Leslie's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leslie's Bundle

Leslie's operates within a dynamic retail landscape, facing pressures from powerful suppliers and intense rivalry among existing competitors. Understanding these forces is crucial for navigating the pool supply industry.

The complete report reveals the real forces shaping Leslie's’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Leslie's reliance on a concentrated supplier base for essential pool chemicals and equipment significantly impacts its bargaining power. When a few dominant suppliers control critical inputs, such as specialized pump components or key chemical formulations, they gain considerable leverage. This can translate into higher prices or less favorable payment terms for Leslie's, as the company has fewer alternatives for sourcing these vital materials.

Leslie's faces a challenge with the bargaining power of suppliers due to high switching costs for specialized chemicals and proprietary equipment. For instance, if Leslie's needs to change suppliers for a unique pool treatment chemical, the process could involve substantial expenses like retooling manufacturing lines or obtaining new certifications, potentially disrupting their operations. This dependency on specific suppliers strengthens their leverage, making Leslie's less inclined to seek alternatives.

The uniqueness of products and services offered by suppliers significantly impacts their bargaining power with Leslie's. If a supplier provides a proprietary chemical formulation or a specialized pool automation component that is critical for Leslie's product performance and cannot be easily replicated by competitors, that supplier gains considerable leverage. This is because Leslie's would face high switching costs and potential disruptions to its business if that supplier were to increase prices or alter terms.

Supplier's Ability to Forward Integrate

Should a key supplier have the capability or inclination to move into the retail or service side of the pool and spa industry, they could directly compete with Leslie's. This potential threat grants suppliers considerable bargaining power during price negotiations. For instance, a major pool chemical manufacturer could launch its own direct-to-consumer online store, bypassing Leslie's distribution channels.

While this forward integration poses a threat, it is generally less common for large-scale manufacturers of chemicals or complex pool equipment to undertake such a strategic shift. Their core competencies often lie in production and innovation rather than retail operations. However, the mere possibility can influence supplier pricing and terms offered to Leslie's.

Consider the implications if a significant equipment supplier, like a leading pump manufacturer, decided to establish its own service network. This would directly challenge Leslie's service revenue streams and necessitate a competitive response, potentially impacting margins. In 2024, the specialty retail sector, including pool and spa supplies, faced ongoing supply chain adjustments and fluctuating consumer demand, making supplier relationships even more critical.

- Supplier Forward Integration Threat: Suppliers could enter Leslie's retail or service markets, becoming direct competitors.

- Leverage in Negotiations: This potential competition provides suppliers with increased bargaining power over Leslie's.

- Manufacturer Tendency: Large chemical and equipment manufacturers are typically less likely to pursue this strategy compared to smaller players.

- Market Context (2024): Supply chain dynamics and consumer demand shifts in 2024 highlighted the importance of managing supplier relationships effectively.

Importance of Leslie's to Supplier

Leslie's reliance on specific suppliers for pool and spa chemicals and equipment significantly influences its bargaining power. If a supplier derives a substantial portion of its revenue from Leslie's, that supplier's leverage is naturally reduced, as they are more dependent on the continued business from Leslie's. For instance, if a specialty chemical producer's primary client is Leslie's, Leslie's can likely negotiate more favorable terms.

Conversely, for large, diversified manufacturers of pool pumps or filters, Leslie's may represent only a small fraction of their overall sales. In such scenarios, these suppliers possess greater bargaining power due to Leslie's comparatively lower impact on their total revenue. This dynamic means Leslie's might have less influence over pricing or product specifications when dealing with these larger, more diversified entities.

In 2023, Leslie's reported cost of goods sold of approximately $795 million. The specific concentration of this spending across its supplier base is a key determinant of its bargaining power. A concentrated supplier base for critical components would inherently grant those suppliers more leverage.

- Supplier Dependence: If Leslie's accounts for a large percentage of a supplier's revenue, the supplier's bargaining power is weakened.

- Diversified Suppliers: For suppliers with many customers, Leslie's represents a smaller portion of their business, increasing the supplier's leverage.

- Cost of Goods Sold (2023): Leslie's $795 million cost of goods sold highlights the scale of its purchasing power, but this is moderated by supplier diversification.

