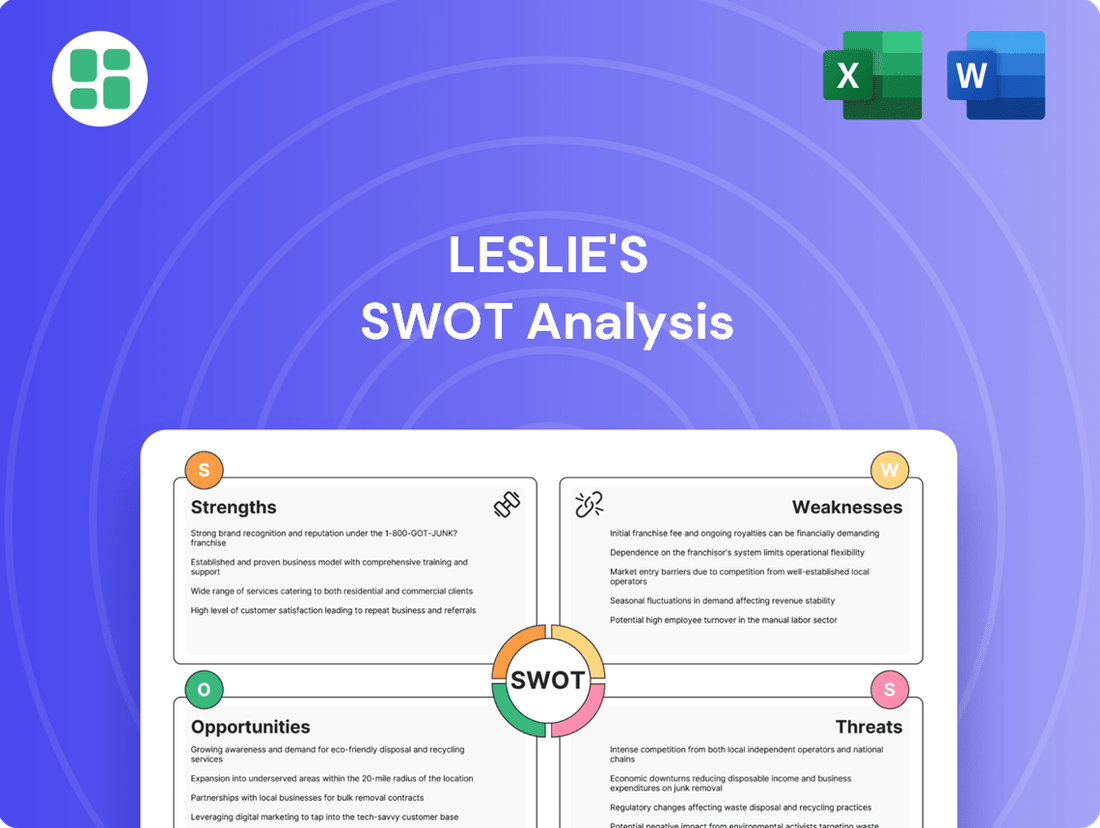

Leslie's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leslie's Bundle

Leslie's, a dominant force in the pool and spa industry, leverages its extensive retail footprint and strong brand recognition as key strengths. However, the company faces potential threats from economic downturns impacting discretionary spending and increasing competition from online retailers.

Want the full story behind Leslie's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Leslie's, Inc. stands as the undisputed leader in the U.S. pool and spa care market, a position solidified by its status as the largest direct-to-consumer brand. This commanding presence, built since 1963, translates into substantial brand equity and deep customer loyalty, giving it a significant edge over competitors.

The company's enduring legacy and recognized expertise cultivate a high degree of consumer trust, making Leslie's the preferred choice for pool and spa maintenance solutions. This established reputation is a powerful asset, driving consistent demand and reinforcing its market dominance.

Leslie's boasts an extensive omnichannel presence, seamlessly integrating over 1,000 physical retail locations with a strong digital platform. This allows customers to engage and shop on their terms, whether online or in-store, offering unparalleled convenience and broad market reach.

Leslie's boasts a comprehensive product and service portfolio, featuring a wide array of chemicals, equipment, and parts, many of which are exclusive to the brand. This extensive selection addresses nearly all pool and spa maintenance needs.

The company's strength lies not only in its product breadth but also in its integrated service offerings, including essential maintenance and repair work. This dual focus allows Leslie's to be a one-stop shop for customers, fostering loyalty and recurring revenue streams.

