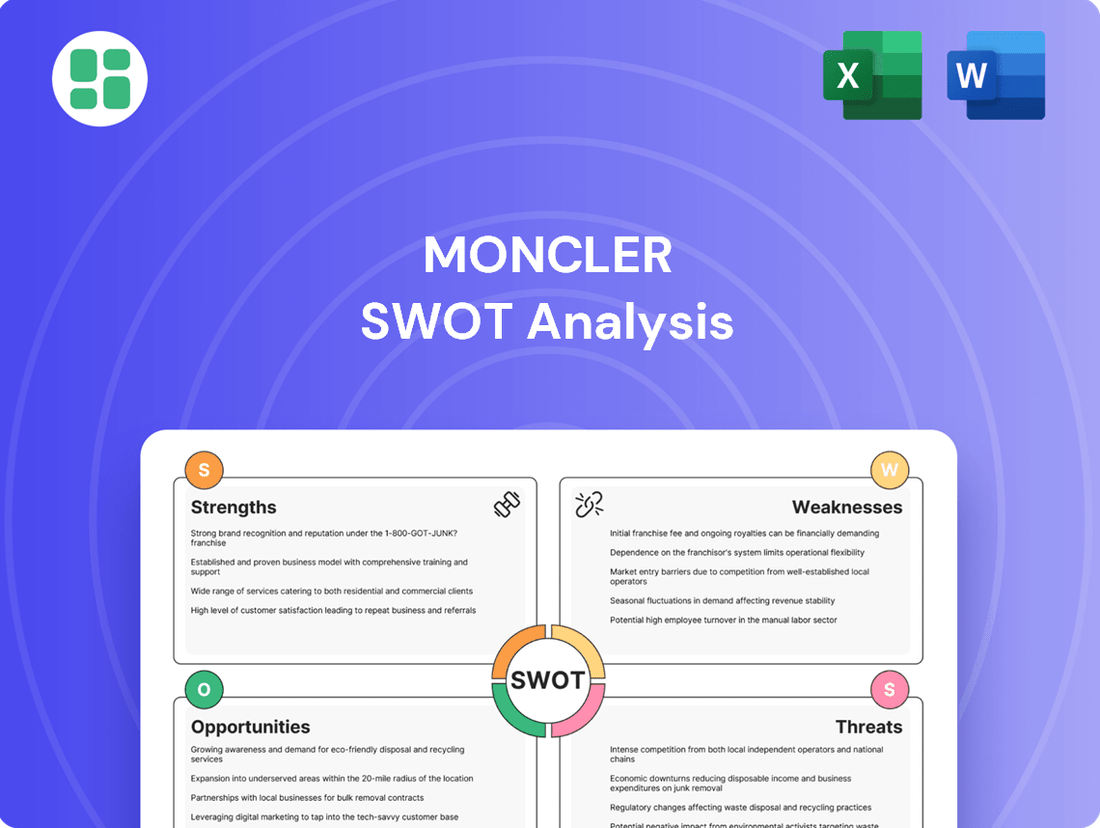

Moncler SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moncler Bundle

Moncler's strong brand heritage and premium positioning are significant strengths, but they also face intense competition and evolving consumer trends. Understanding these dynamics is crucial for navigating the luxury market.

Want the full story behind Moncler's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Moncler's brand prestige, built on a heritage of Italian craftsmanship and association with high-performance outerwear, is a significant strength. This deep-rooted reputation allows for premium pricing, as seen in their average selling price for jackets which often exceeds €1,000. The brand's consistent presence in demanding environments, from mountaineering to fashion runways, reinforces its image as a leader.

Moncler is celebrated for its exceptional craftsmanship and the technical superiority of its down jackets, a testament to its use of advanced materials and innovative design. This focus on high performance and ongoing product development keeps Moncler’s offerings leading the luxury outerwear market.

For instance, in fiscal year 2023, Moncler reported a 12% increase in revenue, reaching €2.04 billion, partly driven by the enduring appeal of its core product lines which consistently showcase superior quality and innovation.