Leslie's faces significant bargaining power from its suppliers, particularly for specialized chemicals and proprietary equipment where switching costs are high. This leverage allows suppliers to command higher prices and dictate terms, impacting Leslie's profitability. The potential for suppliers to integrate forward into Leslie's markets further amplifies this power, though large manufacturers often focus on their core competencies.

| Factor | Impact on Leslie's | 2024 Context |

|---|---|---|

| Supplier Concentration | High leverage for few dominant suppliers of critical inputs. | Supply chain adjustments and fluctuating demand intensified supplier importance. |

| Switching Costs | High costs for specialized chemicals and proprietary equipment limit Leslie's alternatives. | Disruptions and retooling expenses make supplier changes difficult. |

| Supplier Dependence on Leslie's | Weakened supplier leverage if Leslie's is a major customer. | Leslie's $795 million cost of goods sold in 2023 indicates substantial purchasing volume. |

| Leslie's Dependence on Suppliers | Increased supplier leverage if Leslie's represents a small portion of their sales. | Diversified suppliers possess greater negotiation power. |

What is included in the product

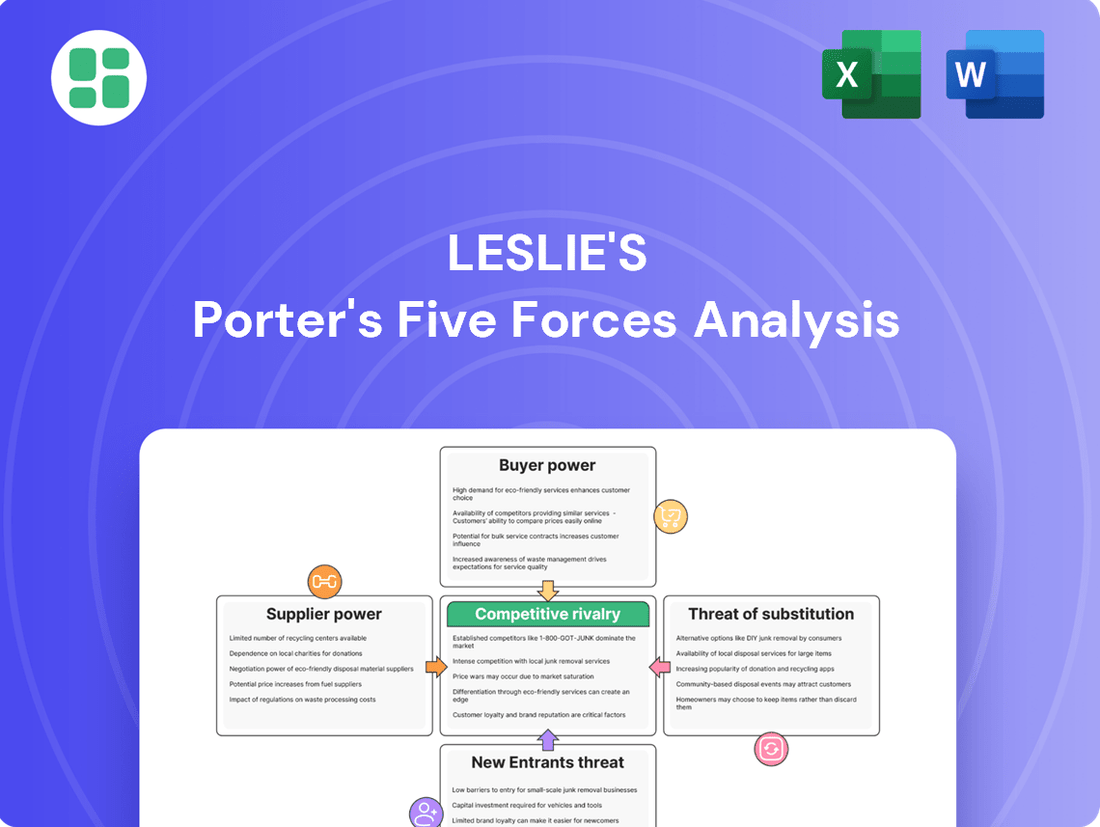

This analysis unpacks the competitive forces shaping Leslie's Pool Supplies' market, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industry.

