Leslie's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leslie's Bundle

Unlock the strategic potential of Leslie's business by understanding its BCG Matrix. See which products are market leaders and which require careful consideration. Purchase the full report for a comprehensive breakdown and actionable insights to optimize your portfolio.

Stars

Leslie's is making a concerted effort to grow its professional customer segment, focusing on pool and spa service professionals. This segment is demonstrating robust growth, making it a key area for the company's expansion strategy.

The company is enhancing its approach by prioritizing pro partner contracts and ensuring better product availability, which directly addresses the needs of these professional customers. This strategic shift aims to solidify Leslie's position within this lucrative market.

By concentrating on this high-growth area, Leslie's intends to significantly increase its market share and establish professional services as a primary source of revenue. For instance, in fiscal year 2023, Leslie's reported that its professional segment represented a substantial portion of its overall sales, highlighting the importance of this customer base.

Smart Pool Technology Products represent a burgeoning category within the pool and spa industry. The market for these innovations, encompassing automation and Internet of Things (IoT) enabled systems, is projected to expand significantly. Analysts forecast a compound annual growth rate (CAGR) ranging from 7.3% to 13.2% between 2024 and 2029, indicating strong upward momentum.

Leslie's, a prominent retailer in this sector, is well-positioned to capitalize on this growth. With its established distribution network and broad customer reach, Leslie's can effectively introduce and promote these advanced pool management solutions. The increasing consumer demand for convenience, enhanced energy efficiency, and remote control capabilities further bolsters the appeal of smart pool technology.

Leslie's e-commerce platform is a significant growth driver, representing almost 20% of its total sales. This strong performance positions it as a leader in the rapidly expanding online market for pool and spa products.

The company's ongoing investment in its digital infrastructure and customer engagement strategies further solidifies its status as a star. This focus aligns perfectly with the increasing consumer preference for online shopping, ensuring continued success in this vital channel.

Premium Energy-Efficient Equipment

Premium energy-efficient equipment, such as variable speed pumps and solar heating systems, aligns with a significant market trend toward sustainable pool solutions. Consumer demand for reduced operational costs and environmental responsibility is fueling growth in this segment. If Leslie's holds a strong market position here, these products are likely stars in their BCG Matrix, representing a high-growth area. Investing further in innovation and marketing for these efficient offerings can cement their star status.

For instance, the U.S. market for pool and spa equipment saw significant growth in 2024, with energy-efficient pumps showing particular strength. Leslie's, with its focus on these premium products, is well-positioned to capitalize on this demand. The company's reported sales figures for Q1 2024 indicated a double-digit increase in the energy-efficient product category.

- Market Trend: Growing consumer preference for sustainable and cost-saving pool technologies.

- Product Category: Variable speed pumps and solar heating systems are key examples.

- Leslie's Position: Strong market share in these high-growth, energy-efficient segments.

- Strategic Focus: Continued investment in innovation and marketing to maintain star status.

Localized Fulfillment Centers

Leslie's is strategically implementing localized fulfillment centers as a key component of its business transformation. This initiative is designed to optimize inventory management and decrease the capital tied up in working capital. By bringing inventory closer to the customer, Leslie's enhances delivery speed and overall convenience, directly boosting customer satisfaction and market share.

This operational enhancement is crucial for Leslie's competitive edge. In 2024, the company continued to invest in its supply chain network, recognizing that efficient fulfillment is a significant differentiator. The goal is to improve service levels, which in turn supports market share growth by making Leslie's the preferred choice for pool and spa supplies.

- Localized Fulfillment Centers: A strategic move to improve inventory turnover and reduce working capital.

- Customer Convenience: Enhances the customer experience through faster, more reliable delivery.

- Market Share Driver: Positions Leslie's for growth by strengthening its service offering in a competitive landscape.

- Operational Efficiency: Aims to streamline supply chain operations for greater cost-effectiveness.

Stars in Leslie's BCG Matrix represent high-growth, high-market-share business segments. These are areas where Leslie's is a leader and the market itself is expanding rapidly. The company's focus on smart pool technology and premium energy-efficient equipment aligns perfectly with this definition. These categories are experiencing significant consumer demand and technological advancement, positioning them as key growth drivers for Leslie's.

