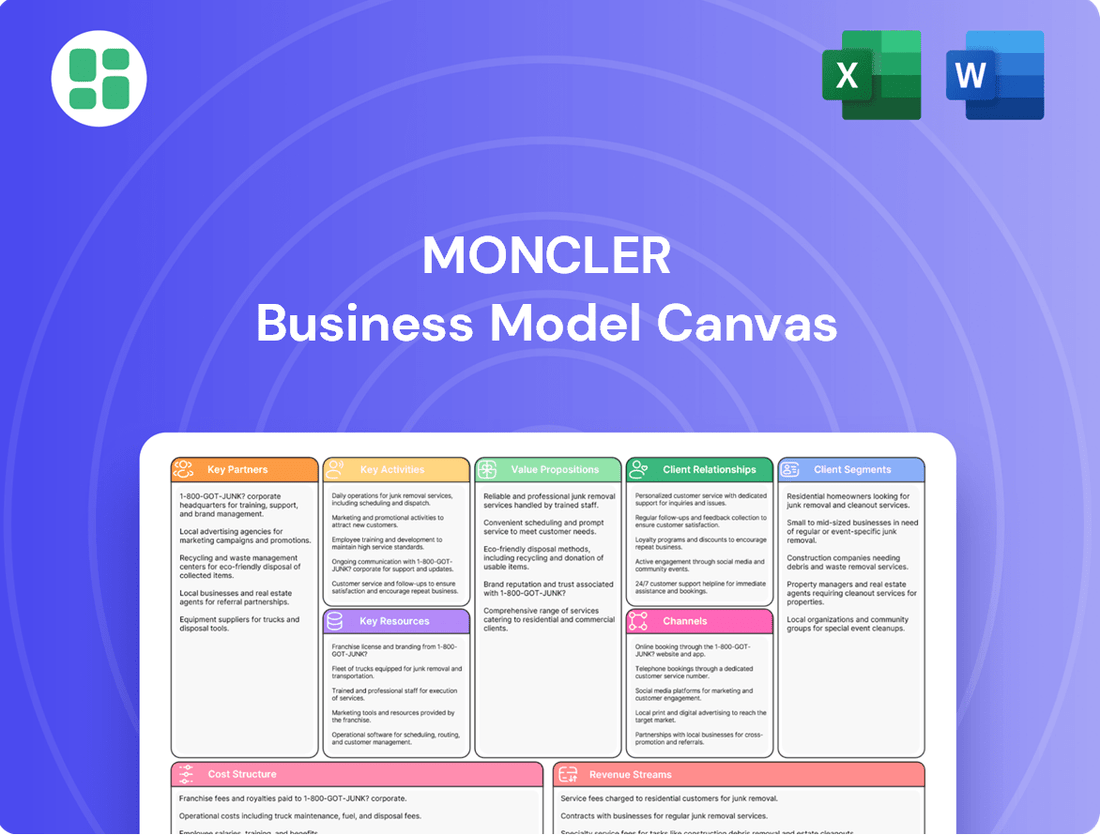

Moncler Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moncler Bundle

Unlock the strategic blueprint behind Moncler's success with our comprehensive Business Model Canvas. Discover how they masterfully blend luxury with performance, targeting affluent adventurers and fashion-forward individuals. This detailed analysis reveals their key partnerships, value propositions, and revenue streams.

Ready to dissect Moncler's winning formula? Our full Business Model Canvas provides a clear, section-by-section breakdown of their customer relationships, cost structures, and channels. Gain actionable insights to inform your own strategic planning.

See how Moncler builds its premium brand and maintains market leadership. This downloadable canvas highlights their core activities, key resources, and competitive advantages, offering a vital resource for entrepreneurs and analysts alike.

Partnerships

Moncler’s commitment to unparalleled quality hinges on its strategic alliances with select luxury material suppliers. These partnerships are foundational, providing access to the finest down, innovative technical fabrics, and meticulously crafted components essential for their iconic outerwear. For instance, Moncler’s reliance on suppliers like Pertex for advanced, lightweight, and durable fabrics underscores their dedication to performance and luxury.

Moncler relies on a network of specialized manufacturing partners, crucial for bringing its intricate designs, particularly its signature down-filled outerwear, to life. These collaborations are vital for upholding the brand's commitment to exceptional quality and craftsmanship, ensuring each piece meets rigorous production standards.

These manufacturing partners often possess proprietary techniques and deep expertise in handling specialized materials and construction methods, especially for the complex layering and filling of down jackets. This specialized knowledge is key to Moncler's product differentiation and premium market positioning.

For instance, in 2023, Moncler's supply chain, while not publicly detailing individual partner contributions, continued to emphasize ethical sourcing and production, with a significant portion of its manufacturing concentrated in Italy and Europe, reflecting a dedication to quality control and brand heritage.

Moncler strategically partners with prestigious department stores like Harrods and Saks Fifth Avenue, alongside exclusive luxury boutiques worldwide. This allows them to reach affluent customers who prefer curated shopping experiences, extending their brand presence beyond Moncler's own retail outlets.

These collaborations are crucial for market penetration, enabling Moncler to tap into diverse geographical regions and connect with a wider spectrum of high-net-worth individuals. For instance, in 2023, Moncler continued to strengthen its presence in key Asian markets through such wholesale relationships, contributing to its overall global sales strategy.

Technology and Innovation Collaborators

Moncler actively collaborates with technology and innovation partners to drive product advancement and enhance customer experiences. A notable example is their partnership with LoveFrom, the creative agency founded by Sir Jony Ive, formerly Apple's chief design officer. This collaboration aims to explore innovative solutions across various aspects of Moncler's business.

