Moncler Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moncler Bundle

Curious about Moncler's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential growth areas and stable revenue generators. Don't miss out on the complete picture—purchase the full BCG Matrix for a comprehensive analysis and actionable insights to elevate your own business strategy.

Stars

Moncler Genius collaborations are a prime example of a star in the BCG matrix, consistently demonstrating high growth and market share. These initiatives, featuring partnerships with diverse designers and artists, successfully draw in younger demographics through innovative and exclusive collections. For instance, events like 'The City of Genius' in Shanghai have significantly boosted global attention and engagement, particularly strengthening Moncler's presence in key Asian markets.

Moncler's direct-to-consumer (DTC) channel in Asia, especially in China and Japan, is a shining star, showing impressive growth and a dominant position in the luxury market. This strategic focus on owned retail and e-commerce is a major contributor to the company's profitability.

The brand's commitment to enhancing its Asian DTC presence through store renovations and tailored marketing campaigns has yielded significant results. In 2024, this segment experienced robust double-digit growth, and early indicators from Q1 2025 suggest these positive trends are continuing, solidifying its star status.

The Moncler Grenoble collection, representing the brand's high-tech performance segment, is poised for significant growth by evolving into an all-season offering, notably with the introduction of a summer range. This strategic expansion targets active millennials who prioritize both performance and fashion, solidifying its strong standing in a burgeoning niche of luxury outerwear.

In 2024, Moncler has continued to invest in dedicated marketing campaigns to further enhance the Grenoble line's appeal. This collection is a key driver for Moncler's brand image, aligning perfectly with its heritage of technical innovation and premium quality, which resonates with a discerning consumer base.

Core Luxury Outerwear (Premium Down Jackets)

Moncler's premium down jackets are the undisputed stars of its portfolio, commanding a significant global market share in luxury outerwear. This segment, though mature, demonstrates resilience and growth in key luxury markets, fueled by the brand's enduring prestige and commitment to quality.

The enduring appeal of Moncler's heritage and the inherent value proposition of its down jackets ensure sustained demand and a leading market position. For instance, in 2023, Moncler reported a revenue of €2.92 billion, with its iconic jackets being a primary driver of this success, underscoring their status as a cash cow.

- Market Dominance: Moncler holds a leading position in the premium down jacket market, a testament to its brand strength.

- Brand Prestige: The company's heritage and perceived value are critical factors in maintaining customer loyalty and demand.

- Resilient Growth: Despite market maturity, specific luxury segments show continued growth for these iconic products.

- Financial Contribution: These jackets are a significant revenue generator, contributing substantially to Moncler's overall financial performance.

Moncler Collection (Mainline Ready-to-Wear)

The Moncler Mainline Ready-to-Wear collection serves as the brand's core offering and a significant revenue driver. This segment consistently demonstrates robust performance, fueled by sustained growth and broad appeal to luxury consumers.

Leveraging Moncler's strong brand equity in quality and luxury, this collection extends its reach beyond traditional outerwear. It actively engages a wider demographic of luxury shoppers through innovative product development and the reimagining of its iconic pieces, ensuring continued relevance and market expansion.

- Revenue Contribution: The mainline collection consistently accounts for a substantial portion of Moncler's total revenue.

- Growth Trajectory: This segment has shown a pattern of consistent year-over-year revenue growth, underscoring its market strength.

- Brand Equity: The collection benefits from Moncler's established reputation for premium quality and luxury craftsmanship.

- Consumer Reach: It appeals to a diverse luxury consumer base, not solely limited to those seeking outerwear.

Moncler's collaborations, like the Genius project, are clear stars, exhibiting high growth and market share. These partnerships attract younger consumers with exclusive, innovative collections. For example, 'The City of Genius' in Shanghai boosted global engagement, particularly in Asia.

The brand's direct-to-consumer (DTC) business in Asia, especially China and Japan, is a star performer, showing strong growth and market leadership. This focus on owned retail and e-commerce significantly drives profitability.

