Moncler Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moncler Bundle

Moncler's competitive landscape is shaped by a complex interplay of forces, from the intense rivalry among established luxury brands to the growing threat of new entrants eager to capture market share. Understanding these dynamics is crucial for navigating the high-end apparel market effectively.

The complete report reveals the real forces shaping Moncler’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Moncler's reliance on premium down, technical fabrics, and luxury leathers means that suppliers of these specialized raw materials hold a significant position. The availability of such high-quality components often comes from a select group of certified providers, granting them moderate to high bargaining power.

Moncler's dedication to sustainability and ethical sourcing practices further concentrates its supplier base. This focus on responsible procurement can amplify the leverage of these preferred suppliers, particularly when it comes to exclusive or traceable materials, impacting Moncler's cost structure and supply chain reliability.

While Moncler works with a broad network of 589 suppliers for its Moncler and Stone Island brands in 2024, a considerable chunk of its spending, over 50%, is directed towards its top 40 suppliers. This concentration means these key partners hold significant sway, as Moncler could face challenges quickly replacing their high-volume, essential supplies.

Moncler's reliance on suppliers with unique production capabilities, such as advanced textile treatments or specialized manufacturing techniques, significantly bolsters supplier bargaining power. These specialized skills, often proprietary and difficult to replicate, mean Moncler faces higher switching costs if they need to find alternative sources for critical components or materials. For instance, suppliers at the cutting edge of waterproof yet breathable fabric technology are invaluable, and their exclusivity grants them considerable leverage.

Vertical Integration and Partnerships

Moncler's pursuit of vertical integration, including potential acquisitions of specialized Italian manufacturers and artisanal workshops, directly addresses supplier power. By bringing critical production capabilities in-house, Moncler can reduce its reliance on external suppliers, thereby diminishing their leverage. This strategy also aims to preserve and enhance Italian craftsmanship, a key element of Moncler's brand identity.

These moves are designed to secure supply chains and maintain stringent quality control, which are vital in the luxury goods market. For instance, in 2024, Moncler continued to invest in its direct-to-consumer channels and supply chain resilience, a trend observed across the luxury sector as companies seek greater control over their value chain.

- In-house Production: Acquiring or partnering with key manufacturers reduces dependence on external suppliers.

- Quality Control: Direct oversight of production ensures brand standards are met, especially in luxury segments.

- Supply Chain Resilience: Integration helps mitigate risks associated with external supply disruptions.

- Brand Heritage: Fostering Italian craftsmanship through these partnerships reinforces Moncler's core brand values.

Ethical and Sustainability Requirements

Moncler's deep commitment to sustainability, encompassing climate action, circular economy initiatives, and ethical sourcing, imposes rigorous ethical and environmental standards on its suppliers. This requirement can increase operational complexity and costs for suppliers, potentially limiting the pool of available partners.

However, suppliers who successfully meet these stringent criteria often find their position strengthened, becoming preferred partners for Moncler. This focus on sustainability also inherently restricts Moncler's supplier choices to those demonstrably committed to robust environmental and ethical practices.

- Supplier Compliance Costs: Meeting Moncler's ethical and sustainability mandates, such as those related to fair labor and reduced environmental impact, can add significant costs for suppliers, potentially affecting their pricing.

- Limited Supplier Pool: The high standards mean Moncler may have fewer supplier options compared to companies with less stringent requirements, potentially increasing supplier bargaining power if they are among the few compliant entities.

- Preferred Partner Status: Suppliers who excel in sustainability and ethical compliance are more likely to secure long-term contracts and preferred supplier status with Moncler, enhancing their own market position.