This unwavering dedication to quality not only justifies its premium pricing strategy but also solidifies its competitive advantage, ensuring customer loyalty and brand desirability.

Moncler boasts a robust global distribution network, encompassing over 300 directly operated stores (DOS) as of early 2024, complemented by strategic wholesale partnerships. This expansive retail footprint, reaching key luxury markets worldwide, ensures strong brand visibility and accessibility for its affluent customer base.

The company's significant investment in its directly operated stores, which accounted for approximately 70% of total sales in 2023, allows for meticulous control over brand presentation and customer experience, fostering loyalty and consistent brand messaging across all touchpoints.

Strong Financial Performance and Profitability

Moncler consistently demonstrates robust financial performance, highlighted by healthy revenue growth and impressive profit margins. For instance, in the first quarter of 2024, Moncler reported a 2.1% increase in revenue to €696.7 million, showcasing sustained demand. This financial strength is a testament to their effective business model and the enduring appeal of their luxury outerwear.

This financial stability is crucial, equipping Moncler with substantial resources for strategic investments, further brand expansion, and the agility to weather market volatility. The company’s resilience, particularly within the competitive luxury sector, directly correlates with its significant brand equity and loyal customer base.

Key financial highlights supporting this strength include:

- Consistent Revenue Growth: Achieved a 2.1% revenue increase in Q1 2024, reaching €696.7 million.

- Healthy Profitability: Moncler typically maintains high-profit margins, reflecting efficient operations and strong pricing power in the luxury market.

- Financial Resilience: The company's financial health allows for continued investment in brand building and market penetration, even during economic downturns.

Effective Brand Collaborations and Marketing

Moncler's innovative marketing, particularly through its Moncler Genius project and high-profile designer/artist collaborations, ensures cultural relevance and broad appeal. These partnerships, like those with JW Anderson and Palm Angels, generate substantial media buzz, attracting new luxury consumer segments and boosting brand desirability. This dynamic approach allows Moncler to continually refresh its image while preserving its core identity.

In 2023, Moncler reported strong revenue growth, partly attributed to the success of its collaborative strategies. For instance, the Moncler Genius collections have consistently driven engagement and sales, with specific drops selling out rapidly. This strategy not only keeps the brand at the forefront of fashion trends but also reinforces its position as a leader in the luxury outerwear market, with sales in the first nine months of 2023 reaching €1.79 billion, a 14% increase year-over-year.

- Moncler Genius: A project featuring rotating collaborations with leading designers, creating limited-edition collections that generate significant hype and sales.

- Designer Partnerships: Collaborations with figures like Jonathan Anderson and Francesco Ragazzi (Palm Angels) have amplified brand visibility and desirability.

- Cultural Relevance: These collaborations ensure Moncler remains a relevant and talked-about brand in the fashion and cultural landscape.

- New Consumer Acquisition: The appeal of these limited-edition drops attracts younger demographics and new luxury consumers to the brand.

Moncler's brand equity is a cornerstone strength, built on a legacy of Italian craftsmanship and association with high-performance outerwear. This prestige allows for premium pricing, with jackets frequently retailing above €1,000. Their consistent presence in demanding settings, from extreme sports to high fashion, solidifies their leadership image.

The company's commitment to superior craftsmanship and technical innovation in its down jackets is a key differentiator. This focus on performance and continuous product development ensures Moncler remains at the forefront of the luxury outerwear market.

Moncler's financial performance remains robust, evidenced by consistent revenue growth and strong profit margins. For instance, the company reported a 2.1% revenue increase in the first quarter of 2024, reaching €696.7 million, demonstrating sustained demand for its products.

