Kesko Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kesko Bundle

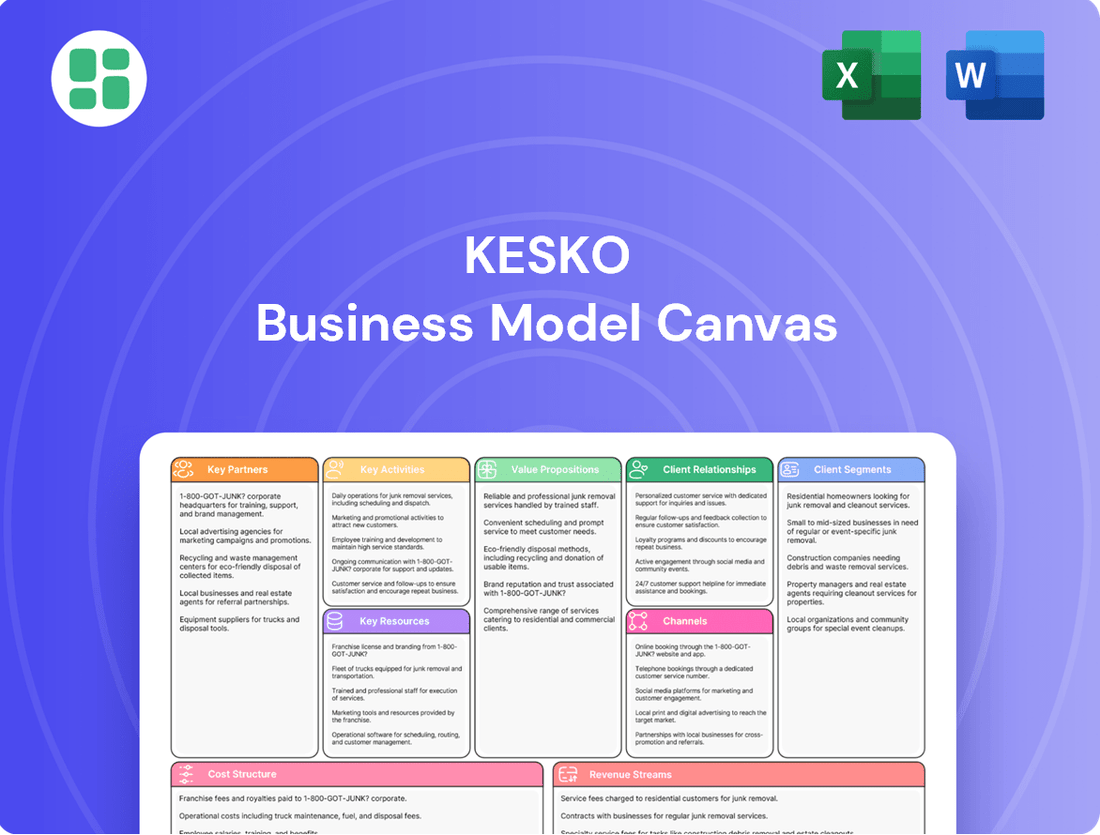

Unlock the strategic blueprint behind Kesko's success with our comprehensive Business Model Canvas. Discover how they effectively engage diverse customer segments, build robust value propositions, and leverage key partnerships to dominate the retail landscape. This detailed analysis is your key to understanding their operational excellence and market penetration strategies.

Partnerships

Kesko’s supplier network is extensive, covering everything from food and groceries to construction materials and automotive components. These partnerships are the backbone of Kesko’s ability to offer a wide variety of products across its different retail segments. In 2023, Kesko worked with thousands of suppliers, ensuring a consistent flow of goods to meet customer needs.

Kesko's key partnerships are built around its independent K-retailer entrepreneurs, who are crucial to its success, particularly in the grocery and building and home improvement sectors. These entrepreneurs manage a significant portion of Kesko's store network.

This model allows for strong local market understanding and community engagement, as retailers are deeply rooted in their areas. In 2023, Kesko's net sales reached €11.7 billion, underscoring the broad reach facilitated by this partnership structure.

Kesko supports these entrepreneurs by providing essential centralized services. These include efficient purchasing, sophisticated logistics, and robust IT systems, enabling retailers to focus on their core operations and customer service.

Kesko relies heavily on strong partnerships with logistics and transportation providers to manage its vast network across Northern Europe. These collaborations are crucial for ensuring that everything from fresh groceries to building materials reaches its destination efficiently and on time. For instance, in 2023, Kesko's grocery division, K-Citymarket, emphasized the importance of a robust cold chain, which is directly dependent on specialized transport partners for maintaining product quality.

These partnerships are designed to optimize inventory and cut down on operational expenses. By working with experts in the field, Kesko can ensure that its supply chain runs smoothly, whether it's delivering perishable goods to its numerous grocery stores or handling bulkier items for its building and technical trade segments. This strategic outsourcing allows Kesko to focus on its core retail operations.