Moncler's investment in its Asian DTC channels, including store upgrades and targeted marketing, has paid off. This segment saw robust double-digit growth in 2024, with early 2025 data indicating continued positive momentum.

The Moncler Grenoble line, its high-tech performance segment, is expanding into an all-season offering with a new summer range. This targets active millennials seeking both performance and fashion, strengthening its position in a growing luxury niche.

In 2024, Moncler actively promoted the Grenoble line through dedicated marketing, reinforcing its image of technical innovation and premium quality, which appeals to a discerning customer base.

Moncler's premium down jackets are undoubtedly stars, holding a substantial global market share in luxury outerwear. Despite market maturity, this segment shows resilience and growth in key luxury markets, supported by the brand's prestige and quality commitment.

The enduring appeal of Moncler's heritage and the value of its down jackets ensure consistent demand and market leadership. In 2023, Moncler's €2.92 billion revenue was largely driven by these iconic jackets, solidifying their star status.

The Moncler Mainline Ready-to-Wear collection is a core offering and a significant revenue generator, consistently showing strong performance and broad appeal. It leverages Moncler's brand equity to attract a wider luxury consumer base through innovative designs and reimagined iconic pieces.

| Segment | Growth Rate (2024 est.) | Market Share (Luxury Outerwear) | Key Drivers |

| Moncler Genius Collaborations | High | Significant | Innovation, Exclusivity, Youth Appeal |

| Asia DTC (China & Japan) | Double-digit | Leading | Strategic Investment, Tailored Marketing |

| Moncler Grenoble | Strong | Growing Niche | Performance, Fashion, All-Season Expansion |

| Premium Down Jackets | Steady | Dominant | Brand Heritage, Quality, Prestige |

| Mainline Ready-to-Wear | Consistent | High | Brand Equity, Broader Consumer Appeal |

