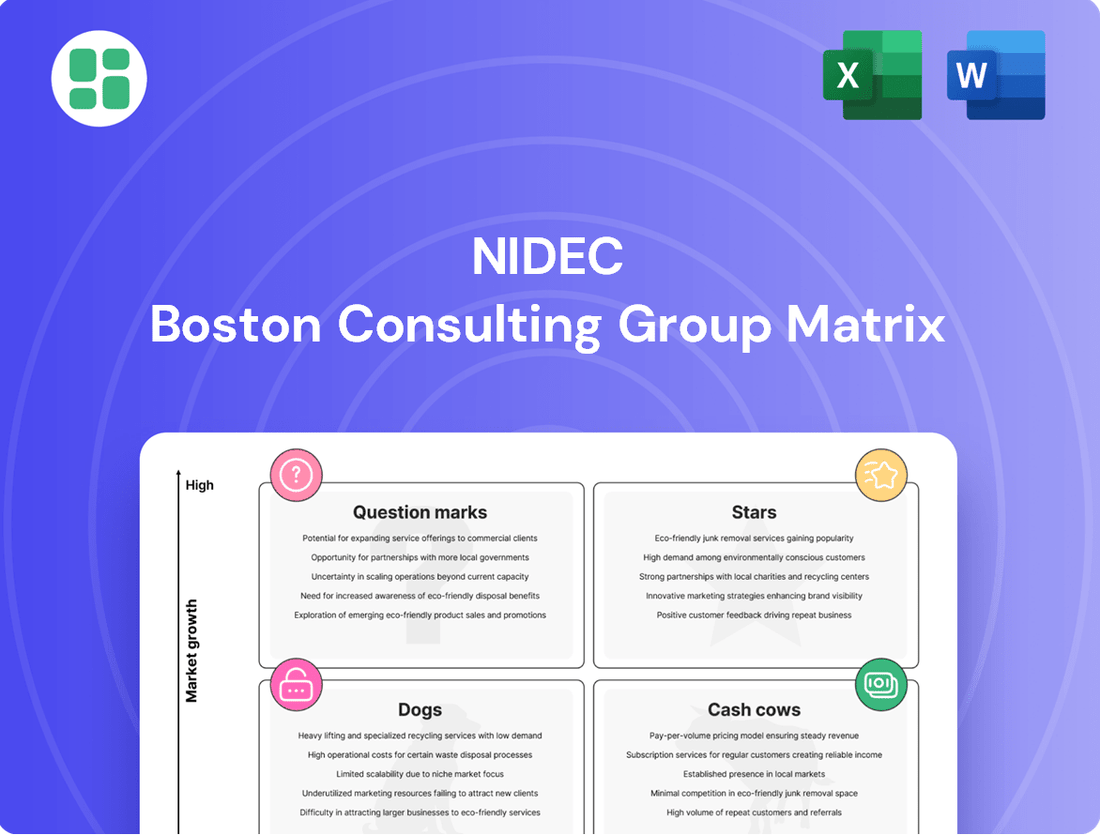

Nidec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nidec Bundle

Uncover the strategic positioning of Nidec's product portfolio with our comprehensive BCG Matrix. See which products are driving growth, which are stable cash generators, and which may require a second look.

This preview offers a glimpse into the power of strategic analysis. Purchase the full BCG Matrix report to gain in-depth insights into each quadrant, enabling you to make data-driven decisions and optimize your investment strategy for Nidec's diverse offerings.

Stars

Nidec's E-Axle units are firmly positioned as a Star in the BCG Matrix, fueled by the explosive growth of the electric vehicle sector. This segment is experiencing hypergrowth, making it a prime area for Nidec's strategic focus and investment.

The company has ambitious plans, targeting a commanding 40-45% share of the global E-Axle market by 2030. This aggressive goal is supported by significant capital expenditures and a push for localized manufacturing, especially within the crucial Chinese market.

The automotive electric motor market itself is projected for strong compound annual growth, underscoring the E-Axle's role as a critical engine for Nidec's future revenue and profitability. This segment is not just growing; it's leading the charge for Nidec in the automotive transition.

