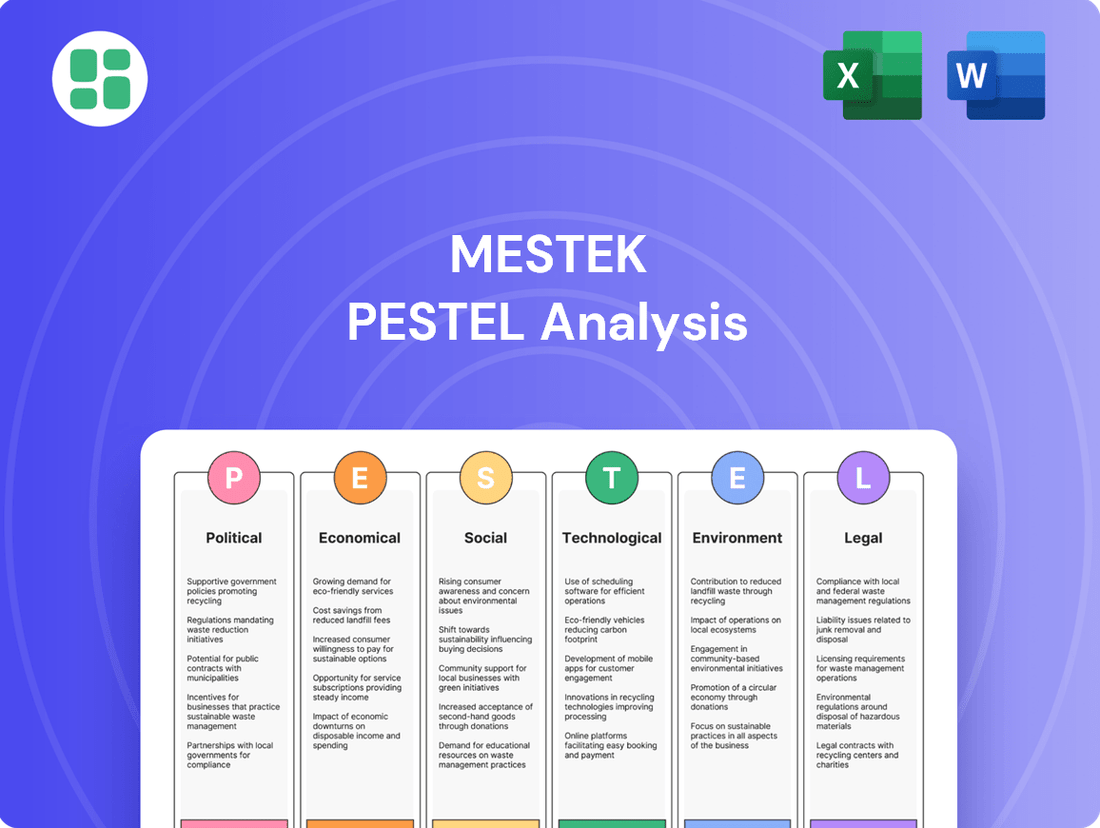

Mestek PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mestek Bundle

Unlock the critical external factors shaping Mestek's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your own strategic planning. Download the full PESTLE analysis now and gain the foresight you need to thrive.

Political factors

Government regulations on HVAC efficiency are becoming increasingly stringent, directly influencing Mestek's product innovation and manufacturing. For instance, the U.S. Department of Energy's ongoing updates to minimum energy efficiency standards for various HVAC equipment, such as furnaces and air conditioners, compel manufacturers like Mestek to invest heavily in R&D to meet these benchmarks.

Compliance with these evolving standards, like the SEER2 (Seasonal Energy Efficiency Ratio 2) standards implemented in 2023 for air conditioners and heat pumps, requires significant capital expenditure on developing and testing new technologies. This not only adds to production costs but also presents an opportunity for Mestek to gain a competitive edge by offering superior energy-efficient solutions in a market increasingly prioritizing sustainability.

Changes in international trade policies, particularly tariffs on essential raw materials like steel and aluminum, directly impact Mestek's production expenses. For instance, in early 2024, the potential for renewed Section 232 tariffs on steel imports continued to create market uncertainty, influencing input costs for manufacturers like Mestek.

Fluctuations in trade relations with major manufacturing nations can disrupt Mestek's supply chains and escalate component prices. For example, ongoing trade disputes between the US and China in 2024 have led to increased shipping costs and longer lead times for certain electronic components used in HVAC and metal framing products.

Effectively managing these trade complexities is vital for Mestek to sustain competitive pricing and ensure operational stability. The company's ability to adapt to evolving trade agreements, such as potential revisions to the USMCA or new bilateral trade pacts, will be a key determinant of its financial performance in the coming years.

Government-led infrastructure spending, particularly in areas like school and hospital construction, directly fuels demand for Mestek's HVAC and metal forming equipment. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 and continuing through 2026, allocates substantial funds for public buildings and upgrades, creating a robust market for heating, ventilation, and air conditioning systems. This sustained investment provides a predictable revenue stream and opportunities for significant, long-term contracts for companies like Mestek.

Political Stability and Geopolitical Events

Global political stability and geopolitical events significantly shape the economic landscape and the reliability of supply chains, directly affecting companies like Mestek. For instance, ongoing geopolitical tensions in Eastern Europe, which escalated in 2022 and continued through 2023 and into 2024, have disrupted energy markets and freight routes, potentially increasing shipping costs and impacting raw material availability for manufacturers. Mestek's reliance on global sourcing means that political unrest in key manufacturing regions, such as parts of Asia or the Middle East, could lead to shortages or price hikes for essential components. To counter these risks, a strategy of diversified sourcing across different geographical areas is crucial for maintaining operational continuity and cost predictability.

