Nidec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nidec Bundle

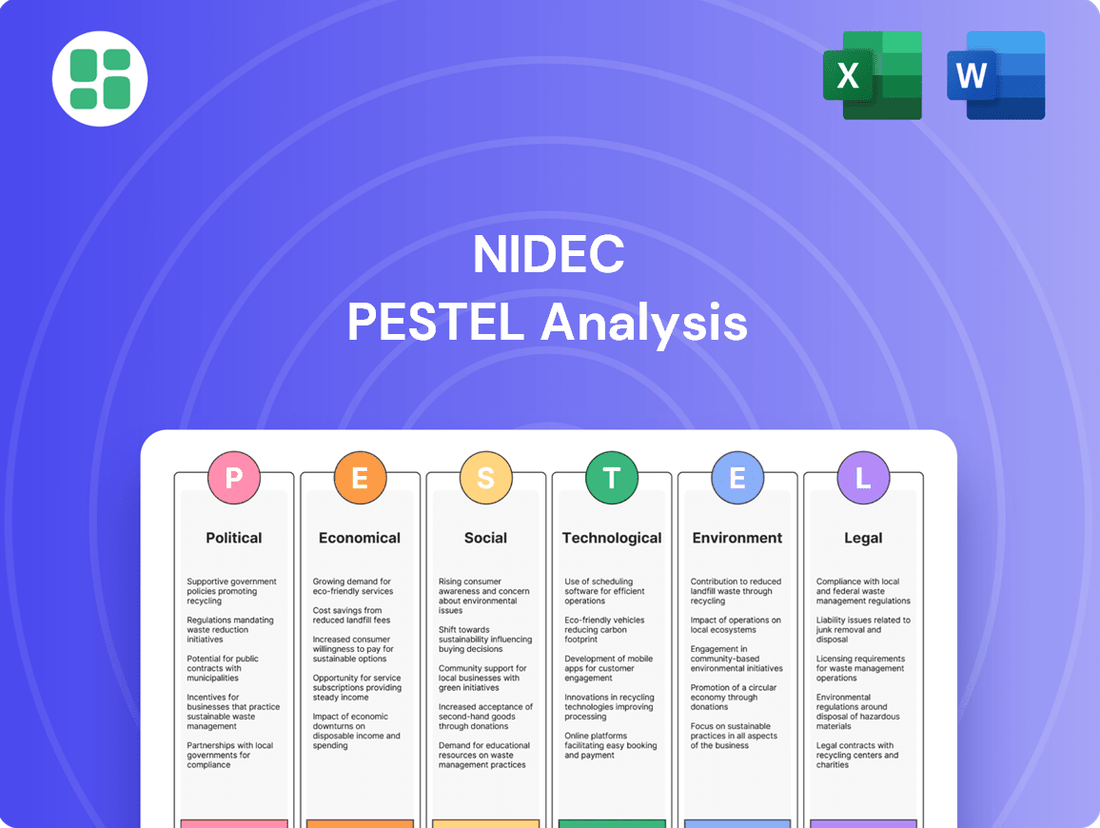

Navigate the complex global landscape affecting Nidec with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a competitive advantage by leveraging these insights for your own strategic planning. Download the full version now for actionable intelligence.

Political factors

Governments globally are actively pushing for electric vehicle (EV) adoption and robotics innovation through various policies. For instance, the United States' Inflation Reduction Act of 2022 offers tax credits up to $7,500 for qualifying EV purchases, driving consumer demand. Similarly, the European Union's Green Deal aims for significant reductions in CO2 emissions, directly benefiting EV manufacturers and component suppliers like Nidec.

Nidec, a major supplier of electric motors for EVs and components for robotics, benefits from these supportive political environments. In 2024, global EV sales are projected to exceed 15 million units, a substantial increase from previous years, underscoring the impact of these policies. However, Nidec must also adapt to diverse regional regulations and incentive structures, such as differing charging standards or local content requirements.

Global trade relations and the imposition of tariffs significantly shape Nidec's operational landscape. For instance, the ongoing trade tensions between the United States and China, which saw tariffs on billions of dollars worth of goods, directly impacted component costs and the pricing strategies for Nidec's products in these key markets. Changes in trade agreements, such as potential revisions to the US-Mexico-Canada Agreement (USMCA), also influence Nidec's manufacturing and sourcing decisions across North America.

