Nidec SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nidec Bundle

Nidec's dominance in electric motors presents significant strengths, but understanding their vulnerabilities and the competitive landscape is crucial. Our comprehensive SWOT analysis dives deep into these areas, revealing actionable insights for strategic advantage.

Want the full story behind Nidec's market position, growth drivers, and potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Nidec commands a leading global position as a comprehensive electric motor manufacturer, boasting an extensive product portfolio that ranges from precision motors for hard disk drives to substantial industrial and automotive components. This broad diversification across sectors like home appliances, commercial equipment, and industrial machinery creates a resilient revenue stream, mitigating risks associated with over-reliance on any single market segment.

The company's established dominance in numerous motor categories highlights its significant market presence and deep technological expertise. For instance, in fiscal year 2023, Nidec reported total sales of ¥2,063.6 billion, with its automotive segment showing robust growth, reflecting its strong foothold in key industries.

Nidec showcased exceptional financial strength, reporting record consolidated net sales of ¥2,176.7 billion and a record operating profit of ¥207.4 billion for the fiscal year ending March 31, 2025. This robust performance, a significant jump from previous years, underscores the company's effective strategies and operational excellence.

Further demonstrating its consistent growth trajectory, Nidec achieved record-high net sales and operating profit in the first half of fiscal year 2024. This sustained upward trend in profitability signals strong market positioning and efficient resource management.

Nidec is a trailblazer in electrification, particularly with its advanced E-Axle units for electric vehicles. These integrated powertrain solutions are crucial for the booming EV market, which saw global sales surpass 13 million units in 2023, a significant jump from previous years.

The company's commitment extends to next-generation technologies, including significant investments in advanced air mobility, such as eVTOLs (electric Vertical Take-Off and Landing aircraft). This forward-looking approach positions Nidec to benefit from the projected growth in the urban air mobility sector.

Nidec's continuous innovation in precision gear solutions for robotics further strengthens its technological edge. As automation and robotics become increasingly vital across industries, Nidec's specialized components are in high demand, contributing to its leadership in these evolving markets.

Robust M&A Strategy and Integration Capabilities

Nidec's aggressive pursuit of strategic acquisitions fuels its growth and market diversification. The March 2024 acquisition of Innomotics, a significant move in the industrial motor sector, alongside the consolidation of Nidec PSA emotors, demonstrates a clear intent to bolster its portfolio. These integrations are designed to unlock substantial sales growth, targeting ambitious figures by 2030 through the synergy of acquired technologies and market reach.

The company's 'One NIDEC' strategy is pivotal in realizing the full potential of these acquisitions. This initiative fosters global integrated management, ensuring that newly acquired businesses are seamlessly woven into the Nidec fabric. The objective is to create operational synergies and leverage combined strengths across the entire group, enhancing overall competitiveness and efficiency.

- Strategic Acquisitions: Nidec actively acquires companies to broaden its market footprint and reduce business risks.

- Key Acquisitions: Notable recent examples include Innomotics (March 2024) and the consolidation of Nidec PSA emotors.

- Growth Target: The M&A strategy is geared towards achieving significant sales growth by 2030.

- Integration Focus: The 'One NIDEC' initiative aims to integrate acquired assets for maximum synergy and global management efficiency.

Commitment to Sustainability and ESG

Nidec's dedication to sustainability and Environmental, Social, and Governance (ESG) principles is a significant strength. The company's recognition as a 2024 A List Company by CDP highlights its robust environmental transparency and proactive measures. This commitment is further underscored by Nidec's ambitious goals, including achieving carbon neutrality in its manufacturing facilities by 2030 and reaching net-zero CO2 emissions across its entire supply chain by fiscal year 2050.

These ESG initiatives not only bolster Nidec's corporate image but also attract a growing segment of investors prioritizing sustainability. Aligning with global decarbonization trends positions Nidec favorably for long-term growth and resilience in an evolving market landscape.

- CDP A List Recognition: Nidec was named a 2024 A List Company by CDP, signifying excellence in environmental transparency and action.

- Carbon Neutrality Target: The company aims for carbon neutrality in its manufacturing plants by 2030.

- Net-Zero Supply Chain Goal: Nidec is committed to achieving net-zero CO2 emissions across its entire supply chain by FY2050.

- Investor Appeal: Strong ESG performance enhances Nidec's attractiveness to environmentally conscious investors and aligns with global sustainability trends.