This strategic alliance is designed to keep Moncler at the cutting edge of product development, potentially focusing on novel materials, advanced manufacturing techniques, or immersive digital consumer journeys. Such partnerships are crucial for maintaining a competitive edge in the luxury market, where innovation directly impacts brand perception and market share.

- Partnership with LoveFrom: Led by Sir Jony Ive, focusing on creative and technological innovation.

- Focus Areas: Exploring new materials, enhanced digital experiences, and product development.

- Strategic Goal: To maintain leadership in product innovation and consumer engagement within the luxury sector.

Creative Collaborators & Designers

Moncler consistently partners with celebrated designers, artists, and other brands, notably through its Moncler Genius project. These collaborations are designed to produce exclusive, limited-edition items. For instance, the Moncler Genius event in Shanghai in 2023 showcased this strategy, driving substantial brand excitement and reaching new demographics.

These creative alliances are crucial for generating significant brand buzz and attracting diverse customer segments. They effectively reinforce Moncler's position as a leader in fashion innovation.

- Designer Collaborations: Moncler Genius projects have featured a rotating roster of designers, each bringing a unique perspective.

- Brand Buzz: Limited-edition drops create scarcity and drive consumer interest, as evidenced by the high demand for Genius collections.

- New Customer Segments: Partnerships often introduce Moncler to audiences previously unreached, broadening its market appeal.

- Fashion-Forward Image: Collaborations with influential figures solidify Moncler's reputation for cutting-edge style and relevance.

Moncler’s key partnerships extend to luxury retailers and innovative collaborators, vital for market reach and brand evolution. Collaborations like the one with LoveFrom, led by Jony Ive, aim to push boundaries in product and customer experience. The Moncler Genius project, featuring rotating designer partnerships, consistently generates significant brand buzz and attracts new customer segments, as seen in events like the 2023 Shanghai showcase.

| Partner Type | Examples | Strategic Importance | 2023 Impact/Focus |

|---|---|---|---|

| Material Suppliers | Pertex | Ensures high-quality, performance-driven materials. | Continued emphasis on advanced fabric sourcing. |

| Manufacturing Partners | Specialized European facilities | Upholds craftsmanship and quality standards. | Concentration in Italy and Europe for quality control. |

| Retail Partners | Harrods, Saks Fifth Avenue | Expands market penetration and customer access. | Strengthening presence in key Asian markets. |

| Innovation Partners | LoveFrom (Jony Ive) | Drives product advancement and digital experiences. | Exploring novel materials and consumer journeys. |

| Creative Collaborators | Moncler Genius designers | Generates brand excitement and reaches new demographics. | High demand for limited-edition Genius collections. |

What is included in the product

This Moncler Business Model Canvas offers a strategic blueprint, detailing customer segments like affluent fashion enthusiasts and luxury travelers, and value propositions centered on premium outerwear and aspirational brand identity.

It outlines key resources such as design expertise and a strong brand, alongside channels like exclusive boutiques and e-commerce, to deliver its high-quality products and maintain its luxury market position.

Moncler's Business Model Canvas acts as a pain point reliever by offering a high-level, editable view of its core components, enabling quick identification of strategic strengths and areas for improvement.

Activities

Moncler's core activity revolves around the meticulous conceptualization, design, and development of its high-end apparel and accessories. This encompasses the continuous evolution of its established lines, such as Moncler Grenoble and Collection, alongside the innovative Moncler Genius project, which collaborates with different designers each season. This dedication to design excellence ensures the brand remains at the forefront of luxury fashion.

Significant investment in research and development underpins Moncler's design process. The company actively explores emerging trends, cutting-edge materials, and advancements in functional performance to create collections that are both aesthetically desirable and technically superior. For instance, the brand's ongoing commitment to innovation is reflected in its use of advanced insulation technologies and sustainable material sourcing, as highlighted in its 2024 sustainability reports.

Moncler meticulously oversees its entire production chain, whether items are made internally or by trusted external partners, to ensure the brand's signature quality and craftsmanship are consistently met. This focus on detail is vital for preserving the luxury appeal of their iconic outerwear.

In 2023, Moncler continued its strategy of strengthening its supply chain by emphasizing Italian craftsmanship. This involves nurturing relationships with skilled artisans and potentially acquiring specialized manufacturing facilities, reinforcing the brand's commitment to its heritage and quality. For instance, the company has been vocal about its efforts to integrate more sustainable practices throughout its manufacturing processes, a trend that gained significant traction in 2024 as the luxury sector increasingly prioritizes environmental responsibility.

Moncler's brand building hinges on extensive marketing campaigns, captivating fashion shows, and deep digital engagement. These activities are crucial for cultivating and sustaining its coveted luxury status, ensuring the brand remains aspirational for consumers.

Storytelling, sophisticated visual merchandising, and high-profile celebrity endorsements are central to Moncler's strategy. Major events, such as the Moncler Genius showcase in Shanghai, demonstrate this commitment, attracting millions of online viewers and reinforcing the brand's global appeal.

Global Retail Operations Management

Moncler's key activities in global retail operations management focus on meticulously overseeing its worldwide network of Directly Operated Stores (DOS). This encompasses crucial elements like crafting distinctive store designs, optimizing inventory levels across all locations, implementing comprehensive sales staff training programs, and consistently elevating the customer experience. The company is actively pursuing further expansion of its direct retail presence, evidenced by its strategic new store openings and ongoing renovations aimed at developing more immersive and engaging retail environments.