Nidec's water-cooling modules for AI data centers are a clear Star in the BCG matrix. The explosive growth of artificial intelligence is driving unprecedented demand for efficient cooling systems, as AI processors generate significant heat. This segment is experiencing rapid sales increases, making it a prime growth opportunity for Nidec.

The market for AI data center cooling solutions is projected to reach billions of dollars by 2025, with water cooling becoming increasingly dominant. Nidec is strategically investing in production capacity and R&D to meet this escalating demand, aiming to solidify its market position in this high-potential area.

Nidec is making significant strides in the advanced industrial automation and robotics sector, a key area within its growth strategy. The company's focus includes supplying high-precision motors for collaborative robots, a segment experiencing robust expansion. This strategic positioning leverages the increasing global demand for automation solutions driven by labor scarcity and the push for more efficient manufacturing.

The market for industrial automation and robotics is a dynamic one, with projections indicating continued strong growth. For instance, the global collaborative robot market alone was valued at approximately $1.5 billion in 2023 and is expected to reach over $7 billion by 2028, demonstrating a compound annual growth rate of around 35%. Nidec's advanced motor technology is well-suited to capitalize on this trend, offering the precision and reliability crucial for these sophisticated applications.

Battery Energy Storage Systems (BESS) Components

Nidec's components for Battery Energy Storage Systems (BESS) are a significant and expanding area, fueled by the global push for green innovation and the rapid growth of the energy sector.

The demand for reliable backup power for critical infrastructure, such as data centers, is a key driver for BESS, directly benefiting Nidec's offerings in this space. For instance, the global BESS market was projected to reach over $100 billion by 2027, indicating substantial growth potential.

Nidec has observed a notable increase in sales for these energy-related products within its Appliance, Commercial and Industrial segment, reflecting the market's positive reception and Nidec's strategic positioning.

- Growing Demand: The global energy storage market is expanding rapidly, with BESS being a primary focus.

- Key Applications: Data centers and renewable energy integration are major demand drivers for BESS components.

- Nidec's Position: Nidec is experiencing increased sales in its BESS-related product categories.

- Market Outlook: Projections suggest continued strong growth in the BESS sector, offering significant opportunities.

High-Efficiency Industrial Motors for Infrastructure

Nidec's high-efficiency industrial motors are positioned as a Star within its BCG Matrix. This classification is driven by their strong market growth and high market share, directly correlating with the global push for energy conservation and sustainable infrastructure development.

The significance of efficient motors cannot be overstated, as they account for roughly half of the planet's electricity usage. This presents a substantial opportunity for Nidec, as the replacement cycle for older, less efficient motors is a key driver of market expansion.

Nidec is strategically capitalizing on this trend by deploying its advanced motor technologies. Key application areas include powering data centers, a sector experiencing rapid growth, and supplying large motors for the vital renewal of social infrastructure projects.

- Market Growth: The demand for energy-efficient motors is accelerating globally, driven by regulatory mandates and corporate sustainability goals.

- Nidec's Position: Nidec holds a strong market share in high-efficiency industrial motors, benefiting from its technological expertise and product innovation.

- Key Applications: Significant growth is observed in motors for data centers and infrastructure upgrades, areas where Nidec is actively expanding its offerings.

- Energy Impact: With motors consuming approximately 50% of global electricity, the shift to higher efficiency models offers substantial energy savings and environmental benefits.

Nidec's E-Axle units are a clear Star, benefiting from the booming electric vehicle market. The company aims for a 40-45% global market share by 2030, backed by substantial investments. The automotive electric motor market's projected growth further solidifies the E-Axle's importance for Nidec's future revenue.

Nidec's water-cooling modules for AI data centers are also Stars. The rapid expansion of AI drives immense demand for efficient cooling, with the market for these solutions expected to reach billions by 2025. Nidec is increasing production and R&D to capture this high-growth segment.

Advanced industrial automation and robotics, particularly collaborative robots, represent another Star. Nidec supplies high-precision motors for this expanding sector, driven by automation needs due to labor shortages. The collaborative robot market alone was valued at approximately $1.5 billion in 2023 and is projected to exceed $7 billion by 2028.

Nidec's components for Battery Energy Storage Systems (BESS) are Stars, propelled by the green energy transition. Critical applications like data center backup power are fueling demand, with the BESS market projected to surpass $100 billion by 2027. Nidec is experiencing increased sales in these energy-related products.