Fluctuations in trade policies between major economic blocs, like the European Union's efforts to strengthen its domestic semiconductor industry through initiatives like the European Chips Act, can affect Nidec's competitive positioning. These policy shifts can lead to altered manufacturing costs and product pricing, requiring Nidec to be agile in adapting its supply chain and market access strategies to maintain profitability and market share in a dynamic global environment.

Nidec's global footprint, with operations spanning numerous countries, makes political stability in these key regions a paramount concern. For instance, in 2024, ongoing geopolitical shifts in East Asia, where Nidec has substantial manufacturing and sales presence, introduce potential disruptions to its extensive supply chains and market access.

Sudden policy changes or increased trade protectionism in major markets like the United States or European Union, where Nidec reported significant revenue in fiscal year 2024, could impact its export-oriented business model and necessitate costly operational adjustments.

Furthermore, the risk of civil unrest or conflict in regions hosting Nidec's production facilities, such as certain Southeast Asian nations, poses a direct threat to business continuity and requires robust risk mitigation strategies for long-term investment security.

Regulatory Environment and Industrial Standards

The regulatory landscape for Nidec is complex, with varying industrial standards, safety regulations, and environmental compliance requirements across different countries. For instance, in 2024, the European Union continued to strengthen its Ecodesign Directive, setting more stringent energy efficiency standards for electric motors, a key product for Nidec. This global patchwork of regulations directly influences Nidec's product development cycles and its ability to enter new markets smoothly.

While navigating these diverse rules can increase operational costs, stricter environmental mandates, such as those related to carbon emissions and energy consumption, can paradoxically boost demand for Nidec's advanced, energy-efficient motor technologies. For example, the push for electrification in the automotive sector, driven by regulations like the 2035 phase-out of new internal combustion engine vehicle sales in California, presents a significant growth opportunity for Nidec's electric vehicle motor divisions. Staying ahead of and meticulously adhering to these evolving global standards is therefore paramount for Nidec's sustained international success and market leadership.

Key regulatory considerations for Nidec include:

- Global Energy Efficiency Standards: Adherence to evolving standards like the IE4 and IE5 efficiency classes for electric motors, which are increasingly mandated in major markets.

- Environmental Compliance: Meeting regulations concerning hazardous materials (e.g., RoHS, REACH) and emissions control in manufacturing processes.

- Product Safety Certifications: Obtaining necessary safety approvals (e.g., UL, CE) for products sold in different regions, ensuring market access.

- Automotive Emission Regulations: Compliance with stringent CO2 emission targets and mandates for electric vehicle adoption, influencing demand for EV powertrain components.

Government Investment in Infrastructure

Government investment in infrastructure is a significant driver for companies like Nidec. For instance, in 2024, many nations are prioritizing upgrades to their energy grids and smart city initiatives. These projects often require advanced industrial motors for everything from power distribution to automated systems. The US Bipartisan Infrastructure Law, enacted in 2021, continues to allocate substantial funds through 2024 and beyond for grid modernization and EV charging infrastructure, directly benefiting Nidec's product lines.

These large-scale government-backed projects create predictable, long-term demand. Nidec can strategically align its research and development efforts and production capacity to meet the specific needs of these infrastructure build-outs. For example, the push for renewable energy sources necessitates robust motor technologies for wind turbines and solar tracking systems, areas where Nidec has a strong presence.

- Increased demand for industrial motors in smart city development.

- Government funding for renewable energy infrastructure supports Nidec's growth.

- US infrastructure spending is projected to reach hundreds of billions through 2027, creating sustained market opportunities.

- Nidec's strategic focus on energy efficiency aligns with government sustainability goals.

Government policies promoting electric vehicle (EV) adoption and robotics directly benefit Nidec, a key supplier in these sectors. Initiatives like the US Inflation Reduction Act, offering EV tax credits, and the EU's Green Deal, targeting emissions reductions, are driving demand. Global EV sales in 2024 are expected to surpass 15 million units, highlighting the impact of these supportive political climates.

What is included in the product

This Nidec PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, offering a strategic framework for understanding its operating landscape.

A clear, actionable summary of Nidec's PESTLE factors, designed to quickly identify and address potential external threats and opportunities for strategic advantage.

Economic factors

Global economic growth projections for 2024 and 2025 indicate a moderate but uneven recovery. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, with a slight uptick expected for 2025. However, risks of recession persist in key markets due to geopolitical tensions and persistent inflation, which directly impacts demand for Nidec's products across sectors like automotive and industrial automation.

Nidec's diverse product range, from electric vehicle motors to home appliance components, is highly sensitive to economic cycles. For instance, a slowdown in major economies like the Eurozone or China could significantly curb demand for automotive components, a key revenue driver for Nidec. Conversely, continued growth in emerging markets offers opportunities for increased sales.