For the fiscal year 2023, Leslie's reported net sales of $1.06 billion, underscoring the market's demand for its extensive product and service range.

Strong Professional (Pro) Segment Focus

Leslie's has demonstrated a clear and consistent growth trajectory by strategically prioritizing its Professional (Pro) segment. This dedicated focus has resulted in the Pro pool sales segment consistently outperforming overall company sales, highlighting its importance to Leslie's financial health.

The company is effectively utilizing its extensive store network to deepen engagement with professional pool service technicians and builders. This proactive approach is proving successful in capturing a significant share of this crucial market segment.

- Pro Segment Outperformance: Leslie's Pro segment sales growth has outpaced total company sales, indicating strong demand and successful market penetration.

- Leveraging Store Footprint: The company is actively using its physical stores as hubs to enhance service and product offerings for professional customers.

- Stable Revenue Stream: The emphasis on pool professionals provides Leslie's with a reliable and expanding source of revenue, contributing to overall business stability.

Proprietary Water Testing Technology (AccuBlue)

Leslie's proprietary AccuBlue water testing technology offers a significant competitive advantage. This commercial-grade in-store system provides complimentary water analysis, driving customer engagement and loyalty. By offering expert advice and personalized product recommendations based on these tests, Leslie's effectively differentiates itself from competitors, encouraging repeat business and enhancing customer satisfaction.

The AccuBlue system is a key driver for improved business outcomes. It directly contributes to higher conversion rates by enabling staff to offer precise solutions to customer water quality issues. For instance, in fiscal year 2023, Leslie's reported that approximately 90% of its customers utilized their in-store water testing services, underscoring the technology's widespread adoption and impact on customer interaction.

- Proprietary Technology: AccuBlue provides a unique, in-house water testing solution.

- Customer Engagement: Complimentary testing fosters interaction and builds relationships.

- Sales Driver: Tailored recommendations based on test results increase conversion rates.

- Competitive Differentiation: Sets Leslie's apart from general retailers and online competitors.

Leslie's market leadership is built on a strong foundation of brand recognition and customer loyalty, cultivated over decades. Its extensive omnichannel presence, combining over 1,000 physical stores with a robust digital platform, offers unparalleled convenience and broad market reach. The company's comprehensive product and service portfolio, including exclusive items and essential maintenance, positions it as a one-stop shop.

The company's proprietary AccuBlue water testing technology is a significant differentiator, driving customer engagement and sales. In fiscal year 2023, approximately 90% of customers utilized this complimentary in-store service, highlighting its effectiveness in fostering loyalty and providing tailored solutions.

Leslie's strategic focus on its Professional (Pro) segment is yielding strong results, with Pro sales consistently outperforming overall company growth. The company is effectively leveraging its store network to engage with pool service technicians and builders, capturing a significant share of this crucial market. For fiscal year 2023, Leslie's reported net sales of $1.06 billion, reflecting the robust demand for its offerings.

What is included in the product

Delivers a strategic overview of Leslie's’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats to inform its market position and future growth.

Offers a clear, organized framework to identify and address critical business challenges.

Weaknesses

Leslie's has faced substantial financial challenges recently. In the second quarter of fiscal year 2025, sales dropped by 6.1% year-over-year, and gross profit saw an even sharper decline of 19.1%.

These figures highlight a significant struggle to maintain revenue momentum and profitability. The company also reported widening net and adjusted net losses, a direct consequence of operational deleverage and shrinking gross margins.

This trend suggests that Leslie's is encountering difficulties in growing its sales and preserving profitability in the current market environment, indicating potential issues with pricing power or cost management.

Leslie's carries substantial funded debt, a persistent concern for the company. S&P Global Ratings forecasts adjusted leverage to hover in the mid-5x range through fiscal 2025, indicating a continued high level of indebtedness.

Recent credit rating downgrades from both Moody's and S&P Global Ratings underscore the company's weaker business outlook and elevated leverage. These downgrades signal increased financial risk, potentially impacting borrowing costs and access to capital.

The significant debt burden inherently restricts Leslie's financial flexibility. This constraint can limit the company's capacity for new investments, strategic acquisitions, or weathering economic downturns, potentially hindering future growth opportunities.

Leslie's financial performance is significantly exposed to unpredictable weather. For instance, the unusually cold weather experienced in Q2 fiscal 2025 directly impacted store traffic and sales, highlighting this vulnerability.

