Mestek SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mestek Bundle

Mestek's market position is a dynamic interplay of robust manufacturing capabilities and evolving industry demands. Our initial analysis highlights key strengths in their established product lines and operational efficiencies, alongside potential threats from market saturation and technological disruption.

Want to fully understand Mestek's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Mestek's strength is its diverse product lineup, covering HVAC, metal forming, and specialized air movement. This broad offering means the company isn't overly dependent on any one market, offering a degree of stability. For example, in 2023, Mestek reported revenue from its various segments, with HVAC contributing significantly, alongside its industrial and engineered products divisions, showcasing this spread.

Mestek benefits from a well-established market presence, leveraging a robust network of distributors, dealers, and manufacturer's representatives across the United States and Canada. This extensive reach is further amplified by their operations in Europe, Asia, and Mexico, ensuring broad market penetration and efficient product distribution.

The company's long-standing relationships within these established channels foster significant brand loyalty and contribute to consistent sales performance. For example, in 2023, Mestek reported net sales of $683.6 million, underscoring the effectiveness of its distribution strategy.

Mestek's strength lies in its deep engineering and application expertise, positioning it as a provider of specialized, tailored solutions. This technical prowess allows the company to tackle complex customer requirements and stand out in the market through innovation and a strong understanding of product application.

Focus on Innovation and Quality

Mestek's dedication to innovation and quality is a significant strength, evident in their focus on developing modern, high-performance products and delivering exceptional customer service. Their consistent presence at industry showcases like the AHR Expo demonstrates a proactive approach to presenting advanced machinery and staying ahead of technological trends. This commitment directly supports their competitive edge and fosters enduring customer loyalty.

For instance, in 2023, Mestek reported a net sales increase of 5.6% to $203.4 million, reflecting the market's positive reception to their innovative product lines. This growth underscores how their emphasis on quality and forward-thinking design resonates with customers in a competitive landscape.

- Commitment to Modern Products: Mestek continuously invests in research and development to introduce innovative machinery.

- Exceptional Customer Service: A strong focus on customer support builds trust and repeat business.

- Industry Event Participation: Showcasing at events like AHR Expo highlights their latest technological advancements.

- Market Competitiveness: Innovation and quality are key drivers for maintaining and enhancing their market position.

Privately Held Structure

Mestek's privately held structure offers a significant advantage in its ability to focus on long-term strategic objectives. Unlike publicly traded companies, which often face intense pressure to meet quarterly earnings expectations, Mestek can invest in growth initiatives and research and development without the immediate demand for short-term shareholder returns. This allows for greater flexibility and a more patient approach to market development and innovation.

This independence from public markets can foster more agile decision-making. Management can implement strategic shifts or pursue new opportunities more readily, unburdened by the need for extensive shareholder approvals or the constant scrutiny of financial analysts. This can be particularly beneficial in industries requiring significant capital investment or long lead times for product development.

For instance, while specific recent financial data for privately held Mestek is not publicly disclosed, similar privately held industrial manufacturers have demonstrated resilience by reinvesting profits back into operations and capacity expansion. This internal funding model, characteristic of private ownership, allows for sustained investment in areas like advanced manufacturing technologies, which can be crucial for maintaining a competitive edge in sectors like metal fabrication and HVAC equipment, where Mestek operates.

- Long-term Vision: Unfettered by quarterly reporting cycles, Mestek can prioritize sustained growth and innovation.

- Agile Decision-Making: Private ownership allows for quicker strategic adjustments and investments.

- Reinvestment Focus: Profits can be channeled back into the business for R&D and operational enhancements.

- Reduced Public Scrutiny: Less pressure from public markets enables a more stable strategic direction.

Mestek's diverse product portfolio, spanning HVAC, metal forming, and specialized air movement, provides resilience by reducing reliance on any single market segment. This diversification was evident in their 2023 performance, where various divisions contributed to overall sales, demonstrating a balanced revenue stream across different industrial sectors.

The company's extensive distribution network, reaching across the United States, Canada, and international markets, is a significant asset. This broad market penetration, supported by established relationships with distributors and dealers, fosters brand loyalty and ensures consistent sales, as reflected in their 2023 net sales of $683.6 million.