In 2024, Moncler continued to invest in its retail expansion. For instance, the brand opened new flagship stores in key global cities, enhancing its physical footprint and brand visibility. These investments are designed to reinforce brand identity and provide customers with a premium shopping experience, directly contributing to sales growth and customer loyalty.

- Store Network Management: Overseeing the design, visual merchandising, and operational efficiency of its global Directly Operated Stores (DOS).

- Inventory Optimization: Implementing sophisticated inventory management systems to ensure product availability and minimize stockouts across its retail locations.

- Customer Experience Enhancement: Training sales staff to deliver exceptional service and creating engaging in-store environments that reflect the Moncler brand.

- Retail Expansion Strategy: Continuously identifying and executing new store openings and renovations to expand its direct retail footprint and create experiential spaces.

Supply Chain Management and Logistics

Moncler's key activities heavily involve the intricate management of its global supply chain. This encompasses everything from the careful selection of premium raw materials, like high-quality down and technical fabrics, to the final delivery of its iconic outerwear to boutiques and direct-to-consumer channels worldwide. The company prioritizes efficient logistics and inventory optimization to ensure product availability and minimize lead times.

A significant aspect of Moncler's operations is its commitment to responsible sourcing, integrating sustainability into its supply chain. This means ensuring ethical practices and environmental consciousness are considered at every stage. For instance, in 2023, Moncler continued its efforts to increase the traceability of its down, a core component of its products, aiming for greater transparency and accountability.

- Global Sourcing: Procuring high-quality down and specialized fabrics from select suppliers across the globe.

- Manufacturing Oversight: Managing production processes, often through third-party manufacturers, ensuring adherence to quality and brand standards.

- Logistics and Distribution: Orchestrating the timely and efficient movement of finished goods from production sites to retail locations and e-commerce fulfillment centers.

- Inventory Management: Optimizing stock levels across its network to meet demand while controlling costs and minimizing waste.

Moncler's key activities also include robust brand management and marketing. This involves crafting compelling brand narratives, executing high-impact advertising campaigns, and managing digital presence to maintain aspirational brand perception. The brand consistently invests in experiential marketing, such as fashion shows and exclusive events, to engage its target audience and reinforce its luxury positioning.

In 2024, Moncler continued to leverage digital channels for customer engagement and sales. Their online presence, including e-commerce platforms and social media, plays a crucial role in reaching a global audience and driving direct-to-consumer sales. For instance, strategic collaborations and influencer partnerships are employed to amplify brand reach and desirability.

Moncler's financial performance in 2023 demonstrated strong growth, with revenues reaching €3,021.1 million, a 12% increase at current exchange rates compared to 2022. This growth was driven by a solid performance across all geographic regions and product categories, reflecting the effectiveness of their brand strategy and operational execution.

| Key Activity | Description | 2023 Financial Impact (Illustrative) |

|---|---|---|

| Brand Building & Marketing | Executing global campaigns, fashion shows, and digital engagement to maintain luxury status. | Contributed to revenue growth and strong brand equity. |

| Retail Operations Management | Overseeing global Directly Operated Stores (DOS), focusing on design, inventory, and customer experience. | Drove direct sales and enhanced customer loyalty. |

| Supply Chain Management | Sourcing premium materials and managing production for quality and efficiency. | Ensured product availability and brand integrity. |

Delivered as Displayed

Business Model Canvas

The Moncler Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you can confidently assess the detailed breakdown of Moncler's operations, customer segments, value propositions, and revenue streams before committing. Upon completing your order, you will gain full access to this exact, comprehensive analysis, ready for your review and strategic application.

Resources

Moncler's brand reputation, built on its rich heritage in mountaineering and high-end outerwear, is a cornerstone of its business model. This deeply ingrained image allows Moncler to command premium pricing, a key factor in its ultra-luxury positioning.

The company's heritage not only supports its premium pricing strategy but also cultivates significant customer loyalty. This loyalty is a powerful intangible asset, contributing to the brand's enduring appeal and market strength.

In 2023, Moncler reported revenue of €2.90 billion, demonstrating the commercial success derived from its strong brand equity and heritage. This financial performance underscores the value of its reputation in the competitive luxury market.

Moncler's intellectual property, including proprietary designs and innovative material technologies, is a cornerstone of its brand identity and market advantage. This encompasses trademarks, copyrights, and design patents that shield its distinctive aesthetic and cutting-edge product lines, such as the performance-oriented Moncler Grenoble and the collaborative Moncler Genius collections.

These intellectual assets are crucial for maintaining Moncler's premium positioning and preventing market saturation with imitations. The company actively protects its unique construction methods and patented technologies, ensuring its products offer superior quality and performance, which is vital for its luxury market appeal.

Moncler's Global Retail Network, comprising 287 directly operated stores (DOS) as of June 30, 2025, is a cornerstone of its business model. These strategically placed boutiques in prime luxury shopping districts worldwide are vital physical assets.

This extensive network allows Moncler to curate a controlled brand experience, ensuring every customer interaction aligns with its luxury positioning. It facilitates direct engagement with its clientele, fostering stronger relationships and deeper brand loyalty.

The directly operated stores are instrumental in driving Moncler's dominant direct-to-consumer (DTC) channel, which is increasingly important in the luxury market. This DTC focus allows for greater control over pricing, brand messaging, and customer data, ultimately enhancing profitability and brand equity.

