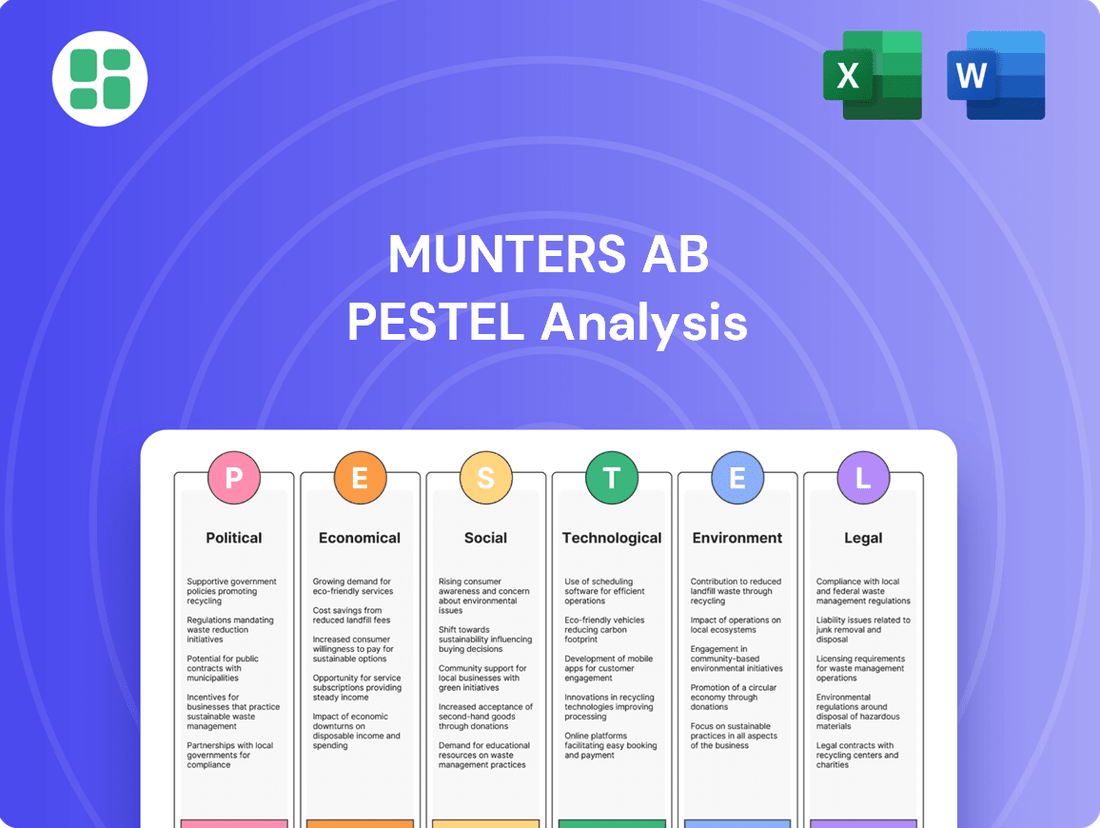

Munters AB PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Munters AB Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Munters AB's trajectory. Our comprehensive PESTLE analysis provides the essential context for strategic decision-making, helping you anticipate challenges and capitalize on opportunities. Download the full report now to gain actionable intelligence and stay ahead of the curve.

Political factors

Governments worldwide are stepping up efforts to promote energy efficiency, particularly in industrial and commercial sectors. This trend is evident in policies like the European Union's Energy Performance of Buildings Directive, which aims for nearly zero-energy buildings by 2030. Such regulations directly boost the market for advanced climate control systems like those offered by Munters, as companies seek to meet new standards and reduce operational costs.

These governmental policies, including carbon pricing mechanisms and stringent energy performance standards, are significant drivers for Munters' business. For instance, the increasing adoption of carbon taxes in various economies incentivizes investments in technologies that lower energy consumption. Munters' dehumidification and climate control solutions are well-positioned to capitalize on this demand, as they demonstrably reduce energy usage compared to traditional systems.

Staying ahead of these evolving regulatory landscapes is paramount for Munters. The company's ability to adapt its product offerings and demonstrate compliance with frameworks such as the US Department of Energy's energy efficiency standards for commercial equipment will be key to maintaining its competitive edge and market share. This proactive approach ensures Munters remains a relevant and valuable partner for businesses navigating the energy transition.

Global trade policies, including tariffs and import/export restrictions, significantly influence Munters' operational costs and market reach. For instance, the ongoing trade tensions between major economies can lead to increased duties on components, impacting the cost of goods sold. In 2024, the World Trade Organization (WTO) reported that the value of world merchandise trade was projected to grow by 2.6%, a modest increase but one that still highlights the importance of navigating these international agreements.

Fluctuations in international trade relations directly affect the pricing of essential raw materials and the cost of exporting Munters' climate control solutions. Changes in trade agreements, such as those impacting the European Union or North America, can alter the competitiveness of products in different regions. Munters' ability to adapt to these policy shifts is crucial for managing operational expenses and ensuring successful market penetration in a dynamic global landscape.