High-efficiency industrial motors are Stars for Nidec, driven by strong market growth and share in the energy conservation sector. These motors are crucial as they consume about half of global electricity. Nidec's advanced motors are key for data centers and infrastructure renewal projects.

| Nidec BCG Matrix: Stars | Market Growth | Nidec's Position | Key Applications | Financial Impact |

| E-Axle Units | Hypergrowth (EV Sector) | Targeting 40-45% global share by 2030 | Electric Vehicles | Major revenue driver for automotive transition |

| AI Data Center Cooling Modules | Explosive Growth (AI) | Increasing production capacity and R&D | AI Data Centers | High-potential growth area |

| Industrial Automation Motors | Robust Expansion (Robotics) | Supplying high-precision motors | Collaborative Robots, Automation | Capitalizing on automation trends |

| BESS Components | Rapid Growth (Energy Storage) | Experiencing increased sales | Data Centers, Renewable Energy Integration | Benefiting from green innovation push |

| High-Efficiency Industrial Motors | Strong Growth (Energy Conservation) | Strong market share, technological expertise | Data Centers, Social Infrastructure | Significant energy savings, environmental benefits |

What is included in the product

The Nidec BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

Nidec BCG Matrix: A clear, quadrant-based overview of business units, simplifying strategic decisions.

Cash Cows

Nidec's spindle motors for near-line HDDs are a classic cash cow. With over 70% global market share, Nidec dominates this crucial segment for data centers.

Despite the PC HDD market maturing, demand for high-capacity drives in servers remains robust, even showing signs of recovery. This stability, coupled with Nidec's strong market position and high entry barriers, ensures consistent and substantial cash generation from this product line.

Nidec's motors for home appliances, powering everything from washing machines to refrigerators, are a clear Cash Cow. This segment is a significant contributor to Nidec's overall revenue, representing 40.3% of consolidated sales in fiscal year 2025. The market for these motors is mature, yet remarkably stable, providing a consistent stream of income.

These home appliance motors are highly valued for their energy efficiency and quiet operation. This focus on performance and user experience ensures their continued demand and profitability within Nidec's portfolio, solidifying their position as a reliable profit generator.

Nidec's Electric Power Steering (EPS) motors are a prime example of a Cash Cow. As a dominant player in this mature automotive component market, Nidec enjoys a substantial market share. This segment, despite the ongoing transition to electric vehicles, continues to be vital for both conventional and electric cars, ensuring consistent demand.

The stability of the EPS motor business translates into reliable revenue streams and strong cash flow generation for Nidec. This is largely due to the product line's established market presence and widespread integration across various vehicle platforms. In 2024, the automotive industry saw continued demand for advanced driver-assistance systems, including EPS, underscoring the product's enduring relevance.

Compressor Motors for Commercial Refrigeration

Nidec's compressor motors for commercial refrigeration and HVAC systems are firmly established in a mature market. In this segment, energy efficiency and unwavering reliability are paramount for customers, driving consistent demand. Nidec's significant market share ensures a stable revenue stream, acting as a reliable cash generator for the company's Appliance, Commercial and Industrial division.

These motors are critical components across numerous commercial applications, from supermarkets to industrial cooling. For instance, in 2024, the global commercial refrigeration market was valued at approximately $45 billion, with HVAC systems representing a substantial portion of this. Nidec's strong position in supplying these essential motors contributes to its robust cash flow.

- Market Maturity: The commercial refrigeration and HVAC market is well-established, with growth primarily driven by replacement cycles and energy efficiency upgrades.

- Key Demand Drivers: Energy savings and long-term reliability are the primary purchasing considerations for commercial end-users.

- Nidec's Position: Nidec holds a significant share in this market, benefiting from established relationships and a reputation for quality.

- Financial Contribution: These motors consistently generate stable cash flow, supporting Nidec's overall financial health and investment capacity.

General Industrial Motors for Established Sectors

Nidec's General Industrial Motors segment serves foundational industries like agriculture, gas, mining, and water and sewage. These established sectors, while experiencing low to moderate growth, provide a bedrock of stable demand for Nidec's robust motor solutions.