The ongoing trade disputes and the potential for new tariffs, particularly between major economic blocs, represent another significant political factor. As of early 2024, discussions around trade policies and protectionist measures continue, which could affect the cost of imported components or the competitiveness of Mestek's products in certain international markets. Political decisions regarding industrial policy and domestic manufacturing incentives can also create both opportunities and challenges. For example, government initiatives to boost domestic production of critical goods could benefit companies with a strong local manufacturing presence, while shifts in regulatory environments related to environmental standards or labor laws could necessitate adjustments in operational strategies and capital expenditure plans.

- Geopolitical Tensions: Continued instability in regions like Eastern Europe and the Middle East impacts global energy prices and shipping logistics, potentially increasing operational costs for Mestek.

- Trade Policies: Evolving trade agreements and potential tariffs between major economies in 2024 can influence the cost of raw materials and the market access for Mestek's manufactured goods.

- Industrial Policy: Government incentives for domestic manufacturing or changes in regulatory frameworks, such as environmental standards, can affect Mestek's production costs and strategic investment decisions.

- Supply Chain Resilience: Political instability highlights the need for Mestek to maintain diversified sourcing strategies to mitigate risks associated with disruptions in any single manufacturing region.

Taxation Policies

Changes in corporate taxation policies significantly impact Mestek's bottom line and strategic choices. For instance, the U.S. corporate tax rate was reduced from 35% to 21% in 2017, a move that would have boosted retained earnings for companies like Mestek, potentially freeing up capital for investment. In 2024, discussions around potential adjustments to these rates or the introduction of new tax credits, such as those for domestic manufacturing or research and development, could directly influence Mestek's profitability and expansion plans.

Favorable tax environments, including targeted incentives, can act as a strong catalyst for growth and innovation. If governments offer enhanced R&D tax credits, Mestek might accelerate its product development cycles. Conversely, an uptick in corporate tax rates would likely diminish the capital available for reinvestment, potentially slowing down growth initiatives or acquisitions.

For example, if a new tax law in 2025 introduces a 5% tax credit for companies investing in advanced manufacturing equipment, Mestek could see a direct financial benefit encouraging such investments. Conversely, a proposed increase in the U.S. federal corporate tax rate to 28% in 2025, as has been discussed, would reduce Mestek's after-tax profits, impacting its capacity for capital expenditures.

Key considerations for Mestek regarding taxation policies include:

- Monitoring proposed changes in corporate tax rates and their potential impact on net income.

- Evaluating the availability and benefits of R&D tax credits to foster innovation.

- Assessing incentives for domestic manufacturing and their influence on operational costs and investment decisions.

- Understanding how international tax laws might affect subsidiaries and global profit repatriation.

Government regulations on HVAC efficiency are becoming increasingly stringent, directly influencing Mestek's product innovation and manufacturing. For instance, the U.S. Department of Energy's ongoing updates to minimum energy efficiency standards for various HVAC equipment, such as furnaces and air conditioners, compel manufacturers like Mestek to invest heavily in R&D to meet these benchmarks.

Compliance with these evolving standards, like the SEER2 (Seasonal Energy Efficiency Ratio 2) standards implemented in 2023 for air conditioners and heat pumps, requires significant capital expenditure on developing and testing new technologies. This not only adds to production costs but also presents an opportunity for Mestek to gain a competitive edge by offering superior energy-efficient solutions in a market increasingly prioritizing sustainability.

Changes in international trade policies, particularly tariffs on essential raw materials like steel and aluminum, directly impact Mestek's production expenses. For instance, in early 2024, the potential for renewed Section 232 tariffs on steel imports continued to create market uncertainty, influencing input costs for manufacturers like Mestek.

Fluctuations in trade relations with major manufacturing nations can disrupt Mestek's supply chains and escalate component prices. For example, ongoing trade disputes between the US and China in 2024 have led to increased shipping costs and longer lead times for certain electronic components used in HVAC and metal framing products.

Effectively managing these trade complexities is vital for Mestek to sustain competitive pricing and ensure operational stability. The company's ability to adapt to evolving trade agreements, such as potential revisions to the USMCA or new bilateral trade pacts, will be a key determinant of its financial performance in the coming years.

Government-led infrastructure spending, particularly in areas like school and hospital construction, directly fuels demand for Mestek's HVAC and metal forming equipment. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021 and continuing through 2026, allocates substantial funds for public buildings and upgrades, creating a robust market for heating, ventilation, and air conditioning systems. This sustained investment provides a predictable revenue stream and opportunities for significant, long-term contracts for companies like Mestek.

Global political stability and geopolitical events significantly shape the economic landscape and the reliability of supply chains, directly affecting companies like Mestek. For instance, ongoing geopolitical tensions in Eastern Europe, which escalated in 2022 and continued through 2023 and into 2024, have disrupted energy markets and freight routes, potentially increasing shipping costs and impacting raw material availability for manufacturers. Mestek's reliance on global sourcing means that political unrest in key manufacturing regions, such as parts of Asia or the Middle East, could lead to shortages or price hikes for essential components. To counter these risks, a strategy of diversified sourcing across different geographical areas is crucial for maintaining operational continuity and cost predictability.

The ongoing trade disputes and the potential for new tariffs, particularly between major economic blocs, represent another significant political factor. As of early 2024, discussions around trade policies and protectionist measures continue, which could affect the cost of imported components or the competitiveness of Mestek's products in certain international markets. Political decisions regarding industrial policy and domestic manufacturing incentives can also create both opportunities and challenges. For example, government initiatives to boost domestic production of critical goods could benefit companies with a strong local manufacturing presence, while shifts in regulatory environments related to environmental standards or labor laws could necessitate adjustments in operational strategies and capital expenditure plans.

