Munters AB Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Munters AB Bundle

Munters AB faces a dynamic competitive landscape shaped by significant buyer power and the constant threat of substitutes in its climate control solutions market. Understanding the intensity of these forces is crucial for strategic positioning.

The complete report reveals the real forces shaping Munters AB’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Munters AB's reliance on highly specialized components for its advanced air treatment systems, such as those used in dehumidification and evaporative cooling, can significantly influence supplier bargaining power. The proprietary nature of many of these components means there are often few qualified suppliers available, concentrating power in the hands of these specialized providers.

This limited supplier base can lead to higher input costs for Munters, particularly if the switching costs associated with changing suppliers are substantial due to integration with existing designs or contractual obligations. For instance, if a critical component requires extensive re-engineering to accommodate an alternative, Munters faces a deterrent to seeking new suppliers, thereby strengthening the position of incumbent ones.

The supply chains for critical climate technologies, essential for Munters' operations, are often highly concentrated. This means a limited number of companies, frequently located in specific geographic areas, control the production of vital components. This concentration naturally gives these suppliers more leverage.

For instance, in 2024, the semiconductor industry, a key component supplier for advanced climate control systems, continued to experience supply chain vulnerabilities. Major chip manufacturers, while increasing output, still faced demand that outstripped capacity in certain specialized segments, allowing them to command premium pricing. This situation directly impacts companies like Munters that rely on these sophisticated electronic parts.

This concentration of suppliers means Munters has fewer alternatives when sourcing key materials. Any disruptions, whether due to geopolitical events, natural disasters, or production issues at these few dominant suppliers, can create significant bottlenecks. Such disruptions can directly affect Munters' production schedules and lead to increased costs, as they may have to pay more to secure limited supply.

Munters' focus on energy-efficient solutions means suppliers of advanced materials crucial for these technologies hold significant bargaining power. Companies providing innovative, high-performance components that meet strict environmental and efficiency standards can likely charge premium prices. This is especially true as global demand for sustainable products continues to rise, exemplified by the growing market for green building materials, which saw a global market size of approximately $244 billion in 2023, projected to reach over $370 billion by 2028.

Impact of Global Supply Chain Dynamics

Global supply chain dynamics, influenced by geopolitical shifts and economic unpredictability, significantly impact the cost and availability of essential raw materials and components for companies like Munters AB. Munters' broad international footprint, with operations in over 30 countries, exposes it to these widespread risks, potentially empowering suppliers in stable or critical regions.

For instance, disruptions in the semiconductor market, a key component for many of Munters' advanced control systems, can lead to price hikes and extended lead times. In 2024, ongoing trade tensions and localized conflicts continued to create volatility, with some suppliers leveraging their control over niche or strategically vital materials.

- Geopolitical Instability: Events in key manufacturing regions can disrupt production and increase raw material costs.

- Economic Volatility: Fluctuations in currency exchange rates and inflation directly affect the price of components sourced globally.

- Supplier Concentration: Industries with fewer dominant suppliers for critical components can see increased supplier bargaining power.

- Logistics and Transportation Costs: Rising fuel prices and shipping container shortages in 2024 continued to add to the overall cost of goods.

Supplier Innovation and Technology Leadership

Suppliers leading in innovation, particularly in materials science or critical component technology for air treatment, can significantly influence Munters AB. For instance, if a supplier introduces a breakthrough technology that demonstrably improves the energy efficiency or filtration capabilities of Munters' systems, the company might find itself reliant on that specific supplier's expertise. This reliance can translate into greater bargaining power for the supplier.

Munters' potential dependence on such technologically advanced suppliers can lead to increased costs or limited product development options if those suppliers leverage their position. For example, a supplier holding patents on advanced desiccant materials or high-efficiency fan technology could command premium pricing. Munters' strategy may involve fostering strong partnerships and even co-development initiatives to secure access to these innovations and mitigate supplier power.

- Supplier Innovation Impact: Suppliers at the cutting edge of materials science or component technology for air treatment systems hold substantial sway.

- Dependence on Proprietary Tech: If a supplier offers unique technology that boosts Munters' product performance or lowers production costs, Munters may become dependent.

- Relationship Management: This interdependence encourages Munters to cultivate robust supplier relationships and consider investing in their development to ensure continued access to vital innovations.

