted in specific regions, such as the US and Central Europe, where growth has been observed, suggesting potential for recovery and increased demand.

Supply Chain Costs and Logistics

Fluctuations in raw material prices, energy costs, and global logistics expenses significantly impact New Wave Group's cost of goods sold and operating margins. For instance, the average cost of shipping a 40-foot container globally saw substantial increases throughout 2024, with some routes experiencing a doubling of rates compared to pre-pandemic levels, directly affecting import costs for New Wave Group.

The company's strategic investments in warehouse automation are designed to enhance operational efficiency and counteract these escalating costs. By implementing advanced robotics and AI-driven inventory management systems, New Wave Group aims to reduce labor expenses and minimize handling errors, which is vital for preserving a stable gross profit margin in the face of a volatile economic landscape.

- Rising Energy Prices: Global energy prices, particularly for oil and natural gas, continued to be a significant factor in 2024, impacting transportation and manufacturing costs.

- Logistics Disruptions: Ongoing geopolitical tensions and port congestion in key trade regions contributed to extended lead times and higher freight rates for New Wave Group.

- Raw Material Volatility: Prices for key materials used in New Wave Group's products experienced unpredictable swings, influenced by supply chain bottlenecks and demand shifts.

- Automation Investment: New Wave Group's commitment to warehouse automation, projected to increase operational efficiency by an estimated 15-20% by the end of 2025, is a direct response to these cost pressures.

Interest Rates and Access to Capital

Changes in interest rates directly impact New Wave Group's cost of capital. For instance, if the Riksbank (Sweden's central bank) were to raise its policy rate, borrowing for new ventures like warehouse automation upgrades or potential acquisitions would become more expensive. This could slow down investment in growth initiatives.

Despite New Wave Group's robust financial health, evidenced by a strong equity ratio, fluctuating interest rate environments present challenges for long-term financial planning. A higher cost of debt could reduce the attractiveness of leveraged expansion, forcing a re-evaluation of capital allocation strategies for future growth phases.

For example, the European Central Bank's key interest rates, which often influence broader European economic conditions, remained at 4.00% as of early 2024, a level maintained to combat inflation. While this provides some stability, any upward adjustments could increase New Wave Group's financing costs for significant capital expenditures planned for 2024-2025.

- Impact on Borrowing Costs: Higher interest rates increase the expense of loans, affecting New Wave Group's ability to finance expansion projects affordably.

- Investment Strategy Adjustments: Fluctuating rates can necessitate changes in investment priorities, potentially delaying or scaling back capital-intensive projects like automation.

- Financial Planning Uncertainty: A volatile interest rate landscape complicates long-term financial forecasting and budgeting for future growth.

- Access to Capital: While New Wave Group has a strong balance sheet, significantly higher borrowing costs could make external capital less accessible or desirable for new strategic moves.

Elevated inflation rates, notably in Sweden and Southern Europe, have dampened consumer spending, directly impacting New Wave Group's retail and promotional sales. For instance, Sweden's inflation hovered around 4.1% in Q1 2024, significantly reducing purchasing power for both consumers and businesses.

Currency exchange rate fluctuations also pose a risk, as a stronger Swedish Krona in early 2025 negatively affected the translation of foreign earnings, impacting reported net sales and profitability despite positive organic growth.

The company's performance is intrinsically tied to overall economic growth in key markets like Europe and North America, with a soft economic environment in 2024 impacting demand across its diverse product segments.

New Wave Group's strategy includes significant investments in warehouse automation, aiming for a 15-20% efficiency increase by the end of 2025, as a direct response to rising logistics and raw material costs.

| Economic Factor | Impact on New Wave Group | Data/Example (2024-2025) |

| Inflation | Reduced consumer and business spending | Sweden inflation: 4.1% (Q1 2024) |

| Currency Fluctuations | Negative translation effects on foreign earnings | Strengthening SEK in Q1 2025 |

| Economic Growth | Directly impacts demand across all segments | Soft economic environment impacting retail/promo channels |

| Logistics Costs | Increased cost of goods sold | Global container shipping rates doubled on some routes in 2024 |

| Interest Rates | Higher borrowing costs for expansion | ECB key rates at 4.00% (early 2024) |

What You See Is What You Get

New Wave Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the New Wave Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping the New Wave Group's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis provides a robust framework for understanding the opportunities and threats facing the New Wave Group.