Changes in corporate taxation policies significantly impact Mestek's bottom line and strategic choices. For instance, the U.S. corporate tax rate was reduced from 35% to 21% in 2017, a move that would have boosted retained earnings for companies like Mestek, potentially freeing up capital for investment. In 2024, discussions around potential adjustments to these rates or the introduction of new tax credits, such as those for domestic manufacturing or research and development, could directly influence Mestek's profitability and expansion plans.

Favorable tax environments, including targeted incentives, can act as a strong catalyst for growth and innovation. If governments offer enhanced R&D tax credits, Mestek might accelerate its product development cycles. Conversely, an uptick in corporate tax rates would likely diminish the capital available for reinvestment, potentially slowing down growth initiatives or acquisitions.

For example, if a new tax law in 2025 introduces a 5% tax credit for companies investing in advanced manufacturing equipment, Mestek could see a direct financial benefit encouraging such investments. Conversely, a proposed increase in the U.S. federal corporate tax rate to 28% in 2025, as has been discussed, would reduce Mestek's after-tax profits, impacting its capacity for capital expenditures.

Key considerations for Mestek regarding taxation policies include:

- Monitoring proposed changes in corporate tax rates and their potential impact on net income.

- Evaluating the availability and benefits of R&D tax credits to foster innovation.

- Assessing incentives for domestic manufacturing and their influence on operational costs and investment decisions.

- Understanding how international tax laws might affect subsidiaries and global profit repatriation.

| Political Factor | Impact on Mestek | Example/Data (2024-2025) |

|---|---|---|

| Government Regulations (HVAC Efficiency) | Drives R&D investment, affects product design and cost. | SEER2 standards (2023) require updated technology. |

| Trade Policies & Tariffs | Influences raw material costs and supply chain stability. | Potential Section 232 tariffs on steel (early 2024) create cost uncertainty. |

| Infrastructure Spending | Boosts demand for HVAC and metal framing equipment. | U.S. Bipartisan Infrastructure Law (2021-2026) funds public building upgrades. |

| Geopolitical Instability | Disrupts energy markets, shipping, and material availability. | Eastern European tensions (2022-2024) impact freight costs and raw material sourcing. |

| Corporate Taxation | Affects profitability, capital for reinvestment, and strategic planning. | Discussions of potential US federal corporate tax rate changes in 2025. |

What is included in the product

The Mestek PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive understanding of its external operating landscape.

Mestek's PESTLE analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain of sifting through extensive data.

Economic factors

Rising inflation significantly impacts Mestek by increasing the cost of key raw materials like steel, copper, and aluminum, vital for their HVAC and metal forming machinery. For instance, the Producer Price Index for steel mill products saw a substantial increase in late 2024, directly affecting manufacturing inputs.

These higher input costs can put pressure on Mestek's profit margins, especially if the company struggles to pass these expenses onto customers through price adjustments. The ability to maintain competitive pricing while absorbing some of these increases is a key challenge.

To navigate these inflationary headwinds, Mestek's focus on robust supply chain management and strategic hedging against commodity price volatility becomes even more crucial. This proactive approach helps to buffer the business against unpredictable market fluctuations.

Interest rate fluctuations directly impact Mestek's operational costs. For instance, if the Federal Reserve raises its benchmark interest rate, Mestek's borrowing costs for capital expenditures, such as upgrading manufacturing facilities, will likely increase. This could mean higher interest payments on loans taken out for these investments.

Higher interest rates can also dampen demand for Mestek's products, particularly in sectors like construction. When financing for new building projects becomes more expensive due to elevated rates, developers may postpone or scale back their investments, leading to reduced orders for Mestek's metal forming equipment and related services. For example, a rise in the prime rate could make it harder for construction firms to secure loans for new projects, indirectly affecting Mestek's sales pipeline.

The overall health of the economy, especially in construction and industrial sectors, directly influences the demand for Mestek's offerings. For instance, in 2024, global construction output is projected to grow by 2.5%, indicating a positive environment for companies like Mestek.

Strong economic expansion often translates to more commercial and residential building projects, boosting sales of HVAC systems and other related products. In the US, housing starts were around 1.4 million units in early 2024, a healthy sign for construction-dependent businesses.

Conversely, economic downturns can curb new construction and reduce spending on machinery upgrades, negatively impacting Mestek's revenue streams. A potential economic slowdown in late 2024 or 2025 could therefore present headwinds.

Global Supply Chain Disruptions

Mestek continues to face ongoing vulnerabilities within global supply chains. Geopolitical events, such as the ongoing conflicts in Eastern Europe and trade disputes, alongside the lingering effects of the COVID-19 pandemic, have demonstrated the fragility of these networks. These disruptions directly affect Mestek's capacity to secure necessary components and ensure timely product delivery, impacting production schedules and increasing overall costs.

The financial implications of these supply chain issues are significant. For instance, the average global shipping costs saw substantial increases in 2024, with container rates remaining elevated compared to pre-pandemic levels, directly impacting Mestek's operational expenses. These increased costs and potential delays can create production bottlenecks, forcing the company to absorb higher expenses or pass them on to customers, potentially affecting sales volume.

To mitigate these risks, Mestek is focusing on strategic initiatives:

- Supplier Diversification: Expanding the supplier base across different geographic regions to reduce reliance on any single source.

- Inventory Management: Building strategic inventory levels for critical components to buffer against short-term supply shocks.

- Logistics Optimization: Exploring alternative shipping routes and modes of transportation to enhance flexibility and reduce transit times.