Technology and IT Partners

Kesko actively partners with technology and IT providers to build and manage its robust digital ecosystem. These collaborations are crucial for advancing its e-commerce capabilities, data analytics, and overall IT infrastructure, ensuring a seamless omnichannel customer journey.

These strategic alliances enable Kesko to implement cutting-edge solutions that optimize operations, from supply chain management to sophisticated customer loyalty programs. For instance, in 2024, Kesko continued to invest in cloud-based solutions and advanced data platforms to gain deeper customer insights and drive personalized experiences.

- Digital Infrastructure Enhancement: Partnerships focus on modernizing and scaling Kesko's IT backbone to support growing online traffic and data volumes.

- E-commerce Platform Development: Collaborations aim to innovate and improve the user experience on Kesko's online sales channels, including feature enhancements and performance optimization.

- Data Analytics and AI Integration: Working with tech partners to leverage data for better forecasting, personalized marketing, and operational efficiency improvements.

- Supply Chain and Logistics Technology: Implementing advanced software and systems to streamline inventory management, order fulfillment, and delivery processes.

Financial and Service Partners

Kesko collaborates with financial institutions to manage payments and secure financing, a crucial aspect of its retail operations. For instance, in 2024, Kesko continued its focus on efficient payment solutions across its diverse business segments.

Partnerships with service providers are vital for enhancing customer offerings. This includes insurance providers and specialized services that add value to Kesko's retail and automotive divisions. In the automotive sector, Kesko is actively integrating EV charging networks, underscoring a commitment to sustainable mobility solutions through strategic alliances.

These collaborations are designed to streamline financial processes and broaden the scope of services available to Kesko's customer base. The company leverages these partnerships to offer integrated solutions, from everyday retail transactions to specialized automotive financing and maintenance, thereby strengthening its market position.

- Financial Institutions: Facilitate payment processing and provide financing options for customers and the company.

- Service Providers: Offer insurance, car financing, maintenance, and EV charging network integration.

- Operational Efficiency: Streamline internal financial management and customer-facing service delivery.

- Customer Value: Enable comprehensive solutions that enhance the customer experience across various business units.

Kesko's key partnerships are foundational, especially with its independent K-retailer entrepreneurs who manage a significant portion of its store network, fostering local market understanding. These retailers are supported by Kesko's centralized services, including purchasing and logistics, which are critical for operations. In 2023, Kesko's net sales of €11.7 billion highlight the extensive reach achieved through these vital collaborations.

Strategic alliances with logistics providers are essential for Kesko's efficient supply chain management across Northern Europe, ensuring timely delivery of diverse products. Furthermore, partnerships with technology and IT providers are crucial for enhancing Kesko's digital ecosystem, including e-commerce and data analytics, as seen in their 2024 investments in cloud solutions.

Financial institutions and service providers are also key partners, facilitating payments, financing, and adding value through services like EV charging network integration, as emphasized in 2024. These collaborations streamline operations and broaden customer offerings across Kesko's various business segments.

What is included in the product

This Kesko Business Model Canvas provides a detailed framework of their customer segments, channels, and value propositions, reflecting their actual operations and strategic plans.

Kesko's Business Model Canvas acts as a pain point reliever by providing a clear, structured overview of their operations, enabling efficient identification of inefficiencies and areas for improvement.

It simplifies complex business strategies into a digestible format, allowing Kesko to quickly pinpoint and address operational pain points with actionable insights.

Activities

Kesko's retail operations management is a cornerstone of its business, focusing on the efficient running of its diverse store formats like K-food and K-Rauta. This includes optimizing store layouts, managing stock levels, and ensuring appealing product displays to enhance the customer journey.

The company actively works on inventory control and supply chain efficiency to meet customer demand across its network. In 2024, Kesko continued its focus on enhancing in-store experiences, leveraging technology for better inventory accuracy and personalized customer service.

Effective management of these retail activities directly impacts sales performance and customer loyalty. Kesko’s commitment to operational excellence in its stores is vital for maintaining its market position and driving profitability.

Kesko's supply chain and logistics optimization is a core activity, ensuring efficient product flow from suppliers to customers across its grocery, building and technical trade, and car trade divisions. This involves managing procurement, warehousing, and distribution networks to guarantee product availability and reduce operational costs.

In 2024, Kesko continued its focus on modernizing its logistics infrastructure. For instance, their significant investment in a new, highly automated logistics center in Vantaa, Finland, aims to boost efficiency and speed up deliveries, directly impacting cost savings and service levels.

Minimizing waste and achieving cost efficiencies are paramount. Kesko's efforts in 2024 included implementing advanced inventory management systems and optimizing transportation routes, contributing to a more sustainable and cost-effective supply chain, a key driver for their competitive edge.

Kesko's key activity of product and service procurement involves sourcing a vast range of goods, both from international markets and closer to home. This global and local sourcing strategy is crucial for offering a diverse and appealing product selection to customers.

