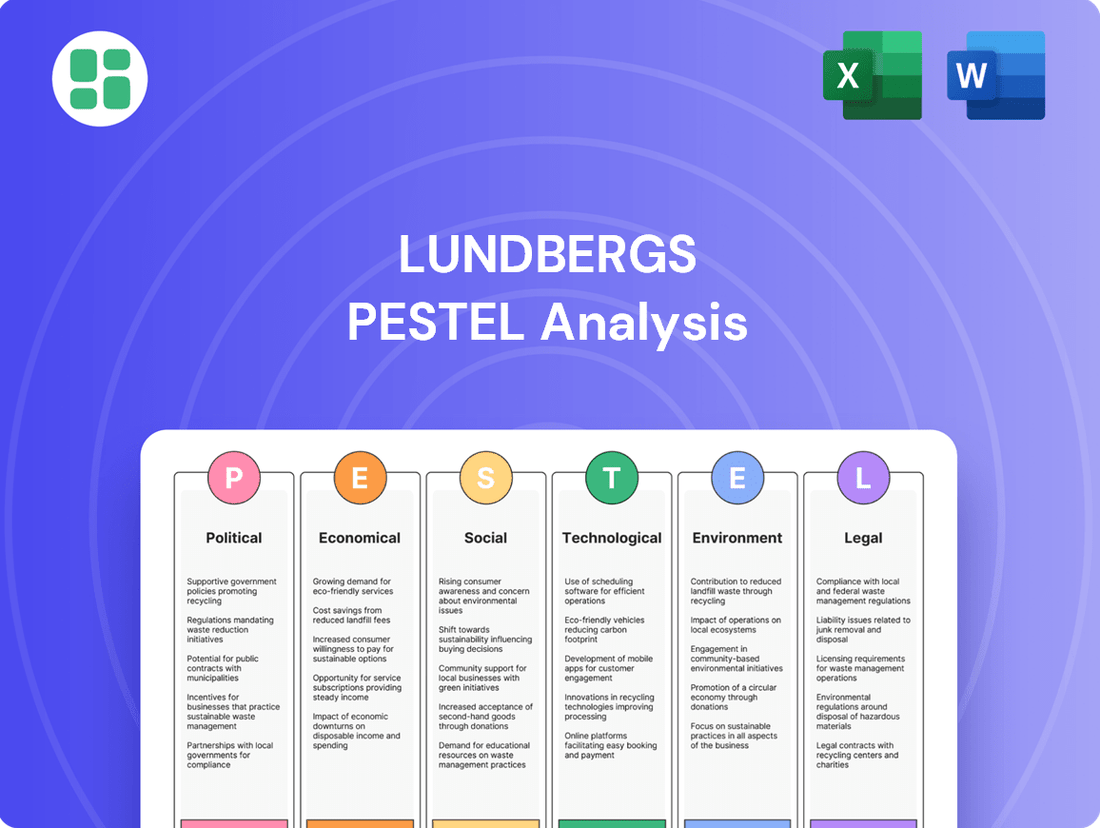

Lundbergs PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lundbergs Bundle

Uncover the critical political, economic, and technological forces shaping Lundbergs's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into the external landscape, offering actionable insights to inform your strategic decisions. Download the full version now and gain a competitive edge.

Political factors

The stability of the Swedish government and its long-term policy direction are crucial for investment companies like Lundbergs. A consistent political landscape reduces uncertainty for its diverse holdings, which span real estate and industrial sectors. For instance, the Swedish government's commitment to fiscal responsibility, as evidenced by a projected budget surplus for 2024, provides a stable economic backdrop.

The Swedish regulatory environment significantly shapes Lundbergs' operations. For instance, the Finansinspektionen (FI), Sweden's financial supervisory authority, enforces rules on capital adequacy, such as Solvency II for insurance companies within the group, which dictates minimum capital reserves. Changes in disclosure requirements, like those under MiFID II, also mean increased reporting burdens and compliance costs, potentially impacting how Lundbergs manages its investment portfolio and communicates with stakeholders.

Government policies on urban planning and land use significantly shape the landscape for Lundbergs' substantial real estate investments, primarily managed through Hufvudstaden. For instance, Stockholm's ambitious urban development plans, such as the Norra Djurgårdsstaden project, create opportunities for new construction and property value appreciation, directly benefiting Hufvudstaden's portfolio. These policies influence where and how development can occur, impacting Lundbergs' strategic growth in the property sector.

Environmental standards for buildings and rental market regulations also play a crucial role. New regulations mandating energy-efficient retrofits or stricter building codes can increase development costs but also enhance the long-term value and attractiveness of properties. In 2024, Sweden continued to emphasize sustainability in construction, with government incentives for green building certifications potentially influencing Hufvudstaden’s development strategies and operational expenses.