Moncler's reliance on a concentrated group of top suppliers, representing over 50% of spending among its 589 partners in 2024, grants these key entities significant bargaining power. This is amplified by Moncler's need for specialized materials like premium down and technical fabrics, often sourced from a limited number of certified providers.

| Supplier Characteristic | Impact on Moncler | Example |

|---|---|---|

| Concentration of Spending (Top 40 Suppliers) | High Bargaining Power | Over 50% of spending in 2024 |

| Specialized Materials (Down, Technical Fabrics) | Moderate to High Bargaining Power | Limited certified providers |

| Proprietary Production Capabilities | High Bargaining Power | Advanced textile treatments |

| Sustainability & Ethical Compliance | Moderate to High Bargaining Power (for compliant suppliers) | Rigorous standards limit supplier pool |

What is included in the product

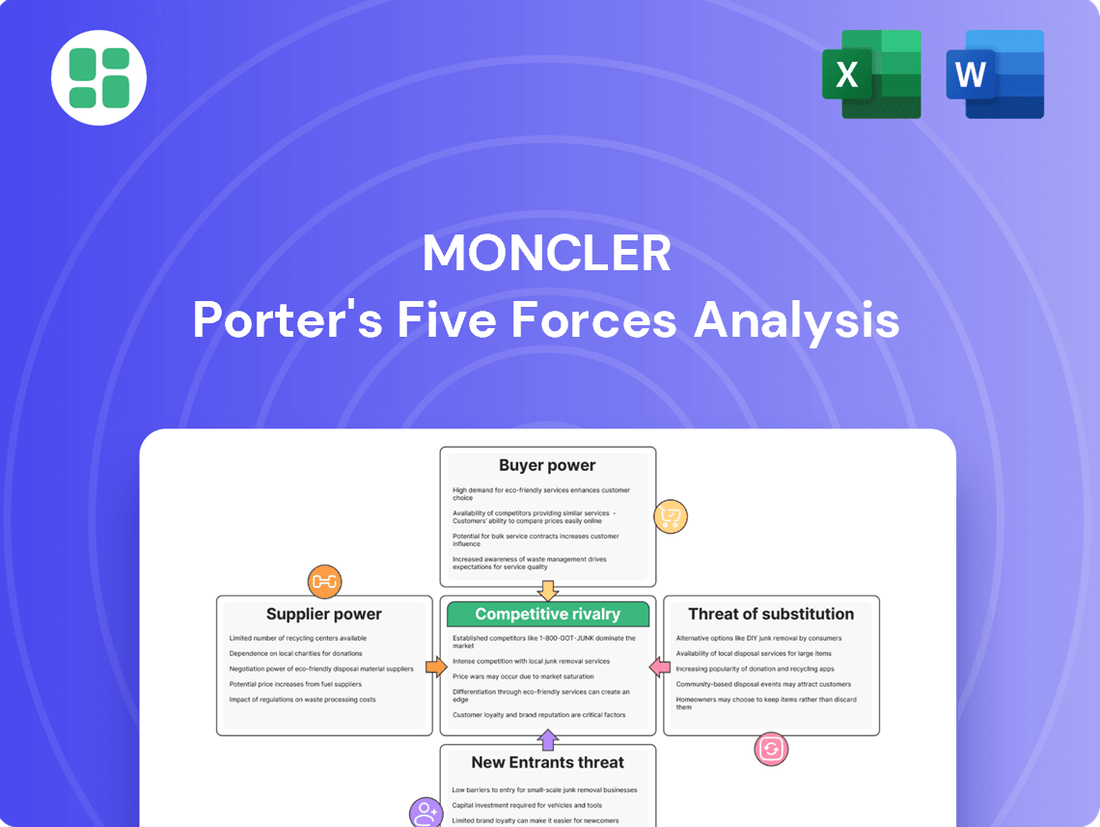

This analysis meticulously examines the competitive landscape for Moncler, dissecting the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the luxury outerwear market.

Instantly identify and mitigate competitive threats with a clear, actionable overview of Moncler's market landscape.

Customers Bargaining Power

Moncler's focus on high-income, brand-loyal consumers significantly curtails their bargaining power. These affluent customers prioritize exclusivity, superior quality, and the prestige associated with the Moncler brand over minor price fluctuations.

This strong brand loyalty, cultivated through consistent quality and distinctive designs, means customers are less likely to switch brands for cost savings. For instance, Moncler's revenue in 2023 reached €2.9 billion, showcasing the strong demand from its target demographic.

While Moncler enjoys significant brand loyalty, the luxury market offers numerous high-end alternatives. Competitors such as Canada Goose, Prada, and Burberry provide consumers with choices, especially if Moncler's products don't align with their preferences or if pricing becomes a concern. For instance, the global luxury goods market was projected to grow by 7% in 2024, indicating continued consumer spending, but also a competitive landscape where value perception is key.