Visually map competitive pressures to easily identify and address key threats, providing immediate clarity for strategic adjustments.

Customers Bargaining Power

Leslie's serves a vast number of individual residential pool and spa owners. This widespread customer base, with no single customer holding significant sway, inherently dilutes the bargaining power of any one buyer. This fragmentation means no individual residential customer can meaningfully impact Leslie's overall revenues or dictate lower prices.

Residential customers, particularly those buying basic pool chemicals, show a noticeable price sensitivity. This is because these products are largely undifferentiated, making it easy for consumers to shop around for the best deal.

The competitive landscape, with numerous brick-and-mortar stores and a robust online marketplace, amplifies this price sensitivity. Consumers can readily compare prices across different retailers, directly impacting Leslie's ability to command premium pricing for standard items.

In 2023, the average consumer spent approximately $1,200 annually on pool maintenance, with chemicals representing a significant portion of this. This figure highlights the substantial out-of-pocket expense, further encouraging price-conscious purchasing decisions among homeowners.

Customers can easily find alternative ways to maintain their pools and spas, significantly increasing their bargaining power. They can purchase generic pool chemicals from large retailers like Walmart or Home Depot, or even order them online from sites like Amazon.

In 2023, the U.S. market for swimming pool chemicals was valued at approximately $2.5 billion, indicating a substantial competitive landscape with many readily available alternatives to specialized retailers like Leslie's.

Furthermore, the rise of DIY pool maintenance resources and tutorials online empowers consumers to handle tasks themselves, reducing their reliance on professional services or specialized stores. This accessibility to substitutes and self-sufficiency directly challenges Leslie's pricing and service offerings.

Information Availability and Transparency

Customers today have unprecedented access to information, significantly bolstering their bargaining power. Online platforms, review sites, and price comparison tools empower shoppers with detailed knowledge about product features, quality, and pricing across various retailers. For instance, by mid-2024, the average consumer was found to spend over 30 minutes researching a product online before making a purchase, demonstrating a heightened level of due diligence.

This readily available data fosters transparency in the market, allowing customers to easily identify the best value propositions. They can compare specifications, read peer experiences, and pinpoint the most competitive prices, directly influencing their purchasing decisions and putting pressure on businesses to offer attractive terms. In 2024, e-commerce platforms reported that over 70% of consumers actively used comparison shopping features.

- Enhanced Information Access: Customers can easily find product details, reviews, and pricing from multiple sources.

- Price Transparency: Online tools enable direct comparison of prices across different sellers.

- Informed Decision-Making: Greater information availability leads to more confident and strategic purchasing choices by consumers.

Bargaining Power of Commercial/Pro Customers

Leslie's commercial and professional customers, such as pool service companies, wield significant bargaining power. Their substantial purchase volumes and potential for recurring service contracts give them leverage to negotiate better pricing and terms. This is particularly true for larger clients who can easily switch suppliers if their demands aren't met.

The company's Q1 2025 earnings report highlighted growth in pro pool contracts, indicating an increasing reliance on this segment. This growth, while positive, also means that the bargaining power of these professional clients is likely to remain a key factor in Leslie's pricing strategies and operational planning.

- High Volume Purchases: Commercial clients buy in much larger quantities than individual homeowners.

- Long-Term Relationships: Ongoing service contracts foster loyalty but also create opportunities for negotiation.

- Switching Costs: While not always high, the effort to change suppliers can be a point of leverage for large customers.

- Market Concentration: If a few large pool service companies dominate a region, their collective bargaining power increases.