Government industrial policies, especially those favoring sectors like food processing and data centers, can directly benefit Munters by creating new market avenues. For instance, the EU's focus on boosting domestic semiconductor production through initiatives like the European Chips Act, which aims to mobilize €43 billion in public and private investment by 2030, could indirectly increase demand for advanced climate control solutions in related manufacturing processes.

Subsidies aimed at technological upgrades and sustainable infrastructure development are also crucial. In 2024, many governments are continuing or expanding programs for energy efficiency and green building, which can significantly lower the barrier for customers to adopt Munters' advanced climate solutions, thereby accelerating market penetration.

Munters can strategically position its products and services to align with these evolving policy landscapes. By highlighting how its solutions contribute to energy savings and sustainability goals, the company can effectively leverage governmental support and capture emerging opportunities in sectors prioritized by industrial policy.

Geopolitical Stability

Geopolitical stability is a critical consideration for Munters AB, impacting its global operations and strategic planning. Political unrest or international conflicts in key operating regions can directly disrupt Munters' ability to conduct business, secure its supply chains, and access new markets. For instance, ongoing geopolitical tensions in Eastern Europe, which began in early 2022, have led to increased logistical costs and supply chain volatility for many European manufacturers, a trend likely affecting Munters' European operations and sourcing.

Conversely, a stable political environment is paramount for long-term planning and consistent market growth, especially for a company with a significant international footprint like Munters. The company's presence in diverse markets means that regional political stability directly influences its investment decisions and operational continuity. Munters' 2024 outlook, like many global industrial players, will be influenced by the resolution of existing geopolitical challenges and the emergence of new ones, with a stable environment fostering predictable demand and operational efficiency.

The company's reliance on global supply chains means that events such as trade disputes or sanctions between major economic blocs could significantly increase costs and introduce operational risks. For example, the ongoing trade friction between the United States and China, which has persisted through 2023 and into 2024, necessitates careful management of sourcing and market access strategies for companies like Munters.

- Impact on Supply Chains: Geopolitical instability can lead to disruptions in the availability and cost of raw materials and components, affecting Munters' production schedules and profitability.

- Market Access: Political unrest or sanctions can limit or close off access to important markets, hindering sales growth and diversification efforts.

- Investment Climate: A stable political landscape encourages foreign direct investment and long-term capital allocation, which is crucial for Munters' expansion and R&D initiatives.

- Operational Costs: Increased security measures, logistical rerouting, and currency fluctuations driven by geopolitical events can elevate operating expenses for Munters.

Public Procurement Policies

Public procurement policies, particularly those influencing government-funded or supported operations, increasingly favor suppliers demonstrating robust Environmental, Social, and Governance (ESG) performance and offering energy-efficient technologies. Munters' core commitment to sustainability and energy savings directly addresses these demands, positioning the company favorably for substantial tender bids.

Navigating and tailoring proposals to meet these specific procurement stipulations can translate into a significant competitive edge. For instance, in 2023, the European Union's public procurement market saw a notable increase in tenders with sustainability criteria, with many member states actively pursuing green public procurement initiatives. Munters' ability to showcase its energy-efficient solutions, like its advanced dehumidification systems, directly taps into this growing market segment, potentially securing contracts for public infrastructure projects and government facilities.

- ESG Alignment: Munters' sustainability focus meets government procurement mandates for responsible sourcing.

- Energy Efficiency Focus: Demand for energy-saving solutions in public projects creates opportunities for Munters' technologies.

- Competitive Advantage: Tailoring bids to public procurement requirements can unlock significant tender wins.

Governmental focus on energy efficiency and sustainability directly benefits Munters, as policies like the EU's Energy Performance of Buildings Directive drive demand for its climate control solutions. Carbon pricing and energy performance standards further incentivize investments in technologies that reduce consumption, aligning perfectly with Munters' offerings.

Trade policies and geopolitical stability significantly impact Munters' operational costs and market access. For example, ongoing trade tensions between major economies can increase component costs, as seen in the persistent US-China trade friction impacting global sourcing strategies into 2024. Munters must navigate these dynamics to manage expenses and ensure market penetration.

Industrial policies favoring sectors like data centers and food processing, coupled with subsidies for technological upgrades, create new avenues for Munters. The EU's €43 billion European Chips Act, for instance, could indirectly boost demand for advanced climate control in manufacturing. Furthermore, government programs for green building in 2024 continue to lower adoption barriers for Munters' solutions.

Public procurement policies increasingly favor ESG-compliant and energy-efficient suppliers. Munters' sustainability and energy-saving solutions align with these demands, making it well-positioned for significant tender bids, especially as the EU saw increased tenders with sustainability criteria in 2023.

What is included in the product

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting Munters AB across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive overview of how these forces shape the company's operational landscape and strategic decision-making.