Nidec's primary strength lies in its unparalleled global leadership as a comprehensive electric motor manufacturer, offering a vast product range from precision motors for hard drives to substantial industrial and automotive components. This broad diversification across sectors like home appliances, commercial equipment, and industrial machinery creates a resilient revenue stream, mitigating risks associated with over-reliance on any single market segment. The company's established dominance in numerous motor categories highlights its significant market presence and deep technological expertise. For instance, in fiscal year 2023, Nidec reported total sales of ¥2,063.6 billion, with its automotive segment showing robust growth, reflecting its strong foothold in key industries.

Nidec showcased exceptional financial strength, reporting record consolidated net sales of ¥2,176.7 billion and a record operating profit of ¥207.4 billion for the fiscal year ending March 31, 2025. This robust performance, a significant jump from previous years, underscores the company's effective strategies and operational excellence. Further demonstrating its consistent growth trajectory, Nidec achieved record-high net sales and operating profit in the first half of fiscal year 2024. This sustained upward trend in profitability signals strong market positioning and efficient resource management.

Nidec is a trailblazer in electrification, particularly with its advanced E-Axle units for electric vehicles. These integrated powertrain solutions are crucial for the booming EV market, which saw global sales surpass 13 million units in 2023, a significant jump from previous years. The company's commitment extends to next-generation technologies, including significant investments in advanced air mobility, such as eVTOLs. Nidec's continuous innovation in precision gear solutions for robotics further strengthens its technological edge, as automation and robotics become increasingly vital across industries.

Nidec's aggressive pursuit of strategic acquisitions fuels its growth and market diversification, with notable recent examples including Innomotics (March 2024) and the consolidation of Nidec PSA emotors. The 'One NIDEC' strategy is pivotal in realizing the full potential of these acquisitions, fostering global integrated management to create operational synergies and leverage combined strengths across the entire group. The company's dedication to sustainability, recognized by its 2024 CDP A List status, and its ambitious carbon neutrality goals by 2030 further enhance its appeal to environmentally conscious investors.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Market Leadership & Diversification | Comprehensive Electric Motor Manufacturer | Leading global position across diverse sectors (appliances, industrial, automotive). Fiscal Year 2023 Sales: ¥2,063.6 billion. |

| Financial Performance | Record Profitability & Sales | FY ending March 31, 2025: Record Net Sales ¥2,176.7 billion, Record Operating Profit ¥207.4 billion. Record H1 FY2024 performance. |

| Technological Innovation & EV Focus | Electrification & Advanced Mobility | Pioneering E-Axle units for EVs (global EV sales > 13 million in 2023). Investments in eVTOLs and robotics precision gears. |

| Strategic Growth & ESG Commitment | Acquisitions & Sustainability | Acquisitions like Innomotics (March 2024). 'One NIDEC' strategy for synergy. CDP 2024 A List recognition; Carbon Neutrality by 2030. |

What is included in the product

Delivers a strategic overview of Nidec’s internal and external business factors, highlighting its competitive position and the opportunities and risks shaping its future.

Identifies critical market shifts and internal vulnerabilities to proactively address potential disruptions.

Weaknesses

Nidec grapples with governance and compliance weaknesses, evidenced by an Italian subsidiary's improper declaration of motor origin for U.S. exports. This misstep directly caused a delay in Nidec's fiscal 2025 securities report, signaling potential cracks in internal oversight mechanisms.

The fallout from this incident has attracted regulatory attention, raising concerns about potential financial penalties and a tarnished brand image. An ongoing internal probe into other subsidiaries suggests these governance issues might be more widespread, demanding a comprehensive review and remediation.

Nidec's extensive global footprint, with products sold across Asia, the Americas, Europe, and Japan, leaves it particularly vulnerable to geopolitical instability and economic slowdowns, especially in crucial markets like China. For instance, in fiscal year 2023, China represented a significant portion of Nidec's sales, making any regional downturn a substantial risk.

Trade disputes, the imposition of tariffs, and sudden shifts in government policies can directly impact demand for Nidec's diverse product portfolio and create significant disruptions within its complex global supply chain. The company's reliance on international trade makes it susceptible to fluctuating trade regulations and their potential financial repercussions.

Nidec has poured considerable resources into its electric vehicle (EV) motor division, yet profitability remains an uphill battle. The company has grappled with a noticeable slowdown in growth within the Battery EV sector, compounded by intense price wars.

In fiscal year 2023, Nidec incurred significant structural reform expenses, amounting to ¥50 billion (approximately $330 million USD based on an exchange rate of ¥150/USD), specifically to bolster the financial health and profitability of its EV motor operations. This highlights the ongoing struggle to achieve sustainable profits in a market characterized by rapid technological shifts and aggressive competition.