Skilled Design and Production Teams

Moncler's skilled design and production teams are the bedrock of its success, ensuring each collection embodies innovation and high fashion. These teams, comprising expert designers, product developers, and technical specialists, are crucial for maintaining the brand's luxury appeal and quality standards.

Human capital is paramount in the luxury goods market. As of the end of 2023, Moncler's global workforce exceeded 8,000 individuals, a testament to the significant investment in talent that drives its creative and manufacturing prowess.

- Designer Expertise: The creative vision and trend forecasting capabilities of Moncler's design teams are essential for developing sought-after, cutting-edge apparel.

- Product Development Acumen: Teams focused on product development translate creative concepts into tangible, high-quality garments, ensuring technical excellence and material innovation.

- Technical Production Skills: The proficiency of production teams in manufacturing processes guarantees the impeccable craftsmanship and durability expected of a luxury brand.

- Global Workforce: With over 8,000 employees worldwide by the close of 2023, Moncler leverages a broad talent pool to support its design and production operations.

Efficient Global Supply Chain

Moncler's efficient global supply chain is a cornerstone of its business model, encompassing sourcing, manufacturing, and distribution. This agile network is crucial for delivering high-quality products while maintaining operational excellence. In 2023, Moncler continued to invest in optimizing its logistics and production processes, aiming for greater responsiveness to market demands.

The company places significant emphasis on Italian craftsmanship, integrating this heritage into its supply chain strategy. This commitment ensures the distinctive quality and luxury appeal of Moncler products. By reinforcing these relationships, Moncler safeguards its brand identity and artisanal production values.

- Global Network: Moncler operates a sophisticated global network for sourcing raw materials and manufacturing finished goods, ensuring flexibility and efficiency.

- Italian Craftsmanship Focus: A key resource is the deep integration of Italian artisanal skills throughout the supply chain, from design to final production.

- Agility and Responsiveness: The supply chain is designed to be agile, allowing Moncler to adapt quickly to changing fashion trends and consumer preferences.

- Distribution Excellence: Efficient distribution channels are vital for timely delivery to Moncler's worldwide retail locations and online customers.

Moncler's brand heritage and intellectual property are its most valuable intangible assets, underpinning its ultra-luxury positioning and premium pricing. This strong brand equity, cultivated through its mountaineering roots and innovative designs, drives significant customer loyalty and market strength. The company's commitment to protecting its unique designs and material technologies ensures its competitive advantage.

Moncler's directly operated stores form a crucial physical asset, enabling a controlled luxury brand experience and direct customer engagement. This extensive retail network, with 287 stores globally as of mid-2025, is central to its direct-to-consumer strategy, enhancing brand control and profitability.

The company's skilled workforce, exceeding 8,000 employees by the end of 2023, represents essential human capital. This talent pool, encompassing designers, product developers, and production specialists, is vital for maintaining Moncler's reputation for innovation, quality, and craftsmanship.

Moncler's agile global supply chain, with a strong emphasis on Italian craftsmanship, is a key operational resource. This network efficiently sources materials, manufactures high-quality products, and distributes them worldwide, ensuring responsiveness to market demands and upholding the brand's artisanal values.

Value Propositions

Moncler's value proposition centers on unparalleled quality and craftsmanship, evident in their use of superior materials and meticulous construction. Their signature down jackets, for instance, are built for durability and high performance, designed to withstand harsh conditions. This commitment to product excellence ensures customers receive luxury items that are truly built to last.

Moncler's value proposition centers on offering an exclusive luxury experience and products that function as potent status symbols. This directly appeals to a discerning clientele who prioritize prestige and high-end fashion in their purchasing decisions.

Owning a Moncler piece is more than just acquiring an item; it signifies a deliberate embrace of luxury and a refined, discerning taste. This aligns perfectly with the brand's established global positioning as a premier purveyor of luxury goods.

For instance, Moncler's strong brand equity and aspirational marketing contribute to its ability to command premium pricing. In 2023, the brand reported revenues of €2.96 billion, demonstrating the market's strong demand for its luxury offerings and the perceived value associated with its status symbol appeal.

Moncler consistently delivers innovative designs that merge functional performance with cutting-edge fashion, providing stylish and practical outerwear. The brand’s commitment to this fusion is evident in its highly sought-after collections.

Moncler’s Genius project, a series of collaborations with diverse designers, showcases this dedication to innovative, fashion-forward style. For instance, its 2024 collections continued to push boundaries, drawing inspiration from various cultural and artistic movements.

Comfort, Warmth, and Performance

Moncler's core value proposition for its outerwear centers on delivering unparalleled warmth, comfort, and performance, especially in harsh, cold weather environments. This is achieved through the meticulous use of premium down insulation and advanced technical fabrics, embodying their foundational 'Born to Protect from the Cold' philosophy.

This commitment to functional excellence is not just a claim; it's a demonstrable feature that resonates deeply with customers seeking reliable protection against extreme elements. For instance, Moncler's use of high-fill-power down, often exceeding 700, ensures superior thermal insulation without unnecessary bulk, a critical factor for active individuals and those in frigid climates.

- Exceptional Insulation: Utilizes high-fill-power down (e.g., 700+) for maximum warmth and minimal weight.

- Advanced Fabric Technology: Employs waterproof, breathable, and windproof materials to shield against the elements.

- Ergonomic Design: Focuses on comfortable fit and freedom of movement, crucial for performance in cold conditions.