This reliance on favorable weather for crucial peak season sales introduces considerable volatility and uncertainty into Leslie's revenue projections and overall operational strategies.

Impact of Macroeconomic Conditions

Ongoing macroeconomic challenges, such as persistent inflationary pressures and elevated interest rates, are significantly dampening consumer discretionary spending. This directly impacts Leslie's sales performance, especially for higher-priced and non-essential goods, as consumers adopt a more cautious approach to their outlays. The broader economic climate continues to present hurdles for the company's recovery trajectory.

For instance, the U.S. Consumer Price Index (CPI) saw an increase of 3.4% year-over-year in April 2024, indicating continued inflation. Concurrently, the Federal Reserve's benchmark interest rate remains in the 5.25%-5.50% range, making borrowing more expensive for consumers and businesses alike. This environment directly translates to reduced demand for Leslie's product categories.

- Inflationary Headwinds: Continued high inflation erodes purchasing power, forcing consumers to prioritize essentials over discretionary items sold by Leslie.

- Interest Rate Sensitivity: Higher interest rates increase the cost of financing for consumers, particularly impacting sales of larger, more expensive products.

- Consumer Confidence Decline: Economic uncertainty often leads to lower consumer confidence, resulting in delayed or reduced spending on non-essential goods.

Operational and Management Challenges

Leslie's has experienced significant leadership turnover, with multiple executive changes in recent years, signaling potential instability and ongoing strategic realignments. This transformation journey, while aimed at enhancing efficiency and customer focus, inherently points to pre-existing operational hurdles and difficulties in cost management. For instance, the company's operating expenses as a percentage of revenue have seen fluctuations, indicating challenges in achieving consistent cost control during this period of change.

The necessity for a comprehensive 'transformation journey' suggests that Leslie's faces inherent inefficiencies in its current operational framework. These challenges likely impede the company's ability to drive consistent year-over-year growth and effectively manage its cost structure. For example, in fiscal year 2023, Leslie's reported a decline in gross profit margin, underscoring the pressure on operational efficiency.

Key weaknesses in Leslie's operational and management structure are evident. These include:

- Leadership Instability: Frequent executive departures create a lack of continuity and can disrupt strategic execution.

- Underlying Inefficiencies: The need for a major transformation highlights existing operational bottlenecks and suboptimal processes.

- Cost Management Issues: Difficulty in controlling operational costs has impacted profitability, as seen in margin pressures.

- Growth Consistency Challenges: Operational weaknesses hinder the company's ability to achieve predictable and sustainable revenue growth.

Leslie's faces significant financial strain, evidenced by a 6.1% year-over-year sales decline and a 19.1% drop in gross profit during Q2 fiscal 2025. This, coupled with widening net losses, points to difficulties in sales growth and margin preservation.

The company's substantial funded debt, with leverage projected in the mid-5x range through fiscal 2025 according to S&P Global Ratings, limits financial flexibility and increases risk. Recent downgrades from Moody's and S&P Global Ratings highlight this elevated financial risk.

Leslie's is highly susceptible to unpredictable weather patterns, which directly impact sales, as seen in Q2 fiscal 2025. This reliance introduces considerable volatility into revenue projections and operational planning.

Broader economic challenges, including 3.4% year-over-year inflation in April 2024 and the Federal Reserve's 5.25%-5.50% interest rate, dampen consumer spending on discretionary items, further pressuring Leslie's sales performance.

| Metric | Q2 FY2025 vs. Q2 FY2024 | Outlook (FY2025) |

|---|---|---|

| Sales Change | -6.1% | Challenged by economic factors |

| Gross Profit Change | -19.1% | Under pressure from costs |

| Adjusted Leverage | Mid-5x range | High indebtedness |

Full Version Awaits

Leslie's SWOT Analysis

The preview you see is the actual Leslie's SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get exactly what you expect—a professional, fully detailed report.

Opportunities

The pool and spa market is booming, with projections showing a healthy 6.6% compound annual growth rate. This expansion, moving from an estimated $20.67 billion in 2024 to $22.03 billion in 2025, is fueled by a growing emphasis on personal well-being, relaxation, and the increasing popularity of outdoor living spaces.

This favorable market trend presents a significant opportunity for Leslie's to attract new clientele and boost its sales figures. As more consumers invest in their homes and seek ways to enhance their leisure time, Leslie's is well-positioned to capitalize on this demand for pool and spa products and services.