Integration Risks of Acquired Businesses

Nidec's aggressive acquisition strategy, while a significant growth driver, carries inherent integration risks. Successfully merging new businesses, realizing expected synergies, and adapting to evolving market dynamics post-acquisition are critical. Failure in these areas could negatively impact Nidec's financial performance and operational stability.

The company's experience with the canceled Makino Milling Machine takeover bid, following a court ruling, highlights potential challenges in executing its M&A plans. Such setbacks can disrupt strategic growth trajectories and require significant resource reallocation.

- Integration Challenges: Nidec faces the ongoing challenge of effectively integrating diverse acquired businesses, ensuring operational alignment and cultural compatibility to unlock full potential.

- Synergy Realization: The ability to consistently achieve projected cost savings and revenue enhancements from acquisitions remains a key determinant of M&A success.

- Market Adaptability: A failure to swiftly and effectively integrate acquisitions or adapt to market shifts through M&A could hinder Nidec's competitive positioning.

- Execution Hurdles: Past instances, such as the failed Makino Milling Machine bid, underscore the potential for external factors and legal challenges to impede M&A execution.

Reliance on Specific Regional Markets and Potential Water Risks

Nidec's significant operational footprint in specific regions, particularly China for both manufacturing and sales, presents a notable weakness. This geographical concentration leaves the company vulnerable to localized economic downturns or policy shifts. For instance, in 2023, China accounted for a substantial portion of Nidec's revenue, making it susceptible to any disruptions within that market.

Furthermore, Nidec faces potential water-related risks, a critical concern given its manufacturing sites. Reports indicate water scarcity and flooding issues impacting facilities in China, Thailand, Vietnam, and India. These environmental challenges could lead to production halts, increased operational expenses due to water management or repairs, and disruptions to its global supply chain, potentially affecting delivery schedules and overall profitability.

- Geographic Concentration: Over-reliance on China for production and sales exposes Nidec to regional economic and political volatility.

- Water Scarcity and Flooding: Operations in China, Thailand, Vietnam, and India are at risk from water-related environmental events, potentially impacting production continuity and costs.

- Supply Chain Vulnerability: Environmental disruptions at key manufacturing hubs can create significant bottlenecks and delays in Nidec's global supply network.

Nidec's governance and compliance framework shows vulnerabilities, as demonstrated by an Italian subsidiary's incorrect declaration of motor origin for U.S. exports. This incident caused a delay in Nidec's fiscal 2025 securities report, indicating potential weaknesses in internal oversight. The situation has drawn regulatory scrutiny, raising concerns about possible fines and reputational damage.

The company's substantial global operations, with sales spanning Asia, the Americas, Europe, and Japan, make it susceptible to geopolitical instability and economic slowdowns, particularly in key markets like China. For example, in fiscal year 2023, China was a major contributor to Nidec's revenue, meaning any regional economic contraction poses a significant risk.

Nidec's substantial investments in its electric vehicle (EV) motor division have not yet translated into consistent profitability. The company has experienced a notable deceleration in growth within the Battery EV sector, exacerbated by aggressive price competition. In fiscal year 2023, Nidec allocated ¥50 billion (approximately $330 million USD based on a ¥150/USD exchange rate) for structural reforms aimed at enhancing the financial health and profitability of its EV motor operations, highlighting ongoing challenges in achieving sustainable profits in this dynamic market.

Nidec's aggressive acquisition strategy, while a growth engine, carries inherent integration risks. Successfully merging new businesses, realizing projected synergies, and adapting to evolving market conditions post-acquisition are critical. Failures in these areas could negatively impact Nidec's financial performance and operational stability. The company's experience with the canceled Makino Milling Machine takeover bid, following a court ruling, illustrates potential obstacles in executing M&A plans, which can disrupt strategic growth and necessitate resource reallocation.