Rising inflation presents a significant challenge for Nidec, as it directly impacts their cost structure. For instance, if inflation pushes up the price of key components like copper or rare earth metals, Nidec's manufacturing expenses will climb, potentially squeezing profit margins. This was evident in early 2024, where persistent inflation in several key economies led to increased input costs across the manufacturing sector.

Interest rate fluctuations also play a crucial role in Nidec's financial strategy. Higher interest rates can make it more expensive for Nidec to finance new projects, such as expanding production capacity or investing in advanced research and development. Furthermore, increased borrowing costs can impact the affordability of Nidec's products for consumers and businesses, particularly for durable goods like automotive components and industrial machinery, potentially dampening demand.

Exchange rate volatility significantly impacts Nidec, a global entity operating across various currencies. Fluctuations in the Japanese yen against major currencies like the US dollar and Euro directly affect the translated value of Nidec's overseas earnings and costs. For instance, if the yen strengthens, international sales revenue will appear lower when reported in yen, potentially impacting profitability.

In 2023, Nidec reported that a 1 yen appreciation against the US dollar would reduce its operating income by approximately 3 billion yen. Conversely, a weaker yen would boost reported profits. This sensitivity highlights the critical need for robust currency risk management.

To navigate this, Nidec employs currency hedging strategies, such as forward contracts, to lock in exchange rates for future transactions. Diversifying its sales and manufacturing bases across different regions also helps to naturally offset some of these currency exposures, creating a more resilient financial structure.

Supply Chain Costs and Disruptions

Nidec's operational efficiency and profitability are heavily influenced by the economic stability of its supply chain, encompassing component costs, logistics, and potential global disruptions. For instance, rising semiconductor prices and shipping container rates in 2024 continue to exert pressure on manufacturing expenses.

Price volatility of key materials, such as rare earth magnets, coupled with fluctuating transportation costs and geopolitical tensions, can directly lead to increased production expenses and delivery delays for Nidec's diverse product lines, including electric vehicle motors and industrial automation components.

- Component Costs: Fluctuations in raw material prices, like copper and aluminum, directly impact Nidec's cost of goods sold.

- Logistics Expenses: Global shipping rates, which saw significant increases in 2024, add to the overall cost of bringing components to manufacturing facilities and finished goods to market.

- Geopolitical Risks: Trade disputes or regional conflicts can disrupt the flow of essential parts, forcing Nidec to seek alternative, potentially more expensive, suppliers.

Market Demand for Electric Vehicles and Automation

The accelerating global demand for electric vehicles (EVs) presents a significant growth avenue for Nidec, particularly with its e-axle and motor technologies. By the end of 2024, the global EV market is projected to surpass 17 million units sold, a substantial increase from previous years, indicating robust consumer adoption. This trend is further bolstered by government incentives and improving battery technology, directly translating into higher sales volumes for Nidec's core EV components.

Furthermore, the industrial automation sector continues its upward trajectory, fueled by a need for increased efficiency and labor cost optimization across various industries. Nidec's precision motors are integral to robotic systems and automated manufacturing processes. Global spending on industrial automation is expected to reach over $200 billion in 2024, highlighting the sustained investment in technologies that rely on Nidec's specialized motor solutions.

- EV Market Growth: Global EV sales are anticipated to reach approximately 17.5 million units in 2024, demonstrating strong consumer interest and market expansion.

- Automation Investment: The industrial automation market is projected to see investments exceeding $200 billion in 2024, underscoring the demand for advanced robotics and manufacturing technologies.

- Nidec's Role: Nidec's e-axles and precision motors are critical components for both EV powertrains and industrial robots, positioning the company to benefit from these expanding markets.

Global economic growth is projected to be moderate in 2024 and 2025, but with uneven recovery across regions. Persistent inflation and geopolitical tensions pose recession risks, directly impacting demand for Nidec's automotive and industrial products. Interest rate hikes also increase financing costs for Nidec's investments and can reduce consumer affordability of its goods.

Exchange rate volatility significantly affects Nidec's reported earnings, with a 1 yen appreciation against the US dollar estimated to reduce operating income by approximately 3 billion yen in 2023. Rising material and logistics costs, such as increased shipping rates in 2024, also pressure Nidec's manufacturing expenses.

