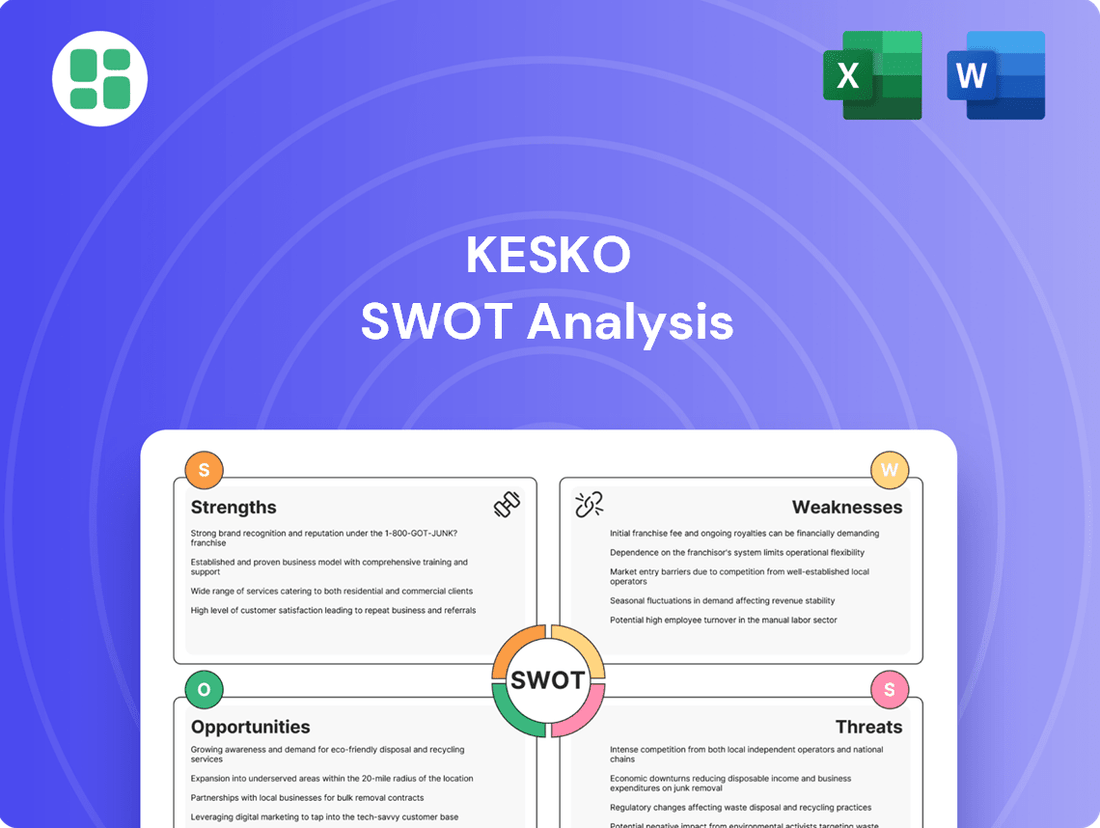

Kesko SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kesko Bundle

Kesko's strong brand recognition and extensive store network present significant strengths, while its reliance on the Finnish market and evolving consumer habits pose key challenges. Understanding these dynamics is crucial for navigating the competitive retail landscape.

Want the full story behind Kesko's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Kesko's strength lies in its diversified business portfolio, spanning grocery trade, building and technical trade, and car trade. This broad operational base offers significant resilience, as performance in one sector can cushion downturns in another. For instance, the consistent demand for groceries provides a stable revenue stream even when the cyclical building or automotive markets experience slowdowns.

Kesko, operating as K Group, holds a dominant position in Finland's retail sector and is a major force across Northern Europe. This extensive network, encompassing roughly 1,700 stores in eight countries, underpins its operational strength and brand equity.

This significant market penetration translates into substantial economies of scale, allowing Kesko to optimize its supply chain and purchasing power. For instance, in 2023, K Group's net sales reached €11.7 billion, demonstrating the sheer volume of its operations and its influence in the regions it serves.

Kesko's strength lies in its robust digital and multi-channel capabilities, seamlessly blending online sales with its vast physical store presence. This integration ensures a smooth customer journey, reaching more consumers and offering convenience that aligns with modern retail trends, especially the surge in online grocery shopping and rapid delivery services.

Strategic Focus on Profitability and Growth

Kesko's strategic focus for 2024-2026 is firmly set on achieving profitable growth, a move that clearly defines its competitive edges and aims to bolster its standing in key business areas. This focused approach, demonstrated through effective implementation even amidst a demanding economic climate, has allowed the company to sustain robust sales figures and healthy profitability.