What You See Is What You Get

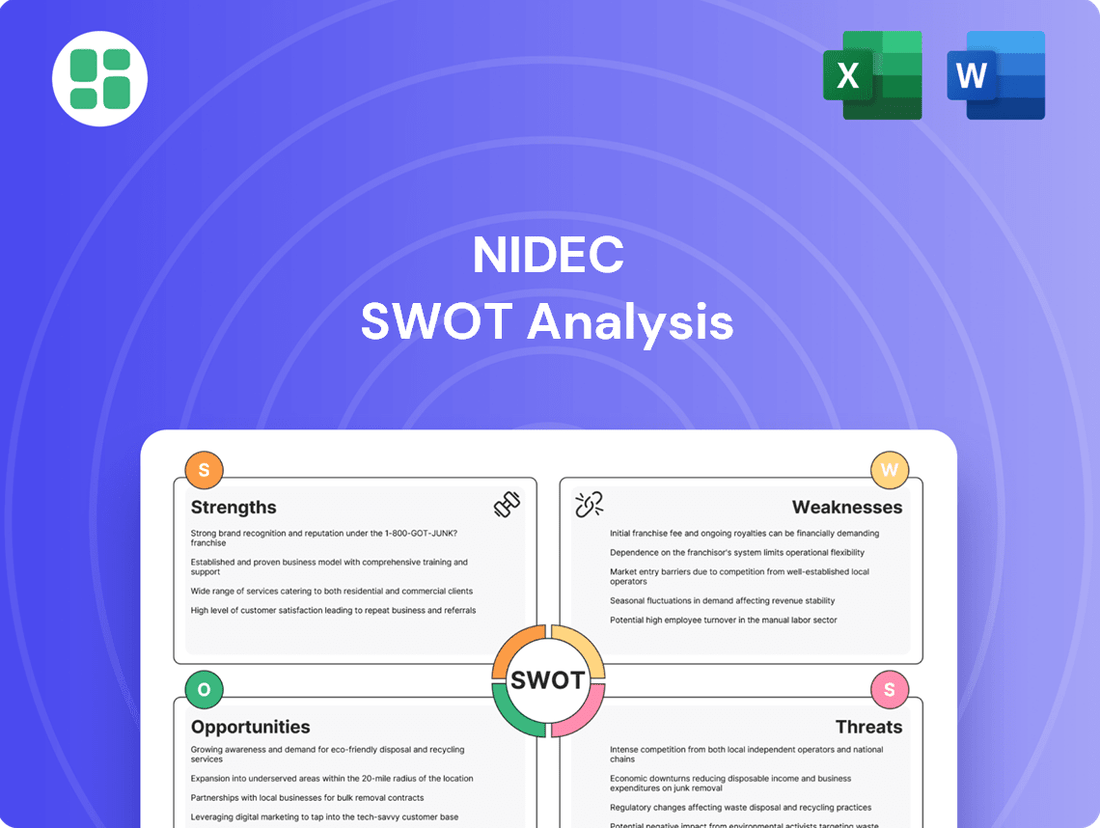

Nidec SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Nidec's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Nidec's competitive landscape and internal capabilities.

Opportunities

The global transition to electric vehicles and the emerging advanced air mobility sector represent a significant growth avenue for Nidec. Leveraging its established expertise in EV motor technology, particularly its E-Axle, and its strategic investments in propulsion systems for electric vertical take-off and landing (eVTOL) aircraft, Nidec is well-positioned to benefit.

This accelerating demand for sustainable transportation solutions is expected to fuel substantial sales growth for Nidec. The company's ambitious target of selling millions of EV drive motors annually by 2030 underscores its commitment to capturing a significant share of this expanding market.

The expanding robotics and industrial automation markets present significant growth avenues for Nidec, leveraging its specialized gear technologies and advanced motor solutions. Industries worldwide are increasingly investing in automation to boost productivity and efficiency, creating a strong demand for Nidec's essential components in robotic systems.

Nidec's strategic participation in major robotics and automation trade shows, such as Automate in the US and Hannover Messe in Germany, highlights its commitment to capturing market share in these dynamic sectors. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to reach over $100 billion by 2030, indicating substantial room for Nidec's component sales.

Growing global environmental consciousness and increasingly stringent regulations are fueling a significant rise in demand for energy-efficient motors and sustainable solutions. This trend presents a substantial opportunity for Nidec to expand its market presence.

Nidec's strategic focus on reducing CO2 emissions through its product portfolio, including motors for data center power generation and Battery Energy Storage Systems (BESS), directly addresses this market demand. For instance, the global market for energy storage systems is projected to reach $150 billion by 2030, highlighting the scale of this opportunity.

Furthermore, Nidec's recognized commitment to sustainability and its ongoing ESG (Environmental, Social, and Governance) improvement plans bolster its competitive advantage. In 2024, Nidec was recognized by the Dow Jones Sustainability Index, underscoring its strong position in this growing market segment.

