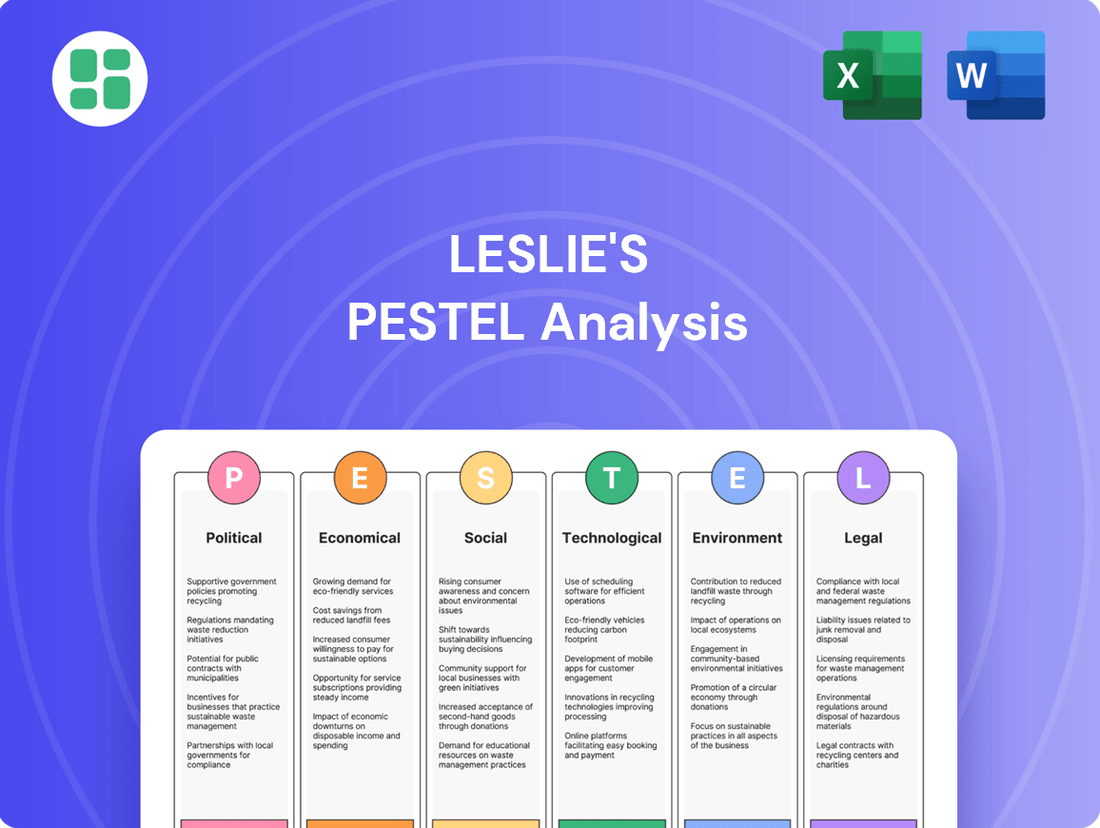

Leslie's PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leslie's Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Leslie's future. Our PESTLE analysis provides a strategic roadmap, highlighting opportunities and potential challenges. Equip yourself with actionable intelligence to make informed decisions and secure your competitive advantage. Download the full PESTLE analysis now for a comprehensive understanding.

Political factors

Changes in federal, state, or local regulations regarding the sale, storage, and disposal of pool chemicals directly affect Leslie's operations and product availability. For instance, in 2024, several states considered new restrictions on certain chlorine-based products due to environmental concerns, potentially impacting Leslie's inventory and sourcing strategies.

Stricter environmental or health and safety standards, such as those proposed by the EPA in late 2023 for chemical handling, could necessitate product reformulation or updated handling protocols. This would likely increase Leslie's operational costs, potentially by 5-10% for compliance-related adjustments in affected product lines.

Conversely, a stable regulatory environment, as seen in many of Leslie's key markets throughout 2024, allows for predictable business planning and investment in existing product lines. Favorable regulations, such as tax incentives for businesses adopting safer chemical alternatives, could also present opportunities for Leslie to expand its eco-friendly product offerings.

Leslie's business is significantly influenced by trade policies and tariffs, particularly concerning the import and export of pool and spa products and their components. For instance, changes in tariffs on chemicals, plastics, or manufactured parts sourced from countries like China or Mexico can directly impact Leslie's cost of goods sold. In 2023, the U.S. maintained tariffs on many goods from China, which could have increased the cost of certain pool equipment components for Leslie's.

Fluctuations in import/export duties can necessitate adjustments to Leslie's pricing strategy. If tariffs on key materials increase, Leslie might face higher product costs, potentially leading to price hikes for consumers. This could, in turn, affect sales volumes if demand is price-sensitive. For example, a 10% tariff increase on imported pool pumps could add a noticeable amount to the retail price, impacting consumer purchasing decisions.

Global trade stability plays a vital role in ensuring Leslie's supply chain remains efficient and cost-effective. Disruptions due to trade disputes or sudden policy changes can create significant challenges. The ongoing geopolitical landscape and trade negotiations in 2024 and 2025 will continue to be a critical factor for Leslie's operational planning and inventory management, ensuring a steady flow of products to meet customer demand.