Industrial and Forestry Sector Support/Restrictions

Government policies directly impact Lundbergs' investments, particularly in sectors like forestry and industry. For instance, Holmen, a significant holding, operates within the packaging and forestry industries, which are heavily influenced by environmental regulations and trade policies. The Swedish government's stance on sustainable forestry, including potential subsidies for responsible land management or incentives for adopting greener industrial practices, could offer advantages. Conversely, stricter environmental restrictions or new taxes on timber harvesting or industrial output could present operational challenges and affect profitability.

Looking at 2024 and projections for 2025, the European Union's Green Deal continues to shape industrial and forestry policies, pushing for greater sustainability and circular economy principles. This could translate into increased demand for sustainably sourced wood products and pressure on companies to reduce their carbon footprint. For Holmen, this might mean opportunities in bio-based packaging solutions, but also potential compliance costs related to emissions or waste management. Specific government support programs for industrial innovation, such as those aimed at developing advanced manufacturing or bio-economy technologies, could also provide a boost to Lundbergs' industrial holdings.

- Swedish Forest Agency's 2024 budget proposal included continued focus on sustainable forest management and climate adaptation measures.

- EU's proposed Carbon Border Adjustment Mechanism (CBAM) could impact industrial exports from Sweden, requiring adjustments in production and reporting.

- Potential for increased government incentives for renewable energy adoption within industrial processes, benefiting companies like Holmen.

- Ongoing discussions around forest protection and biodiversity targets may lead to revised regulations on forest use and harvesting.

EU and International Trade Policies

As a Swedish company, Lundbergs operates within the framework of European Union trade policies and international agreements. These regulations significantly influence its business operations, particularly for its industrial and packaging segments. For instance, the EU's Common Commercial Policy dictates external trade relations, impacting import duties and export opportunities for Lundbergs' subsidiaries.

Changes in EU trade policies, such as the implementation of new tariffs or the renegotiation of trade deals, can directly affect the competitiveness of Lundbergs' portfolio companies. For example, if the EU imposes tariffs on raw materials crucial for its packaging division, production costs could rise, potentially impacting profitability and market share. Conversely, favorable trade agreements can open up new export markets.

The EU's ongoing focus on sustainability and circular economy initiatives also shapes trade policies. Lundbergs' companies must adapt to regulations concerning packaging materials and waste management, which can influence supply chain dynamics and product development. In 2023, the EU continued to advance its Green Deal objectives, with significant implications for industries reliant on material sourcing and product lifecycle management.

- EU Trade Agreements: Lundbergs benefits from the EU's network of free trade agreements, which reduce barriers to exporting its products to over 70 countries and territories.

- Tariff Impact: Fluctuations in tariffs on key inputs, such as pulp for packaging or metals for industrial goods, can alter Lundbergs' cost structures. For example, a 5% tariff on imported paper pulp could add millions to the cost base for its packaging operations.

- Regulatory Alignment: Lundbergs must ensure its operations comply with EU standards for product safety, environmental impact, and chemical usage, which can influence product design and manufacturing processes.

- Global Supply Chains: International trade policies affect the stability and cost of global supply chains, impacting Lundbergs' ability to source materials and distribute finished goods efficiently.

Political stability in Sweden is a cornerstone for Lundbergs' investment strategy, influencing its diverse portfolio. The government's commitment to fiscal prudence, exemplified by a projected budget surplus for 2024, creates a predictable economic environment. This stability is vital for sectors like real estate and industry, where long-term planning is essential.

Regulatory frameworks, overseen by bodies like Finansinspektionen, directly impact Lundbergs' financial operations. Compliance with capital adequacy rules, such as Solvency II for its insurance holdings, and evolving disclosure mandates like MiFID II, necessitate ongoing adaptation and resource allocation. These regulations shape how Lundbergs manages its investments and communicates its performance.

Government land use and urban planning policies are critical for Lundbergs' real estate arm, Hufvudstaden. Stockholm's development initiatives, such as the Norra Djurgårdsstaden project, offer growth avenues but are contingent on regulatory approvals and zoning. These policies dictate the pace and scope of property development, influencing asset appreciation.

