Lundbergs SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lundbergs Bundle

Lundberg's strong brand recognition and commitment to organic products are key strengths, but they face challenges with market competition and rising ingredient costs. Understanding these dynamics is crucial for navigating their path forward.

Want the full story behind Lundberg's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Lundbergs' strength lies in its highly diversified investment portfolio, spanning both real estate and industrial sectors. This broad exposure, with roughly 22% in real estate via Hufvudstaden and Lundbergs Fastigheter, and about 78% in publicly traded industrial firms like Holmen, Industrivärden, Husqvarna, Handelsbanken, Sandvik, and Skanska, significantly reduces reliance on any single market. Such a balanced approach enhances stability and resilience, especially during economic fluctuations.

Lundbergs' long-term active ownership is a cornerstone of its strategy, enabling deep engagement and support for its portfolio companies' strategic evolution. This hands-on approach, guided by experienced leadership, cultivates sustainable value and bolsters competitive standing.

By prioritizing enduring partnerships over fleeting profits, Lundbergs empowers its investments to pursue innovation and establish robust market advantages. For instance, in 2024, Lundbergs maintained significant stakes in key industrial and financial sectors, demonstrating its commitment to long-term growth and strategic influence within these businesses.

Lundbergs boasts a robust financial foundation, evidenced by the consistent appreciation of its net asset value per share. This metric, crucial for understanding shareholder value, reached SEK 555 after deferred tax by the close of 2024, showcasing a healthy 10-year average annual growth rate of 10.7%.

The company's commitment to rewarding shareholders is clear through its dividend policy. Lundbergs aims for favorable and steady dividend growth, proposing a dividend of SEK 4.60 per share for 2024. This continues a decade-long trend of an average annual dividend growth of 6.3%, underscoring financial stability and shareholder focus.

Expertise in Real Estate and Industrial Sectors

Lundbergs' considerable expertise in real estate and industrial sectors is a significant strength. This is evident through its direct and indirect holdings in companies like Lundbergs Fastigheter and Hufvudstaden, as well as substantial investments in industrial leaders such as Holmen and Industrivärden. This focused knowledge base enables Lundbergs to make astute investment choices and effectively manage its core holdings.

The company's robust presence in the real estate market is underscored by the significant valuation of its holdings. For instance, Hufvudstaden's real estate portfolio alone was valued at SEK 47.7 billion at the close of 2024, demonstrating Lundbergs' strong position in prime property markets.

This deep understanding translates into tangible benefits:

- Informed Investment Decisions: Specialized sector knowledge leads to more strategic and profitable investment choices.

- Strategic Development: Expertise allows for the effective planning and execution of growth strategies within core sectors.

- Optimized Management: Deep insight facilitates efficient and value-enhancing management of real estate and industrial assets.

- Strong Market Position: Significant holdings in key companies like Hufvudstaden (valued at SEK 47.7 billion in 2024) highlight a commanding presence in its chosen markets.

Commitment to Sustainability

Lundbergs demonstrates a strong commitment to sustainability, embedding it deeply within its operational framework as a core driver of long-term value. This is clearly articulated in their 2024 annual and sustainability report, which details significant progress in areas like responsible governance, environmental impact reduction, and fostering employee and customer satisfaction.

This proactive approach to sustainability is not merely about corporate responsibility; it's a strategic advantage. By addressing societal needs and environmental concerns, Lundbergs effectively mitigates potential business risks while simultaneously capitalizing on emerging opportunities within the sustainability sector. This dual benefit strengthens their market position and enhances their overall long-term viability.

- Integrated Strategy: Sustainability is woven into Lundbergs' business model, directly linking it to long-term value creation.

- 2024 Report Highlights: The annual and sustainability report for 2024 details advancements in responsible governance, environmental footprint reduction, and stakeholder satisfaction.

- Risk Mitigation & Opportunity: The company proactively addresses societal challenges, reducing business risks and leveraging sustainability-driven opportunities.

- Reputation & Viability: This commitment bolsters Lundbergs' reputation and ensures its continued relevance and success in the evolving market landscape.