The bargaining power of suppliers for Munters AB is notably high due to reliance on specialized components and limited supplier options. This is exacerbated by global supply chain vulnerabilities, as seen in the semiconductor industry in 2024, where demand outstripped capacity, leading to premium pricing for critical parts.

Munters' focus on energy-efficient solutions further empowers suppliers of advanced materials and technologies, who can command higher prices for innovative components. This dependence on proprietary technology necessitates strong supplier relationships and potential co-development to mitigate risks and ensure access to innovation.

| Factor | Impact on Munters AB | 2024 Data/Trend |

| Supplier Concentration | Limited suppliers for specialized components increase their leverage. | Continued consolidation in niche tech sectors. |

| Proprietary Technology | Dependence on unique innovations strengthens supplier position. | Growth in demand for advanced materials in sustainable tech. |

| Geopolitical & Economic Volatility | Disruptions in key regions and currency fluctuations increase costs. | Ongoing trade tensions and inflation impacting global logistics. |

What is included in the product

This analysis unpacks the competitive intensity faced by Munters AB by examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players in its key markets.

Munters AB Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making on competitive pressures.

Customers Bargaining Power

Munters' climate solutions are often mission-critical for clients in sectors like food processing, pharmaceuticals, and data centers. In these industries, maintaining exact temperature and humidity levels is non-negotiable for product integrity and operational continuity. For instance, in pharmaceutical manufacturing, deviations can lead to costly batch failures, highlighting the essential nature of Munters' offerings.

The critical role these solutions play means customers are less likely to prioritize price over performance and reliability. This dependency can grant Munters a degree of pricing power, as clients understand the significant financial risks of subpar climate control. In 2024, the demand for robust climate control in sensitive industries continued to rise, driven by stricter regulations and the increasing value of goods produced under controlled conditions.

Customers are increasingly prioritizing energy efficiency and sustainability, driven by factors like digitalization and electrification. This means they are actively seeking climate solutions that offer both environmental benefits and long-term operational cost savings. For Munters, this trend presents an opportunity to meet these demands, but it also intensifies the need for competitive pricing and demonstrable performance in these critical areas.

Munters AB caters to a broad spectrum of industries, including critical sectors like data centers and pharmaceuticals, each demanding specialized climate control solutions. This diversity generally dilutes the power of any single customer. However, major industrial clients undertaking large-scale projects, such as constructing a new data center, represent a significant portion of Munters' revenue and can exert considerable influence due to their substantial purchasing volume.

The need for highly customized solutions for these large projects further amplifies customer bargaining power. For instance, a pharmaceutical company requiring precise humidity and temperature control for sterile manufacturing environments might negotiate terms based on the unique engineering and integration services Munters provides. In 2023, Munters reported that its largest customers accounted for a notable percentage of its total sales, underscoring the leverage these clients can wield in price and contract negotiations.

Availability of Competing Solutions

The availability of competing solutions significantly influences the bargaining power of customers in the climate solutions market. While Munters holds a strong global position, the broader landscape features numerous providers offering alternatives in dehumidification and evaporative cooling technologies. This competitive environment empowers customers to shop around, comparing different suppliers based on crucial factors like price, energy efficiency, after-sales support, and the sophistication of their technological offerings. For instance, in 2024, the global industrial dehumidification market was estimated to be worth billions, with a significant portion of that value driven by competition among various established and emerging players.

Customers can leverage the presence of multiple suppliers to negotiate better terms, pushing companies like Munters to maintain competitive pricing and superior value propositions. This dynamic forces Munters to continuously innovate and optimize its product lines and service agreements to retain its market share. The ability for customers to easily switch between providers, especially for standardized solutions, directly translates into increased bargaining power.

- Market Competition: The global climate solutions market, including dehumidification and evaporative cooling, is characterized by a diverse range of competitors.

- Customer Options: Customers have access to numerous providers and technologies, enabling them to compare offerings.

- Key Comparison Factors: Customers evaluate solutions based on cost, efficiency, service, and technological advancements.

- Impact on Munters: This competitive pressure necessitates Munters to remain competitive across all these critical aspects to retain its customer base.

Integration of Smart Technologies and Service Focus

The increasing integration of smart technologies like IoT and AI into HVAC systems significantly empowers customers. They now expect connected solutions offering real-time monitoring and optimization, shifting the focus from mere product sales to ongoing service and performance. For instance, Munters' commitment to innovation in smart solutions, like their Oasis 360 platform, caters to this demand, but also raises customer expectations for advanced features and reliable post-sales support.