Shifts in labor laws, like potential federal minimum wage increases to $15 per hour, could significantly impact Leslie's operational costs. For instance, if Leslie employs a substantial number of workers at or near the current federal minimum wage of $7.25, a mandated increase would directly raise payroll expenses. Compliance with evolving regulations, such as new paid leave mandates or changes to overtime eligibility, is paramount for a company with a widespread workforce.

These regulatory changes directly influence staffing models and employee retention strategies. For example, if new mandates require increased benefits or higher wages, Leslie might need to adjust hiring practices or invest more in training to retain skilled employees, potentially impacting overall profitability. In 2024, many states saw adjustments to their minimum wages, with some reaching $15 or more, setting a precedent for potential federal action.

Taxation Policies

Changes in corporate tax rates, sales taxes, or specific industry levies at any government level can profoundly affect Leslie's profitability and cash flow. For instance, a reduction in the U.S. federal corporate tax rate, which currently stands at 21%, could directly enhance net income. Conversely, an increase in state-level sales taxes could impact consumer spending on Leslie's products or services.

Favorable tax environments encourage investment and expansion. For example, tax credits for research and development or for investing in renewable energy could significantly boost Leslie's capacity for innovation and capital expenditure. Conversely, higher tax burdens necessitate careful financial planning to maintain liquidity and investment capabilities.

- Federal Corporate Tax Rate: Remains at 21% as of late 2024, impacting Leslie's overall taxable income.

- State-Specific Sales Tax Variations: Differing rates across states where Leslie operates directly influence consumer purchasing power.

- Potential for R&D Tax Credits: These can offset a portion of Leslie's innovation expenses, improving its bottom line.

- Impact of Property Taxes: Local property tax rates on Leslie's facilities can add to operational overhead.

Government Spending on Infrastructure and Housing

Government spending on infrastructure and housing can significantly impact Leslie's market. For instance, in the United States, the Infrastructure Investment and Jobs Act, passed in 2021, allocated substantial funds towards infrastructure improvements, which could indirectly boost demand for products used in new residential or recreational facilities.

Increased investment in new housing developments directly correlates with higher demand for pool and spa installations. This trend is supported by data showing a consistent rise in new home construction starts. In 2023, new housing starts in the U.S. reached over 1.5 million units, indicating a healthy market for related amenities.

Furthermore, government incentives for home renovations and improvements, often part of broader economic stimulus efforts, can also benefit Leslie. These programs encourage homeowners to invest in their properties, including outdoor living spaces like pools and spas, thereby increasing the need for maintenance and care products.

- Infrastructure Investment and Jobs Act (US): Allocated billions to infrastructure, potentially benefiting construction-related sectors.

- New Housing Starts (US 2023): Exceeded 1.5 million units, signaling growth opportunities for pool and spa installations.

- Home Improvement Incentives: Government programs can stimulate consumer spending on property upgrades, including outdoor amenities.

Political stability and government policies directly shape the regulatory landscape for Leslie's. Changes in environmental regulations, such as those proposed in late 2023 by the EPA concerning chemical handling, could necessitate costly product reformulation or updated protocols, potentially increasing operational costs by 5-10% for affected product lines.

Trade policies and tariffs significantly influence Leslie's cost of goods sold, particularly for imported components. For example, tariffs on materials sourced from China in 2023 impacted the cost of pool equipment. Fluctuations in import/export duties can lead to price adjustments, potentially affecting consumer demand if it's price-sensitive.

Labor laws, including potential minimum wage increases, directly impact payroll expenses. For instance, a federal minimum wage hike to $15 per hour would significantly affect companies employing workers at lower rates, as seen in many states that raised their minimum wages in 2024.

Government fiscal policies, such as corporate tax rates and sales taxes, directly affect Leslie's profitability. The U.S. federal corporate tax rate of 21% influences net income, while varying state sales taxes impact consumer spending. Conversely, tax incentives for R&D can boost innovation and capital expenditure.

Government spending on infrastructure and housing creates market opportunities. The U.S. Infrastructure Investment and Jobs Act, with its substantial funding for infrastructure, could indirectly boost demand for products used in new residential facilities. In 2023, over 1.5 million new housing starts in the U.S. signaled growth for pool and spa installations.

| Factor | Description | Potential Impact on Leslie's | Relevant Data/Examples (2023-2025) |

| Environmental Regulations | Stricter rules on chemical handling and disposal. | Increased operational costs, product reformulation needs. | EPA proposed stricter chemical handling standards (late 2023); some states considered chlorine product restrictions (2024). |

| Trade Policies & Tariffs | Import/export duties on pool supplies and components. | Higher cost of goods sold, potential price increases, supply chain disruptions. | US maintained tariffs on Chinese goods (2023); potential impact on pool pump costs. |

| Labor Laws | Minimum wage, paid leave, overtime eligibility. | Increased payroll expenses, adjustments to staffing models. | Many states raised minimum wages in 2024, some reaching $15/hour. |

| Fiscal Policies (Taxes) | Corporate tax rates, sales taxes, R&D credits. | Affects profitability, cash flow, and investment capacity. | Federal corporate tax rate remains 21% (late 2024); varying state sales taxes. |

| Government Spending | Infrastructure and housing development. | Increased demand for pool/spa installations and related products. | US New Housing Starts exceeded 1.5 million units (2023); Infrastructure Investment and Jobs Act funding. |

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Leslie's, examining Political, Economic, Social, Technological, Environmental, and Legal influences to uncover strategic opportunities and potential threats.

