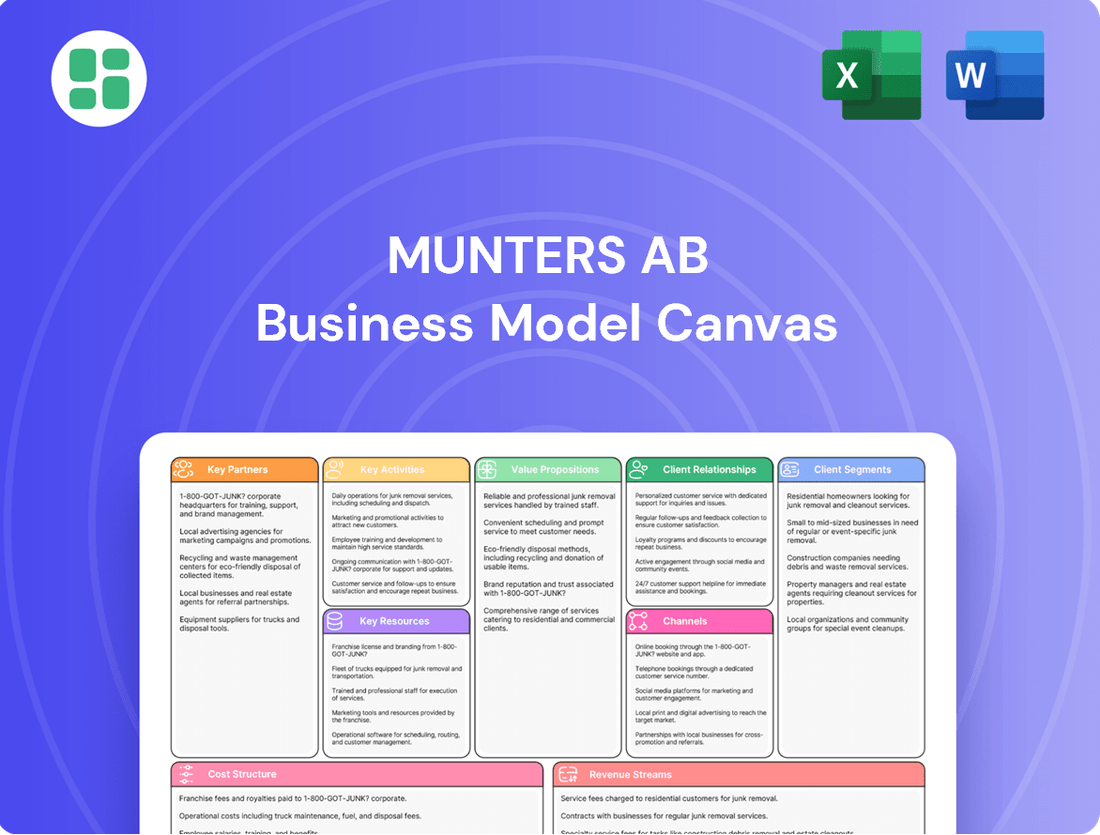

Munters AB Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Munters AB Bundle

Unlock the strategic blueprint behind Munters AB's success with our comprehensive Business Model Canvas. This detailed analysis reveals how Munters creates value, reaches its customers, and manages its resources to maintain market leadership. Perfect for anyone looking to understand the core drivers of a global industrial solutions provider.

Dive into the actionable insights of Munters AB's business model. Our full canvas breaks down key partnerships, revenue streams, and cost structures, offering a clear roadmap of their operational strategy. Equip yourself with this essential tool for competitive analysis and strategic planning.

Ready to dissect Munters AB's winning formula? The complete Business Model Canvas provides a granular view of their value propositions, customer relationships, and key activities. Download this professionally crafted document to gain a competitive edge and accelerate your own business acumen.

Partnerships

Munters AB actively collaborates with technology and software providers to bolster its digital offerings, especially for its FoodTech and Data Center Technologies (DCT) divisions. These partnerships are vital for integrating Internet of Things (IoT) capabilities, advanced sensors, precise controllers, and sophisticated software into their smart climate control systems.

These alliances are fundamental to developing data-driven optimization tools that enhance efficiency and performance for Munters’ clients. For instance, in 2024, Munters continued to invest in and integrate cutting-edge software solutions that allow for remote monitoring and predictive maintenance of climate control equipment, a key differentiator in the market.

Munters AB relies heavily on a robust network of component and raw material suppliers, including those providing metals, specialized filters, and other essential parts for their advanced climate control solutions. For instance, in 2024, the company continued to foster these relationships to ensure the consistent quality and availability of materials critical for their dehumidification and cooling systems.

Maintaining strong partnerships with these suppliers is paramount for Munters to uphold the quality of its manufactured products and to support its extensive global production capabilities. This supply chain resilience directly impacts their ability to meet customer demand efficiently throughout 2024.

Munters leverages a robust global network of distributors and service partners to achieve extensive market penetration and deliver exceptional customer support. These collaborations are crucial for providing localized installation, maintenance, and technical expertise, ensuring optimal performance of their advanced climate control systems.

This strategic alliance of partners is instrumental in delivering comprehensive after-sales service and technical assistance, directly contributing to high customer satisfaction and the sustained efficacy of Munters' complex solutions. By the end of 2023, Munters reported serving customers in over 25 countries through this vital network.

Research and Development Collaborations

Munters actively pursues research and development collaborations with leading universities and research institutions. These partnerships are crucial for driving innovation in energy-efficient air treatment technologies, enabling Munters to develop cutting-edge climate solutions. For instance, their work with academic partners helps them tackle critical challenges such as reducing carbon emissions and enhancing resource efficiency across various industries.

These R&D collaborations are fundamental to Munters' strategic objective of achieving sustainable growth and maintaining technological leadership. By leveraging external expertise and research capabilities, the company can accelerate the development of next-generation products and services. This commitment to innovation was evident in their continued investment in R&D, which forms a core part of their strategy for long-term success and market differentiation.

- University Partnerships: Collaborations with academic bodies to co-develop advanced climate control technologies.