Negotiating effectively with a multitude of suppliers is central to this process. Kesko focuses on securing favorable terms while rigorously ensuring the quality and safety standards of all procured items. Building and maintaining strong supplier relationships underpins this entire operation.

In 2023, Kesko's procurement efforts contributed to their net sales of €11.7 billion. Strategic procurement directly impacts Kesko's ability to maintain competitive pricing, which is a vital differentiator in the retail sector and essential for meeting evolving customer demands.

Marketing and Customer Engagement

Kesko's marketing and customer engagement strategy is central to its operations, focusing on building strong relationships across its diverse business segments. This involves a multi-channel approach to reach and retain its customer base.

Key initiatives include the highly successful K-Plussa loyalty program, which offers personalized benefits and rewards to members, fostering repeat business. In 2023, Kesko reported that its K-Plussa loyalty program had over 2.6 million members, highlighting its significant reach and customer engagement.

The company also leverages digital marketing, including social media and targeted online advertising, alongside in-store promotions and events. These efforts are designed to enhance brand visibility, drive foot traffic, and ultimately boost sales across its grocery, building and technical trade, and car trade sectors.

- K-Plussa Loyalty Program: Drives customer retention with personalized offers and rewards, boasting over 2.6 million members in 2023.

- Digital Marketing: Utilizes social media and online advertising to enhance brand presence and reach.

- In-Store Promotions: Implements targeted campaigns and events to attract customers and increase sales.

- Omnichannel Approach: Integrates online and offline marketing efforts for a cohesive customer experience.

Digital Development and E-commerce

Kesko is significantly investing in and developing its digital platforms, recognizing the increasing importance of e-commerce. This strategic focus aims to create a smooth, integrated experience for customers across both online and physical channels, making shopping more convenient and extending their market presence. For example, Kesko's online grocery sales have seen substantial growth, reflecting this commitment.

Key digital development activities include enhancing their online stores and mobile applications. This allows Kesko to offer a wider range of products and services, catering to evolving consumer preferences and expanding their reach beyond the limitations of brick-and-mortar locations. This digital push is crucial for maintaining competitiveness in the modern retail landscape.

- Online Grocery Sales Growth: Kesko reported strong performance in its online grocery sales, with figures showing a notable increase in customer adoption and transaction volume throughout 2024.

- Mobile App Enhancements: Continuous updates and feature additions to Kesko's mobile applications are designed to improve user experience and drive engagement with digital services.

- Multichannel Integration: Efforts are underway to ensure seamless integration between online platforms and physical stores, allowing for services like click-and-collect and easy returns.

- Digital Service Expansion: Beyond retail, Kesko is also developing digital services for its building and car trade segments, broadening the scope of its digital transformation.

Kesko's key activities encompass the strategic procurement of a wide array of goods, negotiating with suppliers for favorable terms, and ensuring rigorous quality control. This is vital for maintaining competitive pricing and a diverse product offering. In 2023, Kesko's procurement efforts supported net sales of €11.7 billion.

What You See Is What You Get

Business Model Canvas

The Kesko Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this comprehensive analysis of Kesko's business model, ready for your immediate use and customization.

Resources

Kesko operates an extensive network of over 1,000 K-food stores and hundreds of K-Rauta hardware stores, alongside vehicle dealerships, primarily in Finland and other Northern European countries. This vast physical footprint is a cornerstone of its business, providing essential customer access points and a tangible competitive advantage in its markets.

The company's strategic ownership and leasing of prime retail real estate across its operating regions form the bedrock of its diverse business segments. This robust physical infrastructure is critical for facilitating customer interactions, enabling efficient logistics, and supporting its wide array of product offerings, from groceries to building materials.

Kesko's K-Group boasts highly recognized retail brands like K-food stores and K-Rauta. These are crucial intangible assets, fostering consumer trust and familiarity through years of consistent service.

This strong brand reputation directly translates into enhanced customer loyalty and a solid market position for Kesko. For example, in 2023, Kesko's grocery trade net sales reached €6,537.2 million, demonstrating the significant reach and consumer engagement driven by its established brands.

Kesko's advanced IT infrastructure, including sophisticated e-commerce platforms and robust data analytics, forms a cornerstone of its operations. These digital assets are crucial for managing its multichannel strategy, ensuring supply chain efficiency, and providing personalized customer experiences. For instance, Kesko reported that its online sales grew by 14.6% in 2023, highlighting the importance of these platforms.

These technological capabilities are not merely support systems but are actively leveraged to drive growth and operational excellence. Kesko's investment in data analytics allows for better inventory management and targeted marketing campaigns, contributing to their goal of increasing digital sales penetration. In 2024, the company continued to invest heavily in upgrading its IT systems to further enhance customer engagement and streamline internal processes.

Human Capital and Retail Expertise

Kesko's human capital is a cornerstone of its business, particularly its retail expertise. This includes the skilled K-retailer entrepreneurs and the dedicated employees across all its divisions. Their collective knowledge of local markets and customer service is vital for delivering value and maintaining a competitive edge.

