Munters AB Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Munters AB Bundle

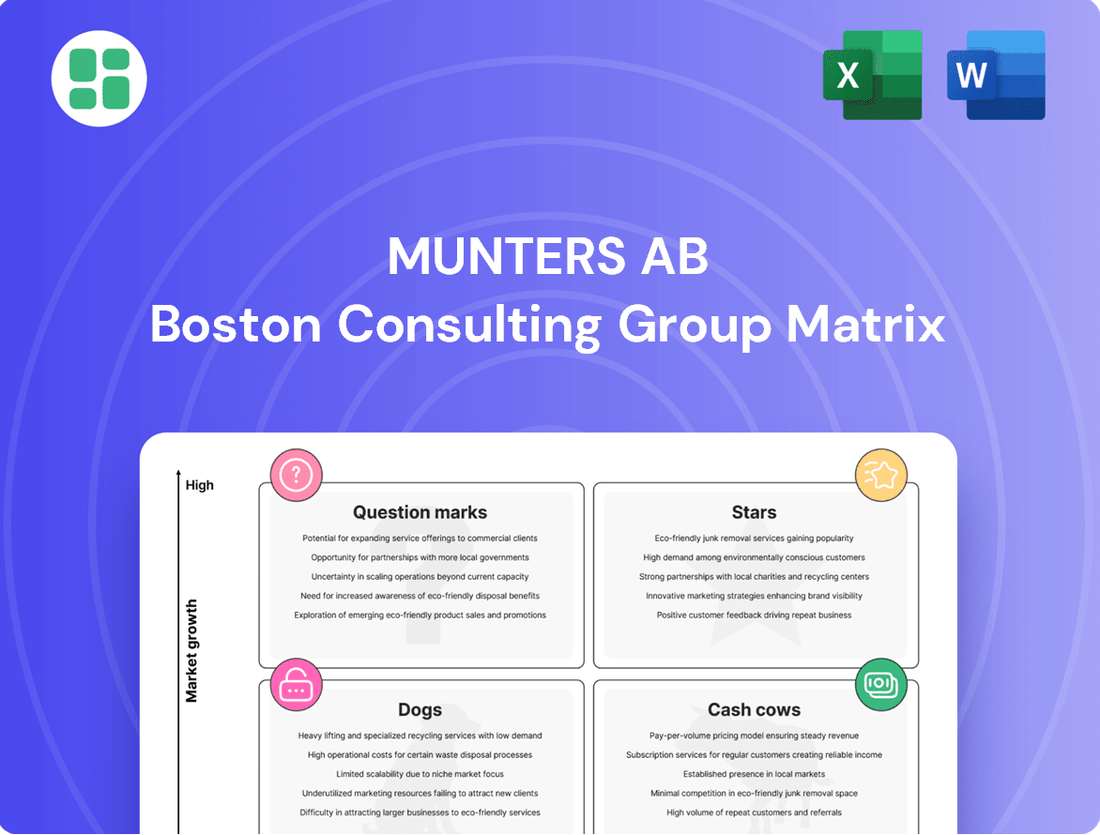

Munters AB's BCG Matrix offers a critical lens to understand their product portfolio's market share and growth potential. Are their innovative solutions Stars poised for rapid expansion, or are established offerings Cash Cows generating steady revenue?

This glimpse is just the beginning. Purchase the full BCG Matrix to unlock detailed quadrant placements, identify potential Dogs needing divestment, and uncover the strategic implications of their Question Marks. Gain the clarity you need to make informed investment and product development decisions.

Stars

Munters' Data Center Technologies (DCT) segment is a shining Star in their portfolio. In 2024, it saw robust growth in order intake and net sales, with the Americas leading the charge. This surge is fueled by the insatiable demand from the booming data center market, especially for advanced liquid cooling solutions like their LCX system.

The strategic acquisition of Geoclima in 2023 significantly bolstered Munters' DCT capabilities, solidifying their leadership in this rapidly expanding sector. This integration not only broadens their product offerings but also enhances their competitive edge in providing critical cooling infrastructure for the digital age.