Lundbergs' strength is anchored in its diversified portfolio, balancing real estate and industrial holdings. This diversification, with approximately 22% in real estate and 78% in industrial firms as of 2024, provides significant stability. Its long-term active ownership model fosters deep engagement and strategic support for its portfolio companies, cultivating sustainable value and competitive advantages.

The company's financial health is robust, demonstrated by a consistent increase in net asset value per share. By the end of 2024, this value reached SEK 555 after deferred tax, reflecting a strong 10-year average annual growth of 10.7%. Furthermore, Lundbergs prioritizes shareholder returns, proposing a 2024 dividend of SEK 4.60 per share, continuing a decade-long trend of average annual dividend growth at 6.3%.

Lundbergs possesses deep sector expertise, particularly in real estate and industrial sectors. This is evident in its substantial holdings, such as Hufvudstaden, whose real estate portfolio was valued at SEK 47.7 billion at the close of 2024. This specialized knowledge informs investment decisions, facilitates strategic development, and enables optimized management of its core assets, solidifying its market position.

A key strength is Lundbergs' integrated approach to sustainability, which drives long-term value creation. Their 2024 sustainability report highlights progress in governance, environmental impact reduction, and stakeholder satisfaction. This proactive stance not only mitigates risks but also capitalizes on emerging opportunities within the sustainability sector, enhancing their reputation and long-term viability.