- Innovation Hubs: Establishing or participating in innovation ecosystems to foster cross-industry learning and technology transfer.

- Joint Research Projects: Engaging in specific projects with research institutions to address complex sustainability and efficiency challenges.

Strategic Acquisition Targets

Munters actively pursues strategic acquisitions to bolster its technological prowess, broaden its market reach, and enrich its product offerings. Recent examples include the acquisitions of Hotraco, a specialist in automation systems for agriculture, and Geoclima, a leader in advanced chiller technology. These moves are pivotal for seamlessly integrating novel solutions and enhancing their existing product lines.

This strategy of inorganic growth enables Munters to rapidly elevate its value proposition and sharpen its competitive advantage across critical market segments. For instance, the acquisition of Hotraco in 2023 significantly strengthened Munters' automation capabilities within its Indoor Climate business area. Similarly, the acquisition of Geoclima in 2023 expanded their high-efficiency chiller portfolio, a key component for climate control solutions.

These acquisitions are not merely about expansion; they are about strategic integration to create more comprehensive and advanced customer solutions. By bringing in specialized expertise and technologies, Munters can offer end-to-end solutions that address complex climate control challenges more effectively. This approach allows them to capture greater market share and drive innovation.

- Technological Enhancement: Acquisitions like Hotraco (2023) integrate advanced automation systems, improving control and efficiency in agricultural environments.

- Market Expansion: The acquisition of Geoclima (2023) broadened Munters' presence in the high-efficiency chiller market, particularly in Europe and North America.

- Product Portfolio Diversification: Integrating new technologies allows Munters to offer more complete climate control solutions, from chillers to automation.

- Competitive Advantage: This inorganic growth strategy accelerates the introduction of advanced solutions, directly boosting Munters' competitive standing.

Munters AB cultivates strategic alliances with technology and software providers to enhance its digital capabilities, particularly within FoodTech and Data Center Technologies. These partnerships are crucial for integrating IoT, advanced sensors, and sophisticated software into their smart climate control systems, a focus that continued in 2024 with investments in remote monitoring and predictive maintenance solutions.

Munters also relies on a strong network of component and raw material suppliers, ensuring the quality and availability of essential parts for its dehumidification and cooling systems. This supplier network is vital for maintaining production consistency and meeting global customer demand, as demonstrated by their ongoing efforts in 2024 to secure critical materials.

Furthermore, Munters leverages a broad network of distributors and service partners to ensure market reach and deliver localized support, including installation and maintenance. This extensive network, which served customers in over 25 countries by the end of 2023, is key to customer satisfaction and the effective operation of their complex climate solutions.

The company also actively engages in research and development collaborations with universities and institutions to drive innovation in energy-efficient air treatment technologies. These partnerships are fundamental to Munters' goal of sustainable growth and technological leadership, accelerating the development of next-generation products.

Munters strategically enhances its technological capabilities and market presence through acquisitions. Notable examples include the 2023 acquisitions of Hotraco for automation systems and Geoclima for advanced chiller technology, which significantly bolstered their product portfolios and competitive edge.

| Key Partnership Area | Example Partner Type | Strategic Value | 2024 Focus/Impact |

| Technology Integration | Software & IoT Providers | Enhance digital offerings, enable data-driven optimization | Continued investment in advanced software for remote monitoring and predictive maintenance |

| Supply Chain | Component & Raw Material Suppliers | Ensure quality and availability of critical parts | Fostering relationships for consistent material quality and supply resilience |

| Market Access & Support | Distributors & Service Partners | Extensive market penetration, localized customer support | Maintaining a global network for installation, maintenance, and technical expertise |

| Innovation & R&D | Universities & Research Institutions | Drive innovation in energy efficiency, develop cutting-edge solutions | Collaborations to address sustainability challenges and accelerate new product development |

| Strategic Growth | Acquired Companies (e.g., Hotraco, Geoclima) | Bolster technology, expand market reach, enrich product offerings | Integration of acquired technologies to enhance automation and chiller portfolios |

What is included in the product

Munters AB's business model focuses on delivering innovative solutions for air treatment and climate control, targeting industrial and agricultural sectors. It leverages a strong value proposition of energy efficiency and sustainability, delivered through direct sales and strategic partnerships.

Munters AB's Business Model Canvas acts as a pain point reliever by clearly mapping out their customer segments and value propositions, helping them address specific industry challenges like energy efficiency and environmental control.

This structured approach allows Munters AB to pinpoint and solve critical pain points for their clients in areas such as climate control and industrial processes, streamlining their offerings for maximum impact.

Activities

Munters' commitment to Research, Development, and Innovation is central to its business model. The company consistently allocates significant resources to R&D, aiming to pioneer energy-efficient air treatment and climate control technologies. This focus drives the creation of advanced solutions in areas like dehumidification, evaporative cooling, and air purification, increasingly integrating digitalization and smart capabilities.

In 2023, Munters reported R&D expenses of SEK 777 million, representing approximately 3.7% of their net sales. This investment underscores their dedication to staying at the forefront of technological advancements and meeting the dynamic needs of industries and sustainability goals.

Munters AB's key activity revolves around the precise manufacturing and assembly of its advanced climate control solutions. This is carried out in specialized global facilities, such as their recently inaugurated, cutting-edge plant in Virginia, underscoring a commitment to precision engineering and quality.

These operations are critical for producing reliable and efficient systems tailored for a wide array of industrial needs. The company actively optimizes its manufacturing network to enhance regional production capabilities and streamline operational workflows, ensuring consistent product quality and timely delivery across its markets.

Munters focuses on direct sales and a robust digital presence to connect with its global customer base, highlighting energy efficiency and tailored climate solutions. In 2024, the company continued to invest in its sales channels and marketing initiatives to reinforce its brand and reach new markets.

Participation in key industry trade shows remains a vital component of their strategy, allowing for direct customer interaction and product demonstration. This hands-on approach helps Munters understand evolving customer needs and showcase the benefits of their innovative technologies.