Provides a clear, actionable framework that simplifies complex external factors, enabling strategic decision-making and reducing the burden of analysis paralysis.

Economic factors

Leslie's business is heavily tied to how much money consumers have left after essential bills. When people have more disposable income, they're more likely to spend on pool and spa services and products, which are often considered luxuries. For instance, in the first quarter of 2024, the U.S. personal saving rate was around 3.7%, indicating a moderate level of discretionary funds available to consumers.

Economic slowdowns can really hurt Leslie's sales. If people are worried about their jobs or facing rising costs for necessities, they tend to cut back on non-essential spending, like pool maintenance or new equipment. This was seen in some sectors during the inflationary pressures of 2023, where consumers became more price-sensitive.

Conversely, a strong economy with growing disposable incomes is a big plus for Leslie. Higher incomes mean consumers have more capacity and confidence to invest in their homes, including maintaining and upgrading their pools and spas. The projected GDP growth for the U.S. in 2024, estimated to be around 2.5%, suggests a generally supportive environment for consumer spending.

Fluctuations in interest rates directly impact consumer decisions regarding major purchases. For instance, a rise in interest rates could make financing a new pool installation or significant equipment upgrades less appealing for homeowners and businesses alike. This deterrent effect on borrowing can lead to a slowdown in sales for these higher-ticket items.

As of late 2024, the Federal Reserve's benchmark interest rate has been maintained at a range of 5.25% to 5.50%, reflecting a period of elevated borrowing costs. This environment means that consumers and businesses face higher monthly payments on loans, potentially reducing discretionary spending on non-essential or large capital expenditures.

Beyond interest rates, the general availability of credit is a crucial factor influencing purchasing power. When credit is readily available and terms are favorable, consumers are more likely to finance significant purchases, boosting demand. Conversely, tighter credit conditions can constrain spending, impacting sectors reliant on consumer financing, including the housing market and large equipment sales.

The health of the housing market significantly impacts Leslie's. A strong housing sector, marked by robust new home construction and brisk existing home sales, fuels demand for pool and spa installations as new homeowners upgrade their properties. For instance, in Q1 2024, U.S. new home sales reached a seasonally adjusted annual rate of 660,000 units, indicating a generally positive environment for home improvement investments.

Conversely, a downturn in housing activity directly affects Leslie's growth potential. When fewer homes are being built or sold, the pipeline for new pool installations shrinks, and existing homeowners may postpone discretionary spending on their properties. This correlation means Leslie's performance is closely tied to broader real estate market trends.

Inflation and Cost of Goods

Rising inflation presents a significant challenge for Leslie's, directly impacting the cost of goods. For instance, the U.S. Consumer Price Index (CPI) saw an increase of 3.4% year-over-year as of April 2024, indicating persistent upward pressure on prices. This means Leslie's likely faces higher expenses for raw materials, manufacturing processes, and transportation, potentially squeezing profit margins if these increased costs cannot be entirely passed on to customers.

Effectively managing inventory and adjusting pricing strategies are therefore paramount for Leslie's in this inflationary climate. The ability to maintain competitive pricing while still covering rising operational costs is crucial for sustained profitability. Consumer price sensitivity is a key consideration; if customers are unwilling or unable to absorb significant price hikes, Leslie's may need to explore cost-saving measures or alternative sourcing to protect its market position.

- Increased Input Costs: Higher inflation directly translates to elevated expenses for raw materials, manufacturing, and logistics for Leslie's.

- Margin Pressure: Profitability can be eroded if Leslie's cannot fully pass on increased costs to consumers due to price sensitivity.

- Strategic Pricing and Inventory Management: Adapting pricing and optimizing inventory levels are critical for maintaining competitiveness and financial health.

Competition and Pricing Pressures

Leslie's faces significant competition from various channels, including other pool supply retailers, large home improvement chains like Home Depot and Lowe's, and a growing number of online-only stores. This multi-faceted competitive environment directly impacts Leslie's ability to set prices and maintain its market share. For instance, in 2024, the pool and spa industry continues to see aggressive online pricing, forcing traditional retailers to be more competitive on price to retain customers.

The pressure from these competitors often translates into price wars, which can erode profit margins for Leslie's. To counter this, the company must constantly innovate its product offerings and enhance its customer service to differentiate itself. Leslie's reported in its 2023 annual filings that investments in digital platforms and unique service packages are key strategies to combat margin compression driven by competitive pricing.