| Metric | 2024 Value | 10-Year Avg Annual Growth |

|---|---|---|

| Net Asset Value per Share (SEK) | 555 (after deferred tax) | 10.7% |

| Proposed Dividend per Share (SEK) | 4.60 | 6.3% |

| Hufvudstaden Real Estate Portfolio Value (SEK Billion) | 47.7 | N/A |

What is included in the product

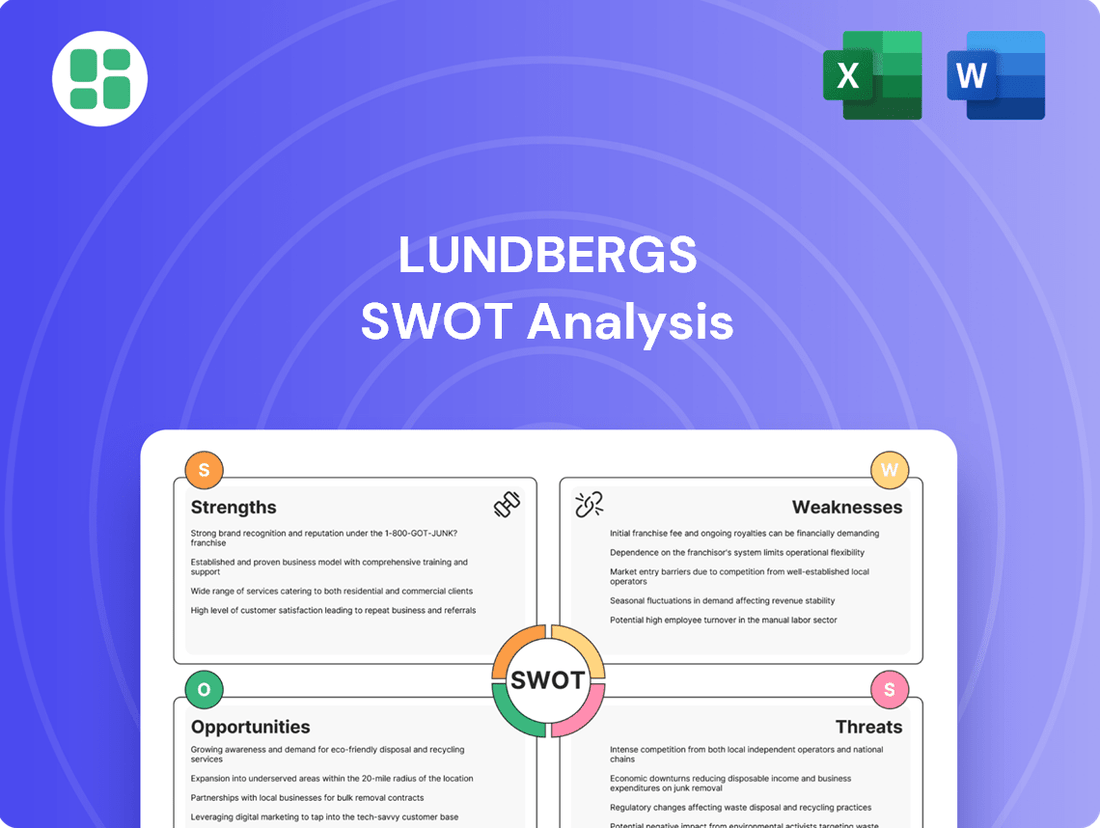

Analyzes Lundbergs’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address internal weaknesses and external threats, thereby alleviating strategic uncertainty.

Weaknesses

While Lundbergs benefits from diversification, a significant portion of its investments are in industries inherently tied to economic cycles. For instance, its substantial stakes in Holmen, a forest products company, and various industrial and packaging businesses mean its performance can be directly impacted by shifts in global demand and manufacturing activity.

These sectors are particularly vulnerable to economic downturns, where reduced consumer spending and industrial output can lead to lower revenues and profitability for Lundbergs' portfolio companies. For example, the paper and packaging industry, a key area for Lundbergs, often sees demand soften during recessions, affecting pricing and sales volumes.

Furthermore, the real estate sector, another core holding, is also sensitive to economic cycles. Rising interest rates or a general economic slowdown can depress property values and rental income, creating headwinds for Lundbergs' real estate investments. This reliance on cyclical industries presents a notable weakness, as a broad economic contraction could disproportionately affect its overall financial results.

Lundberg's substantial real estate portfolio, primarily managed by Hufvudstaden, makes it particularly vulnerable to shifts in interest rates. For example, if interest rates were to rise by 1%, Hufvudstaden's annual interest expenses could increase significantly, impacting its net operating income and overall profitability. This sensitivity means that periods of monetary tightening, like those seen in late 2023 and into 2024, pose a direct financial risk to Lundberg's earnings and the valuation of its properties.

While Lundbergs is diversified across sectors, its significant, often controlling, stakes in a few large companies like Holmen, Hufvudstaden, and Industrivärden present a notable weakness. For instance, as of the first quarter of 2024, Lundbergs' net asset value was heavily influenced by these core holdings.

This concentration means that a substantial underperformance or a specific operational challenge within one of these key companies, such as a downturn in the forestry sector impacting Holmen or a slowdown in the real estate market affecting Hufvudstaden, could disproportionately drag down Lundbergs' overall financial performance and net asset value.

Potential for Underperforming Associated Companies

Lundbergs' earnings from its stakes in associated companies can be quite unpredictable. For instance, in 2024, these earnings dropped to SEK 3,392 million from SEK 6,228 million in 2023. This volatility highlights how the financial results of companies where Lundbergs holds a significant but not controlling interest can heavily sway its overall profitability.

The challenge lies in managing and influencing the performance of these associated companies. Since Lundbergs doesn't have complete control, ensuring consistent positive contributions from these investments can be difficult. This lack of direct oversight means that external factors impacting these companies can directly affect Lundbergs' financial performance.

- Earnings Volatility: 2024 earnings from associated companies were SEK 3,392 million, down from SEK 6,228 million in 2023.

- Impact on Profitability: Fluctuations in these earnings can significantly affect Lundbergs' overall profit after financial items.

- Control Limitations: Managing and influencing the performance of associated companies where Lundbergs lacks full control presents a persistent challenge.

Dependence on Swedish Market Conditions

Lundbergs' significant concentration on the Swedish market presents a notable weakness. As a holding company primarily invested in Swedish industrial and real estate sectors, its financial performance is intrinsically tied to the health of the Swedish economy. For instance, in 2023, Sweden experienced a contraction in GDP, impacting the valuations and earnings of many of Lundbergs' core holdings.

This geographical focus, while fostering deep local knowledge, inherently limits diversification benefits. Consequently, Lundbergs is more susceptible to country-specific risks. These could include adverse changes in Swedish fiscal policy, shifts in consumer or business confidence within Sweden, or regulatory adjustments that disproportionately affect its portfolio companies. For example, potential changes to property taxation laws in Sweden could directly impact its substantial real estate investments.

