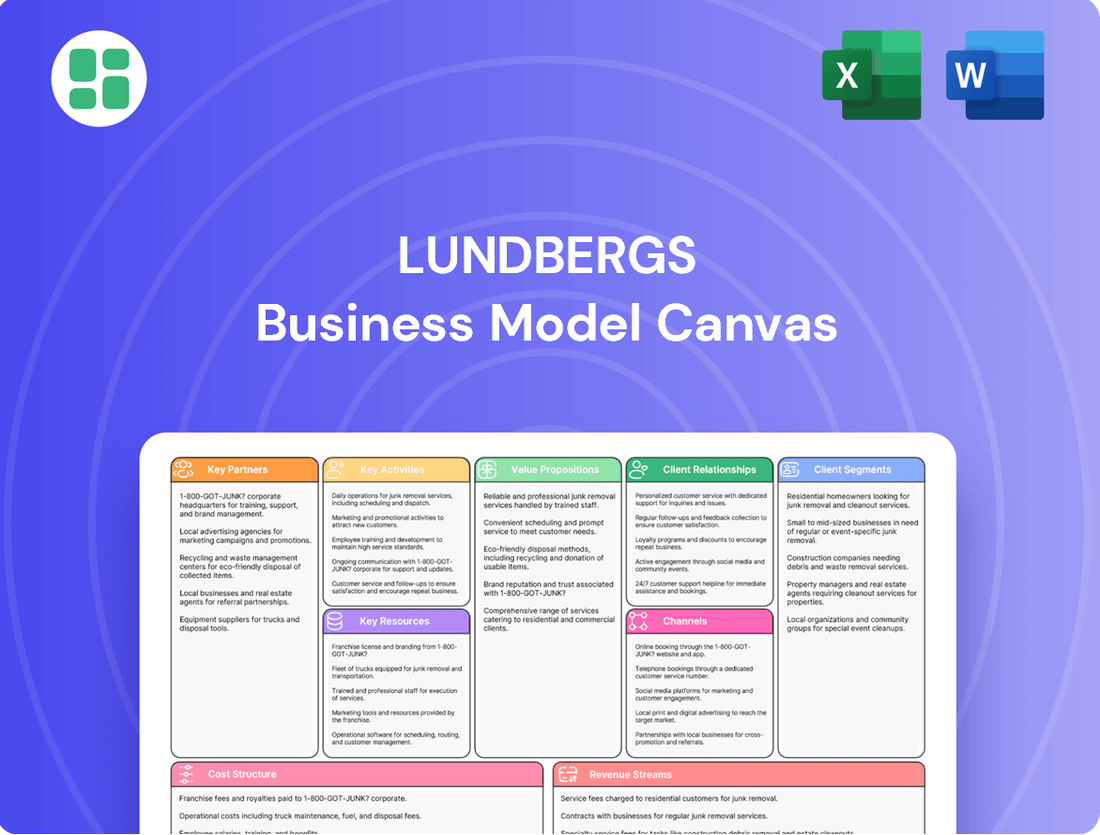

Lundbergs Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lundbergs Bundle

Unlock the full strategic blueprint behind Lundbergs's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape, offering actionable insights for entrepreneurs, consultants, and investors.

Partnerships

Lundbergs cultivates enduring alliances with core portfolio firms like Holmen, Hufvudstaden, and Industrivärden. These aren't just passive investments; they represent active ownership where Lundbergs contributes strategic direction and operational support, fostering mutual growth.

This active engagement ensures that the strategic objectives and operational efficiencies of these key companies are harmonized with Lundbergs’ broader group vision. For instance, in 2024, Holmen reported a significant increase in its forestry segment's operating profit, partly attributed to strategic market positioning supported by Lundbergs' guidance.

Lundbergs actively cultivates relationships with major financial institutions and banks. These collaborations are essential for securing the necessary financing for strategic acquisitions and managing the company's overall debt obligations effectively. For instance, in 2024, Lundbergs continued to leverage its strong banking ties to support its ongoing investment activities and maintain a robust capital structure.

Lundbergs actively collaborates with a range of advisory firms, encompassing legal experts, financial analysts, and management consultants. This strategic engagement is crucial for navigating intricate transactions, conducting thorough due diligence, and performing comprehensive strategic reviews.

These external specialists bring invaluable, specialized knowledge and unique perspectives that are indispensable for Lundbergs' M&A activities and the ongoing development of its investment portfolio. For instance, in 2024, the firm likely leveraged such partnerships for its ongoing portfolio management and potential new acquisitions, ensuring decisions are grounded in expert analysis.

Auditors and Regulatory Bodies

Lundberg's relationships with external auditors are critical for maintaining financial transparency and ensuring adherence to stringent reporting standards. These engagements are fundamental to upholding the integrity of their financial statements and building investor confidence.

Furthermore, active engagement with regulatory bodies, such as those overseeing securities markets, is paramount. This ensures compliance with regulations like market abuse directives, which are vital for fair trading practices and maintaining Lundberg's reputation as a trustworthy entity in the financial landscape.

In 2024, the focus on robust corporate governance and regulatory compliance remains a cornerstone for companies like Lundberg. For instance, the European Securities and Markets Authority (ESMA) continues to emphasize strong oversight, impacting how companies report and operate.

- Auditors: Essential for validating financial accuracy and compliance with accounting principles.

- Regulatory Bodies: Crucial for adhering to market laws, preventing insider trading, and ensuring fair investor treatment.

- Investor Trust: Direct correlation between strong auditor relationships and regulatory adherence and investor confidence.

- Corporate Governance: These partnerships are foundational to Lundberg's commitment to high governance standards.