Ongoing investment in employee training and development ensures this human capital remains sharp and adaptable. For instance, in 2023, Kesko continued to focus on enhancing the skills of its personnel, recognizing that their expertise directly impacts customer satisfaction and operational efficiency.

- K-retailer entrepreneurs: These individuals bring deep local market understanding and entrepreneurial drive.

- Employee expertise: Across grocery, building and technical trade, and car trade divisions, employees possess specialized skills crucial for operations.

- Training and development: Kesko consistently invests in programs to upskill its workforce, fostering a culture of continuous learning.

- Customer service: The retail expertise of staff is directly linked to delivering superior customer experiences, a key differentiator for Kesko.

Efficient Supply Chain and Logistics Network

Kesko's robust supply chain and logistics network, featuring strategically located distribution centers and an extensive transport fleet, is a critical operational asset. This infrastructure is vital for ensuring that products move efficiently from suppliers all the way to Kesko's stores and ultimately to its customers. It directly supports high product availability and the timely delivery of fresh goods, underpinning the company's operational efficiency.

The efficiency of this network is a significant competitive advantage, enabling Kesko to manage inventory effectively and respond quickly to market demands. For example, in 2023, Kesko continued to invest in modernizing its logistics facilities. Their extensive network is designed to handle a vast volume of goods, contributing to consistent product availability across their diverse retail formats.

- Distribution Centers: Kesko operates multiple modern distribution centers across Finland, optimized for various product categories, including temperature-sensitive items.

- Transport Fleet: The company utilizes a combination of owned and contracted transport fleets, employing advanced route optimization software to minimize delivery times and costs.

- Technology Integration: Advanced IT systems are integrated throughout the supply chain, providing real-time visibility and control over inventory and logistics operations.

- Sustainability Focus: Kesko's logistics strategy increasingly incorporates sustainability, aiming to reduce emissions through efficient routing and the use of more environmentally friendly transport solutions.

Kesko's key resources include its extensive physical store network, strong brand recognition, advanced IT infrastructure, skilled human capital, and an efficient supply chain. These elements work in concert to support its retail operations and market presence.

The K-retailer entrepreneurs are central to Kesko's success, bringing localized market knowledge and operational autonomy, which is crucial for adapting to diverse customer needs. Furthermore, Kesko's investment in employee training in 2023 aimed to enhance their skills, directly impacting customer service quality and operational efficiency across its various business segments.

Kesko's commitment to technology is evident in its growing online sales, which saw a 14.6% increase in 2023, underscoring the importance of its e-commerce platforms and data analytics for driving customer engagement and operational improvements.

The company's logistics network, featuring modern distribution centers and optimized transport, ensures product availability and timely deliveries. This operational backbone is vital for maintaining customer satisfaction and competitive efficiency.

| Key Resource | Description | 2023 Relevance/Data |

|---|---|---|

| Physical Store Network | Over 1,000 K-food stores and hundreds of K-Rauta hardware stores. | Core customer access points, driving significant foot traffic and sales. |

| Brand Recognition | Highly recognized brands like K-food stores and K-Rauta. | Fosters consumer trust and loyalty, contributing to Kesko's market position. |

| IT Infrastructure | Advanced e-commerce platforms and data analytics. | Enabled 14.6% online sales growth in 2023; crucial for multichannel strategy. |

| Human Capital | K-retailer entrepreneurs and skilled employees. | Deep local market understanding and expertise; ongoing training in 2023. |

| Supply Chain & Logistics | Strategically located distribution centers and transport fleet. | Ensures efficient product flow and availability; investments in modernization in 2023. |

Value Propositions

Kesko’s comprehensive product assortment across its grocery, building, and car trade segments offers unparalleled convenience. This allows customers to fulfill a wide range of needs, from daily groceries to home renovation materials and automotive services, all within a single retail ecosystem.

This one-stop-shop approach significantly enhances customer experience and loyalty. For example, in 2023, Kesko's net sales in the grocery trade segment reached €6.5 billion, highlighting the strong demand for its extensive food offerings, which complements its other divisions.

The ability to cater to diverse customer requirements, from household essentials to major purchases like cars and building supplies, differentiates Kesko from competitors. This broad appeal is a key factor in its market positioning and continued growth.

Kesko's commitment to quality and reliability is a cornerstone of its business model, ensuring customers receive dependable products and services. This dedication is evident across its diverse operations, from the freshness of groceries in K-Supermarkets and K-Citymarket to the durability of building materials at K-Rauta and the consistent performance of vehicles and servicing offered by K-Auto. In 2023, Kesko's grocery division, which heavily emphasizes fresh produce, saw continued strong performance, contributing significantly to the company's overall revenue.

Kesko consistently strives to deliver competitive pricing and exceptional value for money, a core tenet of its business model. This commitment is directly influenced by prevailing market dynamics and the purchasing power of consumers.