This technological shift means customers can more easily compare performance and demand tailored solutions. Munters' strategic focus on service, aiming to enhance customer satisfaction through continuous improvement and support, directly addresses this evolving customer power. However, this also translates into higher customer expectations for functionality, data insights, and responsive technical assistance, potentially increasing their bargaining leverage.

- Smart Technology Integration: Customers increasingly seek HVAC systems with IoT and AI capabilities for remote monitoring and performance optimization, as seen with Munters' smart solutions.

- Service Expectation: Munters' emphasis on service and innovation means customers anticipate advanced features and robust post-sales support, enhancing their demands.

- Data-Driven Demands: The availability of real-time data allows customers to scrutinize performance and negotiate based on quantifiable benefits and service levels.

- Customer Loyalty vs. Leverage: While smart services can foster loyalty, they simultaneously equip customers with greater leverage to demand superior performance and support.

Munters' customers, especially those in critical sectors like data centers and pharmaceuticals, often face high switching costs due to the integrated and specialized nature of climate solutions. These costs can include significant investment in new equipment, recalibration, and potential operational downtime. For example, a pharmaceutical manufacturer relying on Munters' precise humidity control for sterile production would incur substantial expenses and risks in switching to a different supplier, thereby reducing their bargaining power.

However, the increasing availability of standardized climate control components and the growing emphasis on energy efficiency by customers can somewhat offset this. As customers become more informed about alternative technologies and their long-term operational savings, their ability to negotiate better terms increases. In 2024, the market saw a continued push towards modular and adaptable climate solutions, potentially lowering future switching costs for some clients.

Munters' significant market share in certain niche areas, like advanced dehumidification for industrial processes, means some customers have limited alternative suppliers for highly specialized needs. This lack of readily available substitutes for cutting-edge or highly customized solutions grants Munters a stronger position. For instance, a food processing plant requiring highly specific moisture removal capabilities might find few direct competitors offering equivalent performance, thus limiting their bargaining leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Evidence/Example |

|---|---|---|

| Switching Costs | Generally Low to Moderate | High initial investment and operational disruption for specialized, integrated solutions can make switching costly. For example, pharmaceutical clients may face significant recalibration and validation expenses. |

| Product Differentiation | Low to Moderate | While Munters offers specialized solutions, the increasing availability of standardized components and energy-efficient alternatives provides customers with options, slightly enhancing their negotiating position. |

| Availability of Substitutes | Low to Moderate | For highly specialized or mission-critical applications, direct substitutes may be limited, reducing customer leverage. However, for more general climate control needs, a wider array of competitors exists. |

| Price Sensitivity | Moderate | Customers in critical sectors prioritize reliability and performance over price, but are increasingly sensitive to long-term operational costs, including energy efficiency. |