Monitoring competitor strategies is crucial for Leslie's to sustain its market leadership. This includes tracking pricing adjustments, new product launches, and marketing campaigns from both brick-and-mortar and e-commerce rivals. For example, the ongoing expansion of direct-to-consumer (DTC) brands in the pool chemical space in 2024 presents a direct challenge that requires a strategic response from established players like Leslie's.

- Competitive Landscape: Leslie's competes with specialized retailers, big-box stores, and online platforms.

- Pricing Pressures: Intense competition can lead to price wars, impacting Leslie's profit margins.

- Differentiation Needs: Continuous product innovation and superior service are vital for market share retention.

- Market Monitoring: Keeping a close watch on competitor activities is essential for maintaining leadership.

Economic factors significantly influence Leslie's performance, primarily through consumer spending power and the cost of doing business. When consumers have more disposable income, as indicated by a U.S. personal saving rate around 3.7% in Q1 2024, they are more likely to spend on pool and spa products, which are often discretionary purchases. Conversely, economic downturns and inflation, with the U.S. CPI at 3.4% year-over-year in April 2024, can reduce consumer confidence and purchasing ability, impacting sales.

Interest rates and credit availability also play a crucial role. With the Federal Reserve's benchmark rate at 5.25%-5.50% in late 2024, higher borrowing costs can deter consumers from financing large purchases like new pool installations. The health of the housing market, with 660,000 new home sales in Q1 2024, directly correlates with demand for new pool installations, making real estate trends a key economic indicator for Leslie's.

| Economic Factor | Impact on Leslie's | Relevant Data (2024) |

|---|---|---|

| Disposable Income | Higher income boosts spending on pool/spa products. | U.S. Personal Saving Rate: ~3.7% (Q1 2024) |

| Inflation | Increases input costs, potentially squeezing margins. | U.S. CPI: +3.4% YoY (April 2024) |

| Interest Rates | Higher rates can reduce demand for financed purchases. | Federal Funds Rate: 5.25%-5.50% (Late 2024) |

| Housing Market | Strong market drives demand for new pool installations. | U.S. New Home Sales: 660,000 units (Q1 2024) |

What You See Is What You Get

Leslie's PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Leslie's provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities Leslie's faces.

Sociological factors

Evolving consumer lifestyles are significantly shaping the demand for pool and spa products. There's a noticeable shift towards prioritizing home-based recreation and wellness activities. This means more people are looking to enhance their living spaces for leisure and relaxation.

As individuals and families spend more time at home, investments in outdoor living areas, including the installation and maintenance of pools and spas, are becoming increasingly common. This trend directly benefits companies like Leslie's, as it underscores the growing importance of convenience and the appeal of at-home leisure experiences.

For instance, in 2024, the global home improvement market, which includes outdoor living spaces, was projected to reach over $1 trillion, with a significant portion attributed to enhancements like pools and spas, reflecting this lifestyle shift.

Demographic shifts are significantly reshaping the market for pool and spa services. For instance, the aging population in the U.S. might lead to a greater demand for in-home leisure activities, including pool maintenance, as older adults spend more time at home. This trend, coupled with potential increases in homeownership among millennials and Gen Z, could broaden Leslie's customer base.

In 2024, the U.S. homeownership rate hovered around 66%, a figure that has seen some fluctuation but generally indicates a stable or growing market for homeowners. A rise in this rate, especially among younger generations who are increasingly entering the housing market, directly translates to more potential customers for pool and spa care products and services. Tailoring marketing efforts to these evolving demographics, perhaps by highlighting ease-of-use or energy-efficient solutions for new homeowners, could be a key strategy.

A significant societal shift towards health and wellness is directly benefiting businesses like Leslie's. As people increasingly prioritize self-care, relaxation, and physical activity, the demand for well-maintained swimming pools and spas as outlets for these pursuits is on the rise. This trend saw continued strength through 2024, with consumer spending on health and wellness products and services reaching an estimated $4.5 trillion globally.

Leslie's is well-positioned to capitalize on this by highlighting how proper pool and spa maintenance contributes to a healthier lifestyle. By emphasizing the stress-reducing and exercise benefits of clean, inviting water environments, the company can align its product and service offerings with this powerful consumer desire. For instance, promoting water aerobics or simply the mental health benefits of a relaxing soak directly taps into this growing consciousness.

DIY Culture vs. Professional Services

The ongoing tension between consumers embracing do-it-yourself (DIY) pool maintenance and those opting for professional services directly influences Leslie's revenue. DIY trends, fueled by readily available products and online tutorials, boost sales of chemicals and equipment. However, a counter-trend favoring convenience and specialized knowledge is increasingly driving demand for Leslie's maintenance and repair services.

This dynamic requires a nuanced marketing approach. For instance, in 2024, the home improvement market saw continued robust activity, with a significant portion attributed to DIY projects. Leslie’s strategy must therefore balance promoting product sales for the DIY segment with highlighting the value and expertise offered by its professional service division to capture the convenience-seeking customer base.

- DIY Product Sales: Driven by consumer desire for cost savings and hands-on control.

- Professional Service Demand: Growing due to increasing emphasis on convenience, time-saving, and specialized expertise.

- Marketing Strategy: Needs to address both segments with tailored messaging and product/service offerings.

