Mestek Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mestek Bundle

Mestek's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the intensity of rivalry within its industry. Understanding these dynamics is crucial for any strategic decision.

The complete Porter's Five Forces Analysis delves into each of these pressures, revealing the underlying strengths and weaknesses that define Mestek's market position. Unlock the full report to gain a comprehensive strategic advantage.

Suppliers Bargaining Power

Raw material cost volatility significantly impacts Mestek's profitability. Fluctuations in the prices of steel, aluminum, and copper, crucial for their HVAC and metal forming products, directly affect the cost of goods sold. For instance, steel prices saw considerable swings in 2023 and early 2024, with some reports indicating a potential for continued upward pressure through 2025 due to global supply chain dynamics and demand shifts.

This price instability grants suppliers of these essential metals greater bargaining power. When raw material costs rise, suppliers can command higher prices, squeezing Mestek's profit margins if they cannot fully pass these increases onto customers. Forecasts for 2025 suggest that these metal prices may remain volatile or even increase, further strengthening the suppliers' position and potentially impacting Mestek's ability to maintain competitive pricing.

Component shortages, particularly for semiconductor chips and specialized HVAC components like compressors and heat exchangers, have significantly extended lead times throughout 2024. This scarcity directly bolsters supplier bargaining power, as manufacturers like Mestek face increased competition for limited inventory.

The high demand coupled with constrained supply means suppliers can dictate terms, pushing up prices and impacting Mestek's production timelines and overall cost of goods sold. For instance, lead times for certain electronic components have stretched to over 52 weeks in some industries, a trend impacting manufacturing efficiency.

Mestek's reliance on specialized technology and parts for its advanced HVAC systems and metal forming machinery significantly influences supplier bargaining power. If key components are proprietary or have limited alternative manufacturers, these suppliers gain leverage.

For instance, in the HVAC sector, suppliers of advanced heat exchangers or unique control systems that are integral to Mestek's high-efficiency units can command higher prices or dictate terms. Similarly, specialized tooling or precision components for its metal forming equipment, if sourced from only a handful of highly skilled providers, present a similar dynamic. This dependence on unique inputs grants suppliers a stronger position in negotiations.

Supplier Concentration

Supplier concentration for Mestek's essential inputs, such as specialized metal press components and industrial heating elements, is a key factor in assessing supplier bargaining power. If the market for these critical materials is dominated by a few large manufacturers, Mestek faces a greater risk of suppliers dictating terms and prices.

For instance, if the primary producers of high-grade steel alloys or precision-engineered casings are limited to a handful of global entities, these suppliers gain significant leverage. This concentration means Mestek has fewer alternative sources, potentially leading to increased input costs and supply chain disruptions if these dominant suppliers face issues.

- High Supplier Concentration: A market with few dominant suppliers for critical inputs like specialized metal press components or industrial heating elements grants those suppliers considerable bargaining power.

- Limited Alternatives: When Mestek has few alternative suppliers for essential materials, it reduces its ability to negotiate favorable terms and increases reliance on existing providers.

- Price Sensitivity: Concentrated supplier markets can lead to higher input costs for Mestek, directly impacting its profitability and pricing strategies.

- Supply Chain Vulnerability: A small number of key suppliers can create vulnerabilities in Mestek's supply chain, making it susceptible to price hikes or supply interruptions.

Switching Costs for Mestek

Switching costs for Mestek are a significant factor in assessing supplier bargaining power. If Mestek were to change its primary suppliers for critical components, it would likely face substantial expenses. These costs could include retooling manufacturing equipment to accommodate new part specifications, the lengthy process of re-qualifying new suppliers and their parts to ensure quality and reliability, and the administrative burden of renegotiating contracts and supply chain logistics.

The presence of high switching costs creates a strong incentive for Mestek to maintain existing supplier relationships, even in the face of potential price increases or minor service disruptions. This reluctance to switch strengthens the hand of suppliers, as they understand the significant hurdles Mestek would need to overcome to find an alternative. For example, if Mestek's core products rely on highly specialized, custom-engineered components, finding a new supplier capable of meeting those exact specifications, let alone at a comparable price and quality, could be a multi-year endeavor involving considerable investment.

- High Retooling Expenses: Significant capital investment may be required to modify existing machinery or purchase new equipment to process components from a different supplier.