The bargaining power of Leslie's customers is moderate to high, influenced by product substitutability, customer price sensitivity, and the availability of information. While individual residential customers have low individual power due to small purchase volumes, their collective price sensitivity, amplified by competition and easy access to alternatives, exerts pressure on Leslie's pricing for basic goods. Professional clients, however, hold more significant leverage due to their larger order sizes and potential for long-term contracts.

| Customer Segment | Bargaining Power Factor | Impact on Leslie's |

|---|---|---|

| Residential Customers | High price sensitivity for undifferentiated products; easy access to substitutes (Walmart, Amazon). | Limits pricing power on basic chemicals; necessitates competitive pricing strategies. |

| Commercial/Professional Customers | High purchase volumes; potential for recurring service contracts; ability to switch suppliers. | Significant leverage to negotiate better pricing and terms, influencing profitability on larger accounts. |

Full Version Awaits

Leslie's Porter's Five Forces Analysis

This preview showcases the complete Leslie's Porter's Five Forces Analysis, detailing the competitive landscape and strategic considerations for the pool supply industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing a comprehensive understanding of industry rivalry, the threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitute products.

Rivalry Among Competitors

The pool and spa care market is characterized by intense competition, featuring a broad spectrum of players. Leslie's, as a national chain, faces rivalry from regional specialists, numerous independent local service providers, and even large general retailers like Home Depot and Walmart, which offer pool and spa supplies. This extensive and varied competitive field amplifies the pressure on market participants.

The pool and spa market is showing robust growth, with its size projected to expand from USD 26.02 billion in 2024 to USD 27.78 billion in 2025. This upward trend, with an anticipated compound annual growth rate of 6.45% reaching USD 37.86 billion by 2030, generally tempers competitive rivalry. However, the industry's susceptibility to economic fluctuations and seasonal demand shifts means that companies still fiercely compete for market share, even amidst this expansion.

Leslie's operates with substantial fixed costs, including expenses for its numerous retail stores, extensive warehouse networks, and sophisticated inventory management systems, particularly for specialized items like pool chemicals and equipment. These high overheads compel the company to maintain consistent sales volume. For instance, in fiscal year 2023, Leslie's reported selling, general, and administrative expenses of $657.8 million, a significant portion of which reflects these fixed operational costs.

This cost structure often pressures Leslie's and its competitors to engage in aggressive pricing, especially when demand is lower, such as during off-peak seasons or periods of economic downturn. The drive to cover fixed costs can lead to price wars, intensifying competitive rivalry within the pool supply industry. The need to move inventory, particularly perishable chemicals, further fuels this dynamic, as unsold stock represents a direct financial loss.

Low Switching Costs for Customers

Customers can easily switch between pool and spa product and service providers because the costs associated with changing suppliers are generally low. This low barrier to entry and exit means that Leslie's must constantly work to keep customers happy and loyal, as they can readily move to a competitor. In 2024, the pool and spa industry saw continued emphasis on customer retention strategies, with many businesses offering loyalty programs and personalized service to combat this very issue.

This ease of switching directly fuels competitive rivalry. When customers have little to lose by switching, companies are pressured to offer competitive pricing, superior product quality, and exceptional customer service to maintain their market share. For instance, a customer might switch for a slight discount on chemicals or a faster appointment for pool maintenance, making price and convenience key differentiators.

- Low Switching Costs: Customers can easily move between Leslie's and competitors for pool and spa products and services.

- Intensified Competition: This ease of switching forces companies to compete aggressively on price, quality, and service.

- Customer Retention Focus: Businesses in the sector are prioritizing loyalty programs and personalized experiences to combat customer churn.

Brand Differentiation and Loyalty

Leslie's attempts to stand out by offering specialized knowledge, high-quality customer service, and unique product lines. This strategy aims to build a loyal customer base that values more than just price.

For more standardized pool supplies, where the product itself is less distinct, brand loyalty can be more fragile. Customers might switch based on promotions or convenience, increasing competitive pressure.

- Brand Recognition: Leslie's strong brand presence, built over years, helps in attracting and retaining customers, especially for those seeking reliability.

- Service as a Differentiator: The company emphasizes its expertise and in-store services, which can be a significant factor for consumers who need guidance on pool maintenance.

- Private Label vs. National Brands: While Leslie's offers exclusive brands, the availability of widely recognized national brands in the market means customers still have choices that can dilute loyalty to Leslie's own offerings.

- Impact of Online Retailers: The rise of online competitors, often focusing on price, can challenge Leslie's differentiation strategy, particularly for less complex or commoditized products.