The smart pool technology market, for instance, is projected for robust growth with a CAGR between 7.3% and 13.2% from 2024 to 2029. Similarly, the demand for energy-efficient pool solutions, like variable speed pumps, saw strong performance in 2024, with Leslie's reporting double-digit increases in this category in Q1 2024. These segments, coupled with Leslie's strong e-commerce presence, which accounts for nearly 20% of its total sales, solidify their star status.

| Category | Market Growth Outlook | Leslie's Position | Key Growth Factors |

|---|---|---|---|

| Smart Pool Technology | High (7.3%-13.2% CAGR 2024-2029) | Leader | Consumer demand for convenience, automation, IoT |

| Premium Energy-Efficient Equipment | High (Strong 2024 performance) | Strong Market Share | Sustainability, cost savings, environmental responsibility |

| E-commerce Platform | High (Nearly 20% of total sales) | Leader | Consumer preference for online shopping, digital infrastructure investment |

What is included in the product

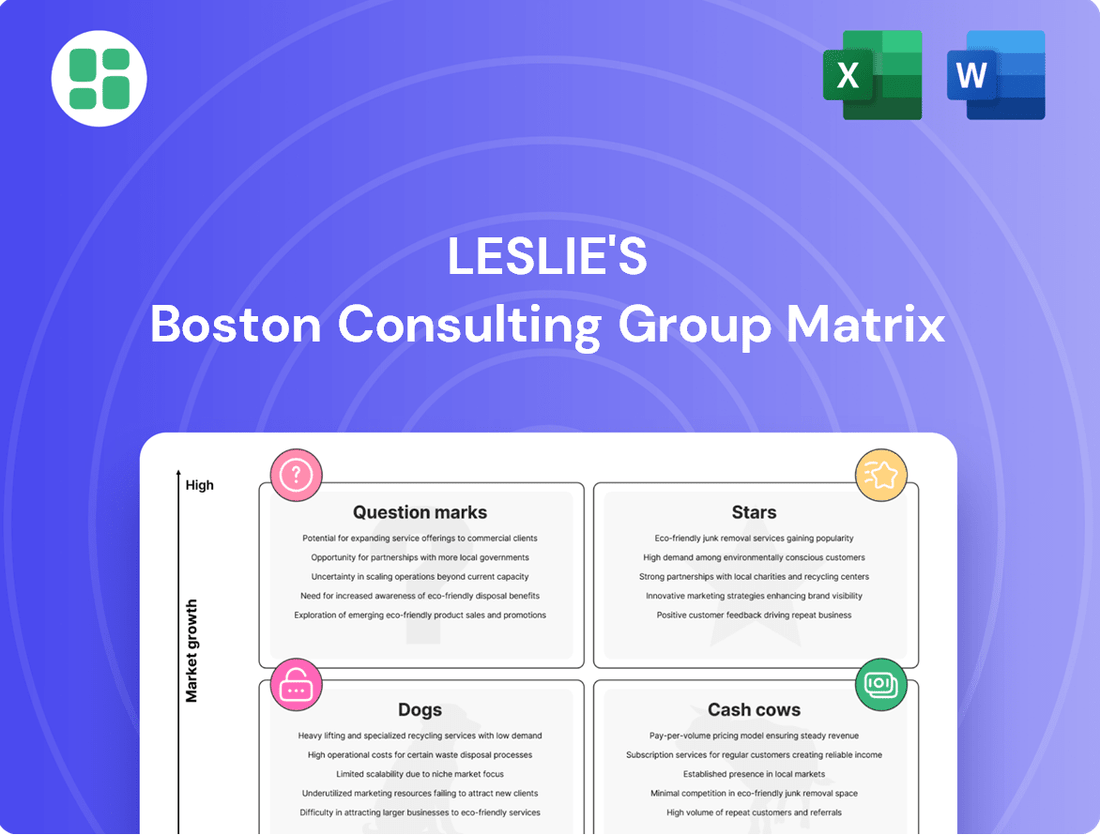

Leslie's BCG Matrix provides a strategic overview of its pool supply business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides Leslie's decisions on investment, holding, or divesting specific product lines to optimize its portfolio.

A clear, visual representation of Leslie's business units, simplifying complex strategic decisions.

Cash Cows

Leslie's commands a significant share in the stable, high-volume pool chemical market. These products, such as chlorine and algaecides, represent recurring, non-discretionary purchases for pool owners, underpinning consistent revenue streams. The global pool chemical market is expected to grow steadily, with North America leading, which further solidifies Leslie's robust cash generation from these foundational offerings.