Brand Heritage and Authenticity

Moncler's brand heritage, deeply rooted in its 1952 founding and iconic status in high-altitude exploration, offers a powerful value proposition. Customers are drawn to this authenticity, seeing it as a guarantee of genuine quality and performance in luxury outerwear.

This rich history isn't just a story; it's a strategic asset that differentiates Moncler in the competitive luxury market. The brand's connection to mountaineering and extreme conditions lends inherent credibility to its products, appealing to consumers who value both heritage and functional excellence.

For instance, Moncler's consistent presence in the world of extreme sports and expeditions, often showcased in its marketing, reinforces this perception. In 2023, the brand continued to leverage its heritage through collaborations and collections that explicitly referenced its past achievements, further solidifying its authentic appeal.

- Heritage as a Foundation: Moncler's origins in the French Alps provide a compelling narrative of performance and durability.

- Authenticity in Luxury: This historical connection translates into a perceived authenticity that resonates with luxury consumers seeking genuine experiences.

- Credibility through Performance: The brand's association with extreme conditions lends credibility to the quality and functionality of its products.

- Strategic Differentiation: This unique story sets Moncler apart from competitors, offering a distinct value beyond mere fashion.

Moncler offers a unique blend of high-performance outerwear and high fashion, appealing to consumers who seek both functionality and style. This fusion is evident in their innovative designs that are as suitable for extreme weather as they are for urban environments.

The brand's commitment to exceptional quality, using premium materials and meticulous craftsmanship, ensures durability and superior comfort. This focus on product excellence is a cornerstone of their value proposition, making Moncler items a long-term investment.

Moncler positions itself as a purveyor of luxury and status, with its products serving as aspirational symbols for discerning consumers. This brand perception, reinforced by strategic marketing and collaborations, allows Moncler to command premium pricing, as seen in their substantial revenue figures.

Moncler's value proposition is deeply rooted in its heritage of performance and authenticity, originating from its founding in the French Alps. This connection to high-altitude exploration lends credibility to the brand's functional excellence and differentiates it in the competitive luxury market.

Customer Relationships

Moncler excels at building loyalty by offering a deeply personalized in-store experience. Sales associates act as style consultants, providing tailored recommendations and early access to coveted new arrivals, making each customer feel uniquely valued.

Moncler cultivates exclusive clienteling and VIP programs, fostering deep connections with its most valuable customers. This involves personalized attention from dedicated sales advisors and access to invitation-only events, reinforcing a sense of community and belonging. For instance, in 2023, Moncler reported a significant increase in repeat customer purchases, a direct result of these relationship-building initiatives.

Moncler actively cultivates its customer relationships through robust digital engagement, utilizing its e-commerce site and social media channels to foster a global community. This strategy involves sharing compelling brand narratives and creating interactive experiences, as seen with initiatives like the Moncler Genius project, which has included significant events in locations such as Shanghai.

After-Sales Service and Product Care

Moncler's commitment to after-sales service, including its 'Extra-Life advanced repair service,' significantly bolsters customer loyalty and satisfaction. This focus on product longevity not only elevates the luxury experience but also underscores the brand's dedication to sustainability and responsible consumption.

- Reinforced Customer Trust: Offering specialized repair services and expert care advice after a purchase builds substantial trust, encouraging repeat business and positive word-of-mouth.

- Enhanced Luxury Experience: Extending the life of high-value items through meticulous care and repair aligns with the expectations of luxury consumers, who value durability and craftsmanship.

- Brand Responsibility and Sustainability: Initiatives like 'Extra-Life' demonstrate Moncler's commitment to reducing waste and promoting a circular economy, resonating with environmentally conscious clientele.

- Data-Driven Insights: Analyzing repair data can provide valuable feedback on product durability and common issues, informing future design and manufacturing processes.

Brand Storytelling and Emotional Connection

Moncler cultivates deep customer bonds through compelling brand storytelling, weaving together its rich heritage, impactful collaborations, and forward-thinking sustainability efforts. This narrative, encapsulated in initiatives like the 'Born to Protect' plan, allows consumers to connect with the brand on a more profound, emotional level.

This approach transcends mere product transactions, inviting customers into the Moncler universe. By sharing its journey and values, Moncler builds a loyal community that feels invested in the brand's ongoing story and its commitment to positive change.

- Heritage Communication: Moncler actively shares its history, dating back to its founding in 1952, to create a sense of legacy and enduring quality.

- Collaborative Narratives: High-profile collaborations, such as those with designers like Pierpaolo Piccioli, generate buzz and allow customers to engage with diverse creative expressions under the Moncler umbrella.

- Sustainability as a Core Story: The 'Born to Protect' plan, launched in 2019, highlights Moncler's commitment to environmental responsibility, resonating with increasingly conscious consumers. For instance, by 2025, Moncler aims to have 100% of its down sourced from suppliers certified for animal welfare.

Moncler fosters strong customer relationships through personalized service, exclusive programs, and digital engagement, creating a loyal global community. Their focus on after-sales care, like the 'Extra-Life' repair service, reinforces trust and enhances the luxury experience, aligning with sustainability values. This multifaceted approach ensures customers feel valued and connected to the brand's heritage and mission.

Channels

Moncler's directly operated stores (DOS) are its cornerstone for both product distribution and delivering its distinct brand experience. As of June 30, 2025, the company boasted a significant global presence with 287 Moncler boutiques. This extensive network allows for complete control over the customer journey, ensuring a consistent and high-quality luxury environment.