Same Document Delivered

Munters AB Porter's Five Forces Analysis

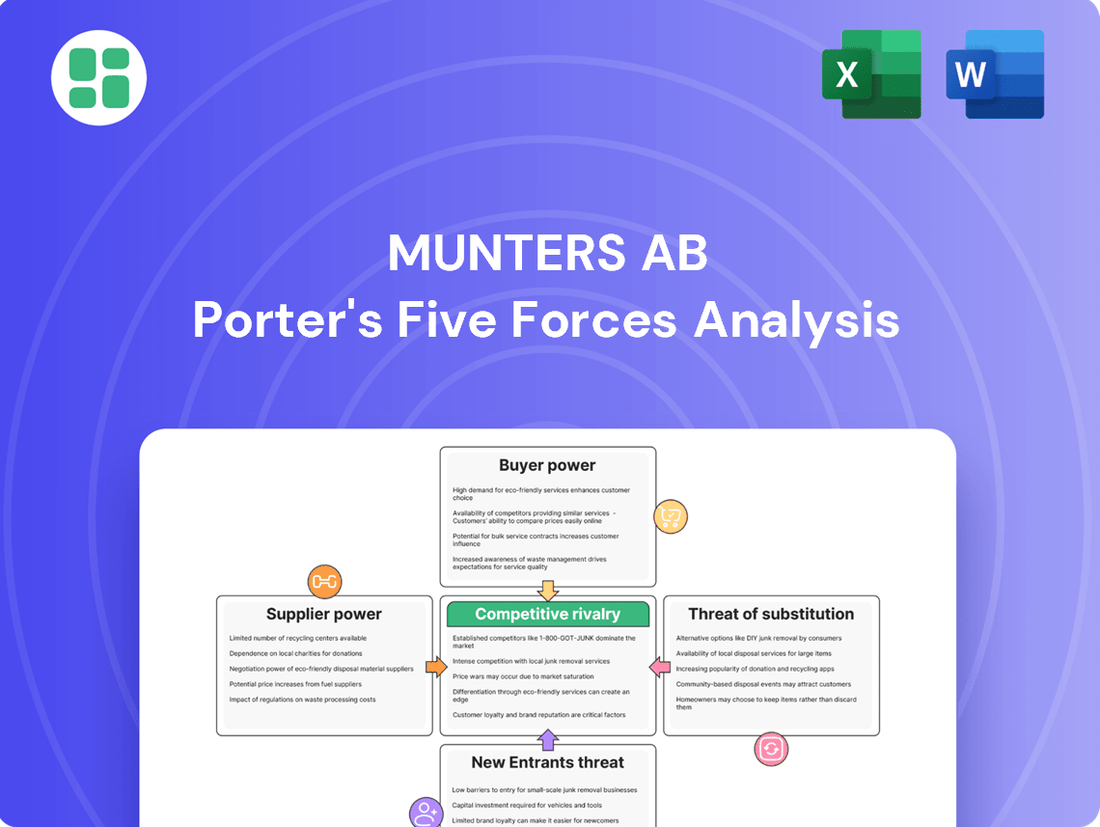

This preview displays the comprehensive Porter's Five Forces analysis for Munters AB, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The insights provided are crucial for understanding Munters AB's industry landscape and strategic positioning. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

Munters AB holds a prominent global leadership position within its niche markets for energy-efficient air treatment and climate solutions. Despite this strong standing, the competitive landscape is populated by a significant number of regional and global competitors, many of whom focus on specific sub-segments such as industrial air filtration or specialized cooling technologies.

This dynamic suggests that while Munters is a key player, its market position is robust rather than overwhelmingly dominant. For instance, in 2024, the global air purification market was valued at approximately USD 15.5 billion and is projected to grow, indicating ample room for multiple strong contenders.

The presence of these specialized players intensifies the rivalry, compelling Munters to prioritize ongoing innovation and robust market differentiation strategies to maintain and expand its competitive edge.

The industrial air treatment and climate solutions market is quite fragmented, meaning there are many different companies competing. These competitors aren't all the same size or focus; you have big, well-known HVAC companies alongside smaller, specialized firms that focus on very specific niches. This diversity means Munters has to be sharp across the board.

Munters faces rivalry from a range of players. For instance, companies like Donaldson Company and Entegris are significant competitors, as are CECO Environmental, Daikin Industries, and Lennox International. Each of these companies brings its own strengths, whether it's a broad product range or a strong presence in certain regions, making the competitive environment dynamic.

The markets Munters AB operates in, such as evaporative cooling, dehumidification, and industrial air filtration, are seeing significant growth. This expansion is largely due to rising environmental awareness and a strong push for greater energy efficiency across industries. For instance, the global dehumidification market was valued at approximately USD 3.5 billion in 2023 and is projected to grow substantially.

This healthy market growth acts like a magnet, attracting new companies and encouraging existing ones to invest more. Consequently, the competitive landscape becomes more crowded and intense. Players are likely to face increased pressure on pricing as more options become available to customers, and marketing expenditures may rise as companies strive to differentiate themselves and capture market share.

Technological Innovation and Product Differentiation

Technological innovation is a major driver of competition in the climate solutions sector. Companies like Munters are continuously pushing the boundaries to develop more energy-efficient, sustainable, and intelligent products. This innovation race means that competitors are also heavily investing in research and development to stay ahead.

Product differentiation is therefore a critical battleground. Competitors are actively diversifying their product portfolios and integrating advanced smart features to offer unique functionalities. For instance, many are focusing on IoT capabilities for remote monitoring and control, and advanced materials for enhanced performance and durability.

Munters' ability to maintain a competitive edge hinges on its capacity to deliver superior performance and innovative features. In 2024, the market saw a significant uptick in demand for solutions that not only reduce operational costs but also contribute to environmental sustainability goals.

- R&D Investment: Competitors' R&D spending is increasing, with a focus on energy efficiency and smart technology integration.

- Product Diversification: Companies are expanding their offerings to include a wider range of climate control solutions, often with customizable options.