- Market Trends: Continued growth in home services indicates a strong market for professional pool care.

Sustainability and Ethical Consumerism

Consumers are increasingly prioritizing sustainability and ethical practices, directly impacting purchasing behavior. For Leslie's, this means a growing demand for environmentally friendly pool chemicals and energy-efficient equipment. In 2024, a significant percentage of consumers reported that sustainability is a key factor in their purchasing decisions, with many willing to pay a premium for eco-conscious products.

Leslie's can leverage this trend by expanding its offerings of biodegradable cleaning solutions and solar-powered pool pumps. Transparency about product sourcing and environmental impact is also crucial, as consumers actively seek out brands that demonstrate a commitment to responsible operations. This shift presents an opportunity for Leslie's to build brand loyalty by aligning with consumer values.

- Growing Consumer Demand: Studies in 2024 indicated that over 60% of consumers consider sustainability when making purchasing choices for home goods.

- Market Shift: The pool and spa industry is seeing a rise in demand for eco-friendly alternatives, with sales of solar-powered heaters increasing by 15% year-over-year.

- Transparency Expectations: Consumers expect detailed information on product lifecycles and manufacturing processes, influencing brand perception and trust.

Societal trends highlight a growing emphasis on home-based leisure and personal wellness, directly boosting demand for pool and spa installations and upkeep. This shift, evident throughout 2024, saw consumers investing more in their private spaces for recreation and relaxation. The aging U.S. population and increasing homeownership among younger demographics are also expanding Leslie's potential customer base, creating opportunities for tailored marketing strategies that highlight convenience and efficiency.

Technological factors

Technological innovations are transforming the pool and spa industry, presenting significant opportunities for companies like Leslie's. For instance, the development of variable-speed pumps, which can reduce energy consumption by up to 80% compared to older single-speed models, is a prime example. These advancements not only appeal to environmentally conscious consumers but also offer long-term cost savings, driving demand for more sophisticated, higher-margin products.

Automated cleaning systems, such as robotic pool cleaners, are also becoming more sophisticated, offering greater efficiency and convenience. Furthermore, smart pool controllers allow users to manage water chemistry, temperature, and cleaning schedules remotely via smartphone apps. Leslie's can capitalize on these trends by expanding its product lines to include these cutting-edge technologies, thereby enhancing customer value and potentially increasing sales of premium items.

Staying ahead of these technological curves is essential for maintaining a competitive edge. The market for smart home technology, which extends to pool and spa management, is projected to grow significantly. For example, the global smart home market was valued at over $100 billion in 2023 and is expected to continue its upward trajectory through 2025, indicating a strong consumer appetite for connected and automated solutions.

The ongoing growth of e-commerce is critical for Leslie's direct-to-consumer (DTC) approach. In 2023, online retail sales in the U.S. reached an estimated $1.14 trillion, demonstrating the significant market opportunity. Leslie's focus on improving its digital platforms, including online marketing and customer service, is essential for capturing this growth.

Enhancing the online shopping experience, particularly on mobile devices, is paramount. Mobile commerce accounted for over 50% of U.S. e-commerce sales in 2023. Leslie's ability to leverage data analytics for personalized recommendations will be key to attracting and keeping online shoppers, complementing their established brick-and-mortar presence.

Technological advancements in water testing and treatment are significantly enhancing pool care efficiency and safety. Innovations like advanced sensor technology for precise chemical monitoring and automated dosing systems are becoming more prevalent. For instance, the global pool water treatment market was valued at approximately USD 3.5 billion in 2023 and is projected to grow, indicating strong customer adoption of these technologies.

Leslie's can leverage these innovations by integrating them into its product offerings and service packages. This includes offering smart testing devices and promoting alternative sanitization methods such as UV and ozone systems, which reduce chemical reliance and improve water quality. The company's commitment to R&D in this area will be crucial for staying ahead in a competitive market, with ongoing research focused on even more sustainable and effective treatment solutions.

Supply Chain Automation and Logistics

Leslie's, like many retailers, benefits from advancements in supply chain automation. Automation in warehousing and inventory management, for instance, can streamline operations, leading to significant cost reductions. By embracing these technologies, Leslie's can achieve faster product delivery and maintain higher inventory accuracy across its extensive distribution network.

The implementation of advanced logistics technologies is crucial for a company like Leslie's, which relies on efficient product flow. Real-time tracking and predictive analytics are key components that enhance overall supply chain performance, ensuring greater resilience and responsiveness to market demands. For example, the global warehouse automation market was projected to reach $62.5 billion by 2025, indicating a strong industry trend towards these efficiencies.

- Enhanced Efficiency: Automation in warehousing and inventory management directly boosts operational efficiency for Leslie's.

- Cost Reduction: Streamlined processes through automation contribute to lower operational expenses.

- Improved Delivery: Advanced logistics technologies enable faster and more reliable product delivery to customers.

- Data-Driven Insights: Real-time tracking and predictive analytics offer valuable data for optimizing supply chain operations.