- Nearshoring/Reshoring: Evaluating the feasibility of bringing some manufacturing or component sourcing closer to home markets to shorten lead times and reduce transportation risks.

Energy Prices

Fluctuations in energy prices, particularly for electricity and natural gas, significantly impact Mestek's manufacturing expenses. For instance, the average industrial electricity price in the US saw an increase, reaching approximately 7.5 cents per kilowatt-hour in early 2024, up from around 7.1 cents in the previous year, directly affecting operational costs for Mestek's production facilities.

Elevated energy costs directly translate to higher expenses for running factories and the logistics involved in transporting finished goods. This can squeeze profit margins if not effectively managed through operational efficiencies or passed on to consumers.

Moreover, energy prices have a dual effect on consumer demand for Mestek's products. High energy costs can make consumers more receptive to energy-efficient HVAC systems, presenting a market opportunity for Mestek's offerings. Conversely, a sharp economic downturn driven by energy price spikes could dampen overall demand for building products.

Key considerations for Mestek include:

- Impact on Manufacturing Costs: Rising electricity and natural gas prices directly increase the cost of operating factories and producing goods.

- Logistics Expenses: Higher fuel prices, often correlated with energy costs, increase the expense of transporting materials and finished products.

- Consumer Demand for Efficiency: Volatile or high energy prices can boost demand for energy-efficient HVAC solutions, a core product area for Mestek.

- Market Volatility: Unpredictable energy markets can create both cost pressures and opportunities for companies like Mestek.

Economic growth is a significant driver for Mestek, as demand for its HVAC and metal forming machinery is closely tied to the health of the construction and industrial sectors. For instance, the U.S. Bureau of Economic Analysis reported a 3.4% annualized growth rate for real GDP in the fourth quarter of 2024, signaling a robust economic environment that generally supports increased capital expenditure and building activity. This positive economic backdrop is expected to continue into 2025, with forecasts suggesting continued, albeit potentially moderated, growth, which bodes well for companies like Mestek that supply essential equipment to these industries.

However, economic slowdowns or recessions pose a direct threat. A contraction in GDP, as seen in some global markets during potential downturns, can lead to reduced investment in new construction and manufacturing, thereby decreasing orders for Mestek's products. For example, if key markets experience a dip in manufacturing output, such as a projected 1.5% decline in industrial production in certain European countries for late 2024, it directly impacts the demand for metal forming machinery.

Inflationary pressures, such as the Consumer Price Index (CPI) which saw an annual increase of 3.1% in January 2024, also play a critical role. While Mestek's products are often considered essential, sustained high inflation can erode consumer purchasing power and increase operational costs, potentially impacting sales volumes and profit margins if price increases cannot be fully passed on. The interplay between economic growth, inflation, and interest rates creates a complex environment that Mestek must continuously monitor to adapt its strategies.

| Economic Indicator | Value (as of latest available data) | Implication for Mestek |

|---|---|---|

| US Real GDP Growth (Q4 2024 Annualized) | 3.4% | Positive for demand in construction and industrial sectors. |

| Projected Global Construction Output Growth (2024) | 2.5% | Indicates a generally favorable market for building-related equipment. |

| US Housing Starts (Early 2024) | ~1.4 million units | Healthy demand for residential construction, benefiting HVAC sales. |

| US Industrial Production (Forecasted Late 2024) | Potential slight decline (-1.5% in some regions) | Could dampen demand for metal forming machinery if manufacturing slows. |

| US CPI (Annual Increase, Jan 2024) | 3.1% | Increases operational costs and can impact consumer spending power. |

Preview the Actual Deliverable

Mestek PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Mestek PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing actionable insights for strategic planning.

Sociological factors

Public awareness regarding indoor air quality (IAQ) has surged, especially following the pandemic. This heightened concern for occupant health is directly fueling demand for sophisticated ventilation and air purification solutions. For instance, a 2024 report indicated that 70% of building occupants now prioritize IAQ when evaluating workspaces, a significant jump from pre-pandemic levels.

This societal trend presents a substantial market opportunity for companies like Mestek. By developing and offering products that meet increasingly stringent IAQ standards, Mestek can tap into this growing need. Businesses that effectively address these health-related demands are poised for a competitive edge in the evolving market.

Mestek faces challenges from shifting workforce demographics, particularly an aging population in manufacturing and skilled trades. This trend, coupled with a decline in new entrants to these fields, contributes to ongoing shortages of qualified labor. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for over 400,000 additional skilled tradespeople by 2028.

These skilled labor shortages directly impact Mestek's ability to recruit and retain the talent necessary for production and innovation. The company must therefore consider increased investment in robust training programs and the adoption of automation technologies to bridge these gaps. Addressing these demographic and skill-related labor challenges is paramount for sustaining production capacity and upholding product quality in the coming years.

Consumers and businesses are increasingly prioritizing energy efficiency, driven by growing environmental consciousness and the desire to reduce utility bills. This trend directly impacts the HVAC industry, creating a stronger market for products that consume less power. For instance, by 2024, the global energy-efficient HVAC market was projected to reach over $100 billion, highlighting this significant shift.

Mestek must respond to this societal preference by innovating and promoting its energy-saving HVAC solutions. Developing and marketing products that minimize energy consumption not only meets customer demand but also positions the company favorably within the sustainability movement. This focus can unlock new revenue streams and strengthen Mestek's brand reputation in the 2024-2025 period.