For instance, Kesko reported a comparable operating profit of €228.7 million in the first quarter of 2024, a significant increase from €183.4 million in the same period of 2023, underscoring the success of its profitability-driven strategy.

- Clear Strategic Direction: The 2024-2026 strategy prioritizes profitable growth and competitive advantage.

- Market Position Strengthening: Kesko aims to enhance its market share in core segments.

- Resilient Performance: The company has maintained strong sales and profitability despite market challenges.

- Financial Highlights: Q1 2024 comparable operating profit reached €228.7 million, a notable year-on-year improvement.

Commitment to Sustainability

Kesko's dedication to sustainability is deeply ingrained in its business strategy, serving as a significant competitive differentiator. The company actively aims to facilitate sustainable purchasing decisions for its customers and foster positive change throughout its entire supply chain.

The company's commitment is made transparent through its annual sustainability reporting, which aligns with recognized international benchmarks and indices. This practice not only bolsters Kesko's corporate image but also resonates strongly with consumers and investors who prioritize environmental responsibility.

- Sustainability as a Core Strategy: Kesko's vision is to empower customers to make sustainable choices and to drive change across its value chain.

- Transparent Reporting: Annual sustainability reports adhere to international standards, enhancing reputation and appeal to eco-conscious stakeholders.

- Competitive Advantage: A strong sustainability focus attracts environmentally aware consumers and investors, differentiating Kesko in the market.

- Value Chain Impact: Kesko actively works to influence and improve sustainability practices throughout its operations and supplier network.

Kesko's diversified business model, encompassing grocery, building and technical, and car trades, provides significant stability. This breadth allows strong sectors to offset weaker ones, ensuring consistent revenue streams. Its extensive retail network, with approximately 1,700 stores across eight countries, solidifies its market leadership, particularly in Northern Europe.

| Metric | 2023 | Q1 2024 |

| Net Sales (€ billion) | 11.7 | N/A |

| Comparable Operating Profit (€ million) | N/A | 228.7 |

What is included in the product

Analyzes Kesko’s competitive position through key internal and external factors, identifying its strengths in market leadership and operational efficiency, while acknowledging weaknesses in e-commerce integration and opportunities in digitalization and sustainability, alongside threats from intense competition and economic volatility.

Kesko's SWOT analysis provides a clear, structured framework to identify and address strategic challenges, relieving the pain of navigating complex market dynamics.

Weaknesses

Kesko's building and technical trade, along with its car trade segments, are particularly susceptible to the ebb and flow of economic cycles. These divisions are directly impacted by shifts in consumer confidence and the willingness of businesses and individuals to invest, making them vulnerable during economic slowdowns.

The construction sector's recovery pace is a key indicator; a slower-than-expected rebound in 2025, as observed, directly influences Kesko's financial performance. This sensitivity was evident when the company revised its profit outlook, underscoring the direct correlation between the construction cycle and Kesko's earnings potential.

Kesko's significant reliance on the Finnish market, with roughly 80% of its net sales generated domestically, exposes it to fluctuations in the Finnish economy and local competitive pressures. This concentration means that any downturn or intensified competition within Finland can disproportionately impact Kesko's overall performance.

Certain business segments within Kesko have encountered headwinds. For example, the grocery trade division saw a dip in net sales and comparable operating profit in the first half of 2025. This was influenced by factors such as the timing of Easter and adjustments to pricing strategies, alongside weaker non-food sales in K-Citymarket stores.

Integration Risks of Acquisitions

Kesko's acquisition strategy, especially in the Danish building and home improvement sector, introduces significant integration risks. Successfully merging operations, cultures, and IT systems is complex and can lead to unexpected costs and disruptions.

These integration challenges can directly affect financial performance. For instance, Kesko has highlighted that its Danish acquisitions are projected to have a negative impact of less than €5 million on its 2025 comparable operating profit, underscoring the immediate financial strain these ventures can impose.

- Integration Complexity: Merging diverse business units and IT systems post-acquisition is inherently challenging.

- Cost Overruns: Unexpected expenses during the integration process can erode profitability.

- Operational Disruption: Integrating new operations can temporarily hinder efficiency and customer service.

- Financial Impact: As seen with the projected less than €5 million impact on 2025 comparable operating profit from Danish acquisitions, integration costs can weigh on short-term financial results.

Impact of Geopolitical Tensions

Geopolitical crises and tensions represent significant uncertainties for Kesko. These external factors can directly impact the company by disrupting its intricate supply chains, which are vital for sourcing and distributing goods across its markets. For instance, ongoing conflicts or trade disputes in key sourcing regions could lead to increased import costs or availability issues, directly affecting Kesko's product offerings and margins.