The electric vehicle market is a key growth driver, with global sales projected to exceed 17 million units in 2024, benefiting Nidec's e-axle and motor technologies. Similarly, industrial automation spending is expected to surpass $200 billion in 2024, boosting demand for Nidec's precision motors used in robotics and automated systems.

| Economic Factor | 2024 Projection/Impact | 2025 Projection/Impact | Nidec Relevance |

| Global GDP Growth | ~3.2% (IMF) | Slightly higher than 2024 | Impacts demand for automotive and industrial products. |

| Inflation | Persistent in key markets | Expected to moderate but remain a concern | Increases input costs and may affect profit margins. |

| Interest Rates | Rising in many economies | Likely to remain elevated | Increases financing costs for expansion and R&D. |

| Exchange Rates (JPY/USD) | Volatile | Volatile | Affects translated overseas earnings and costs. |

| EV Market Growth | >17 million units sold | Continued strong growth | Drives demand for Nidec's EV powertrain components. |

| Industrial Automation Spending | >$200 billion | Continued investment | Boosts demand for Nidec's precision motors. |

Same Document Delivered

Nidec PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Nidec PESTLE analysis offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion of global shoppers willing to pay more for eco-friendly products. This shift is evident across Nidec's key markets, from home appliances to automotive sectors. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions, a number that has steadily climbed in recent years.

Nidec's strategic investments in high-efficiency motors and advanced cooling systems directly address this growing demand. The company's commitment to developing energy-saving technologies positions it favorably as consumers and businesses alike seek to reduce their environmental footprint. This alignment with societal values is a crucial driver for future sales and market share growth.

Demographic shifts present both challenges and opportunities for Nidec. For instance, in Japan, Nidec's home market, the workforce is aging, with the median age projected to approach 50 by 2030, potentially impacting the availability of younger, skilled labor. Conversely, emerging markets often boast a younger demographic, offering a larger pool of potential employees, though skill development remains a key focus.

The increasing demand for expertise in cutting-edge fields like electric vehicle (EV) powertrains and advanced robotics necessitates a strategic approach to talent. Nidec's investment in global training programs and partnerships with educational institutions aims to bridge this skill gap. For example, by 2025, Nidec plans to expand its global R&D workforce by 15%, focusing on specialized engineering roles.

Public sentiment towards automation and AI significantly impacts Nidec's growth in robotics and industrial solutions. A growing acceptance, like the 70% of Americans who, according to a 2024 Pew Research Center survey, believe AI will create more jobs than it eliminates, fuels demand. Conversely, widespread fears of job losses, as seen in some European countries, could slow market penetration and invite stricter regulations on AI deployment.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for Corporate Social Responsibility (CSR) are intensifying, pushing companies towards ethical labor, community involvement, and transparent governance. Nidec’s dedication to ESG principles is therefore vital for its standing and appeal to investors and customers alike.

Nidec actively pursues ESG initiatives, such as fostering gender equality and conducting thorough supplier assessments. For instance, in fiscal year 2023, Nidec reported that 29.7% of its managerial positions were held by women, a step towards its goal of 30% by 2025.

- Ethical Labor: Nidec emphasizes fair treatment and development for its employees, aiming to create a positive work environment.

- Community Engagement: The company participates in local initiatives and supports community development programs in the regions where it operates.

- Transparent Governance: Nidec is committed to clear and ethical business practices, ensuring accountability to all stakeholders.

- ESG Reporting: The company regularly publishes sustainability reports detailing its progress on environmental, social, and governance targets.

Health and Safety Standards in Manufacturing

Societal expectations for robust health and safety standards in manufacturing are increasingly stringent, influencing consumer and employee trust. Nidec, like its peers, faces pressure to demonstrate a commitment to safe working environments across its diverse global sites. For instance, in 2024, manufacturing sectors globally saw a continued focus on reducing workplace incidents, with organizations like the International Labour Organization reporting on best practices.

Ensuring safe working conditions is not just a regulatory requirement but a core component of Nidec's social license to operate, directly impacting its ability to attract and retain talent. Companies that prioritize employee well-being often experience lower turnover rates. In 2023, reports indicated that companies with strong safety cultures were perceived as more desirable employers, contributing to a competitive advantage in talent acquisition.

Adherence to high health and safety standards also serves as a critical risk mitigation strategy, preventing costly legal battles and reputational damage. A single major safety incident can lead to significant financial penalties and erode public confidence, impacting sales and market valuation. For example, in the automotive supply chain, where Nidec is a significant player, safety recalls due to manufacturing defects can have cascading negative effects.