Moncler's strategic marketing, particularly through its Moncler Genius project and high-profile collaborations, maintains its cultural relevance and broad appeal. These partnerships generate significant media attention, attracting new luxury consumer segments and enhancing brand desirability.

| Key Strength | Description | Supporting Data (as of early 2024/2023) |

| Brand Prestige & Craftsmanship | Italian heritage, high-performance outerwear, premium pricing. | Average selling price for jackets often exceeds €1,000. |

| Global Distribution Network | Over 300 directly operated stores (DOS) and strategic wholesale partnerships. | DOS accounted for ~70% of total sales in 2023. |

| Financial Performance | Consistent revenue growth and healthy profit margins. | Q1 2024 revenue: €696.7 million (up 2.1%). FY 2023 revenue: €2.04 billion (up 12%). |

| Innovative Marketing & Collaborations | Moncler Genius project, designer/artist partnerships. | Moncler Genius collections consistently drive engagement and rapid sell-outs. FY 2023 sales (first nine months): €1.79 billion (up 14%). |

What is included in the product

Delivers a strategic overview of Moncler’s internal and external business factors, highlighting its strong brand, premium positioning, and global reach while acknowledging potential market saturation and reliance on specific product categories.

Identifies Moncler's brand strength and market position to leverage competitive advantages and mitigate potential threats.

Weaknesses

Moncler's significant reliance on its signature down jackets and outerwear, while a hallmark of its brand, also poses a considerable weakness. This product concentration makes the company particularly susceptible to shifts in consumer tastes and evolving fashion trends. For instance, a decline in demand for luxury outerwear could disproportionately impact Moncler's financial performance.

Moncler's luxury positioning means its products come with a premium price tag, naturally restricting its customer base to those with significant disposable income. This exclusivity, while a hallmark of luxury, inherently caps the brand's potential reach into more mainstream consumer segments, potentially limiting overall sales volume compared to brands offering a wider spectrum of price points.

Moncler's reliance on winter apparel creates a significant seasonal dependency, with sales heavily concentrated in colder quarters. This natural ebb and flow impacts revenue predictability and complicates inventory management, as seen in historical sales patterns where Q4 typically outperforms other quarters. For instance, in 2023, the fourth quarter often accounts for a disproportionately large share of annual revenue compared to the summer months.

This seasonality poses a challenge for maintaining consistent sales and cash flow throughout the year. While Moncler has expanded its offerings to include lighter collections, the core business remains tied to cold-weather demand. This makes efficient inventory planning and production scheduling particularly critical to avoid overstocking during off-peak seasons or stockouts during peak demand periods.

Dependence on Key Geographic Markets

Moncler's significant reliance on key geographic markets, notably Asia (with China being a primary driver) and Europe, presents a notable weakness. This concentration means that any economic downturn, political unrest, or shifts in consumer preferences within these regions can have an outsized negative effect on the company's financial results. For instance, while specific 2024/2025 data is still emerging, historical trends show a substantial portion of Moncler's revenue originating from these areas, highlighting the inherent concentration risk.

This dependence creates a vulnerability; a slowdown in luxury spending in China, for example, directly impacts Moncler's top line. Similarly, geopolitical tensions in Europe could disrupt consumer confidence and purchasing power. The company's growth trajectory is therefore closely tied to the economic health and stability of these specific luxury hubs.

- Geographic Concentration: High sales volume and growth heavily tied to Asian (especially China) and European markets.

- Economic Sensitivity: Vulnerable to economic slowdowns and shifts in consumer sentiment in these key regions.

- Concentration Risk: Over-reliance on a limited number of markets creates a significant exposure to regional volatility.

Vulnerability to Counterfeiting

Moncler's desirability makes it a prime target for counterfeiters, especially in developing economies. The prevalence of fake goods can diminish the brand's exclusive image and lead to substantial revenue loss. For instance, the luxury goods market faces billions in losses annually due to counterfeiting, impacting brands like Moncler directly.

The constant battle against fakes requires ongoing investment in intellectual property protection and proactive monitoring. This includes legal action, supply chain security, and consumer education to combat the dilution of brand value and prevent customer deception. The financial burden of combating counterfeiting is a significant operational challenge.

- Brand Dilution: Counterfeits erode Moncler's luxury appeal and exclusivity.