- Geographic Concentration: Over-reliance on the Swedish economy for revenue and asset growth.

- Country-Specific Risks: Vulnerability to Swedish economic downturns, policy changes, and market sentiment.

- Limited Diversification: Lack of exposure to international markets reduces resilience against localized economic shocks.

- Sectoral Interdependence: The Swedish industrial and real estate sectors are often correlated, amplifying sector-specific downturns' impact.

Lundbergs' significant concentration on the Swedish market presents a notable weakness, making its financial performance intrinsically tied to the health of the Swedish economy. For instance, Sweden's GDP contracted in 2023, directly impacting the valuations and earnings of Lundbergs' core holdings.

This geographic focus, while leveraging local expertise, inherently limits global diversification. Consequently, Lundbergs is more susceptible to country-specific risks, such as adverse fiscal policy changes or shifts in domestic business confidence. For example, potential changes to Swedish property taxation laws could directly affect its substantial real estate investments.

The company's substantial holdings in cyclical industries, such as forest products (Holmen) and industrials, mean its performance is highly sensitive to economic downturns. Reduced consumer spending and industrial output during recessions can lead to lower revenues and profitability across its portfolio. For example, the paper and packaging sector, a key area for Lundbergs, typically experiences softened demand and pricing pressure during economic contractions.

Furthermore, Lundbergs' considerable real estate portfolio, managed by Hufvudstaden, is vulnerable to interest rate fluctuations. An increase in interest rates, such as the hikes observed in late 2023 and into 2024, directly increases borrowing costs for Hufvudstaden, potentially impacting its net operating income and overall profitability. This sensitivity means monetary tightening poses a direct financial risk.

The company's earnings from associated companies can be unpredictable, as seen in 2024 when these earnings dropped to SEK 3,392 million from SEK 6,228 million in 2023. This volatility underscores the challenge of managing and influencing companies where Lundbergs holds significant but not controlling stakes, making consistent positive contributions difficult due to external factors impacting these entities.

| Weakness Category | Specific Issue | Impact | Data Point/Example |

|---|---|---|---|

| Geographic Concentration | Over-reliance on Swedish Market | Vulnerability to country-specific economic downturns and policy changes. | Sweden's GDP contracted in 2023, affecting Lundbergs' core holdings. |

| Cyclical Industry Exposure | Significant stakes in cyclical sectors | Performance highly sensitive to economic cycles and demand shifts. | Holmen (forest products) and industrial holdings are impacted by global manufacturing activity. |

| Interest Rate Sensitivity | Large real estate portfolio (Hufvudstaden) | Increased borrowing costs and potential impact on profitability during periods of monetary tightening. | Rising interest rates in late 2023/2024 increase Hufvudstaden's interest expenses. |

| Earnings Volatility from Associated Companies | Lack of full control over significant stakes | Unpredictable contributions to overall profitability, influenced by external factors. | Earnings from associated companies fell to SEK 3,392 million in 2024 from SEK 6,228 million in 2023. |

Full Version Awaits

Lundbergs SWOT Analysis

The file shown below is not a sample—it’s the real Lundbergs SWOT analysis you'll download post-purchase, in full detail. You can trust that what you see is exactly what you'll get, providing a comprehensive and actionable understanding of Lundbergs' strategic position.

Opportunities

Lundbergs has a prime opportunity to diversify its investment portfolio by venturing into high-growth sectors like technology and renewable energy. For instance, the global renewable energy market is projected to reach $1.977 trillion by 2030, presenting significant upside. This strategic move would leverage their established investment acumen to tap into markets with potentially higher returns than their traditional industrial and real estate holdings.

Lundberg's portfolio companies can capitalize on the ongoing digital transformation by further integrating technology. For instance, its real estate segment could adopt smart building solutions, enhancing energy efficiency and tenant experience, a trend that saw significant investment in building technology globally in 2024, with projections for continued growth into 2025.