Furthermore, geopolitical instability can significantly sway consumer behavior. In times of uncertainty, consumers may reduce discretionary spending, opting for essential goods, which could impact Kesko's sales volumes, particularly in its non-food segments. Economic instability stemming from these tensions, such as currency fluctuations or inflation, can also erode purchasing power and create a challenging operating environment.

Kesko's exposure to various regions means it's susceptible to a range of geopolitical risks. For example, increased tensions in Eastern Europe, a key market for some of Kesko's operations, could lead to:

- Supply chain disruptions impacting the availability of goods.

- Currency volatility affecting profitability and import costs.

- Reduced consumer confidence leading to lower sales.

- Potential for increased operational costs due to heightened security measures or regulatory changes.

Kesko's reliance on the Finnish market, representing approximately 80% of its net sales, makes it highly vulnerable to domestic economic downturns and intensified local competition. This concentration means that any slowdown in Finland, such as the projected slower-than-expected recovery in the construction sector for 2025, directly and disproportionately impacts the company's overall financial health and earnings potential.

The building and technical trade, along with the car trade segments, are particularly susceptible to economic cycles. These divisions are directly affected by shifts in consumer confidence and business investment, meaning economic slowdowns can significantly hinder their performance. For instance, the grocery trade division experienced a dip in net sales and comparable operating profit in the first half of 2025, partly due to weaker non-food sales in K-Citymarket stores.

Kesko's strategic acquisitions, particularly in Denmark's building and home improvement sector, introduce substantial integration risks. The complexity of merging operations, cultures, and IT systems can lead to unforeseen costs and operational disruptions. These integration challenges are projected to negatively impact Kesko's 2025 comparable operating profit by less than €5 million, highlighting the immediate financial strain these ventures can impose.

Geopolitical crises and tensions pose a significant threat to Kesko by disrupting its crucial supply chains and impacting consumer behavior. Conflicts or trade disputes can increase import costs and affect product availability. Furthermore, economic instability stemming from these tensions, such as currency fluctuations, can erode purchasing power and create a challenging operating environment, potentially leading to reduced consumer confidence and lower sales volumes.

| Weakness | Description | Impacted Segment(s) | Financial Implication (2025 Projection) | Contributing Factors |

| Market Concentration | High reliance on the Finnish market (approx. 80% of net sales). | All segments | Vulnerability to Finnish economic downturns and local competition. | Domestic economic sensitivity, intensified local competition. |

| Economic Cycle Sensitivity | Vulnerability of certain trade segments to economic fluctuations. | Building & Technical Trade, Car Trade | Reduced sales and profitability during economic slowdowns. | Consumer confidence, business investment levels. |

| Acquisition Integration Risks | Challenges in merging acquired businesses and IT systems. | Building & Home Improvement (Denmark) | Projected negative impact of less than €5 million on 2025 comparable operating profit. | Complexity of integration, potential cost overruns, operational disruption. |

| Geopolitical Vulnerability | Susceptibility to supply chain disruptions and consumer behavior changes due to global instability. | All segments (especially those with international sourcing) | Increased import costs, reduced sales volumes, currency volatility. | Global conflicts, trade disputes, economic instability. |

Full Version Awaits

Kesko SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Kesko's strategic focus on Northern Europe, especially in the building and technical trade, offers significant growth avenues. The company has actively pursued both organic expansion and mergers and acquisitions (M&A) to solidify its presence. For instance, recent acquisitions in Denmark underscore this commitment, signaling an intent to broaden its geographical reach and reinforce its market leadership in the region.

Kesko is well-positioned to capitalize on the ongoing surge in online grocery sales, particularly with the increasing demand for express delivery options. This trend, evident across the retail sector, presents a substantial opportunity for growth.

By continuing to invest in and enhance its digital platforms and e-commerce infrastructure, Kesko can deepen customer engagement and secure a more significant portion of the expanding online market. This strategic focus on digital services is crucial for future expansion.

For instance, in 2023, Kesko's online sales saw a notable increase, reflecting the broader market shift. The company's commitment to developing its digital capabilities is a key driver in capturing this evolving consumer behavior.

The construction sector is showing signs of a turnaround, with expectations for improvement in 2025 from its current low point. This recovery is particularly beneficial for Kesko's building and technical trade division, suggesting a more favorable market environment ahead.

Despite a generally subdued market, both new and used car sales have demonstrated robust performance. This resilience in the automotive sector, a key area for Kesko, points to continued growth opportunities and consumer demand.

