Nidec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nidec Bundle

Nidec operates in a landscape shaped by intense competition, the bargaining power of its customers, and the influence of its suppliers. Understanding these forces is crucial for navigating its market effectively.

The full Porter's Five Forces Analysis delves into the threat of new entrants and the potential for substitute products, offering a comprehensive view of Nidec's competitive environment. Unlock actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Nidec, a significant player in motor manufacturing, faces potential supplier power stemming from the concentration of key component providers. For instance, the availability and pricing of rare-earth magnets, vital for energy-efficient motors, can be heavily influenced by a small number of global suppliers, particularly those in China. In 2023, China accounted for approximately 85% of the world's rare-earth production, highlighting a significant dependency for companies like Nidec.

Suppliers offering highly specialized or patented motor components, like advanced magnetic materials or unique semiconductor chips for motor control, wield significant bargaining power. Nidec's ability to innovate and effectively integrate these specialized inputs, all while keeping costs in check, is crucial for sustaining its competitive advantage in the market.

Nidec's suppliers can exert significant bargaining power if switching to an alternative provider involves substantial costs. For instance, if changing a motor component supplier necessitates extensive redesign of Nidec's existing product lines or requires costly retooling of manufacturing processes, Nidec is effectively locked in. This is especially relevant in sectors like automotive, where components are deeply integrated and requalification processes for new suppliers can be lengthy and expensive, potentially taking months or even years.

Threat of Forward Integration

The threat of forward integration by suppliers could directly impact Nidec. If suppliers, particularly those providing specialized components or advanced technologies, possess the capability and incentive, they might begin manufacturing motors themselves. This would place them in direct competition with Nidec.

While raw material suppliers are less likely to integrate forward, manufacturers of critical or proprietary components could pose a more significant risk. For instance, a supplier of advanced semiconductor components crucial for high-performance motors might consider entering the motor manufacturing market if they see a lucrative opportunity and possess the necessary expertise.

- Supplier Capability: Suppliers with strong R&D and manufacturing expertise are more likely to integrate forward.

- Technological Dependence: Nidec's reliance on specific, proprietary components from a few suppliers increases this risk.

- Market Incentives: High profit margins or growing demand in the motor market could incentivize suppliers to move downstream.

- Competitive Landscape: The presence of numerous capable suppliers can mitigate this threat, as competition among them reduces the incentive for any single supplier to integrate forward.

Importance of Supplier's Input to Nidec's Cost Structure

The cost of essential raw materials like copper, steel, and rare-earth elements forms a substantial portion of Nidec's production expenses. For instance, copper prices, a key input for electric motors, saw significant volatility in 2024, impacting Nidec's cost base. These price swings directly influence Nidec's profitability, giving suppliers of these critical inputs considerable leverage.

Nidec's reliance on specialized components, often sourced from a limited number of manufacturers, further amplifies supplier bargaining power. When these specialized parts are difficult to substitute or procure elsewhere, suppliers can dictate terms, affecting Nidec's pricing and margins.

- Copper Price Volatility: In early 2024, LME copper prices fluctuated between $8,000 and $10,000 per metric ton, directly impacting Nidec's motor manufacturing costs.

- Rare-Earth Element Dependence: Nidec's high-performance motors often require rare-earth magnets, with supply concentrated in a few regions, increasing supplier leverage.

- Steel Costs: Fluctuations in global steel prices, a fundamental material for motor casings and components, also contribute to Nidec's input cost variability.

Suppliers of critical components, especially those with unique or proprietary technology, hold significant sway over Nidec. This is amplified when few alternatives exist, allowing suppliers to influence pricing and terms. Nidec's reliance on specialized materials like advanced alloys or custom-designed semiconductors for its high-performance motors underscores this vulnerability.

The cost of essential raw materials, such as copper and rare-earth elements, directly impacts Nidec's profitability, granting suppliers of these inputs considerable leverage. For example, copper prices, a key input for electric motors, saw significant volatility in 2024, with LME prices fluctuating between $8,000 and $10,000 per metric ton, directly impacting Nidec's motor manufacturing costs.