Strategic Acquisitions for Market Expansion

Nidec's strategic acquisition plan, aiming for 3 trillion yen in sales from new acquisitions by 2030, presents a substantial opportunity for inorganic growth. This focus on acquiring companies with synergistic technologies, diversified business risks, and expanded geographical reach is key to enhancing Nidec's competitive standing and product portfolio.

By pursuing this M&A strategy, Nidec can accelerate its entry into new sectors and customer segments, effectively broadening its market footprint.

- Targeted Acquisitions: Nidec aims to achieve 3 trillion yen in sales via acquisitions by 2030, demonstrating a clear commitment to inorganic expansion.

- Synergistic Integration: Acquiring companies with complementary technologies allows Nidec to enhance its existing product lines and develop innovative solutions.

- Geographic and Market Diversification: Targeting businesses in new regions and industries helps Nidec mitigate risk and access broader customer bases.

- Accelerated Growth: M&A provides a faster route to market penetration and revenue growth compared to solely organic development.

Growth in AI Server and Data Center Related Demand

The burgeoning AI server market and the continuous expansion of data centers represent a significant growth avenue for Nidec. This trend directly supports the company's 'Base of AI Society' business pillar, as AI technologies increasingly require robust infrastructure.

Nidec is strategically positioned to capitalize on this by supplying essential components like advanced water-cooling systems for AI servers. These systems are critical for managing the intense heat generated by high-performance AI processors, ensuring operational stability and efficiency.

Furthermore, the company's power generators are vital for the reliable operation of data centers, which demand uninterrupted power supply. The projected growth in AI computational power, driving demand for more sophisticated hardware, translates into substantial opportunities for Nidec's related product lines.

- AI Server Market Growth: The global AI server market is projected to reach over $100 billion by 2027, a substantial increase from previous years, driven by demand for AI model training and inference.

- Data Center Expansion: Investments in data center construction and upgrades are accelerating, with significant global spending expected in 2024-2025 to accommodate growing data storage and processing needs.

- Nidec's Role: Nidec's specialized cooling solutions and power systems are becoming increasingly critical for the efficient and reliable operation of these advanced AI-centric data centers.

Nidec is poised to benefit from the burgeoning AI server market and the continuous expansion of data centers, aligning with its 'Base of AI Society' strategy. The company's supply of critical components like advanced water-cooling systems for AI servers is essential for managing the heat generated by high-performance processors. Additionally, Nidec's power generators are vital for the uninterrupted operation of these data centers, which are experiencing significant global investment in 2024 and 2025 to meet escalating data demands.

| Opportunity Area | Market Projection | Nidec's Relevance |

|---|---|---|

| AI Server Market | Projected to exceed $100 billion by 2027 | Supplies critical cooling and power systems |

| Data Center Expansion | Significant global investment in 2024-2025 | Provides reliable power generation solutions |

| Sustainable Transportation | EV motor sales target of millions annually by 2030 | Leader in EV motor technology (E-Axle) |

| Robotics & Automation | Global market valued at $50 billion in 2023, projected to exceed $100 billion by 2030 | Supplies specialized gear and motor solutions |

Threats

Nidec faces significant threats from intense competition, especially in the rapidly evolving Battery EV market. This sector is experiencing a slowdown in growth and aggressive price wars, which directly impacts Nidec's profitability.

The company must contend with established global electric motor manufacturers and a growing number of new players, particularly those focused on emerging technologies. This crowded landscape constantly challenges Nidec's market share and puts downward pressure on profit margins.

To counter these competitive pressures, Nidec's strategic imperative is to continuously enhance its technological edge and maintain cost leadership. For instance, in 2024, the automotive sector saw increased investment in EV technology, leading to more players vying for market dominance, which will likely intensify price competition.

Nidec faces significant threats from supply chain vulnerabilities, as evidenced by recent trade violations and improper component origin declarations. These incidents underscore the fragility of its global network, potentially causing shipment delays and damaging customer and regulatory trust.

The company's reliance on a complex, international supply chain makes it susceptible to disruptions from geopolitical tensions and unforeseen global events. For example, the semiconductor shortage impacting the automotive industry in 2021-2022, which affected many electronics manufacturers, illustrates the broader risk of component scarcity and production halts.

These disruptions can directly translate into increased operational costs due to expedited shipping, sourcing from alternative, more expensive suppliers, and potential penalties. In 2023, global supply chain costs saw a notable increase, with shipping rates fluctuating significantly, impacting companies with extensive international logistics.