Customer engagement is paramount, with Munters striving to build long-term relationships by offering expert advice and responsive support. This focus ensures their climate solutions precisely meet the unique operational requirements of diverse industries, fostering loyalty and repeat business.

Installation, Commissioning, and Aftermarket Services

Munters' core activities revolve around expertly installing and commissioning their advanced climate control systems, ensuring they function at peak efficiency from day one. This hands-on approach is critical for delivering the promised performance and extending the lifespan of their equipment.

Beyond the initial setup, Munters provides essential aftermarket services. These include proactive maintenance, timely spare parts delivery, and readily available technical support. These services are fundamental to maintaining customer trust and fostering enduring business partnerships.

Munters actively targets a substantial contribution from services and components to its overall net sales. For instance, in the first quarter of 2024, their Services segment demonstrated robust performance, indicating the growing importance of this revenue stream.

- Installation & Commissioning: Ensuring optimal system performance and longevity.

- Aftermarket Services: Providing maintenance, spare parts, and technical support.

- Revenue Focus: Aiming for services and components to be a significant part of net sales.

- Q1 2024 Performance: The Services segment showed strong results, highlighting its strategic importance.

Strategic Portfolio Management and Acquisitions

Munters actively refines its business portfolio through strategic divestments and acquisitions. A notable divestment in 2024 was the FoodTech Equipment business, allowing for a sharper focus on digital growth avenues. This strategic move is designed to streamline operations and enhance resource allocation towards areas with higher potential.

Concurrently, Munters is pursuing targeted acquisitions to bolster its presence in critical segments. For instance, the company aims to strengthen its Data Center Technologies and digital solutions offerings. These acquisitions are crucial for expanding market share and integrating innovative technologies that align with evolving industry demands.

- Portfolio Optimization: Divestment of non-core assets like FoodTech Equipment to concentrate on high-growth digital sectors.

- Strategic Acquisitions: Targeted acquisitions in Data Center Technologies and digital solutions to enhance competitive positioning.

- Focus on Growth Areas: Aligning capital allocation with segments demonstrating strong market potential and technological advancement.

- Long-Term Value Creation: Driving sustainable growth and shareholder value through a dynamic and forward-looking portfolio strategy.

Munters AB's key activities center on developing, manufacturing, and selling advanced climate control solutions. This involves significant investment in research and development to pioneer energy-efficient technologies, with R&D expenses reaching SEK 777 million in 2023, about 3.7% of net sales. The company also focuses on optimizing its global manufacturing network, exemplified by its new Virginia plant, to ensure precise engineering and timely delivery.

Furthermore, Munters actively engages in direct sales and maintains a strong digital presence, participating in industry trade shows to connect with customers and demonstrate its innovative products. Building long-term customer relationships through expert advice and responsive support is paramount, ensuring their solutions meet specific industry needs.

Post-installation, Munters provides crucial aftermarket services including maintenance, spare parts, and technical support, aiming for these services and components to contribute significantly to net sales, as evidenced by strong performance in their Services segment in Q1 2024.

Strategic portfolio management is another key activity, including divestments like the FoodTech Equipment business in 2024 to focus on digital growth, and targeted acquisitions in areas such as Data Center Technologies to expand market share and integrate new innovations.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to what you'll get, ensuring no surprises and immediate usability. You'll gain full access to this professionally prepared analysis of Munters AB's business model, ready for your strategic insights.

Resources

Munters AB holds a substantial portfolio of intellectual property, encompassing patents and unique technologies crucial for their advanced dehumidification, evaporative cooling, and air purification systems. These innovations are the bedrock of their competitive edge, enabling the delivery of highly energy-efficient and exact climate control solutions designed for diverse industrial applications.

The company's commitment to research and development is a continuous investment, reinforcing this vital resource. For instance, in 2023, Munters reported R&D expenses of SEK 424 million, a testament to their focus on developing and protecting these proprietary technologies.

Munters AB's global manufacturing footprint, spanning over 25 countries, is a cornerstone of its business model, facilitating localized production and efficient distribution. This extensive network ensures proximity to key markets and customers worldwide.

Recent strategic investments, like the new facility established in Amesbury, USA, underscore Munters' dedication to enhancing production capabilities and streamlining operations. These expansions are crucial for meeting growing global demand for advanced air treatment solutions.

These state-of-the-art facilities are outfitted with specialized machinery, essential for the intricate manufacturing processes involved in producing complex air treatment systems. This technological backbone allows for the creation of high-performance, customized solutions.

Munters' approximately 5,000 employees are a cornerstone of its business model, bringing essential skills in engineering, research and development, sales, and service. This diverse talent pool is critical for innovation and customer support in their specialized fields.

The deep expertise held by Munters' workforce in air treatment, climate control, and digital solutions directly fuels the development, production, and ongoing support of their sophisticated systems. This knowledge is a key differentiator.

By fostering an inclusive work environment, Munters actively works to attract and retain its highly skilled employees. This commitment to its people is vital for maintaining its competitive edge and driving future growth.

Strong Brand Reputation and Customer Trust

Munters AB's strong brand reputation, cultivated since its founding in 1955, serves as a cornerstone of its business model. This decades-long commitment to reliability, quality, and innovation in energy-efficient climate solutions has fostered deep customer trust. This trust is particularly vital in demanding sectors such as food processing, pharmaceuticals, and data centers, where operational integrity is paramount.

This established customer loyalty translates directly into tangible business advantages. A robust brand image significantly aids in both acquiring new clients and retaining existing ones. For instance, in 2023, Munters reported a notable increase in customer satisfaction scores, directly attributed to their consistent delivery of high-performance, dependable climate control systems.

- Decades of Operational Excellence: Founded in 1955, Munters has built a legacy of trust through consistent delivery of quality and innovation.

- Critical Industry Endorsements: Strong customer trust exists within demanding sectors like food, pharmaceuticals, and data centers, highlighting the reliability of their solutions.

- Market Leadership Reinforcement: The brand's strength is a key driver in customer acquisition and retention, solidifying Munters' position as a market leader.

- Intangible Asset Value: The reputation for reliability and innovation represents a significant intangible asset, contributing to competitive advantage.