Moncler's strategic focus on its direct-to-consumer (DTC) channels, encompassing both physical stores and its e-commerce platform, significantly shapes customer bargaining power. By managing these channels directly, Moncler gains unparalleled control over the customer journey and collects invaluable direct feedback. This direct engagement, while fostering loyalty and personalization, also provides customers with more immediate and impactful avenues to express their preferences and expectations, thereby amplifying their collective influence on product development and service standards.

The growth in Moncler's DTC segment underscores its effectiveness in building a direct relationship with its clientele. For instance, in the first half of 2024, Moncler reported that its own retail channels, which include its DTC operations, represented a substantial portion of its sales, demonstrating a clear trend towards customers engaging directly with the brand. This direct interaction empowers customers by giving them a clear voice, allowing their collective demands and feedback to directly inform Moncler's strategic decisions and product assortments.

Changing Consumer Preferences and Digital Influence

Modern luxury consumers, especially Millennials and Gen Z, are shifting their focus. They now value personalized products, sustainable practices, and genuine brand interactions more than traditional status symbols. This trend grants them significant leverage.

Digital platforms and social media play a crucial role in shaping these preferences. Consumers actively share reviews and experiences, influencing purchasing decisions for others. For example, in 2024, over 60% of luxury purchases were influenced by online research and social media trends.

Moncler needs to stay agile, constantly updating its products and marketing strategies to align with these evolving consumer demands. This responsiveness is key to maintaining customer loyalty and market share.

- Shifting Priorities: Luxury consumers increasingly seek personalization and sustainability, moving away from pure status.

- Digital Dominance: Social media and online platforms heavily influence consumer choices and brand perception.

- Consumer Power: Evolving preferences give customers indirect but substantial bargaining power through their purchasing and engagement.

Luxury Resale Market Growth

The burgeoning luxury resale market significantly influences customer bargaining power. Driven by a growing emphasis on sustainability and the desire for more accessible luxury, customers now have viable alternatives to purchasing brand-new items. This shift can dilute the perceived exclusivity of new luxury goods and empower customers by providing a secondary market where they can acquire desired items at potentially lower price points.

For instance, the global luxury resale market was projected to reach $32 billion in 2023 and is expected to grow to $77 billion by 2025, indicating a substantial increase in consumer choice and a potential shift in brand pricing power. This growth means customers can more readily find pre-owned luxury items, which can lead them to negotiate harder on new purchases or opt for resale entirely.

Brands are increasingly recognizing this trend and are beginning to integrate resale into their business models. This strategic move acknowledges the evolving customer landscape and aims to capture value from this growing segment, potentially mitigating some of the direct impact on new product sales.

Key aspects of this trend include:

- Increased Consumer Choice: The resale market offers a wider selection of luxury goods, often from past seasons, providing customers with more options beyond current collections.

- Price Sensitivity: Affordability remains a key driver, allowing customers to access luxury brands they might not otherwise be able to purchase new.

- Sustainability Focus: A growing segment of consumers prioritizes environmentally conscious purchasing, making resale a more attractive option.

- Brand Adaptation: Luxury brands are exploring partnerships with resale platforms or launching their own certified pre-owned programs to engage with this market.

While Moncler cultivates strong brand loyalty, the luxury market's competitive nature, featuring brands like Prada and Burberry, means customers have alternatives. The global luxury goods market's projected 7% growth in 2024 highlights this dynamic. Moncler's direct-to-consumer (DTC) strategy, with DTC sales forming a substantial part of its revenue in early 2024, empowers customers by giving them a direct channel for feedback, influencing product and service standards.