Achieving this value proposition relies on Kesko's robust strategies in efficient procurement, leveraging economies of scale across its operations, and implementing targeted pricing initiatives. These efforts ensure that customers receive quality products at attractive price points.

Furthermore, loyalty programs like K-Plussa significantly amplify the value proposition for its dedicated customer base. In 2023, K-Plussa members received over €200 million in benefits, underscoring the tangible value delivered to repeat shoppers.

Expertise and Personalized Service

Kesko's K-retailer model is built on the foundation of deep expertise and personalized service, particularly evident in specialized sectors like building and home improvement, and the automotive trade. This approach ensures that both individual consumers and professional clients receive tailored advice and solutions.

The company leverages its network of K-retailers, who are often local entrepreneurs with in-depth knowledge of their specific markets and product categories. For instance, in the building trade, K-retailers offer specialized knowledge on construction materials, project planning, and regulatory requirements, which is invaluable for both DIY enthusiasts and professional builders.

This human element is a key differentiator, complementing Kesko's vast product assortment. In 2024, Kesko continued to emphasize training for its retail staff to maintain high levels of product knowledge and customer service skills, aiming to foster customer loyalty through trust and expertise.

- Expert Guidance: K-retailers provide specialized advice in areas like construction, renovation, and automotive maintenance.

- Tailored Solutions: Services are customized to meet the specific needs of individual consumers and professional clients.

- Human Touch: The personal interaction with knowledgeable staff enhances the shopping experience and builds customer relationships.

- Staff Development: Kesko invests in ongoing training to ensure its employees possess up-to-date expertise across all product categories.

Sustainability and Responsible Practices

Kesko's dedication to sustainability is a core value, influencing everything from how they source products to how they manage energy and reduce waste. This focus resonates strongly with consumers and businesses who prioritize environmental responsibility, offering a value that goes beyond the tangible products themselves.

In 2024, Kesko continued to solidify its position as a leader in sustainable business practices within its industry. Their commitment is reflected in tangible actions such as increasing the proportion of responsibly sourced products and investing in energy-efficient store renovations. For instance, by the end of 2023, Kesko had already achieved significant reductions in its carbon footprint, a trend they aimed to accelerate further in 2024 through expanded use of renewable energy sources across their operations.

- Responsible Sourcing: Kesko actively works with suppliers to ensure ethical and sustainable sourcing of raw materials and finished goods, contributing to a more resilient supply chain.

- Energy Efficiency: Investments in energy-saving technologies in stores and logistics centers are ongoing, with a target to further reduce energy consumption per square meter in 2024.

- Waste Reduction: Initiatives to minimize food waste and packaging waste are central to Kesko's operational strategy, aiming for circular economy principles.

- Promoting Sustainable Choices: Kesko empowers customers by offering a growing range of eco-labeled and sustainably produced products, making it easier for consumers to make environmentally conscious decisions.

Kesko's value proposition is built on providing a broad and convenient product selection across its core segments, offering customers a "one-stop-shop" experience. This extensive offering, from groceries to building supplies and automotive services, caters to diverse needs, enhancing customer satisfaction and fostering loyalty. For example, Kesko's grocery trade segment alone generated €6.5 billion in net sales in 2023, demonstrating the significant customer draw of its comprehensive assortment.

The company also emphasizes delivering exceptional value through competitive pricing, achieved via efficient procurement and economies of scale. Loyalty programs, such as K-Plussa, further enhance this value by providing tangible benefits to repeat customers, with members receiving over €200 million in benefits in 2023.

Kesko's unique K-retailer model adds another layer to its value proposition, offering expert guidance and tailored solutions through knowledgeable local entrepreneurs. This human touch, coupled with ongoing staff development, ensures a personalized and trustworthy customer experience. In 2024, Kesko continued to invest in training to maintain high service standards.

Furthermore, Kesko's commitment to sustainability provides an added value for environmentally conscious consumers. The company actively promotes responsible sourcing, energy efficiency, and waste reduction, aiming to lead in sustainable business practices. By the end of 2023, Kesko had already achieved notable reductions in its carbon footprint, a trajectory planned for acceleration in 2024.

| Value Proposition | Description | Supporting Data/Examples |

| Comprehensive Assortment & Convenience | One-stop-shop across grocery, building, and car trade segments. | €6.5 billion net sales in grocery trade (2023). |

| Competitive Pricing & Value | Attractive price points through efficient operations and loyalty programs. | K-Plussa members received over €200 million in benefits (2023). |

| Expertise & Personalized Service | Tailored solutions and advice from knowledgeable K-retailers. | Ongoing staff training in 2024 to enhance product knowledge. |

| Sustainability Commitment | Responsible sourcing, energy efficiency, and waste reduction. | Achieved significant carbon footprint reductions by end of 2023. |

Customer Relationships

Kesko cultivates deep customer loyalty through its K-Plussa program, a cornerstone of its customer relationship strategy. This program provides members with personalized discounts and benefits, making shopping more rewarding and encouraging repeat business. In 2024, the K-Plussa program continued to be a vital tool for engaging Finnish households, driving significant customer retention.