Competitive rivalry at Leslie's is intense due to a fragmented market with numerous players, from national chains to local specialists. The industry's growth, projected to reach $37.86 billion by 2030, doesn't fully negate this, as companies fight for market share. Leslie's high fixed costs, exemplified by $657.8 million in SG&A in FY23, push for consistent sales, often leading to price competition.

Low switching costs for consumers mean companies must excel in pricing, quality, and service to retain customers. In 2024, customer retention strategies like loyalty programs are key differentiators. Leslie's leverages its brand, specialized knowledge, and in-store services to build loyalty, though online retailers and national brands present ongoing challenges for its differentiation strategy.

| Competitive Factor | Leslie's Position | Market Dynamic |

|---|---|---|

| Number of Competitors | High (National, Regional, Local, Big Box) | Fragmented market |

| Market Growth (2024-2030) | Projected CAGR of 6.45% | Growth generally tempers rivalry, but share battles persist |

| Fixed Costs | Substantial (Stores, Warehouses, Inventory) | Drives need for sales volume, can lead to price wars |

| Switching Costs | Low for consumers | Forces focus on price, quality, and service |

| Differentiation Strategies | Brand, Expertise, In-store Service, Private Label | Key to combatting commoditization and online competition |

SSubstitutes Threaten

Homeowners undertaking their own pool and spa maintenance represent a significant substitute for Leslie's offerings. This DIY approach involves purchasing chemicals and basic equipment from a variety of sources, including general retailers, online platforms, and even local hardware stores, directly competing with Leslie's specialized product lines and services.

The persistent threat of DIY maintenance is underscored by the increasing availability of affordable pool care products and readily accessible online tutorials. For instance, a 2024 survey indicated that approximately 40% of pool owners engage in some level of self-maintenance, often citing cost savings as the primary motivator.

General retailers and online marketplaces like Amazon, Walmart, and Home Depot present a significant threat of substitutes for Leslie's Pool Corp. Customers can easily find many pool and spa chemicals and basic accessories on these broad platforms, often at lower price points. In 2024, online retail continued its strong growth, with e-commerce sales projected to reach over $2.7 trillion globally, highlighting the accessibility and competitive pricing these channels offer.

While traditional chemicals remain dominant, alternative water treatment technologies are emerging. Advanced UV sanitizers, ozone generators, and natural pool systems, though currently niche, represent a growing substitution threat by reducing reliance on conventional chemicals. The pool and spa industry saw a significant increase in interest in sustainable and smart solutions in 2024, with companies reporting a 15% rise in inquiries for non-chemical treatment options.

Hot Tubs as a Substitute for Pools

For some consumers, a hot tub can indeed act as a substitute for a swimming pool, particularly those seeking relaxation and hydrotherapy benefits rather than full-scale swimming. This segment of the market might find hot tubs more appealing due to their smaller footprint and reduced maintenance needs compared to a large pool. For instance, the U.S. hot tub market was valued at approximately $1.5 billion in 2023, indicating a significant consumer base for these products.

The perceived threat of substitutes like hot tubs for pool manufacturers and retailers like Leslie's is tied to how well these alternatives meet core consumer needs. While a hot tub doesn't offer the same recreational space as a pool, its ability to provide year-round comfort and therapeutic benefits can be a strong draw. In 2024, the demand for home wellness solutions, including hot tubs, continued to be robust, potentially diverting some discretionary spending that might otherwise go towards pool installations or upkeep.

The cost factor also plays a role. While initial hot tub purchase prices can be substantial, the ongoing costs for chemicals, heating, and maintenance are generally lower than those associated with a swimming pool. This cost-effectiveness can make hot tubs a more attractive option for budget-conscious consumers or those who prefer a simpler ownership experience.

- Hot Tubs Offer Compact Relaxation: Hot tubs provide a smaller, more manageable alternative for consumers prioritizing relaxation and hydrotherapy over large-scale swimming.

- Reduced Maintenance Appeal: The lower maintenance requirements of hot tubs compared to swimming pools can be a significant factor for consumers seeking convenience.

- Market Size Indicates Substitute Potential: The U.S. hot tub market's valuation of around $1.5 billion in 2023 highlights a substantial segment of consumers for whom hot tubs are a viable alternative.