Leveraging Sustainability as a Competitive Edge

Kesko's robust dedication to sustainability, evidenced by its inclusion in prominent international sustainability indices, presents a significant opportunity to enhance its market position. This commitment can be further amplified by developing and actively promoting a wider range of eco-friendly products and services.

This strategic focus is particularly appealing to the rapidly expanding segment of consumers who prioritize environmental responsibility, thereby fostering stronger brand loyalty and potentially capturing a larger market share. For instance, in 2023, Kesko reported that its own brand products with sustainability claims saw a notable increase in sales, indicating a clear consumer preference.

- Attracting Eco-Conscious Consumers: Capitalize on the growing demand for sustainable options, a trend projected to continue its upward trajectory through 2025.

- Strengthening Brand Loyalty: Deepen customer relationships by aligning with consumer values, leading to repeat business and positive word-of-mouth marketing.

- Innovation in Sustainable Offerings: Drive product development in areas like reduced packaging, energy-efficient appliances, and ethically sourced materials to meet evolving market needs.

- Enhanced Reputation and Index Performance: Continued investment in sustainability initiatives can lead to improved rankings in key ESG (Environmental, Social, and Governance) indices, further bolstering Kesko's image.

Optimizing K-Citymarket's Non-Food Trade

Kesko's strategic push to enhance K-Citymarket's non-food offerings, by tailoring assortments to individual store needs and leveraging data analytics, is a significant opportunity. This data-driven approach aims to boost sales and profitability in a segment that can benefit from optimized product mixes and targeted marketing.

By revitalizing the non-food trade, Kesko can better utilize the existing foot traffic within its hypermarkets, converting more visitors into buyers of these higher-margin items. This initiative is particularly timely, as consumer spending patterns continue to evolve, creating demand for more curated and convenient shopping experiences.

- Targeted Assortment: Implementing store-specific non-food selections based on local customer data can increase conversion rates.

- Profitability Boost: Optimizing non-food inventory and merchandising can lead to improved gross margins, as these categories often carry higher markups than groceries.

- Customer Flow Monetization: Capturing a larger share of the non-food spend from existing K-Citymarket customers enhances overall basket value and loyalty.

- Competitive Edge: A well-executed non-food strategy can differentiate K-Citymarket from competitors, attracting a broader customer base seeking one-stop shopping solutions.

Kesko's strategic expansion into the Danish building and technical trade market, through acquisitions, presents a clear path for growth and market share consolidation in Northern Europe. The company is also poised to benefit from the increasing digitalization of retail, particularly the strong upward trend in online grocery sales and express delivery services, as evidenced by their notable online sales growth in 2023.

The anticipated recovery of the construction sector in 2025 offers a tailwind for Kesko's building and technical trade division, while the resilience shown in both new and used car sales provides ongoing opportunities within the automotive segment. Furthermore, Kesko's commitment to sustainability, recognized in international indices and reflected in the growing sales of its eco-labeled own-brand products in 2023, appeals to a key consumer demographic and enhances brand reputation.

Enhancing the non-food assortment in K-Citymarkets through data analytics and tailored offerings represents a significant opportunity to boost sales and profitability by capturing more of existing customers' spending. This strategic move leverages high foot traffic for higher-margin items, aligning with evolving consumer preferences for curated shopping experiences.

Threats

The grocery sector in Finland is a battleground for pricing, with rivals like S Group consistently investing to offer lower prices. This intense competition directly impacts Kesko's grocery division, its largest segment, potentially squeezing profit margins. For instance, in 2023, Kesko's grocery sales grew by 4.5%, but maintaining this growth while absorbing price pressures requires constant strategic maneuvering to protect profitability.

A significant threat for Kesko is a sluggish economic recovery, which could dampen consumer spending and business investment. This directly affects sales, particularly in sectors like building and technical trade, where demand is sensitive to economic conditions.

Kesko itself has flagged a slower-than-expected improvement in its operating environment as a key risk. This could lead to reduced sales volumes and lower profitability, especially impacting divisions like building and technical trade and car trade, which rely heavily on robust economic activity.

For instance, if consumer confidence remains subdued throughout 2024 and into 2025, it could translate into fewer home improvement projects and reduced spending on durable goods, directly hitting Kesko's revenue streams in these segments.

Global supply chain disruptions and ongoing inflation present a significant hurdle for Kesko. These factors can directly lead to higher operational expenses and create uncertainty around product availability, potentially affecting sales and customer satisfaction. For instance, the continued volatility in global shipping costs, which saw significant spikes in 2024, directly impacts the landed cost of goods for retailers like Kesko.