Sociological factors

Consumers and businesses are increasingly prioritizing products that are sustainable and ethically produced, demanding transparency in supply chains and responsible labor practices. This shift is driven by a growing awareness of environmental and social issues, influencing purchasing decisions across various sectors.

New Wave Group is responding by embedding sustainability into its business model, with initiatives like enhancing working conditions in its production countries and adopting stricter chemical management protocols. The company's focus on using preferred fibers and materials, such as organic cotton, aligns directly with this rising consumer expectation.

For brands like Cottover, which are built on a foundation of sustainability, this trend presents a substantial market opportunity. For instance, the global ethical fashion market was valued at approximately $7.5 billion in 2023 and is projected to grow significantly, indicating strong consumer willingness to pay a premium for responsibly made goods.

Consumers increasingly expect products and services tailored to their individual needs, a shift particularly evident in the corporate, sports, and gifting markets. This demand for personalization is a significant sociological factor shaping purchasing decisions.

New Wave Group's strategic emphasis on branding and customization directly caters to this burgeoning trend. By offering businesses bespoke solutions, they not only meet client demands but also foster stronger brand recognition and loyalty in a competitive landscape.

The enduring migration of consumer spending to online platforms is a significant sociological trend. By 2024, global e-commerce sales are projected to exceed $6.3 trillion, underscoring the necessity for businesses like New Wave Group to cultivate a strong digital footprint. This shift demands substantial investment in digital infrastructure and sophisticated online marketing strategies to effectively engage a growing online consumer base.

New Wave Group's success hinges on its ability to adapt to this digital-first retail environment. A robust e-commerce presence, coupled with streamlined online distribution, is paramount for reaching both business-to-business (B2B) and business-to-consumer (B2C) segments. Failing to prioritize these digital channels could limit market penetration and hinder competitive positioning in the evolving landscape.

Corporate Gifting and Branding Culture

The prevailing corporate culture surrounding gifting and brand promotion significantly shapes the business-to-business (B2B) segment for companies like New Wave Group. For instance, in 2024, the promotional products industry in the US alone was projected to reach approximately $25.8 billion, indicating a robust demand for branded merchandise. This trend underscores how corporate events, employee recognition programs, and client appreciation initiatives directly drive the need for promotional items and branded apparel. New Wave Group must remain adaptable, constantly refreshing its product catalog and marketing strategies to align with evolving client preferences and corporate branding trends.

The increasing emphasis on experiential marketing and employee well-being in 2025 further influences corporate gifting. Companies are moving beyond traditional items to more sustainable and experience-based gifts, impacting the types of promotional products in demand. This shift requires New Wave Group to innovate its offerings, potentially incorporating eco-friendly materials and unique brand experiences into its B2B solutions. Staying attuned to these cultural nuances is crucial for maintaining a competitive edge.

- Market Size: The US promotional products market was estimated to be around $25.8 billion in 2024.

- Key Drivers: Corporate events, employee recognition, and client engagement are primary demand generators.

- Cultural Shift: A growing preference for sustainable and experiential corporate gifts is observed.

- Adaptability: New Wave Group needs to continuously update product offerings and marketing to meet evolving corporate branding culture.

Health, Wellness, and Sports Participation Trends

There's a growing societal focus on health and wellness, which naturally fuels a higher demand for sportswear and comfortable leisure apparel. This trend is a significant tailwind for companies like New Wave Group, particularly its Sports & Leisure segment.

Brands such as Craft, a prominent name within New Wave Group, are well-positioned to capitalize on this. To stay ahead, they need to constantly innovate their products, focusing on both performance features and appealing designs that resonate with consumers who are increasingly active and health-conscious.

- Global sports apparel market projected to reach $234.1 billion by 2027, growing at a CAGR of 5.4%.

- Increased participation in fitness activities like running, cycling, and yoga directly boosts demand for specialized apparel.

- Consumer spending on athleisure wear saw a significant uptick, with many reporting increased purchases in 2023 and early 2024.

Societal shifts towards sustainability and ethical consumption are paramount, influencing consumer choices and brand loyalty. New Wave Group's commitment to preferred fibers and enhanced working conditions directly addresses these evolving values. The global ethical fashion market, valued at approximately $7.5 billion in 2023, highlights the commercial viability of this approach.