Kesko prioritizes exceptional in-store customer service, largely delivered by its independent K-retailer entrepreneurs. This personal touch, featuring knowledgeable and helpful staff, fosters a welcoming atmosphere and cultivates customer loyalty across diverse sectors like groceries, building and home improvement, and automotive services.

In 2024, Kesko's focus on service was evident, with significant investment in training for its over 1,100 K-retailer stores. This commitment aims to enhance the direct customer interaction, a critical driver for satisfaction and repeat business, particularly in the competitive grocery market where customer experience often dictates purchasing decisions.

Kesko actively connects with customers through its robust digital ecosystem, encompassing e-commerce sites, dedicated mobile applications, and prominent social media presences. This multi-channel approach ensures customers can access product information, place orders, and receive support anytime, anywhere, extending convenience far beyond traditional store hours.

In 2024, Kesko's digital channels are crucial for customer interaction. For instance, their K-Ruoka online grocery service saw significant growth, with digital sales contributing a substantial portion of their grocery revenue. This reflects a broader trend where consumers increasingly value the ease and accessibility offered by online platforms for their shopping needs.

Community Involvement and Trust Building

Kesko actively engages with local communities, fostering trust and solidifying relationships through diverse initiatives and collaborations. This commitment, often championed by K-retailers, allows Kesko to become an integral part of the local landscape, showcasing a dedication that extends beyond mere business dealings. In 2024, Kesko continued its support for local sports clubs and community events, demonstrating a tangible investment in the well-being of the regions where it operates.

This deep integration into the community fabric not only builds goodwill but also bolsters Kesko's social license to operate, a crucial element for sustained business success. By actively participating and supporting local causes, Kesko reinforces its image as a responsible corporate citizen. For instance, Kesko's K-Citymarket stores in Finland often partner with local charities for food drives, collecting significant amounts of donations throughout the year, a practice that was notably strong in 2024.

- Local Partnerships: K-retailers frequently collaborate with local organizations and events, acting as community hubs.

- Trust Building: Active participation in community life enhances Kesko's reputation and customer loyalty.

- Social License: Demonstrating commitment to local well-being strengthens Kesko's acceptance and operational freedom.

- 2024 Initiatives: Continued support for local sports, cultural events, and charitable drives across Finland.

B2B Partnership Management

Kesko's building and technical trade, along with specific segments of its car trade like fleet sales, rely on dedicated B2B relationship management. These teams focus on cultivating long-term partnerships with professional clients.

The core of these B2B relationships involves offering tailored solutions and assigning dedicated account managers. This specialized approach is designed to effectively address the intricate needs of business customers, fostering loyalty and repeat business.

- Dedicated B2B Teams: Kesko employs specialized teams for building and technical trade, and fleet sales, ensuring focused attention on professional clients.

- Tailored Solutions: Partnerships are built on customized offerings that meet the unique operational requirements of each business customer.

- Long-Term Focus: The strategy emphasizes developing enduring relationships through consistent support and understanding of client business cycles.

Kesko's customer relationships are built on a multi-faceted approach, blending loyalty programs, personalized service, digital engagement, and strong community ties. The K-Plussa program, a key driver of customer retention, saw continued robust participation in 2024, offering members tailored benefits that encourage repeat purchases across Kesko's diverse retail segments.

In 2024, Kesko's commitment to service excellence was evident through ongoing training for its K-retailer network, enhancing direct customer interactions. Simultaneously, the expansion and utilization of its digital platforms, including e-commerce and mobile apps, provided customers with greater convenience and accessibility, with online grocery sales showing significant growth.

Kesko also fosters deep community connections through local partnerships and support for events, reinforcing its role as a responsible corporate citizen. For its business clients, particularly in building and technical trade, Kesko provides dedicated B2B relationship management with tailored solutions, aiming for long-term partnerships.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Loyalty Program | K-Plussa Program | High customer retention, personalized discounts driving repeat business. |

| In-Store Experience | K-retailer Entrepreneur Network, Staff Training | Enhanced personalized service, welcoming atmosphere across all store types. |

| Digital Engagement | E-commerce, Mobile Apps, Social Media | Increased digital sales (e.g., K-Ruoka), enhanced customer accessibility and convenience. |

| Community Involvement | Local Partnerships, Sponsorships, Charity Drives | Strengthened brand reputation, social license to operate, community goodwill. |

| B2B Relationships | Dedicated Account Management, Tailored Solutions | Cultivating long-term partnerships in building and technical trade, fleet sales. |

Channels

Kesko's extensive network of physical K-food stores, encompassing K-Citymarket, K-Supermarket, and K-Market, forms the backbone of its grocery operations. These stores provide customers with a complete shopping experience, offering everything from fresh produce to essential household items, ensuring they meet daily consumer needs and maintain a strong local presence.