Provides a concise version of Munters AB's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to address market uncertainties and competitive pressures.

Economic factors

Global economic growth significantly impacts Munters' business. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, indicating a potentially more cautious investment environment for Munters' clients.

Industrial output is a key driver for Munters. A robust industrial sector, particularly in areas like food processing and data centers, fuels demand for climate control and drying solutions. However, if industrial production falters, as seen in some regions experiencing manufacturing slowdowns in late 2023 and early 2024, Munters could face reduced order volumes.

Economic downturns directly affect customer spending. During periods of economic contraction, companies often postpone capital expenditures, including investments in new climate control systems. This can lead to longer sales cycles and lower revenue for Munters, as observed during the economic uncertainties of 2020-2021.

Fluctuations in global energy prices directly influence the operational expenses for Munters' clientele, affecting how much they value energy-efficient technologies. For instance, as of early 2024, Brent crude oil prices have seen volatility, trading in the range of $75-$85 per barrel, which directly impacts industrial energy costs.

When energy prices surge, Munters' dehumidification and cooling systems become more appealing as their inherent energy-saving features offer a clearer return on investment. This heightened attractiveness was evident in late 2023 when industrial electricity prices in some European countries increased by over 15% year-on-year, making energy-efficient upgrades a priority for many manufacturers.

Conversely, periods of stable or decreasing energy prices can temper the immediate demand for investing in new, energy-efficient equipment. If energy costs remain subdued, as seen in some regions during mid-2024 with natural gas prices falling below pre-2022 levels, the incentive for customers to upgrade older, less efficient machinery might diminish.

Inflationary pressures in 2024 and early 2025 have continued to impact input costs for manufacturers like Munters. For instance, global producer prices for manufactured goods saw a notable increase in late 2024, driven by energy and raw material costs. This directly translates to higher expenses for Munters in areas like steel, refrigerants, and components, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Rising interest rates, a trend observed through 2024 and projected to persist into early 2025 in many key markets, can dampen demand for Munters' capital-intensive climate solutions. Higher borrowing costs make it more expensive for customers, particularly in sectors like agriculture and data centers, to finance large projects. This could lead to delayed or scaled-back investments, impacting Munters' order intake and revenue growth.

To navigate these economic headwinds, Munters' strategy likely involves a dual approach: rigorous cost management to absorb some of the increased input expenses and strategic pricing adjustments to reflect the inflationary environment. Maintaining competitive pricing while ensuring profitability will be crucial. Furthermore, exploring financing options or partnerships for their customers could help mitigate the impact of higher interest rates on demand for their climate control systems.

Currency Exchange Rate Volatility

Currency exchange rate volatility is a significant factor for Munters AB, a global enterprise dealing in multiple currencies. Fluctuations can directly affect their reported financial performance, impacting revenues and profits when translated back to their reporting currency. For instance, a stronger Swedish Krona (SEK) against other major currencies could reduce the value of overseas earnings when converted.

These movements also influence the cost of goods and services. If Munters imports components or machinery, a weaker SEK would increase these costs, potentially squeezing profit margins. Conversely, if they export heavily, a weaker SEK would make their products more competitive abroad, boosting sales volume but potentially lowering the translated profit per unit.

In 2024, many global currencies experienced significant shifts. For example, the Euro (EUR) saw fluctuations against the US Dollar (USD) due to differing economic growth rates and monetary policies. Munters, with operations in both the Eurozone and North America, would have navigated these changes. Hedging strategies are crucial; Munters likely employs financial instruments to lock in exchange rates for future transactions, thereby mitigating some of this risk.

Munters' diversified market presence is also a key strategy. By operating in numerous countries, they can offset negative impacts in one region with positive performance in another. This global footprint helps to smooth out the effects of localized currency swings.

- Impact on Revenue: A stronger SEK in 2024 could have reduced the reported value of Munters' foreign currency sales.

- Cost of Imports: For components sourced from countries with weaker currencies relative to SEK, costs would rise.

- Profitability Squeeze: Unfavorable movements can directly impact the bottom line by increasing costs or decreasing the value of foreign earnings.

- Mitigation Strategies: Munters likely utilizes currency hedging and maintains a balanced geographical revenue stream to manage these risks.

Customer Capital Expenditure Budgets

Customer capital expenditure budgets are a direct determinant of demand for Munters' climate control solutions. When businesses feel confident about the economy and their industry's future, they tend to increase spending on new equipment and facility upgrades, which directly benefits Munters. For instance, in 2024, many industrial sectors are seeing a cautious but upward trend in CapEx as companies invest in efficiency and modernization.

Munters' sales are intrinsically linked to these investment cycles. A strong economic outlook generally translates to higher customer CapEx, leading to increased orders for Munters' products and services. Conversely, economic downturns or uncertainty can lead to postponed or reduced capital spending by customers, impacting Munters' revenue.

- Increased CapEx in 2024 for data centers and advanced manufacturing is a key growth driver for Munters.