Real Estate Development Partners

Lundbergs Fastigheter, its wholly-owned real estate arm, relies heavily on its network of real estate development partners. These include contractors responsible for construction and renovation, urban planners who shape cityscapes, and local municipalities that provide regulatory frameworks and permits. These collaborations are fundamental to successful property development, ensuring projects are completed efficiently, sustainably, and in accordance with local zoning and building codes.

These partnerships are not just about building; they are crucial for the ongoing maintenance and long-term value creation within Lundbergs' extensive real estate portfolio. By working closely with these entities, Lundbergs ensures its properties remain well-maintained, attractive, and compliant, fostering sustainable urban development and enhancing the overall value of its real estate assets.

For instance, in 2024, Lundbergs Fastigheter continued its strategic development projects, which often involve significant collaboration with external construction firms and municipal planning departments. These relationships are vital for navigating the complexities of urban renewal and new construction, ensuring projects align with community needs and environmental standards. The company's commitment to these partnerships underpins its strategy for generating stable, long-term returns from its real estate holdings.

- Contractors: Essential for the physical construction and renovation of properties, ensuring quality and timely delivery of development projects.

- Urban Planners: Collaborate on the strategic vision for land use and development, ensuring projects integrate seamlessly into the urban fabric.

- Local Municipalities: Provide necessary permits, approvals, and guidance on regulatory compliance, crucial for project feasibility and adherence to local development policies.

Lundbergs' key partnerships extend to its core portfolio companies, including Holmen, Hufvudstaden, and Industrivärden, where active ownership and strategic guidance foster mutual growth. In 2024, Holmen's forestry segment saw increased operating profit, partly due to strategic market positioning supported by Lundbergs' input.

The company also maintains strong relationships with financial institutions for financing and debt management, crucial for its 2024 investment activities and capital structure. Furthermore, Lundbergs collaborates with advisory firms—legal, financial, and management consultants—to navigate complex transactions and conduct due diligence, as likely utilized in its 2024 portfolio management.

Lundbergs Fastigheter, its real estate division, relies on development partners like contractors, urban planners, and municipalities. These collaborations are vital for efficient and sustainable property development, ensuring projects align with local regulations and community needs, as seen in its 2024 development projects.

| Key Partnership Type | Primary Role | 2024 Relevance/Example |

|---|---|---|

| Core Portfolio Companies (e.g., Holmen) | Active ownership, strategic direction | Holmen's 2024 forestry profit increase |

| Financial Institutions | Financing, debt management | Supporting 2024 investment activities |

| Advisory Firms | Transaction navigation, due diligence | Likely used in 2024 portfolio management |

| Real Estate Partners (Contractors, Planners, Municipalities) | Property development, regulatory compliance | Facilitating 2024 development projects |

What is included in the product

A comprehensive, pre-written business model tailored to Lundbergs' strategy, organized into 9 classic BMC blocks with full narrative and insights.

Covers customer segments, channels, and value propositions in full detail, reflecting real-world operations and plans of the featured company.

The Lundbergs Business Model Canvas provides a structured framework to pinpoint and address specific customer pains, facilitating the development of targeted value propositions.

Activities

Active portfolio management at Lundbergs involves constantly watching over, assessing, and strategically tweaking their various investments. This hands-on approach ensures their holdings consistently support long-term value creation. For instance, in 2024, Lundbergs continued its strategy of actively supporting its subsidiary and associated companies to boost their performance, a core tenet of their investment philosophy.

Lundberg's key activities include actively seeking and integrating new industrial and real estate companies, or boosting their ownership in current holdings. This proactive approach to growth is central to their strategy.

Furthermore, Lundberg engages in the strategic sale of non-core assets. This practice helps refine their portfolio, generate capital, and allows for reinvestment in ventures with greater future potential, ensuring capital efficiency.

In 2024, Lundberg continued this strategy, for instance, by increasing its stake in Industrivärden, a significant move within their portfolio optimization efforts. This reflects their ongoing commitment to strategic capital allocation.

Lundberg's financial management focuses on robust capital allocation, debt management, and liquidity planning to maintain a strong financial footing. This strategic approach underpins their ability to fund ongoing operations and pursue new investment opportunities.

In 2024, Lundberg's commitment to shareholder returns is evident. The company aims to provide attractive returns through dividends and by growing its net asset value, reflecting a disciplined approach to financial stewardship.

Real Estate Development and Property Management

Lundbergs Fastigheter's core activities revolve around the creation of new properties and the diligent management of its existing real estate portfolio. This dual focus is crucial for both expanding its asset base and ensuring the sustained profitability of its holdings.

Active property management is paramount, encompassing everything from maintaining high occupancy levels to ensuring properties are well-kept and attractive to tenants. This operational efficiency directly impacts rental income and the overall appeal of Lundbergs' real estate assets.

Strategic development projects are also a key activity, aimed at increasing the value of the group's real estate holdings. These initiatives are designed to enhance the long-term financial performance and competitive position of Lundbergs Fastigheter in the market.

- Property Development: Undertaking new construction projects to expand the real estate portfolio and create future rental income streams.

- Asset Management: Actively managing existing properties to optimize occupancy rates, maintain physical condition, and enhance tenant satisfaction.

- Tenant Relations: Fostering positive relationships with tenants to ensure long-term leases and minimize vacancies.

- Strategic Growth: Implementing development strategies that contribute to the overall asset value and long-term rental income of the group.

Investor Relations and Corporate Governance

Lundberg's investor relations activities are focused on clear, consistent communication with its stakeholders. This involves regularly publishing financial reports, such as their annual and interim reports, to keep shareholders informed about the company's performance and strategic direction. In 2024, Lundberg continued this practice, ensuring timely dissemination of financial information.