Leslie's established retail store network, exceeding 1,000 physical locations, represents its largest direct-to-consumer footprint in the U.S. pool and spa care market. This extensive network acts as a consistent cash generator, leveraging its broad accessibility and loyal customer base for reliable sales of essential products and services.

Standard pool equipment and parts, like pumps and filters, are a core part of Leslie's business. These items address the regular upkeep required for many pools and spas, ensuring a consistent demand in a well-established market.

This segment benefits from a strong market share and the continuous need for replacement parts. This consistent aftermarket demand translates into a reliable source of cash flow for the company, reflecting its position as a mature but vital offering.

In-Store Water Testing (AccuBlue)

Leslie's complimentary AccuBlue water testing service is a cornerstone of their strategy, particularly within the mature pool maintenance market. This service is a significant driver of foot traffic to their physical stores, directly translating into sales of essential pool chemicals, which are often high-margin products.

The AccuBlue service holds a substantial market share in its segment, acting as a powerful lead generation tool. This fosters strong customer loyalty, encouraging repeat business and securing a consistent revenue stream for Leslie's, especially for their chemical offerings.

- Market Share: AccuBlue is a leader in the pool water testing market.

- Customer Acquisition: It serves as a primary driver for new customer visits to Leslie's retail locations.

- Revenue Generation: The service directly correlates with increased sales of pool chemicals, a key profit center for Leslie's.

- Customer Loyalty: By providing a valuable, free service, Leslie's builds strong relationships and encourages repeat purchases.

Residential Maintenance and Repair Services

Residential maintenance and repair services are a cornerstone of Leslie's business, acting as a strong Cash Cow within its BCG Matrix. This segment benefits from a consistent, year-round demand from homeowners who view pool upkeep as a necessity rather than a discretionary expense. Even during economic slowdowns, the need for essential services like cleaning, chemical balancing, and minor repairs remains relatively inelastic, providing Leslie's with a stable revenue stream. This reliability is crucial for funding other, more growth-oriented ventures within the company.

The high market share Leslie's holds in this segment, coupled with the steady demand, translates directly into significant cash generation. For instance, in fiscal year 2023, Leslie's reported that its pool and lawn care segment, which heavily includes these services, continued to be a strong performer. While specific revenue breakdowns for maintenance and repair alone aren't always itemized separately, the overall segment's performance underscores the cash-generating power of these recurring customer relationships. This segment's stability allows Leslie's to maintain its market leadership and invest strategically.

- Stable Demand: Pool maintenance is an ongoing need, making this service less vulnerable to economic downturns.

- High Market Share: Leslie's established presence and brand recognition allow it to capture a significant portion of this recurring revenue.

- Consistent Cash Flow: The predictable nature of these services provides a reliable source of cash to support other business areas.

- Essential Nature: Unlike discretionary pool products, maintenance and repair are often seen as necessary upkeep by pool owners.

Leslie's core pool chemicals, like chlorine and pH balancers, are prime examples of Cash Cows. These are essential, frequently repurchased items that maintain a stable demand regardless of economic fluctuations. The consistent sales volume, driven by the necessity of pool maintenance, generates significant and reliable cash flow for the company.

The company's extensive retail footprint, with over 1,000 locations, serves as a powerful distribution channel for these high-volume, low-margin essentials. This widespread presence ensures easy customer access, reinforcing the recurring purchase behavior for chemicals and related maintenance supplies.

Leslie's also benefits from the aftermarket for pool equipment parts. These are replacement items for pumps, filters, and heaters, which are necessary for ongoing pool operation. The steady demand for these parts, coupled with Leslie's market share, contributes to a predictable and substantial cash generation.

The AccuBlue water testing service, while free, acts as a significant customer acquisition and retention tool. It drives foot traffic to stores, directly leading to the sale of chemicals and other consumables, further solidifying the Cash Cow status of these product categories.

| Category | BCG Quadrant | Key Characteristics | Cash Flow Generation |

|---|---|---|---|

| Pool Chemicals (Chlorine, Algaecides) | Cash Cow | High market share, stable demand, recurring purchases | High, consistent |

| Pool Equipment Parts (Pumps, Filters) | Cash Cow | Essential replacements, steady aftermarket demand | High, consistent |

| Residential Maintenance & Repair Services | Cash Cow | Necessity-driven, inelastic demand, strong market share | High, reliable |

Preview = Final Product

Leslie's BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use tool. You can confidently expect the same depth of market insight and clear presentation in the final version. This is the exact strategic resource you'll download, enabling immediate application in your business planning and competitive analysis.