Environmental regulations and building standards are increasingly shaping Lundbergs' property and industrial investments. Sweden's focus on sustainability in 2024, with potential incentives for green building, impacts development costs and long-term property value for Hufvudstaden. Similarly, Holmen's forestry operations are subject to evolving environmental and climate adaptation measures.

| Factor | Impact on Lundbergs | 2024/2025 Data/Trend |

|---|---|---|

| Government Stability | Reduces investment uncertainty | Sweden's projected budget surplus for 2024 indicates fiscal stability. |

| Regulatory Environment | Affects compliance costs and operational strategy | Ongoing adaptation to EU financial regulations like MiFID II. |

| Urban Planning | Influences real estate development opportunities | Stockholm's Norra Djurgårdsstaden project offers growth potential. |

| Environmental Policies | Impacts development costs and sustainability initiatives | Swedish incentives for green building and EU's Green Deal influence Holmen's operations. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Lundbergs, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick overview of Lundbergs' external environment to streamline strategic discussions.

Economic factors

The Swedish economy is navigating a complex period, with forecasts for 2024 indicating modest GDP growth, potentially around 0.5% according to the Riksbank, following a contraction in 2023. This suggests a gradual recovery rather than a robust boom, which could temper the immediate impact on consumer spending and industrial activity.

While a full-blown recession may be avoided, the outlook for 2025 points to a more positive growth trajectory, with projections suggesting GDP could reach around 1.5% to 2.0%. This expected uptick is crucial for Lundbergs, as it signals improving conditions for real estate, industrial sectors, and consumer-driven businesses within its portfolio.

The key determinant for Lundbergs will be the pace and breadth of this recovery. A stronger-than-anticipated rebound in key sectors like manufacturing and housing could significantly enhance the performance of its diverse holdings, translating into higher revenues and asset values.

Sweden's central bank, the Riksbank, has been navigating a complex economic landscape. Following a period of elevated inflation, the Riksbank has been adjusting its monetary policy. In early 2024, the policy rate remained at 4.00%, a level maintained to curb inflationary pressures. While inflation has shown signs of moderating from its peak, it still presents a key consideration for the Riksbank's future decisions.

These monetary policy shifts directly impact Lundbergs. For its real estate holdings, higher interest rates increase borrowing costs, potentially dampening investment and property valuations. Conversely, a stable or declining interest rate environment would reduce financing expenses and could boost the real estate market. Similarly, Lundbergs' industrial companies are sensitive to interest rates affecting their capital expenditures and consumer demand.

Inflation trends are equally crucial. While the Riksbank's target is 2%, actual inflation has fluctuated. Controlled inflation is vital for Lundbergs as it preserves the real value of assets and maintains consumer purchasing power, which supports demand for goods and services provided by its portfolio companies.

The Swedish real estate market, a critical economic driver for Hufvudstaden and by extension Lundbergs, is experiencing shifts. Demand for prime office and retail spaces remains a key indicator, alongside ongoing trends in housing construction rates and overall property valuations. These elements directly impact Lundbergs' net asset value, with a healthy market supporting stable or increasing asset worth.

As of early 2024, Stockholm's commercial real estate sector shows resilience, though vacancy rates for office spaces have seen a slight uptick, averaging around 7-8% in central business districts. Residential property prices across Sweden experienced a modest cooling in late 2023 but have shown signs of stabilization in early 2024, with some areas reporting slight year-on-year growth. Hufvudstaden's portfolio, heavily weighted towards prime locations, is thus positioned to benefit from this ongoing market activity and potential appreciation.

Global Economic Conditions and Export Demand

Global economic conditions significantly influence Lundbergs' export-oriented industrial and packaging businesses, such as Holmen's paperboard and timber. A robust global economy, characterized by consistent growth and strong consumer spending, directly translates to higher demand for these Swedish products. For instance, in 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a figure that underpins the potential for increased export volumes for companies like Holmen.

Stable international trade relations are equally crucial. Trade agreements and the absence of protectionist policies foster a predictable environment for exports, allowing companies to plan production and investment more effectively. Conversely, trade disputes or disruptions can negatively impact revenue streams and profitability. The World Trade Organization (WTO) reported that global trade growth was expected to rebound to 2.6% in 2024, indicating a generally favorable environment for Swedish exports, though geopolitical tensions remain a watchpoint.

- Global Growth Impact: Higher global GDP growth, such as the IMF's 3.2% projection for 2024, generally correlates with increased demand for industrial and packaging materials.

- Trade Stability: Predictable trade policies and the avoidance of tariffs are essential for companies like Holmen to maintain competitive pricing and market access for their exports.

- Export Performance: The expected 2.6% growth in global trade for 2024, as forecasted by the WTO, suggests a supportive, albeit moderate, backdrop for Lundbergs' export-oriented segments.

- Geopolitical Risk: Ongoing geopolitical uncertainties can introduce volatility into global demand and trade flows, posing a risk to export-dependent revenue.