DCT consistently delivers strong profitability, making it a key driver of Munters' overall financial success. The segment's ability to capture market share in high-growth areas underscores its status as a strategic asset, poised for continued expansion and value creation.

Munters' FoodTech business, particularly its digital solutions like software, control systems, and IoT platforms, is a strong performer. This segment is experiencing significant growth, driven by the increasing need for efficient and sustainable food production. The company's strategic move to focus on these digital offerings, rather than just equipment, is a key driver.

The acquisitions of MTech Systems and Automated Environments (AEI) underscore this strategic pivot. These moves position Munters to capitalize on the expanding market for advanced food processing technologies. For instance, the demand for precision agriculture and smart food supply chains continues to rise, creating opportunities for these digital solutions.

Munters' advanced dehumidification solutions are crucial for specialized industrial sectors like pharmaceuticals, where maintaining precise humidity levels is paramount for product integrity and regulatory compliance. These high-growth niche markets are expanding rapidly, driven by increasing demands for quality and efficiency in manufacturing processes.

The company's commitment to developing energy-efficient technologies directly supports this expansion, offering significant operational cost savings for clients. For instance, in 2024, Munters' innovations in desiccant dehumidification technology are enabling pharmaceutical manufacturers to achieve unprecedented levels of environmental control, directly impacting yield and reducing waste.

Green Bonds & Sustainable Technology Investments

Munters AB's strategic emphasis on green bonds and sustainable technology investments firmly places these initiatives within the Star quadrant of the BCG Matrix. This commitment is not merely about corporate social responsibility; it's a calculated move to capture market share in a sector experiencing significant tailwinds.

The company's issuance of green bonds, such as the SEK 1,000 million bond in 2023, underscores its dedication to financing projects with positive environmental impact. These investments are critical for developing and scaling technologies that address global climate challenges, aligning with increasing investor demand for sustainable options. For instance, Munters' focus on energy-efficient climate control solutions for data centers and agriculture directly taps into markets driven by ESG mandates and efficiency gains.

- Green Bond Issuance: Munters issued a SEK 1,000 million green bond in 2023, demonstrating a clear financial commitment to sustainability.

- Market Growth: The global market for sustainable technologies, particularly in climate control and energy efficiency, is projected for substantial growth, driven by regulatory pressures and corporate sustainability goals.

- Competitive Advantage: Early and significant investment in these areas positions Munters as a leader, attracting capital and talent in a burgeoning eco-conscious market.

- Future Revenue Streams: These technologies are expected to be key drivers of future revenue and profitability as demand for sustainable solutions accelerates.

Chiller Technology (post-Geoclima acquisition)

Since acquiring Geoclima, Munters' chiller technology has become a cornerstone of its cooling solutions. This integration has propelled chillers into a high-demand category, especially within the booming data center market.

The acquisition has significantly boosted Munters' capabilities in providing advanced cooling for data centers and other sectors with intensive cooling needs. This strategic move solidifies Munters' standing in a rapidly expanding product segment.

- Market Growth: The global data center cooling market is projected to reach $27.7 billion by 2026, growing at a CAGR of 12.5%.

- Acquisition Impact: Geoclima's expertise and product portfolio are key drivers of Munters' increased market share in chiller technology.

- Product Demand: High-efficiency chillers are in strong demand due to increasing energy costs and environmental regulations.

Munters' Data Center Technologies (DCT) segment, particularly its liquid cooling solutions, stands out as a Star. The segment experienced robust growth in order intake and net sales in 2024, driven by the booming data center market and strategic acquisitions like Geoclima. This strong performance, coupled with high profitability, solidifies DCT's position as a key growth driver for Munters.

The FoodTech business, especially its digital solutions, is another Star. Munters' focus on software, control systems, and IoT platforms, bolstered by acquisitions like MTech Systems, is yielding significant growth. This strategic shift capitalizes on the increasing demand for efficient and sustainable food production technologies, positioning FoodTech for continued success.