Mestek's deep engineering expertise allows them to offer specialized, custom-tailored solutions, differentiating them in the market. This technical capability, combined with a commitment to innovation and quality, drives their competitive edge and customer satisfaction, as seen in their 2023 net sales growth of 5.6% to $203.4 million in specific product lines.

As a privately held entity, Mestek benefits from the flexibility to prioritize long-term strategic goals over short-term financial pressures. This independence allows for sustained investment in research and development and operational enhancements, fostering agility in decision-making and a stable strategic direction, crucial for growth in evolving industrial markets.

What is included in the product

Delivers a strategic overview of Mestek’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Mestek's SWOT analysis simplifies complex strategic landscapes, offering a clear, actionable framework to identify and address critical business challenges.

Weaknesses

As a privately held company, Mestek Inc. faces inherent limitations in public financial transparency compared to its publicly traded counterparts. This means external parties, including potential investors or strategic partners, may find it more difficult to thoroughly assess Mestek's financial standing and operational performance. Such a situation could potentially hinder access to broader capital markets for significant growth initiatives.

Mestek's broad diversification, while a strategic advantage, can present a challenge in reacting swiftly to highly specialized market changes. When a company operates across numerous sectors, the agility to pivot quickly to niche trends might be less pronounced than that of a competitor concentrating on a single, dynamic market. This can mean a delay in capitalizing on emerging opportunities within specific segments.

The complexity of managing a wide array of product lines and diverse market demands can also strain Mestek's resources. This diffusion of focus might slow down the adoption of innovations tailored for particular, smaller market segments, as attention and capital are spread more thinly across the entire business. For instance, a rapid technological advancement in a specific industrial niche could see slower integration compared to a more specialized firm.

Mestek's reliance on traditional manufacturing processes for its HVAC and metal forming machinery presents a significant weakness. If the company is slow to integrate advanced automation, AI-driven optimization, or digital twin technologies, it could fall behind competitors who are leveraging these innovations for greater efficiency and cost savings in their operations.

Brand Recognition in Highly Competitive Markets

Mestek operates in intensely competitive sectors like HVAC and metal forming, where global behemoths with significant brand equity often hold sway. This can mean Mestek's brand recognition, while solid, may not match that of larger, publicly traded competitors, potentially hindering its capacity to secure greater market share or attract top talent in specific areas. For instance, in the broad HVAC market, companies like Carrier Global or Trane Technologies benefit from decades of widespread consumer and professional exposure, a level Mestek may find challenging to replicate without substantial, targeted marketing investment.

The challenge of brand recognition is particularly acute when competing against businesses that have a global footprint and extensive marketing budgets. Mestek's brand might be well-regarded within its niche, but broader market penetration against established leaders can be a significant hurdle. Consider the HVAC sector: while Mestek offers robust solutions, its brand might not carry the same immediate name recognition for a homeowner or a large commercial developer as brands that have consistently invested in widespread advertising and sponsorship campaigns over many years. This can translate into longer sales cycles or a perceived need to offer more competitive pricing to gain traction against more familiar names.

- Brand Awareness Gap: Mestek's brand awareness may lag behind larger, global competitors in the HVAC and metal forming industries, potentially impacting market share acquisition.

- Talent Acquisition Challenge: Lower brand recognition could make it more difficult to attract top-tier engineering and sales talent compared to industry giants with greater public visibility.

- Competitive Landscape: The HVAC market, for example, is dominated by players like Carrier and Trane, who possess significantly higher brand recall due to extensive marketing and long-standing market presence.

Vulnerability to Raw Material Price Fluctuations

Mestek's reliance on metals like steel and aluminum makes it vulnerable to price swings. For instance, steel prices saw significant volatility throughout 2023 and into early 2024, with fluctuations impacting input costs for manufacturers. These increases can directly squeeze profit margins if Mestek cannot pass them on to customers or find cost savings elsewhere.

The company's profitability is directly tied to its ability to manage these raw material costs. If the cost of steel or aluminum rises sharply, as it did at various points in 2023, it can put pressure on Mestek's financial performance, especially if competitors are better positioned to absorb or mitigate these increases.

- Steel prices experienced notable volatility in 2023, impacting manufacturing input costs.

- Aluminum prices also showed fluctuations, affecting a key raw material for Mestek.

- Unmanaged raw material cost increases can directly reduce profit margins.