Switching suppliers for deeply integrated components can incur substantial costs for Nidec, including redesign and retooling. This lock-in effect strengthens supplier bargaining power, particularly in sectors like automotive where component integration is complex and requalification processes can take months.

The threat of suppliers moving into motor manufacturing themselves, known as forward integration, poses a risk to Nidec. This is more probable for suppliers of specialized, high-value components who possess the technical expertise and see market incentives to compete directly.

| Component/Material | Nidec's Dependence Level | Supplier Bargaining Power Factor | 2024 Price Impact (Example) |

|---|---|---|---|

| Rare-Earth Magnets | High (for high-performance motors) | Concentrated global supply | Price fluctuations due to geopolitical factors |

| Advanced Semiconductors | High (for motor control) | Proprietary technology, limited producers | Supply chain disruptions impacting availability and cost |

| Copper | High (essential for windings) | Commodity price volatility | LME prices $8,000-$10,000/ton (early 2024) |

| Specialized Alloys | Medium (for specific motor parts) | Unique material properties, few manufacturers | Cost increases for specialized inputs |

What is included in the product

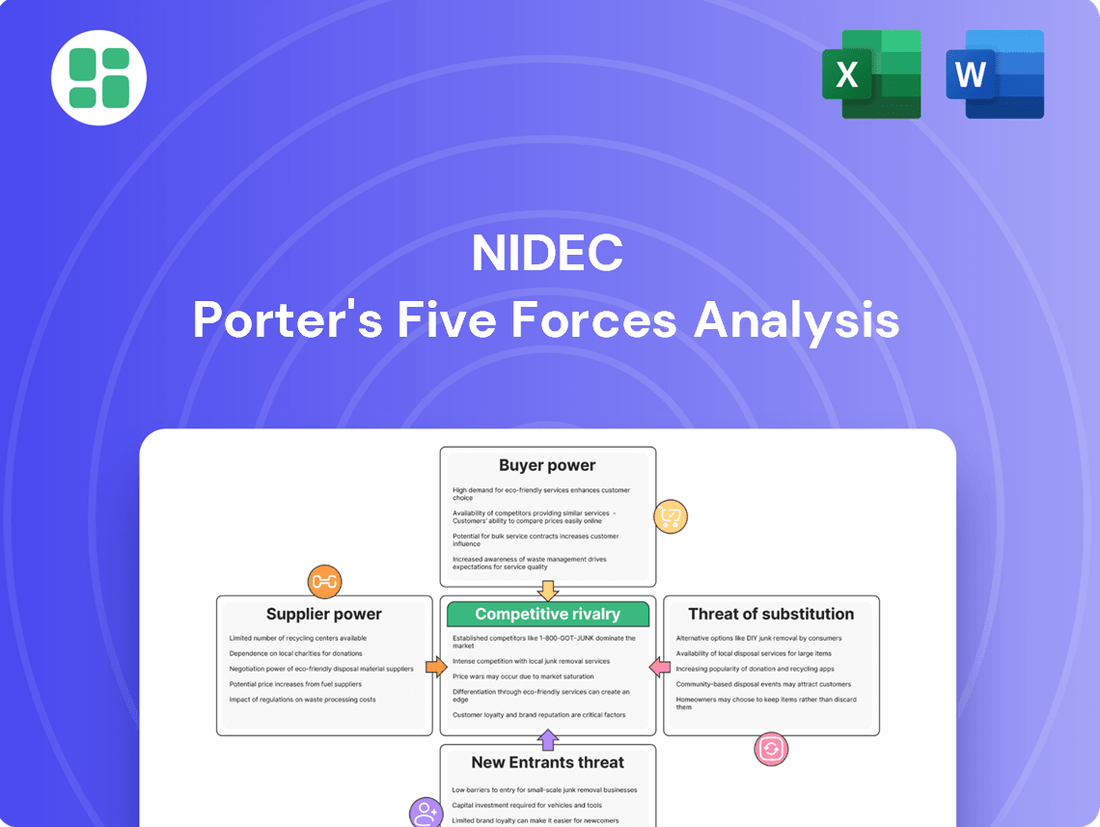

Nidec's Porter's Five Forces Analysis dissects the competitive intensity and profitability potential within its diverse markets, examining threats from new entrants, substitutes, and rivals, alongside the bargaining power of suppliers and buyers.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force on a dynamic radar chart.