Munters' commitment to sustainable technologies, including its green bond issuances, also qualifies as a Star. The SEK 1,000 million green bond in 2023 highlights this dedication. This focus taps into a rapidly growing market driven by ESG mandates and the increasing need for energy-efficient climate control solutions across various industries.

Chiller technology, significantly enhanced by the Geoclima acquisition, represents a Star within Munters' portfolio. The strong demand from the data center market, projected to reach $27.7 billion by 2026, underscores the importance of these high-efficiency cooling solutions. Geoclima's expertise is a key factor in Munters' increased market share in this segment.

| Business Segment | BCG Category | Key Drivers | 2024 Performance Indicators | Strategic Importance |

| Data Center Technologies (DCT) | Star | Data center growth, Liquid cooling demand, Geoclima acquisition | Robust order intake and net sales growth | High profitability, market leadership |

| FoodTech (Digital Solutions) | Star | Demand for sustainable food production, IoT and software integration, MTech/AEI acquisitions | Significant growth in digital offerings | Capturing market share in smart food supply chains |

| Sustainable Technologies (Green Bonds) | Star | ESG mandates, Energy efficiency demand, Green financing | SEK 1,000 million green bond (2023) | Attracting capital, leadership in eco-conscious markets |

| Chiller Technology | Star | Data center cooling market expansion, Geoclima expertise | Strong demand, increased market share | Cornerstone of cooling solutions, high-growth segment |

What is included in the product

Munters AB's BCG Matrix likely categorizes its diverse product lines to guide strategic investment decisions.

This analysis would pinpoint which offerings are market leaders (Stars), stable cash generators (Cash Cows), nascent opportunities (Question Marks), or underperformers (Dogs).

Munters AB BCG Matrix provides clarity on business unit performance, relieving the pain of resource allocation uncertainty.

Cash Cows

Munters' established air treatment systems in mature industries, like food and beverage processing or general manufacturing, are prime examples of Cash Cows. These are reliable products that generate consistent cash flow with relatively lower investment in promotion, serving foundational customer needs in stable segments.

In 2024, Munters reported a strong performance in its Industrial segment, which houses many of these mature offerings. The company's focus on operational efficiency and cost management for these established product lines allows them to contribute significantly to overall profitability, much like a classic Cash Cow.

Standard dehumidification and evaporative cooling products from Munters AB function as Cash Cows within its BCG Matrix. These are core offerings, widely adopted across numerous industries, where Munters holds a significant market share. While the overall market for these standard solutions isn't experiencing explosive growth, Munters benefits from strong brand recognition and a substantial existing customer base, ensuring consistent and reliable revenue streams.

Munters' service and components business is a strong Cash Cow, offering essential after-market support, spare parts, and maintenance for their installed equipment. This segment thrives on predictable, recurring revenue streams, a hallmark of its high-margin nature. For instance, in 2023, Munters reported significant growth in their Services segment, which directly reflects the stability and profitability of this business unit.

Traditional FoodTech Climate Solutions

Munters' traditional FoodTech climate solutions, primarily serving livestock farming and greenhouses, represent a significant cash cow. Despite the broader FoodTech sector's pivot towards digital, these established systems remain vital for essential food production. Their critical role ensures consistent demand and strong cash generation, even with a less dynamic growth trajectory.

These offerings continue to be a reliable source of income for Munters. For instance, in 2024, the company reported that its Agri division, which heavily features these climate solutions, maintained a stable performance, contributing substantially to overall profitability. This stability underscores their cash cow status.

- Established Market Position: Munters holds a strong market share in climate control for traditional agriculture.

- Consistent Cash Flow Generation: These solutions are critical for ongoing food production, leading to steady revenue.

- Moderate Growth: While not a high-growth area, the segment provides reliable financial returns.

- 2024 Performance Indicators: The Agri division, encompassing these solutions, demonstrated resilience and profitability throughout 2024.