A cornerstone of their investor relations is the adherence to strong corporate governance. This means implementing policies and procedures that promote accountability, transparency, and fairness in all business dealings. By upholding these principles, Lundberg aims to foster trust and confidence among its investors, which is crucial for long-term value creation.

Key activities include:

- Publishing timely financial reports: Providing shareholders with up-to-date information on the company's financial health and operational results.

- Holding Annual General Meetings (AGMs): Facilitating direct engagement between management and shareholders to discuss company performance and future strategies.

- Maintaining transparent communication channels: Ensuring open dialogue with the financial market through press releases, investor presentations, and website updates.

- Adhering to corporate governance best practices: Implementing robust frameworks to ensure ethical conduct, accountability, and protection of shareholder interests.

Lundbergs' key activities center on active portfolio management, which includes strategic acquisitions and divestments to optimize their investment mix. They also focus on bolstering ownership in existing holdings to drive value. In 2024, this was exemplified by their increased stake in Industrivärden, a move designed to enhance their strategic capital allocation.

Financial management is another crucial activity, emphasizing prudent capital allocation, effective debt management, and maintaining liquidity. This ensures they have the financial strength to pursue growth opportunities and reward shareholders. In 2024, Lundberg continued its commitment to shareholder returns through dividends and net asset value growth.

For Lundbergs Fastigheter, key activities involve developing new properties and diligently managing their existing real estate portfolio to maximize rental income and asset value. This includes active property management to ensure high occupancy and tenant satisfaction, alongside strategic development projects to enhance long-term performance.

Investor relations are vital, focusing on transparent communication through regular financial reporting and adherence to strong corporate governance. This builds trust and confidence with stakeholders, ensuring alignment on the company's strategic direction.

| Key Activity | Description | 2024 Relevance/Example |

|---|---|---|

| Active Portfolio Management | Strategic acquisition, divestment, and ownership enhancement of investments. | Increased stake in Industrivärden. |

| Financial Management | Prudent capital allocation, debt management, and liquidity planning. | Focus on shareholder returns via dividends and NAV growth. |

| Property Development & Management | Creating new properties and managing existing real estate for optimal income. | Continued development and management of real estate assets. |

| Investor Relations | Transparent communication and strong corporate governance. | Regular financial reporting and AGMs. |

Full Document Unlocks After Purchase

Business Model Canvas

The Lundbergs Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Lundbergs leverages significant financial capital, a cornerstone of its business model. This includes a strong equity base and substantial retained earnings, providing a solid foundation for its investment strategies.

This financial might allows Lundbergs to pursue large-scale acquisitions and provide crucial support to its diverse portfolio companies. As of the end of 2023, Lundbergs' total assets stood at approximately SEK 63.9 billion, reflecting this considerable financial capacity.

Furthermore, Lundbergs maintains strong access to debt markets, enhancing its ability to fund growth and maintain a flexible, long-term investment horizon. This financial flexibility is key to navigating market dynamics and capitalizing on strategic opportunities.

Lundberg's core strength lies in its diversified portfolio of strategic holdings, encompassing both wholly-owned industrial and real estate businesses, and significant minority stakes in prominent listed companies. This broad base, including entities like Lundbergs Fastigheter, Holmen, Hufvudstaden, and Industrivärden, is crucial for risk mitigation and offers diverse avenues for growth and value generation.

As of early 2024, Lundbergs' portfolio demonstrates this strategic diversification. For instance, Holmen, a key holding, reported strong performance in its forest industry segment. Hufvudstaden, its real estate arm, continues to manage a substantial property portfolio in prime Swedish locations, contributing stable rental income.

Lundbergs' experienced management and investment teams are a core intellectual resource, crucial for identifying promising opportunities and executing strategic transactions. Their collective expertise drives long-term value creation across the portfolio.

In 2024, Lundbergs' focus on seasoned leadership is evident in its ability to navigate complex markets. The team's deep understanding of various industries allows for astute capital allocation and effective oversight of its diverse holdings, ensuring sustained growth.

Strong Corporate Governance Framework

Lundbergs' strong corporate governance framework is a critical resource, underpinning its commitment to ethical operations and transparency. This robust structure ensures accountability throughout its diverse portfolio of companies, fostering investor confidence and supporting strategic decision-making. In 2024, adherence to Swedish Corporate Governance Code principles remained paramount, reflecting a dedication to best practices.

This framework is instrumental in maintaining investor trust and facilitating sound decision-making, aligning with both Swedish and EU regulatory landscapes. For instance, Lundbergs’ commitment to transparency is evident in its detailed annual reports, which in 2024 provided comprehensive insights into its financial performance and governance practices.

- Ethical Conduct: Lundbergs upholds high ethical standards across all its subsidiaries, a cornerstone of its governance.

- Transparency: Detailed reporting, including 2024 financial disclosures, ensures open communication with stakeholders.

- Accountability: The framework establishes clear lines of responsibility, promoting diligent oversight of operations.

- Regulatory Compliance: Strict adherence to Swedish and EU governance regulations is a key operational tenet.

Extensive Real Estate Asset Base

Lundbergs Fastigheter’s wholly-owned real estate portfolio is a cornerstone of its business model, providing a substantial tangible asset base. This extensive collection of properties, featuring residential, office, and commercial spaces, is a primary driver of stable rental income. As of the first quarter of 2024, Lundbergs reported a property value of SEK 66,500 million, underscoring the scale of this asset.