Customers Bargaining Power

Nidec's diverse customer base, spanning automotive OEMs, industrial machinery makers, and appliance firms, presents a mixed picture regarding customer bargaining power. While a broad customer base generally dilutes individual customer influence, certain segments wield considerable sway.

The automotive sector, particularly with the rapid expansion of electric vehicles (EVs), is a key area where large-volume customers can exert significant pressure. For instance, major EV manufacturers placing substantial orders for Nidec's electric motors can demand lower per-unit pricing or highly specific, customized product configurations. This concentration of demand from a few key players in a high-growth market amplifies their bargaining leverage.

Nidec's robust product differentiation, particularly in high-performance motors for sectors like electric vehicles and robotics, significantly curtails customer bargaining power. By offering superior energy efficiency and compact designs, Nidec creates products that are not easily substitutable, giving customers fewer alternatives to negotiate with on price.

For instance, Nidec's advanced motors for electric vehicles, which boast higher power density and longer lifespans, command premium pricing. This specialization means that customers in these demanding markets are less likely to switch suppliers based on price alone, as performance and reliability are paramount.

Customer switching costs are a significant factor influencing Nidec's bargaining power with its clients. For instance, in the automotive sector, a major market for Nidec, changing a motor supplier often necessitates extensive re-engineering, rigorous testing, and recertification processes for entire vehicle systems. This can easily run into millions of dollars and significant development time, making customers hesitant to switch.

These high switching costs effectively diminish the leverage customers have to negotiate lower prices or more favorable terms. For example, a car manufacturer deeply integrated with Nidec's specific motor technology for a new model year would face substantial financial and temporal penalties if they attempted to switch suppliers mid-production. This situation strengthens Nidec's position by reducing the threat of customers easily moving to competitors.

Availability of Substitutes for Customers

The availability of substitutes significantly influences customer bargaining power. If customers can easily switch to comparable motors or drive systems from other manufacturers, their ability to negotiate better terms with Nidec increases. This is particularly relevant in segments where Nidec's offerings are more commoditized.

However, Nidec strategically counters this by focusing on high-efficiency, specialized, and integrated motor solutions. For instance, its E-Axle for electric vehicles offers a comprehensive system rather than just a motor, embedding multiple components and functionalities. This integration makes direct substitution more difficult and less cost-effective for customers in these advanced applications.

In 2024, the automotive industry's shift towards electrification intensified the demand for specialized EV components. Nidec's investment in technologies like the E-Axle positions it to capture value in a market where standard motor substitutes are less relevant for cutting-edge EV platforms. The company's ability to offer tailored solutions with advanced features can therefore diminish the bargaining power of customers seeking these specific capabilities.

Consider these factors regarding substitutes:

- High availability of generic electric motors can empower customers in less specialized segments.

- Nidec's integrated solutions, like the E-Axle, reduce the ease of substitution for EV manufacturers.

- The complexity and performance requirements of advanced applications limit the direct comparability of alternative motor systems.

- Customer switching costs are higher when opting for integrated, specialized solutions compared to standalone components.

Customer Price Sensitivity

Customer price sensitivity significantly influences their bargaining power, especially in mature markets. For instance, in the home appliance sector, where Nidec has a presence, consumers often compare prices extensively, giving them leverage to demand lower costs. This sensitivity is a key factor that Nidec must consider.

However, this dynamic shifts in rapidly evolving sectors. In areas like electric vehicles (EVs) or advanced robotics, where Nidec is increasingly investing, performance, innovation, and reliability often take precedence over minor price differences. Customers in these segments are less likely to switch suppliers based solely on price if it means compromising on critical features or dependable operation.

- Nidec's exposure to price-sensitive markets like home appliances means customers can exert considerable pressure for lower prices, impacting profit margins.

- In contrast, Nidec's strategic focus on high-growth areas such as EV powertrains and industrial automation sees customers prioritizing technological advancement and performance over absolute cost.