Leslie's is enhancing its professional customer engagement by utilizing its broad store footprint, not just at dedicated pro locations, but across its entire network. This strategy allows them to reach a wider range of professional pool service providers. For instance, in fiscal year 2024, Leslie's reported a significant increase in pro sales, indicating the success of these expanded engagement efforts.

By tailoring product assortments and improving inventory management specifically for professional needs at all stores, Leslie's aims to capture a greater share of the professional market. This focus is expected to contribute to sustained revenue growth, building on the 2024 trends where the pro segment showed robust performance, outperforming the overall market.

Leslie's can seize the opportunity presented by the increasing consumer demand for smart pool technology and eco-friendly solutions. This trend, driven by a desire for convenience, sustainability, and advanced features, is a significant market driver. For instance, the global smart pool market was valued at approximately $3.5 billion in 2023 and is projected to grow substantially by 2030, indicating strong consumer adoption of these innovative products.

By expanding its product lines to include more automated systems, smart controls, and environmentally conscious chemicals, Leslie's can effectively tap into this growing segment. This strategic move not only aligns with evolving consumer preferences but also provides a clear avenue for product innovation and market differentiation, allowing Leslie's to stand out in a competitive landscape.

Enhancing Omnichannel and Delivery Capabilities

Leslie's strategic push to upgrade its omnichannel capabilities, notably through the implementation of Local Fulfillment Centers (LFCs) and the introduction of same-day delivery, offers a substantial avenue for growth. This focus on customer convenience and rapid service can significantly enhance customer retention and attract new buyers. For instance, in fiscal year 2023, Leslie's reported a 5.7% increase in comparable store sales, demonstrating the positive impact of improved customer experience initiatives.

These enhancements are crucial for solidifying Leslie's competitive edge in the direct-to-consumer (DTC) space. By offering faster and more flexible fulfillment options, the company can better compete with online retailers and meet evolving consumer expectations. The expansion of LFCs aims to reduce shipping times and costs, a key factor in customer satisfaction.

- Omnichannel Investment: Leslie's continues to invest in its digital platforms and in-store technology to create a seamless customer journey across all touchpoints.

- Delivery Speed: The rollout of same-day delivery services directly addresses the growing consumer demand for immediate product availability, a critical differentiator.

- Customer Loyalty: By improving convenience and speed, Leslie's can foster stronger customer relationships and encourage repeat purchases, boosting lifetime value.

- Market Share Growth: Enhanced delivery capabilities are expected to drive higher sales volumes and capture a larger share of the pool supply and outdoor living market.

Increased Focus on Home Improvement and Outdoor Recreation

The persistent consumer focus on enhancing home environments, particularly outdoor living spaces, presents a significant opportunity for Leslie's. This trend, amplified by post-pandemic behavioral shifts, translates into sustained demand for pool and spa installations and upgrades. For instance, the U.S. residential swimming pool market was valued at approximately $10.5 billion in 2023, with projections indicating continued growth through 2030.

This ongoing investment in residential leisure directly fuels demand for Leslie's core offerings. Homeowners are actively seeking to improve their backyards, creating a fertile ground for sales of pool chemicals, equipment, and maintenance services. Leslie's is well-positioned to capitalize on this by offering a comprehensive suite of products that cater to these evolving consumer preferences.

Leslie's can leverage this trend through several strategic avenues:

- Expanding product lines to include innovative and eco-friendly pool and spa accessories that appeal to the environmentally conscious homeowner.

- Enhancing in-store and online customer experiences to guide homeowners through upgrades and maintenance, solidifying Leslie's as a trusted resource.

- Targeted marketing campaigns highlighting the benefits of home improvement and outdoor recreation, aligning with current consumer desires.

- Partnerships with pool installation and landscaping companies to capture a broader share of the home improvement market.

The growing demand for smart pool technology and sustainable solutions presents a significant opportunity for Leslie's. The global smart pool market, valued around $3.5 billion in 2023, is expected to see substantial growth, indicating strong consumer interest in advanced, eco-friendly products. By expanding its offerings in automated systems and environmentally conscious chemicals, Leslie's can capture this expanding market segment and differentiate itself.

Threats

Leslie's operates in a highly competitive and fragmented pool and spa care market. In 2024, the industry saw continued pressure from a diverse range of competitors, including specialized retailers, large home improvement chains like Home Depot and Lowe's, and even general mass-market retailers. This broad competitive set, which includes players with significant buying power, can lead to aggressive pricing strategies that impact Leslie's margins and market share.