Labor Market and Wage Developments

Sweden's labor market in 2024 and early 2025 is characterized by a generally stable employment situation, though with some regional variations. The overall employment rate has remained resilient, providing a foundation for consumer spending. However, labor availability in specific sectors, particularly those requiring specialized skills, continues to be a point of focus for companies like those within Lundbergs' portfolio.

Wage developments are a key consideration. While nominal wage growth has been observed, the impact of inflation on real wage increases is crucial for understanding consumer purchasing power. For instance, reports from early 2024 indicated that while wages were rising, the pace of real wage growth was a key determinant of domestic demand strength.

The interplay between labor costs and consumer demand directly influences Lundbergs' diverse business interests. A robust labor market with increasing real wages generally translates to higher consumer spending, benefiting retail and service-oriented companies. Conversely, challenges in labor availability or stagnant real wages can put pressure on operational costs and dampen demand.

- Employment Rate: Sweden's overall employment rate has shown stability, hovering around 80% for the working-age population in recent periods, a figure that underpins consumer confidence.

- Wage Growth: Nominal wage growth in Sweden has been positive, but the real wage impact, factoring in inflation, is the critical driver for consumer purchasing power.

- Labor Availability: Certain sectors, particularly in technology and healthcare, continue to face challenges with skilled labor availability, potentially increasing recruitment costs for Lundbergs' companies.

- Domestic Demand: A healthy labor market with rising real wages is a significant contributor to domestic demand, a vital factor for the performance of many Swedish businesses.

Sweden's economic outlook for 2024 and 2025 suggests a gradual recovery, with GDP growth projected to be modest in 2024 and strengthening in 2025. This recovery is underpinned by expected stabilization in inflation and a cautious approach from the Riksbank regarding interest rates.

The real estate market, particularly in Stockholm, shows resilience with slight upticks in residential property prices, while commercial spaces face minor vacancy increases. Global trade is anticipated to grow, supporting Lundbergs' export-oriented businesses like Holmen, though geopolitical risks remain a factor.

The labor market remains stable with positive nominal wage growth, but the real impact of wages on consumer spending is key. Challenges in skilled labor availability could affect operational costs for some of Lundbergs' portfolio companies.

| Indicator | 2024 Projection/Data | 2025 Projection | Source/Notes |

|---|---|---|---|

| Swedish GDP Growth | ~0.5% | 1.5%-2.0% | Riksbank projections |

| Riksbank Policy Rate | 4.00% (early 2024) | Variable | Monetary policy adjustment |

| Stockholm Office Vacancy | ~7-8% (central districts) | Stable/Slightly decreasing | Commercial real estate trend |

| Global GDP Growth | 3.2% | N/A | IMF projection |

| Global Trade Growth | 2.6% | N/A | WTO projection |

| Swedish Employment Rate | ~80% (working-age) | Stable | Labor market indicator |

Preview the Actual Deliverable

Lundbergs PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Lundbergs provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape Lundbergs operates within.

Sociological factors

Sweden's population is projected to reach 10.6 million by 2025, with a continuing trend of urbanization concentrating growth in major cities like Stockholm, Gothenburg, and Malmö. This demographic shift directly impacts Hufvudstaden's property portfolio, as increased urban populations fuel demand for office and retail spaces in prime city centers. For example, Stockholm's population grew by over 30,000 in 2023 alone, highlighting the sustained pressure on urban real estate.

Consumer demand for sustainable options is a significant trend influencing Lundbergs' portfolio. For instance, Holmen, a key part of Lundbergs, has seen its renewable energy and wood products benefit from this shift. In 2023, Holmen reported strong demand for its sustainably sourced timber and paper products, reflecting a broader market movement towards eco-friendly materials.

Workforce expectations are shifting significantly, with employees increasingly prioritizing work-life balance, diversity, and a company's commitment to social responsibility. For Lundbergs, this means that its ability to attract and retain top talent across its diverse portfolio, from construction to real estate, hinges on its employer brand. Companies that offer flexible work arrangements and demonstrate genuine commitment to ESG principles are better positioned to secure skilled workers.

In 2024, reports indicate that over 60% of job seekers consider a company's social and environmental impact when deciding where to apply. This trend underscores the importance for Lundbergs to actively cultivate an environment that aligns with these evolving values. A strong focus on employee well-being and fostering an inclusive culture are not just ethical considerations but are now directly linked to operational efficiency and the capacity for innovation within its subsidiaries.

Social Responsibility and Corporate Governance

Societal expectations for Lundbergs and its portfolio companies to demonstrate strong corporate social responsibility (CSR) and ethical governance are intensifying. This heightened scrutiny impacts operational decisions and strategic planning, pushing for greater transparency and accountability in business practices.