Mestek's operational efficiency might be hampered by its extensive product portfolio, potentially slowing down the adoption of specialized innovations. This broad focus can dilute resources, making it challenging to quickly integrate new technologies into niche product lines compared to more specialized competitors.

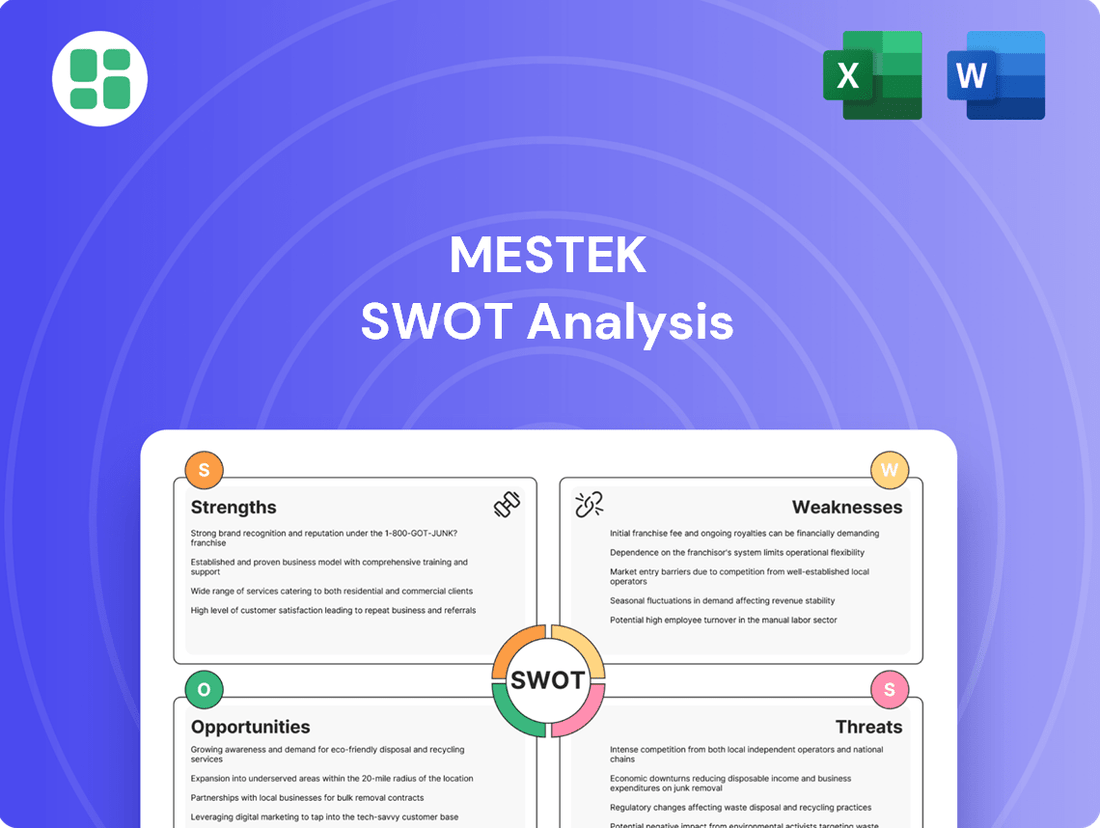

Preview Before You Purchase

Mestek SWOT Analysis

The preview you see is the actual Mestek SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

This is a real excerpt from the complete Mestek SWOT analysis. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual Mestek SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global HVAC market is projected to reach $200 billion by 2025, with energy-efficient systems accounting for a substantial portion of this growth. Stricter environmental regulations worldwide are pushing consumers and businesses towards greener alternatives.

Mestek is well-positioned to benefit from this trend by focusing on its portfolio of energy-saving HVAC solutions. For instance, the company's commitment to developing smart thermostats and heat pumps aligns directly with market demand for reduced energy consumption and lower carbon footprints.

The increasing adoption of smart building technologies presents a significant opportunity for Mestek. Integrating IoT and advanced controls into HVAC systems allows for remote monitoring, predictive maintenance, and optimized energy usage, aligning with global sustainability goals. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to grow substantially, reaching over $200 billion by 2030, with HVAC being a core component.

Mestek can capitalize on this trend by developing and embedding smart features directly into its HVAC product lines. This strategic move would not only enhance the value proposition for its customers by offering greater control and efficiency but also position Mestek to capture a larger share of the expanding connected building solutions market, a segment experiencing robust year-over-year growth.