- Re-qualification Time and Cost: New suppliers and their parts necessitate rigorous testing and validation, consuming valuable engineering resources and potentially delaying production.

- Contractual Lock-ins: Existing supply agreements may contain clauses that impose penalties for early termination, further increasing the cost of switching.

- Supply Chain Disruption Risk: A change in suppliers can lead to unforeseen production delays and quality issues, impacting Mestek's ability to meet customer demand.

Mestek faces significant bargaining power from its suppliers, particularly for raw materials like steel and aluminum, where price volatility in 2023 and early 2024 has been notable, with forecasts for 2025 suggesting continued upward pressure. Component shortages in 2024, especially for semiconductors and specialized HVAC parts, have extended lead times, giving suppliers leverage to dictate terms and increase prices. This power is amplified by Mestek's reliance on proprietary or limited-source components, where a few specialized providers can command higher prices, and by high switching costs associated with retooling and re-qualifying new suppliers, which can take years and significant investment.

| Factor | Impact on Mestek | Supplier Leverage |

|---|---|---|

| Raw Material Price Volatility | Increased cost of goods sold, potential margin squeeze | High, especially for steel and aluminum |

| Component Shortages (2024) | Extended lead times, production delays, higher component costs | Significant, due to competition for limited inventory |

| Reliance on Specialized Components | Limited alternative sourcing options, higher input costs | High for proprietary or unique parts |

| Supplier Concentration | Vulnerability to price hikes and supply disruptions | High when few dominant suppliers exist |

| High Switching Costs | Incentive to maintain existing relationships, less negotiation flexibility | Strong, due to retooling and re-qualification expenses |

What is included in the product

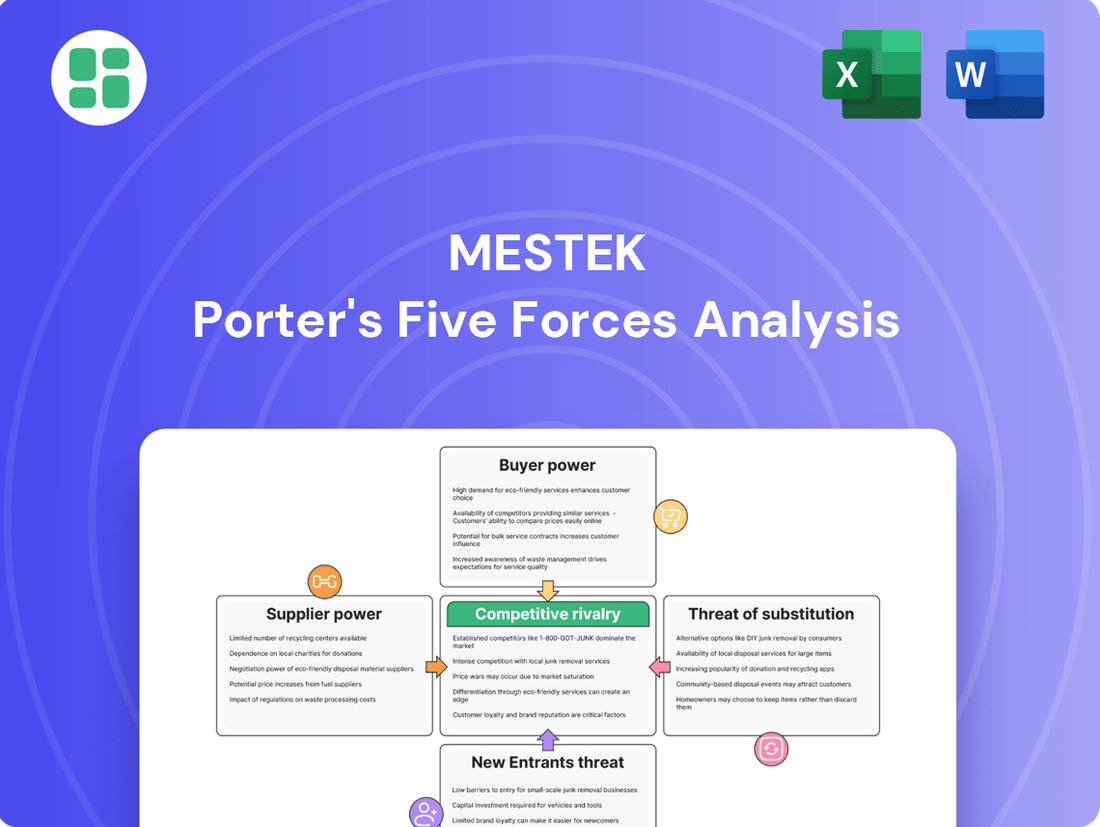

Mestek's Porter's Five Forces analysis dissects the competitive intensity and attractiveness of its operating industries, examining threats from new entrants, the power of buyers and suppliers, and the impact of substitutes and existing rivals.