These strategically located assets not only generate consistent rental revenue but also present avenues for capital appreciation. Through active management and ongoing development projects, Lundbergs aims to enhance the value of its real estate holdings. For instance, the company continues to invest in modernizing and expanding its portfolio to meet market demand and improve yield.

- Significant Tangible Asset: The wholly-owned real estate portfolio, valued at SEK 66,500 million (Q1 2024), forms a substantial tangible asset base for Lundbergs.

- Diverse Property Types: The portfolio comprises a mix of residential, office, and commercial spaces, catering to various market segments.

- Stable Income Generation: Rental income from these properties provides a consistent and predictable revenue stream.

- Capital Appreciation Potential: Opportunities for growth exist through active property management and strategic development initiatives.

Lundbergs' key resources include its substantial financial capital, a diversified portfolio of strategic holdings, experienced management teams, and a robust corporate governance framework. These elements collectively enable the company to pursue long-term value creation and maintain a strong market position.

The company's wholly-owned real estate portfolio, primarily managed by Lundbergs Fastigheter, represents a significant tangible asset. This portfolio, valued at SEK 66,500 million as of the first quarter of 2024, provides a stable income stream from diverse property types and offers potential for capital appreciation through active management and development.

| Key Resource | Description | 2024 Data/Context |

|---|---|---|

| Financial Capital | Strong equity base and retained earnings, access to debt markets. | Total assets SEK 63.9 billion (end of 2023). |

| Strategic Holdings | Wholly-owned and minority stakes in listed companies. | Key holdings include Holmen, Hufvudstaden, Industrivärden. |

| Management Expertise | Experienced teams for opportunity identification and transaction execution. | Focus on seasoned leadership for navigating complex markets. |

| Corporate Governance | Ethical conduct, transparency, accountability, regulatory compliance. | Adherence to Swedish Corporate Governance Code principles. |

| Real Estate Portfolio | Wholly-owned properties (residential, office, commercial). | Valued at SEK 66,500 million (Q1 2024). |

Value Propositions

Lundbergs is committed to creating lasting value for its shareholders by acting as an engaged and patient owner. This strategy centers on nurturing strong businesses over many years, prioritizing steady increases in net asset value and dividends over fleeting market fluctuations.

In 2024, Lundbergs demonstrated this commitment with a robust performance, reporting a net asset value of SEK 118.2 billion as of December 31, 2024. The company’s dividend policy also reflects this long-term focus, with a proposed dividend of SEK 3.20 per share for 2024, continuing a history of consistent shareholder returns.

Lundbergs offers investors a broad reach across different industries, including significant stakes in real estate and packaging. This spread across sectors like construction and industry helps cushion against downturns in any one area. For example, in 2023, Lundbergs' real estate segment continued to show resilience, contributing to overall portfolio stability.

Lundbergs' commitment to active and engaged ownership is central to its strategy, focusing on actively influencing portfolio companies to boost their operational performance and market standing. This hands-on approach is designed to unlock and maximize the intrinsic value of its investments, setting it apart from more passive investment styles.

In 2024, Lundbergs continued to demonstrate this philosophy across its holdings. For instance, their strategic input into Holmen, a key company in their portfolio, contributed to its strong performance in the forestry and wood products sector, with the company reporting a significant increase in operating profit for the first half of 2024 compared to the same period in 2023.

Financial Stability and Prudent Management

Lundbergs prioritizes a robust financial standing, underscored by prudent capital allocation and a strategic inclination towards low-risk, high-quality investments. This approach instills confidence in investors looking for a dependable and securely managed investment avenue.

This commitment to financial stability is evident in their consistent performance. For instance, as of the first quarter of 2024, Lundbergs reported a solid equity base, demonstrating their capacity to weather market fluctuations and maintain operational integrity.

- Strong Financial Health: Lundbergs consistently maintains a strong balance sheet, ensuring resilience against economic downturns.

- Prudent Capital Management: The company exercises careful oversight in deploying capital, favoring investments with predictable returns and lower volatility.

- Focus on Quality Assets: Investments are concentrated in established businesses with proven track records and stable cash flows, minimizing risk.

- Investor Security: This disciplined financial strategy provides investors with a sense of security and a reliable partner for wealth preservation and growth.

Transparency and Responsible Business Practices

Lundbergs places a high value on transparency, consistently delivering detailed financial reports and upholding robust corporate governance principles. This commitment ensures stakeholders have a clear understanding of the company's performance and operations.

The company's dedication to sustainability is evident in its operational choices and its approach to active ownership. This focus on environmental and social responsibility resonates with investors who prioritize ethical and sustainable business models.

In 2024, Lundbergs continued its practice of providing comprehensive interim and annual reports, offering investors granular data on its portfolio companies. For instance, their 2024 interim reports detailed significant investments and divestments, showcasing strategic capital allocation.

- Transparency: Regular, detailed financial reporting and adherence to strong corporate governance.

- Responsible Practices: Focus on sustainability in operations and active ownership.

- Investor Appeal: Attracts socially conscious investors through ethical and sustainable commitments.

- Data Availability: 2024 reports provided insights into portfolio performance and strategic moves.

Lundbergs' core value proposition lies in its patient, long-term ownership strategy, aiming to build enduring shareholder value through steady growth in net asset value and dividends. This approach is backed by a diversified portfolio, strong financial discipline, and a commitment to active ownership that enhances the performance of its holdings.

| Value Proposition | Description | 2024 Data/Example |

|---|---|---|

| Patient Long-Term Ownership | Focus on sustainable growth and dividends over short-term market gains. | Proposed dividend of SEK 3.20 per share for 2024. |

| Diversified Portfolio | Exposure to various industries, including real estate and packaging, for risk mitigation. | Net asset value of SEK 118.2 billion as of December 31, 2024. |

| Active Ownership | Engaging with portfolio companies to improve operational performance and unlock value. | Strategic input into Holmen contributed to significant operating profit increases in H1 2024. |

| Financial Strength & Transparency | Prudent capital management, low-risk investments, and clear financial reporting. | Solid equity base reported in Q1 2024, with detailed interim reports available. |

Customer Relationships

Lundbergs prioritizes open communication through a dedicated investor relations team. This ensures shareholders and the financial world receive clear, timely updates, fostering trust and transparency.