- Lost Revenue: Sales are directly impacted as consumers are misled by fake products.

- Reputational Risk: Poor quality fakes can damage consumer perception of genuine Moncler items.

- Investment Drain: Significant resources are diverted to anti-counterfeiting efforts.

Moncler's strong brand identity, while an asset, can also be a weakness if it leads to a perception of being overly focused on a specific aesthetic. This might alienate potential customers who are looking for greater stylistic diversity. The brand's commitment to its iconic puffer style, while popular, could limit its appeal to those seeking broader fashion expressions.

What You See Is What You Get

Moncler SWOT Analysis

You’re viewing a live preview of the actual Moncler SWOT analysis file. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

This is the same Moncler SWOT analysis document included in your download. The full content, detailing strategic insights and actionable recommendations, is unlocked after payment.

Opportunities

Moncler can significantly boost its growth by venturing into new luxury apparel categories beyond its renowned outerwear. This includes expanding its ready-to-wear collections, introducing stylish footwear, and developing a robust accessories line. Such diversification would not only lessen dependence on seasonal outerwear sales but also appeal to a broader customer base seeking a complete luxury wardrobe.

Moncler has a significant opportunity to tap into rapidly expanding luxury markets in Southeast Asia, the Middle East, and Latin America. These regions are experiencing a rise in disposable incomes, directly fueling demand for premium and high-end fashion brands like Moncler.

For instance, the luxury goods market in Southeast Asia was projected to grow by over 10% annually leading up to 2025, with a notable increase in spending power among affluent consumers. Strategic market entry, potentially through flagship stores or targeted e-commerce initiatives, coupled with culturally relevant marketing campaigns, can effectively capture these new customer bases and unlock substantial revenue streams for Moncler.

Moncler's opportunity lies in deepening its digital and e-commerce footprint. By investing further in its online sales platforms and digital marketing, the company can tap into the growing segment of luxury consumers who prefer online research and purchasing. This strategy is projected to boost global reach and customer interaction.

A strong e-commerce presence is vital for connecting with today's luxury shopper. In 2023, Moncler reported that its direct-to-consumer channel, which includes online sales, accounted for a significant portion of its revenue, highlighting the importance of this digital avenue for sustained growth and market penetration.

Focus on Sustainability and Ethical Practices

Consumers are increasingly prioritizing sustainability and ethical production, especially in the luxury sector. This growing demand offers Moncler a significant opportunity to enhance its brand reputation and attract a key demographic of environmentally and socially conscious shoppers. By highlighting its commitment to these values, Moncler can foster deeper customer loyalty and stand out in a competitive market.

Moncler can leverage this trend by investing in and transparently communicating its sustainability efforts. This includes everything from sourcing materials responsibly to ensuring fair labor practices throughout its supply chain. For instance, in 2023, luxury brands that demonstrated strong ESG (Environmental, Social, and Governance) performance saw an average stock return of 15%, outperforming the broader market. Moncler's focus on these areas could translate into tangible financial benefits and a stronger brand narrative.

- Growing Consumer Demand: A significant portion of Gen Z and Millennial luxury consumers consider sustainability a key purchasing factor.

- Brand Differentiation: Transparent sustainability initiatives can set Moncler apart from competitors who may lag in these areas.

- Enhanced Brand Loyalty: Aligning with evolving consumer values strengthens emotional connections and encourages repeat business.

- Positive Financial Impact: Brands with robust ESG strategies often experience improved investor relations and market valuation.

Strategic Acquisitions and Partnerships

Moncler can significantly expand its reach and offerings by strategically acquiring brands that complement its existing luxury outerwear focus or by forging partnerships. This approach allows for diversification beyond its core product line and taps into new customer segments. For instance, acquiring a high-end leather goods or accessories brand could create cross-selling opportunities.

These strategic moves can accelerate growth by injecting new revenue streams and market share, thereby strengthening Moncler's competitive stance in the wider luxury market. Access to new distribution networks or innovative technologies through partnerships, such as those in sustainable materials or digital retail experiences, can also provide a significant edge. Moncler's commitment to innovation was evident in its 2021 €1.2 billion acquisition of Stone Island, a move that bolstered its casual luxury segment and expanded its customer base.