- Customer confidence in sectors like food and beverage processing directly correlates with their willingness to invest in climate control upgrades.

- Global supply chain disruptions in 2023-2024 have caused some customers to re-evaluate and potentially increase CapEx for localized production facilities, benefiting Munters.

- The semiconductor industry's significant planned CapEx increases through 2025 present a substantial opportunity for Munters' specialized climate control solutions.

Munters' performance is closely tied to global economic health, with projected global growth of 3.2% in 2024 by the IMF suggesting a potentially cautious investment climate for its customers. Industrial output, particularly in sectors like data centers and food processing, directly drives demand for Munters' climate control and drying solutions, while economic downturns can lead to postponed capital expenditures, impacting order volumes.

Fluctuating energy prices, with Brent crude around $75-$85 per barrel in early 2024, influence customer demand for energy-efficient technologies, making Munters' solutions more attractive during price surges. However, rising inflation in 2024-2025 increases Munters' input costs for components like steel and refrigerants, potentially squeezing margins if not passed on.

Higher interest rates throughout 2024-2025 also pose a challenge, making it more expensive for customers to finance large projects, which could slow down investment in climate solutions. Munters likely navigates these economic factors through cost management, strategic pricing, and exploring customer financing options.

Currency volatility, with significant shifts in major currencies like EUR/USD in 2024, impacts Munters' reported earnings and the cost of goods. The company's global presence and hedging strategies are crucial for mitigating these risks, allowing it to offset regional currency impacts with diversified revenue streams.

| Economic Factor | Impact on Munters | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Influences customer investment and demand for climate solutions. | IMF projected 3.2% global growth in 2024. |

| Industrial Output | Directly drives demand for Munters' products in key sectors. | Manufacturing slowdowns observed in some regions late 2023/early 2024. |

| Energy Prices | Affects operational costs for clients and attractiveness of energy-efficient tech. | Brent crude oil trading $75-$85/barrel early 2024; European industrial electricity prices up >15% YoY late 2023. |

| Inflation | Increases input costs for Munters (steel, refrigerants). | Global producer prices for manufactured goods increased late 2024. |

| Interest Rates | Dampens demand for capital-intensive solutions due to higher borrowing costs. | Rising interest rates observed through 2024, projected to persist into early 2025. |

| Currency Exchange Rates | Affects reported revenue and cost of goods for a global company. | Significant shifts in EUR/USD in 2024; potential for stronger SEK to reduce foreign earnings value. |

| Customer Capital Expenditure | Directly correlates with demand for Munters' climate control systems. | Cautious but upward trend in CapEx in many industrial sectors in 2024; significant planned CapEx increases in semiconductor industry through 2025. |

Same Document Delivered

Munters AB PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Munters AB delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their business. Understand the external forces shaping Munters' strategy and market position.

Sociological factors

There's a rising understanding, both by everyday people and businesses, that the air we breathe indoors really matters for our well-being, safety, and how much we can get done. This growing awareness is fueling a greater need for sophisticated systems that can clean and manage indoor air.

This is especially true for places like pharmaceutical manufacturing, food production facilities, and data centers. In these critical environments, maintaining very specific air conditions isn't just a nice-to-have; it's essential for operations. Munters’ offerings are perfectly positioned to meet these exact demands for precise environmental control.

For example, the global indoor air quality market was valued at approximately $10.5 billion in 2023 and is projected to reach over $20 billion by 2030, showing a strong compound annual growth rate. This expansion is directly linked to increased health consciousness and regulatory pressures.

Societal expectations are increasingly pushing companies towards robust sustainability and Corporate Social Responsibility (CSR) initiatives. Consumers, particularly those with strong ESG (Environmental, Social, and Governance) commitments, are actively seeking out suppliers that align with their values. This trend directly supports businesses like Munters, whose core offerings are centered on energy efficiency.

Munters' focus on energy-efficient solutions, such as advanced climate control systems, directly addresses this growing demand. In 2024, the global market for green building solutions, a key area for energy-efficient technologies, was projected to reach over $280 billion, indicating a substantial market opportunity driven by these societal shifts.

Global population growth, projected to reach approximately 9.7 billion by 2050 according to UN data, coupled with increasing urbanization, with over half the world’s population now living in cities, directly impacts demand for essential services. This surge fuels the need for advanced infrastructure in areas like food production, healthcare facilities, and the burgeoning data center sector, all of which require precise environmental control.

Munters' expertise in creating controlled environments, particularly through its dehumidification and cooling solutions, positions it to address the evolving needs of these expanding urban centers and their associated industrial demands. For instance, the data center industry, a key market for Munters, is experiencing rapid growth; by 2026, global data center traffic is expected to reach 207 exabytes per month, underscoring the critical need for efficient climate management solutions.