The demand for personalized products and experiences is a key sociological driver, particularly in the corporate and gifting sectors. New Wave Group's focus on customization and bespoke solutions aligns with this trend, aiming to foster stronger client relationships and brand recognition.

The pervasive migration of consumer spending to online platforms necessitates a robust digital presence. With global e-commerce sales projected to exceed $6.3 trillion by 2024, New Wave Group's investment in digital infrastructure and online marketing is crucial for market penetration and competitive positioning.

A growing societal emphasis on health and wellness significantly boosts demand for sportswear and athleisure. The global sports apparel market, projected to reach $234.1 billion by 2027, underscores the opportunity for brands like Craft within New Wave Group to innovate and capitalize on increased fitness participation.

Technological factors

The ongoing advancement of e-commerce platforms is a significant technological factor impacting New Wave Group. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the sheer volume of business conducted online. New Wave Group's ability to leverage user-friendly online ordering systems and efficient digital payment gateways directly influences its competitive edge in both B2B and B2C markets.

Investments in digital sales tools are crucial for enhancing customer experience and driving revenue. For instance, personalized digital showrooms can significantly boost engagement; a McKinsey report indicated that personalization can increase sales by 5-15%. As of early 2025, the trend towards seamless online transactions and tailored digital experiences continues to accelerate, making these technological capabilities non-negotiable for sustained growth.

New Wave Group is significantly investing in warehouse automation and a new business system to boost efficiency and streamline logistics. This strategic move is vital for improving operational outcomes and accelerating order fulfillment as the company grows, particularly in key markets like the USA and Germany.

By adopting advanced technologies, New Wave Group aims to gain a competitive edge through faster inventory management and more responsive supply chains. For instance, many retail and logistics companies reported significant improvements in order accuracy and delivery times after implementing similar automation solutions in 2024, with some seeing up to a 20% reduction in fulfillment costs.

New Wave Group's strategic advantage is significantly bolstered by its sophisticated use of data analytics. By leveraging big data, the company gains unparalleled insights into consumer behavior, emerging market trends, and the performance of its diverse product portfolio. This technological edge is crucial for refining product development, streamlining inventory, and executing highly targeted marketing initiatives, directly impacting market share and strategic planning.

In 2024, the global data analytics market was projected to reach over $300 billion, highlighting the immense value placed on data-driven decision-making across industries. For New Wave Group, this translates into a competitive advantage by allowing for more precise forecasting and resource allocation. For instance, analyzing purchase patterns can inform inventory levels, reducing waste and ensuring popular items are readily available, a key factor in maintaining customer satisfaction and sales momentum.

The application of advanced analytics extends to optimizing marketing spend and effectiveness. By understanding which channels and messages resonate most with specific consumer segments, New Wave Group can maximize its return on investment for promotional activities. This data-informed approach not only drives sales but also supports agile responses to market shifts, ensuring the company remains at the forefront of consumer preferences and competitive landscapes.

Product Innovation and Smart Materials

Technological advancements in textile manufacturing and material science are a major driver for companies like New Wave Group. Innovations such as smart textiles, which can monitor vital signs or change color, and the development of eco-friendly fabrics, like those made from recycled plastics or bio-based materials, are transforming the apparel industry. For instance, the global smart textiles market was valued at approximately USD 4.5 billion in 2023 and is projected to grow significantly in the coming years.

New Wave Group's strategic emphasis on design and brand development allows it to effectively integrate these technological innovations. By incorporating smart materials and sustainable manufacturing processes, the company can create a distinct competitive advantage. This also directly addresses the growing consumer demand for apparel that is not only high-performance but also environmentally responsible, a trend that saw sustainable fashion sales increase by an estimated 15% in 2024 across key European markets.

- Smart Textiles: Integration of sensors and conductive threads for functional apparel.

- Eco-Friendly Fabrics: Utilization of recycled polyester, organic cotton, and biodegradable materials.

- Advanced Manufacturing: Adoption of 3D printing and automated production for efficiency and customization.

- Digital Design Tools: Use of CAD and AI for faster product development and virtual prototyping.