Key considerations for Nidec in this area include:

- Employee Training and Development: Investing in comprehensive safety training programs for all personnel, updated to reflect the latest industry standards and technologies.

- Risk Assessment and Mitigation: Regularly conducting thorough risk assessments of manufacturing processes and implementing effective controls to minimize hazards.

- Compliance and Auditing: Ensuring strict adherence to all relevant national and international health and safety regulations, supported by regular internal and external audits.

- Incident Reporting and Investigation: Establishing clear protocols for reporting and investigating all safety incidents, near misses, and occupational illnesses to identify root causes and prevent recurrence.

Societal expectations for ethical labor and community engagement are growing, influencing Nidec's brand perception and talent acquisition. For instance, Nidec reported that 29.7% of its managerial positions were held by women in fiscal year 2023, aiming for 30% by 2025, reflecting a commitment to gender equality.

Public sentiment regarding automation and AI adoption impacts Nidec's robotics division, with a 2024 survey showing 70% of Americans believe AI will create more jobs than it eliminates, fostering demand for automated solutions.

The increasing emphasis on sustainability means Nidec's investments in energy-efficient motors are well-aligned with consumer preferences, as over 60% of global shoppers consider sustainability in purchasing decisions, a trend accelerating since 2024.

Technological factors

Continuous innovation in electric motor design, materials, and manufacturing is a key technological driver for Nidec. The company is focused on creating lighter, more powerful, and energy-efficient motors for everything from consumer electronics to the rapidly expanding electric vehicle market. For instance, Nidec's commitment to R&D is evident in its development of advanced traction motors for EVs, a segment projected to reach over $1.5 trillion globally by 2030.

Nidec's strategic push into electric vehicles (EVs) and robotics hinges directly on rapid technological progress in these areas. The company’s success will be shaped by its capacity to incorporate advancements like more efficient e-axle systems, next-generation battery technologies, and sophisticated autonomous driving components into its offerings.

For instance, the global EV market is projected to reach over $1.5 trillion by 2030, highlighting the immense growth potential. Nidec's ability to innovate in areas such as robotic motion control, crucial for industrial automation and next-gen robotics, will be equally vital. By integrating these cutting-edge technologies, Nidec aims to solidify its position in these dynamic, high-growth sectors.

Nidec is heavily investing in automation and smart manufacturing, aiming to boost efficiency and quality. For instance, their fiscal year 2024 projections indicate continued capital expenditure focused on advanced production technologies, with a significant portion dedicated to smart factory initiatives. This strategic move is designed to streamline operations, reduce waste, and accelerate the introduction of innovative products to market.

Digitalization and Cybersecurity Threats

Nidec's increasing reliance on digitalization across its operations, from supply chain management to customer interactions, promises significant efficiency improvements. However, this digital transformation also amplifies exposure to cybersecurity threats. Protecting critical data, intellectual property, and operational continuity is therefore a top priority.

Cyberattacks pose a substantial risk, capable of causing operational disruptions, financial losses, and severe reputational damage. The global cybersecurity market is projected to reach $300 billion by 2025, underscoring the scale of this challenge. Recent incidents across various industries serve as stark reminders of the constant need for advanced and robust cybersecurity defenses.

- Digitalization Benefits: Nidec leverages digital tools to streamline supply chains and enhance customer interfaces, aiming for greater operational efficiency.

- Cybersecurity Risks: The interconnected nature of digital systems increases vulnerability to cyberattacks, threatening data integrity and business operations.

- Cost of Breaches: The average cost of a data breach globally was $4.35 million in 2022, highlighting the significant financial implications of security failures.

- Mitigation Strategy: Continuous investment in advanced cybersecurity measures is essential to safeguard Nidec's assets and maintain stakeholder trust.

Material Science Innovations

Innovations in material science are a critical technological factor for Nidec. Advancements in areas like new magnetic materials, high-performance composites, and lighter alloys directly influence the efficiency, durability, and cost-effectiveness of Nidec's electric motors and related components. For instance, research into rare-earth-free magnets or advanced composite materials for motor housings can lead to significant performance gains and reduced reliance on potentially volatile supply chains.

The pursuit of sustainable and advanced materials also plays a key role. Nidec's focus on developing more energy-efficient motors, often through material improvements, aligns with global environmental objectives. This includes exploring materials that offer better thermal conductivity for heat dissipation or enhanced wear resistance for longer product lifespans. For example, the development of new insulation materials could allow motors to operate at higher temperatures, increasing power density.

- New Magnetic Materials: Research into permanent magnets with higher coercivity and energy product, potentially reducing reliance on critical elements like Neodymium.