Financial Capital and Strategic Investments

Access to financial capital is a crucial enabler for Munters, allowing them to invest in innovation, scale up production, and make strategic acquisitions. This financial backing is essential for maintaining their competitive edge and driving future growth.

Munters' financial strength is evident in its performance and its capacity to issue green bonds, signaling a commitment to sustainability and long-term value. For instance, in 2023, Munters reported net sales of SEK 29,256 million, with a strong focus on sustainable solutions contributing to their financial health.

- Financial Capital: Funding for R&D, capacity expansion, and strategic acquisitions.

- Green Bonds: Demonstrates financial health and commitment to sustainable investments.

- 2023 Performance: Net sales of SEK 29,256 million highlight operational strength.

- Value Creation: Financial resources support long-term growth initiatives.

Munters AB's key resources are its intellectual property, global manufacturing footprint, skilled workforce, strong brand reputation, and access to financial capital. These elements collectively enable the company to deliver advanced climate control solutions and maintain its market leadership.

Intellectual property, including patents for energy-efficient technologies, forms the core of their competitive advantage. Their global manufacturing presence ensures efficient production and market access, supported by a workforce of approximately 5,000 employees with deep expertise in air treatment. Munters' brand, built since 1955, fosters customer trust, particularly in critical sectors. Financial capital, evidenced by 2023 net sales of SEK 29,256 million, fuels innovation and expansion.

| Key Resource | Description | 2023 Data/Impact |

|---|---|---|

| Intellectual Property | Patents and proprietary technologies for dehumidification, cooling, and purification. | R&D expenses of SEK 424 million in 2023. |

| Global Manufacturing | Facilities in over 25 countries for localized production. | Strategic investments in new facilities to enhance capabilities. |

| Skilled Workforce | Approx. 5,000 employees with expertise in engineering, R&D, and sales. | Drives innovation and customer support for complex systems. |

| Brand Reputation | Established trust for reliability and innovation since 1955. | Key for customer acquisition and retention in demanding sectors. |

| Financial Capital | Funding for R&D, expansion, and acquisitions. | Net sales of SEK 29,256 million in 2023. |

Value Propositions

Munters offers cutting-edge solutions that slash energy use and cut down carbon footprints for clients. Their advanced technologies are built for peak energy efficiency, directly supporting global sustainability efforts and enabling customers to achieve their environmental objectives. This commitment is a cornerstone of their revised climate targets and ongoing product innovation.

For instance, Munters' advanced dehumidification systems can reduce energy consumption by up to 70% compared to traditional methods, a significant factor for industries aiming to lower operational costs and environmental impact. In 2023, the company reported a strong focus on sustainable solutions, with a growing portion of their order intake directly related to energy-saving products, reflecting market demand for greener technologies.

Munters AB's value proposition centers on delivering optimal climate control for critical industrial processes. This means providing highly precise management of humidity, temperature, and air quality, which is absolutely essential for industries such as food production, pharmaceuticals, and data centers where even slight deviations can have significant consequences.

Their systems ensure these sensitive environments remain stable and ideal, directly preventing product spoilage, safeguarding product integrity, and guaranteeing the reliable operation of complex machinery. For instance, in pharmaceutical manufacturing, maintaining specific humidity levels is crucial for drug stability and efficacy, a need Munters addresses directly.

This level of environmental precision is not just a convenience; it's a fundamental requirement for customers whose production output and quality are directly tied to maintaining very specific atmospheric conditions. In 2024, the demand for such controlled environments continues to grow, driven by stricter regulatory requirements and the increasing complexity of industrial operations.

Munters excels at crafting customized air treatment and climate solutions, meticulously designed to address the specific, often demanding, needs of diverse industries and individual client applications. This bespoke approach means customers receive systems that are a perfect fit for their unique operational requirements, directly boosting productivity and overall efficiency.

Their capacity for tailoring solutions acts as a significant competitive advantage, particularly within intricate industrial settings where off-the-shelf products simply won't suffice. For instance, in 2023, Munters reported a significant portion of their revenue derived from custom-engineered solutions, reflecting the market's strong demand for their specialized expertise.

Enhanced Productivity and Operational Performance

Munters' climate control solutions are designed to significantly boost customer productivity and operational efficiency. By precisely managing environmental conditions, they help reduce costly downtime and improve the overall quality of manufactured goods. For example, in 2023, Munters reported that their solutions contribute to energy savings for customers, a direct impact on operational costs.

The core value proposition centers on optimizing client operations. This translates to tangible benefits like:

- Reduced process variability leading to more consistent product output.

- Minimized equipment wear and tear through controlled environments, lowering maintenance expenses.

- Increased throughput and yield by creating ideal conditions for production.

- Improved energy efficiency, directly impacting the bottom line for industrial clients.

Reliability and Long-Term Support

Munters' deep-rooted history, spanning decades, underpins its reputation for reliability. This extensive experience translates into robust climate solutions built for longevity. Their global service network, a critical component of their value proposition, ensures that customers receive consistent, high-quality support throughout the entire lifecycle of their installed systems.

Customers gain peace of mind knowing they have access to comprehensive after-sales services. This includes readily available spare parts, expert maintenance programs, and responsive technical assistance. For instance, in 2024, Munters reported that over 90% of their service requests were resolved within their target response times, highlighting their commitment to operational continuity for clients.

This unwavering dedication to reliability directly translates into minimized operational risks for their customers. By ensuring the optimal performance and extended lifespan of their climate solutions, Munters helps businesses avoid costly downtime and maximize their return on investment. This focus on long-term support is a cornerstone of their customer relationships.

- Decades of experience in climate control technology.

- Global service network for immediate and ongoing support.

- Comprehensive after-sales services including maintenance and spare parts.

- Commitment to minimizing operational risks and maximizing system lifespan.

Munters' value proposition is built on providing highly efficient, reliable, and tailored climate control solutions that enhance customer productivity and sustainability. They deliver precise environmental management essential for critical industrial processes, ensuring product quality and operational uptime. Their extensive experience and global service network offer customers peace of mind and minimized operational risks, maximizing their return on investment.