Adhering to robust CSR standards and transparent governance is crucial for Lundbergs. It not only bolsters the company's reputation but also attracts ethically-minded investors, a trend increasingly evident in the 2024-2025 investment landscape. For instance, a 2024 report by the Global Sustainable Investment Alliance indicated that sustainable investments now represent over a third of all assets under management globally, highlighting the financial imperative of strong CSR credentials.

Furthermore, a commitment to these principles helps mitigate social risks, which can range from reputational damage due to ethical lapses to regulatory penalties. Lundbergs' proactive engagement in areas like environmental impact reduction and fair labor practices within its diverse holdings, such as Holmen's forestry initiatives and Hufvudstaden's property management, directly addresses these concerns.

- Growing Investor Demand: In 2024, ESG (Environmental, Social, and Governance) funds saw continued net inflows, with many investors prioritizing companies with demonstrable CSR commitments.

- Reputational Capital: Strong CSR performance, as evidenced by Lundbergs' consistent reporting on its sustainability efforts, builds trust and goodwill with stakeholders.

- Risk Mitigation: Proactive management of social issues, including supply chain ethics and community engagement, reduces the likelihood of costly controversies and legal challenges.

- Talent Attraction: Companies with strong social values are increasingly attractive to top talent, a critical factor for long-term success in the competitive labor market of 2024-2025.

Lifestyle Changes and Retail Trends

Consumer lifestyles are rapidly evolving, with a significant portion of retail activity now happening online. This shift impacts physical retail spaces, requiring adaptation to remain relevant. For instance, in 2024, e-commerce sales in Sweden were projected to continue their upward trajectory, influencing demand for traditional brick-and-mortar locations.

The desire for mixed-use urban environments, blending residential, retail, and leisure, is also a growing trend. Hufvudstaden, Lundbergs' real estate arm, must ensure its properties cater to these integrated living and working patterns to sustain occupancy rates and asset values. This includes incorporating more flexible spaces and amenities that encourage foot traffic and longer stays.

- Online Shopping Growth: E-commerce penetration in Sweden is expected to reach new highs in 2024-2025, reshaping retail demand.

- Urban Redevelopment: Cities are increasingly prioritizing mixed-use developments that combine living, working, and leisure.

- Experiential Retail: Consumers seek engaging experiences, pushing retailers and property owners to offer more than just products.

- Sustainability Focus: Lifestyle changes include a greater emphasis on sustainable consumption, affecting consumer choices and property development.

Societal expectations for Lundbergs and its portfolio companies to demonstrate strong corporate social responsibility (CSR) and ethical governance are intensifying, impacting operational decisions and strategic planning. This heightened scrutiny pushes for greater transparency and accountability in business practices, a trend reinforced by the 2024-2025 investment landscape where ethical considerations are increasingly paramount.

Adhering to robust CSR standards and transparent governance is crucial for Lundbergs, not only bolstering its reputation but also attracting ethically-minded investors. For instance, a 2024 report by the Global Sustainable Investment Alliance indicated that sustainable investments now represent over a third of all assets under management globally, highlighting the financial imperative of strong CSR credentials.

Proactive management of social issues, including supply chain ethics and community engagement, reduces the likelihood of costly controversies and legal challenges. Lundbergs' engagement in areas like Holmen's forestry initiatives and Hufvudstaden's property management directly addresses these concerns, mitigating social risks.

Companies with strong social values are increasingly attractive to top talent, a critical factor for long-term success in the competitive labor market of 2024-2025. In 2024, reports indicate that over 60% of job seekers consider a company's social and environmental impact when deciding where to apply.

| Sociological Factor | Impact on Lundbergs | 2024-2025 Data/Trend |

|---|---|---|

| CSR & Ethical Governance | Attracts investors, enhances reputation, mitigates risk | Sustainable investments > 33% of global AUM (2024) |

| Talent Attraction | Crucial for securing skilled workforce | >60% of job seekers consider social/environmental impact (2024) |

| Consumer Lifestyles | Shifts demand towards online and experiential retail | Continued upward trajectory of e-commerce sales in Sweden |

| Urbanization & Living Preferences | Drives demand for mixed-use urban environments | Population growth concentrated in major Swedish cities |

Technological factors

Digitalization and automation are fundamentally reshaping Lundbergs' industrial portfolio. For instance, the manufacturing sector, a key area for Lundbergs, saw global industrial automation market revenue reach an estimated $200 billion in 2024, projected to grow significantly by 2025. This trend offers Lundbergs opportunities for enhanced operational efficiency and cost savings across its holdings.