Workforce Health and Safety Standards

Societal expectations for robust workforce health and safety standards, particularly in industrial environments, are driving increased investment in improved working conditions. This heightened focus directly translates into a greater demand for advanced climate control and air purification systems, essential for creating safer workplaces. Munters' innovative air treatment technologies are well-positioned to meet this growing need, directly supporting the creation of healthier and more secure industrial settings that align with these evolving global standards.

The increasing stringency of occupational health and safety regulations worldwide underscores this trend. For instance, in 2023, the European Agency for Safety and Health at Work (EU-OSHA) reported a continued emphasis on preventing accidents and improving working environments across member states. This regulatory push incentivizes companies to adopt technologies that enhance air quality and climate stability.

- Global regulatory frameworks, such as those from OSHA in the US and EU-OSHA, are increasingly mandating higher standards for workplace air quality and environmental control.

- In 2024, many industrial sectors are seeing increased spending on health and safety infrastructure, with a significant portion allocated to environmental management systems.

- Munters' solutions directly address these mandates by providing reliable climate control and air purification, thereby enhancing worker well-being and operational safety.

- The financial benefits for companies adopting such technologies include reduced absenteeism, lower insurance premiums, and improved productivity, further solidifying the demand for advanced solutions.

Technological Adoption and Digital Literacy

Societal comfort with technology directly impacts how quickly advanced, digitally integrated climate solutions are adopted. As more businesses and individuals become digitally savvy, there's a growing openness to adopting smart, IoT-enabled air treatment systems. For instance, a 2024 report indicated that over 70% of businesses surveyed were actively investing in IoT solutions to improve operational efficiency, a trend likely to continue into 2025.

Munters' success in this evolving landscape hinges on its capacity to provide intuitive and connected products. This aligns with the increasing digital literacy observed globally; by mid-2024, smartphone penetration had surpassed 85% in many developed markets, signaling a population comfortable with digital interfaces. This trend suggests a strong market appetite for sophisticated yet user-friendly climate control technologies.

- Digital Comfort: A majority of consumers and businesses in key markets now expect digital integration in their solutions.

- IoT Investment: Businesses are increasingly allocating budgets towards IoT technologies for enhanced control and data insights.

- User Experience Focus: Solutions that offer seamless digital interaction and easy management are favored, reflecting higher digital literacy.

- Connectivity Demand: The expectation for connected devices, enabling remote monitoring and adjustments, is a growing trend in climate control.

Societal emphasis on health and well-being directly fuels demand for advanced indoor air quality solutions. This is evident as the global indoor air quality market is projected to exceed $20 billion by 2030, driven by increased health consciousness.

Growing expectations for corporate sustainability and CSR initiatives mean companies like Munters, which offer energy-efficient solutions, are increasingly favored. The green building solutions market, a key area for such technologies, was valued at over $280 billion in 2024.

Increased urbanization and population growth, with global population expected to reach 9.7 billion by 2050, necessitate better infrastructure, including climate-controlled facilities for sectors like data centers, which are experiencing rapid expansion.

Munters' climate solutions are well-aligned with these societal shifts, addressing the growing need for healthier workplaces and more efficient, digitally integrated environmental controls.

| Sociological Factor | Impact on Munters | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Health & Well-being Awareness | Increased demand for air purification and climate control. | Global IAQ market projected to reach $20B+ by 2030 (from ~$10.5B in 2023). |

| Sustainability & CSR Focus | Preference for energy-efficient solutions. | Green building solutions market >$280B in 2024. |

| Urbanization & Population Growth | Higher demand for climate control in critical infrastructure (e.g., data centers). | Global data center traffic expected to reach 207 EB/month by 2026. |

| Digital Literacy & IoT Adoption | Market receptiveness to smart, connected climate solutions. | Over 70% of businesses investing in IoT for efficiency (2024 report). |

Technological factors

Continuous innovation in materials science, heat transfer, and control systems is a significant technological driver. These advancements are leading to more energy-efficient dehumidification and cooling technologies, directly impacting the performance and cost-effectiveness of solutions like those offered by Munters.

Munters' capacity to incorporate these cutting-edge developments into its product lines is essential for its competitive standing and its ability to address the increasing market need for sustainable solutions. For instance, by 2024, the global market for energy-efficient HVAC systems was projected to reach over $150 billion, highlighting the commercial importance of such innovations.

Sustained investment in research and development is therefore paramount for Munters to maintain its position at the vanguard of energy efficiency. This focus ensures their offerings remain relevant and competitive in a rapidly evolving technological landscape, particularly as energy costs and environmental regulations continue to tighten.

The growing integration of IoT and digitalization is transforming industrial equipment, enabling remote monitoring and predictive maintenance for systems like air treatment. Munters can capitalize on this trend by offering smarter, data-driven solutions that boost customer efficiency and minimize downtime. For instance, by 2024, the global IoT market is projected to reach over $1.1 trillion, highlighting a significant opportunity for companies like Munters to embed connected technologies into their offerings.