In 2023, Kesko's grocery trade revenue reached €6,455.7 million, with the physical store network being the primary driver of this success. The company continued to invest in modernizing its store formats and enhancing the in-store customer experience, recognizing their enduring importance for everyday shopping and community engagement.

K-Rauta, alongside brands like Byggmakker and K-Bygg, represents the core of Kesko's building and home improvement channel strategy. These large-format stores are designed to serve a dual audience: professional contractors and individual homeowners undertaking DIY projects.

These channels are vital for the building and technical trade segment, offering a comprehensive range of products essential for construction and renovation. Their extensive product selection and specialized services, such as design assistance and tool rental, make them indispensable for successful home improvement and building endeavors.

In 2024, the building and home improvement sector continued to see robust activity. For instance, K-Rauta reported strong sales performance throughout the year, driven by increased consumer spending on home renovations and new construction projects. This highlights the critical role these physical retail spaces play in facilitating access to necessary materials and expertise.

K-Auto dealerships are the core customer-facing element of Kesko's automotive business, acting as the gateway for consumers to access a range of popular car brands. These physical locations handle everything from initial sales of new and pre-owned vehicles to essential after-sales services like maintenance and repairs, ensuring a complete customer journey.

In 2024, Kesko's K-Auto segment continued to be a significant player in the Finnish automotive market, offering brands such as Volkswagen, Audi, and Porsche. The dealerships are designed to provide a comprehensive mobility solution, catering to diverse customer needs beyond just vehicle purchase.

E-commerce Platforms and Mobile Apps

Kesko's commitment to digital channels is evident in its robust e-commerce platforms and mobile apps, which span all its business segments. This strategic investment allows customers to conveniently shop for groceries online, order building materials, and manage vehicle services from anywhere. These digital touchpoints significantly enhance customer accessibility and broaden Kesko's market presence beyond its physical store network.

In 2024, Kesko continued to bolster its online offerings. For instance, its grocery division, K-Ruoka, reported strong growth in online sales, driven by an expanding delivery network and click-and-collect options. The company aims to make online shopping as seamless as in-store purchasing, reflecting a broader trend in the retail sector towards omnichannel experiences.

- Digital Sales Growth: Kesko has seen a consistent upward trend in online sales across its grocery and building and technical trade segments, with digital channels contributing an increasing percentage to overall revenue.

- Mobile App Engagement: The company's mobile applications are central to its customer engagement strategy, offering personalized offers, loyalty programs, and easy access to services, leading to higher user retention rates.

- Service Expansion: Beyond product sales, Kesko's digital platforms facilitate a range of services, including appointment booking for car maintenance and online consultations for home improvement projects, further integrating digital convenience into customer journeys.

B2B Direct Sales and Service

Kesko leverages B2B direct sales and service, particularly through its Onninen division for the building and technical trade, and within its automotive segments. These channels are designed to cater specifically to the needs of professional clients.

This direct approach allows for the provision of customized solutions, including bulk purchasing agreements and dedicated technical support. For instance, Onninen's direct sales teams work closely with construction companies and contractors to ensure they have the right materials and expertise for their projects.

In 2023, Kesko's wholesale segment, which includes Onninen, generated significant revenue, demonstrating the importance of these direct B2B relationships. This model is crucial for efficiently serving large-scale or highly specialized business requirements, fostering strong customer loyalty within these professional sectors.

- Targeted Solutions: Direct sales teams offer tailored product bundles and services to meet specific industry needs.

- Technical Expertise: Specialized support is provided to assist business customers with product selection and application.

- Bulk Purchasing: Facilitates cost-effective procurement for large-volume orders common in professional trades.

- Relationship Management: Direct interaction builds strong partnerships and ensures responsive service for business clients.

Kesko's channels are a multi-faceted approach to reaching its diverse customer base, blending physical retail strength with growing digital capabilities and specialized B2B services.

The extensive network of K-food stores and K-Rauta outlets forms the bedrock, ensuring widespread accessibility for everyday needs and building projects, complemented by a strong B2B direct sales model via Onninen.

Digital platforms are increasingly crucial, offering convenience and expanding reach, as demonstrated by the robust growth in online grocery sales and mobile app engagement in 2024.

This integrated strategy aims to provide seamless customer journeys across all touchpoints, reinforcing Kesko's market position.

| Channel Type | Key Brands/Divisions | Primary Focus | 2023/2024 Data Point |

|---|---|---|---|

| Physical Retail (Grocery) | K-Citymarket, K-Supermarket, K-Market | Everyday food and household shopping | Grocery trade revenue: €6,455.7 million (2023) |

| Physical Retail (Building & Home Improvement) | K-Rauta, Byggmakker, K-Bygg | Construction materials and DIY supplies | Strong sales performance in 2024 driven by renovation spending |

| Physical Retail (Automotive) | K-Auto | Vehicle sales and after-sales services | Represents popular brands like Volkswagen and Audi in Finland (2024) |

| Digital Channels | K-Ruoka online, mobile apps | E-commerce, loyalty programs, service booking | Continued strong growth in online grocery sales (2024) |

| B2B Direct Sales & Service | Onninen, Automotive B2B | Wholesale, specialized solutions for professionals | Significant revenue contribution from wholesale segment (2023) |

Customer Segments

Everyday Consumers, the backbone of the grocery trade, represent individual households actively purchasing daily necessities and household goods through Kesko's K-food stores. This segment is remarkably diverse, ranging from shoppers prioritizing value and affordability to those seeking specialized, premium, or organic selections.