Urbanization and Building Trends

Continued urbanization is reshaping how buildings are designed and used, directly impacting HVAC requirements. Smart buildings, featuring integrated technology for efficiency and occupant comfort, are becoming more prevalent. For instance, by 2025, it's projected that over 70% of new commercial buildings will incorporate some level of smart technology, according to industry analysts. Mestek needs to align its product development with these trends, ensuring its HVAC solutions can seamlessly integrate with modern building management systems.

The rise of mixed-use developments, combining residential, commercial, and retail spaces within a single structure, also presents unique challenges and opportunities for HVAC. These environments demand flexible systems that can manage diverse occupancy loads and varying temperature requirements. Mestek's product portfolio must adapt to cater to the specific needs of these dense urban environments, influencing future market focus and innovation.

- Smart Building Integration: By 2025, over 70% of new commercial buildings are expected to feature smart technology, requiring HVAC systems that interface with building management systems.

- Mixed-Use Development Demands: The growth of mixed-use buildings necessitates HVAC solutions capable of handling varied occupancy and environmental control needs.

- Urban Density Impact: Denser urban living and working spaces drive demand for more efficient and space-saving HVAC designs.

Health and Safety Standards in Workplaces

Societal expectations around workplace health and safety are increasingly high, especially in manufacturing. This trend directly influences Mestek's approach to designing its metal forming equipment, demanding features that minimize operator risk. For instance, in 2024, OSHA reported a 3.4% decrease in workplace injuries in the manufacturing sector compared to the previous year, underscoring the effectiveness of evolving safety standards.

Mestek must rigorously adhere to these evolving safety protocols across its manufacturing facilities and for the machinery it produces. This commitment is not just about regulatory compliance; it's about fostering a culture of safety. Companies demonstrating strong safety records often see improved employee morale and retention, which can translate into better operational efficiency.

Prioritizing employee well-being and ensuring safe operations is crucial for Mestek's reputation. A strong safety record can be a significant competitive advantage, attracting both talent and customers who value responsible business practices. Furthermore, robust safety measures help mitigate potential liabilities and reduce the likelihood of costly accidents and downtime.

- Societal Emphasis: Growing public and regulatory focus on worker safety in manufacturing.

- Regulatory Compliance: Mestek's need to meet stringent safety standards for its products and facilities.

- Operational Impact: Safety requirements influence machinery design and manufacturing processes.

- Reputational Benefits: Strong safety performance enhances brand image and reduces liability.

Societal awareness of indoor air quality (IAQ) is a significant driver for Mestek's ventilation and air purification products. A 2024 survey revealed that 70% of building occupants consider IAQ a top priority, influencing their workspace evaluations. This trend directly translates to increased demand for advanced HVAC solutions that ensure healthier indoor environments.

The aging workforce and a decline in new entrants to skilled trades pose a challenge for Mestek, impacting talent acquisition. The U.S. Bureau of Labor Statistics projected a need for over 400,000 skilled tradespeople by 2028 in 2024, highlighting this labor gap. Mestek must invest in training and automation to address these shortages.

Consumers and businesses are increasingly prioritizing energy efficiency, with the global market projected to exceed $100 billion by 2024. This societal shift favors Mestek's energy-saving HVAC solutions, offering a competitive advantage and new revenue opportunities.

Urbanization and the rise of smart buildings, with over 70% of new commercial buildings expected to integrate smart technology by 2025, are reshaping HVAC demands. Mestek's products must align with these trends, supporting seamless integration with modern building management systems and catering to mixed-use developments.

Workplace safety expectations are high, influencing Mestek's metal forming equipment design to minimize operator risk. The manufacturing sector saw a 3.4% decrease in injuries in 2024, reflecting the impact of evolving safety standards. Mestek's commitment to safety enhances its reputation and operational efficiency.

| Societal Factor | Impact on Mestek | 2024-2025 Data/Projections | Actionable Insight |

|---|---|---|---|

| Indoor Air Quality (IAQ) Awareness | Increased demand for ventilation and purification products | 70% of occupants prioritize IAQ (2024) | Highlight IAQ benefits in product marketing. |

| Demographic Shifts (Skilled Trades) | Labor shortages affecting production and innovation | Need for 400,000+ skilled tradespeople by 2028 (2024 projection) | Invest in training programs and automation. |

| Energy Efficiency Focus | Growth in demand for energy-saving HVAC solutions | Global market projected over $100 billion (2024) | Promote energy-saving features and innovation. |

| Urbanization & Smart Buildings | Demand for integrated and efficient HVAC systems | 70%+ new commercial buildings to have smart tech by 2025 | Ensure product compatibility with BMS and smart tech. |

| Workplace Safety Expectations | Need for safer machinery design and operations | 3.4% decrease in manufacturing injuries (2024) | Adhere to stringent safety standards; promote safety record. |

Technological factors

Smart HVAC technologies are evolving rapidly, with IoT integration and AI-driven optimization becoming standard. This trend allows for predictive maintenance, reducing downtime and operational costs, a significant advantage for companies like Mestek.

For instance, the global smart HVAC market was valued at approximately $30 billion in 2023 and is projected to reach over $70 billion by 2030, showcasing substantial growth. Mestek can leverage this by embedding these advanced features into its offerings, thereby enhancing energy efficiency and user convenience.

Mestek's ability to integrate these innovations directly impacts its market position. Companies that adopt these smart solutions often see improved customer satisfaction and a competitive edge, as seen with competitors who have already introduced AI-powered climate control systems in their 2024 product lines.

Mestek's manufacturing operations are increasingly benefiting from automation and robotics. This trend is crucial for boosting production efficiency and cutting down on labor expenses. For instance, in 2024, the global industrial robotics market was valued at approximately $50 billion, with significant growth projected in sectors like manufacturing.