This consistent demand allows Nidec to command a significant market share within these mature industries. The company leverages this position to generate reliable and predictable cash flows, a hallmark of a Cash Cow.

Further bolstering their Cash Cow status, Nidec actively engages in providing essential maintenance and servicing for the extensive motor installations within these critical sectors. This focus on after-sales support creates recurring revenue streams and deepens customer relationships.

- Stable Demand: Established sectors like mining and water treatment offer predictable, ongoing needs for industrial motors.

- High Market Share: Nidec's established presence in these mature markets translates to a dominant position.

- Consistent Cash Generation: The combination of stable demand and market leadership results in reliable profit generation.

- Maintenance Revenue: Service and maintenance contracts for existing motor fleets provide an additional, steady income source.

Nidec's spindle motors for near-line HDDs are a classic cash cow, holding over 70% global market share. Despite the PC HDD market maturing, demand for high-capacity drives in servers remains robust, even showing signs of recovery. This stability, coupled with Nidec's strong market position and high entry barriers, ensures consistent and substantial cash generation from this product line.

Nidec's motors for home appliances represent a significant contributor to revenue, making up 40.3% of consolidated sales in fiscal year 2025. This mature but stable market provides a consistent income stream, driven by the motors' energy efficiency and quiet operation.

Electric Power Steering (EPS) motors are another prime example of a Cash Cow for Nidec, a dominant player in this mature automotive component market. Continued demand in 2024 for advanced driver-assistance systems, including EPS, underscores the product's enduring relevance and stable revenue generation.

Nidec's compressor motors for commercial refrigeration and HVAC systems are firmly established in a mature market, valued at approximately $45 billion globally in 2024. Energy efficiency and reliability drive consistent demand, with Nidec's significant market share ensuring stable cash flow for the Appliance, Commercial and Industrial division.

| Product Segment | Market Status | Nidec's Position | Cash Flow Contribution |

| Near-line HDD Spindle Motors | Mature, Stable Demand | >70% Global Market Share | High, Consistent |

| Home Appliance Motors | Mature, Stable | Significant Revenue Driver (40.3% FY25) | Reliable Profit Generator |

| Electric Power Steering (EPS) Motors | Mature Automotive | Dominant Player | Strong, Stable Cash Flow |

| Commercial Refrigeration/HVAC Motors | Mature Market ($45B in 2024) | Significant Market Share | Stable Cash Generator |

Full Transparency, Always

Nidec BCG Matrix

The Nidec BCG Matrix preview you are currently viewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a comprehensive strategic tool ready for immediate application. You can be confident that the professional design and insightful analysis presented here are precisely what you'll be working with to guide your business decisions. This document is prepared to offer you a clear and actionable framework for evaluating Nidec's product portfolio.

Dogs

Spindle motors for PC HDDs represent a declining market for Nidec. The widespread shift to tablets and smartphones has significantly reduced demand for traditional PC hard drives, leading to low growth prospects for this segment. Nidec's overall strong position in HDD motors doesn't negate the challenges in this specific sub-category.

Motors for optical disc drives (ODDs) operate within a market experiencing a pronounced mid-to-long-term decline in demand. This trend is driven by the diminishing reliance on physical media for data storage and software distribution, directly impacting the need for ODDs.

Given this market trajectory, the ODD motor segment likely contributes minimal cash flow while simultaneously immobilizing valuable resources. Consequently, it presents a strong case for divestiture or a substantial scaling back of operations.

For instance, the global optical drive market size was valued at approximately USD 1.5 billion in 2023 and is projected to contract further, underscoring the challenges for this product category.

Motors for traditional office automation equipment, much like those used in optical disc drives (ODDs), are positioned in Nidec's BCG Matrix as potential Dogs. This is due to a consistent decline in demand as businesses increasingly adopt digital workflows and cloud-based solutions, rendering older hardware obsolete.

Nidec's involvement in this segment represents a low-growth, low-market-share area. The financial returns are minimal, and these products may consume valuable resources that could be better allocated to more promising growth sectors within Nidec's portfolio.