- Market Share Expansion: Acquisitions can immediately increase market share by absorbing competitors or entering new geographic regions.

- Brand Portfolio Diversification: Partnering with or buying brands in adjacent luxury categories (e.g., accessories, footwear) can reduce reliance on a single product type.

- Synergistic Capabilities: Combining R&D, supply chains, or marketing efforts with partners can lead to cost efficiencies and enhanced product development.

- Access to New Channels: Strategic alliances can unlock access to exclusive retail locations or e-commerce platforms previously unavailable.

Moncler can capitalize on the growing demand for sustainable luxury by enhancing its ESG initiatives and communicating these efforts transparently. This strategy appeals to environmentally conscious consumers and can improve brand loyalty and market valuation, as demonstrated by the 15% higher stock returns seen in 2023 for brands with strong ESG performance.

Expanding into new luxury markets, particularly in Southeast Asia, the Middle East, and Latin America, presents a significant growth opportunity. These regions show rising disposable incomes, with Southeast Asia's luxury market projected for over 10% annual growth leading up to 2025, indicating substantial potential for Moncler.

Diversifying its product offerings beyond outerwear into categories like footwear and accessories, and strategically acquiring complementary brands like Stone Island (acquired in 2021 for €1.2 billion), can broaden Moncler's customer base and reduce reliance on seasonal sales, thereby strengthening its overall market position.

Deepening its digital and e-commerce capabilities is crucial, as Moncler's direct-to-consumer channel already forms a significant revenue base. Investing in online platforms and digital marketing will enhance global reach and customer engagement in an increasingly online luxury market.

Threats

The luxury apparel sector is a battlefield, with established giants and nimble newcomers constantly vying for consumer attention and spending. Moncler, despite its strong brand, operates in this intensely competitive environment, facing pressure from brands offering comparable high-end outerwear and broader luxury assortments. For instance, in 2024, the global luxury goods market was projected to reach approximately €362 billion, highlighting the sheer scale and competition within the industry.

This persistent rivalry necessitates ongoing investment in product innovation, marketing campaigns, and maintaining brand desirability to retain its premium positioning. Competitors like Canada Goose, Stone Island, and even broader luxury houses such as Louis Vuitton and Gucci, which increasingly offer technical outerwear, present a constant challenge. Moncler's ability to stay ahead requires a keen understanding of evolving consumer tastes and a commitment to differentiation in a crowded marketplace.

Economic downturns pose a significant threat to Moncler, as luxury goods are discretionary. For instance, a global recession in 2024 or 2025 could see a notable drop in consumer confidence, directly impacting Moncler’s sales. This vulnerability is amplified because affluent consumers, while more resilient, still adjust spending during periods of economic uncertainty, potentially shifting away from non-essential luxury purchases.

Moncler faces a significant threat from rapidly shifting consumer preferences and evolving fashion trends, particularly influenced by younger demographics. In 2024, the luxury market saw a continued emphasis on sustainability and digital engagement, areas where brands need to continuously adapt to maintain appeal. Failing to anticipate and respond to these changes could lead to a decline in demand for Moncler's signature puffer jackets and other core offerings, as consumers increasingly seek novelty and alignment with current aesthetic directions.

Supply Chain Disruptions and Material Costs

Global supply chain vulnerabilities, exacerbated by geopolitical events, pose a significant threat to Moncler's production. Rising costs for essential materials like high-quality down and technical fabrics directly impact operational expenses and profit margins. For instance, the price of down feathers saw a notable increase in early 2024 due to avian flu outbreaks and increased demand, potentially affecting Moncler's cost of goods sold.

Moncler's reliance on specific suppliers or regions for specialized materials introduces a considerable risk of disruption. Any interruption in these key supply lines, whether due to political instability, trade disputes, or unforeseen logistical challenges, could lead to production delays and increased material costs. This dependence creates cost volatility that can be difficult to manage, impacting the company's ability to maintain consistent pricing and availability of its luxury products.