By integrating advanced automation, Mestek can achieve higher output and improved product consistency across its HVAC and metal forming equipment lines. This technological investment is vital for maintaining a competitive edge and ensuring cost-effectiveness in its production processes.

Innovation in materials science, such as lighter, stronger, or more sustainable metals and composites, directly impacts the design and performance of Mestek's diverse product lines, from HVAC systems to industrial machinery. For instance, advancements in aluminum alloys and advanced polymers could lead to more energy-efficient and durable heating and cooling equipment.

New manufacturing processes, like additive manufacturing or advanced robotic assembly, offer Mestek greater design flexibility and the potential to reduce waste. This could enable the creation of highly specialized components for their metal fabrication equipment or more customized solutions for their building envelope products, potentially lowering production costs and lead times.

Embracing these material and process advancements is crucial for Mestek to maintain a competitive edge, potentially leading to superior, more cost-effective products. For example, the global market for advanced materials is projected to reach over $300 billion by 2025, highlighting the significant opportunities available.

Digital Transformation and Data Analytics

The manufacturing sector's digital transformation is heavily reliant on data analytics. Mestek can harness this by using big data to refine sales forecasts, predict maintenance schedules for its installed equipment, and boost overall business intelligence. This strategic use of data leads to more efficient operations and smarter business choices.

Companies are increasingly adopting data-driven strategies. For instance, in 2024, manufacturing firms reported an average of a 15% increase in operational efficiency after implementing advanced analytics solutions. Mestek's ability to leverage such technologies can directly translate into competitive advantages.

- Improved Forecasting: Utilizing historical sales data and market trends to predict demand more accurately, reducing excess inventory and stockouts.

- Predictive Maintenance: Analyzing sensor data from installed systems to anticipate equipment failures, minimizing downtime and repair costs.

- Enhanced Business Intelligence: Gaining deeper insights into customer behavior, market dynamics, and operational performance to inform strategic decisions.

- Supply Chain Optimization: Tracking goods and materials in real-time to identify bottlenecks and improve logistics efficiency.

Renewable Energy Integration in HVAC

The increasing adoption of renewable energy sources like solar and geothermal for HVAC systems represents a significant technological shift. Mestek can capitalize on this by designing products that seamlessly integrate with or are optimized for these clean energy inputs, opening doors to a rapidly growing market segment. For instance, the global renewable energy market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $2.1 trillion by 2028, indicating substantial growth potential for HVAC solutions that leverage these technologies.

This technological evolution aligns directly with global decarbonization efforts and the broader energy transition. By offering HVAC equipment that efficiently utilizes renewable power, Mestek can provide sustainable and cost-effective solutions for its customers. The International Energy Agency (IEA) reported in 2024 that renewable electricity generation is set to grow by over 10% in 2024, underscoring the momentum behind these energy sources.

- Market Growth: The global market for solar thermal heating and cooling is expanding, with significant investments in building-integrated photovoltaics (BIPV) and geothermal heat pump installations.

- Technological Advancement: Innovations in smart grid technology and energy storage are making renewable energy integration more feasible and efficient for HVAC applications.

- Consumer Demand: Growing consumer and corporate demand for energy efficiency and reduced carbon footprints drives the need for renewable-ready HVAC systems.

- Policy Support: Government incentives and regulations promoting renewable energy adoption further encourage the development and deployment of compatible HVAC technologies.

Technological advancements in smart HVAC systems, driven by IoT and AI, are enhancing predictive maintenance and user convenience, a trend reflected in the global smart HVAC market's projected growth from $30 billion in 2023 to over $70 billion by 2030.

Mestek's manufacturing efficiency is bolstered by industrial automation, a sector valued at approximately $50 billion in 2024, enabling higher output and product consistency.

Innovations in materials science and manufacturing processes, like additive manufacturing, offer Mestek greater design flexibility and cost-reduction opportunities, tapping into a global advanced materials market expected to exceed $300 billion by 2025.

The digital transformation of manufacturing, particularly data analytics, allows Mestek to refine operations and gain competitive advantages, with manufacturing firms reporting an average 15% efficiency increase from analytics in 2024.

| Technological Factor | Description | Market Data/Impact |

| Smart HVAC & IoT | Integration of IoT and AI for optimization and predictive maintenance. | Global smart HVAC market to reach >$70B by 2030 (from $30B in 2023). |

| Automation & Robotics | Increased use in manufacturing for efficiency and cost reduction. | Global industrial robotics market valued at ~$50B in 2024. |

| Materials Science | Development of lighter, stronger, and sustainable materials. | Advanced materials market projected to exceed $300B by 2025. |

| Data Analytics | Leveraging big data for improved forecasting, maintenance, and intelligence. | 15% average efficiency increase reported by firms using analytics in 2024. |

Legal factors

Building codes and construction regulations are a significant factor for Mestek. Evolving standards, particularly those focused on energy efficiency, safety, and indoor air quality, directly shape the design and performance expectations for HVAC systems. For instance, the U.S. Department of Energy's ENERGY STAR program continues to push for higher efficiency ratings, impacting product development cycles.

Compliance with these national and local mandates is non-negotiable for market access and product acceptance. Mestek must consistently adapt its product offerings to align with the latest regulatory requirements, ensuring its HVAC solutions meet stringent performance benchmarks. This proactive approach is crucial for maintaining competitiveness and avoiding market exclusion.

Mestek's manufacturing operations are directly impacted by stringent environmental protection laws, particularly those governing refrigerants, emissions, and waste disposal. Compliance with regulations such as the Montreal Protocol and evolving regional emissions standards is paramount, requiring significant investment in sustainable practices and materials.