- Wellness Trend Supports Hot Tubs: The ongoing demand for home wellness solutions in 2024 means hot tubs are well-positioned to capture consumer spending that might otherwise be allocated to swimming pools.

Professional Pool Service Companies

The threat of substitutes for Leslie's is significant, primarily from professional pool service companies. These companies offer a comprehensive solution, handling everything from chemical balancing to equipment maintenance, directly competing with Leslie's core business of selling pool supplies for do-it-yourself (DIY) customers. This service-based alternative bypasses the need for customers to purchase individual products from Leslie's, impacting their retail sales and in-store service revenue streams. For instance, a study by the Pool & Hot Tub Alliance in 2023 indicated that a substantial portion of pool owners utilize professional maintenance services, highlighting the market penetration of this substitute.

These professional services represent a complete substitution for Leslie's product sales. Instead of customers buying chemicals, filters, and cleaning tools from Leslie's, they can opt for a monthly or weekly service contract. This can be particularly appealing to busy homeowners or those who lack the time or expertise for regular pool upkeep. The convenience factor of a full-service provider directly challenges Leslie's value proposition for DIY customers.

Furthermore, the growth of the professional pool service sector can be seen as a direct drain on Leslie's potential customer base. As more consumers choose to outsource their pool maintenance, the pool of individuals actively seeking DIY solutions shrinks. This trend is supported by industry reports suggesting steady growth in the pool service market, with some regions experiencing annual growth rates of 5-7% in professional maintenance services as of 2024 data.

- Direct Competition: Professional pool service companies offer an all-inclusive alternative to DIY pool care, directly impacting Leslie's product sales.

- Convenience Factor: For time-strapped homeowners, professional services eliminate the need for purchasing and applying pool chemicals or performing maintenance tasks.

- Market Trend: Industry data from 2023 and 2024 indicates a growing preference for professional pool maintenance, potentially reducing the addressable market for DIY solutions.

The threat of substitutes for Leslie's is multifaceted, ranging from DIY pool maintenance to alternative relaxation options and professional services. Consumers can opt for entirely different leisure activities or invest in products that offer similar benefits with less upkeep. For instance, the rise of smart home technology has also influenced the pool and spa market, with integrated systems offering automated maintenance and control, presenting a technological substitute.

The market for pool and spa chemicals and equipment is also subject to substitution from alternative water treatment methods. While traditional chlorine remains prevalent, technologies like salt chlorinators, UV sanitizers, and ozone generators are gaining traction. These alternatives can reduce the reliance on chemical purchases, directly impacting Leslie's core product sales. In 2024, sales of non-chemical pool treatment systems saw a notable increase, with industry reports indicating a 10% year-over-year growth.

| Substitute Category | Description | Impact on Leslie's | 2024 Market Data/Trend |

|---|---|---|---|

| DIY Pool Maintenance | Homeowners performing their own pool upkeep using purchased chemicals and equipment. | Directly competes with Leslie's product sales and in-store expertise. | Approximately 40% of pool owners engage in some DIY maintenance, driven by cost savings. |

| General Retailers & Online Platforms | Large retailers (Amazon, Walmart) and e-commerce sites offering a wide range of pool supplies. | Provides convenient access to competing products, often at lower price points. | Global e-commerce sales projected to exceed $2.7 trillion in 2024. |

| Alternative Water Treatment | Technologies like UV sanitizers, ozone generators, and natural pool systems. | Reduces reliance on traditional chemical purchases, a key revenue stream for Leslie's. | 15% rise in inquiries for non-chemical treatment options reported in 2024. |

| Hot Tubs | Smaller, more manageable units offering relaxation and hydrotherapy. | Appeals to consumers seeking less maintenance and year-round usability, potentially diverting spending from pools. | U.S. hot tub market valued at $1.5 billion in 2023; demand for home wellness solutions remained robust in 2024. |

| Professional Pool Services | Companies offering comprehensive pool maintenance contracts. | Bypasses the need for customers to purchase individual products from Leslie's, impacting retail and service revenue. | Professional service market experiencing steady growth, with some regions showing 5-7% annual growth in 2024. |

Entrants Threaten

The significant capital required to establish a robust physical retail and service infrastructure presents a formidable barrier for potential entrants. Leslie's, with its extensive network, necessitates substantial upfront investment in prime real estate, diverse inventory, and skilled personnel. This high cost of entry effectively deters many smaller players from attempting to replicate Leslie's scale and reach.