Effortlessly identify and mitigate competitive threats with a visual representation of all five forces, simplifying complex strategic analysis.

Customers Bargaining Power

Mestek serves a broad customer base, encompassing large commercial organizations, HVAC contractors, and distributors, alongside industrial clients in metal forming. This diversity means that certain customer segments possess considerable influence.

For instance, major commercial entities or contractors who purchase in substantial volumes can leverage their purchasing power to negotiate more favorable pricing, extended payment terms, or even request tailored product modifications. This ability to influence terms directly amplifies their bargaining power within Mestek's market.

If Mestek's products in the HVAC and metal forming sectors are highly standardized, customers gain significant leverage. This standardization means buyers can easily switch to a competitor offering similar goods, increasing their bargaining power. For instance, in 2024, the HVAC market saw continued competition with numerous manufacturers offering comparable boiler and air handling units, making product differentiation a key battleground.

Mestek's customers often exhibit significant price sensitivity, especially in segments like HVAC where cost is a major driver of purchasing decisions. This is particularly true in highly competitive markets where numerous suppliers vie for business, pushing down prices.

Economic downturns or inflationary periods can amplify this sensitivity. For instance, during periods of high inflation, customers may become more reluctant to absorb price increases, forcing companies like Mestek to either absorb those costs themselves, thereby reducing profit margins, or risk losing sales volume.

In 2024, the construction industry, a key market for Mestek, experienced mixed signals. While some sectors saw robust activity, others faced headwinds from higher interest rates and material costs, leading many buyers to scrutinize every dollar spent and prioritize the lowest cost options.

Customer Switching Costs

Customer switching costs for Mestek's HVAC systems and metal forming machinery can significantly influence their bargaining power. If customers face substantial expenses or operational disruptions when switching to a competitor, their ability to demand lower prices or better terms from Mestek is diminished.

For instance, the initial investment in installing complex HVAC systems, including ductwork and control integration, represents a significant hurdle for many clients. Furthermore, retraining staff on new equipment or dealing with the potential incompatibility of existing infrastructure with a new supplier's offerings adds to these switching costs. In 2024, the average cost for commercial HVAC system replacement in the US can range from $10,000 to $50,000, depending on the system's size and complexity, making such decisions impactful.

- High Installation and Integration Costs: The complexity and expense associated with installing and integrating Mestek's specialized machinery create a barrier for customers looking to switch.

- Training and Operational Disruption: End-users often require training on new equipment, and the transition period can lead to temporary dips in productivity, increasing the perceived cost of switching.

- Long-Term Service and Support Agreements: Existing service contracts or warranties tied to Mestek's products can make it financially disadvantageous for customers to move to a competitor prematurely.

- Customization and Specificity: If Mestek's products are highly customized to meet specific client needs, switching to a standard offering from a competitor might not be a viable or cost-effective solution.

Information Availability and Transparency

In the HVAC and metal forming sectors, customers increasingly benefit from readily available information. Online platforms and industry publications provide detailed pricing, product specifications, and comparisons of alternative suppliers. This transparency empowers buyers, allowing them to easily identify the best value and negotiate more effectively with Mestek.

For instance, a 2024 report indicated that over 70% of B2B buyers in manufacturing industries now conduct extensive online research before making a purchase, significantly increasing their awareness of market options. This readily accessible data directly enhances their bargaining power.

- Increased Online Research: A significant majority of B2B buyers in manufacturing utilize online resources for product and supplier evaluation.

- Price Transparency: Customers can readily compare pricing across multiple HVAC and metal forming suppliers.

- Product Specification Access: Detailed product information is widely available, enabling informed decision-making.

- Supplier Alternatives: Information on numerous alternative suppliers is easily discoverable, intensifying competition.