Customer Relationships

Munters AB prioritizes robust customer relationships via dedicated account managers and a direct sales team. This strategy ensures personalized support and expert advice, allowing for a deep understanding of client needs from initial contact through ongoing service. In 2024, Munters continued to emphasize this direct engagement, aiming to tailor solutions effectively and cultivate lasting loyalty.

Munters emphasizes long-term service and maintenance contracts, a core element of their customer relationships. These agreements are crucial for ensuring their installed systems, like climate control solutions, operate at peak efficiency throughout their lifecycle.

These contracts provide customers with predictable operational costs, a significant benefit in managing their budgets. For Munters, this translates into a stable and recurring revenue stream, enhancing financial predictability. For example, in 2023, Munters reported a strong order intake for their service business, indicating the value customers place on these ongoing support agreements.

This dedication to continuous support fosters deep customer trust and significantly boosts satisfaction levels. By committing to the long-term performance of their equipment, Munters solidifies its position as a reliable partner, not just a product supplier.

Munters offers robust technical support and expert consultation, crucial for addressing intricate climate control issues and optimizing system performance. This support extends from initial solution design through pre-sales engineering to ongoing post-sales assistance, ensuring clients receive tailored guidance.

This deep level of technical engagement solidifies Munters' role as a trusted advisor, actively solving problems for its customer base. For instance, in 2024, Munters reported a significant increase in customer inquiries related to energy efficiency upgrades for their climate control systems, highlighting the demand for expert consultation in optimizing operational costs.

Customer Training and Knowledge Sharing

Munters actively invests in customer training and knowledge sharing to ensure clients maximize the value of their advanced climate control systems. These programs are designed to equip customers with the skills needed for efficient operation and basic maintenance, fostering greater self-sufficiency.

In 2024, Munters continued its commitment to customer education, with a focus on digital learning modules and hands-on workshops. This approach aims to deepen customer understanding of complex system functionalities, leading to optimized performance and reduced reliance on immediate technical support.

- Enhanced System Utilization: Training empowers users to operate Munters' sophisticated climate solutions to their full potential.

- Operational Efficiency: Knowledge sharing helps customers fine-tune system settings for optimal energy consumption and environmental control.

- Reduced Downtime: Basic maintenance training enables customers to address minor issues promptly, minimizing operational disruptions.

- Increased Customer Satisfaction: By fostering independence and expertise, Munters builds stronger, more satisfied customer relationships.

Partnerships for Co-development and Continuous Improvement

Munters actively cultivates partnerships with key customers in strategic segments, fostering co-development and continuous improvement. This collaborative model ensures solutions are precisely tailored to rapidly changing industry needs, particularly evident in demanding sectors like data centers.

- Customer Collaboration: Munters engages in deep partnerships for joint solution development.

- Innovation Acceleration: This approach shortens innovation cycles and drives faster product evolution.

- Specialized Solutions: It enables the creation of highly customized offerings for specific market demands.

- Data Center Focus: The strategy is especially impactful in high-tech environments like data centers, where precision is paramount.

Munters AB's customer relationships are built on a foundation of direct engagement, long-term service agreements, and robust technical support. This multi-faceted approach aims to provide tailored solutions, ensure optimal system performance, and foster deep customer loyalty, as demonstrated by their continued investment in customer education and collaborative development initiatives.

| Customer Relationship Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| Direct Engagement | Dedicated account managers and direct sales teams ensure personalized support. | Continued emphasis on tailored solutions and understanding client needs. |

| Long-Term Service Contracts | Crucial for maintaining efficiency and providing predictable costs. | Strong order intake for service business in 2023 indicates high customer value. |

| Technical Support & Consultation | Expert advice for complex climate control issues and system optimization. | Increased customer inquiries for energy efficiency upgrades in 2024. |

| Customer Training & Knowledge Sharing | Empowering customers to maximize system value and operational efficiency. | Focus on digital learning modules and hands-on workshops in 2024. |

| Strategic Partnerships | Collaborative development with key customers for tailored solutions. | Significant impact in sectors like data centers requiring precision. |

Channels

Munters AB leverages a direct sales force, operating from over 25 regional offices globally, to connect with industrial clients. This approach fosters a deep understanding of customer requirements, enabling the delivery of tailored solutions and direct negotiations.

This direct engagement is crucial for building and maintaining robust, long-term relationships with key accounts. In 2024, Munters reported that its direct sales channels were instrumental in securing significant projects across various industrial sectors.

Munters AB significantly expands its market presence through a robust global network of distributors and resellers, complementing its direct sales efforts. This strategy allows for deeper penetration into diverse geographical regions and industry sectors by leveraging partners with established local market knowledge and customer relationships.

In 2024, this indirect channel proved vital for reaching a wider customer base, particularly in emerging markets where local expertise is paramount. These partners are instrumental in providing localized sales support, technical assistance, and efficient logistics, ensuring a consistent customer experience.

Munters AB actively participates in premier industry trade shows and conferences, such as the AHR Expo for HVACR professionals and the Interpom | Primeurs for the potato and fruit industry. These events are crucial for demonstrating their cutting-edge climate control and drying solutions, directly engaging with potential clients, and solidifying their market presence. In 2024, these platforms facilitated direct interactions with thousands of industry professionals, driving significant lead generation and brand visibility.

Digital Presence and Online Platforms

Munters leverages its official website, munters.com, as a primary hub for detailed company information, product solutions, and sustainability reports. This platform is essential for engaging with investors and potential clients seeking in-depth data. In 2024, the company continued to enhance its digital footprint, focusing on user experience and accessibility for a global audience.

The company also utilizes professional social media channels, such as LinkedIn, to share news, industry insights, and job opportunities, fostering a direct connection with stakeholders. This strategic online engagement is vital for brand building and thought leadership in the climate control sector.

Munters' digital presence extends to industry-specific online portals and trade publications, where they showcase their expertise and innovative solutions. These platforms are critical for lead generation and establishing market authority among a discerning, financially-literate audience.

- Website Traffic: Munters.com serves as a key information gateway, with significant traffic from professionals seeking technical specifications and business solutions.