Solutions for Pharmaceutical Industry

Munters' solutions for the pharmaceutical industry, focusing on critical temperature and humidity control for manufacturing and storage, function as cash cows within their business portfolio. This segment benefits from a mature, stable, and highly regulated market, ensuring consistent demand. For instance, in 2024, the global pharmaceutical market was valued at over $1.5 trillion, with stringent quality control measures driving the need for specialized environmental solutions like those offered by Munters.

These offerings, characterized by deep expertise and an established market presence, generate reliable, high-value revenue streams. Munters' dehumidification and climate control systems are essential for maintaining product integrity and compliance with Good Manufacturing Practices (GMP), leading to long-term customer contracts and predictable cash flow. This stability allows them to be a significant contributor to the company's overall financial health.

- Stable Demand: The pharmaceutical industry's consistent need for precise environmental control supports predictable revenue.

- High Value Contracts: Specialized equipment and ongoing service agreements generate substantial income.

- Regulatory Compliance: Strict industry regulations necessitate reliable, high-performance solutions from trusted providers like Munters.

- Market Maturity: The established nature of the pharmaceutical market ensures a consistent, albeit not rapidly growing, revenue base.

Munters' established dehumidification and climate control systems for industries like food processing and general manufacturing act as significant cash cows. These products serve well-defined needs in stable markets, generating consistent revenue with minimal need for aggressive expansion investment. In 2024, Munters highlighted strong performance in its Industrial segment, which houses many of these mature, cash-generating offerings, underscoring their reliable contribution to profitability.

The company's service and components business, providing after-market support and spare parts for its installed base, is another prime example of a cash cow. This segment benefits from predictable, recurring, and high-margin revenue streams. Munters' 2023 financial reports showed substantial growth in its Services segment, directly reflecting the profitability and stability of this crucial business unit.

| Product/Segment | BCG Category | Market Characteristics | Munters' Position | Financial Contribution |

| Industrial Dehumidification & Climate Control | Cash Cow | Mature, stable industries, consistent demand | Strong market share, established customer base | Reliable, high-margin revenue, significant profitability driver |

| Services & Components | Cash Cow | Recurring revenue, essential after-market support | High brand recognition, extensive installed base | Predictable, high-margin income, stable cash flow |

Delivered as Shown

Munters AB BCG Matrix

The preview you see is the exact Munters AB BCG Matrix report you will receive upon purchase, offering a comprehensive strategic overview. This document is fully formatted and ready for immediate use, providing actionable insights without any watermarks or demo content. You can confidently download this analysis-ready file to inform your business planning and competitive strategies. It's designed for professional application, ensuring you get a polished and complete report for your decision-making needs.

Dogs

The battery sub-segment within Munters' AirTech business area is currently positioned as a Dog in the BCG matrix. This is due to a combination of weak demand and significant price pressure observed throughout 2024, a trend anticipated to persist into 2025.

This segment is experiencing delays in investment across all geographical regions, directly impacting its growth trajectory. Consequently, it holds a low market share and is characterized by low market growth, which negatively affects the profitability of the broader AirTech division through under-absorption of costs.

Munters AB strategically divested its FoodTech Equipment offering in Q1/Q2 2025. This move suggests the business unit was likely a Dog in the BCG Matrix, as it was resource-intensive without contributing significantly to the company's growth trajectory or future digital strategy. For instance, while Munters reported strong growth in its digital solutions segment, the divested equipment business may have shown stagnant revenue or declining profitability, necessitating the sale to reallocate capital more effectively.

Certain regional AirTech operations, notably in the Americas, are facing challenges with reduced sales volumes and an unfavorable product and regional mix. This has led to a noticeable dip in net sales and a decrease in the adjusted EBITA margin for these specific areas.

These underperforming pockets within AirTech, characterized by low market share and stagnant growth, are prime candidates for a thorough strategic review. Munters AB needs to assess whether these operations warrant significant restructuring or divestment to optimize its overall portfolio.