- For example, while a standard washing machine motor might be a commodity, an advanced motor for an electric vehicle requires specialized engineering, reducing the customer's ability to substitute based on price alone.

Nidec's customer bargaining power is a mixed bag, influenced by segment, product differentiation, and switching costs. While large automotive clients in the EV space can exert pressure, Nidec's specialized, high-performance motors, like its E-Axle, reduce customer leverage due to high switching costs and limited substitutability. Price sensitivity varies, with appliance customers having more power than those in advanced tech sectors.

In 2023, Nidec reported automotive segment sales of ¥1,343.4 billion, highlighting the significant revenue tied to this sector where customer influence is substantial. The company's strategic push into EV components, such as its E-Axle, aims to lock in customers by increasing integration and, consequently, switching costs. This focus on advanced solutions in high-growth markets like EVs, where performance is paramount, helps mitigate the bargaining power of price-sensitive buyers.

| Factor | Nidec's Position | Customer Bargaining Power Impact |

|---|---|---|

| Customer Concentration | High in automotive (major EV OEMs) | Potentially High for key clients |

| Product Differentiation | Strong in specialized EV motors, robotics | Lowers customer power |

| Switching Costs | High for integrated solutions (e.g., E-Axle) | Lowers customer power |

| Availability of Substitutes | Lower for advanced, integrated solutions | Lowers customer power |

| Price Sensitivity | High in appliances, lower in advanced tech | High in appliances, lower in advanced tech |

Same Document Delivered

Nidec Porter's Five Forces Analysis

This preview shows the exact Nidec Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape of the electric motor industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Nidec's market. This comprehensive document is fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

The global motor manufacturing market is intensely competitive, with a vast array of players. Nidec faces rivals from massive multinational corporations like Siemens and Bosch, alongside many smaller, specialized manufacturers. This broad competitive landscape means Nidec must constantly innovate and maintain efficiency across its diverse product lines, from tiny precision motors to substantial industrial and automotive units.

While some segments of the motor market are mature, high-growth areas like automotive electric motors and motors for robotics and AI data centers are experiencing rapid expansion. This dynamic creates intense competition as companies vie for dominance in these lucrative and expanding sectors.

The global automotive electric motors market, a key growth driver, is projected to reach approximately $200 billion by 2030, according to various industry analyses. This substantial market size fuels fierce rivalry as established players and new entrants aggressively compete for market share.

Competitive rivalry in the electric motor industry, including Nidec's market, is fierce. Companies are locked in a continuous race to develop motors that are not only more efficient but also smaller and packed with advanced technology. This constant push for improvement means that staying ahead requires significant investment in research and development.

Nidec's strategic approach to this intense competition is clearly visible in its product development. The company's significant focus on brushless DC motors, which offer superior efficiency and longevity, is a prime example. Furthermore, its development of E-Axle systems, crucial components for electric vehicles, and advanced water-cooling modules designed for the high-performance demands of AI servers, underscore its commitment to technological differentiation.

Exit Barriers

Nidec operates in an industry where substantial capital investment in manufacturing facilities, specialized machinery, and ongoing research and development creates significant exit barriers. This means that once a company has committed these resources, it is very difficult and costly to leave the market.

These high exit barriers compel existing players to remain competitive and fight for market share, even when facing challenging economic conditions. This persistence directly fuels intense rivalry among motor manufacturers, as the cost of exiting outweighs the potential losses from continued operation.

- High Capital Intensity: The motor industry requires significant upfront investment in specialized production lines and advanced R&D, making it financially prohibitive for many firms to simply shut down operations.

- Specialized Assets: Machinery and equipment used in motor production are often highly specialized, with limited resale value or alternative uses, further increasing the cost of exit.

- Employee Expertise: The need for a skilled workforce with specialized knowledge in motor design and manufacturing also contributes to exit barriers, as retraining or redeploying these employees can be complex and costly.

Strategic Stakes

The electric motor market, particularly within the burgeoning EV and industrial automation sectors, is viewed by numerous competitors as a critical battleground for future expansion. This strategic importance drives significant investment and consolidation activities across the industry.