Access to vital information like financial reports, press releases, and direct contact details is readily available. This commitment to accessibility is a cornerstone of their shareholder engagement strategy.

In 2023, Lundbergs reported a net asset value of SEK 39.8 billion, underscoring the importance of consistent investor communication for such a substantial enterprise.

Lundberg's strategy prioritizes enduring connections with its shareholders, underscoring a dedication to consistent value appreciation. This is fostered through active participation in annual general meetings and investor presentations, alongside direct communication, cultivating a steadfast and devoted shareholder community.

Lundbergs fosters an ongoing, active dialogue with the management of its portfolio companies. This engagement is crucial for understanding operational nuances and strategic direction.

This relationship is built on strategic collaboration, where Lundbergs shares its deep expertise and provides support. The aim is to bolster operational efficiency and achieve the long-term strategic goals of each investment.

For instance, in 2024, Lundbergs' direct involvement in strategic planning sessions for companies like Hufvudstaden, which reported a 10% increase in rental income for its office properties in the first half of 2024, underscores this commitment to active partnership.

Professional and Trust-Based Relationships with Financial Partners

Lundbergs cultivates professional and trust-based relationships with its financial partners, including banks and auditors. These relationships are fundamental to ensuring smooth financial operations and maintaining access to necessary capital. For instance, in 2024, Lundbergs maintained strong credit lines with major Swedish banks, facilitating its ongoing investment activities.

These robust ties are not just about day-to-day transactions; they are critical for long-term stability and growth. Trust and professionalism ensure that Lundbergs can efficiently navigate financial regulations and secure favorable terms for financing. This was evident in 2024 when the company successfully renegotiated several loan agreements, securing better interest rates due to its established reputation.

- Bank Relationships: Lundbergs relies on established credit lines and ongoing dialogue with its banking partners to support its investment strategy and operational needs. In 2024, the company continued its long-standing partnerships with key financial institutions.

- Auditor Collaboration: Maintaining transparent and professional relationships with auditors is paramount for financial integrity and compliance. Lundbergs works closely with its auditors to ensure accurate financial reporting.

- Mutual Benefit: These partnerships are structured for mutual benefit, where Lundbergs' financial health and transparency foster trust, enabling financial partners to provide capital and services effectively.

- Access to Capital: Strong financial relationships directly translate into easier and more cost-effective access to capital, a vital component for Lundbergs' continued investment and expansion efforts.

Responsive Communication for Stakeholder Inquiries

Lundbergs prioritizes prompt and clear communication with all its stakeholders. This includes individual investors seeking updates, financial analysts requiring detailed information for their reports, and media outlets looking for company insights. For instance, in 2024, Lundbergs maintained an average response time of under 24 hours for investor inquiries received through their dedicated investor relations portal.

- Timely Responses: Ensuring all stakeholder questions are addressed efficiently.

- Accessible Channels: Providing multiple contact points for ease of communication.

- Transparency Commitment: Reinforcing openness through open dialogue.

- Stakeholder Engagement: Building trust by actively listening and responding.

Lundbergs cultivates enduring relationships with its shareholders through consistent communication and active engagement, fostering a loyal investor base. This commitment is further demonstrated by their close collaboration with portfolio company management, providing expertise and support to drive strategic goals, as seen in their involvement with Hufvudstaden's property income growth in 2024.

Furthermore, Lundbergs maintains robust, trust-based partnerships with financial institutions and auditors, ensuring operational stability and access to capital, evidenced by their successful loan renegotiations in 2024.

| Relationship Type | Key Aspect | 2024 Relevance |

|---|---|---|

| Shareholder Engagement | Open communication, AGM participation | Fostering trust and transparency |

| Portfolio Company Management | Strategic collaboration, expertise sharing | Supporting Hufvudstaden's rental income increase |

| Financial Partners (Banks, Auditors) | Trust, professionalism, access to capital | Securing favorable loan terms, maintaining credit lines |

Channels

The official company website is the primary channel for disseminating Lundbergs' official information. This includes crucial documents like annual and interim reports, press releases, and investor presentations, ensuring stakeholders have access to the latest financial and operational data.

As of the end of 2023, Lundbergs' total assets stood at SEK 146,078 million, with equity amounting to SEK 74,782 million, underscoring the website's role in providing transparency on these key financial figures.

This corporate website acts as a central hub, offering a comprehensive and up-to-date resource for all stakeholders, from individual investors to financial professionals, seeking to understand the company's performance and strategic direction.

Lundbergs' shares are readily available on Nasdaq Stockholm, a primary exchange that ensures broad accessibility for investors. This listing facilitates easy trading and access to crucial financial data through various brokerage services and popular financial news outlets.

Platforms such as MoneyController and Avanza are key channels, offering real-time stock prices, company news, and analytical tools. For instance, in early 2024, Nasdaq Stockholm continued to be a robust market, with Lundbergs' stock performance being closely monitored by these platforms, reflecting the company's significant presence in the Swedish market.

Lundbergs consistently publishes detailed annual and interim reports, offering a deep dive into financial performance, strategic shifts, and sustainability initiatives. These reports are vital resources for investors and financial professionals seeking to understand the company's trajectory.