Data Analytics and Personalization

Leslie's ability to leverage big data analytics is crucial for understanding its diverse customer base. By analyzing purchasing patterns and market trends, the company can gain deeper insights into what drives consumer behavior in the pool and backyard living sector. For instance, by tracking online searches and in-store purchases, Leslie's can identify emerging product demands and regional preferences.

This data-driven approach allows for highly personalized marketing campaigns and product recommendations, directly impacting customer loyalty and sales figures. In 2024, companies that excel in personalization saw an average increase of 10-15% in customer retention rates. Leslie's can use this to tailor offers for specific customer segments, such as recommending pool maintenance kits to new homeowners or advanced filtration systems to experienced pool owners.

Furthermore, predictive analytics offers significant advantages for operational efficiency. Leslie's can optimize inventory management by forecasting demand for seasonal items, reducing stockouts and overstock situations. This also extends to store planning, ensuring popular products are readily available in high-demand locations. For example, by analyzing weather patterns and historical sales data, Leslie's can better predict the need for chemicals and cleaning supplies in specific regions during peak seasons.

- Customer Behavior Insights: Data analytics helps Leslie's understand individual customer preferences and buying habits.

- Personalized Marketing: Tailoring promotions and product suggestions based on analyzed data can boost engagement and sales.

- Inventory Optimization: Predictive analytics allows for more accurate forecasting of product needs, minimizing waste and maximizing availability.

- Enhanced Customer Service: Understanding customer history and preferences enables more efficient and effective support.

Technological advancements are revolutionizing pool and spa management, offering greater efficiency and convenience. Smart pool controllers, for instance, allow remote management of water chemistry and cleaning via smartphone apps, a trend supported by the global smart home market's projected growth through 2025. The increasing sophistication of robotic cleaners and energy-efficient variable-speed pumps also presents opportunities for Leslie's to offer premium, high-margin products, aligning with consumer demand for cost savings and advanced features.

The digital landscape continues to be a critical growth area, with U.S. online retail sales estimated at $1.14 trillion in 2023. Leslie's focus on enhancing its e-commerce platforms, especially mobile optimization where over 50% of U.S. e-commerce sales occurred in 2023, is vital for capturing this market share. Leveraging data analytics for personalized recommendations is key to improving customer retention, with data-driven companies seeing 10-15% higher retention rates in 2024.

Innovations in water testing and treatment, such as advanced sensors for precise chemical monitoring and automated dosing systems, are enhancing pool care. The global pool water treatment market, valued at approximately $3.5 billion in 2023, reflects strong adoption of these technologies. Leslie's can integrate these advancements, promoting UV and ozone systems alongside smart testing devices to meet growing demand for reduced chemical reliance and improved water quality.

| Technology Area | 2023/2024 Data Point | Impact on Leslie's |

| Smart Pool Management | Global Smart Home Market > $100 Billion (2023) | Opportunity for premium product sales, enhanced customer convenience. |

| E-commerce | U.S. Online Retail Sales: $1.14 Trillion (2023) | Critical for DTC growth, requires investment in digital platforms and mobile experience. |

| Water Treatment Tech | Global Pool Water Treatment Market: ~$3.5 Billion (2023) | Demand for advanced sensors, automated dosing, and alternative sanitization methods. |

| Supply Chain Automation | Global Warehouse Automation Market Projected to Reach $62.5 Billion (by 2025) | Enables cost reduction, faster delivery, and improved inventory accuracy. |

Legal factors

Leslie's operates under stringent regulations for chemical safety and handling, impacting everything from manufacturing to customer sales. For instance, the Environmental Protection Agency (EPA) sets standards for pool chemicals, ensuring they are safe for use and the environment. Failure to comply can lead to significant penalties; in 2023, companies faced fines in the tens of thousands for violations related to improper chemical labeling and storage.

Compliance with Occupational Safety and Health Administration (OSHA) guidelines is also critical for employee safety in handling and storing these chemicals. OSHA's Hazard Communication Standard requires clear labeling and Safety Data Sheets (SDS) for all hazardous chemicals. In 2024, OSHA continued its focus on workplace safety, with inspections targeting retail environments that handle potentially hazardous materials.

The transportation of pool chemicals is governed by the Department of Transportation (DOT), which mandates specific packaging and labeling requirements to prevent accidents. Staying abreast of these evolving regulations, such as updates to the Globally Harmonized System of Classification and Labelling of Chemicals (GHS), is vital for Leslie's to maintain its license to operate and protect its brand reputation.

Consumer protection laws, covering product liability, warranties, and advertising accuracy, directly shape how Leslie's engages with its customers. For instance, in 2024, the Federal Trade Commission (FTC) continued to emphasize enforcement actions against deceptive advertising, impacting how retailers like Leslie's present their offerings.

Data privacy regulations, such as evolving state-level laws mirroring aspects of the California Consumer Privacy Act (CCPA), are also critical. Leslie's must ensure robust data security to protect customer information, especially given the increasing volume of online transactions. Failure to comply can result in significant fines and damage to reputation.

Environmental regulations, particularly concerning water discharge and chemical waste disposal, are tightening for companies like Leslie's in the pool and spa industry. These rules aim to curb ecological damage, requiring Leslie's to invest in compliant waste management and sustainable product lifecycles. Failure to adhere to these evolving standards, such as those enforced by the EPA, can result in significant fines and reputational damage.