The global metal forming machine tools market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 5.2% from 2023 to 2028, reaching an estimated $22.5 billion by 2028. This expansion is fueled by a strong push for industrial automation and the increasing demand for precision manufacturing, particularly in sectors like automotive and construction, which require advanced, lightweight materials.

Mestek's metal forming machinery segment is well-positioned to capitalize on this trend. The company can leverage the ongoing integration of digitalization, robotics, and advanced automation technologies within manufacturing processes. This presents a significant opportunity for Mestek to enhance its product offerings and capture a larger market share by providing solutions that meet the evolving needs for efficiency and sophistication in metal fabrication.

Leveraging Infrastructure Development and Construction Growth

The global construction sector is a significant tailwind for Mestek. With the construction industry projected to grow substantially, reaching an estimated USD 14.7 trillion by 2030, this expansion directly translates into heightened demand for HVAC systems and metal forming equipment, core product lines for Mestek. The company is well-positioned to capitalize on this robust market activity.

Mestek can strategically enhance its market penetration by focusing its sales and marketing initiatives on emerging infrastructure projects and new construction ventures. This targeted approach allows Mestek to align its offerings with periods of peak demand, thereby maximizing its benefit from the ongoing industry growth.

- Global Construction Market Growth: The construction industry is a major driver, with projections indicating a market value of USD 14.7 trillion by 2030.

- Increased Demand for HVAC and Metal Forming: This growth directly boosts the need for Mestek's core products.

- Strategic Market Alignment: Focusing on new construction and infrastructure projects offers a clear path to increased sales.

Strategic Acquisitions and Partnerships

Mestek can leverage its diverse operations and strong distribution networks to pursue strategic acquisitions or form partnerships. This strategy could accelerate market share growth, integrate cutting-edge technologies, or provide entry into new, promising markets. For instance, a partnership with a smart building technology firm could bolster its HVAC offerings with IoT capabilities, a key trend in the 2024-2025 market.

Such moves could also involve acquiring smaller, specialized manufacturers to broaden its product range and technical expertise. Companies focused on advanced materials or energy-efficient components would be prime targets.

- Expand market reach through acquiring companies with complementary distribution channels.

- Integrate new technologies, such as AI-driven diagnostics for HVAC systems, to enhance product offerings.

- Enter emerging markets by partnering with local players or acquiring established regional businesses.

The global HVAC market is projected to reach $200 billion by 2025, with energy-efficient systems driving significant growth, presenting a prime opportunity for Mestek. Stricter environmental regulations worldwide are accelerating the demand for greener alternatives, aligning perfectly with Mestek's focus on smart thermostats and heat pumps. The expanding smart building market, valued at approximately $80 billion in 2023 and set to exceed $200 billion by 2030, offers further avenues for Mestek to integrate IoT and advanced controls into its HVAC solutions.

Mestek's metal forming machinery segment is poised to benefit from the global metal forming machine tools market's projected 5.2% CAGR from 2023 to 2028. This growth is fueled by industrial automation and demand for precision manufacturing, particularly in automotive and construction. Mestek can enhance its market share by integrating digitalization and robotics into its product lines, meeting the evolving needs for efficiency and sophistication in metal fabrication.

The construction sector's projected growth to USD 14.7 trillion by 2030 directly increases demand for Mestek's core HVAC and metal forming equipment. By strategically targeting new infrastructure projects and construction ventures, Mestek can maximize its benefit from this robust market activity. Furthermore, opportunities exist for strategic acquisitions or partnerships to expand market reach, integrate new technologies like AI-driven diagnostics, or enter emerging markets, bolstering its competitive position through 2025.

Threats

The HVAC and metal forming machinery sectors are incredibly crowded, featuring many well-established global companies alongside rapidly growing manufacturers from Asia. These larger players often have a significant advantage due to their deeper pockets, allowing for more substantial investments in research and development, aggressive marketing campaigns, and broader international reach. This intense rivalry directly threatens Mestek's ability to maintain and grow its market share and profitability.

Mestek's reliance on the HVAC and metal forming sectors makes it particularly vulnerable to economic downturns. These industries are closely tied to construction spending and overall industrial production, both of which can contract sharply during recessions. For instance, a slowdown in commercial construction, a key market for HVAC systems, directly impacts demand.