- Smart Features: The integration of IoT, AI, and advanced analytics for predictive maintenance and optimized performance is becoming standard.

- Sustainability Focus: Innovations are increasingly geared towards reducing carbon footprints and meeting stringent environmental regulations.

Market Specific Challenges and Opportunities

Munters operates in markets with varied competitive landscapes. Its Data Center Technologies (DCT) segment, for example, is characterized by intense rivalry, driven by rapid technological advancements and a growing demand for efficient cooling solutions. In contrast, the AirTech segment has navigated challenges stemming from a slowdown and overcapacity within the battery market, impacting its competitive positioning and pricing power.

These differing dynamics underscore the need for Munters to implement agile and market-specific strategies. For the DCT business, this might involve focusing on innovation and cost leadership to maintain an edge against numerous competitors. The AirTech segment, however, requires a more nuanced approach, potentially involving diversification or a focus on niche applications to mitigate the impact of broader market oversupply.

- DCT Segment: High competition due to rapid technological evolution and increasing demand for advanced cooling.

- AirTech Segment: Faces challenges from a market slowdown and overcapacity in the battery sector, affecting competitive intensity.

- Strategic Imperative: Tailoring strategies to specific end-markets and regions is crucial for adapting to shifting demand and competitive pressures.

The competitive rivalry within Munters AB's operating sectors remains a significant factor, with a mix of global powerhouses and specialized regional players. This fragmented market compels continuous innovation and strategic differentiation to maintain market share.

For instance, in 2024, the global HVAC market, a broad category encompassing many of Munters' solutions, was estimated to be worth over USD 150 billion, highlighting the scale and the number of participants vying for dominance.

Munters faces direct competition from established entities like Carrier Global Corporation and Trane Technologies, alongside more niche providers focusing on specific technologies such as industrial air filtration or advanced dehumidification systems.

The intensity of this rivalry is further amplified by the rapid pace of technological advancement, particularly in areas like energy efficiency and smart building integration, forcing companies to invest heavily in R&D to stay competitive.

| Competitor | Key Product Areas | 2023 Revenue (Approx. USD Bn) | Key Strengths |

|---|---|---|---|

| Carrier Global Corporation | HVAC, Refrigeration, Fire & Security | 19.7 | Broad product portfolio, global reach |

| Trane Technologies | HVAC & Building Solutions | 17.0 | Energy efficiency focus, integrated solutions |

| Daikin Industries | HVAC, Refrigeration, Chemicals | 26.3 (JPY 3.7 Trillion) | Strong R&D, global manufacturing presence |

| Donaldson Company | Filtration Systems | 3.7 | Specialized filtration expertise, industrial focus |

| CECO Environmental | Air Quality & Fluid Handling | 0.6 | Environmental solutions, industrial applications |

SSubstitutes Threaten

Conventional HVAC and refrigerant-based systems represent a significant threat of substitution for Munters' evaporative cooling solutions. These traditional systems, while often more energy-intensive, are well-established and understood by the market, offering a familiar and sometimes preferred solution, particularly in regions where high humidity is a concern and precise temperature control is critical.

The widespread availability and established infrastructure for conventional AC units mean they can be a readily accessible alternative. For instance, in 2024, the global air conditioning market was valued at over $120 billion, indicating its substantial market presence and the entrenched nature of these substitute technologies.

Munters' desiccant dehumidification systems encounter competition from readily available refrigerant-based compressor dehumidifiers. These alternatives are often more cost-effective for lower humidity levels or warmer ambient temperatures, a segment where Munters' core desiccant technology might be less economically advantageous. For example, in residential or light commercial settings, compressor units are prevalent due to their lower initial purchase price.

The decision between desiccant and refrigerant technology hinges on application specifics like target humidity, operating temperature, and energy consumption goals. While desiccant systems excel in low-temperature, low-humidity environments, refrigerant systems are typically more energy-efficient at higher temperatures and humidity levels. This technological divergence allows customers to select solutions that best match their operational parameters, presenting a threat if Munters' value proposition isn't clearly differentiated.

The market provides a wide array of dehumidifier capacities and types, enabling customers to tailor their choices to precise requirements and financial constraints. This broad availability of alternatives, from compact portable units to industrial-scale systems, means Munters must ensure its desiccant solutions offer superior performance, reliability, or total cost of ownership to remain competitive, especially as the global dehumidifier market is projected to grow, with various technologies vying for market share.