Leslie's has cultivated a robust brand identity and deep customer trust over many years, solidifying its position as the leading direct-to-consumer provider in the pool and spa care industry. This established reputation presents a significant barrier for any new competitor aiming to enter the market.

New entrants would need to invest heavily and strategically to replicate Leslie's decades-long effort in building brand recognition and fostering customer loyalty. Without this, they would struggle to attract and retain customers, making market penetration a formidable task.

Leslie's sophisticated supply chain and distribution network for specialized pool and spa products act as a significant barrier for potential new entrants. The company's established infrastructure, built over years, allows for efficient sourcing and delivery of chemicals, equipment, and parts. In fiscal year 2023, Leslie's reported a 1.4% increase in net sales to $1.17 billion, demonstrating the strength and reach of its operational network.

Regulatory and Safety Standards

The pool and spa industry presents a significant threat of new entrants due to stringent regulatory and safety standards. Companies must meticulously adhere to regulations concerning the handling of chemicals, water quality, and equipment safety. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce regulations on pool and spa sanitizers, requiring specific labeling and safety data sheets for products. Newcomers face substantial costs and time investment in obtaining necessary certifications and establishing robust safety protocols to comply with these requirements.

- Navigating Chemical Handling Regulations New entrants must understand and implement safe handling procedures for chemicals like chlorine and bromine, adhering to guidelines set by bodies such as the Occupational Safety and Health Administration (OSHA).

- Product Certification Requirements Obtaining certifications for pool and spa equipment, such as Underwriters Laboratories (UL) listings for electrical safety, is crucial and adds to the barrier for new players.

- Water Safety Standards Compliance with local and national water safety standards, including those related to filtration and sanitation, is mandatory and requires investment in quality control and testing.

Expertise and Specialized Knowledge

The pool and spa care industry demands a significant level of expertise, particularly in areas like water chemistry, equipment diagnostics, and ongoing maintenance procedures. New companies entering this space would face a steep learning curve to develop this specialized knowledge. Leslie's Pool Supplies, with its established history, has cultivated a team of highly trained and certified technicians, a crucial asset that new entrants would find challenging and time-consuming to build and validate.

This expertise translates into a competitive advantage for Leslie's, making it harder for newcomers to gain customer trust and market share. For instance, in 2024, Leslie's continued to emphasize its in-store and online resources for customer education, reinforcing its position as a knowledgeable provider. This commitment to expertise acts as a significant barrier, as replicating the depth of knowledge and practical experience held by Leslie's staff is not easily achieved.

- Specialized Skills: Water chemistry balancing, equipment repair, and seasonal maintenance require specific training and certifications.

- Certified Technicians: Leslie's employs technicians with certifications, a credential that builds immediate customer confidence and is difficult for new entrants to acquire rapidly.

- Knowledge Replication: The time and investment needed to train a comparable workforce present a substantial hurdle for new competitors.

The threat of new entrants into the pool and spa market is moderate, largely due to established barriers like significant capital requirements for infrastructure and inventory, as well as the need for specialized expertise. Leslie's strong brand recognition and customer loyalty further deter new players. While regulatory hurdles exist, they are manageable for well-funded entrants.

| Barrier | Impact on New Entrants | Leslie's Advantage |

|---|---|---|

| Capital Investment | High (real estate, inventory, staffing) | Extensive existing infrastructure and scale |

| Brand Loyalty & Reputation | Challenging to build | Decades of established trust and recognition |

| Expertise & Training | Steep learning curve, time-intensive | Highly trained and certified technicians |

| Supply Chain & Distribution | Complex and costly to replicate | Efficient, established network |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available company filings (like 10-Ks and annual reports), industry-specific market research reports from firms such as Gartner and Forrester, and macroeconomic indicators sourced from government agencies and international financial institutions.