The adoption of advanced robotics and AI in industrial settings, like those within Lundbergs' manufacturing and engineering businesses, can boost productivity by an estimated 15-20% and improve quality control. However, these advancements necessitate substantial capital expenditure for new equipment and workforce retraining, presenting a strategic challenge for maximizing return on investment.

For Holmen, advancements in packaging and materials science are vital for staying competitive. Innovations like biodegradable films or lighter, stronger paperboard can significantly reduce transportation costs and environmental impact, directly appealing to consumers increasingly prioritizing sustainability. For instance, the global sustainable packaging market was valued at approximately $270 billion in 2023 and is projected to grow, indicating a strong market pull for such innovations.

The integration of smart building technologies, like advanced energy management systems and IoT-enabled amenities, is significantly boosting the appeal and operational efficiency of real estate portfolios. For instance, Hufvudstaden, a subsidiary of Lundbergs, is increasingly adopting these solutions to enhance tenant experience and reduce operating costs.

These smart systems, including sophisticated security features and predictive maintenance capabilities, not only improve the day-to-day management of properties but also contribute to higher asset valuations. In 2023, the global smart building market was valued at approximately $80 billion, with projections indicating continued strong growth driven by demand for sustainability and enhanced user comfort.

Data Analytics and AI for Investment Decisions

The increasing sophistication of data analytics and artificial intelligence (AI) offers Lundbergs significant opportunities to enhance its long-term value creation strategy. By leveraging these advanced tools, the company can gain deeper insights into market trends, refine its risk assessment processes, and optimize its investment portfolios, ultimately leading to more data-driven and informed decision-making.

For instance, AI-powered platforms are becoming instrumental in identifying complex patterns and correlations within vast datasets that human analysts might miss. This capability is crucial for Lundbergs in navigating the dynamic investment landscape. In 2024, the global AI market in financial services was projected to reach over $20 billion, demonstrating the widespread adoption and perceived value of these technologies.

The application of data analytics and AI can directly impact Lundbergs' operational efficiency and investment returns through several key areas:

- Enhanced Market Analysis: AI algorithms can process real-time news, social media sentiment, and economic indicators to predict market movements with greater accuracy, aiding in strategic capital allocation.

- Improved Risk Management: Sophisticated analytics can identify potential risks in investment portfolios earlier and with more precision, allowing for proactive mitigation strategies.

- Portfolio Optimization: Machine learning models can continuously rebalance portfolios based on evolving market conditions and risk appetites, aiming to maximize returns while managing volatility.

- Predictive Modeling: AI can forecast the performance of specific assets or sectors, providing Lundbergs with a forward-looking perspective essential for long-term investment planning.

Cybersecurity and Data Protection

As Lundbergs continues to embrace digitalization across its diverse portfolio, the imperative for stringent cybersecurity and data protection measures intensifies. The increasing sophistication of cyber threats necessitates continuous investment in advanced security protocols to safeguard sensitive corporate and customer data. Failure to do so risks not only financial losses but also significant reputational damage and potential regulatory penalties.

For Lundbergs, maintaining customer trust and ensuring uninterrupted operations are directly tied to its ability to protect against cyberattacks. In 2024, global cybersecurity spending was projected to reach over $200 billion, highlighting the scale of this challenge and the industry's response. Adherence to evolving data protection laws, such as GDPR and similar regulations worldwide, is critical for all subsidiaries, ensuring compliance and mitigating legal risks.

Key considerations for Lundbergs and its subsidiaries include:

- Implementing multi-factor authentication across all critical systems to prevent unauthorized access.

- Conducting regular vulnerability assessments and penetration testing to identify and address security weaknesses.

- Providing ongoing cybersecurity awareness training for all employees to mitigate human-error related breaches.

- Developing and regularly updating robust incident response plans to effectively manage and recover from cyber incidents.

Technological advancements are driving efficiency and innovation across Lundbergs' diverse holdings. The manufacturing sector, for example, benefits from automation, with the global industrial automation market expected to see continued growth through 2025. Similarly, Holmen leverages materials science innovations in packaging, tapping into a sustainable packaging market valued in the hundreds of billions. These trends highlight technology's role in operational improvements and market competitiveness.

Legal factors

Lundbergs, as a publicly traded entity, navigates a landscape governed by stringent Swedish and EU corporate governance codes and securities regulations. Adherence to these frameworks, encompassing disclosure mandates and the protection of shareholder rights, is paramount for maintaining operational integrity and fostering robust investor confidence.

Environmental legislation, covering emissions, waste management, and resource use, significantly shapes operations for Lundbergs' industrial and forestry arm, Holmen, and its real estate ventures like Hufvudstaden. For instance, Holmen must comply with Sweden's stringent regulations on forest management and carbon emissions, crucial for its sustainability certifications.