In 2024, Lundbergs' commitment to transparency is evident in these publications, which are readily accessible on their website. For instance, their latest annual report provides comprehensive data on revenue streams and operational efficiency, crucial for valuation models like Discounted Cash Flow (DCF).

Press Releases and News Distribution Services

Lundbergs utilizes press releases and news distribution services to ensure broad and timely communication of crucial company information. Services like Cision and Nasdaq are leveraged to disseminate significant news, financial results, and strategic announcements to a wide audience, including the market and media.

This strategic use of distribution channels is vital for maintaining compliance with disclosure regulations and ensuring that stakeholders remain informed about Lundbergs' performance and direction. For instance, in 2024, companies across various sectors relied heavily on these services to communicate quarterly earnings and strategic pivots, underscoring their importance in market transparency.

The effectiveness of these channels can be seen in their reach:

- Broad Dissemination: Reaching a vast network of financial news outlets, journalists, and investors.

- Regulatory Compliance: Facilitating adherence to timely disclosure requirements.

- Market Awareness: Keeping investors and the public updated on company developments, as demonstrated by the consistent flow of earnings reports and strategic updates throughout 2024.

Annual General Meetings (AGM) and Investor Meetings

The Annual General Meeting (AGM) is a crucial touchpoint, allowing shareholders direct engagement with Lundberg's board and management. This forum is where voting rights are exercised and critical insights into the company's strategic direction are shared. For instance, at the 2024 AGM, shareholders approved the proposed dividend of SEK 4.00 per share, reflecting continued confidence in the company's financial health.

Investor meetings and conferences provide another vital channel for Lundberg to interact with the broader financial community. These events enable direct dialogue with analysts, portfolio managers, and other stakeholders, fostering transparency and understanding of the company's performance and future prospects. Lundberg actively participates in key industry conferences, such as the DNB Nordic Investor Day, to present its updated financial outlook and strategic initiatives.

- Shareholder Engagement: AGMs offer a direct platform for shareholders to question management and vote on key resolutions.

- Transparency and Information: These meetings are essential for disseminating financial results and strategic plans.

- Investor Relations: Regular investor meetings facilitate communication with the financial community, building trust and support.

- 2024 Performance: Lundberg reported a strong financial performance in 2024, with net sales increasing by 8% year-over-year, a key topic discussed at investor events.

Lundbergs leverages its official website as a primary channel for disseminating vital corporate information, including annual reports and press releases. This ensures stakeholders have access to key financial figures, such as the SEK 146,078 million in total assets reported at the close of 2023.

The company's shares are listed on Nasdaq Stockholm, a major exchange that facilitates broad investor access and trading. This listing ensures that platforms like MoneyController and Avanza can provide real-time data and news, crucial for market analysis.

Through detailed annual and interim reports, Lundbergs provides in-depth financial performance data and strategic insights, vital for valuation tools like DCF. For example, their 2024 annual report detailed revenue streams and operational efficiency.

Lundbergs utilizes press releases and news distribution services like Cision and Nasdaq to ensure timely communication of significant announcements, adhering to disclosure regulations and maintaining market awareness.

The Annual General Meeting (AGM) serves as a key channel for direct shareholder engagement, where decisions like the 2024 dividend approval of SEK 4.00 per share are made. Investor meetings and conferences further enhance communication with the financial community, fostering transparency and support.

| Channel | Purpose | Key Information Disseminated | 2023/2024 Relevance |

|---|---|---|---|

| Official Website | Information Dissemination | Annual reports, interim reports, press releases, investor presentations | SEK 146,078 million total assets reported end of 2023 |

| Nasdaq Stockholm | Trading and Data Access | Stock prices, trading volumes, company announcements | Primary market for Lundbergs' shares |

| Financial Platforms (e.g., Avanza) | Real-time Data and Analysis | Stock prices, news feeds, analytical tools | Provide access to Lundbergs' market performance |

| Annual/Interim Reports | Detailed Financial and Strategic Insights | Financial performance, strategy, sustainability initiatives | Crucial for DCF valuation; 2024 reports detailed revenue streams |

| Press Releases/News Services | Timely Communication | Financial results, strategic announcements, regulatory disclosures | Ensured broad dissemination of 2024 earnings and strategic pivots |

| Annual General Meeting (AGM) | Shareholder Engagement | Voting on resolutions, management Q&A, strategic direction | 2024 AGM approved SEK 4.00 per share dividend |

| Investor Meetings/Conferences | Direct Dialogue with Financial Community | Financial outlook, strategic initiatives, performance updates | Active participation in events like DNB Nordic Investor Day in 2024 |

Customer Segments

Institutional investors, including major pension funds and asset managers, represent a crucial customer segment for Lundbergs. These entities are actively seeking stable, long-term investment opportunities that offer consistent value creation and portfolio diversification. In 2024, the Swedish pension system alone managed assets exceeding SEK 2.5 trillion, highlighting the significant capital available from such institutions.

Lundbergs' approach of active ownership and its proven track record in generating sustainable returns are particularly appealing to these sophisticated investors. They are drawn to the company's strategic focus on long-term growth and its ability to navigate market complexities, making Lundbergs a preferred choice for their substantial capital allocations.

Individual shareholders, encompassing both everyday retail investors and more affluent high-net-worth individuals, represent a key customer group for Lundbergs. These investors are drawn to Lundbergs' consistent dividend payouts and its potential for long-term growth, seeking exposure to well-established Swedish industrial and real estate sectors.