Companies are actively pursuing acquisitions and R&D to fortify their market standing and enhance their technological prowess, directly intensifying competitive pressures. Nidec's own strategic maneuvers, including significant capital expenditures and potential M&A, reflect this industry-wide trend.

- Strategic Importance: The EV and industrial automation segments are seen as key growth drivers, attracting substantial competitive focus.

- Investment & Acquisitions: Companies are pouring capital into R&D and making strategic acquisitions to gain market share and technological advantages.

- Nidec's Role: Nidec's proactive investments and strategic initiatives are indicative of the high stakes involved and contribute to the overall intensity of rivalry.

- Market Dynamics: The pursuit of dominance in these electric motor markets fuels aggressive competition, with players constantly seeking to outmaneuver rivals through innovation and strategic positioning.

Competitive rivalry within the motor manufacturing industry, where Nidec operates, is exceptionally high. This is driven by the presence of numerous global players, from large corporations like Siemens and Bosch to specialized niche manufacturers, all vying for market share. The rapid growth in sectors like electric vehicles and AI data centers intensifies this competition, as companies invest heavily in R&D and strategic acquisitions to gain an edge.

The significant capital investment required for specialized machinery and R&D creates high exit barriers, forcing existing firms to remain competitive and fight for market position. This dynamic, coupled with the strategic importance of segments like EV motors, fuels a constant race for innovation and efficiency, with companies like Nidec actively developing advanced technologies such as brushless DC motors and E-Axle systems.

| Key Competitors | Market Focus | 2024 Market Position Indicator (Estimated) |

|---|---|---|

| Siemens | Industrial Automation, Energy | Strong Global Presence |

| Bosch | Automotive, Industrial | Leading Automotive Supplier |

| Nidec | Automotive, Industrial, Appliances | Major Player, Strong EV Focus |

| ABB | Industrial Automation, Robotics | Key Player in Industrial Motors |

SSubstitutes Threaten

The threat of substitutes for electric motors in motion control primarily stems from alternative technologies like pneumatic and hydraulic systems, particularly in demanding industrial settings. While these alternatives exist, electric motors generally maintain an advantage due to their superior efficiency and precision, crucial for many modern applications. For instance, in 2024, the global industrial automation market, a key sector for motor usage, was projected to reach hundreds of billions of dollars, with electric motors forming a significant portion due to these performance benefits.

While direct substitutes for electric motors are scarce in many core applications, emerging technologies present a potential threat. For instance, advancements in highly efficient mechanical gearing systems or the development of passive systems could replace certain motor-driven components in specific, niche areas, thereby reducing demand for motors in those segments.

The increasing customer adoption of highly integrated systems, exemplified by Nidec's E-Axle, significantly diminishes the threat of individual motor substitutes. These comprehensive solutions offer optimized performance and convenience, making standalone motor replacements less appealing. For instance, in 2024, the global electric vehicle (EV) market saw continued growth, with integrated powertrain solutions becoming a key differentiator for many manufacturers.

However, the landscape isn't entirely secure. The emergence of alternative integrated propulsion systems that bypass Nidec's specific motor technologies presents a potential threat. If competitors develop equally compelling or superior integrated solutions that don't depend on Nidec's core motor expertise, customers might shift their preferences, impacting Nidec's market position.

Energy Source Alternatives

The threat of substitutes for Nidec's electric motors is influenced by the availability and adoption of alternative energy sources and power generation methods. While the global shift towards electrification in the automotive sector is a strong tailwind, the long-term viability of internal combustion engines (ICEs) versus electric powertrains remains a factor. For example, continued innovation in ICE efficiency could slow the transition, impacting demand for Nidec's automotive electric motors.

However, the overwhelming global trend is towards electrification, which significantly mitigates this threat. By 2024, projections indicate a substantial increase in electric vehicle (EV) sales, with some estimates suggesting EVs could represent over 30% of new car sales globally by the end of the year. This widespread adoption of EVs directly boosts demand for electric motors, Nidec's core products.

The threat of substitutes also extends to other applications where Nidec operates. For instance, in industrial automation, alternative power sources or more energy-efficient mechanical systems could emerge. However, the inherent efficiency and controllability of electric motors generally position them favorably against many traditional mechanical alternatives.