Digital Marketing and Brand Building Tools

Digital marketing and online brand building are increasingly critical for New Wave Group. The company must continually invest in these technologies to stay competitive. In 2024, global digital ad spending was projected to reach over $600 billion, highlighting the shift towards online channels. New Wave Group can leverage platforms like social media, search engines, and influencer marketing to connect with a broader customer base and enhance brand loyalty across its various product lines.

Effective utilization of these digital tools allows New Wave Group to:

- Expand reach: Accessing global markets and niche segments more efficiently than traditional methods.

- Enhance engagement: Building direct relationships with consumers through interactive content and personalized communication.

- Strengthen brand equity: Consistently reinforcing brand messaging and values across multiple digital touchpoints, which is crucial for a diverse portfolio.

- Measure ROI: Utilizing analytics to track campaign performance and optimize marketing spend for better results.

New Wave Group's technological strategy is heavily influenced by the rapid evolution of digital platforms and data analytics. The company's investment in e-commerce and digital sales tools, such as personalized showrooms, is crucial for enhancing customer experience and driving revenue, with personalization estimated to boost sales by 5-15%. Furthermore, the adoption of advanced analytics, supported by a global data analytics market projected to exceed $300 billion in 2024, allows for precise forecasting and optimized marketing spend, directly impacting market share and strategic planning.

| Technology Area | Impact on New Wave Group | Supporting Data/Trend (2024/2025) |

|---|---|---|

| E-commerce & Digital Sales | Enhances customer experience, drives revenue, competitive edge | Global e-commerce sales projected over $6.3 trillion (2024); Personalization can increase sales by 5-15% |

| Data Analytics | Provides insights into consumer behavior, market trends; optimizes marketing | Global data analytics market projected over $300 billion (2024) |

| Automation & Systems | Boosts efficiency, streamlines logistics, accelerates order fulfillment | Companies implementing automation report up to 20% reduction in fulfillment costs (2024) |

| Digital Marketing | Expands reach, enhances engagement, strengthens brand equity | Global digital ad spending projected over $600 billion (2024) |

Legal factors

New Wave Group's extensive brand portfolio, encompassing numerous proprietary designs and product innovations, hinges on strong intellectual property rights (IPR) protection. This is a significant legal consideration as they operate across diverse global markets.

Proactive measures against counterfeiting and robust IPR enforcement are crucial for safeguarding their market position and brand value. For instance, in 2024, the global market for counterfeit goods was estimated to be in the hundreds of billions of dollars, highlighting the scale of this threat.

New Wave Group must navigate a complex web of international and regional product safety and quality standards. For instance, in 2024, the EU's General Product Safety Regulation (GPSR) places increased responsibility on manufacturers and distributors to ensure product safety throughout the supply chain, impacting New Wave Group's sports equipment and home furnishings. Non-compliance can lead to significant fines and reputational damage.

Adherence to standards like ISO 9001 for quality management systems is crucial for maintaining consumer trust and brand integrity across all product categories, including corporate wear. In 2025, stricter enforcement of chemical restrictions, such as those under REACH in Europe, will further necessitate rigorous testing and sourcing practices for materials used in their apparel and home goods.

New Wave Group's operations across Europe and North America necessitate strict adherence to data privacy laws like GDPR and CCPA. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, emphasizing the financial risk of non-compliance. Maintaining robust data security practices is paramount to safeguard customer and employee information, thereby preserving brand reputation and avoiding substantial penalties.

Labor Laws and Ethical Sourcing Compliance

New Wave Group's extensive production network, heavily reliant on Asian manufacturing hubs, demands rigorous compliance with diverse international labor laws and ethical sourcing mandates. Navigating these varied legal landscapes is crucial for maintaining operational integrity and brand reputation.

The company's commitment to fair working conditions, equitable compensation, and the upholding of human rights across its supply chain is a cornerstone of its sustainability strategy. This focus is not merely ethical but a critical risk management approach to avoid costly legal disputes and reputational damage.

- Supply Chain Audits: New Wave Group conducts regular audits of its suppliers to ensure compliance with labor standards, with a reported 95% of key suppliers meeting their ethical sourcing criteria as of their latest sustainability report (2024).

- Regulatory Landscape: Adherence to regulations such as the International Labour Organization (ILO) conventions and country-specific labor acts in countries like Vietnam and Bangladesh is paramount.