What is included in the product

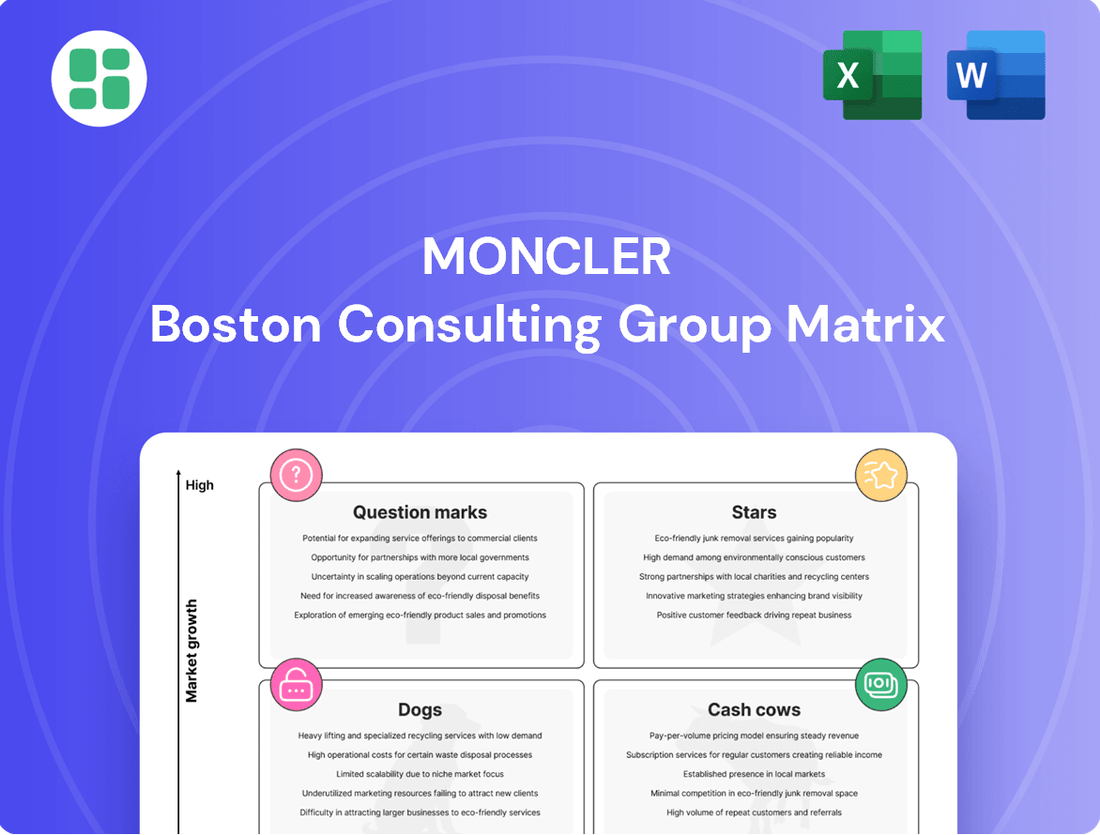

The Moncler BCG Matrix offers a strategic overview of its product portfolio, categorizing items as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which product lines to grow, maintain, or divest for optimal resource allocation.

Moncler's BCG Matrix offers a clear overview, relieving the pain of strategic uncertainty by pinpointing growth opportunities and resource allocation.

Cash Cows

Moncler's global network of directly operated stores (DOS) is a prime example of a cash cow. These stores are the backbone of Moncler's revenue generation, consistently delivering strong sales with predictable operational expenses. For instance, as of the first quarter of 2024, Moncler operated 317 DOS, demonstrating the scale and established nature of this retail presence.

This robust retail infrastructure provides a dependable source of cash flow, allowing Moncler to fund other strategic initiatives. The company's focus remains on refining and enhancing these existing locations, with renovations and strategic repositioning aimed at boosting efficiency and customer experience rather than aggressive store openings.

The Moncler brand, a cornerstone of the group's success, operates as a powerful cash cow, consistently generating impressive profit margins and robust financial performance. Its resilience is evident in its strong EBIT margins, which have historically remained high, providing the financial bedrock for the entire organization.

This brand is a dominant force in its market, effectively producing more cash than it requires for its operations and growth. For instance, in 2023, Moncler reported a revenue of €2.04 billion, contributing significantly to the group's overall financial health and enabling investments in other ventures.

Moncler's e-commerce and direct online sales channels have become a robust cash cow, representing a substantial and growing share of its overall revenue. This mature channel leverages established digital infrastructure and the brand's strong global recognition, demanding less aggressive investment in promotion compared to nascent markets.

In 2023, Moncler reported that its digital channels accounted for approximately 20% of total sales, a figure that has steadily climbed. This efficiency translates into a highly profitable revenue stream, benefiting from lower overheads and direct consumer engagement.

Luxury Accessories (excluding footwear)

Moncler's luxury accessories, including scarves, hats, and small leather goods, are positioned as cash cows within its product portfolio. These items benefit significantly from Moncler's established brand prestige, allowing for substantial profit margins. Their consistent demand and lower marketing expenditure relative to seasonal apparel contribute to stable and reliable revenue generation.

These accessories effectively capitalize on Moncler's existing customer loyalty and facilitate cross-selling opportunities, further solidifying their cash cow status. For instance, in 2023, the accessories segment demonstrated robust performance, contributing to Moncler's overall revenue growth. The brand's ability to translate its core apparel success into these complementary product categories highlights their strategic importance.

- Brand Equity Leverage: Accessories benefit from Moncler's strong brand recognition, commanding premium pricing.

- High Profit Margins: Typically, accessories carry higher profit margins than apparel due to lower production complexity and material costs.

- Reduced Marketing Needs: Their established demand means less need for aggressive marketing campaigns compared to new or seasonal clothing lines, lowering operational costs.

- Cross-Selling Synergy: Accessories complement core outerwear purchases, driving incremental sales and enhancing customer lifetime value.