- Advanced Composites: Utilization of carbon fiber or polymer composites for motor casings and rotors to reduce weight and improve mechanical strength.

- Lightweight Alloys: Development and application of aluminum alloys or magnesium alloys for motor components to enhance power-to-weight ratios, crucial for EV applications.

- Sustainable Materials: Exploration of recycled or bio-based materials for non-critical motor components to improve the environmental footprint of Nidec's product portfolio.

Nidec’s technological advancements are critical, particularly in electric motor design for EVs and robotics, aiming for lighter, more powerful, and energy-efficient solutions. The company's investment in smart manufacturing and digitalization enhances operational efficiency but also necessitates robust cybersecurity measures, given the global cybersecurity market's projected $300 billion valuation by 2025.

Innovations in material science, such as new magnetic materials and advanced composites, are key to improving motor performance and reducing costs. For instance, research into rare-earth-free magnets could mitigate supply chain risks.

| Technology Area | Nidec Focus | Market Impact/Data Point |

|---|---|---|

| Electric Motors | Lighter, more powerful, energy-efficient designs for EVs and robotics. | Global EV market projected to exceed $1.5 trillion by 2030. |

| Digitalization | Supply chain optimization, enhanced customer interfaces. | Average cost of a data breach globally was $4.35 million in 2022. |

| Material Science | New magnetic materials, advanced composites, lightweight alloys. | Research into rare-earth-free magnets to reduce supply chain volatility. |

| Smart Manufacturing | Automation, AI integration for efficiency and quality. | Fiscal year 2024 capital expenditure focused on advanced production technologies. |

Legal factors

Nidec, operating globally, faces a critical need to comply with a complex web of international trade laws. This includes navigating diverse import/export regulations, varying customs duties across jurisdictions, and adhering to international sanctions regimes. For instance, in 2024, the World Trade Organization (WTO) continued to monitor trade practices, with member countries implementing new tariff adjustments and non-tariff barriers that directly impact global supply chains.

Failure to comply with these evolving legal frameworks can result in severe consequences for Nidec. Penalties can range from substantial fines to the seizure of goods, leading to significant supply chain disruptions. Furthermore, instances of non-compliance can irreparably damage Nidec's global reputation, affecting customer trust and investor confidence. The ongoing efforts by various nations to enforce trade restrictions, such as those impacting semiconductor supply chains in 2024 and 2025, highlight the critical nature of this legal factor.

Nidec's vast product range, from electric motors to automotive components, faces rigorous product liability and safety regulations globally. For instance, in the European Union, the General Product Safety Regulation (2001/95/EC) mandates that only safe products are placed on the market, with non-compliance leading to significant penalties. Failure to meet these standards can result in substantial fines and damage to Nidec's brand reputation.

Adhering to evolving safety standards is paramount for Nidec. In 2024, automotive safety regulations, such as those concerning autonomous driving systems and electric vehicle battery safety, continue to be refined. Nidec's commitment to rigorous testing and quality assurance, including obtaining certifications like ISO 9001 and industry-specific safety marks, is vital to mitigate the risk of product recalls and legal challenges, which can cost millions in remediation and lost sales.

Protecting Nidec's extensive intellectual property, particularly its advanced motor technologies and unique designs, is paramount to sustaining its market leadership. This includes a significant portfolio of patents, with Nidec holding over 25,000 patents globally as of early 2024, underscoring the depth of its innovation.

Navigating the diverse legal landscapes for intellectual property protection across its operating regions is a continuous challenge for Nidec. The company actively engages in monitoring and enforcing its patent rights worldwide to deter infringement and safeguard its technological innovations from unauthorized replication.

Labor Laws and Employment Regulations

Nidec's global operations mean it must navigate a complex web of labor laws and employment regulations across numerous countries. These regulations cover critical areas such as minimum wages, working hours, workplace safety, anti-discrimination policies, and the rights of employees to organize and bargain collectively. For instance, in 2024, many European nations continued to strengthen worker protections, with some countries implementing new laws around the right to disconnect outside of working hours.

Compliance is not just a legal obligation but a strategic imperative for Nidec. Failure to adhere to these diverse labor laws can lead to significant legal penalties, costly litigation, and damage to the company's reputation. For example, a significant labor dispute in one region could disrupt production and impact global supply chains. Nidec's commitment to fair labor practices and robust HR policies is therefore crucial for maintaining positive employee relations and fulfilling its corporate social responsibility.