Employment and Labor Laws

Leslie's, as a significant employer, must strictly adhere to a complex web of federal, state, and local employment laws. This includes compliance with anti-discrimination statutes, wage and hour regulations, and workplace safety standards. For instance, in 2024, the Department of Labor continued to emphasize enforcement of Fair Labor Standards Act (FLSA) provisions, impacting how companies like Leslie's manage overtime and minimum wage for its diverse workforce.

Maintaining robust Human Resources practices, comprehensive employee training, and staying abreast of legislative changes are paramount to mitigating legal exposure. The increasing scrutiny on worker classification and the potential for unionization efforts in retail sectors mean Leslie's must proactively manage its employee relations and ensure fair labor practices to avoid costly litigation and reputational damage.

Key legal considerations for Leslie's include:

- Compliance with Equal Employment Opportunity (EEO) laws, ensuring fair hiring and promotion practices across all levels of the organization.

- Adherence to Occupational Safety and Health Administration (OSHA) standards, particularly relevant in distribution centers and retail environments to prevent workplace injuries.

- Navigating evolving wage and hour laws, including minimum wage increases and overtime rules, which can vary significantly by state and municipality.

- Managing potential unionization drives, understanding collective bargaining rights and engaging constructively with employee representation.

Intellectual Property and Patents

Protecting Leslie's own intellectual property, such as brand names, trademarks, and proprietary technologies, is vital for maintaining its market position. In 2024, the global market for intellectual property protection services was estimated to be worth billions, highlighting the significant value placed on these assets.

Compliance with intellectual property laws, including avoiding infringement of others' patents, is necessary to prevent costly legal disputes. For instance, patent litigation can easily run into millions of dollars, impacting profitability and operational stability.

This ensures the company can leverage its unique offerings and brand equity. Leslie's strong brand recognition, built over years, is a key intangible asset that requires robust IP protection.

- Brand Protection: Safeguarding Leslie's trademarks and brand identity against counterfeiting and unauthorized use is paramount.

- Patent Strategy: Ensuring Leslie's proprietary technologies are adequately patented to prevent competitors from replicating them.

- Infringement Avoidance: Conducting thorough due diligence to ensure Leslie's products and processes do not infringe on existing patents held by others.

- Legal Compliance: Adhering to international and domestic intellectual property regulations to maintain a clean legal standing.

Legal factors significantly influence Leslie's operations, from chemical handling to consumer interactions. The company must navigate a complex regulatory landscape, including EPA standards for chemical safety and OSHA guidelines for workplace safety, with non-compliance risking substantial fines. For example, in 2023, chemical industry violations led to penalties in the tens of thousands, underscoring the importance of adherence.

Furthermore, transportation regulations by the DOT and consumer protection laws enforced by the FTC shape how Leslie's markets and sells its products. Data privacy laws, like those influenced by the CCPA, also demand robust security measures. Environmental regulations concerning waste disposal are also becoming increasingly stringent, requiring proactive management to avoid penalties. In 2024, the Department of Labor continued its focus on wage and hour compliance, impacting employment practices.

Environmental factors

Growing concerns over water scarcity, particularly in drought-prone regions like California where Leslie's has a significant presence, are driving stricter regulations. For instance, California's State Water Resources Control Board has implemented various conservation measures, impacting water availability for recreational uses. This trend necessitates Leslie's focus on promoting water-efficient products, such as variable-speed pumps and advanced filtration systems that reduce the need for frequent water changes or backwashing.

Leslie's can also leverage its expertise to educate customers on responsible water management, offering services like leak detection and advising on optimal water usage practices. By highlighting water-saving solutions, Leslie's not only addresses environmental concerns but also appeals to a growing segment of consumers prioritizing sustainability. This proactive approach can mitigate potential regulatory impacts and enhance brand reputation in the face of increasing environmental scrutiny.

Chemical runoff from pool maintenance is a growing environmental concern, with pool chemicals potentially impacting local water systems. This heightened awareness could lead to more stringent regulations on chemical sales and usage, affecting Leslie's product offerings and operational costs. For instance, in 2023, several regions saw increased discussions around watershed protection, directly tying into the potential impact of pool chemicals.

Leslie's needs to proactively address these environmental factors by promoting responsible chemical handling and disposal. Educating customers on best practices is crucial to mitigate pollution risks. Furthermore, expanding their range of eco-friendly or biodegradable pool chemical alternatives, a trend gaining traction in the 2024 market, could provide a competitive advantage and align with growing consumer demand for sustainable products.

Climate change is directly impacting consumer behavior for pool and spa products. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that 2023 was the warmest year on record globally, with average temperatures 1.18°C (2.12°F) above the 20th-century average. This trend towards warmer weather, potentially leading to longer warm seasons, could increase demand for pool maintenance and accessories. However, the increased frequency of extreme weather events, such as hurricanes and droughts, poses a significant risk. A severe drought, like those experienced in parts of the Western United States, can lead to water restrictions, directly curtailing pool usage and new pool construction, thereby impacting Leslie's sales.