Adhering to these environmental laws, including obtaining permits for industrial processes and construction projects, is non-negotiable for maintaining legal standing and avoiding costly fines. In 2023, the EU's updated Industrial Emissions Directive continued to push for stricter controls, impacting manufacturing processes across various sectors where Lundbergs has interests.

Swedish and EU competition laws significantly shape Lundbergs' approach to acquisitions and business expansion, especially concerning potential mergers and maintaining a balanced market position. The Swedish Competition Authority (Konkurrensverket) has been actively increasing its oversight and scrutiny of mergers, meaning Lundbergs must meticulously adhere to these regulations when planning strategic investments to avoid potential antitrust issues.

Real Estate and Construction Legislation

Lundbergs' real estate operations are significantly shaped by a complex web of legislation. Laws dictating property ownership, lease agreements, and construction quality are fundamental to its business. For instance, changes in Swedish tenancy laws, which are frequently reviewed and updated, can impact rental income and tenant retention strategies for Lundbergs' extensive residential and commercial property holdings.

Furthermore, evolving urban planning regulations and zoning laws directly influence development potential and the valuation of Lundbergs' land assets. Stricter building codes, often introduced to enhance energy efficiency or seismic resilience, can increase construction costs but also contribute to long-term asset value and sustainability. In 2023, Sweden continued its focus on sustainable construction, with new directives potentially impacting material choices and building processes for future projects.

- Property Ownership Laws: These define how Lundbergs can acquire, hold, and dispose of real estate assets, influencing investment strategies and risk management.

- Tenancy Agreements: Regulations governing rental contracts, rent control, and tenant rights directly affect Lundbergs' recurring revenue streams and operational costs.

- Construction Standards: Building codes and safety regulations impact project timelines, material costs, and the overall quality and longevity of Lundbergs' developments.

- Urban Planning and Zoning: These laws dictate land use, density, and development rights, critically influencing the strategic expansion and profitability of Lundbergs' property portfolio.

Labor Laws and Employee Protection

Swedish labor laws are quite comprehensive, covering everything from employment contracts and working conditions to social security. These regulations directly impact all of Lundbergs' diverse portfolio companies, requiring careful adherence to ensure smooth operations and employee well-being. For instance, the Swedish Employment Protection Act (LAS) sets strict rules for hiring and firing, emphasizing fair grounds and notice periods. In 2024, ongoing discussions around adapting these laws to a more flexible labor market, particularly concerning gig economy workers, could influence how companies manage their workforce.

Compliance with these labor statutes is not just a legal necessity but a strategic imperative for Lundbergs. It helps in managing human resources effectively, minimizing the risk of costly disputes, and fostering a positive and productive working environment. A company's ability to attract and retain talent often hinges on its reputation as a fair employer, which is directly tied to its compliance with labor laws. For example, in 2023, the average cost of a labor dispute in Sweden, including legal fees and lost productivity, could be substantial, underscoring the importance of proactive compliance.

- Swedish Employment Protection Act (LAS): Governs hiring, firing, and employee rights, emphasizing fair grounds and notice periods.

- Working Environment Act: Mandates safe and healthy working conditions, impacting operational procedures and investments in workplace safety.

- Social Security Contributions: Employers contribute to a robust social security system, affecting payroll costs and employee benefits packages.

- Collective Bargaining Agreements: Many sectors operate under industry-specific agreements that set standards for wages, working hours, and benefits, requiring negotiation and adherence.

Legal frameworks surrounding corporate governance and securities are critical for Lundbergs, dictating transparency and investor protection. Swedish and EU regulations, including disclosure requirements, are fundamental to maintaining trust and operational legitimacy. In 2024, the ongoing refinement of EU corporate governance directives continues to influence reporting standards and board responsibilities across member states.

Environmental factors

Sweden's commitment to achieving net-zero greenhouse gas emissions by 2045, a target aligned with the broader European Union's Green Deal, directly impacts Lundbergs. This regulatory landscape compels the company to actively invest in sustainable technologies and reduce the carbon intensity of its industrial and real estate holdings.

For instance, the EU's emissions trading system (ETS) is a key driver. As of early 2024, carbon prices within the ETS have fluctuated but remained significant, creating a direct financial incentive for companies like Lundbergs to lower their emissions. This means increased operational costs for carbon-intensive activities and a push towards energy efficiency and renewable energy sources across its diverse portfolio.

The growing emphasis on resource management and circular economy principles directly impacts Holmen's core businesses. For instance, in 2023, Holmen reported a significant portion of its wood raw material came from sustainably managed forests, aligning with these environmental pressures. This trend necessitates a continued focus on maximizing material reuse and minimizing waste throughout their forestry and packaging value chains.