- Worker Welfare Programs: The group invests in worker welfare initiatives, aiming to go beyond minimum legal requirements and foster a positive working environment, with a 10% increase in worker satisfaction scores reported in their 2025 internal surveys.

- Transparency Initiatives: New Wave Group is increasing transparency in its supply chain, with plans to publish a list of its top 50 Tier 1 suppliers by the end of 2025 to enhance accountability.

Consumer Protection and Advertising Regulations

New Wave Group must meticulously adhere to consumer protection laws and advertising regulations across all its operational markets. This commitment is crucial for maintaining brand trust and avoiding legal repercussions. For instance, in 2024, the European Union continued to strengthen its consumer rights directives, impacting how companies like New Wave Group present product information and pricing. Failure to comply can lead to significant fines and damage to reputation.

Key areas of focus for New Wave Group include:

- Accurate Product Descriptions: Ensuring all product details, materials, and functionalities are precisely represented to avoid misleading consumers.

- Transparent Pricing: Clearly communicating all costs, including taxes and potential additional fees, to prevent hidden charges.

- Fair Marketing Practices: Avoiding deceptive advertising, unsubstantiated claims, and aggressive sales tactics that could lead to consumer complaints or legal challenges.

In 2025, regulatory bodies are expected to increase scrutiny on digital advertising and e-commerce practices, making robust compliance frameworks even more critical for New Wave Group’s sustained success and market integrity.

New Wave Group's intellectual property rights are vital, with global counterfeit goods valued in the hundreds of billions in 2024, necessitating strong protection measures.

Navigating diverse product safety standards, like the EU's GPSR in 2024, requires rigorous compliance to avoid fines and reputational harm.

Data privacy laws such as GDPR and CCPA pose significant financial risks, with potential fines up to 4% of global annual revenue, making robust data security essential for New Wave Group.

Adherence to international labor laws and ethical sourcing is critical, with New Wave Group reporting 95% of key suppliers meeting ethical sourcing criteria in 2024.

| Legal Area | Key Regulations/Considerations | Impact on New Wave Group | 2024/2025 Data/Trends |

|---|---|---|---|

| Intellectual Property | Brand protection, design patents, trademark enforcement | Safeguarding proprietary designs and brand value | Global counterfeit goods market valued in hundreds of billions (2024) |

| Product Safety & Quality | EU General Product Safety Regulation (GPSR), ISO standards | Ensuring compliance across sports equipment, home furnishings, corporate wear | Increased manufacturer responsibility under GPSR (2024); stricter chemical restrictions (e.g., REACH) expected in 2025 |

| Data Privacy | GDPR, CCPA | Protecting customer and employee data, avoiding substantial penalties | Fines up to 4% of global annual revenue or €20 million for GDPR non-compliance |

| Labor & Ethical Sourcing | ILO conventions, country-specific labor acts | Maintaining operational integrity and brand reputation in manufacturing hubs | 95% of key suppliers met ethical sourcing criteria (2024); plans to publish top 50 Tier 1 suppliers by end of 2025 |

| Consumer Protection | EU consumer rights directives, advertising standards | Ensuring accurate product descriptions and transparent pricing | Increased scrutiny on digital advertising and e-commerce practices expected (2025) |

Environmental factors

New Wave Group is navigating the evolving landscape of sustainability regulations, notably the EU's Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS), which came into full effect for many companies in 2024. These stringent requirements demand detailed reporting on environmental, social, and governance (ESG) performance, pushing companies like New Wave Group to significantly enhance their data collection and disclosure processes.

The CSRD and ESRS mandate a comprehensive overview of a company's environmental footprint, including greenhouse gas emissions, water usage, and biodiversity impact, along with associated risks and opportunities. For instance, companies are now required to report on Scope 1, 2, and increasingly Scope 3 emissions, a move that underscores the growing emphasis on supply chain sustainability. This regulatory shift compels New Wave Group to not only formalize its existing sustainable practices but also to proactively identify and address any gaps in its transparency and performance metrics.

The global push towards waste reduction and circular economy principles is significantly shaping New Wave Group's approach to product development and supply chain management. This includes a heightened emphasis on using recycled materials and designing products for longevity and easier disassembly, reflecting a growing consumer and regulatory demand for sustainability.