- Supply Chain Vulnerabilities: Geopolitical tensions and global events can disrupt the flow of raw materials and finished goods.

- Material Cost Volatility: Fluctuations in the prices of down, technical fabrics, and other key inputs directly affect production costs.

- Supplier Dependence: Reliance on a limited number of suppliers or specific geographic regions for specialized materials creates a risk of interruption.

- Operational Impact: Disruptions can lead to increased operational expenses, production delays, and reduced profit margins for Moncler.

Geopolitical and Trade Uncertainties

Geopolitical and trade uncertainties pose a significant threat to Moncler's global business. For instance, ongoing trade disputes, such as those impacting luxury goods between major economic blocs, could lead to increased tariffs on imported materials or finished products, directly affecting Moncler's cost of goods sold and pricing strategies. Political instability in key manufacturing or sales regions can disrupt supply chains and consumer demand. New regulatory changes, like stricter import/export controls or shifting consumer protection laws in markets such as China or the US, could create operational hurdles and impact market access, potentially affecting Moncler's revenue streams.

Protectionist policies implemented by governments can erect barriers to entry or increase the cost of doing business in certain countries. This could range from local content requirements to outright bans on certain imported goods, forcing Moncler to re-evaluate its market penetration strategies. Such shifts in international relations can create complexities in managing a global brand and negatively impact profitability across diverse geographical segments. For example, a sudden imposition of tariffs on Italian luxury goods in a major market could significantly reduce sales volumes and margins.

- Trade Tensions: Ongoing trade friction between major economic powers could result in tariffs impacting Moncler's supply chain and profitability.

- Political Instability: Unrest or changes in government in key operational or sales regions can disrupt business continuity and consumer spending.

- Regulatory Changes: New trade regulations or protectionist measures could restrict market access and increase operational costs for Moncler.

Moncler faces intense competition from both established luxury brands and emerging players, requiring continuous innovation and marketing investment to maintain its premium status. Economic downturns also present a significant threat, as luxury purchases are discretionary and consumer confidence can sharply decline, impacting sales volumes. Shifting consumer preferences, especially among younger demographics who prioritize sustainability and digital engagement, necessitate constant adaptation to remain relevant and desirable.

Supply chain vulnerabilities, including material cost volatility and supplier dependence, pose operational risks that can lead to production delays and reduced profit margins. Geopolitical and trade uncertainties, such as tariffs and regulatory changes, can create barriers to market access and increase the cost of doing business globally. For instance, the luxury goods market was projected to reach €362 billion in 2024, underscoring the scale of competition Moncler navigates.

| Threat Category | Specific Threat | Impact on Moncler | Example/Data Point (2024/2025 Focus) |

|---|---|---|---|

| Competition | Intense rivalry from established and emerging luxury brands | Requires constant innovation and marketing to maintain market share and brand desirability. | Global luxury market projected at €362 billion in 2024, indicating high competition. |

| Economic Factors | Economic downturns and recessions | Reduced consumer spending on discretionary luxury items, impacting sales. | Affluent consumers still adjust spending during economic uncertainty. |

| Consumer Trends | Rapidly shifting fashion preferences and evolving consumer tastes | Risk of declining demand if brand fails to adapt to new aesthetics and values like sustainability. | Increased demand for sustainability and digital engagement in luxury in 2024. |

| Supply Chain | Geopolitical tensions, material cost volatility, supplier dependence | Disruptions in production, increased operational costs, and reduced profit margins. | Price of down feathers increased in early 2024 due to avian flu and demand. |

| Geopolitical/Trade | Trade disputes, political instability, regulatory changes | Tariffs, market access restrictions, increased operational costs, and revenue impact. | Potential for increased tariffs on luxury goods between major economic blocs. |

SWOT Analysis Data Sources

This Moncler SWOT analysis is built upon a foundation of credible data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.