These strategically located boutiques are crucial for cultivating brand loyalty and driving profitability. By managing every aspect of the retail experience, from store design to customer service, Moncler can effectively communicate its brand values and reinforce its premium positioning in the market. The direct relationship fostered through DOS also provides invaluable customer data, informing future product development and marketing strategies.

Moncler's official e-commerce platform is a cornerstone of its global sales strategy, offering unparalleled convenience and accessibility to a worldwide customer base. This digital flagship provides access to the brand's complete product assortment, ensuring a consistent and premium shopping experience online.

The brand's commitment to its e-commerce channel is evident in its projected growth. For instance, in 2023, Moncler reported a significant increase in digital sales, which are anticipated to continue their upward trajectory, reflecting the growing importance of online channels in the luxury market.

Moncler leverages wholesale partnerships with prestigious department stores and independent luxury boutiques worldwide. This strategy broadens their market presence, offering consumers access to Moncler's distinctive outerwear in curated, high-end retail environments. For instance, in 2024, Moncler continued to maintain strong relationships with key luxury retailers like Saks Fifth Avenue and Harrods, contributing significantly to their global brand visibility and sales volume.

While Moncler is increasingly focusing on its direct-to-consumer (DTC) channels, the wholesale segment remains a vital component of its distribution network. This approach allows them to reach a wider customer base and capitalize on the established foot traffic and customer loyalty of these premium retail partners. The brand's wholesale revenue in 2024, though a smaller portion compared to DTC, still represented a substantial contribution to their overall financial performance, underscoring the channel's enduring importance.

Pop-Up Stores and Temporary Retail Concepts

Moncler frequently utilizes pop-up stores and temporary retail concepts to generate excitement and offer unique brand experiences. These ephemeral spaces are strategically employed to launch limited-edition collections, such as their Moncler Genius collaborations, or to test the waters in new geographic markets. For instance, in 2024, the brand continued its successful pop-up strategy in key global cities, often coinciding with major fashion events or seasonal peaks, driving significant foot traffic and social media engagement.

These temporary installations play a crucial role in building brand buzz and fostering a sense of exclusivity among consumers. By creating limited-time shopping opportunities, Moncler encourages immediate purchase decisions and reinforces its premium positioning. The success of these events is often measured by sales per square foot and media mentions, with many pop-ups exceeding traditional retail performance benchmarks.

Key aspects of Moncler's pop-up strategy include:

- Brand Experience Enhancement: Creating immersive environments that reflect Moncler's heritage and innovative spirit.

- New Collection Launches: Providing a dedicated platform for high-profile product drops, generating immediate consumer interest.

- Market Testing: Assessing demand and consumer reception in new or emerging markets before committing to permanent retail presence.

- Exclusivity and Urgency: Leveraging the temporary nature of the stores to drive sales and create a sense of scarcity.

Digital Marketplaces and Strategic Online Partners

Moncler strategically leverages digital marketplaces to complement its robust direct-to-consumer e-commerce. This approach allows for targeted reach into specific customer demographics and geographical markets where a curated presence on exclusive luxury platforms can enhance brand visibility and desirability.

For instance, in 2024, Moncler continued to refine its digital strategy, focusing on partnerships that align with its premium brand image. While specific marketplace collaborations are often proprietary, the trend in luxury retail indicates a careful selection of platforms that offer a high-end customer experience and strong brand guardianship.

- Controlled Expansion: Partnering with select online marketplaces enables Moncler to expand its digital footprint without diluting its brand exclusivity, reaching new affluent consumers.

- Customer Segmentation: These partnerships allow Moncler to target niche customer segments who prefer the convenience and discovery offered by curated luxury online environments.

- Geographic Reach: Digital marketplaces can provide access to markets where establishing a full direct-to-consumer presence might be more complex or time-consuming, facilitating international growth.

- Brand Synergy: Collaborating with platforms that share a commitment to quality and luxury reinforces Moncler's brand positioning and ensures a consistent customer experience.

Moncler's channels are a carefully curated mix of direct and indirect touchpoints designed to deliver its luxury experience globally. The brand prioritizes its directly operated stores (DOS) and its e-commerce platform for maximum brand control and customer engagement.

Wholesale partnerships remain important for broader market reach, while pop-up stores and select digital marketplaces offer strategic avenues for targeted engagement and brand building. This multi-channel approach ensures Moncler connects with its discerning clientele across diverse retail environments.

Customer Segments

Affluent Global Luxury Consumers represent a core customer segment for Moncler, characterized by substantial disposable income and a discerning taste for premium, high-quality fashion. These individuals actively seek out exclusive items that signify status and are willing to invest in brands renowned for exceptional craftsmanship and unique design.

This demographic is particularly prevalent in key luxury markets, with Asia, especially China, playing a significant role in driving demand. For instance, in 2024, the global luxury goods market was projected to reach over $300 billion, with a substantial portion attributed to spending by affluent consumers in these regions.

Their purchasing decisions are heavily influenced by brand heritage, perceived exclusivity, and innovative design. Moncler's ability to consistently deliver on these fronts, particularly with its iconic down jackets and collaborative collections, resonates strongly with this status-conscious consumer base.

Fashion-Forward Trendsetters are individuals deeply immersed in the latest styles, actively seeking unique pieces that express their personal flair. They are drawn to Moncler's ability to fuse cutting-edge design with practical functionality, especially through its highly anticipated Moncler Genius collaborations. In 2023, Moncler's revenue reached €2.95 billion, reflecting strong demand from this segment.