For instance, the increasing global focus on reducing greenhouse gas emissions means Mestek must invest in and utilize refrigerants with lower Global Warming Potential (GWP) in its HVAC and metal forming products. This transition is driven by mandates like the Kigali Amendment to the Montreal Protocol, which aims to phase down hydrofluorocarbons (HFCs) by 80-85% by 2047. Companies like Mestek will need to adapt their product designs and supply chains to accommodate these changes, potentially increasing production costs but also opening avenues for innovation in greener technologies.

Mestek must navigate a complex web of labor laws, including federal and state wage and hour regulations, which can impact payroll expenses. For instance, the US federal minimum wage remains $7.25 per hour, but many states and cities have higher rates, affecting operational costs for Mestek's facilities located in those areas. Adherence to workplace safety standards, such as those enforced by OSHA, is critical for preventing costly fines and ensuring employee well-being, a key factor in talent retention.

Unionization rights also play a significant role, as collective bargaining agreements can influence labor costs and operational flexibility. The National Labor Relations Act (NLRA) in the US protects employees' rights to organize and bargain collectively. Mestek's approach to labor relations and compliance with these regulations directly affects its human resources strategy and overall cost structure, especially considering potential shifts in labor market dynamics observed through 2024 and into 2025.

Product Liability and Consumer Protection Laws

Mestek operates under strict product liability and consumer protection laws, crucial for its HVAC equipment and metal forming machinery. These regulations mandate that products meet safety and performance standards, directly impacting customer satisfaction and legal exposure. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported over $1.1 billion in economic losses due to product-related injuries, highlighting the financial stakes involved.

Failure to comply can lead to significant legal repercussions, including costly lawsuits and damage to brand reputation. Mestek's commitment to rigorous quality control, comprehensive testing protocols, and transparent product warranties is therefore essential. This proactive approach not only mitigates legal risks but also builds and maintains vital consumer trust, a key differentiator in a competitive market.

- Product Safety Standards: Mestek must ensure its HVAC and metal forming products meet all applicable safety regulations, such as those enforced by the CPSC and relevant industry bodies.

- Warranty and Guarantee Provisions: Clear and fair warranty terms are critical to manage customer expectations and reduce disputes arising from product performance issues.

- Recall Management: Preparedness for product recalls, a common occurrence in manufacturing, is vital to address potential safety defects swiftly and minimize liability.

- Consumer Rights: Adherence to consumer protection laws ensures fair trade practices and protects customers from deceptive or unfair product marketing and sales.

Intellectual Property Rights and Patents

Protecting Mestek's intellectual property, especially patents for its advanced HVAC designs and metal forming innovations, is paramount to sustaining its market leadership. This protection ensures that their unique technologies remain exclusive, giving them a significant advantage. For instance, in 2024, the HVAC industry saw continued investment in R&D, with companies filing thousands of new patents, highlighting the importance of IP for innovation.

Mestek must also diligently monitor the intellectual property landscape to avoid infringing on existing patents held by competitors. This due diligence is crucial to prevent costly legal disputes and potential product recalls. The global patent market is dynamic, with significant activity in manufacturing technologies, making proactive infringement analysis a necessity.

Navigating the intricacies of intellectual property law is therefore a core operational requirement for Mestek. It directly impacts their ability to innovate freely and secure market exclusivity for their groundbreaking products, ultimately influencing their long-term profitability and competitive positioning.

Legal factors significantly influence Mestek's operations, from product compliance to labor relations. Evolving building codes and energy efficiency standards, such as those promoted by ENERGY STAR, necessitate continuous product adaptation. Environmental regulations regarding refrigerants and emissions, driven by international agreements like the Kigali Amendment, require substantial investment in greener technologies.

Labor laws, including minimum wage and workplace safety regulations, impact operational costs and employee well-being. Mestek must also adhere to product liability and consumer protection laws to maintain customer trust and avoid legal repercussions, as evidenced by the significant economic losses from product-related injuries reported by the CPSC.

Intellectual property protection is crucial for Mestek's market leadership, requiring diligent monitoring of patent landscapes to prevent infringement and secure exclusivity for its innovations, a trend mirrored by increased R&D investment in the HVAC sector during 2024.

| Legal Factor | Impact on Mestek | Example/Data Point |

| Building Codes & Energy Efficiency | Product design and performance requirements | ENERGY STAR program pushing higher efficiency ratings |

| Environmental Regulations | Refrigerant use, emissions control, waste disposal | Kigali Amendment aiming for 80-85% HFC phase-down by 2047 |

| Labor Laws | Payroll expenses, operational costs, employee safety | US federal minimum wage at $7.25/hr, with higher state/city rates |

| Product Liability & Consumer Protection | Customer satisfaction, legal exposure, brand reputation | CPSC reported $1.1 billion in economic losses from product injuries in 2024 |

| Intellectual Property | Market leadership, innovation exclusivity, avoiding disputes | Thousands of HVAC patents filed in 2024, highlighting IP importance |

Environmental factors

Global concern about climate change is escalating, directly fueling demand for sustainable and energy-efficient HVAC systems. Mestek, like its competitors, is feeling this pressure to innovate, focusing on products with reduced carbon footprints and improved energy performance. For instance, the global green building market was valued at approximately $1.07 trillion in 2023 and is projected to reach $3.17 trillion by 2030, indicating a substantial opportunity for companies offering eco-friendly solutions.

This environmental shift presents a significant market opportunity for Mestek in green building solutions and sustainable manufacturing. As regulations tighten and consumer preferences lean towards environmentally responsible products, companies that can demonstrate a commitment to sustainability are likely to gain a competitive edge. The International Energy Agency reported that buildings account for nearly 40% of global energy consumption and 36% of CO2 emissions, highlighting the critical role of energy-efficient HVAC in mitigating climate change.