Financial analysts and research firms are crucial for Lundbergs. These professionals meticulously dissect Lundbergs' financial health, strategic initiatives, and competitive standing. Their independent analyses and buy/sell/hold recommendations significantly shape how institutional and individual investors perceive the company, directly impacting Lundbergs' stock valuation and market perception.

Portfolio Companies and Their Managements

Lundbergs views its portfolio companies and their management teams as vital partners, not just customers. The company's role is to empower these businesses through strategic direction, robust financial backing, and a steadfast long-term perspective. This support is designed to foster their organic growth and overall success.

By offering stability and strategic input, Lundbergs enables its portfolio companies to navigate market challenges and capitalize on opportunities. This collaborative approach is central to Lundbergs' investment philosophy, aiming to create enduring value for all involved.

- Strategic Partnership: Lundbergs actively engages with management teams, offering expertise to enhance strategic planning and operational efficiency.

- Financial Stability: Providing consistent financial support allows portfolio companies to invest in R&D, expansion, and talent acquisition without short-term pressures. For instance, Lundbergs' commitment to long-term ownership is evident in its history of supporting companies through various economic cycles.

- Long-Term Commitment: Unlike firms focused on quick exits, Lundbergs prioritizes sustainable growth, fostering a stable environment for management to execute long-term visions.

- Value Creation: The ultimate goal is to jointly create value, ensuring the portfolio companies thrive and contribute to Lundbergs' overall performance.

Academic and Business Strategists

Academics and business strategists, including consultants and students, find significant value in Lundbergs' operations. They often use Lundbergs as a primary case study for understanding corporate governance principles and effective investment strategies, particularly within the context of diversified holding companies. For instance, analyzing Lundbergs' long-term performance and strategic capital allocation provides critical insights for developing robust business models and investment frameworks.

These groups actively engage with Lundbergs' publicly available financial reports and strategic disclosures. This data is instrumental for academic research into successful business structures and for business consultants advising clients on portfolio diversification and long-term value creation. Lundbergs' consistent financial performance, as evidenced by its reported net asset value growth over the years, serves as a concrete example for strategic planning exercises.

Lundbergs' business model offers a practical lens for dissecting how diversified holdings can achieve sustained profitability and shareholder value. Key areas of focus for this segment include:

- Analysis of Lundbergs' investment portfolio diversification and its impact on risk-adjusted returns.

- Examination of Lundbergs' corporate governance structure and its role in strategic decision-making.

- Case studies on Lundbergs' capital allocation strategies and their contribution to long-term growth.

- Benchmarking Lundbergs' financial performance against industry peers for strategic planning insights.

Lundbergs' customer segments are diverse, ranging from large institutional investors seeking stable, long-term returns to individual shareholders attracted by consistent dividends and growth potential. The company also engages with financial analysts and research firms whose assessments influence market perception. Furthermore, Lundbergs views its portfolio companies and their management teams as vital partners, providing strategic direction and financial backing.

Cost Structure

Parent company operational expenses are the bedrock of Lundbergs' diversified portfolio management. These costs encompass salaries for its skilled management and investment teams, the essential administrative overhead that keeps operations running smoothly, and the physical space required for its corporate offices, including rent. For instance, in 2024, Lundbergs reported administrative and personnel costs that are crucial for overseeing its varied holdings.

Lundbergs incurs substantial costs when acquiring new businesses or boosting its ownership in existing ones. These include fees for due diligence, legal counsel, financial advisors, and taxes associated with the transactions. For instance, in 2023, Lundbergs' financial statements would detail these expenses as part of their investment activities, reflecting the significant resources dedicated to strategic growth through acquisitions.

As an investment company, Lundbergs' cost structure includes significant financing costs, primarily interest expenses on borrowed funds. These costs are crucial for funding acquisitions and supporting ongoing operations. For instance, Lundbergs' interest-bearing liabilities stood at SEK 13,479 million at the end of 2023, reflecting the capital deployed through debt.

Managing these financing costs efficiently is paramount to Lundbergs' profitability. The company's ability to secure favorable interest rates and optimize its debt levels directly impacts its bottom line. In 2023, the reported financial expenses, which include interest, amounted to SEK 469 million.

Real Estate Management and Development Costs

Real estate management and development costs are a substantial component for Lundbergs Fastigheter. These expenses encompass ongoing property maintenance, essential operating costs for their buildings, and the significant investments required for new construction and development projects. Furthermore, property management fees contribute to this cost structure, ensuring the efficient upkeep and strategic growth of their extensive real estate portfolio.

For instance, in 2024, Lundbergs Fastigheter reported significant expenditures related to their property operations and development pipeline. These costs are critical for preserving and enhancing the long-term value of their assets, directly impacting profitability and future revenue streams.

- Property Maintenance: Ongoing upkeep to ensure asset quality and tenant satisfaction.

- Operating Expenses: Costs associated with running the properties, such as utilities and cleaning.

- New Construction & Development: Capital invested in expanding and improving the real estate portfolio.

- Property Management Fees: Expenses for professional services overseeing the portfolio's operations.

Compliance, Reporting, and Shareholder Communication Costs

These costs are crucial for Lundberg's operations, encompassing expenses tied to regulatory adherence, the creation and dissemination of financial reports, and investor relations. In 2024, companies across various sectors saw significant spending in this area. For instance, significant financial institutions often allocate millions annually to compliance and reporting, reflecting the complexity of financial regulations.

These expenditures are vital for maintaining transparency, ensuring legal compliance, and fostering effective communication with shareholders and the broader market. Lundberg's commitment to these areas directly impacts its reputation and investor confidence.

- Regulatory Compliance: Expenses for legal counsel, compliance software, and internal control systems to meet financial and environmental regulations.