Key areas of labor law Nidec must manage include:

- Wage and Hour Laws: Ensuring compliance with minimum wage, overtime pay, and payment frequency regulations in each operating jurisdiction.

- Discrimination and Equal Opportunity: Adhering to laws prohibiting discrimination based on age, gender, race, religion, disability, and other protected characteristics.

- Workplace Safety and Health: Meeting stringent standards for occupational safety and health to prevent accidents and ensure employee well-being.

- Union Relations and Collective Bargaining: Managing relationships with labor unions and adhering to regulations governing collective bargaining agreements and employee representation.

Antitrust and Competition Laws

Nidec's aggressive growth, often fueled by mergers and acquisitions, places it squarely under the watchful eye of antitrust and competition regulators worldwide. For instance, in 2023, Nidec acquired a majority stake in a leading electric motor manufacturer, a move that likely underwent significant antitrust review in the relevant markets to ensure it did not unduly stifle competition.

Compliance is paramount. These laws aim to prevent market dominance and ensure a level playing field, meaning Nidec must navigate a complex web of regulations to avoid penalties or blocked deals. Failing to comply could result in substantial fines, divestitures, or even the halting of strategic expansion plans, impacting its ability to achieve its ambitious growth targets.

The need for rigorous legal scrutiny is evident. Each acquisition, from smaller component suppliers to larger industry players, requires a thorough assessment of potential anti-competitive effects. This due diligence is critical for Nidec's sustained expansion and its reputation in the global marketplace.

Key considerations for Nidec include:

- Market Share Thresholds: Monitoring Nidec's combined market share in specific product segments post-acquisition to stay below regulatory triggers.

- Regulatory Filings: Ensuring timely and accurate submissions to competition authorities in jurisdictions where significant transactions occur.

- Potential Competitor Impact: Assessing how acquisitions might affect smaller competitors or the overall innovation landscape.

- Ongoing Compliance Programs: Maintaining robust internal processes to ensure adherence to competition laws across all business operations.

Nidec must navigate international trade laws, including import/export regulations and sanctions, with the WTO continuing to monitor practices in 2024. Failure to comply can lead to fines, seized goods, and reputational damage, especially with ongoing trade restrictions impacting supply chains in 2024-2025.

Product liability and safety regulations are critical, with the EU's General Product Safety Regulation requiring only safe products. Nidec's commitment to rigorous testing and certifications like ISO 9001 is vital, particularly as automotive safety standards for EVs and autonomous systems evolve in 2024.

Protecting Nidec's extensive intellectual property, holding over 25,000 patents globally as of early 2024, is crucial for market leadership. The company actively enforces its patent rights across diverse legal landscapes to prevent infringement.

Nidec faces complex labor laws globally, covering wages, safety, and discrimination, with countries like those in Europe strengthening worker protections in 2024. Compliance is strategic, preventing legal penalties and reputational harm from labor disputes.

Environmental factors

Growing global awareness of climate change is driving more stringent rules around carbon emissions, prompting industries to shift towards decarbonization. Nidec is proactively setting and meeting aggressive CO2 reduction goals throughout its operations and supply chain, in line with global efforts such as the Science Based Targets initiative (SBTi).

For instance, Nidec has committed to reducing Scope 1 and 2 greenhouse gas emissions by 50% by fiscal year 2030 compared to fiscal year 2021. This commitment not only ensures regulatory adherence but also establishes Nidec as a frontrunner in sustainable manufacturing practices.

The availability and cost of raw materials, especially rare earth elements and crucial metals for motor production, present significant environmental challenges. For instance, the global demand for critical minerals, vital for electric vehicle motors, is projected to surge dramatically by 2030, with lithium demand potentially increasing sixfold and cobalt demand by over 70% according to the International Energy Agency (IEA) in their 2024 outlook.

Nidec's commitment to sustainable sourcing, material efficiency, and investigating alternative materials is paramount. This strategy helps them navigate the risks tied to resource limitations and fluctuating prices. In 2023, Nidec reported a 5% increase in their use of recycled materials across various product lines, demonstrating a proactive approach to resource management.

Environmental regulations are tightening, with a strong push towards reducing waste and embracing circular economy principles. This means companies like Nidec need to be diligent about managing manufacturing byproducts and actively seek ways to extend product life through recycling and remanufacturing. For instance, in 2024, the EU's Circular Economy Action Plan continues to drive initiatives aimed at minimizing waste and maximizing resource efficiency across industries.