Mestek's customers, particularly large-volume buyers in HVAC and metal forming, wield considerable bargaining power. This is amplified by product standardization and significant price sensitivity, especially evident in the 2024 construction market where cost-consciousness was paramount. The ease of accessing market information online further empowers these buyers to negotiate favorable terms.

| Factor | Impact on Mestek's Customer Bargaining Power | Supporting Data (2024 Context) |

|---|---|---|

| Customer Concentration/Volume | High for large buyers | Major commercial entities can negotiate better pricing due to bulk purchases. |

| Product Standardization | Increases power | HVAC market in 2024 featured many comparable units, facilitating easy switching. |

| Price Sensitivity | High, especially in HVAC | Construction sector in 2024 prioritized cost due to economic pressures. |

| Switching Costs | Moderate to High | HVAC system installation costs can range from $10,000-$50,000, deterring frequent changes. |

| Information Availability | Increases power | Over 70% of B2B manufacturing buyers research extensively online, enhancing negotiation leverage. |

Preview Before You Purchase

Mestek Porter's Five Forces Analysis

This preview showcases the complete Mestek Porter's Five Forces analysis, offering a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing actionable insights without any placeholders or alterations.

Rivalry Among Competitors

Mestek operates in markets characterized by a substantial number of competitors, both in HVAC equipment and metal forming machinery. This diverse competitive field includes large, globally recognized corporations as well as smaller, highly specialized manufacturers, fostering a climate of intense rivalry.

In the HVAC sector, for instance, companies like Carrier Global Corporation and Trane Technologies are significant players, alongside numerous regional and specialized providers. Similarly, the metal forming machinery industry sees competition from established names such as Amada Co., Ltd. and Bystronic, alongside many other focused equipment suppliers.

The growth rate within Mestek's operating industries significantly shapes competitive rivalry. The HVAC sector, with a projected compound annual growth rate (CAGR) between 6.1% and 7.9% for the period of 2025-2029, offers ample opportunities for expansion. Similarly, the metal forming industry is anticipated to grow at a CAGR of 3.6% to 4.8% during the same timeframe.

Generally, robust industry growth can temper intense rivalry. When markets are expanding, companies often prioritize capturing new market share and increasing production volume. This focus can lead to less aggressive price competition as firms are less desperate for immediate sales, allowing them to concentrate on innovation and operational efficiency to meet rising demand.

Mestek's competitive rivalry is influenced by its product differentiation strategies. The company strives to set its products apart through advancements in technology, superior quality, enhanced energy efficiency, and dedicated customer service.

For instance, Mestek's focus on developing energy-efficient HVAC solutions directly addresses growing market demand and regulatory pressures, creating a distinct advantage. In 2024, the increasing emphasis on sustainability in building codes and consumer preferences means that products offering higher energy efficiency, like those Mestek develops, face less direct price-based competition.

When products are highly differentiated, as Mestek aims for with its technological innovations and quality build, the intensity of rivalry tends to decrease. This is because customers are less likely to view the offerings as interchangeable commodities, shifting the competitive landscape away from pure price wars and towards value-added features and performance.

Exit Barriers

Mestek's industries often feature considerable exit barriers. These can include highly specialized machinery and facilities, meaning assets have low resale value if a company decides to leave the market. For instance, the manufacturing of specific HVAC components or metal forming equipment requires dedicated, often custom-built, production lines.

These high fixed costs and asset specificity mean that shutting down operations can result in substantial write-offs. Furthermore, long-term supply agreements or customer contracts can obligate companies to continue production even when unprofitable, as breaking these commitments may incur penalties.

Consequently, these exit barriers can contribute to intensified competitive rivalry. Companies might choose to soldier on at reduced profitability rather than incur the steep costs of exiting, which can lead to persistent overcapacity in the market. This dynamic can put downward pressure on prices and profitability for all players, including Mestek.

For example, in the industrial machinery sector, a significant portion of capital expenditure is often tied to specialized equipment. In 2023, capital expenditures for manufacturers in related sectors averaged around 5-8% of revenue, indicating substantial investments that are difficult to recoup upon exit.

Strategic Objectives of Competitors

Competitors in Mestek's markets, such as those in the HVAC and metal forming sectors, often pursue aggressive growth strategies. For example, many aim to capture greater market share through product innovation and strategic acquisitions. In 2024, several key players announced significant R&D investments focused on energy efficiency and smart building technologies, signaling a push for technological leadership.