In its industrial holdings, adopting advanced manufacturing processes, such as AI-driven automation and predictive maintenance, presents a clear opportunity. Companies that embraced Industry 4.0 principles in 2024 reported an average of 15% improvement in operational efficiency, a metric Lundberg could aim to replicate or surpass.

Furthermore, exploring e-commerce integration for its retail properties can unlock new revenue streams and customer engagement channels. The global e-commerce market continued its robust expansion through 2024, with retail property owners increasingly looking to leverage their physical spaces as part of a broader omnichannel strategy.

Lundbergs is well-positioned to leverage the increasing investor appetite for sustainable and green investments. Capitalizing on its established sustainability focus, the company can expand its portfolio into areas like circular economy solutions, sustainable forestry, and eco-friendly packaging, aligning with global environmental priorities and attracting a growing segment of responsible investors.

This strategic direction is supported by market trends, with sustainable investment funds experiencing significant growth. For instance, Holmen, a Lundbergs-owned company, exemplifies this opportunity through its strong commitment to sustainable forestry and renewable energy production, demonstrating a clear alignment with the burgeoning green economy.

Strategic Acquisitions and Consolidation

Lundbergs is well-positioned to capitalize on strategic acquisition opportunities, particularly in a consolidating investment landscape. By targeting firms or assets that align with its existing portfolio, the company can unlock significant synergistic benefits. For instance, acquiring a specialized asset manager could bolster Lundbergs' capabilities in a high-growth sector, potentially enhancing overall returns.

The fragmented nature of certain investment markets presents a prime chance for Lundbergs to pursue consolidation. Expanding its asset base through judicious acquisitions can lead to greater market share and operational efficiencies. This strategy leverages Lundbergs' robust financial standing, evidenced by its strong balance sheet and consistent profitability, allowing it to act decisively when attractive targets emerge.

- Acquire complementary investment firms to broaden service offerings and client base.

- Target specific assets or companies in high-growth sectors to diversify the portfolio.

- Leverage financial strength for consolidation, aiming for economies of scale and enhanced market position.

International Market Expansion

Lundbergs, primarily operating within Sweden, possesses a significant opportunity to expand into international markets. European markets, particularly those demonstrating stability and consistent economic growth, present attractive entry points. For instance, Germany's GDP growth was projected to be around 0.3% for 2024, with expectations for a slight uptick in 2025, indicating a potentially receptive environment for investment. This geographical diversification would not only mitigate risks associated with over-reliance on the Swedish economy but also unlock new avenues for revenue generation and overall value enhancement.

Exploring international expansion necessitates a robust approach to due diligence. This includes a deep understanding of the regulatory landscapes, tax implications, and consumer behaviors within target countries. For example, navigating the complexities of the German market would require careful consideration of its stringent environmental regulations and labor laws. Such strategic moves could bolster Lundbergs' long-term resilience and competitive positioning.

- Geographic Diversification: Reduce dependence on the Swedish market by entering stable European economies.

- Growth Avenues: Tap into new customer bases and revenue streams in international markets.

- Risk Mitigation: Spread economic and political risks across multiple jurisdictions.

- Market Research: Conduct thorough analysis of target markets' regulatory environments and economic conditions.

Lundbergs can capitalize on the growing demand for sustainable and ESG-focused investments. The company's existing commitment to sustainability, exemplified by Holmen's operations in forestry and renewable energy, positions it well to attract this capital. This aligns with global trends, as sustainable investment funds saw substantial inflows throughout 2024, indicating a strong market appetite.

Threats

A significant economic downturn in Sweden or globally presents a substantial threat to Lundbergs. Such a downturn could dampen consumer spending and industrial activity, directly impacting the performance of its diverse industrial holdings. For example, if Sweden experiences a recession, as some forecasts suggest could happen in late 2024 or early 2025 due to persistent inflation and high interest rates, this would likely translate to lower sales and profitability for companies like Holmen, which is sensitive to economic cycles.

Furthermore, recessionary pressures would likely reduce demand in the real estate sector, potentially leading to lower occupancy rates and rental income for Lundbergs' property portfolio. This could also result in a decrease in the overall valuation of these assets, directly impacting Lundbergs' net asset value. For instance, a prolonged period of negative GDP growth could see commercial property values decline by 5-10% or more, as observed in previous downturns.