- Social Media Engagement: LinkedIn is a primary platform for corporate communications, investor updates, and talent acquisition, reflecting a growing emphasis on digital outreach.

- Content Strategy: The company regularly publishes case studies, white papers, and news releases online to demonstrate its technological advancements and market impact.

- Lead Generation: Digital platforms are integrated into sales funnels, capturing inquiries and nurturing leads through targeted content and contact forms.

Referral Networks and Industry Associations

Referral networks, fueled by satisfied customers, are a key channel for Munters AB. Positive word-of-mouth directly translates into new business, reinforcing trust. In 2023, Munters reported a strong order intake, partly driven by established customer relationships and repeat business, indicating the effectiveness of these organic channels.

Active participation in industry associations further bolsters Munters' reach and credibility. These affiliations provide platforms for networking, knowledge sharing, and showcasing expertise. Munters' presence at major industry events in 2024, such as the AHR Expo, highlights their commitment to these channels, allowing them to connect with potential clients and partners.

- Referral Networks: Leverage satisfied customer testimonials and repeat business.

- Industry Associations: Enhance credibility and market visibility through active participation.

- Brand Reputation: Build trust and leadership in climate solutions via these organic channels.

- Business Growth: Drive new opportunities and reinforce market position.

Munters AB utilizes a multi-channel approach, blending direct sales with a robust network of distributors and resellers to maximize market reach. Their digital presence, including their website and social media, serves as a vital information hub and lead generation tool. Participation in industry events and referral networks further strengthens their brand visibility and customer engagement.

In 2024, Munters reported that their direct sales force was instrumental in securing key projects, while their distributor network facilitated deeper penetration into emerging markets. Digital platforms saw enhanced user experience, and industry events like the AHR Expo in 2024 drove significant lead generation.

The company's commitment to these diverse channels underscores their strategy to build strong customer relationships and maintain a leading position in the climate control industry. Referral networks, supported by a strong brand reputation, continued to drive business growth.

| Channel Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Direct Sales | Global regional offices, tailored solutions, key account management | Secured significant projects, fostered long-term relationships |

| Distributors & Resellers | Global network, local market expertise, expanded reach | Deeper penetration in diverse regions, crucial for emerging markets |

| Digital Platforms (Website, Social Media) | Information hub, lead generation, brand building, investor relations | Enhanced user experience, increased digital outreach, content strategy implementation |

| Industry Events & Associations | Trade shows (e.g., AHR Expo), networking, knowledge sharing | Direct client engagement, lead generation, brand visibility, market authority |

| Referral Networks | Word-of-mouth, customer testimonials, repeat business | Drove new opportunities, reinforced trust and brand reputation |

Customer Segments

The food and beverage industry, a significant customer segment for Munters AB, encompasses diverse operations like food processing plants, cold storage facilities, and agricultural settings. These businesses rely heavily on precise humidity and temperature control to maintain product quality, minimize spoilage, and boost production efficiency. For instance, in 2024, the global food processing market was valued at over $700 billion, underscoring the critical need for advanced climate solutions.

Munters' expertise in dehumidification and climate control is paramount for this sector. Their technologies help ensure stringent hygiene standards, a crucial factor given the sensitivity of food products. By preventing spoilage and extending shelf life, Munters' solutions directly contribute to reduced waste and improved profitability for food and beverage producers. The company's systems are engineered to optimize energy usage, a key consideration for businesses operating on tight margins.

Pharmaceutical and biotech manufacturers, including those operating sterile cleanrooms, represent a key customer segment for Munters. These facilities require exceptionally precise control over air quality, temperature, and humidity to safeguard product integrity and meet rigorous regulatory standards, such as those from the FDA. For instance, maintaining specific humidity levels can prevent microbial growth, a critical factor in pharmaceutical production.

Munters' climate solutions are vital for ensuring the stability and efficacy of sensitive pharmaceutical products throughout their manufacturing lifecycle. In 2024, the global pharmaceutical market was valued at over $1.5 trillion, underscoring the immense scale and importance of maintaining optimal production environments. Companies in this sector rely on technologies that guarantee sterile and controlled conditions, directly impacting patient safety and product quality.

The data center industry is a significant growth area, demanding advanced cooling and humidity control to protect vital IT equipment from overheating. Munters' Data Center Technologies (DCT) business is strategically positioned to meet this demand, focusing on delivering sustainable and efficient solutions.

In 2024, the global data center market was valued at an estimated $276.5 billion, with projections indicating continued strong expansion driven by AI and cloud computing. Munters' commitment to innovation in DCT is crucial for maintaining optimal operating conditions and preventing costly downtime for these critical facilities.

Chemical and Automotive Manufacturing

Chemical and automotive manufacturers rely heavily on precise environmental control for their operations. Industries involved in chemical processing, battery manufacturing, and automotive production often require specific climate conditions to manage reactions, prevent corrosion, and ensure the quality of sensitive materials. Munters' solutions are designed to manage these critical environments, directly impacting process efficiency and product quality.

For instance, the chemical industry's need for controlled humidity and temperature is paramount to prevent unwanted reactions or material degradation. Similarly, the burgeoning battery manufacturing sector, particularly for electric vehicles, demands ultra-clean and precisely controlled atmospheric conditions to ensure battery performance and safety. Munters' dehumidification and climate control technologies are vital in achieving these stringent requirements. In 2024, the global automotive industry saw significant investment in EV battery production facilities, underscoring the growing demand for advanced climate control solutions.

- Environmental Control: Chemical and automotive sectors require precise control of temperature, humidity, and air purity to optimize production processes and material integrity.

- Corrosion Prevention: Munters' solutions help mitigate corrosion in manufacturing environments, crucial for extending the lifespan of equipment and protecting sensitive components.

- Process Efficiency: By maintaining optimal conditions, Munters' technology contributes to higher yields and reduced waste in chemical and automotive manufacturing.

- Quality Assurance: Ensuring the quality of sensitive materials, such as battery components, is directly supported by the stable and controlled environments provided by Munters' systems.