Profitability remains a central objective for most rivals, driving them to optimize operational costs and pursue higher-margin product lines. This can lead to intense price competition in certain segments. For instance, in the fabricated metal products industry, companies have been seen to adjust pricing strategies based on raw material costs, aiming to maintain healthy profit margins even amidst fluctuating input prices.

- Market Share Expansion: Many competitors are focused on increasing their footprint, particularly in emerging markets, by offering competitive pricing and localized product solutions.

- Technological Advancement: A significant strategic objective is to lead in innovation, especially in areas like automation, digital integration, and sustainable manufacturing processes.

- Profitability Enhancement: Competitors strive to improve their bottom line through cost efficiencies, supply chain optimization, and the development of premium product offerings.

Competitive rivalry within Mestek's operating sectors is significant due to the presence of numerous players, ranging from large corporations to specialized niche manufacturers. This intense competition is further fueled by differing growth rates in the HVAC and metal forming industries, with HVAC showing a stronger projected growth. While robust industry growth can temper rivalry, Mestek's strategy of product differentiation, particularly in energy-efficient HVAC solutions, aims to create a competitive edge and reduce price-based battles.

High exit barriers, such as specialized machinery and contractual obligations, can keep less profitable firms in the market, potentially intensifying rivalry. Competitors are actively pursuing market share expansion and technological leadership, as seen in their R&D investments in smart building technologies in 2024. This drive for growth and profitability can lead to aggressive pricing strategies, especially when raw material costs fluctuate.

| Industry | Projected CAGR (2025-2029) | Key Competitive Focus | Example of 2024 Activity |

|---|---|---|---|

| HVAC Equipment | 6.1% - 7.9% | Energy Efficiency, Smart Building Tech | Increased R&D investment in sustainable solutions |

| Metal Forming Machinery | 3.6% - 4.8% | Automation, Digital Integration | Acquisitions to expand technological capabilities |

SSubstitutes Threaten

The threat of substitutes for Mestek's products, particularly in the HVAC sector, is growing due to advancements in alternative technologies. For example, innovations in geothermal heating systems offer a sustainable alternative to traditional HVAC, potentially reducing reliance on Mestek's equipment. Similarly, enhanced building insulation and passive climate control designs can decrease the overall demand for active heating and cooling solutions.

The threat of substitutes for Mestek's products, particularly in the HVAC and metal forming sectors, hinges on the performance-price trade-off. If alternative solutions offer comparable or better performance at a lower cost, Mestek faces significant pressure. For instance, advancements in building insulation or passive cooling technologies could reduce the demand for traditional HVAC systems, presenting a direct substitute.

In the metal forming industry, innovative materials or additive manufacturing techniques might offer lighter, stronger, or more cost-effective components, thereby diminishing the need for conventional metal fabrication methods. For example, the increasing adoption of advanced composites in automotive and aerospace industries, offering superior strength-to-weight ratios, directly challenges traditional metal forming processes. Mestek's ability to innovate and maintain a competitive price point against these evolving substitutes will be crucial for its sustained market position.

Customers are increasingly open to switching to alternative solutions for their heating and cooling needs, driven by a combination of factors. The ease of adopting new technologies, like the growing availability of installer training for heat pumps, directly impacts this propensity. For instance, in 2024, the U.S. Department of Energy reported a significant uptick in consumer interest in heat pump technology, signaling a growing awareness of its benefits.

The perceived benefits, such as lower operational costs and environmental advantages, are powerful motivators for customers to consider substitutes. As energy prices fluctuate, the cost savings offered by alternatives like high-efficiency heat pumps become more attractive compared to traditional systems. This trend is further accelerated by stricter energy efficiency regulations being implemented globally, pushing consumers and businesses alike to explore more sustainable options.

Regulatory and Environmental Shifts

Evolving regulations, especially those pushing for sustainability and lower carbon emissions, can significantly speed up the adoption of substitute technologies. For example, new rules requiring eco-friendly refrigerants or net-zero building standards could make alternative HVAC systems more attractive than existing ones.

These regulatory shifts create a direct threat by making current offerings less competitive or even obsolete. Consider the push for energy efficiency; buildings designed to meet stricter energy codes might opt for integrated systems that reduce reliance on traditional, standalone HVAC units.