Rising interest rates present a significant threat to Lundbergs. For instance, if benchmark rates climb by another 1% by mid-2025, the annual interest expense for a company like Hufvudstaden, with its substantial property portfolio and associated debt, could increase by tens of millions of SEK. This directly impacts profitability and cash flow.

Persistent inflation also poses a challenge. If inflation remains above the Riksbank's target of 2% through 2025, Lundbergs' portfolio companies may face higher input costs for materials and labor. This could squeeze profit margins, especially in sectors where price increases are difficult to pass on to consumers, potentially reducing the overall value of the conglomerate.

Changes in national or international regulations, particularly concerning real estate and environmental standards, could increase compliance burdens for Lundbergs. For instance, stricter energy efficiency mandates for properties or new reporting requirements for sustainability could necessitate significant investment in upgrades and administrative processes. In 2024, the European Union continued to advance its Green Deal, which may introduce further obligations for companies with substantial real estate holdings.

Intensified Competition in Investment Landscape

The investment arena is incredibly crowded, with many companies, both Swedish and global, actively seeking the same promising assets. This intense rivalry means Lundbergs must be prepared for higher purchase prices and potentially lower future earnings on its acquisitions. For instance, as of early 2025, global M&A deal volumes remained robust, with private equity firms particularly active in sectors where Lundbergs traditionally invests, pushing valuations upwards.

This heightened competition directly impacts Lundbergs' ability to secure top-tier, long-term investments. It necessitates a proactive and adaptable strategy to navigate the market effectively. The pressure is on to not only identify opportunities but also to execute deals swiftly and efficiently before competitors do.

- Increased Acquisition Costs: Competitors bidding on the same assets can inflate purchase prices, reducing the potential upside for Lundbergs.

- Reduced Investment Opportunities: High demand for quality assets means fewer attractive deals may be available at reasonable valuations.

- Pressure on Returns: Higher entry costs due to competition can compress expected future returns on investment.

- Need for Strategic Agility: Lundbergs must remain flexible and quick to adapt its investment strategies to stay ahead of rivals.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical instability, including ongoing regional conflicts and trade disputes, poses a significant threat to Lundbergs' diversified portfolio. These tensions can trigger sharp increases in market volatility, making it harder to predict investment performance. For instance, disruptions in key shipping routes, as seen with Red Sea transit issues impacting container shipping rates which saw a surge of over 50% in early 2024, can directly affect the cost of goods and the efficiency of supply chains for companies within Lundbergs' industrial and packaging segments.

The direct impact on Lundbergs' holdings could manifest as elevated energy and raw material prices. Companies reliant on global sourcing or with extensive international operations may face higher production costs and potential shortages. This could squeeze profit margins and reduce sales volumes, particularly for those in sectors like manufacturing and consumer goods that are sensitive to input costs and consumer demand fluctuations. For example, the price of oil, a key indicator of energy costs, remained volatile throughout 2024, with Brent crude fluctuating between $75 and $90 per barrel, reflecting ongoing supply concerns linked to geopolitical events.

- Increased operational costs: Higher energy and raw material prices directly impact production expenses for Lundbergs' industrial companies.

- Supply chain disruptions: Geopolitical events can lead to delays and increased shipping costs, affecting timely delivery and inventory management.

- Market volatility: Global tensions contribute to unpredictable swings in stock markets, potentially impacting the valuation of Lundbergs' investments.

- Reduced demand: Economic uncertainty stemming from geopolitical instability can dampen consumer and business spending, affecting sales volumes.

Intensified competition for attractive investments is a significant threat, potentially driving up acquisition costs and reducing the pool of available deals. For instance, in early 2025, robust global M&A activity, particularly from private equity, has pushed valuations higher in sectors where Lundbergs typically invests. This competitive landscape necessitates greater strategic agility to secure favorable long-term opportunities and can compress expected future returns on investment.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including Lundbergs' official financial filings, comprehensive market research reports, and expert industry commentary, ensuring a well-rounded and accurate assessment.