Outdated or Less Energy-Efficient Product Models

Older product models within Munters AB, particularly those that are less energy-efficient, can be categorized as potential Dogs in a BCG Matrix analysis. These are products that have been largely replaced by newer, more sustainable technologies. For instance, older generations of desiccant dehumidifiers or cooling systems that do not meet current energy efficiency standards fall into this category.

While these legacy products might still contribute to revenue, their market position is weakening as customer demand shifts towards greener solutions. Munters' focus in 2024 and beyond is on innovation and sustainability, meaning resources are increasingly directed towards their high-growth, high-market share products.

The challenge with these older models is that continued investment in their development or marketing may not provide a strong return on investment. Their declining market share and the increasing regulatory and consumer pressure for energy efficiency make them less attractive for significant capital allocation.

- Declining Market Share: Older, less energy-efficient models face a shrinking customer base as sustainability becomes a key purchasing driver.

- Low Growth Potential: The market for outdated technology is unlikely to expand, offering limited opportunities for revenue growth.

- Potential for Divestment: Munters might consider phasing out or divesting these product lines if they no longer align with strategic goals or profitability targets.

- Resource Drain: Continued support for these products can divert valuable R&D and marketing resources from more promising offerings.

Niche AirTech Applications with Stagnant Demand

Within Munters' AirTech segment, certain niche applications might be categorized as Dogs if they exhibit stagnant demand and low market penetration. These are areas where growth is minimal, and Munters hasn't established a dominant market share. For instance, specialized dehumidification systems for very specific industrial processes with limited adoption could fit this description.

These applications may not align with Munters' strategic growth priorities, which are likely focused on more dynamic and expanding markets. The lack of significant market share in these niche areas means they are unlikely to generate substantial future revenue or profit for the company. As of late 2024, the industrial solutions market, while robust overall, has pockets of maturity where innovation has slowed.

Consider these characteristics for potential Dog applications:

- Low Market Growth: The overall market for the specific niche application is not expanding, or is growing at a very slow rate, perhaps less than 2% annually.

- Limited Competitive Advantage: Munters does not hold a leading position or a strong competitive moat in these particular niche segments.

- Low Investment Returns: Past investments in these areas have not yielded significant returns, and future prospects appear dim.

- Strategic Misalignment: These niche applications do not fit with the company's broader strategic goals for innovation and market leadership.

The battery sub-segment within Munters' AirTech business area is a clear example of a Dog in the BCG matrix, facing weak demand and intense price pressure throughout 2024, a situation expected to continue into 2025. This segment suffers from delayed investments globally, resulting in a low market share and minimal market growth, which consequently impacts the profitability of the entire AirTech division through cost under-absorption.

Munters AB's strategic divestment of its FoodTech Equipment offering in early to mid-2025 strongly suggests this unit was also a Dog. This business was resource-intensive without contributing meaningfully to growth or the company's digital future, likely showing stagnant revenues or declining profits, prompting the sale to reallocate capital more effectively.

Older, less energy-efficient product models within Munters AB, such as legacy desiccant dehumidifiers, are potential Dogs. Their market position is eroding as demand shifts to sustainable technologies, and continued investment in these products offers a poor return, especially as focus shifts to newer, more efficient solutions.

Certain niche applications within AirTech, where demand is stagnant and market penetration is low, can also be classified as Dogs. These segments, like specialized dehumidification systems with limited adoption, do not align with Munters' growth priorities and offer minimal future revenue or profit potential, especially given the maturity in some industrial solution markets as of late 2024.

Question Marks

Munters is actively expanding its digital offerings beyond its core FoodTech segment, aiming to increase its share of data-driven products and Software-as-a-Service (SaaS) revenues. This strategic move targets high-growth areas, but these new ventures are still in their early stages.

These nascent digital initiatives require substantial investment to capture market share and demonstrate profitability. For instance, in 2023, Munters reported that its digital solutions contributed to a significant portion of its growth, with a clear ambition to further monetize its data capabilities across various industries.