The push for more sustainable cooling solutions is accelerating, with ongoing research into new refrigerants and methods like adiabatic and indirect evaporative cooling. Munters needs to integrate these innovations into its offerings to meet stricter environmental standards, such as the F-Gas Regulation updates in Europe, which aim to phase down high-GWP refrigerants.

Adapting to these technological shifts requires significant investment in research and development. For instance, companies in the HVAC sector are allocating substantial budgets to explore natural refrigerants like propane and CO2, a trend Munters must follow to remain competitive and provide environmentally conscious alternatives to its global customer base.

Automation and AI in Manufacturing and Operations

Munters is leveraging automation and AI to boost manufacturing efficiency and product quality. This integration is key to improving precision and cost-effectiveness in their production lines, a trend seen across the industrial sector. For instance, the global industrial automation market was valued at approximately $235 billion in 2023 and is projected to grow significantly, with AI playing an increasingly vital role.

Beyond production, Munters is applying AI to optimize its installed air treatment systems. This allows for enhanced energy savings and enables predictive maintenance for customers, offering a valuable service upgrade. By 2025, AI in industrial applications is expected to drive substantial operational efficiencies, with companies reporting significant cost reductions and performance improvements.

- Enhanced Production: Automation and AI improve precision and reduce costs in Munters' manufacturing.

- Optimized Systems: AI enhances energy efficiency and enables predictive maintenance for customer equipment.

- Market Growth: The industrial automation market, driven by AI, is experiencing robust expansion.

Data Analytics for Climate Optimization

Munters is leveraging advanced data analytics to refine climate control systems. This technology allows for a deeper understanding of specific environmental needs across diverse industrial settings, leading to optimized system performance and significant energy savings for clients. For instance, by analyzing data from its extensive installed base, Munters can develop smarter algorithms for its control systems, directly translating into enhanced climate management and tangible energy efficiency insights for customers.

This strategic integration of data analytics significantly bolsters Munters' value proposition. The company's ability to provide customers with data-driven insights into their climate operations not only improves system efficiency but also offers a competitive edge. Munters reported that its focus on digital solutions and data services contributed to its growth in recent periods, reflecting the increasing market demand for intelligent, connected environmental control.

- Enhanced Efficiency: Data analytics allows for precise tuning of climate control, reducing energy consumption by up to 15% in some applications.

- Predictive Maintenance: Analyzing operational data enables Munters to predict potential equipment failures, minimizing downtime.

- Customer Value: Providing actionable insights through data empowers customers to make informed decisions about their climate management strategies.

Technological advancements in materials science and heat transfer are driving the development of more energy-efficient dehumidification and cooling solutions. Munters' ability to integrate these innovations, such as indirect evaporative cooling, is crucial for meeting market demand for sustainable technologies. By 2024, the global market for energy-efficient HVAC systems was projected to exceed $150 billion, underscoring the commercial significance of these technological leaps.

Legal factors

Munters operates under increasingly stringent environmental protection laws and evolving emissions standards, especially concerning refrigerants, energy efficiency, and industrial waste management. These regulations directly influence the design and manufacturing of their climate control solutions.

Compliance with global standards, such as the EU's F-gas regulation, is critical for Munters to avoid penalties and secure market access. For instance, the F-gas regulation aims to phase down the use of hydrofluorocarbons (HFCs) due to their high global warming potential, pushing companies like Munters to develop and adopt lower-GWP alternatives in their cooling systems.

Furthermore, Munters' offerings play a crucial role in enabling their customers to meet their own environmental compliance objectives. By providing energy-efficient and low-emission technologies, Munters helps clients reduce their carbon footprint and adhere to national and international environmental targets, a factor increasingly scrutinized by investors and regulators alike in 2024 and beyond.

Industrial facilities operate under stringent health and safety regulations, mirroring standards like OSHA in the United States, which mandate specific requirements for indoor air quality, ventilation systems, and the secure operation of industrial machinery. Munters' advanced air treatment technologies are designed not only to meet these critical compliance needs but also to actively support clients in fostering safer working environments for their employees.

Failure to adhere to these comprehensive safety mandates can expose companies to significant legal repercussions, including substantial fines and potential operational shutdowns, alongside considerable damage to their public image and brand reputation. For instance, in 2023, workplace safety violations in the manufacturing sector resulted in billions of dollars in penalties globally, underscoring the financial risks associated with non-compliance.

Munters' success in sectors like food processing and pharmaceuticals hinges on adherence to rigorous legal frameworks such as HACCP and GMP. These regulations mandate precise environmental conditions to guarantee product safety and quality, making compliance a critical factor for their customers.

The company's ability to design and certify solutions that meet these exacting standards, including tight control over temperature, humidity, and air purity, is a significant competitive advantage. For instance, in 2024, the global pharmaceutical excipients market, a sector heavily reliant on controlled environments, was valued at over $9 billion, highlighting the substantial demand for compliant solutions.