- Regulatory Push for Sustainability: Growing mandates for reduced carbon footprints and increased energy efficiency directly impact industries like HVAC, favoring alternatives that meet these new environmental benchmarks.

- Impact on Existing Technologies: Regulations mandating specific refrigerant types or performance standards can render current systems less viable, pushing consumers towards newer, compliant substitutes.

- Accelerated Adoption of Alternatives: For instance, the EU's F-Gas Regulation phase-down of hydrofluorocarbons (HFCs) is driving demand for systems using lower global warming potential (GWP) refrigerants, which are often found in newer or alternative technologies.

- Economic Incentives and Penalties: Government incentives for adopting green technologies, coupled with potential penalties for non-compliance, further strengthen the threat of substitutes by altering the cost-benefit analysis for businesses and consumers.

Innovation in Adjacent Industries

Innovations in adjacent sectors pose a significant threat of substitution for Mestek. For instance, advancements in 3D printing and additive manufacturing could diminish the demand for traditional metal forming processes that Mestek utilizes in its manufacturing. By 2024, the global 3D printing market was projected to reach over $20 billion, indicating a growing capability to produce complex metal components that could bypass conventional manufacturing methods.

Furthermore, evolving construction methodologies might alter the demand for HVAC systems, a key market for Mestek. Innovations in building insulation, smart climate control, and passive heating/cooling techniques could reduce the overall need for traditional HVAC equipment, presenting an alternative to Mestek's core offerings. For example, the increasing adoption of net-zero energy building standards by 2025 could significantly impact the HVAC market size.

- 3D Printing Impact: Advancements in additive manufacturing could substitute traditional metal forming processes, potentially impacting Mestek's core manufacturing operations. The 3D printing market's rapid growth, exceeding $20 billion in 2024, highlights this disruptive potential.

- Construction Methodologies: New building techniques and materials that improve energy efficiency may reduce the reliance on conventional HVAC systems, a primary revenue stream for Mestek.

- HVAC Alternatives: Innovations like advanced insulation and passive climate control offer substitutes for traditional HVAC solutions, potentially shrinking the addressable market for Mestek's products.

The threat of substitutes for Mestek's products is intensifying, particularly in the HVAC sector, as alternative technologies gain traction. Innovations like geothermal heating and advanced building insulation reduce the need for traditional HVAC systems. For instance, the U.S. Department of Energy noted a significant rise in consumer interest for heat pumps in 2024, signaling a shift towards more energy-efficient alternatives.

In metal forming, additive manufacturing and advanced composite materials present direct substitutes. These technologies can offer superior performance at a competitive price point, challenging Mestek's established processes. The global 3D printing market's expansion, projected to exceed $20 billion in 2024, underscores this disruptive trend.

Regulatory shifts, especially those promoting sustainability and energy efficiency, further bolster the threat of substitutes. Mandates for lower carbon emissions and eco-friendly refrigerants, like the EU's F-Gas Regulation phase-down, make newer, compliant technologies more appealing, potentially impacting Mestek's market share.

| Factor | Impact on Mestek | Example/Data Point (2024) |

| Technological Advancements | Reduces demand for traditional HVAC and metal forming | U.S. DOE: Increased consumer interest in heat pumps. |

| Performance-Price Trade-off | Substitutes offer comparable or better value | Global 3D printing market projected to exceed $20 billion. |

| Environmental Regulations | Favors sustainable alternatives | EU F-Gas Regulation driving demand for low-GWP refrigerant systems. |

Entrants Threaten

Entering the HVAC equipment manufacturing or metal forming machinery sectors, like those Mestek operates in, demands substantial upfront capital. This includes significant investments in manufacturing facilities, advanced machinery, and ongoing research and development to stay competitive. For instance, establishing a new, fully operational HVAC manufacturing plant could easily run into tens of millions of dollars, creating a formidable barrier for potential new players.

Established companies like Mestek often leverage significant economies of scale in production, purchasing, and distribution. This means they can produce goods more cheaply per unit due to higher output volumes. For instance, Mestek's large-scale manufacturing operations allow for bulk purchasing of raw materials, securing better pricing and reducing input costs compared to smaller, newer competitors.