Munters views emerging clean technologies as a key area for future growth, aligning with global sustainability megatrends. The company is actively investing in product development and market entry within these high-growth segments, aiming to capture a significant share. For instance, in 2024, Munters continued to expand its offering in areas like energy-efficient cooling for data centers and advanced dehumidification solutions for industrial processes, both critical for reducing environmental impact.

Munters AB's approach to specialized climate solutions for emerging sectors, like advanced battery manufacturing or vertical farming, represents a potential "Question Mark" in the BCG Matrix. These areas offer significant future growth but currently demand substantial upfront investment in research and development to tailor their core dehumidification and climate control technologies.

For instance, the burgeoning vertical farming industry, projected to reach over $20 billion globally by 2026, requires highly specific humidity and temperature control to optimize crop yields. Munters' investment in understanding these unique environmental needs and developing specialized product lines for such niche markets can unlock high growth potential, though initial market penetration might be slow.

Expansion into New Geographic Markets (e.g., specific APAC regions for DCT)

Munters' presence in the Asia Pacific (APAC) region for its Data Center Technologies (DCT) segment can be viewed as a Question Mark in the BCG Matrix. This classification stems from the combination of a rapidly growing market and Munters' relatively small current market share within that specific segment and region. The APAC data center market is experiencing significant expansion, driven by digitalization and cloud adoption. For instance, by the end of 2024, the APAC region is projected to represent a substantial portion of global data center capacity growth.

Despite the overall market strength, Munters' limited penetration in APAC for DCT implies that substantial investment would be required to increase its market share and capitalize on this growth opportunity. This investment would be necessary to build brand awareness, establish distribution channels, and potentially adapt product offerings to local market needs. The company faces the challenge of deciding whether to invest heavily to turn this Question Mark into a Star or to divest if the potential returns do not justify the required capital outlay.

- Market Growth: The APAC data center market is a high-growth area, with projections indicating continued strong expansion through 2024 and beyond.

- Low Market Share: Munters currently holds a comparatively small share of the DCT market within the APAC region.

- Investment Need: Significant investment is necessary to increase market share and leverage the growth potential.

- Strategic Decision: Munters must evaluate whether to invest for growth or consider other strategic options for its APAC DCT operations.

Integration of Acquired Technologies into New Applications

Munters' acquisition of Geoclima has indeed positioned its chillers as a Star within the data center market, a segment experiencing robust growth. For instance, the global data center market was valued at approximately $275 billion in 2023 and is projected to reach over $470 billion by 2028, showcasing the significant opportunity.

The strategic integration of acquired technologies, such as those from Geoclima, into new, high-growth application areas represents a potential pathway to developing new Stars. This involves identifying nascent markets where Munters' technological expertise can be leveraged. The acquisition of Hotraco, for example, in the FoodTech sector, opens doors to applying its automation and control solutions to emerging areas within food processing and preservation.

Developing these new applications requires focused investment and market penetration strategies. These ventures, while currently in their early stages, could evolve into significant revenue drivers if nurtured effectively. Munters' ability to adapt and apply its core competencies to these adjacent markets will be crucial for future growth and portfolio diversification.

- Data Center Growth: The data center market's projected expansion highlights the success of Geoclima's chillers as a Star.

- New Application Exploration: Leveraging acquired technologies like Hotraco's into new FoodTech applications signifies a move towards potential Stars.

- Strategic Nurturing: Investing in and developing these new market entries is key to transforming them into future Stars.

Munters' ventures into specialized climate solutions for emerging sectors, like advanced battery manufacturing or vertical farming, represent potential Question Marks. These areas offer significant future growth but demand substantial upfront investment in R&D to adapt their core technologies. For example, the vertical farming market, projected to exceed $20 billion globally by 2026, requires precise climate control, a niche Munters is targeting. This requires investment to build market share in these nascent, high-potential segments.

BCG Matrix Data Sources

Our Munters AB BCG Matrix is informed by a blend of financial disclosures, market research reports, and internal performance data. This comprehensive approach ensures accurate and actionable strategic insights.