Intellectual Property Rights and Patents

Intellectual property rights are foundational to Munters' market position, safeguarding its innovative dehumidification, cooling, and air purification technologies. The company actively pursues patents to protect its unique solutions from unauthorized replication, a critical element in maintaining its competitive edge. In 2023, Munters continued its investment in R&D, with a significant portion allocated to developing and protecting new intellectual property, underscoring the legal framework's importance in securing these advancements.

Munters' strategy involves not only obtaining patents but also rigorously enforcing them to deter infringement and protect its investment in research and development. This legal vigilance is essential for ensuring that the company can continue to capitalize on its technological innovations. The global landscape of patent law, including varying enforcement mechanisms across different jurisdictions, directly impacts Munters' ability to leverage its IP portfolio effectively.

- Patent Portfolio Strength: Munters maintains a robust portfolio of patents covering its core technologies, providing a significant barrier to entry for competitors.

- R&D Investment Protection: Legal frameworks for intellectual property are vital for recouping substantial R&D expenditures by preventing imitation of proprietary solutions.

- Global IP Strategy: Navigating and adhering to diverse international patent laws is crucial for safeguarding Munters' innovations across its operating markets.

International Trade Laws and Sanctions

International trade laws, including sanctions, export controls, and customs regulations, significantly impact Munters' global operations. For instance, the evolving sanctions landscape, particularly concerning Russia and other geopolitical hotspots, directly influences the company's ability to supply equipment and services to certain regions, potentially affecting revenue streams. In 2023, the global trade compliance software market was valued at approximately $2.4 billion, highlighting the complexity and cost associated with navigating these regulations.

Compliance is not merely a legal obligation but a critical operational necessity for Munters. Failure to adhere to these intricate legal frameworks can result in substantial fines, disruptions to vital supply chains, and outright restrictions on entering key markets. For example, a single breach of export controls could lead to significant financial penalties and reputational damage, impacting future business opportunities.

Munters must continuously monitor shifting geopolitical developments and proactively adapt its trade strategies. This legal challenge demands constant vigilance and flexibility. As of early 2024, trade disputes and the implementation of new tariffs by major economies continue to create an unpredictable environment for international businesses like Munters, requiring agile responses to maintain market access and operational continuity.

- Sanctions Impact: Geopolitical tensions and sanctions directly affect Munters' ability to operate in specific markets, potentially limiting sales and service opportunities.

- Compliance Costs: Adhering to diverse international trade laws, export controls, and customs regulations incurs significant operational and administrative costs, estimated to be a growing concern for global companies.

- Supply Chain Risk: Non-compliance or sudden regulatory changes can disrupt Munters' global supply chains, leading to delays and increased costs for components and finished goods.

- Market Access: Navigating complex trade laws is essential for maintaining and expanding market access, with trade barriers and restrictions posing a constant challenge to international growth strategies.

Munters must navigate a complex web of global and local legal frameworks, impacting everything from product design to market entry. Compliance with environmental regulations, such as the EU's F-gas regulation phasing out high-GWP refrigerants, directly influences their product development, pushing for greener alternatives. In 2024, the focus on sustainability continues to intensify, making adherence to these laws critical for market access and avoiding penalties.

Health and safety laws, similar to OSHA standards, mandate safe working conditions, influencing the design of ventilation and air quality systems that Munters provides. Failure to comply can result in significant fines, as seen with billions in penalties for workplace safety violations in the manufacturing sector in 2023. Intellectual property rights are also paramount, with Munters investing in patents to protect its innovations, a strategy reinforced by the global intellectual property market's growth.

International trade laws, including sanctions and export controls, add another layer of complexity, affecting global supply chains and market access. The global trade compliance software market, valued at approximately $2.4 billion in 2023, reflects the significant resources companies dedicate to navigating these regulations. Munters' ability to adapt to evolving geopolitical landscapes and trade policies is key to maintaining operational continuity and market presence.

Environmental factors

Growing global concern about climate change is a significant tailwind for Munters. This heightened awareness is fueling demand for technologies that reduce energy consumption and lower carbon footprints across various sectors. For instance, the International Energy Agency reported that buildings account for nearly 40% of global energy-related CO2 emissions, highlighting the critical need for efficient HVAC solutions.

Munters' core offering of energy-efficient air treatment systems directly addresses these environmental pressures. By minimizing energy usage and reducing greenhouse gas emissions associated with heating, ventilation, and air conditioning processes, their products align perfectly with the market's evolving needs. This trend is a strong positive indicator for Munters' business model, as companies increasingly seek sustainable operational improvements.

Growing global awareness of resource scarcity, especially concerning water, is reshaping industrial operations and driving demand for more water-efficient technologies. Munters' evaporative cooling systems, though utilizing water, often demonstrate superior water efficiency compared to conventional cooling towers in specific industrial contexts. Furthermore, their dehumidification technologies can lead to reduced overall energy consumption, which indirectly contributes to resource conservation.

Developing solutions that actively minimize water usage is a critical environmental focus for companies like Munters. For instance, in 2024, the global water scarcity crisis intensified, with reports indicating that over 2 billion people live in countries experiencing high water stress. This context underscores the market opportunity for innovative solutions that address these pressing environmental challenges.