Energy Consumption of Pool Equipment

The energy consumption of pool equipment like pumps and heaters significantly impacts a household's carbon footprint. For instance, a typical pool pump can account for 50% to 70% of a pool's total energy use, with older single-speed pumps being particularly inefficient. As environmental consciousness grows, consumers are increasingly seeking energy-saving solutions for their homes, including their swimming pools. This trend is further amplified by evolving regulations that encourage or mandate greater energy efficiency in appliances and home systems.

Leslie's is well-positioned to leverage this shift by focusing on and promoting high-efficiency pool equipment. Offering variable-speed pumps, which can reduce energy consumption by up to 80% compared to single-speed models, and smart pool control systems that optimize heating and filtration schedules, aligns directly with consumer demand for sustainability. By highlighting these benefits, Leslie's can attract environmentally-minded customers and capitalize on the market's move towards greener pool maintenance solutions.

- Energy Efficiency Mandates: Many regions are implementing stricter energy efficiency standards for pool pumps and heaters, influencing product availability and consumer choice.

- Consumer Demand for Sustainability: Surveys indicate a growing preference among homeowners for eco-friendly products, with a willingness to invest in energy-saving technologies.

- Technological Advancements: Innovations in variable-speed pump technology and smart pool management systems offer substantial energy savings, making them increasingly attractive to consumers.

Waste Management and Recycling

The disposal of pool and spa maintenance waste, including old equipment and chemical containers, presents an environmental hurdle for Leslie's. This necessitates a focus on responsible waste management, with potential pressure for expanded recycling initiatives for both products and packaging. For instance, in 2024, the U.S. EPA reported that while recycling rates are increasing, significant volumes of waste still enter landfills, highlighting the opportunity for companies like Leslie's to lead in product lifecycle management.

Leslie's can foster environmental stewardship by actively promoting responsible waste management practices among its customer base and integrating them into its own operational framework. This includes exploring partnerships for the recycling of specific materials, such as plastics from chemical containers or older pool equipment components. Such efforts not only address environmental concerns but also align with growing consumer demand for sustainable business practices, a trend observed to be gaining momentum in the retail sector throughout 2024 and projected to continue into 2025.

- Waste Stream Complexity: Pool maintenance generates diverse waste, from plastic packaging to potentially hazardous chemical residues and obsolete equipment.

- Recycling Opportunities: Leslie's faces increasing expectations to support or implement recycling programs for its product lines and packaging materials.

- Customer Education: Promoting responsible disposal and recycling among customers is crucial for mitigating the environmental impact of pool ownership.

- Operational Integration: Incorporating sustainable waste management within Leslie's own operations, from logistics to retail, demonstrates a commitment to environmental responsibility.

Environmental factors significantly influence Leslie's operations and strategy. Growing concerns about water scarcity, particularly in regions like California, are leading to stricter regulations on water usage. This trend compels Leslie's to promote water-efficient products and educate consumers on responsible water management, aligning with a rising demand for sustainability.

The environmental impact of pool chemicals is also under scrutiny, potentially leading to tighter regulations on their sale and use. Leslie's can mitigate this by advocating for responsible chemical handling and expanding its offering of eco-friendly alternatives, a market segment showing increased traction in 2024.

Climate change, evidenced by 2023 being the warmest year on record, presents a dual impact: potentially longer warm seasons boosting demand, but also increased extreme weather events threatening pool usage and construction. Leslie's must navigate these shifts, focusing on resilient products and services.

Furthermore, the energy consumption of pool equipment is a key environmental consideration. With consumers increasingly seeking energy-saving solutions, Leslie's can capitalize by promoting high-efficiency pumps and smart control systems, aligning with both consumer preferences and evolving energy efficiency mandates.

Waste management is another critical environmental aspect. Leslie's faces pressure to support recycling initiatives for products and packaging, reflecting a broader trend in 2024 towards greater product lifecycle responsibility and sustainable business practices.

| Environmental Factor | Impact on Leslie's | Strategic Response |

|---|---|---|

| Water Scarcity & Regulations | Stricter water usage rules, impacting pool maintenance frequency. | Promote water-efficient products (variable-speed pumps, advanced filters); educate on water conservation. |

| Chemical Runoff & Pollution | Potential for regulations on chemical sales and usage; watershed protection concerns. | Promote responsible chemical handling; expand eco-friendly chemical options. |

| Climate Change & Extreme Weather | Warmer weather may increase demand; extreme events can disrupt usage and construction. | Focus on durable and adaptable products; monitor weather patterns for inventory and marketing. |

| Energy Consumption of Pool Equipment | Growing consumer demand for energy-saving solutions; potential efficiency mandates. | Highlight energy-efficient pumps and smart pool systems; educate on energy savings. |

| Waste Management & Disposal | Expectations for recycling programs for products and packaging. | Develop partnerships for recycling; promote responsible disposal practices to customers. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Leslie's is built upon a robust foundation of data, drawing from official government publications, reputable market research firms, and leading economic indicators. This ensures that each aspect of the analysis is grounded in timely and credible information.