New Wave Group is actively working to boost resource efficiency, aiming to integrate circular economy models where waste streams are reimagined as valuable inputs for new production cycles. This strategic shift not only supports broader environmental objectives but also presents opportunities for cost savings and innovation in material sourcing.

New Wave Group faces increasing demands from consumers, investors, and regulatory bodies to actively reduce its carbon footprint and establish clear emissions reduction targets. This environmental pressure directly impacts how the company manages its operations, especially in areas like manufacturing and the complex web of transportation and logistics that underpins its business.

In response, New Wave Group is actively pursuing strategies to mitigate its environmental impact. A key component of this is streamlining its transport and logistics networks, aiming for greater efficiency to lower overall emissions. For instance, by optimizing delivery routes and consolidating shipments, they can significantly cut down on fuel consumption and associated greenhouse gas output.

Water Usage and Resource Management

Responsible water usage and broader resource management are increasingly vital environmental concerns, particularly within the textile industry. New Wave Group acknowledges this, integrating efficient resource management and minimizing environmental impact across its entire value chain as a core tenet of its sustainable development strategy.

The company's commitment is reflected in its operational practices, aiming to reduce water consumption and improve wastewater treatment. For instance, in 2023, New Wave Group reported a 5% reduction in water intensity across its manufacturing facilities compared to the previous year, a step towards their 2025 target of a 15% overall decrease.

- Water Intensity Reduction: Targeting a 15% reduction in water intensity by 2025.

- Wastewater Treatment: Implementing advanced technologies to ensure compliance with stringent environmental regulations.

- Resource Efficiency: Continuously seeking innovative methods to optimize the use of raw materials and energy.

Eco-labeling and Certifications

Consumers and businesses are increasingly seeking out products with eco-labels and certifications, driving demand for sustainable options. For New Wave Group, securing and maintaining these certifications is crucial for boosting market appeal and showcasing a genuine commitment to environmental responsibility.

For instance, the global market for green building certifications like LEED and BREEAM has seen significant growth, with many corporate clients now prioritizing certified sustainable spaces. In 2024, the demand for certified sustainable products across various sectors, including textiles and consumer goods, is projected to continue its upward trajectory, with some reports indicating double-digit growth in specific segments.

- Growing Consumer Demand: An increasing number of consumers, particularly millennials and Gen Z, factor environmental credentials into their purchasing decisions.

- Corporate Sustainability Goals: Many businesses are setting ambitious sustainability targets, leading them to favor suppliers with recognized environmental certifications for their own supply chains.

- Market Differentiation: Eco-labels can serve as a powerful differentiator in competitive markets, allowing New Wave Group to stand out and attract environmentally conscious customers.

- Risk Mitigation: Adhering to certification standards can help New Wave Group mitigate regulatory risks and avoid potential penalties associated with environmental non-compliance.

New Wave Group is navigating a landscape increasingly shaped by stringent environmental regulations like the EU's CSRD and ESRS, effective from 2024, which mandate detailed reporting on emissions and resource use. The company is also responding to a growing demand for circular economy practices and product sustainability, evident in the projected double-digit growth of certified sustainable products in 2024.

Key environmental factors impacting New Wave Group include the push for reduced carbon footprints, with a focus on optimizing logistics to lower emissions, and responsible water usage, targeting a 15% reduction in water intensity by 2025. Consumer preference for eco-labels is also a significant driver, influencing purchasing decisions and market differentiation.

| Environmental Factor | Impact on New Wave Group | Key Data/Target |

|---|---|---|

| Regulatory Compliance | Enhanced reporting requirements (CSRD/ESRS) | Full effect for many companies in 2024 |

| Circular Economy & Waste Reduction | Product design, material sourcing | Focus on recycled materials, product longevity |

| Carbon Footprint Reduction | Logistics optimization, emissions targets | Streamlining transport, reducing fuel consumption |

| Water & Resource Management | Operational efficiency, wastewater treatment | Target: 15% reduction in water intensity by 2025 |

| Consumer Demand for Sustainability | Market appeal, eco-labeling | Projected double-digit growth for certified products in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for New Wave Group is built upon a robust foundation of data from reputable sources, including official government publications, international economic bodies, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and socio-cultural trends to ensure a comprehensive and accurate assessment.