Dogs

As the pool and spa industry rapidly embraces energy-efficient and smart technologies, older equipment models that Leslie's might still stock are increasingly becoming obsolete. These items are likely experiencing declining sales and hold a very small market share when compared to the advanced alternatives now available. For instance, traditional pool pumps, which are far less energy-efficient than variable-speed models, represent a prime example of such products.

Niche, low-demand recreational accessories, such as specialized pool cleaning tools for older filtration systems or unique, out-of-fashion pool floats, often land in the Dog quadrant of Leslie's BCG Matrix. These items, while perhaps having a dedicated, albeit small, customer base, are characterized by very low sales volumes and virtually no market growth. For instance, sales of older-model pool vacuums might have declined by over 15% year-over-year as newer, more efficient models gain traction.

Leslie's, with its broad store footprint, might identify certain legacy retail locations as Dogs in its BCG Matrix. These are stores in mature, slow-growth markets that consistently show low sales volumes and weak profitability.

Such underperforming locations often drain resources, consuming operational costs without generating adequate returns. For instance, if a store’s revenue consistently falls below its operating expenses and overhead, it becomes a drag on overall financial performance.

Leslie's emphasis on optimizing asset utilization means these underperformers would be prime candidates for evaluation. The company's strategy likely involves assessing whether divesting or repurposing these assets would better serve its capital allocation and efficiency objectives.

Manual Pool Testing Kits

Manual pool testing kits, while once a staple, are increasingly being relegated to Dog status within Leslie's product portfolio. The company's push for its AccuBlue in-store water testing system, offering superior accuracy and convenience, directly competes with these older methods.

As customers gravitate towards digital and professional testing solutions, the market share for manual kits is expected to shrink further.

- Declining Market Share: Manual kits likely see a significant drop in sales as more consumers embrace advanced testing technologies.

- Niche Appeal: These kits may only serve a small, diminishing segment of budget-conscious or less tech-savvy consumers.

- Lower Profit Margins: Compared to advanced systems, manual kits typically offer lower profit margins, making them less attractive for investment.

- Strategic Shift: Leslie's focus on AccuBlue indicates a strategic move away from supporting products with limited growth potential.

Outdated Cleaning Tools

The market for traditional, manual pool cleaning tools is likely facing a decline. With the swift evolution of robotic and automated pool cleaners, basic tools such as brushes and nets are becoming less appealing to consumers. This shift towards convenience and efficiency means that demand for these older cleaning methods could be shrinking considerably.

These outdated tools might be categorized as cash traps within Leslie's portfolio. They likely experience low sales volume and minimal market growth, tying up capital without generating substantial returns. For instance, while the overall pool and spa market saw robust growth, the segment for manual cleaning accessories might be lagging significantly behind the automated solutions.

- Diminishing Demand: Consumer preference increasingly favors automated pool cleaners, impacting sales of manual tools.

- Market Share Erosion: As smart cleaning solutions gain traction, older, less efficient tools are losing ground.

- Cash Trap Potential: Low sales and stagnant growth for manual tools could represent an inefficient use of company resources.

Products classified as Dogs in Leslie's BCG Matrix are those with low market share and low market growth. These items typically generate minimal revenue and often require significant resources to maintain, making them a drain on profitability. For example, Leslie's might identify certain older chemical formulations or accessories for discontinued pool equipment models as Dogs, as their sales volumes are minimal and the market for them is shrinking.

These products are characterized by their inability to compete effectively in a dynamic market. Their low sales figures, often coupled with declining demand, mean they contribute little to overall revenue. In 2024, Leslie's continued to streamline its inventory, likely phasing out many such low-performing items to focus on more profitable segments.

The strategic implication for Dogs is often divestment or discontinuation. Leslie's, aiming for operational efficiency and capital optimization, would likely seek to exit these product categories. This allows the company to reallocate resources towards Stars and Question Marks with higher growth potential.

For instance, if a particular line of pool filters designed for older systems saw a year-over-year sales decline of 20% and represented less than 1% of total filter sales in 2024, it would firmly be in the Dog category. Such products offer little strategic advantage and are prime candidates for removal from the product catalog.

Question Marks

The smart pool technology market, including AI-powered monitors and predictive maintenance systems, is experiencing robust growth. Analysts project this segment to reach approximately $1.5 billion globally by 2027, with a compound annual growth rate of over 15% leading up to that. Leslie's may be investing in or developing AI-driven pool management solutions that are still in their nascent stages of market penetration.