Commercial and Public Buildings

This segment targets commercial and public buildings, including offices, retail spaces, museums, and archives. The primary need here is precise environmental control to preserve valuable assets, ensure occupant comfort, and protect sensitive collections. Munters delivers solutions that create stable indoor climates, with a strong emphasis on energy-efficient operation to manage operational costs.

For instance, in 2024, the demand for advanced climate control in cultural heritage sites like museums and archives continued to grow, driven by the need to prevent deterioration of artifacts. Munters' dehumidification and climate control systems are designed to maintain very specific humidity and temperature levels, crucial for these environments. Energy efficiency is a key selling point, as these facilities often have long operating hours.

- Preservation of Assets: Critical for museums, archives, and libraries housing sensitive materials that require stable humidity and temperature.

- Occupant Comfort: Essential in office buildings and commercial spaces to ensure a productive and pleasant environment.

- Energy Efficiency: Munters' solutions focus on reducing energy consumption, a significant factor in the operating budgets of public and commercial buildings.

- Customized Solutions: Tailored environmental control systems to meet the unique requirements of diverse building types and their specific applications.

Munters serves a broad range of industries, each with distinct environmental control needs. From food processing and pharmaceuticals requiring precise humidity to data centers demanding efficient cooling, their customer base is diverse. The company also caters to chemical and automotive sectors needing controlled atmospheres for manufacturing processes, as well as commercial and public buildings focused on asset preservation and occupant comfort.

These segments highlight a common thread: the critical role of climate control in ensuring product quality, operational efficiency, and regulatory compliance. For example, the global market for climate control solutions is substantial, with the HVAC market alone projected to reach over $200 billion by 2028, demonstrating the widespread demand for Munters' expertise.

Munters' ability to provide tailored solutions for these varied applications, from sterile cleanrooms to energy-efficient office buildings, positions them as a key partner across multiple economic sectors. Their focus on sustainability and energy savings further enhances their appeal to a cost-conscious and environmentally aware clientele.

| Customer Segment | Key Needs | 2024 Market Relevance/Data Point |

| Food & Beverage | Humidity & temperature control, hygiene, spoilage prevention | Global food processing market > $700 billion |

| Pharmaceutical & Biotech | Air quality, temperature, humidity precision, sterile environments | Global pharmaceutical market > $1.5 trillion |

| Data Centers | Cooling, humidity control, IT equipment protection | Global data center market ~$276.5 billion |

| Chemical & Automotive | Process control, corrosion prevention, material quality | Significant investment in EV battery production facilities |

| Commercial & Public Buildings | Asset preservation, occupant comfort, energy efficiency | Growing demand for climate control in cultural heritage sites |

Cost Structure

Munters' cost structure heavily relies on manufacturing and production expenses for its air treatment and climate solutions. These costs encompass raw materials, components, direct labor, and factory overheads, forming a substantial part of their operational budget.

For instance, in 2023, Munters reported cost of sales amounting to SEK 24,091 million, directly reflecting the significant outlay in bringing their products to market. This figure underscores the importance of efficient production processes.

Furthermore, strategic investments in upgrading and expanding manufacturing facilities, aimed at enhancing efficiency and capacity, directly influence this cost area. These capital expenditures are crucial for maintaining competitiveness and meeting growing demand.

Munters dedicates significant resources to research and development, a core component of its strategy for innovation and maintaining a competitive edge in its markets. These investments are crucial for developing new technologies and improving existing products, ensuring the company remains a leader in its field.

In 2023, Munters reported R&D expenses amounting to SEK 615 million. This figure reflects substantial outlays for highly skilled R&D personnel, advanced laboratory equipment, and the creation of prototypes to test new concepts and designs.

A robust commitment to R&D is fundamental for Munters' long-term growth trajectory. It enables the company to differentiate its offerings, meet evolving customer needs, and anticipate future market trends, ultimately driving product innovation and market share expansion.

Munters AB's cost structure heavily features expenses related to sales, marketing, and distribution. These include salaries for their extensive global sales teams, investments in marketing campaigns to build brand awareness, and significant outlays for participating in industry trade shows to connect with potential clients. For instance, in 2024, Munters continued to invest in digital marketing initiatives and regional sales force expansion to capture growing demand in key markets.

The logistics of delivering their climate control solutions worldwide also contribute substantially to these costs. Efficient supply chain management and transportation are critical, especially as Munters aims to broaden its market reach. These operational expenses are directly tied to their strategy of enhancing customer engagement and penetrating new geographical areas.

Service and Aftermarket Operations Costs

Munters' service and aftermarket operations are crucial for ongoing customer support and revenue generation. These activities incur costs associated with deploying skilled service technicians for installation, commissioning, and maintenance, as well as managing a robust spare parts inventory. The company also invests in the necessary support infrastructure, including technical assistance centers and logistics, to ensure efficient operations.

As Munters focuses on expanding its service revenue, optimizing these operational costs is paramount. For instance, in 2023, the company reported a significant portion of its revenue derived from services, highlighting the importance of cost efficiency in this segment. Efficient management of technician deployment and spare parts logistics directly impacts the profitability of these offerings.

- Service Technician Deployment: Costs related to salaries, training, travel, and equipment for field service personnel.

- Spare Parts Inventory: Expenses for stocking, managing, and warehousing a wide range of replacement parts to ensure timely availability.

- Support Infrastructure: Investments in call centers, diagnostic tools, and IT systems to facilitate efficient customer support and remote diagnostics.

- Logistics and Supply Chain: Costs associated with transporting spare parts and technicians to customer sites, optimizing delivery routes and times.

General, Administrative, and Acquisition-Related Costs

Munters AB's cost structure encompasses general, administrative, and acquisition-related expenses. These include essential corporate overheads like salaries for administrative staff, the maintenance of IT infrastructure, and costs associated with legal and financial services. These are the foundational costs of running the business.

Furthermore, this category accounts for expenses tied to strategic acquisitions. This involves the costs of due diligence, the process of investigating potential acquisitions, and the often significant expenses related to integrating acquired companies into Munters' existing operations. Effective management of these integration efforts is crucial for realizing the intended value from acquisitions.