The threat of substitutes for Munters AB's air filtration products, particularly in the generic air filtration market, is a significant consideration. A wide array of less specialized and more basic filtration systems are readily available, often at lower price points.

For customers with less demanding air quality needs or tighter budgets, these generic alternatives can present a compelling substitute. For instance, in some industrial applications where stringent purity isn't paramount, a standard panel filter might be chosen over Munters' advanced, custom-engineered solutions.

This availability of lower-cost substitutes can potentially dilute demand for Munters' premium offerings if the company's unique value proposition, focused on high efficiency and tailored performance, isn't effectively communicated and demonstrated to the market.

Emergence of Hybrid and Integrated Solutions

The market is increasingly witnessing the emergence of hybrid cooling systems, which blend evaporative and conventional cooling techniques. Additionally, integrated climate control solutions are gaining traction.

These innovations present a tangible threat of substitutes for Munters AB. By offering a novel approach to achieving desired climate conditions, these hybrid and integrated systems could attract customers seeking potentially more comprehensive or cost-effective alternatives to Munters' established product lines.

- Hybrid Systems: Combining evaporative and conventional cooling methods.

- Integrated Solutions: Offering all-in-one climate control.

- Market Capture: Potential to gain share if more cost-effective or comprehensive.

Do-It-Yourself or Less Sophisticated Approaches

For less critical or smaller applications, customers might choose simpler, less advanced solutions, or even attempt DIY climate control. While Munters focuses on industrial and mission-critical settings, the vast number of smaller needs means basic or less professional options can substitute for a portion of the market. For instance, in smaller agricultural setups or workshops, basic ventilation fans or dehumidifiers might be considered instead of Munters' advanced systems.

These DIY or less sophisticated approaches represent a threat because they can capture segments of the market where absolute precision and advanced technology are not paramount. For example, a small business owner might opt for readily available, lower-cost air purifiers or basic ventilation systems rather than investing in Munters' specialized solutions for humidity control in sensitive manufacturing processes.

While Munters’ core business is in high-performance, mission-critical environments, the existence of these alternatives means that for certain less demanding applications, the perceived value of Munters’ advanced technology might be lower. This can limit market penetration in niche areas where cost-effectiveness and simplicity outweigh the need for cutting-edge climate control capabilities.

Conventional HVAC and refrigerant-based systems are significant substitutes for Munters' evaporative cooling solutions, especially where high humidity or precise control is less critical. The established infrastructure and market familiarity of these traditional systems, valued at over $120 billion globally in 2024, present a ready alternative.

Similarly, compressor dehumidifiers serve as a cost-effective substitute for Munters' desiccant technology, particularly in less demanding applications or warmer, more humid conditions where their lower initial purchase price is attractive. The broad availability of diverse dehumidifier capacities and types means Munters must continually emphasize the superior performance and total cost of ownership of its specialized solutions.

Emerging hybrid cooling systems and integrated climate control solutions also pose a threat by offering novel, potentially more comprehensive or cost-effective approaches to achieving desired environmental conditions, potentially drawing customers away from Munters' established product lines.

| Substitute Technology | Key Characteristics | Market Relevance for Munters | 2024 Market Value (Approx.) |

| Conventional HVAC/Refrigerant Cooling | Established, familiar, precise control (but often higher energy use) | Direct competitor in many cooling applications | >$120 Billion (Global AC Market) |

| Refrigerant Dehumidifiers | Cost-effective for moderate humidity/temperature, lower initial cost | Substitute for desiccant systems in less critical applications | Significant portion of the dehumidifier market |

| Hybrid/Integrated Climate Control | Blends technologies, offers comprehensive solutions | Potential to capture market share with novel approaches | Growing segment |

Entrants Threaten

The specialized nature of Munters' energy-efficient air treatment and climate solutions demands substantial capital for research and development, advanced manufacturing, and global distribution. For instance, developing cutting-edge dehumidification and evaporative cooling technologies requires significant financial outlay.

This high upfront investment acts as a considerable barrier for potential new entrants. The need for substantial financial resources to develop and produce innovative, specialized technologies makes it difficult for new companies to enter the market and compete effectively with established players like Munters.

Munters' leadership in specialized climate control solutions, like advanced dehumidification and purification systems, is underpinned by significant intellectual property and deep technical know-how. This creates a formidable barrier for potential new entrants who would need to invest heavily in research and development to replicate or surpass Munters' established technological capabilities. For instance, in 2023, Munters reported R&D expenses of SEK 309 million, highlighting the ongoing commitment to innovation required to maintain its competitive edge.