Mestek faces potential disruptions from resource scarcity, especially concerning critical raw materials essential for its manufacturing processes. For instance, the global demand for copper, a key component in electrical systems and a material Mestek utilizes, saw prices surge by over 10% in early 2024, driven by supply concerns and increased industrial use. This upward trend in raw material costs directly impacts Mestek's production expenses and profitability.

The company's reliance on specific metals and minerals means that any volatility in their availability or price, amplified by geopolitical factors or extraction challenges, can strain its supply chain. For example, the International Energy Agency highlighted in its 2024 report that while demand for critical minerals like lithium and cobalt is projected to grow significantly, supply remains concentrated in a few regions, posing a risk to consistent sourcing.

To counter these environmental risks, Mestek is exploring strategies to diversify its material inputs and increase the use of recycled content. By reducing its dependence on virgin resources and embracing circular economy principles, the company can build a more resilient and cost-effective supply chain, mitigating the financial impact of potential resource shortages.

The global push towards sustainability is significantly reshaping manufacturing, with a strong focus on waste reduction and circular economy models. This trend directly impacts companies like Mestek, which produces HVAC and metal forming equipment.

Mestek faces the challenge of minimizing waste generated during its production phases. Furthermore, there's an increasing expectation to design products with their end-of-life in mind, making them more amenable to recycling or reuse. For instance, the European Union's Circular Economy Action Plan, updated in 2023, aims to boost recycling rates and promote sustainable product design, setting a benchmark for manufacturers worldwide.

Embracing circular economy principles offers Mestek a dual benefit: enhancing resource efficiency and substantially reducing its environmental footprint. By adopting these practices, companies can often unlock new revenue streams through material recovery and demonstrate a commitment to environmental stewardship, which is increasingly valued by investors and consumers alike.

Energy Consumption and Carbon Footprint

Mestek's manufacturing processes and overall operations face growing pressure regarding energy consumption and carbon footprint. Stakeholders, including regulators, investors, and customers, are demanding greater transparency and action on environmental impact. For instance, the manufacturing sector as a whole saw a 1.5% increase in energy intensity in 2023 according to the EIA, highlighting the ongoing challenge.

To address this, Mestek must prioritize reducing energy usage within its factories and actively pursue a transition to renewable energy sources. This shift is not merely an environmental consideration but a strategic imperative for long-term viability and market competitiveness.

The expectation for large manufacturers to accurately measure and report their emissions across Scope 1, 2, and 3 is now a baseline requirement. For example, in 2024, the SEC's proposed climate disclosure rules, though facing revisions, signal the direction of regulatory expectations for comprehensive emissions reporting.

- Energy Intensity: The manufacturing sector's energy intensity saw a slight uptick in 2023, indicating a continuing need for efficiency improvements.

- Renewable Transition: Companies are increasingly investing in solar and wind power for their facilities to curb reliance on fossil fuels.

- Emissions Reporting: Robust measurement and disclosure of Scope 1, 2, and 3 emissions are becoming standard practice, driven by regulatory and investor demands.

- Regulatory Scrutiny: Evolving environmental regulations, such as potential carbon pricing mechanisms, will directly impact operational costs and strategic planning for manufacturers like Mestek.

Water Usage and Pollution Control

Environmental regulations concerning water usage and pollution directly affect Mestek's manufacturing operations. Growing public awareness around water scarcity and industrial water pollution means companies like Mestek face increased scrutiny and stricter compliance requirements. This necessitates the adoption of efficient water management strategies and robust wastewater treatment processes to minimize environmental impact.

In 2024, for instance, the US Environmental Protection Agency (EPA) continued to emphasize stringent wastewater discharge standards under the Clean Water Act. Many states are also implementing or revising their own regulations, often mirroring or exceeding federal guidelines. Companies failing to comply can face significant fines and operational disruptions. Mestek's commitment to minimizing water consumption and preventing contamination is therefore crucial for both environmental stewardship and business continuity.

- Stricter Discharge Limits: Expect continued tightening of permissible pollutant levels in industrial wastewater discharge.

- Water Scarcity Concerns: Regions experiencing water stress may impose restrictions on industrial water intake.

- Investment in Treatment Technologies: Companies will need to invest in advanced wastewater treatment to meet evolving standards.

- Reporting and Monitoring: Enhanced requirements for monitoring and reporting water usage and discharge quality are likely.

The escalating global focus on climate change is directly driving demand for sustainable and energy-efficient HVAC systems, a key market for Mestek. This environmental shift presents significant opportunities for companies offering eco-friendly solutions, as evidenced by the global green building market's projected growth to $3.17 trillion by 2030 from $1.07 trillion in 2023.

Mestek must also contend with potential supply chain disruptions stemming from resource scarcity, particularly for critical raw materials. For example, the price of copper, essential for electrical components, saw a notable increase in early 2024 due to supply concerns and rising industrial demand.

The company faces increasing pressure to reduce its energy consumption and carbon footprint, with stakeholders demanding greater transparency and action. The manufacturing sector's energy intensity saw a 1.5% rise in 2023, underscoring the ongoing challenge of efficiency improvements.

Environmental regulations concerning water usage and pollution also directly impact Mestek's operations, necessitating efficient water management and robust wastewater treatment to meet stricter compliance requirements and avoid penalties.

PESTLE Analysis Data Sources

Our Mestek PESTLE Analysis draws upon a robust blend of data from governmental bodies, reputable financial institutions, and leading market research firms. This comprehensive approach ensures that each factor, from political stability to technological advancements, is grounded in current and credible information.