Key considerations regarding energy source alternatives include:

- Automotive Electrification: The accelerating adoption of EVs is the primary driver reducing the threat of ICE substitutes for Nidec's automotive motor business.

- Industrial Efficiency: Advancements in energy efficiency for traditional machinery could present a substitute threat in industrial applications, though electric motors often offer superior performance.

- Renewable Energy Integration: The growth of renewable energy sources, like solar and wind, primarily increases demand for electric motors used in power generation and grid management, rather than posing a substitute threat.

Software-Driven Optimization

Advances in software and control algorithms are making simpler mechanical systems more competitive in certain low-power applications. This means that highly sophisticated motors might not always be necessary, potentially impacting demand for Nidec's core products. For instance, the growing adoption of variable speed drives (VSDs) in HVAC systems, powered by advanced software, allows for precise motor control, reducing energy consumption and potentially substituting traditional, less adaptable motor solutions.

However, Nidec is not standing still. The company is actively developing and integrating its own control units and comprehensive solutions. This strategic move allows Nidec to capitalize on the software-driven optimization trend rather than being a victim of it. By offering integrated motor and control systems, Nidec can provide enhanced performance and efficiency, thereby strengthening its position even as the underlying technology evolves.

- Software Optimization Threat: Sophisticated algorithms can enhance simpler mechanical systems, creating viable alternatives for less demanding applications.

- Market Impact: This trend could reduce the need for Nidec's more complex motor technologies in specific market segments.

- Nidec's Response: Nidec is proactively developing and integrating its own control units and complete solutions to adapt and lead in this evolving landscape.

- Example: The widespread use of software-controlled VSDs in HVAC systems illustrates how optimization can impact motor demand.

While electric motors are dominant, pneumatic and hydraulic systems serve as substitutes in specific industrial niches, though electric motors generally win on efficiency and precision. For example, the global industrial automation market, a key sector for motor use, was projected to be worth hundreds of billions of dollars in 2024, with electric motors holding a significant share due to their performance advantages.

Highly integrated solutions, like Nidec's E-Axle, effectively reduce the threat of individual motor substitutes by offering optimized performance and convenience. The growing EV market in 2024, with integrated powertrains becoming a key differentiator, exemplifies this trend.

However, alternative integrated propulsion systems that bypass Nidec's specific motor technologies pose a threat if they offer comparable or superior performance without relying on Nidec's core expertise.

The accelerating global shift towards electrification, with EV sales projected to exceed 30% of new car sales globally by the end of 2024, significantly reduces the threat of internal combustion engine substitutes for Nidec's automotive motor business.

Entrants Threaten

Entering the motor manufacturing sector, particularly for high-volume or advanced technology motors like those Nidec specializes in, demands significant upfront capital. Companies need to invest heavily in research and development to innovate, establish state-of-the-art manufacturing plants, and build robust supply chains. For instance, setting up a new, automated motor production line can easily cost tens of millions of dollars, creating a formidable barrier for aspiring competitors.

Established players like Nidec leverage significant economies of scale in manufacturing, purchasing raw materials, and research and development. This allows them to achieve lower per-unit production costs, a barrier for newcomers. For instance, in 2023, Nidec's revenue reached approximately ¥1.9 trillion (around $13 billion USD), indicating a substantial operational footprint that new entrants would find challenging to replicate quickly.

The experience curve further solidifies this advantage. As Nidec has produced millions of units over decades, its processes have become more efficient, leading to further cost reductions. A new entrant would lack this accumulated learning, facing higher initial production costs and a steeper learning curve to achieve comparable efficiency.

Nidec's formidable patent portfolio, encompassing over 100,000 patents globally as of early 2024, presents a significant barrier to entry. This intellectual property, particularly in advanced motor technologies like brushless DC and specialized electric vehicle (EV) motors, requires new entrants to either undertake costly, time-consuming R&D to develop equivalent innovations or secure expensive licensing agreements.