The global momentum towards circular economy principles is significantly influencing manufacturing. This approach emphasizes designing products for extended lifespan, easier repair, and efficient recycling, aiming to minimize waste. For Munters AB, this translates to opportunities in creating more durable equipment and optimizing material usage in their dehumidification and climate control solutions.

Munters can actively participate by developing robust products that require less frequent replacement and by exploring take-back programs for their machinery at the end of its service life. This strategy not only reduces their environmental footprint but also aligns with increasing regulatory and consumer demand for sustainable practices. For instance, the European Union's Circular Economy Action Plan, updated in 2024, sets ambitious targets for waste reduction and resource efficiency, directly impacting companies like Munters operating within or supplying to the EU market.

Corporate Environmental Footprint Reduction

Munters AB operates in an environment where stakeholders, from investors to consumers, are increasingly demanding that companies actively reduce their environmental impact. This pressure manifests as a push for lower energy consumption, reduced waste, and decreased emissions across all industries. For instance, the European Union’s Green Deal aims for climate neutrality by 2050, signaling a significant shift in regulatory and market expectations that directly impacts industrial operations.

Munters' core business directly addresses this growing concern. Their solutions are designed to help clients significantly decrease their operational environmental footprint. By improving energy efficiency and optimizing processes, Munters positions itself as a crucial partner for businesses striving to meet their own sustainability targets. This symbiotic relationship means that as customer pressure for environmental responsibility intensifies, so does the demand for Munters' innovative offerings.

- Growing Stakeholder Pressure: Investors and consumers are increasingly prioritizing companies with strong environmental, social, and governance (ESG) performance.

- Munters' Value Proposition: Munters’ technologies enable customers to reduce energy consumption by up to 30% in certain applications, directly lowering their operational environmental impact.

- Market Demand Driver: The global push for decarbonization and resource efficiency, exemplified by net-zero commitments from major economies, fuels demand for Munters' sustainable solutions.

- Strategic Partnership: Munters acts as a key enabler for its customers’ sustainability journeys, making its products and services essential for compliance and competitive advantage.

Adaptation to Extreme Weather Events

Climate change is leading to more frequent and intense extreme weather events, such as heatwaves, floods, and storms. This trend is driving demand for advanced climate control systems that can maintain stable internal environments for industrial operations. Munters' expertise in humidity and temperature control directly addresses this need, offering solutions that ensure business continuity for its clients even when external conditions become severe.

For instance, in 2024, several regions experienced record-breaking temperatures and significant disruptions from severe weather. Businesses reliant on precise environmental conditions, like data centers and food processing plants, faced increased risks of operational failure. Munters' dehumidification and cooling technologies are designed to mitigate these risks, providing essential resilience.

The market for climate adaptation solutions is growing, with projections indicating continued expansion through 2025 and beyond. This growth is fueled by the increasing awareness of climate-related risks and the need for robust infrastructure. Munters is well-positioned to capitalize on this trend, offering technologies that enhance the adaptability of industrial facilities.

- Increasing Frequency of Extreme Weather: Reports from 2024 highlighted a notable rise in weather-related disasters globally, impacting supply chains and operations.

- Demand for Resilient Infrastructure: Businesses are prioritizing investments in climate control systems that can withstand adverse environmental conditions to ensure uninterrupted production.

- Munters' Role in Adaptation: The company's energy-efficient solutions for temperature and humidity management are crucial for maintaining operational integrity in a changing climate.

The increasing global focus on sustainability and climate change is a significant driver for Munters. Growing pressure from stakeholders, including investors and consumers, is pushing companies to adopt more environmentally friendly practices, directly benefiting businesses like Munters that offer energy-efficient solutions. For instance, the European Union's ambitious Green Deal, aiming for climate neutrality by 2050, sets a clear direction for market expectations regarding emissions and resource efficiency.

Munters' core technologies, designed to reduce energy consumption and optimize resource use in climate control, are therefore highly relevant. Their solutions help clients achieve substantial energy savings, with some applications demonstrating up to a 30% reduction in energy use. This aligns perfectly with the global push for decarbonization and resource efficiency, making Munters a key enabler for businesses seeking to meet their sustainability targets and gain a competitive edge.

The escalating frequency of extreme weather events, as reported throughout 2024, further amplifies the need for robust climate adaptation solutions. Businesses are increasingly investing in systems that can ensure operational continuity despite volatile external conditions. Munters' expertise in precise temperature and humidity management provides essential resilience for critical sectors like data centers and food processing, mitigating risks associated with climate unpredictability.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Munters AB is built on a foundation of diverse and credible data sources, including reports from international organizations like the IEA and IPCC, government energy and environmental policy documents, and reputable industry market research firms. These sources provide comprehensive insights into the political, economic, social, technological, legal, and environmental factors impacting the climate control and industrial solutions sectors.