While Kesko's recent reports haven't highlighted these as explicit threats, the broader economic climate in 2024 and into 2025 suggests these pressures are real. They could challenge Kesko's capacity to keep its profit margins steady and ensure a consistent supply of products to its customers. Inflationary pressures, in particular, can squeeze consumer purchasing power, impacting demand for non-essential goods.

Changes in Consumer Behavior and Preferences

Consumer preferences are evolving rapidly, and Kesko must remain agile. For instance, the Finnish market saw a significant increase in electric vehicle sales, with registrations of new battery electric vehicles (BEVs) growing by 45% in 2023 compared to 2022, reaching over 20,000 units. A similar swift shift towards specific product categories or retail formats, such as a strong preference for discount chains, could challenge Kesko's market position if its offerings don't align.

The ongoing trend towards digitalization and changing shopping habits presents a notable threat. While Kesko has invested in its online presence, a more pronounced migration of consumers to purely online channels, away from physical stores, could diminish the value of its extensive brick-and-mortar network. This is particularly relevant as e-commerce penetration in Finland continued its upward trajectory, with online retail sales accounting for a growing share of total retail turnover.

- Shifting demand: A rapid increase in demand for niche products or services that Kesko is not currently positioned to supply effectively.

- Discount retail surge: Increased competition from discount retailers, potentially drawing price-sensitive consumers away from Kesko's brands.

- Online channel dominance: A faster-than-expected shift to online shopping, impacting the profitability and relevance of Kesko's physical store infrastructure.

Regulatory Changes and Environmental Compliance Costs

Kesko, as a major retailer, faces potential headwinds from evolving regulatory landscapes, particularly concerning sustainability and environmental mandates. Stricter rules on emissions, waste management, or product sourcing could increase operational expenses. For instance, the EU's Green Deal initiatives, which aim for climate neutrality by 2050, are likely to introduce more stringent requirements for businesses operating within the bloc, potentially impacting Kesko's supply chain and product offerings.

The financial implications of these changes can be significant. Increased investment in eco-friendly packaging, energy-efficient logistics, or sustainable sourcing practices might be necessary, thereby affecting profit margins. Furthermore, failure to comply with new environmental standards could lead to penalties or reputational damage, impacting consumer trust and sales. For example, if new regulations require significant upgrades to store energy systems, the capital expenditure could be substantial.

- Increased operational costs due to new environmental regulations.

- Potential impact on profit margins from investments in sustainability.

- Risk of penalties for non-compliance with climate and nature targets.

- Need for adaptation in supply chain management to meet stricter sourcing standards.

Intense price competition from rivals like S Group poses a significant threat, potentially squeezing Kesko's profit margins, especially in its largest grocery segment where sales grew 4.5% in 2023. A sluggish economic recovery and subdued consumer confidence throughout 2024 and 2025 could dampen spending, particularly affecting the building and technical trade sectors. Furthermore, global supply chain disruptions and persistent inflation continue to drive up operational costs and create product availability uncertainties.

The rapid evolution of consumer preferences, such as the 45% surge in Finnish electric vehicle sales in 2023, necessitates agility to avoid misalignment with market demands. A faster-than-anticipated shift towards online channels also threatens the value of Kesko's extensive physical store network, as e-commerce penetration continues to rise in Finland. Additionally, evolving regulatory landscapes, particularly EU Green Deal initiatives, could increase operational expenses and impact profit margins through investments in sustainability and supply chain adaptations.

| Threat Category | Specific Risk | Potential Impact | Supporting Data (2023/2024 Outlook) |

|---|---|---|---|

| Competitive Pressure | Price Wars in Grocery | Margin Squeeze | S Group's continued investment in lower prices; Kesko's grocery sales grew 4.5% in 2023. |

| Economic Conditions | Sluggish Recovery / Low Consumer Confidence | Reduced Sales Volumes (esp. Building & Technical Trade) | Demand sensitivity in these sectors to economic activity; potential for reduced spending on durable goods. |

| Operational Challenges | Supply Chain Disruptions & Inflation | Increased Costs, Product Availability Issues | Volatility in global shipping costs observed in 2024; inflationary pressures impacting consumer purchasing power. |

| Market & Consumer Trends | Shifting Preferences / Online Dominance | Loss of Market Share, Reduced Physical Store Value | 45% growth in Finnish EV sales (2023); continued rise in e-commerce penetration. |

| Regulatory Environment | Sustainability Mandates | Increased Operational Costs, Potential Penalties | EU Green Deal initiatives; potential need for significant capital expenditure on store energy systems. |

SWOT Analysis Data Sources

This Kesko SWOT analysis is built upon a robust foundation of data, incorporating Kesko's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and informed perspective.