Munters operates in sectors like pharmaceuticals, food processing, and data centers, all of which are governed by rigorous regulations concerning air quality, environmental control, and energy conservation. Meeting these demanding standards necessitates substantial investment in research, development, and certification processes, acting as a considerable barrier for new companies aiming to enter these markets.

Established Brand Reputation and Customer Relationships

Munters AB, established in 1955, benefits from a deeply entrenched brand reputation and robust customer relationships built over decades. This long history has fostered trust and loyalty, particularly within demanding industrial sectors that prioritize proven reliability and extensive service capabilities. Newcomers must overcome this significant hurdle of establishing comparable brand recognition and securing the confidence of a discerning global clientele.

For instance, in 2023, Munters reported net sales of SEK 14,415 million, underscoring its substantial market presence and the scale of its existing customer base. The cost and time required for a new entrant to replicate this level of market penetration and customer loyalty are considerable, acting as a substantial barrier.

- Established Brand: Munters' founding in 1955 signifies a long operational history, fostering deep customer trust.

- Customer Relationships: Decades of service have cultivated strong, enduring relationships with industrial clients worldwide.

- Barriers to Entry: New entrants face significant challenges in matching Munters' brand recognition and proven track record.

- Service Capabilities: The company's established service network is a critical factor that new competitors must replicate.

Integration of Smart Technologies and Industry 4.0

The increasing integration of smart technologies, including IoT and AI, into climate control systems significantly elevates the barrier to entry for new companies. Developing these advanced, interconnected solutions demands substantial expertise beyond traditional HVAC engineering, encompassing software development, data analytics, and robust cybersecurity measures. This technological sophistication requires considerable upfront investment in research and development, making it more challenging for newcomers to establish a competitive foothold.

For instance, companies entering the industrial climate control market in 2024 must contend with the expectation of sophisticated digital twins and predictive maintenance capabilities. Munters AB, a leader in this space, has been investing in its digital offerings, aiming to provide data-driven insights to customers. This trend means that a new entrant would likely need to demonstrate comparable or superior digital integration to be considered a viable competitor.

- Technological Sophistication: Industry 4.0 concepts require expertise in IoT, AI, and data analytics, not just traditional HVAC.

- Investment Requirements: Developing interconnected, data-driven solutions necessitates significant R&D and infrastructure investment.

- Cybersecurity Demands: Protecting sensitive operational data adds another layer of complexity and cost for new entrants.

The threat of new entrants for Munters AB is generally low due to substantial barriers. High capital requirements for R&D and manufacturing, coupled with stringent regulatory compliance in key sectors like pharmaceuticals, demand significant upfront investment. For example, Munters' 2023 R&D expenditure of SEK 309 million highlights the ongoing need for innovation investment.

Furthermore, Munters' established brand reputation, built since its founding in 1955, and deep customer relationships create a significant hurdle for newcomers. Replicating Munters' extensive service capabilities and market penetration, evidenced by 2023 net sales of SEK 14,415 million, is a costly and time-consuming endeavor for potential competitors.

The increasing demand for smart, interconnected climate control solutions, integrating IoT and AI, further elevates entry barriers. New entrants must possess advanced technological expertise in software development and data analytics, in addition to traditional engineering, to compete effectively in the 2024 market landscape.

| Barrier Type | Description | Munters' Strength | Impact on New Entrants |

| Capital Requirements | High R&D, manufacturing, and distribution costs. | Significant investment in advanced technologies. | Substantial financial barrier. |

| Brand & Relationships | Decades of trust and loyalty in industrial sectors. | Long history (since 1955) and strong client base. | Difficult to match recognition and trust. |

| Technological Sophistication | Integration of IoT, AI, and advanced data analytics. | Leading digital offerings and predictive maintenance. | Requires specialized expertise and investment. |

| Regulatory Compliance | Strict standards in pharma, food processing, data centers. | Proven ability to meet demanding industry regulations. | High cost and time for certification. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Munters AB is built upon a foundation of reliable data, including their annual reports, investor presentations, and industry-specific market research from firms like Frost & Sullivan and MarketsandMarkets. We also incorporate insights from competitor financial filings and trade publications to provide a comprehensive view of the competitive landscape.