Legacy, Low-Efficiency Motor Lines

Certain legacy motor product lines within Nidec's portfolio might fall into the Dogs category of the BCG matrix. These are often products that struggle to keep pace with the evolving demand for high energy efficiency, a critical factor in today's industrial landscape. For instance, older motor designs might consume significantly more power than newer, inverter-driven or permanent magnet synchronous motor (PMSM) technologies, making them less attractive to environmentally conscious or cost-sensitive customers.

These legacy lines typically exhibit low growth prospects and a declining or low market share, especially when compared to Nidec's more innovative and high-performance offerings. They may cater to niche, stagnant industrial sectors where technological advancement is slow. While they might still generate some revenue, their contribution to Nidec's overall growth and profitability is minimal, and they necessitate continued investment in maintenance and support without yielding substantial returns.

For example, consider industrial motors designed for applications with fixed speeds and minimal control requirements. While these might have served their purpose in the past, the trend is towards variable speed drives (VSDs) and smart motor technologies that offer significant energy savings and operational flexibility. Nidec's focus in 2024 and beyond is heavily on these advanced solutions, as evidenced by their continued investment in R&D for high-efficiency motors and integrated drive systems.

- Low Market Share: Legacy motor lines often struggle to compete with newer, more efficient technologies, leading to a diminished market presence.

- Low Growth Potential: Operating in stagnant industrial niches or failing to meet modern efficiency standards limits the growth prospects of these products.

- Resource Drain: These products require ongoing maintenance and support, consuming resources that could be better allocated to high-growth, innovative segments.

- Profitability Concerns: Their low market share and limited growth often translate into low profitability, making them candidates for divestment or phasing out.

Older Generation Electronic and Optical Components

Within Nidec's portfolio, older generation electronic and optical components, such as certain legacy micro-motors for consumer electronics or older optical sensor technologies, might fall into the Dogs category. These products often face intense competition from newer, more advanced alternatives and are characterized by declining sales volumes and profitability.

These components typically operate in mature or shrinking markets, with limited potential for future growth or innovation. Nidec's investment in these areas might yield low returns, potentially diverting resources from more promising ventures.

For instance, if Nidec still produces components for older CD/DVD drives, a market that has largely been replaced by streaming and solid-state storage, these would likely be considered Dogs. Such products would exhibit:

- Low market share in a declining industry.

- Minimal revenue growth or declining sales figures.

- Low profitability, potentially requiring significant cost management.

- Limited strategic importance for future company development.

Certain legacy motor product lines, like those for older office automation equipment or traditional PCs, fit Nidec's Dogs category. These segments face declining demand as technology advances, resulting in low market share and minimal growth prospects.

These products often generate low profitability and can tie up valuable resources that could be better invested in Nidec's growth areas. The company's strategic focus in 2024 is on high-efficiency motors and advanced solutions, indicating a move away from these legacy offerings.

For example, the market for motors in optical disc drives, a segment experiencing a pronounced decline, exemplifies a Dog. The global optical drive market was valued around USD 1.5 billion in 2023 and is projected to shrink further, highlighting the challenges.

Similarly, spindle motors for PC HDDs are in a declining market due to the shift towards mobile devices, impacting demand for traditional hard drives.

| Product Segment | BCG Category | Market Trend | Nidec's Position | Strategic Implication |

| HDD Spindle Motors (PC) | Dog | Declining | Strong, but facing reduced demand | Potential divestment or scaling back |

| ODD Motors | Dog | Strong Decline | Low growth, low profitability | Divestiture or significant reduction |

| Legacy Office Automation Motors | Dog | Declining | Low market share, low growth | Resource reallocation |

| Older Consumer Electronics Micro-motors | Dog | Mature/Shrinking | Declining sales and profitability | Focus on advanced alternatives |

Question Marks

Nidec views the electric motorcycle motor segment as a potential growth area, acknowledging the broader electrification trend. While the current market share might be modest, the projected expansion of the electric two-wheeler market, with global sales of electric motorcycles and scooters expected to reach over 10 million units annually by 2028, presents a significant opportunity.

This segment requires considerable investment to capture market share and build a dominant presence. Nidec's strategic focus on this area positions it to potentially transition from a question mark to a star performer in its portfolio, mirroring the broader industry's shift towards cleaner transportation solutions.