Nidec's commitment to responsible waste management and product lifecycle initiatives directly impacts its environmental footprint and ensures compliance with these evolving laws. By investing in advanced recycling technologies and designing products for easier disassembly and reuse, Nidec can not only meet regulatory demands but also uncover new revenue streams and enhance its brand reputation. The global waste management market, valued at over $1.5 trillion in 2023, highlights the significant economic opportunities within this sector.

Water Usage and Pollution Control

Water scarcity and pollution are increasingly critical environmental issues, especially for manufacturing companies like Nidec. Managing water intake and wastewater output is essential for regulatory compliance and reducing ecological footprints. For instance, in 2023, Nidec reported efforts to optimize water usage across its global facilities, aiming for a 5% reduction in water intensity compared to 2022 levels.

Nidec's sustainability strategy increasingly emphasizes initiatives to curb water consumption. These efforts are crucial for long-term operational resilience and meeting stakeholder expectations regarding environmental responsibility. The company's 2024 sustainability report highlights investments in advanced water treatment technologies at several key plants, contributing to a projected 8% decrease in wastewater discharge volume by the end of 2025.

- Water Intensity Reduction: Nidec targets a 5% reduction in water intensity by the end of 2024.

- Wastewater Treatment: Investments in advanced treatment technologies are ongoing.

- Regulatory Compliance: Strict adherence to local water quality and discharge standards is a priority.

- Resource Management: Implementing water-saving measures across all manufacturing sites is a continuous effort.

Biodiversity Protection and Ecosystem Impact

Nidec faces growing pressure to address its impact on biodiversity and ecosystems. This means actively minimizing harm to natural habitats and actively supporting conservation efforts throughout its operations and supply chain. For instance, in 2023, Nidec reported a commitment to reducing its environmental footprint, which implicitly includes biodiversity considerations in its land use and impact assessment processes.

Key areas for Nidec's biodiversity strategy include:

- Responsible Land Use: Implementing sustainable practices for any land Nidec occupies or develops, ensuring minimal disruption to local flora and fauna.

- Supply Chain Scrutiny: Evaluating suppliers for their own biodiversity policies and practices, particularly those involved in resource extraction or manufacturing in ecologically sensitive areas.

- Environmental Impact Assessments: Conducting thorough assessments before initiating new projects to identify and mitigate potential negative effects on biodiversity and ecosystems.

- Conservation Initiatives: Exploring opportunities to actively contribute to biodiversity protection projects, potentially through partnerships or direct investments in conservation.

The increasing global focus on climate change is accelerating the shift towards decarbonization, impacting industries with stricter emission regulations. Nidec is actively pursuing ambitious CO2 reduction targets, aligning with initiatives like the Science Based Targets initiative (SBTi) to meet these evolving environmental demands.

Nidec's commitment includes a 50% reduction in Scope 1 and 2 greenhouse gas emissions by FY2030 from a FY2021 baseline, positioning the company as a leader in sustainable manufacturing. Simultaneously, the demand for critical minerals essential for electric vehicle motors is projected for significant growth, with lithium demand potentially increasing sixfold by 2030 according to the IEA, presenting both challenges and opportunities for resource management.

The company is also prioritizing water conservation, targeting a 5% reduction in water intensity by the end of 2024 and investing in advanced wastewater treatment technologies. These efforts are crucial for regulatory compliance and enhancing long-term operational resilience, reflecting a broader trend towards circular economy principles and responsible waste management across industries.

| Environmental Factor | Nidec's Response/Target | Relevant Data/Initiative |

|---|---|---|

| Climate Change & Emissions | CO2 reduction goals, SBTi alignment | 50% Scope 1 & 2 GHG reduction by FY2030 (vs FY2021) |

| Resource Availability (Critical Minerals) | Sustainable sourcing, material efficiency | IEA projects 6x lithium demand increase by 2030 |

| Waste Management & Circular Economy | Waste reduction, recycling, product lifecycle initiatives | EU Circular Economy Action Plan (2024), 5% increase in recycled materials (2023) |

| Water Scarcity & Pollution | Water consumption reduction, advanced treatment | 5% water intensity reduction target (end of 2024), 8% wastewater discharge reduction projected (end of 2025) |

| Biodiversity & Ecosystems | Responsible land use, supply chain scrutiny, impact assessments | Commitment to reducing environmental footprint (2023) |

PESTLE Analysis Data Sources

Our Nidec PESTLE Analysis draws data from official government publications, leading economic indicators, and reputable industry analysis firms. This ensures a comprehensive understanding of political stability, economic trends, technological advancements, and environmental regulations impacting Nidec.