Given the rapid innovation in AI for pool care, Leslie's current market share in these cutting-edge solutions could be relatively small. This positions these offerings as potential question marks, requiring substantial investment and strategic focus to gauge their future potential. Without significant market adoption or a clear competitive advantage, these new AI tools might not transition into high-growth Stars.

Hyper-personalized chemical delivery services, like subscription models catering to specific pool requirements, are emerging as a significant growth avenue. Leslie's, if actively developing these, likely has a low market share in this nascent segment.

These innovative services demand considerable investment in marketing and operations to achieve broad customer acceptance. For instance, the subscription box market itself saw significant growth, with reports indicating it reached over $22.7 billion in 2023, demonstrating consumer appetite for tailored delivery.

Expanding into niche commercial pool segments, such as advanced water parks or specialized aquatic therapy facilities, positions Leslie's as a potential Question Mark. These markets, while experiencing robust growth, often require tailored solutions and significant upfront investment to establish a foothold.

Leslie's would likely enter these segments with a low market share, necessitating strategic resource allocation to develop expertise and build brand recognition. For instance, the global water park market was valued at approximately $24.8 billion in 2023 and is projected to grow, presenting an opportunity but also the challenge of carving out a significant presence.

Sustainable and Eco-Friendly Pool Construction Materials

The pool industry is increasingly prioritizing sustainable and eco-friendly construction materials, reflecting a broader consumer shift towards environmental consciousness. This trend suggests a burgeoning market for innovative green building solutions within the pool and spa sector.

If Leslie's were to introduce new, eco-friendly pool construction materials, these offerings would likely fall into the "Question Mark" category of the BCG Matrix. This designation signifies a high-growth market potential, as evidenced by the growing demand for sustainable products, but a potentially low current market share for Leslie's specific offerings in this nascent segment.

- Market Growth: The global green building materials market is projected to reach $477.6 billion by 2027, indicating significant growth potential for sustainable pool products.

- Investment Needs: To capture market share, Leslie's would need substantial investment in research and development, manufacturing, and marketing to educate consumers and establish brand recognition for these new materials.

- Competitive Landscape: While the market is growing, it may be characterized by emerging competitors and the need to differentiate through performance, cost-effectiveness, and clear environmental benefits.

Advanced Water Conservation Technologies

Advanced water conservation technologies for swimming pools, such as rainwater harvesting for top-ups and advanced evaporation reduction systems, represent a burgeoning segment within the pool care industry, driven by a global emphasis on sustainability. Leslie's, a prominent player, might be positioning these innovative solutions in a high-growth market where their current market share is likely minimal.

These technologies are critical for addressing water scarcity and reducing operational costs for pool owners. For instance, efficient evaporation control can save thousands of gallons of water annually per pool. The market for pool water management solutions, including conservation technologies, is projected to see significant growth, with estimates suggesting a compound annual growth rate (CAGR) of over 6% in the coming years, reaching billions of dollars globally by 2028.

- Market Growth: The global pool and spa water treatment market, which encompasses conservation technologies, is anticipated to expand robustly.

- Investment Needs: Significant strategic investment is required to develop, market, and scale these advanced water-saving solutions.

- Potential for Innovation: Leslie's could leverage these technologies to differentiate its offerings and capture market share in an environmentally conscious landscape.

Question Marks represent new products or services in high-growth markets where Leslie's currently holds a small market share. These ventures require significant investment to understand their potential and determine if they can become Stars or if they should be divested.

Examples include emerging AI-powered pool management systems and hyper-personalized chemical delivery services, both operating in markets with substantial projected growth but low current penetration for Leslie's. Expanding into niche commercial segments like water parks also fits this profile, demanding tailored solutions and upfront investment.

These areas, like sustainable pool construction materials and advanced water conservation technologies, are characterized by strong market growth potential driven by consumer trends, yet they necessitate substantial investment in R&D, marketing, and brand building to achieve significant market share.

| BCG Category | Market Growth | Market Share | Leslie's Potential Position | Strategic Consideration |

|---|---|---|---|---|

| Question Mark | High | Low | New AI pool tech, personalized chemical services, niche commercial markets, eco-friendly materials, water conservation tech | Invest heavily to gain market share or divest if potential is not realized. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitor analysis, to accurately position each business unit.