- Corporate Overheads: Includes administrative salaries, IT, legal, and financial services.

- Acquisition Costs: Covers due diligence and integration expenses for strategic acquisitions.

- Profitability Impact: Efficient management of these costs is vital for overall company profitability.

- 2024 Data Point: While specific figures for this category are part of broader reporting, Munters has historically focused on operational efficiency to mitigate such costs, aiming to maintain a healthy EBITDA margin. For instance, in their 2023 reporting, the company highlighted efforts to streamline administrative functions as part of their efficiency drive.

Munters' cost structure is built around manufacturing, R&D, sales and marketing, services, and general administration. Manufacturing and R&D are significant investments, while sales, marketing, and service costs are directly linked to market reach and customer support. Acquisition and administrative costs form the overhead base.

| Cost Category | Key Components | 2023 Data (SEK Million) | Notes |

| Cost of Sales (Manufacturing) | Raw materials, direct labor, factory overheads | 24,091 | Reflects production expenses for climate solutions. |

| Research & Development (R&D) | Personnel, lab equipment, prototypes | 615 | Supports innovation and product development. |

| Sales, Marketing & Distribution | Sales force, marketing campaigns, logistics | N/A (Integrated into operating expenses) | Drives market penetration and customer engagement. |

| Service & Aftermarket | Technician deployment, spare parts, support infrastructure | N/A (Significant revenue driver, costs optimized) | Essential for customer support and recurring revenue. |

| General & Administrative (incl. Acquisitions) | Corporate overheads, due diligence, integration | N/A (Focus on operational efficiency) | Foundational business costs and strategic expansion expenses. |

Revenue Streams

Munters AB's core revenue generation is through the sale of its advanced air treatment systems and climate solutions. This includes a range of products like dehumidifiers, evaporative coolers, and sophisticated air purification units, catering to industries that need precise environmental control.

Demand for these products is robust across diverse industrial sectors. Notably, the company has seen significant growth fueled by its Data Center Technologies (DCT) and FoodTech segments, highlighting the increasing need for specialized climate management in these areas.

Munters AB generates recurring revenue through its aftermarket services and spare parts division. This includes offering maintenance contracts, repair services, and selling replacement parts for their installed equipment, fostering long-term customer relationships and ensuring a stable income stream.

The company actively aims for its service and components business to represent a substantial percentage of its overall net sales. For instance, in the first quarter of 2024, Munters reported that their Services segment, which includes aftermarket, contributed SEK 2,240 million to total net sales, highlighting the significance of this revenue stream.

Munters AB generates revenue through installation and commissioning fees for its sophisticated climate control systems. These charges reflect the specialized labor and technical know-how needed to correctly set up and fine-tune the performance of their solutions at client locations. This crucial step guarantees that the systems operate as intended from day one, leading to higher customer satisfaction.

Digital Solutions and Software Subscriptions

Munters AB is increasingly leveraging digital solutions and software subscriptions as a key revenue stream. This strategic focus is particularly evident in their FoodTech segment, where they are generating income from software, advanced controllers, sensors, and broader IoT solutions. This shift is designed to create more predictable, recurring revenue.

The company is exploring and implementing subscription-based models for its sophisticated control systems and data analytics platforms. These offerings provide customers with valuable, data-driven insights, thereby enhancing the appeal of a recurring revenue structure. This approach is a significant part of their digital transformation strategy.

- Digital Solutions: Revenue from software, controllers, sensors, and IoT platforms, especially in FoodTech.

- Subscription Models: Exploring recurring revenue through subscriptions for advanced control and data insights.

- Recurring Revenue Growth: Aiming to build a stable income base from ongoing digital service provision.

- Strategic Shift: Reflects a broader company move towards digital offerings and service-based revenue.

Consulting and Engineering Services

Munters’ consulting and engineering services represent a significant revenue stream, offering customers expert guidance in developing tailored climate control solutions. This segment capitalizes on the company's extensive knowledge base to assist clients in optimizing their operations, particularly in demanding sectors like data centers and industrial processes.

These services go beyond mere product sales, providing value through the design of highly specific and efficient climate strategies. Munters' engineers collaborate with clients to address complex challenges, ensuring that the implemented solutions meet precise performance requirements and deliver tangible benefits. For instance, in 2024, Munters continued to secure substantial contracts for its advanced cooling technologies, which often include significant engineering and consulting components.

- Specialized Expertise: Munters leverages deep industry knowledge to design optimal climate control strategies for diverse applications.

- Value-Added Services: Revenue is generated by providing solutions that extend beyond product sales, focusing on customized project support.

- Complex Project Support: The company assists clients with intricate projects requiring sophisticated engineering and tailored development.

Munters AB's revenue streams are diversified, encompassing product sales, aftermarket services, installation, and consulting. The company's strategic focus on digital solutions and subscription models is designed to create more predictable, recurring revenue, as seen in its FoodTech segment. This shift is supported by strong demand in key sectors like data centers and food production.

| Revenue Stream | Description | Example/Data (2024) |

|---|---|---|

| Product Sales | Sale of air treatment systems and climate solutions. | Strong demand in Data Center Technologies and FoodTech segments. |

| Aftermarket Services & Spare Parts | Maintenance contracts, repairs, and replacement parts. | Services segment contributed SEK 2,240 million in Q1 2024. |

| Installation & Commissioning | Fees for setting up and fine-tuning climate control systems. | Ensures optimal system performance from initial deployment. |

| Digital Solutions & Subscriptions | Software, controllers, sensors, IoT, and data analytics platforms. | Growing revenue from digital offerings, particularly in FoodTech. |

| Consulting & Engineering Services | Expert guidance for tailored climate control solutions. | Secured substantial contracts for advanced cooling technologies with engineering components. |

Business Model Canvas Data Sources

The Munters AB Business Model Canvas is built using a blend of internal financial reports, market research on climate control and environmental solutions, and competitive analysis. These data sources ensure each canvas block is filled with accurate, up-to-date information reflecting Munters' operations and market position.