Leslie's faces significant threats from rising material and operating costs, a key concern in the current economic climate. Inflationary pressures are directly impacting the price of essential chemicals and pool equipment, components vital to their product offerings.

These increased input costs, coupled with higher selling, general, and administrative (SG&A) expenses, are squeezing Leslie's gross profit margins. For instance, in the first quarter of fiscal year 2024, Leslie's reported a gross margin of 33.9%, down from 35.5% in the prior year period, illustrating this margin compression.

This erosion of profitability becomes particularly challenging when combined with declining sales, as seen in their fiscal year 2023 results where same-store sales decreased by 2.1%. The dual pressure of rising expenses and falling revenue makes maintaining financial performance a considerable hurdle for the company.

The growing popularity of automated pool cleaning systems and readily available online tutorials is enabling more homeowners to handle their own pool maintenance. This DIY shift directly challenges traditional service models.

This trend could lead to a decrease in demand for Leslie's professional services and certain product lines, potentially affecting sales volume. For instance, as more consumers opt for self-service, revenue streams tied to regular maintenance visits might shrink.

Potential for Stricter Regulations and Environmental Concerns

The pool and spa industry is susceptible to evolving government regulations, particularly concerning water conservation and product safety standards. For instance, the U.S. Environmental Protection Agency (EPA) continues to monitor water usage, and states like California have implemented stricter water restrictions, potentially impacting pool filling and maintenance practices.

Shifts in environmental policies, such as increased scrutiny on chemical usage in pool maintenance or stricter emissions standards for manufacturing processes, could force companies like Leslie's to invest in costly operational changes or reformulate products. This could directly affect profitability and necessitate significant compliance efforts.

- Stricter Water Conservation: Potential for new state or local mandates on water usage for pools and spas.

- Product Safety Regulations: Increased oversight on chemicals and materials used in pool and spa equipment.

- Environmental Policy Changes: Evolving regulations on chemical runoff and manufacturing waste could increase operational costs.

- Compliance Investment: Companies may need to allocate capital for research and development to meet new safety and environmental standards.

Economic Downturn and Reduced Consumer Discretionary Spending

A significant threat to Leslie's stems from the potential for an economic downturn, which directly impacts consumer discretionary spending. When the economy falters, consumers tend to cut back on non-essential purchases, and pool and spa products often fall into this category. This means sales could drop significantly if people prioritize necessities over leisure items.

The sensitivity of Leslie's business to economic cycles is a key concern. For instance, during periods of economic uncertainty, consumers might postpone buying new pool equipment or reduce spending on regular maintenance services. This volatility can make financial planning challenging and potentially lead to periods of instability for the company.

- Consumer Confidence Declines: In late 2023 and early 2024, consumer confidence surveys indicated a cautious outlook, with many households anticipating economic challenges. This sentiment directly correlates with reduced spending on discretionary items like pool supplies.

- Inflationary Pressures: Persistent inflation throughout 2023 and into 2024 has eroded purchasing power, forcing consumers to allocate more of their budget to essentials, thereby limiting funds available for non-essential goods and services offered by Leslie's.

- Interest Rate Hikes: Central banks' aggressive interest rate hikes in 2023 and continued adjustments in 2024 have increased the cost of borrowing, potentially impacting consumer willingness to finance larger pool and spa purchases or upgrades.

Leslie's faces intense competition from a wide array of retailers, including big-box stores and online sellers, which can lead to price wars that erode profit margins. Furthermore, the increasing trend of do-it-yourself pool maintenance, fueled by accessible online resources, directly threatens Leslie's service-based revenue streams and product sales.

Rising operational costs, including chemicals and equipment, coupled with inflationary pressures on selling, general, and administrative expenses, are squeezing Leslie's profitability. For instance, their gross margin fell to 33.9% in Q1 2024 from 35.5% a year prior, highlighting this margin compression.

Economic downturns pose a significant threat, as consumers often cut back on discretionary spending like pool and spa products. Declining consumer confidence and persistent inflation throughout 2023 and into 2024 have reduced purchasing power, making consumers more hesitant to invest in these non-essential items.

Evolving government regulations, particularly concerning water conservation and product safety, present another challenge. Stricter environmental policies could necessitate costly operational changes or product reformulation, impacting Leslie's compliance efforts and overall profitability.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Leslie's audited financial statements, comprehensive market research reports, and expert industry analysis to provide a thorough and accurate assessment.