Nidec faces significant threats from regulatory and compliance penalties, particularly concerning ongoing investigations into trade violations. The potential for similar issues across its numerous global subsidiaries could lead to substantial financial penalties and damage its reputation. For instance, in early 2024, Nidec was reportedly under investigation in Japan for alleged bid-rigging related to public works projects, highlighting the persistent risk of regulatory scrutiny.

The imposition of tariffs or other sanctions by various governments could directly impact Nidec's profitability and market access. Ensuring stringent compliance across all its operations worldwide is therefore critical to mitigate the risk of future legal challenges and financial liabilities, safeguarding its financial health and market position.

Rapid Technological Obsolescence

The motor and component industries are experiencing incredibly swift technological advancements, especially within the electric vehicle (EV) and robotics sectors. This rapid evolution poses a significant threat of Nidec's products becoming outdated quickly. For instance, advancements in battery technology and motor efficiency for EVs are constantly pushing the boundaries, requiring continuous adaptation.

If Nidec fails to keep pace with these accelerating changes or if disruptive new technologies emerge faster than predicted, its current competitive edge could diminish. The company's substantial R&D investments, which reached approximately ¥200 billion in fiscal year 2023, are crucial for staying ahead. However, the sheer speed of innovation means that even significant R&D efforts might struggle to preemptively counter entirely new technological paradigms.

To counter this threat, Nidec must maintain its commitment to ongoing R&D and be strategically agile. This includes not only improving existing technologies but also actively exploring and investing in next-generation solutions. For example, the company's focus on developing high-performance motors for next-generation EVs and advanced robotics components highlights its strategy to mitigate obsolescence by being at the forefront of innovation.

- Rapid technological shifts in EV and robotics markets

- Risk of product obsolescence if Nidec cannot adapt quickly

- Potential erosion of competitive advantage due to faster-than-anticipated technological emergence

- Necessity for continuous, substantial R&D investment and strategic adaptation

Economic Downturns and Geopolitical Instability

Global economic downturns pose a significant threat to Nidec. For instance, the International Monetary Fund (IMF) projected global growth to slow to 3.2% in 2024, down from 3.5% in 2023, indicating a weaker demand environment. This slowdown, coupled with regional political instability, particularly in key markets like China where consumption trends can shift rapidly, directly impacts Nidec's diverse product portfolio, from automotive components to home appliances.

Fluctuations in capital investment levels within the manufacturing sector, a core market for Nidec's industrial applications, are also a concern. As of early 2024, many regions are experiencing cautious investment due to economic uncertainty, which can directly translate to lower sales for Nidec's industrial motors and systems. Geopolitical events further exacerbate this by disrupting global supply chains and trade routes, potentially hindering Nidec's operational efficiency and market access.

- Economic Slowdown: Projected global growth slowdown in 2024 could dampen demand for Nidec's products.

- Regional Instability: Political shifts in major markets like China can alter consumption patterns, affecting sales.

- Capital Investment Hesitation: Uncertainty in the manufacturing sector may reduce orders for industrial applications.

- Trade Disruptions: Geopolitical events can impede Nidec's global trade and operational flow.

Nidec faces a significant threat from the rapid pace of technological advancement, particularly in the electric vehicle (EV) and robotics sectors. This constant evolution risks making its current product offerings obsolete if the company cannot adapt swiftly. For instance, ongoing breakthroughs in EV battery technology and motor efficiency demand continuous innovation to maintain market relevance.

The company's competitive advantage is vulnerable to the emergence of disruptive new technologies that could outpace Nidec's research and development efforts. While Nidec invested approximately ¥200 billion in R&D in fiscal year 2023, the sheer velocity of innovation necessitates an even more agile approach to preemptively address entirely new technological paradigms.

To mitigate this risk, Nidec must sustain its commitment to R&D and maintain strategic flexibility, not only by enhancing existing technologies but also by actively investing in next-generation solutions. Its focus on developing advanced motors for future EVs and components for sophisticated robotics demonstrates this strategic intent to combat obsolescence.

The company is also exposed to the threat of a global economic slowdown, which could depress demand for its diverse product lines. Projections indicated a slowing global growth rate for 2024, with the IMF estimating 3.2%, down from 3.5% in 2023. This economic climate, coupled with regional instabilities, could significantly impact sales across various sectors Nidec serves.

SWOT Analysis Data Sources

This Nidec SWOT analysis is built upon a robust foundation of data, including Nidec's official financial statements, comprehensive market research reports, and expert industry analysis to ensure a thorough and accurate strategic overview.