Nidec's involvement in drone motors places it in a dynamic, high-growth market. While the overall drone sector is expanding, Nidec's position within specific drone motor segments might be relatively new, classifying it as a Question Mark in the BCG matrix. This classification indicates potential for significant growth but also requires careful evaluation of investment strategies.

To solidify its standing, Nidec needs to invest heavily in research and development to enhance motor efficiency and power for various drone applications. The global drone market was valued at approximately $28.1 billion in 2023 and is projected to reach $111.1 billion by 2030, growing at a CAGR of 21.4%. Capturing a meaningful share of this rapidly expanding market will necessitate aggressive market penetration strategies and potentially strategic partnerships.

Nidec's foray into new niche robotics applications, like highly specialized collaborative robot components and emerging robotic mobility solutions, positions these segments as potential Question Marks in the BCG Matrix. These areas, while exhibiting high growth potential, currently represent a smaller market share for Nidec and necessitate significant strategic investment to cultivate into market leaders. For instance, the global collaborative robot market was projected to reach $10.9 billion by 2027, growing at a CAGR of 44.5% from 2020, indicating substantial opportunity.

Emerging EV Components Beyond E-Axle

Nidec's exploration into emerging EV components beyond its core E-Axle signifies a strategic move into potential "Question Marks" within the BCG matrix. These new ventures, such as advanced in-wheel motors or specialized systems for novel EV architectures, tap into a rapidly expanding market segment. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, indicating substantial growth opportunities for innovative components.

These emerging areas, while offering high growth potential, likely begin with a low market share for Nidec. This necessitates significant capital investment for research, development, and manufacturing scale-up to establish a competitive foothold. Companies entering these nascent markets often face intense competition and require substantial funding to achieve profitability and market penetration.

- High Growth Potential: Emerging EV components are crucial for next-generation vehicles, targeting a market projected for significant expansion.

- Low Initial Market Share: Nidec's new ventures in these areas are expected to start with a small percentage of the market.

- Capital Intensive: Significant investment is required to develop technology, build production capacity, and compete effectively.

- Strategic Importance: These "Question Mark" products are vital for Nidec's long-term diversification and leadership in the evolving EV industry.

Strategic Acquisitions in New Growth Areas

Nidec's strategic acquisitions in new growth areas, even with setbacks like the canceled Makino deal, underscore a clear intent to build market share in promising sectors. This approach positions potential targets as future Stars within the BCG matrix, demanding substantial investment and integration efforts to climb the growth curve.

The company's persistent interest in industries like machine tools, where its current market share is low but growth potential is high, exemplifies this strategy. Nidec aims to leverage its financial strength and operational expertise to transform these nascent ventures into dominant players.

- Pursuit of High-Growth, Low-Share Markets: Nidec actively seeks acquisitions in sectors with significant future potential but limited current presence, aiming to establish a strong foothold.

- Investment in Integration and Development: Successful integration of acquired companies and substantial strategic investments are critical for nurturing these new ventures into Stars.

- Example: Machine Tool Industry Interest: Nidec's continued focus on the machine tool sector, despite past deal cancellations, illustrates its commitment to entering and growing in new, high-potential markets.

Question Marks within Nidec's portfolio represent areas with high market growth but low current market share, requiring significant investment to develop. These segments, such as specialized drone motors and emerging EV components, are crucial for Nidec's future diversification and leadership in rapidly evolving industries.

Nidec's strategic approach involves substantial capital allocation for research, development, and production scale-up to gain a competitive edge in these nascent markets. The company actively pursues acquisitions in promising sectors, aiming to transform these ventures into future market leaders or Stars.

The success of these Question Marks hinges on effective market penetration strategies, potential partnerships, and continuous innovation to capture a significant share of their expanding markets.

| Segment | Market Growth | Nidec's Market Share | Investment Needs | Strategic Goal |

|---|---|---|---|---|

| Electric Motorcycle Motors | High | Low | High | Transition to Star |

| Drone Motors | Very High | Low | High | Market Leadership |

| Niche Robotics Components | High | Low | High | Market Dominance |

| Emerging EV Components | Very High | Low | High | Future Growth Driver |

BCG Matrix Data Sources

Our Nidec BCG Matrix is built on comprehensive market intelligence, integrating financial reports, industry analysis, and strategic competitor data to provide actionable insights.