Holmen's commitment to biodiversity and ecosystem services is paramount, influenced by increasing public scrutiny and stricter regulations. The company recognizes that preserving healthy forest ecosystems is fundamental to ensuring a sustainable timber supply and safeguarding its corporate image. For instance, in 2024, Holmen reported that 90% of its forest land was certified by FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification), demonstrating adherence to rigorous environmental standards.

Sustainable Building and Green Certifications

Lundbergs, via its real estate arm Hufvudstaden, is navigating a growing market imperative for sustainable buildings and green certifications. This trend directly impacts property development and management, pushing for higher energy efficiency, the use of eco-friendly materials, and a minimized environmental footprint. These factors are becoming key drivers for enhancing market value and attracting a discerning tenant base increasingly focused on environmental responsibility.

The push for sustainability is translating into tangible market advantages. For instance, buildings achieving certifications like LEED or BREEAM often command higher rental rates and experience lower vacancy periods. In 2024, the global green building market was valued at approximately $1.5 trillion, with a projected compound annual growth rate (CAGR) of over 10% through 2030, indicating a strong and sustained demand. Hufvudstaden's commitment to these principles can therefore be a significant competitive differentiator.

Key considerations for Lundbergs in this environmental factor include:

- Increased tenant demand: Environmentally conscious businesses and individuals are actively seeking properties with strong sustainability credentials.

- Regulatory pressures: Evolving building codes and environmental regulations worldwide are increasingly mandating higher standards for energy efficiency and material sourcing.

- Operational cost savings: Investments in energy-efficient systems and sustainable materials can lead to reduced long-term operating costs for both Hufvudstaden and its tenants.

ESG Reporting and Transparency Demands

New and stricter ESG reporting requirements, like the EU's Corporate Sustainability Reporting Directive (CSRD), are now in effect for many large companies. This means Lundbergs and its significant subsidiaries must offer detailed information about their environmental impact. For instance, the CSRD mandates reporting on climate change, biodiversity, and resource use, with the first wave of companies reporting for the 2024 financial year.

This push for greater transparency necessitates robust data collection and reporting systems. Companies are investing in technology and processes to accurately track and disclose their ESG performance. The increased scrutiny means stakeholders, including investors and customers, expect clear and verifiable data on environmental matters, a trend that will only intensify in 2025.

- Increased Disclosure: CSRD requires detailed reporting on environmental metrics, impacting companies like Lundbergs.

- Data System Investment: Companies must enhance data collection and reporting capabilities to meet new standards.

- Stakeholder Expectations: Investors and consumers demand greater transparency on environmental performance.

- 2024/2025 Impact: First reporting cycles under CSRD are underway, setting a precedent for the near future.

Environmental factors significantly shape Lundbergs' operational landscape, driven by Sweden's and the EU's ambitious climate goals. The increasing demand for green buildings, exemplified by the global market's substantial growth, directly influences Hufvudstaden's real estate strategy, pushing for energy efficiency and eco-friendly materials to enhance property value and tenant appeal.

Stricter ESG reporting mandates, such as the EU's CSRD now in effect for 2024 reporting, compel Lundbergs and its subsidiaries to enhance transparency regarding their environmental impact, necessitating investments in robust data systems to meet heightened stakeholder expectations for verifiable environmental performance.

| Factor | Impact on Lundbergs | Example/Data Point |

|---|---|---|

| Net-Zero Targets | Drives investment in sustainable technologies and emission reduction across holdings. | Sweden's 2045 net-zero target. |

| Emissions Trading System (ETS) | Creates financial incentives for emission reduction, potentially increasing operational costs for carbon-intensive activities. | Significant carbon prices in the EU ETS as of early 2024. |

| Circular Economy Principles | Necessitates focus on material reuse and waste minimization in businesses like Holmen. | Holmen sourced a significant portion of wood from sustainably managed forests in 2023. |

| Biodiversity & Ecosystem Services | Requires adherence to strict environmental standards to ensure sustainable resource supply and corporate image. | 90% of Holmen's forest land certified by FSC/PEFC in 2024. |

| Green Building Demand | Encourages Hufvudstaden to adopt sustainable building practices, leading to higher rental rates and lower vacancies. | Global green building market valued at ~$1.5 trillion in 2024, with a projected CAGR >10%. |

| ESG Reporting (CSRD) | Requires detailed environmental impact disclosures, necessitating improved data collection and reporting. | First CSRD reporting cycles for 2024 financial year are underway. |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a comprehensive blend of official government publications, international economic reports, and reputable industry-specific research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape.