Lundbergs Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lundbergs Bundle

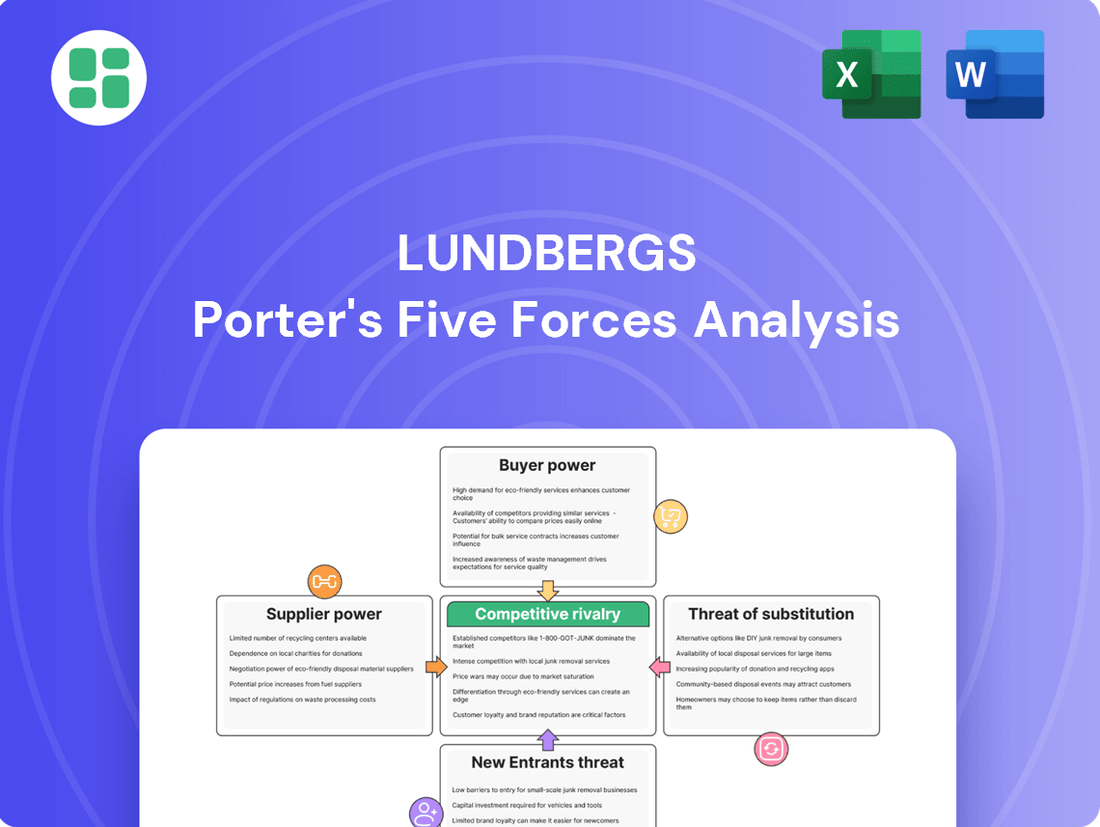

Lundbergs's Porter's Five Forces Analysis reveals a complex competitive landscape, highlighting the significant bargaining power of buyers and the moderate threat of substitute products. Understanding these dynamics is crucial for navigating their market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Lundbergs’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Lundbergs, as an investment company, depends on capital providers like banks, bondholders, and shareholders to finance its growth. Its ability to secure this capital is influenced by its strong financial health, reflected in its A+/stable credit rating from Standard & Poor's. This rating indicates a lower risk for lenders and investors, potentially leading to more favorable terms.

The cost and availability of capital are also shaped by broader economic factors, such as interest rates and the overall health of the financial markets. For instance, Sweden's investment market is projected to grow by 10% in 2025, suggesting a potentially robust domestic capital base that Lundbergs can tap into, facilitating its investment strategies.

Lundberg's portfolio companies regularly utilize professional services like legal counsel, M&A advisory, and auditing. The bargaining power of these suppliers can be significant, especially when specialized knowledge is required or during periods of high demand for consulting. For instance, in 2024, the demand for specialized legal and financial advisory services related to complex cross-border transactions remained robust, potentially increasing supplier leverage.

To counter this, Lundberg focuses on cultivating long-term relationships with key service providers and maintaining a diverse network. This approach helps secure favorable terms and ensures access to expertise, thereby mitigating the potential for excessive cost increases or service disruptions from these critical suppliers.

The bargaining power of suppliers, particularly concerning the talent pool for management, presents a significant consideration for Lundbergs. Securing top-tier executive talent and experienced board members is vital for both Lundbergs and its portfolio companies like Hufvudstaden and Holmen to foster long-term value creation.

A competitive talent market, especially for specialized industrial or real estate expertise, can indeed escalate the costs and challenges associated with attracting and retaining essential personnel. This dynamic directly impacts operational efficiency and strategic execution across Lundbergs' diverse holdings.

Given Lundbergs' active ownership model, the reliance on skilled leadership to effectively drive growth and profitability is paramount. The ability to secure and maintain a high-caliber management team directly influences the success of its investment strategy and the performance of its subsidiaries.

Sellers of Target Companies/Assets

When Lundbergs looks to acquire new companies or real estate, the sellers of these assets wield considerable influence, particularly when the target is a desirable, high-quality business. This is especially true in a market where demand for prime assets is high.

The real estate market's rebound and the shrinking difference in price expectations between buyers and sellers, observed in early 2025, point to a more challenging environment for acquisitions. This means sellers are in a stronger position to negotiate terms.

Transaction volumes in the Nordic real estate sector saw a notable increase in 2024 and continued this trend into 2025. This heightened activity suggests a seller's market, where those looking to sell attractive properties are likely to achieve favorable outcomes.

- Seller Influence: Sellers of target companies and assets possess significant bargaining power, especially for premium businesses.

- Market Dynamics: A recovering real estate cycle and narrowing price gaps in early 2025 indicate a more competitive seller's market.

- Transaction Trends: Increased Nordic real estate transactions in 2024 and 2025 underscore a favorable environment for sellers of sought-after assets.

Raw Material and Energy Suppliers (for portfolio companies)

For Lundberg's industrial holdings, such as Holmen, the bargaining power of raw material and energy suppliers is a critical factor. The cost and consistent availability of essential inputs like wood pulp and chemicals directly influence the profitability of its forest products and packaging businesses. When global commodity markets experience volatility, suppliers can wield significant leverage, dictating terms and impacting margins.

Holmen's financial performance in 2024 serves as a clear illustration of this dynamic. The company's operating profit was notably affected by shifts in paper prices and fluctuations in energy income. These events underscore how external factors, largely controlled by suppliers, can directly shape the financial outcomes of portfolio companies.

- Impact on Profitability: Fluctuations in the price and availability of raw materials and energy directly affect the cost of goods sold for industrial holdings.

- Supplier Leverage: Volatility in global commodity and energy markets grants suppliers increased bargaining power, allowing them to influence pricing and terms.

- 2024 Performance Example: Holmen's operating profit in 2024 was impacted by lower paper prices and changes in energy income, demonstrating supplier influence.

The bargaining power of suppliers for Lundbergs' industrial operations, particularly for raw materials and energy, is a key consideration. For instance, Holmen's 2024 results were significantly influenced by shifts in paper prices and energy income, highlighting the impact suppliers have on profitability.

In 2024, global energy prices saw considerable volatility, which directly empowered energy suppliers. Similarly, the forest products sector experienced fluctuating pulp prices, giving pulp suppliers more leverage over companies like Holmen.

This supplier leverage can lead to increased costs for Lundbergs' portfolio companies, potentially squeezing profit margins if these costs cannot be passed on to customers.

| Input Material/Service | Supplier Bargaining Power Factor (2024/Early 2025) | Impact on Lundbergs' Holdings (e.g., Holmen) |

|---|---|---|

| Energy | High due to global price volatility and geopolitical factors | Increased operating costs, potential margin pressure |

| Wood Pulp | Moderate to High, influenced by global demand and supply chain disruptions | Affects cost of goods sold for paper and packaging segments |

| Specialized Legal/Financial Services | High due to demand for complex transactions and expertise | Potential for higher service fees, impacting administrative costs |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Lundbergs' specific industry positions.

Effortlessly identify and quantify competitive threats with a visual, interactive dashboard that simplifies complex market dynamics.

Customers Bargaining Power

For Hufvudstaden, the bargaining power of tenants is a significant factor, influenced by the specific property type and its location. In 2024, prime office spaces in central business districts continue to see strong demand, limiting tenant leverage. However, properties in less desirable areas or those requiring modernization may experience higher vacancy rates, giving tenants more room to negotiate lease terms.

The office market is anticipated to reach a more balanced state by 2025 as the sector adapts to evolving work trends, which could temper the current tenant advantage. For example, in Q1 2024, Hufvudstaden reported a vacancy rate of 8.5% for its office properties, a slight increase from the previous year, indicating some shift in tenant negotiation power.

Holmen's customers, mainly industrial businesses buying paperboard, paper, and wood, have significant bargaining power. This power is shaped by how much competition exists and the overall global demand for these products. For instance, the decline in paper prices during 2024 directly affected Holmen's operating profit, highlighting how sensitive customers are to pricing and the intense competition in the packaging sector.

Furthermore, customers are increasingly demanding sustainable packaging solutions. This growing trend means that environmental considerations are becoming a key factor in their purchasing decisions, giving them more leverage when choosing suppliers like Holmen.

The bargaining power of customers for Lundbergs, as an investment company, primarily rests with its shareholders, both institutional and retail. These investors wield influence through their decisions to buy, hold, or sell Lundbergs shares, directly impacting its valuation and access to capital. In 2023, Lundbergs reported a net asset value per share of SEK 590, a key metric closely monitored by these stakeholders.

Lundbergs strives to deliver attractive returns to its shareholders, aiming for dividend growth that outpaces market expectations. This commitment is crucial as shareholders can shift their capital to other investment opportunities if Lundbergs' performance falters. For instance, the company's dividend per share for 2023 was SEK 5.00, reflecting its strategy to reward its investor base.

End-users of Industrial Products (other holdings)

For Lundbergs' other industrial holdings, the bargaining power of end-users is a significant factor, especially in competitive sectors where alternatives are plentiful. Companies must remain attuned to customer demand and evolving market trends to safeguard profitability and market share. Lundbergs' active ownership strategy is geared towards fostering growth and enhancing profitability across its varied portfolio.

The bargaining power of customers can be amplified when they purchase in large volumes, as this gives them leverage to negotiate better prices. For instance, in the B2B industrial sector, a major client can significantly influence a supplier's pricing structure and terms.

- Customer Concentration: If a few large customers account for a substantial portion of sales, their individual bargaining power increases.

- Availability of Substitutes: When customers have numerous alternative suppliers or products, their ability to switch and demand lower prices grows.

- Low Switching Costs: If it is easy and inexpensive for customers to change suppliers, their bargaining power is enhanced.

- Price Sensitivity: Customers who are highly sensitive to price will exert more pressure on suppliers to offer competitive rates.

Partners in Co-investments or Joint Ventures

Lundbergs' ability to form co-investments or joint ventures means partners hold significant bargaining power. This power stems from their capital, specialized knowledge, or strategic value to Lundbergs, especially for substantial real estate or infrastructure ventures. Attracting capable partners is crucial for growth and risk management.

In the first half of 2025, Lundbergs saw a notable increase in both debt and equity issuance. This trend highlights a more favorable financing environment, improving access to capital for potential co-investment and joint venture opportunities.

- Capital Contribution: Partners contributing substantial capital can negotiate more favorable terms in joint ventures.

- Expertise and Strategic Importance: Unique skills or market access offered by a partner can enhance their bargaining leverage.

- Financing Conditions (H1 2025): Improved debt and equity markets in early 2025 likely eased capital acquisition for partnerships, potentially influencing negotiation dynamics.

For Lundbergs' industrial holdings, the bargaining power of customers is a key consideration, especially in sectors with many alternatives. When customers buy in large volumes, their ability to negotiate better prices and terms increases significantly. This is particularly evident in business-to-business transactions where a major client can heavily influence a supplier's pricing strategy.

The availability of substitutes and low switching costs further empower customers, allowing them to exert pressure for competitive rates. For example, a customer in the packaging sector might easily switch to a different supplier if Holmen's pricing is not competitive, as noted by the impact of paper price declines on Holmen's 2024 profits.

Customer concentration, where a few large buyers represent a significant portion of sales, directly amplifies their individual bargaining power. This dynamic necessitates that companies like those within Lundbergs' portfolio remain highly attuned to customer demands and market shifts to maintain profitability and market share.

Preview Before You Purchase

Lundbergs Porter's Five Forces Analysis

This preview showcases the complete Lundbergs Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

Lundbergs faces robust competition from other major Swedish investment firms like Investor AB and Kinnevik. These entities also pursue long-term value creation by actively managing diversified portfolios, creating a crowded field for prime investment targets.

The rivalry extends to securing capital and attracting top talent, as all major players aim to enhance shareholder value through strategic acquisitions and operational improvements. For instance, Investor AB reported a total return of 18% in 2023, showcasing the performance benchmarks Lundbergs must meet.

Lundbergs differentiates itself by highlighting its enduring commitment to long-term, active ownership, a strategy designed to foster sustainable growth and competitive advantage against peers who may adopt different investment philosophies.

The competition among private equity firms and institutional investors for attractive acquisition targets is fierce, as these entities constantly vie for similar companies and assets. This dynamic was evident in the Nordic real estate market, which saw a notable recovery and increased transaction volumes in 2024 and into 2025, signaling heightened competition for prime properties.

This elevated competition can lead to inflated asset prices, consequently compressing the potential returns for investors. For instance, in 2024, several major Nordic real estate deals saw significant oversubscription, pushing valuations beyond initial expectations.

Lundbergs' portfolio companies operate in diverse sectors, meaning competitive rivalry is a significant factor influencing their individual profitability and, by extension, Lundbergs' overall performance. For instance, Holmen, a key holding, navigates the competitive global packaging and forest products industry. This sector is shaped by evolving sustainability demands and rapid technological innovation, impacting pricing power and market share.

Hufvudstaden, Lundbergs' real estate arm, faces competition within the Swedish property market. The intensity of this rivalry varies considerably across different regions and property segments. In 2024, the Swedish real estate market experienced fluctuating demand and rental growth rates, directly affecting Hufvudstaden's ability to secure and retain tenants, and thus its revenue streams.

Access to Capital and Financing

Investment companies frequently compete for the most advantageous financing terms from banks and capital markets, a key element of competitive rivalry. Lundbergs' robust credit rating, standing at A+/stable as of early 2024, significantly enhances its ability to secure less expensive borrowing and maintain effective access to money and bond markets. This strong financial standing positions Lundbergs favorably against competitors who may face higher borrowing costs or more restricted access to capital.

While Lundbergs benefits from its creditworthiness, the broader financing landscape and prevailing market risk appetite still shape competitive dynamics. For instance, during periods of economic uncertainty, overall financing conditions can tighten, making it more challenging for all players to access capital, regardless of individual credit quality. The availability and cost of capital are therefore ongoing factors that influence the competitive intensity within the investment sector.

Key aspects of capital access and financing competition include:

- Favorable Borrowing Costs: Lundbergs' A+/stable rating in 2024 allows it to secure loans and issue bonds at lower interest rates compared to companies with weaker credit profiles, directly impacting profitability and investment capacity.

- Market Access and Liquidity: The ability to tap into money and bond markets efficiently is crucial. Lundbergs' established presence and strong credit rating facilitate smoother and more cost-effective access to these vital capital sources.

- Economic Sensitivity: Broader market conditions, such as changes in central bank policy or investor sentiment, can affect the cost and availability of capital for all companies, creating a dynamic competitive environment.

Talent Acquisition and Retention

Lundbergs faces significant competitive rivalry in attracting and retaining top-tier management and specialized talent across its varied portfolio companies. This is crucial for effectively navigating complex investment landscapes and fostering operational enhancements within its holdings.

The competition for skilled professionals capable of managing diverse assets and driving performance is intense. For instance, in 2024, the global shortage of experienced private equity professionals continued, with average compensation packages for senior investment professionals seeing increases of 10-15% in key markets.

Lundbergs' established reputation for long-term value creation and stability serves as a distinct advantage in this talent war. Companies with strong track records and a clear vision often find it easier to draw and keep the best minds, especially when compared to less established or more volatile investment firms.

- Talent Competition: Investment firms vie for management and specialized professionals to oversee complex portfolios and implement strategic improvements.

- Market Dynamics: In 2024, the demand for experienced investment talent outstripped supply, leading to increased compensation and benefits packages.

- Lundbergs' Advantage: A strong reputation for long-term value creation enhances Lundbergs' ability to attract and retain high-caliber individuals.

Lundbergs operates in a highly competitive environment with established Swedish investment firms like Investor AB and Kinnevik, all vying for similar investment opportunities and talent. This intense rivalry means that Lundbergs must consistently demonstrate strong performance, as evidenced by Investor AB's 18% total return in 2023, to maintain its market position.

The competition extends to securing capital, where Lundbergs' strong A+/stable credit rating as of early 2024 provides a distinct advantage in obtaining favorable borrowing costs compared to less creditworthy peers. This financial strength is crucial in a market where access to capital can significantly impact investment capacity and overall returns.

Furthermore, Lundbergs' portfolio companies, such as Holmen in the forest products sector and Hufvudstaden in real estate, face their own industry-specific competitive pressures. For example, the Nordic real estate market saw increased transaction volumes and competition for prime properties in 2024, impacting valuations and potential investor returns.

SSubstitutes Threaten

Investors have various alternatives to Lundbergs, including direct investments in other industrial or real estate companies, or even private equity funds. For instance, in 2024, the European private equity market saw significant activity, with over €1.2 trillion in assets under management, offering a different liquidity profile compared to listed equities.

The appeal of these substitutes hinges on their risk-adjusted returns and how easily investors can access their capital. Lundbergs' strategy to deliver a competitive total return, aiming to exceed market expectations, is crucial for retaining its investor base against these alternatives.

The increasing adoption of remote and hybrid work models poses a significant substitute threat to traditional office spaces, potentially affecting Hufvudstaden's commercial property holdings. As businesses re-evaluate their spatial needs, they may opt for smaller office footprints or more flexible leasing arrangements, reducing overall demand for conventional office leases.

Despite this trend, Stockholm's office commuting figures have shown resilience, returning to over 80% of pre-pandemic levels as of early 2024. This suggests that while the market is adapting, prime office locations and well-equipped spaces still hold considerable appeal for many businesses, mitigating the full impact of substitute solutions.

Holmen, operating in the packaging and forest products sector, confronts a notable threat from substitute materials such as plastics, glass, and metals. These alternatives often compete on cost, performance, or perceived environmental benefits, directly impacting demand for Holmen's wood-based packaging solutions.

The industry is witnessing a significant shift towards more sustainable options, including biodegradable and compostable materials, alongside a trend for minimalist packaging designs. This evolving consumer and regulatory preference necessitates that Holmen actively innovate and adapt its product portfolio to maintain its market position against these emerging alternatives.

Direct Investment in Portfolio Sectors

Investors might bypass Lundbergs as a holding company and instead choose to invest directly in companies within its core sectors, such as real estate or forest products. For instance, instead of holding Lundbergs' shares, an investor could directly purchase stock in a publicly traded real estate developer or a major paper and pulp manufacturer. This approach offers a more focused exposure to specific industries, potentially allowing for greater control over individual company performance and sector allocation.

This direct investment strategy acts as a substitute threat because it provides an alternative avenue for capital allocation without the intermediary of Lundbergs. Investors can gain exposure to the underlying assets and growth potential of these industries independently. For example, as of early 2024, the real estate sector's performance is heavily influenced by interest rate movements, and investors can track and invest in specific REITs or developers based on their outlook for this factor, rather than relying on Lundbergs' diversified approach.

- Direct Sector Investment: Investors can opt to buy shares in individual companies within Lundbergs' portfolio, such as real estate firms like Castellum or forest product companies like Holmen, bypassing the holding company structure.

- Targeted Exposure: This allows for more precise control over sector allocation and direct correlation with the performance of specific industries, rather than benefiting from Lundbergs' diversified holdings.

- Bypassing Active Ownership: While Lundbergs leverages active ownership and strategic influence, direct investors can achieve similar outcomes by selecting and managing individual company investments themselves.

- Alternative Valuation: Investors can perform their own valuations on individual companies, potentially identifying opportunities that might be diluted or less apparent within a diversified holding company's overall valuation.

Passive Investment Strategies

The increasing popularity of passive investment vehicles like exchange-traded funds (ETFs) and index funds presents a notable substitute threat to actively managed investment firms. These passive options provide investors with diversified market exposure at significantly lower expense ratios, potentially drawing capital away from traditional active management. For instance, by the end of 2023, assets under management in global ETFs surpassed $11 trillion, a testament to their growing appeal.

Lundbergs, as an investment company that historically relies on an active management approach, faces this substitute threat directly. Investors may opt for the simplicity and cost-effectiveness of passive strategies, especially if they perceive less value in active stock selection or portfolio management. This shift in investor preference can impact the demand for Lundbergs' services if its performance and fee structure are not competitive relative to passive alternatives.

- Substitute Threat: Passive investment strategies like index funds and ETFs offer a compelling alternative to actively managed funds.

- Key Differentiator: Passive strategies typically boast lower fees and provide broad market exposure, appealing to cost-conscious investors.

- Market Trend: Global ETF assets exceeded $11 trillion by the end of 2023, highlighting the significant growth and adoption of passive investing.

- Lundbergs' Response: Lundbergs aims to counter this threat by emphasizing its consistent dividend growth and long-term total return, showcasing the value proposition of its active management approach.

For Lundbergs, the threat of substitutes primarily comes from investors choosing alternative investment vehicles or direct investments in specific sectors. This means investors might bypass Lundbergs as a holding company and instead invest directly in companies within its core sectors, such as real estate or forest products, seeking more focused exposure and control over their investments.

The appeal of these substitutes is driven by factors like risk-adjusted returns and accessibility. For instance, in 2024, the European private equity market managed over €1.2 trillion in assets, offering a different liquidity profile compared to listed equities, which can be attractive to certain investor segments.

Furthermore, the rise of passive investment strategies like ETFs and index funds, which had over $11 trillion in global assets under management by the end of 2023, presents a cost-effective alternative to Lundbergs' active management approach.

Lundbergs counters this by highlighting its consistent dividend growth and long-term total return, aiming to demonstrate the unique value of its active ownership and strategic influence in its portfolio companies.

Entrants Threaten

While establishing a broad-portfolio investment company like Lundbergs faces significant hurdles due to capital requirements, a proven track record, and established industry connections, the threat of new entrants isn't negligible. Niche players or well-funded family offices could target specific, high-growth sectors within the Nordic region, such as real estate or industrial assets, to gain a foothold.

The Swedish investment market's projected growth in 2025 is a key factor that could lure new participants. For instance, the Swedish private equity market saw significant activity in 2023, with deal volumes indicating a healthy appetite for new investment opportunities, potentially encouraging new firms to enter.

International private equity and institutional investors are increasingly eyeing Nordic markets due to their perceived economic stability and promising growth outlook. This heightened interest from foreign capital can significantly ramp up competition for investment opportunities, potentially leading to inflated asset valuations across various sectors.

For instance, foreign investment in the Nordic and Baltic real estate sector has experienced notable shifts, yet the overall availability of capital from international sources remains robust, indicating a continued appetite for these markets.