This segment comprises affluent individuals who actively engage in outdoor pursuits like skiing, mountaineering, or simply appreciate extreme comfort in harsh climates. They are willing to invest significantly in high-performance gear that also signifies status and sophisticated style. For instance, in 2024, the luxury outdoor apparel market continued its robust growth, with brands like Moncler reporting strong sales driven by demand from this very demographic.

Celebrities and Influencers

Moncler heavily leverages celebrities and influencers as key opinion leaders. These public figures, by wearing and promoting Moncler, significantly shape consumer trends and enhance brand desirability. Their association is vital for brand visibility, even if they aren't always direct customers.

The brand's strategy often involves gifting or collaborations that place their products on prominent individuals. For instance, during the 2024 fashion weeks, numerous A-list celebrities were spotted in Moncler, contributing to millions of social media impressions. This visibility translates directly into increased brand awareness and aspirational appeal, driving demand across various consumer segments.

- Brand Ambassadors: Celebrities like Anne Hathaway and Pharrell Williams have publicly endorsed Moncler, amplifying its reach.

- Social Media Impact: Influencer marketing campaigns in 2024 saw an average engagement rate of 3.5% for luxury fashion posts featuring Moncler.

- Event Presence: Moncler’s presence at high-profile events, often with celebrity attendees, generates substantial earned media value.

Younger, Aspirational Luxury Buyers

Younger, aspirational luxury buyers represent a growing segment for brands like Moncler. These individuals are often new to the high-end market but are eager to own pieces from established, iconic luxury houses. They are highly influenced by what they see on social media platforms and actively look for ways to enter the luxury world, perhaps through more accessible entry-level products or collaborations.

Moncler's strategy to connect with this demographic involves understanding and reflecting the cultural trends and language of younger generations. This includes leveraging digital channels and engaging with influencers who resonate with this audience. For instance, in 2024, the luxury market saw continued strong performance, with Gen Z and Millennials driving a significant portion of growth, often seeking brands that offer both exclusivity and a connection to contemporary culture.

- Digital Influence: Social media platforms are key touchpoints, with luxury brands increasingly investing in digital marketing and influencer collaborations to capture the attention of younger consumers.

- Accessible Entry Points: This segment often seeks more affordable luxury items, such as accessories or diffusion lines, as a way to engage with premium brands.

- Cultural Relevance: Brands that successfully interpret and integrate current cultural codes and trends are more likely to appeal to these aspirational buyers.

- Brand Storytelling: Younger consumers are drawn to brands with a compelling narrative and a clear identity that aligns with their own values and aspirations.

Moncler caters to affluent global luxury consumers who value craftsmanship and exclusivity, with a strong presence in Asian markets like China. Fashion-forward trendsetters are drawn to Moncler's innovative collaborations, as evidenced by the brand's €2.95 billion revenue in 2023. The brand also appeals to outdoor enthusiasts seeking high-performance, stylish gear, a segment experiencing robust growth in 2024. Finally, younger, aspirational buyers are increasingly engaged through digital channels and cultural relevance.

Cost Structure

Moncler's cost structure is heavily influenced by the premium nature of its raw materials. Sourcing high-quality down, often goose down, and advanced technical fabrics like Gore-Tex represents a significant investment. These luxury components are crucial for the brand's performance and image, directly impacting the cost of goods sold.

The manufacturing processes themselves also contribute substantially to costs. This includes the skilled labor required for intricate garment construction and the quality control measures necessary to maintain Moncler's luxury standards. In 2023, Moncler reported cost of sales of €1.26 billion, highlighting the substantial expenditure on these material and manufacturing elements.

Furthermore, Moncler emphasizes responsible sourcing for its materials, which can sometimes lead to higher initial costs but aligns with growing consumer demand for ethical and sustainable luxury. This commitment to quality and ethical practices is embedded within their operational expenses.

Moncler dedicates significant resources to marketing and brand promotion, essential for its luxury positioning. These investments span global campaigns, high-profile fashion shows, extensive digital advertising, public relations efforts, and strategic celebrity endorsements. For instance, in 2023, Moncler’s marketing expenses contributed to its robust brand presence, though they also factored into its earnings before interest and taxes (EBIT) margins.

Moncler incurs substantial costs operating its extensive global network of directly owned stores. These expenses cover prime retail rents, essential utilities, competitive staff salaries, impactful visual merchandising, and ongoing store upkeep. This retail presence represents a significant fixed cost component, particularly as the company continues to expand its physical footprint.

For instance, in 2023, Moncler reported that its selling, general, and administrative expenses, which include store operations, amounted to €1.17 billion. This figure highlights the considerable investment required to maintain its premium retail experience and brand image worldwide.

Research and Development (R&D)

Moncler's commitment to innovation is a significant driver of its cost structure, with substantial investments allocated to Research and Development (R&D). This R&D spending fuels advancements in material science, the creation of novel designs, and the development of more sustainable production technologies. These efforts are crucial for maintaining Moncler's competitive edge and ensuring it consistently delivers cutting-edge products to the market.

Looking ahead, Moncler anticipates its net investments in R&D to hover around 7.0% of its annual revenues. This strategic allocation underscores the company's focus on long-term growth and product differentiation.

- Investment in Material Science: Developing advanced fabrics and insulation for enhanced performance and comfort.

- New Design Development: Creating innovative and trend-setting apparel collections.

- Sustainable Production Technologies: Researching and implementing eco-friendly manufacturing processes.

- R&D Investment Target: Aiming for approximately 7.0% of annual revenues to be reinvested in R&D.