Licensing and Brand Partnerships (non-Genius)

Moncler's established licensing agreements and traditional brand partnerships operate as reliable cash cows. These collaborations generate steady royalty income and maintain brand visibility across different product lines and regions, requiring minimal direct capital outlay from Moncler itself.

These partnerships leverage Moncler's strong brand equity, offering consistent revenue streams. For example, in 2023, Moncler's revenue reached €2.05 billion, showcasing the overall strength of its brand, which underpins these stable income-generating activities.

Key aspects of these cash cow operations include:

- Consistent Royalty Income: Licensing deals provide predictable revenue without the volatility of direct product development.

- Brand Leverage: Existing brand recognition fuels these partnerships, minimizing marketing costs.

- Diversification: These agreements extend the brand's reach into various market segments and product categories.

- Low Investment: They require less capital investment compared to new ventures, contributing to healthy profit margins.

Moncler's directly operated stores (DOS) are a prime example of a cash cow, consistently generating strong sales with predictable operational costs. As of the first quarter of 2024, Moncler operated 317 DOS, highlighting the scale of this established retail presence.

This robust retail network provides a dependable source of cash flow, enabling Moncler to fund other strategic initiatives. The company prioritizes enhancing these existing locations through renovations and strategic repositioning to boost efficiency and customer experience.

The Moncler brand itself acts as a powerful cash cow, consistently delivering impressive profit margins and robust financial performance. Its resilience is underscored by historically high EBIT margins, forming the financial bedrock for the entire organization.

In 2023, Moncler reported revenues of €2.04 billion, demonstrating the brand's dominant market position and its ability to generate more cash than required for operations and growth.

| Segment | Role in BCG Matrix | Key Characteristics | 2023 Performance Indicator |

| Directly Operated Stores (DOS) | Cash Cow | High sales, predictable costs, established presence | 317 stores (Q1 2024) |

| Moncler Brand | Cash Cow | High profit margins, strong brand equity, market dominance | €2.04 billion revenue (2023) |

| E-commerce/Digital Channels | Cash Cow | Growing revenue share, lower overheads, direct consumer engagement | Approx. 20% of total sales (2023) |

| Luxury Accessories | Cash Cow | High profit margins, leverages brand prestige, cross-selling synergy | Robust segment performance (2023) |

| Licensing & Partnerships | Cash Cow | Consistent royalty income, brand visibility, low capital outlay | Underpins stable income streams |

Full Transparency, Always

Moncler BCG Matrix

The Moncler BCG Matrix you're previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered to you without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

Moncler's traditional wholesale channel has experienced a downturn, with revenue figures reflecting a deliberate pivot towards direct-to-consumer (DTC) engagement and enhancements in its distribution network. This strategic repositioning aims to bolster brand control and customer experience.

While this channel continues to generate revenue, its diminishing contribution necessitates diligent oversight to prevent it from becoming a financial burden. Market headwinds and ongoing restructuring initiatives contribute to the challenges faced by this segment, which is crucial to manage effectively as Moncler refines its retail footprint.

Within Moncler's vast product portfolio, certain older or highly niche collections might be categorized as dogs in the BCG matrix. These lines, perhaps from previous fashion seasons or catering to very specific tastes, may no longer align with current luxury market trends or possess significant consumer demand. For instance, if a particular archival outerwear style, once popular, now sees minimal interest, it would fit this description.

Such collections typically contribute very little to Moncler's overall revenue. The costs associated with maintaining inventory for these less popular items, or even small-scale production runs to meet residual demand, can outweigh the returns they generate. This can lead to a negative return on investment, making them candidates for divestment or a strategic decision to phase them out to reallocate resources more effectively.

While Moncler's global performance remains robust, specific geographic markets are showing signs of weakness. For instance, in the second quarter of 2025, both the EMEA (Europe, Middle East, and Africa) and Japan regions experienced a downturn in sales. This dip is largely attributed to a slowdown in tourist spending, a critical driver for luxury brands like Moncler.