Modern luxury consumers, particularly younger demographics, increasingly value personalization and sustainability over mere status. This shift, amplified by social media where over 60% of luxury purchases in 2024 were influenced by online research, grants them significant leverage. The expanding luxury resale market, projected to reach $77 billion by 2025 from $32 billion in 2023, further empowers consumers by offering accessible alternatives and influencing perceptions of new product value.

| Factor | Moncler's Position | Customer Bargaining Power |

| Brand Loyalty & Exclusivity | High, due to premium quality and prestige | Low, customers prioritize brand over price |

| Competition | Significant, with brands like Prada, Burberry | Moderate, customers have alternative choices |

| DTC Channels | Strong direct engagement and feedback loop | Moderate to High, direct influence on brand decisions |

| Evolving Consumer Values | Increasing demand for personalization & sustainability | High, shifts purchasing power towards these factors |

| Luxury Resale Market | Growing availability of pre-owned items | Moderate to High, provides alternative purchasing options |

Full Version Awaits

Moncler Porter's Five Forces Analysis

This preview showcases the complete Moncler Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the luxury outerwear market. You're viewing the exact document that will be delivered instantly upon purchase, providing actionable insights into Moncler's strategic positioning and industry dynamics.

Rivalry Among Competitors

Moncler navigates a fiercely competitive luxury fashion landscape, where established global conglomerates and specialized outerwear brands vie for consumer attention. Major rivals like Kering, with brands such as Gucci and Balenciaga, along with Prada and Burberry, present significant challenges. Canada Goose, a direct competitor in high-performance outerwear, also intensifies this rivalry.

These established luxury players leverage powerful brand equity, vast distribution channels, and substantial financial backing, creating a dynamic environment where Moncler must continually innovate and differentiate to capture market share. For instance, Kering reported revenues of €20.4 billion in 2023, highlighting the scale of resources available to major competitors.

Competitive rivalry in the luxury outerwear market is intense, driven by a constant push for product innovation and design differentiation. Moncler, for instance, leverages its 'Moncler Genius' project, a collaborative initiative that fuses high-performance functionality with high fashion, to stay ahead. This strategy allows them to set trends and maintain a strong competitive edge.

Competitors are not standing still; they also invest significantly in cutting-edge design, advanced material technology, and strategic collaborations to capture the attention of discerning consumers. For example, brands like Canada Goose and The North Face, while perhaps targeting slightly different segments, also emphasize technological advancements in their apparel and engage in high-profile partnerships to enhance their market appeal.

Luxury brands like Moncler engage in intense competition through sophisticated marketing and compelling brand storytelling. This approach aims to build desirability and foster a deep emotional connection with customers. For instance, Moncler's strategic events and digital initiatives, coupled with a strong emphasis on its brand heritage and core values, are crucial differentiators in a crowded market.

Competitors are also actively employing similar tactics. They leverage high-profile celebrity endorsements, prestigious fashion shows, and immersive retail experiences to capture and retain consumer attention. This creates a dynamic landscape where brand narrative and consumer engagement are paramount to market success.

Global Market Dynamics and Regional Performance

Competitive rivalry in the global luxury outerwear market is fierce, with brands like Moncler navigating intense competition across Asia, EMEA, and the Americas. Moncler's robust performance in Asia, for instance, highlights its success in a key growth region, yet it also underscores the pressure from local and international competitors vying for market share.

The dynamic nature of this rivalry means that even strong performers can face challenges. For example, while Moncler reported a notable 20% increase in revenue for the first half of 2024, driven significantly by its Asia-Pacific operations, this growth occurs within a landscape where other luxury brands are also investing heavily in these markets. This necessitates continuous adaptation to local preferences and economic climates to maintain a competitive edge.

- Intensifying Competition: Luxury outerwear brands face escalating rivalry across major global markets, particularly in Asia, EMEA, and the Americas.

- Regional Performance Variances: While Moncler achieved substantial growth in Asia, other regions may exhibit slower expansion or even contractions for specific product categories, reflecting competitive pressures and varying consumer sentiment.

- Strategic Adaptation: Brands must tailor their strategies to address unique local market conditions and economic fluctuations to remain competitive.

Sustainability and Ethical Practices

The competitive landscape for Moncler is increasingly shaped by a brand's dedication to sustainability and ethical operations. Consumers, particularly younger demographics, are actively seeking transparency and demonstrable responsible practices from the brands they support.

Brands that effectively showcase their commitment to these principles can cultivate a distinct competitive edge, resonating with an expanding market of environmentally and ethically aware luxury purchasers. For instance, Moncler's commitment to initiatives like its "Born to Protect" plan, which aims for carbon neutrality by 2025 and increased use of recycled materials, sets a benchmark that rivals must consider. In 2023, the luxury goods market saw a significant portion of consumers stating that sustainability influences their purchasing decisions, with some reports indicating figures as high as 70% among Gen Z and Millennials.

- Consumer Demand: Growing consumer preference for sustainable and ethically sourced products is a key competitive factor.

- Brand Differentiation: Brands demonstrating strong ESG (Environmental, Social, and Governance) performance can attract and retain customers.

- Industry Standards: Companies like Moncler are raising the bar, pushing competitors to adopt more responsible practices.

The luxury outerwear market is characterized by intense competition, with Moncler facing strong rivals like Kering and Prada, as well as specialized brands such as Canada Goose. These competitors possess significant financial resources and established brand recognition, forcing Moncler to continuously innovate through initiatives like its Moncler Genius project to maintain its market position.

The rivalry extends beyond product design to encompass marketing, distribution, and customer engagement. Brands are investing heavily in celebrity endorsements, fashion shows, and immersive retail experiences to capture consumer attention and build emotional connections. This dynamic environment demands constant adaptation to evolving consumer preferences and economic conditions across different global regions.

Sustainability is also emerging as a critical competitive differentiator. Consumers, particularly younger demographics, are increasingly prioritizing brands with transparent and responsible practices. Moncler's commitment to sustainability, exemplified by its 'Born to Protect' plan, sets a benchmark that competitors are increasingly pressured to match, as a significant portion of luxury consumers report that sustainability influences their purchasing decisions.

| Competitor | 2023 Revenue (Approx.) | Key Competitive Strategy |

| Kering (Gucci, Balenciaga) | €20.4 billion | Leveraging strong brand equity, vast distribution, financial backing |

| Prada Group | €4.2 billion | Brand heritage, design innovation, expanding digital presence |

| Burberry | £3.0 billion | Digital innovation, strong brand storytelling, focus on heritage |

| Canada Goose | CAD $1.3 billion | High-performance outerwear focus, strategic collaborations, direct-to-consumer expansion |

SSubstitutes Threaten

The threat of substitutes for Moncler's luxury down jackets comes from a wide array of other warm apparel options. Consumers seeking warmth and style can opt for wool coats, leather jackets, or parkas from a multitude of brands that are not positioned in the luxury segment. These alternatives, while potentially lacking Moncler's specific high-performance features or brand cachet, offer comparable functionality at significantly different price points.

For instance, while Moncler's jackets can range from $1,000 to over $3,000, a high-quality wool coat from a premium but non-luxury brand might be found for $500 to $1,000. This price disparity makes these items accessible to a broader consumer base who prioritize warmth and fashion over overt luxury branding. In 2024, the global outerwear market is robust, with a significant portion catering to these mid-tier and premium segments, indicating a substantial substitute market.

Performance-oriented outdoor apparel brands like Patagonia and The North Face's premium collections present a significant threat. These brands focus on technical functionality and durability for extreme conditions, directly competing with Moncler Porter for consumers who prioritize utility. For instance, Patagonia reported over $1 billion in revenue in 2023, demonstrating substantial market penetration in the performance wear segment.

While these substitutes may not carry the same luxury fashion cachet as Moncler Porter, their lower price points and superior technical performance for specific activities can sway price-sensitive or activity-focused consumers. This is particularly true for individuals engaging in demanding outdoor pursuits or living in regions with harsh climates, where the practical benefits outweigh the fashion appeal.

The growing second-hand luxury market, including platforms like Vestiaire Collective and The RealReal, presents a significant threat to Moncler. In 2023, the global luxury resale market was valued at over $50 billion, with projections indicating continued strong growth. This allows consumers to acquire Moncler items, like their iconic puffer jackets, at a lower price point, directly competing with new sales.

Luxury rental services, though less established than resale, also offer an alternative. For a fraction of the purchase price, consumers can rent designer items for specific occasions, reducing the perceived need to own new luxury goods outright. This trend, fueled by a desire for both affordability and sustainability, directly siphons demand away from Moncler's primary revenue stream.

Changing Fashion Trends and Climate

Shifts in fashion trends present a significant threat to Moncler. If consumer preferences move towards lighter layering or entirely different outerwear styles, the demand for Moncler's signature heavy down jackets could diminish. For instance, a growing emphasis on athleisure wear or minimalist fashion might reduce the appeal of bulky down jackets.

The impact of climate change, particularly global warming, poses another substantial threat. Milder winters in key markets, like Europe and North America, could directly reduce the need for heavy, insulated outerwear. This environmental shift might lead consumers to opt for lighter alternatives, such as performance shells or technical fleeces, as substitutes for Moncler's core product offerings.

- Fashion Trend Shifts: A move towards lighter, more versatile clothing could decrease demand for heavy down jackets.

- Climate Change Impact: Milder winters reduce the necessity for extreme cold weather gear, pushing consumers towards lighter alternatives.

- Consumer Substitution: Consumers may opt for technical outerwear, stylish parkas, or even high-quality athletic wear as substitutes for traditional down jackets.

Counterfeit Products

The market is flooded with counterfeit luxury goods, which, despite being illegal, present a significant threat of substitution for Moncler. These fakes offer a much lower price point, mimicking the distinctive style of Moncler, thereby potentially eroding the brand's perceived value and siphoning off sales from genuine items.

The proliferation of these illicit alternatives means consumers have access to cheaper imitations that can satisfy a desire for the brand's aesthetic, even if the quality and craftsmanship are inferior. This dynamic forces Moncler to invest heavily in brand protection and legal recourse to safeguard its market position.

For instance, reports in early 2024 indicated that the global market for counterfeit goods was estimated to be worth hundreds of billions of dollars, with fashion and luxury items being a major segment. This vast underground economy directly competes with authentic brands like Moncler.

- Prevalence of Counterfeits: The global market for counterfeit goods is substantial, impacting luxury sectors significantly.

- Price as a Substitute: Illicit products offer a drastically lower price, making them an accessible alternative for some consumers.

- Brand Dilution: Counterfeits can dilute Moncler's brand value by association with lower quality and illegality.

- Sales Diversion: A portion of potential Moncler sales is lost to these cheaper, albeit unauthorized, alternatives.

The threat of substitutes for Moncler is multifaceted, encompassing everything from high-performance outdoor gear to the burgeoning second-hand luxury market. Consumers seeking warmth and style have numerous alternatives, often at significantly lower price points. For instance, while Moncler jackets can exceed $3,000, a premium wool coat might cost between $500 and $1,000, making it accessible to a wider audience. The global outerwear market in 2024 is robust, with mid-tier and premium segments offering substantial competition.

| Substitute Category | Example Brands | Typical Price Range (USD) | Key Differentiator |

| Premium Non-Luxury Outerwear | Canada Goose (non-fur options), Mackage, Woolrich | $600 - $1,500 | High quality, strong brand recognition, less overt luxury |

| Performance Outdoor Apparel | Patagonia, The North Face (premium lines), Arc'teryx | $400 - $1,200 | Technical functionality, durability for specific activities |

| Luxury Resale Market | Vestiaire Collective, The RealReal | Varies (often 30-70% of retail) | Affordability of pre-owned luxury items |

| Fashion Athleisure | Lululemon, Outdoor Voices | $150 - $500 | Comfort, versatility, active lifestyle appeal |

Entrants Threaten

Entering the luxury fashion sector, particularly for high-end outerwear like Moncler, demands significant upfront capital. Costs for sourcing premium materials, establishing state-of-the-art production, securing prime retail locations, and executing impactful marketing campaigns to cultivate brand desirability are immense. This financial barrier effectively discourages many aspiring competitors.

Building a luxury brand like Moncler, known for its distinctive puffer jackets and heritage, takes significant time and investment. It requires decades of consistent quality and design innovation to cultivate strong brand equity. For instance, Moncler's brand value was estimated at approximately $2.4 billion in 2023, a testament to its long-standing reputation.

New competitors entering the luxury outerwear market face a substantial hurdle in replicating Moncler's established trust and desirability. Consumers in this segment often prioritize a brand's history and the exclusivity it represents, making it incredibly difficult for newcomers to gain traction without a comparable legacy.

The intricate nature of developing a robust, ethically compliant global supply chain for luxury materials, such as certified down and specialized technical fabrics, presents a significant barrier for potential new entrants. This process is inherently complex and demands considerable time to establish.

Newcomers would find it exceptionally difficult to replicate Moncler's deeply entrenched relationships with suppliers and its unwavering commitment to sustainable and responsible sourcing practices. This dedication is a critical factor, especially as consumers increasingly prioritize environmental and social governance in their purchasing decisions.

Distribution Channel Access

Gaining access to prime distribution channels is a significant hurdle for new entrants in the luxury fashion market. Established brands like Moncler have cultivated deep relationships with prestigious department stores and prime retail locations globally, making it challenging for newcomers to secure similar visibility and shelf space. For instance, securing a presence in flagship stores like Harrods or Saks Fifth Avenue requires substantial investment and proven sales history, which new brands typically lack.

The cost and complexity of building an effective direct-to-consumer e-commerce platform also present a barrier. New entrants must invest heavily in technology, logistics, and marketing to compete with the sophisticated online operations of established players. Moncler, for example, has invested significantly in its digital infrastructure, offering a seamless online shopping experience that is difficult and expensive for emerging brands to replicate. In 2023, luxury e-commerce sales continued to grow, with projections indicating further expansion, underscoring the importance of a strong online presence that is costly to establish.

- Limited prime retail locations: Many high-traffic, desirable retail spaces are already occupied by established luxury brands with long-term leases.

- High cost of e-commerce development: Building a robust and secure online sales platform, including marketing and customer service, requires substantial upfront capital.

- Established brand loyalty and relationships: Existing brands benefit from years of building customer trust and strong partnerships with key retailers, creating a loyalty moat.

- Logistical and supply chain complexities: New entrants face challenges in establishing efficient global logistics and supply chains to match the capabilities of incumbents.

Talent Acquisition and Design Expertise

The luxury fashion industry, including brands like Moncler, faces a significant threat from new entrants concerning talent acquisition and design expertise. Success in this competitive arena hinges on securing the best creative minds, from visionary design directors to highly skilled artisans who craft exquisite pieces. New players entering the market will find it difficult to lure this specialized talent away from established, reputable brands that offer stability and a strong legacy.

Established luxury houses often have decades of brand building, which translates into a magnetic pull for top-tier creative professionals. For instance, in 2024, major luxury groups continued to invest heavily in talent development and acquisition, with many designers holding long-term contracts. This makes it challenging for nascent brands to build a comparable design team, as they must compete for a finite pool of individuals whose skills and vision align with the high standards of luxury fashion.

The cost associated with attracting and retaining such talent can be prohibitive for startups. Consider that a leading creative director in luxury fashion can command an annual salary and bonus package well into the millions of dollars, plus significant equity. New entrants may struggle to match these financial incentives, especially in the early stages of their development, creating a substantial barrier to entry.

- Talent Dependency: Luxury fashion's value is intrinsically linked to the creative vision and craftsmanship of its people.

- High Acquisition Costs: Securing top design talent requires substantial financial investment, a hurdle for new entrants.

- Reputation Advantage: Established brands leverage their legacy and prestige to attract and retain sought-after designers and artisans.

- Limited Talent Pool: The specialized nature of luxury design means a restricted number of individuals possess the required expertise, intensifying competition.

The threat of new entrants into the luxury outerwear market, particularly for a brand like Moncler, is generally low. This is due to the substantial capital required for everything from sourcing premium materials to establishing a global retail presence and executing high-impact marketing. For example, launching a new luxury brand in 2024 could easily require tens of millions of dollars in initial investment.

Building brand equity and customer loyalty in the luxury segment is a long-term endeavor, often taking decades. Moncler's brand value, estimated at around $2.4 billion in 2023, reflects this sustained effort. Newcomers face the immense challenge of cultivating similar desirability and trust, which is difficult to achieve quickly or cheaply.

The complexity of establishing ethical and efficient global supply chains for specialized materials, coupled with securing prime retail locations and attracting top design talent, further erects significant barriers. These operational and creative hurdles make it exceptionally difficult for new players to compete effectively against established luxury houses.

Porter's Five Forces Analysis Data Sources

Our Moncler Porter's Five Forces analysis is built upon a foundation of robust data, drawing from industry-specific market research reports, financial statements of key luxury apparel players, and publicly available sales data. We also incorporate insights from trade publications and expert interviews to capture nuanced aspects of competitive dynamics.