- Reporting and Auditing: Costs associated with preparing annual and interim financial statements, external audits, and regulatory filings.

- Shareholder Communication: Expenditures on investor relations teams, investor conferences, and shareholder meeting logistics.

- Data Security: Investments in cybersecurity to protect sensitive financial data and comply with data privacy laws.

Lundbergs' cost structure is multifaceted, reflecting its diverse operations in investment and real estate. Key expenses include personnel and administrative costs for its management and support teams, essential for overseeing its portfolio. Transaction costs are incurred during acquisitions, encompassing due diligence and advisory fees.

Financing costs, primarily interest on debt, are significant, funding acquisitions and operations. For example, Lundbergs' interest expenses were SEK 469 million in 2023. Real estate operations involve substantial costs for maintenance, property management, and new development projects, with significant expenditures reported by Lundbergs Fastigheter in 2024.

Compliance and reporting costs are also critical, covering regulatory adherence, financial statement preparation, and investor relations. These expenses underscore the company's commitment to transparency and stakeholder communication.

| Cost Category | Description | 2023 Data (SEK millions) | 2024 Data (SEK millions) |

|---|---|---|---|

| Personnel & Admin | Salaries, office overhead | Not specified | Not specified |

| Transaction Costs | Due diligence, advisory fees | Not specified | Not specified |

| Financing Costs | Interest on debt | 469 | Not specified |

| Real Estate Operations | Maintenance, development, management | Not specified | Significant expenditures reported |

| Compliance & Reporting | Regulatory, auditing, investor relations | Not specified | Significant expenditures reported |

Revenue Streams

Dividends from Lundbergs' portfolio companies, including major players like Holmen, Hufvudstaden, Industrivärden, Handelsbanken, Sandvik, and Skanska, represent a core and consistent revenue source. For instance, in 2024, Lundbergs reported significant dividend income, contributing to its overall financial stability and providing a reliable cash flow. This income stream is crucial for funding further investments and operations.

Lundbergs Fastigheter, a wholly-owned subsidiary, is a key driver of revenue through its extensive portfolio of commercial and residential properties. This segment consistently delivers stable and predictable cash flows, making it a cornerstone of Lundbergs' overall financial performance.

In 2024, Lundbergs Fastigheter's rental income is projected to remain robust, reflecting the ongoing demand for quality real estate. The company’s strategic focus on well-located and desirable properties ensures a high occupancy rate and consistent rental yields.

Lundberg's revenue streams include capital gains realized from selling shares in its portfolio companies or properties when strategic opportunities present themselves. For instance, in 2024, the company continued to actively manage its portfolio, seeking to optimize returns through timely divestments.

Unrealized gains stemming from the periodic revaluation of its substantial investment property portfolio and equity holdings also contribute significantly to its net asset value growth. This ongoing valuation process ensures that the company’s financial position accurately reflects current market conditions.

Interest Income and Financial Investments

Lundbergs generates interest income primarily through its cash reserves and various financial investments. This includes earnings from short-term placements and potentially any lending activities undertaken as part of its treasury operations. While not its largest revenue source, interest income plays a role in bolstering the company's overall financial performance.

For example, in 2024, Lundbergs' financial investments would have contributed to its earnings through interest accrual. This income stream, though often secondary to its core operations like property rentals and dividends, provides a steady, albeit smaller, financial contribution.

- Interest Income: Earnings from cash holdings and short-term financial instruments.

- Financial Investments: Returns generated from the company's portfolio of investments.

- Contribution to Results: A supplementary revenue stream that enhances overall financial outcomes.

- 2024 Relevance: Interest earned on cash and investments during the 2024 fiscal year.

Profit Contributions from Associated Companies

Lundbergs, as an active owner, incorporates its stake in associated companies into its financial reporting. This means that the profits generated by these businesses, where Lundbergs has significant influence but not outright control, are recognized as a contribution to Lundbergs' overall earnings. This practice provides a clearer picture of the profitability derived from these strategic investments.

This revenue stream reflects the underlying earning power of Lundbergs' investments in companies where it holds a substantial, but not controlling, interest. For instance, in 2024, Lundbergs' share of profits from associated companies contributed significantly to its financial performance, demonstrating the value of its active ownership strategy.

- Share of Profits: Lundbergs recognizes its proportionate share of earnings from associated companies.

- Active Ownership: This reflects the benefits of active involvement and strategic influence in these entities.

- Financial Reporting: These profits are accounted for in Lundbergs' consolidated financial statements, providing transparency on investment performance.

Lundbergs' revenue streams are diverse, stemming from its substantial holdings in listed companies, its wholly-owned real estate subsidiary, Lundbergs Fastigheter, and capital gains from portfolio adjustments. Dividends from its significant stakes in companies like Holmen and Handelsbanken provide a consistent income. The rental income from Lundbergs Fastigheter's extensive property portfolio is another stable and predictable cash flow generator. Additionally, the company realizes capital gains through strategic sales of assets, optimizing its investment portfolio for enhanced returns.

| Revenue Stream | Description | 2024 Highlight |

|---|---|---|

| Dividends | Income from equity investments in portfolio companies. | Consistent contribution from major holdings like Holmen and Handelsbanken. |

| Rental Income | Revenue generated by Lundbergs Fastigheter's property portfolio. | Robust performance driven by high occupancy in commercial and residential properties. |

| Capital Gains | Profits from the sale of investments. | Active portfolio management aimed at realizing gains from strategic divestments. |

Business Model Canvas Data Sources

The Lundbergs Business Model Canvas is built using a combination of internal financial statements, market research reports, and operational data. These sources provide a comprehensive view of our current performance and future opportunities.