Employee Salaries and Benefits

Moncler's cost structure heavily features employee salaries and benefits, reflecting its global presence and the need for specialized talent. These costs cover over 8,000 employees worldwide, encompassing roles in design, production, retail operations, marketing, and essential corporate functions. The company invests in competitive compensation packages, including salaries, health insurance, retirement plans, and ongoing training to maintain its high-performing workforce.

The significant expenditure on human capital is a direct consequence of Moncler's commitment to quality and brand experience. This includes:

- Salaries: Competitive wages for a diverse, skilled global workforce.

- Benefits: Comprehensive packages such as health insurance, retirement contributions, and paid time off.

- Training and Development: Investment in specialized skills for design, craftsmanship, retail excellence, and management.

Moncler's cost structure is characterized by significant investments in premium materials, skilled manufacturing, extensive marketing, and a global retail network. These elements are crucial for maintaining its luxury brand image and product quality, as evidenced by their substantial cost of sales and operating expenses.

| Cost Category | 2023 Expense (EUR Billion) | Key Drivers |

|---|---|---|

| Cost of Sales | 1.26 | Premium down, technical fabrics, skilled labor |

| Selling, General & Administrative | 1.17 | Retail operations, marketing, global staff |

| Research & Development | ~7.0% of Revenue (Target) | Material innovation, design, sustainability |

Revenue Streams

Moncler's direct-to-consumer (DTC) sales, encompassing both its physical retail stores and its robust e-commerce platform, represent its primary revenue engine. This channel is crucial as it allows Moncler to capture higher profit margins by cutting out intermediaries and fostering direct relationships with its clientele.

In 2023, Moncler saw significant growth in its DTC channel, with retail and e-commerce sales reaching €2.16 billion, an increase of 19% compared to the previous year. This segment accounted for 86% of the group's total revenue, underscoring its importance for the brand's financial performance and strategic focus on direct customer engagement.

Moncler generates revenue through wholesale distribution, selling its luxury apparel to a network of multi-brand retailers and department stores worldwide. This channel, while typically offering thinner profit margins compared to direct-to-consumer sales, is crucial for achieving wider market reach and boosting overall sales volume.

In 2023, Moncler's wholesale channel contributed to its robust financial performance, even as the company strategically prioritizes its direct-to-consumer (DTC) channels. For instance, Moncler reported consolidated revenues of €2,915.7 million in 2023, with wholesale playing a significant, albeit evolving, role in this total.

Moncler generates significant revenue through its collaborative collection sales. These limited-edition items, often featuring partnerships with renowned designers and artists, are priced at a premium, tapping into strong consumer demand. For instance, the brand has historically leveraged collaborations to create buzz and drive sales, with many of these exclusive pieces selling out rapidly upon release.

Footwear Sales

Footwear, especially sneakers, is a significant and expanding revenue stream for Moncler. This category is projected to contribute approximately 10% to the company's total revenue by 2025, highlighting a deliberate strategy to tap into this market's potential and broaden its product portfolio.

- Growing Footwear Segment: Moncler is strategically investing in its footwear division, with sneakers being a key driver of growth.

- Revenue Projection: The company anticipates footwear sales to reach 10% of its total revenue by 2025, indicating strong future performance.

- Market Expansion: This focus on footwear represents an effort to unlock new market opportunities and diversify Moncler's product offerings beyond its core outerwear.

After-Sales Services and Repairs

Moncler generates a minor but valuable revenue stream through its after-sales services, primarily focusing on repairs and specialized product care for its premium outerwear. This includes offerings like the 'Extra-Life advanced' repair service, designed to extend the lifespan of high-value items. This commitment to product longevity not only fosters customer loyalty but also reinforces the brand's image of quality and durability.

While not a primary driver of revenue, these services contribute to customer retention and brand advocacy. By providing expert care and repair, Moncler ensures its products continue to perform and look their best, encouraging repeat purchases and positive word-of-mouth. This focus on the post-purchase experience is crucial for maintaining a premium brand perception.

- After-Sales Services: Repair and specialized care for high-value Moncler products.

- 'Extra-Life advanced' Service: A key offering to extend product lifespan.

- Revenue Contribution: A minor but significant stream, enhancing customer loyalty.

- Brand Reinforcement: Focus on durability and quality post-purchase.

Moncler's revenue streams are dominated by its direct-to-consumer (DTC) channels, which include physical retail and e-commerce. This strategy allows for higher profit margins and direct customer engagement.

Wholesale distribution also contributes to Moncler's sales volume and market reach, although with lower margins than DTC. Collaborative collections and an expanding footwear segment, particularly sneakers, represent further significant revenue drivers.

After-sales services, such as repairs, are a minor but valuable stream that enhances customer loyalty and reinforces the brand's image of quality.

| Revenue Stream | 2023 Contribution (Approx.) | Key Characteristics |

|---|---|---|

| Direct-to-Consumer (DTC) | 86% of total revenue (€2.16 billion) | Higher profit margins, direct customer relationships |

| Wholesale | Significant portion of total revenue (€2.91 billion consolidated) | Wider market reach, increased sales volume |

| Collaborations | Premium pricing, limited editions | Drives buzz and rapid sales |

| Footwear | Projected 10% of total revenue by 2025 | Expanding category, taps into new market potential |

| After-Sales Services | Minor but valuable | Enhances customer loyalty, reinforces brand quality |

Business Model Canvas Data Sources

The Moncler Business Model Canvas is constructed using comprehensive market research, analysis of competitor strategies, and internal financial reports. These diverse data sources ensure a robust and accurate representation of Moncler's operations and market position.