These cost advantages create a substantial barrier for new entrants. Without achieving a similar production and purchasing scale rapidly, new companies struggle to match the per-unit costs of established players. This disparity makes it challenging for newcomers to offer competitive pricing, thereby limiting their ability to gain market share and profitability.

New entrants face significant hurdles in accessing established distribution channels for HVAC equipment and metal forming machinery. Companies like Mestek have built long-standing relationships with contractors and distributors, making it difficult for newcomers to secure reliable sales and service networks. These existing partnerships create a substantial barrier, as new players must invest heavily to replicate the reach and trust that incumbents already possess.

Proprietary Technology and Patents

Mestek's specialized engineering services and proprietary technologies act as significant barriers to entry. Their deep industry expertise, honed over years, is difficult for newcomers to replicate quickly. This technical know-how allows them to offer unique solutions that are not easily matched by competitors.

Patents and unique manufacturing processes further solidify Mestek's position. These intellectual property rights prevent rivals from directly copying their products or methods. For instance, in 2024, Mestek continued to invest in R&D, securing several new patents related to advanced metal forming and HVAC technologies, which are crucial for their competitive edge.

- Mestek's proprietary technologies create high switching costs for customers who rely on their specialized engineering.

- The company's extensive patent portfolio, particularly in areas like advanced coil processing and specialized HVAC components, deters potential entrants by blocking direct replication of their core offerings.

- Deep, accumulated industry expertise is a non-patentable but equally powerful barrier, making it challenging for new firms to achieve Mestek's level of product performance and customer service.

Government Policy and Regulations

Government policies and regulations significantly impact the threat of new entrants in the HVAC industry. For instance, stringent energy efficiency standards, like those mandated by the U.S. Department of Energy, require new manufacturers to invest heavily in research and development to meet performance benchmarks. Building codes and environmental compliance, such as those related to refrigerants and emissions, add further layers of complexity and cost. These regulatory hurdles can deter potential new players who may lack the capital or expertise to navigate such a landscape. In 2024, the ongoing push for decarbonization and stricter emissions controls globally means new entrants must design products that align with evolving environmental mandates, increasing the upfront investment and time required for market entry.

- Energy Efficiency Standards: New HVAC systems must often meet minimum Seasonal Energy Efficiency Ratio (SEER) or Energy Efficiency Ratio (EER) ratings, requiring advanced design and components.

- Building Codes: Local and national building codes dictate installation practices, safety features, and material requirements, adding compliance costs.

- Environmental Regulations: Restrictions on refrigerants (e.g., phasing out HFCs) necessitate the adoption of newer, often more expensive, alternatives.

- Certification and Testing: Obtaining necessary certifications (like ENERGY STAR or UL listing) involves rigorous testing and can be a lengthy and costly process for new entrants.

The threat of new entrants for Mestek is generally moderate to low due to significant capital requirements and established economies of scale. New companies need substantial investments for manufacturing and R&D, often in the tens of millions of dollars for HVAC production. Mestek's large-scale operations provide cost advantages through bulk purchasing, making it difficult for newcomers to compete on price.

Access to established distribution channels and customer relationships is another major barrier. Mestek's long-standing partnerships with contractors and distributors are hard for new entrants to replicate without significant investment. Furthermore, proprietary technologies and patents, like those secured in 2024 for advanced metal forming and HVAC components, offer a strong competitive edge and deter direct imitation.

Government regulations, particularly those concerning energy efficiency and environmental standards, also raise the barrier to entry. New players must invest heavily in R&D to meet stringent requirements, such as SEER ratings and refrigerant regulations, adding complexity and cost to market entry.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment in manufacturing, machinery, and R&D. | Significant hurdle, requiring tens of millions for HVAC production. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | New entrants struggle to match pricing and cost efficiency. |

| Distribution Channels | Established relationships with contractors and distributors. | New entrants need substantial investment to build sales and service networks. |

| Proprietary Technology & Patents | Unique engineering and patented processes. | Deters replication and provides a competitive advantage; 2024 saw new patents secured. |

| Government Regulations | Energy efficiency standards, building codes, environmental rules. | Increases upfront investment and R&D costs for compliance. |

Porter's Five Forces Analysis Data Sources

Our Mestek Porter's Five Forces analysis leverages a comprehensive approach, drawing data from Mestek's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and competitor financial disclosures to gain a holistic understanding of the competitive landscape.