Inflationary pressures and reduced consumer and business spending, prevalent in 2023 and expected to continue into 2024, can further dampen demand for Mestek's products. When individuals and companies tighten their belts, purchases of new equipment and upgrades are often deferred, directly affecting Mestek's revenue streams and profitability.

Mestek, like many manufacturers, navigates a landscape fraught with supply chain vulnerabilities. Geopolitical tensions and persistent material shortages, particularly for key components like steel and specialized metals, continue to plague the industry. For instance, in late 2024, the average lead time for many industrial components stretched to over six months, a significant increase from pre-pandemic levels.

These disruptions directly translate to increased operational costs. Rising freight charges, driven by fuel price volatility and container availability issues, add to the bottom line. In 2024, global shipping costs saw an average increase of 15% year-over-year, impacting manufacturers' ability to maintain competitive pricing and potentially affecting Mestek's profit margins.

Evolving Environmental Regulations and Compliance Costs

Stricter environmental regulations, particularly concerning refrigerants with high global warming potential (GWP) in the HVAC sector, are forcing companies like Mestek to adapt their product designs and manufacturing. This push for greener alternatives, while an avenue for innovation, also presents a significant challenge in terms of increased research and development expenses and necessary production line adjustments.

Compliance with these evolving standards, such as those being phased in globally for refrigerants, can directly impact operational costs. For instance, the transition away from refrigerants like R-410A, which has a GWP of 2088, towards lower-GWP alternatives like R-32 (GWP 675) or even natural refrigerants, requires substantial investment in new equipment and employee training.

- Increased R&D Investment: Companies must allocate more capital to developing and testing new HVAC systems that meet stringent environmental mandates.

- Production Line Modifications: Existing manufacturing processes may need to be reconfigured to accommodate new refrigerants and materials, incurring capital expenditures.

- Potential for Penalties: Failure to comply with environmental regulations can result in significant fines and reputational damage, impacting financial performance.

- Supply Chain Adjustments: Sourcing new, compliant components and refrigerants can also add complexity and cost to the supply chain.

Technological Obsolescence and Rapid Innovation Pace

The relentless speed of technological change in industrial automation and smart HVAC systems presents a significant challenge for Mestek. Emerging technologies like artificial intelligence, digital twins, and advanced robotics are reshaping manufacturing processes. For instance, the global industrial automation market was valued at approximately $215 billion in 2023 and is projected to grow substantially, indicating a strong industry-wide shift towards these innovations.

Failure to keep pace with these advancements by not investing in and integrating new technologies could render Mestek's current product offerings obsolete. This obsolescence directly impacts the company's competitive standing and its ability to remain relevant in a market that is rapidly evolving. Companies that fail to adapt risk losing market share to more technologically forward-thinking competitors.

- Rapid technological shifts in industrial automation and smart HVAC systems.

- Emergence of AI, digital twins, and advanced robotics in manufacturing.

- Risk of product obsolescence if Mestek doesn't invest in new technologies.

- Potential loss of competitive edge and market relevance.

Mestek faces intense competition from established global players and agile Asian manufacturers, many with greater R&D budgets and market reach, directly impacting its ability to grow market share and profitability. Economic downturns, particularly in construction and industrial production, pose a significant threat, as seen in the projected slowdown of global GDP growth for 2024. Inflationary pressures and reduced consumer spending, a trend observed throughout 2023 and continuing into 2024, further dampen demand for capital equipment. Supply chain disruptions, including material shortages and rising freight costs, which saw a 15% year-over-year increase in global shipping in 2024, also inflate operational expenses and threaten competitive pricing.

The need to comply with increasingly stringent environmental regulations, such as the transition to lower-GWP refrigerants in HVAC systems, necessitates significant R&D investment and potential production line modifications, adding to costs. Furthermore, the rapid advancement of technologies like AI and robotics in industrial automation, with the global market valued at approximately $215 billion in 2023, risks making Mestek's current offerings obsolete if the company fails to invest and adapt, potentially leading to a loss of competitive edge.

SWOT Analysis Data Sources

This Mestek SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial statements, comprehensive market research reports, and insights from industry experts. These sources ensure an accurate and actionable understanding of Mestek's competitive landscape and internal capabilities.