Brand Loyalty and Distribution Channels

Nidec's established brand loyalty and extensive distribution network present a significant barrier to new entrants. Building this level of recognition and access globally is a capital-intensive and time-consuming process. For instance, Nidec's deep-rooted relationships with major original equipment manufacturers (OEMs) across automotive, industrial, and consumer electronics sectors in 2024 make it exceptionally difficult for newcomers to secure comparable market penetration.

New companies face immense challenges in replicating Nidec's established global reach and customer trust. These entrenched relationships are crucial for securing sales volumes and market share, acting as a formidable deterrent. Nidec's ability to leverage its existing distribution and sales channels provides a distinct competitive advantage that is hard for nascent competitors to overcome.

- Established Brand Recognition: Nidec has cultivated a strong reputation for quality and reliability over decades, making it a preferred supplier for many global corporations.

- Extensive Distribution Network: The company operates a vast network of sales offices, service centers, and logistics hubs worldwide, facilitating efficient product delivery and customer support.

- Key Customer Relationships: Nidec maintains long-standing partnerships with industry leaders, providing a stable revenue base and market access that new entrants struggle to penetrate.

- High Entry Costs: The significant investment required to build a comparable brand and distribution infrastructure means that new entrants face substantial financial hurdles.

Regulatory Hurdles and Standards

The motor industry, especially for automotive and industrial applications, faces demanding regulations concerning quality, safety, and environmental impact. New companies entering this space must invest heavily to understand and comply with these intricate rules, acting as a substantial barrier.

For example, in 2024, the European Union's Ecodesign for Sustainable Products Regulation (ESPR) continues to tighten energy efficiency requirements for electric motors, demanding significant R&D and manufacturing process adjustments for compliance.

- Stringent Quality and Safety Standards: Compliance with ISO 9001, IATF 16949 (automotive), and UL certifications requires robust quality management systems and product testing, adding to upfront costs.

- Environmental Regulations: Adherence to standards like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) necessitates careful material sourcing and manufacturing processes.

- Emissions and Efficiency Mandates: Government-imposed fuel efficiency standards and emissions targets, such as those from the EPA in the US or WLTP in Europe, directly impact motor design and performance requirements.

- Certification and Testing Costs: Obtaining necessary certifications can involve lengthy and expensive testing procedures, deterring smaller or less capitalized entrants.

The threat of new entrants in the motor manufacturing sector, particularly for Nidec's specialized products, is generally low due to substantial barriers. These include immense capital requirements for R&D and manufacturing, as well as the advantage of economies of scale enjoyed by incumbents. Nidec's extensive patent portfolio and established customer relationships further solidify its market position, making it difficult for new players to gain traction.

New entrants face significant hurdles in matching Nidec's established brand reputation and global distribution network. Building comparable customer trust and market access requires considerable time and investment. For instance, Nidec's deep-rooted partnerships with major OEMs in 2024 provide a stable revenue base and market penetration that is exceptionally difficult for newcomers to replicate.

Regulatory compliance also acts as a considerable barrier. The motor industry, especially for automotive and industrial applications, must adhere to stringent quality, safety, and environmental standards. For example, the EU's 2024 Ecodesign for Sustainable Products Regulation (ESPR) mandates stricter energy efficiency for electric motors, necessitating significant investment in R&D and manufacturing process adjustments for compliance.

| Barrier Type | Description | Nidec's Advantage (2024 Data/Estimates) |

| Capital Requirements | High upfront investment in R&D, plants, and supply chains. | Nidec's revenue of ~ $13 billion USD in 2023 indicates massive operational scale. |

| Economies of Scale | Lower per-unit costs due to high-volume production and purchasing power. | Nidec's vast production capacity allows for significant cost efficiencies. |

| Intellectual Property | Patents protecting advanced motor technologies. | Over 100,000 patents globally as of early 2024. |

| Brand & Distribution | Established customer loyalty and global sales/service network. | Long-standing relationships with major OEMs across sectors. |

| Regulatory Compliance | Meeting quality, safety, and environmental standards. | Adherence to evolving regulations like ESPR for energy efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Nidec is built upon a foundation of publicly available financial reports, industry-specific market research from firms like Statista and IBISWorld, and regulatory filings. This ensures a comprehensive understanding of competitive dynamics and market positioning.