Disruptive financial technology platforms represent a growing threat by lowering entry barriers. For instance, in 2024, the global fintech market was valued at over $2.1 trillion, demonstrating significant growth and innovation.

These platforms can enable direct investment in previously inaccessible asset classes like private equity or real estate, bypassing traditional intermediaries. This shift could redirect capital away from established players like Lundbergs if they don't adapt.

While not directly challenging Lundbergs' core industrial holdings, the increasing efficiency and accessibility of capital markets through fintech could alter the broader competitive landscape for investment and capital allocation.

Expansion of Existing Smaller Players

Smaller, specialized investment firms or private property companies in Sweden could expand, potentially challenging established entities like Lundbergs. This expansion might occur through organic growth or strategic mergers and acquisitions. The competitive landscape is dynamic, with consolidation trends observed in various sectors.

M&A activity within industries such as packaging, which saw significant consolidation in 2024 and is projected to continue into 2025, exemplifies this trend. Such consolidations can lead to the emergence of larger, more formidable competitors that may possess greater resources and market influence.

- Increased Competition: Emerging or expanding smaller players can intensify competition for market share and capital.

- Market Fragmentation: A fragmented market with many growing smaller entities can dilute the dominance of larger incumbents.

- Acquisition Targets: These smaller firms might also become attractive acquisition targets for larger entities, altering the competitive structure.

Regulatory Changes Lowering Entry Barriers

While the investment sector generally faces high regulatory hurdles, future changes that relax capital requirements or streamline investment product creation could indeed lower entry barriers for new competitors. For instance, a hypothetical reduction in minimum capital for certain investment advisory licenses could attract smaller, agile firms.

However, Lundbergs' extensive operational history, robust corporate governance framework, and substantial financial strength act as a powerful deterrent. In 2024, Lundbergs' equity amounted to SEK 24.2 billion, demonstrating a financial solidity that new entrants would struggle to match, thereby maintaining a significant competitive moat.

- Regulatory shifts could ease entry for new investment firms by reducing capital requirements.

- Lundbergs' long-standing history and established governance create a significant competitive advantage.

- The company's strong financial position, evidenced by SEK 24.2 billion in equity in 2024, deters new entrants.

The threat of new entrants for Lundbergs remains moderate, primarily due to the substantial capital and established reputation required to compete effectively in the broad-portfolio investment space. However, the increasing accessibility of capital markets through fintech and growing interest from international investors in stable Nordic economies present avenues for new, albeit specialized, players to emerge.

The Swedish private equity market's continued activity, with deal volumes showing a healthy appetite for investment in 2023, suggests that new firms might be encouraged to enter, particularly in niche sectors like real estate. Furthermore, the global fintech market's valuation exceeding $2.1 trillion in 2024 highlights how technological advancements can lower traditional entry barriers, potentially enabling new entities to offer alternative investment channels.

Despite these potential inroads, Lundbergs' considerable financial strength, evidenced by SEK 24.2 billion in equity in 2024, and its long-standing operational history and robust governance framework serve as significant deterrents for would-be competitors seeking to challenge its established market position.

| Factor | Impact on New Entrants | Lundbergs' Countermeasures |

|---|---|---|

| Capital Requirements | High barrier, requiring substantial initial investment. | Lundbergs' significant equity (SEK 24.2 billion in 2024) deters those with less capital. |

| Industry Reputation & Track Record | New entrants lack established trust and proven success. | Lundbergs benefits from a long operational history and established corporate governance. |

| Fintech Advancements | Lower entry barriers for specialized or digitally-native firms. | Lundbergs must adapt to evolving investment platforms to maintain competitiveness. |

| International Investor Interest | Increased competition for assets in stable Nordic markets. | Lundbergs' deep local knowledge and relationships offer an advantage. |

Porter's Five Forces Analysis Data Sources

Our Lundbergs Porter's Five Forces analysis leverages a comprehensive mix of data, including publicly available financial statements, industry-specific market research reports, and expert analyst commentary to provide a robust understanding of competitive dynamics.