These underperforming regions, if not revitalized through targeted strategies, risk becoming 'dogs' within the BCG matrix. Such a classification signifies markets with low growth and low market share, demanding substantial investment for potential turnaround, with outcomes that are inherently uncertain.

Non-core, Low-volume Product Extensions

Non-core, low-volume product extensions for Moncler, such as niche accessories or limited-edition collaborations that didn't resonate with a broad audience, would likely fall into the 'dog' category of the BCG Matrix. These items, while potentially innovative, may have failed to capture significant market share, tying up valuable resources without delivering substantial profits.

For instance, if Moncler launched a line of specialized ski goggles in 2023 that saw minimal sales, accounting for less than 0.5% of their total revenue in 2024, this would exemplify a dog product. Such products drain capital and management attention that could be better allocated to their high-performing core offerings, like their iconic down jackets.

- Low Market Share: Products with less than a 5% market share in their respective sub-segments.

- Negative or Low Profitability: Items contributing minimally to overall profit margins, potentially even operating at a loss.

- Resource Drain: Products requiring ongoing investment in inventory, marketing, or development without commensurate returns.

- Strategic Re-evaluation: These products warrant a review for potential discontinuation or divestiture to optimize resource allocation.

Inefficient Retail Locations

Inefficient retail locations within Moncler's portfolio can be classified as 'dogs' in the BCG Matrix. These are individual stores that consistently struggle with sales and profitability, dragging down the overall performance of the retail network. For instance, a store in a declining shopping mall might see its revenue drop significantly, while its operating costs like rent and staffing remain high.

These underperforming stores often represent a drain on resources. Their low revenue generation relative to expenses makes them prime candidates for strategic review. Moncler might consider closing these locations or relocating them to more promising areas as part of optimizing its distribution strategy. This ensures capital is allocated to more productive assets.

- Underperforming Stores: Retail outlets with consistently low sales volume and profitability.

- High Operating Costs: Locations incurring significant expenses (rent, utilities, staffing) relative to their revenue.

- Closure/Relocation Candidates: Stores identified for potential closure or relocation to improve network efficiency.

- Network Optimization: Strategic decisions aimed at enhancing the overall performance and profitability of Moncler's retail footprint.

Products or market segments that exhibit low market share and low growth potential are categorized as dogs in Moncler's BCG Matrix. These areas consume resources without generating significant returns, potentially hindering the growth of more promising ventures.

For example, a specific niche accessory line launched in 2023 that generated less than 0.5% of Moncler's total revenue in 2024 would be considered a dog. Such items tie up capital and management attention that could be better invested in core, high-performing products like their iconic down jackets.

Similarly, underperforming retail locations, characterized by low sales and high operating costs, can also be classified as dogs. These stores may require closure or relocation to optimize Moncler's overall retail network efficiency and financial performance.

Identifying and managing these 'dog' segments is crucial for Moncler to maintain its profitability and strategic focus, ensuring resources are directed towards areas with higher potential for growth and return on investment.

Question Marks

Stone Island, now under the Moncler umbrella, presents a complex picture. While it experienced revenue declines in 2024 and the first half of 2025, its performance isn't uniformly negative. There have been notable growth spurts, especially in the Asian market, and improvements in its direct-to-consumer (DTC) channels.

This makes Stone Island a classic question mark in the Moncler BCG Matrix. The brand possesses significant growth potential, particularly in burgeoning markets like Asia, and Moncler is actively investing in strengthening its global presence and direct retail footprint. However, realizing this potential demands substantial ongoing investment, placing it in a category where its future success is promising but not yet guaranteed.

Moncler is strategically investing in its footwear category, particularly trainers, with a target of this segment reaching 10% of total revenue by 2025. This represents a question mark because, while the market is growing for Moncler, it still has substantial untapped potential.

Significant investment in expertise and market penetration is crucial for footwear to transition from a question mark to a star performer within Moncler's portfolio. By 2023, footwear already represented a notable portion of Moncler's sales, indicating a strong foundation for further growth.

Moncler's strategic push into emerging luxury markets, such as certain regions in Southeast Asia or specific segments within the Middle East, exemplifies its question mark strategy. These markets, while showing promising high growth potential, often represent areas where Moncler's brand recognition and market share are still developing, requiring significant investment.

For instance, while specific 2024 data for Moncler's penetration in these nascent luxury markets isn't publicly detailed, industry reports from late 2023 and early 2024 indicated a strong upward trend in luxury goods spending in these regions, with some analysts projecting double-digit growth for the luxury sector in key emerging economies through 2025.

These ventures demand substantial marketing expenditure and the establishment of robust retail infrastructure to build brand awareness and capture market share, akin to the characteristics of a question mark in the BCG matrix, where potential rewards are high but so is the associated risk and investment required.

Advanced Material Innovation & Circular Economy Initiatives

Moncler's ambitious goal to incorporate over 50% lower-impact yarns and fabrics by 2025, alongside broader circular economy initiatives, positions these efforts as question marks within the BCG matrix. This strategic focus taps into a growing consumer demand for sustainable products, a significant growth opportunity. However, the substantial research and development investment needed, coupled with the complex transformation of its supply chain, means the full realization of returns is still uncertain.

These initiatives are vital for future growth but come with inherent risks and require substantial upfront capital. For instance, the development and sourcing of new, sustainable materials often involve higher initial costs compared to conventional options. Moncler's commitment reflects a forward-looking strategy to align with evolving market preferences and regulatory landscapes, aiming to build long-term brand value and resilience.

- Sustainability Target: Over 50% lower-impact yarns and fabrics by 2025.

- Market Driver: Increasing consumer demand for sustainable and ethically produced fashion.

- Investment & Risk: Significant R&D and supply chain transformation costs with uncertain, albeit potentially high, future returns.

- Strategic Importance: Aligns brand with long-term market trends and enhances corporate reputation.

Exploration of New Product Categories (beyond current scope)

Venturing into new luxury product categories, such as high-end home furnishings or premium eyewear, represents a significant strategic question mark for Moncler. These markets, while demonstrating robust growth within the broader luxury sector, would see Moncler entering with no established market presence.

Such expansion would require substantial initial investment to build brand awareness, establish distribution channels, and develop product lines that resonate with discerning consumers. For instance, the global luxury home decor market was valued at approximately $27.7 billion in 2023 and is projected to grow, offering potential but also significant competitive hurdles.

- New Market Entry Costs: Significant capital outlay needed for research, development, marketing, and distribution in unfamiliar product spaces.

- Brand Dilution Risk: Careful management is required to ensure new categories align with Moncler's core luxury identity.

- Competitive Landscape: Entering established luxury segments like eyewear or home goods means competing with brands that have long-standing expertise and customer loyalty.

- Market Potential vs. Investment: Evaluating the long-term profitability and scalability against the high upfront costs is crucial for success.

Question marks in the Moncler BCG Matrix represent business units or products with low market share in high-growth industries. They require significant investment to capture market share and have the potential to become stars if successful, but could also become cash cows or dogs if they fail to gain traction.

Moncler's strategic investments in emerging markets and new product categories, like footwear and sustainability initiatives, are prime examples of question marks. These ventures show promise due to high market growth potential but demand substantial capital for market penetration and brand building, with uncertain future outcomes.

The success of these question marks hinges on Moncler's ability to effectively allocate resources, manage risks, and adapt to evolving consumer preferences and competitive landscapes. Their transition from question marks to stars will be a key indicator of Moncler's future growth trajectory.

For instance, Moncler's footwear division, targeting 10% of total revenue by 2025, demonstrates this question mark characteristic. While the market is expanding, the division requires ongoing investment to solidify its position and achieve its ambitious revenue goals.

BCG Matrix Data Sources

Our Moncler BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis from industry reports and financial disclosures.