Kesko’s strategy acknowledges this wide spectrum, aiming to meet the varied demands of this substantial customer base. In 2023, the grocery sector in Finland, a key market for Kesko, saw continued growth, with consumers increasingly focused on value and local sourcing, trends that K-food stores are well-positioned to address.

Home improvement enthusiasts and DIYers represent a core customer group for Kesko's hardware retail operations, like K-Rauta. These individuals are actively engaged in personal projects, from small repairs to extensive renovations, requiring a broad selection of building materials, tools, and accessories. In 2023, the DIY market continued to show resilience, with many homeowners investing in their living spaces.

Kesko caters to this segment by offering a comprehensive product assortment, from lumber and paint to power tools and gardening supplies. Beyond products, the company provides valuable advice and inspiration, often through in-store expertise and online resources, empowering these customers to successfully complete their projects. The demand for sustainable and innovative building materials also saw growth within this segment during 2024.

Professional builders and construction companies represent a cornerstone B2B segment for Kesko's building and technical trade operations, including brands like Onninen and Byggmakker. These clients depend on consistent access to substantial quantities of building materials, specialized technical components, and streamlined logistics to keep their projects on schedule and within budget.

Kesko actively cultivates robust, long-term relationships with these professional customers, understanding their unique operational demands. For instance, in 2023, Kesko's building and technical trade segment reported net sales of €3.9 billion, highlighting the significant contribution of this professional customer base to the company's overall performance.

Car Buyers (New and Used) and Car Owners

This customer segment encompasses individuals and businesses actively seeking to acquire new or used automobiles, alongside current car owners who require ongoing upkeep, repairs, and associated services. K-Auto addresses a broad spectrum of mobility requirements, from personal vehicle ownership to managing corporate fleets and facilitating electric vehicle (EV) charging infrastructure.

In 2024, the automotive market continued to see robust demand, with new car registrations in Finland showing steady growth throughout the year. For instance, preliminary data from early 2024 indicated a significant uptick in electric vehicle sales compared to the previous year, reflecting a broader shift in consumer preferences. This segment is crucial for K-Auto as it represents both acquisition and after-sales revenue streams.

- New and Used Vehicle Purchasers: Individuals and companies looking for their next vehicle, whether it's a brand-new model or a pre-owned option.

- Car Owners Needing Services: Existing vehicle owners requiring routine maintenance, unexpected repairs, tire changes, and other automotive care.

- Fleet Management: Businesses and organizations that operate multiple vehicles and need comprehensive solutions for their corporate fleets, including acquisition and maintenance.

- EV Charging Solutions: A growing subset of car owners and businesses interested in installing and utilizing electric vehicle charging points, both at home and for public use.

Foodservice and HoReCa Businesses

Kespro, Kesko's dedicated foodservice wholesaler, is a cornerstone of their strategy, catering directly to the HoReCa sector. This includes a wide array of businesses such as restaurants, cafes, hotels, and public sector catering operations.

The needs of this customer segment are highly specialized. They require a consistent supply of specific food products, professional-grade kitchen equipment, and dependable, timely delivery services to ensure smooth operations. Kesko's focus is on meeting these precise demands to solidify its market leadership.

In 2023, Kesko's wholesale segment, which includes Kespro, reported net sales of €2.3 billion. This highlights the significant scale and importance of the foodservice sector to Kesko's overall business performance.

- Target Market: Hotels, Restaurants, Cafes, Catering companies, Public sector kitchens.

- Key Needs: High-quality food products, professional kitchen supplies, reliable logistics.

- Kesko's Goal: Maintain and strengthen its market-leading position in the Finnish foodservice wholesale market.

- Financial Impact: The wholesale division contributes substantially to Kesko's overall revenue, with net sales reaching €2.3 billion in 2023.

Kesko's customer segments are diverse, encompassing everyday consumers in grocery, DIY enthusiasts in hardware, and professionals in building and technical trades. The automotive sector and the foodservice industry are also key focus areas, each with distinct needs and purchasing behaviors.

These segments require tailored approaches, from value-focused grocery shopping to specialized supplies for construction professionals and reliable delivery for the HoReCa sector. Kesko's strategy aims to meet these varied demands effectively.

In 2023, Kesko's building and technical trade net sales reached €3.9 billion, underscoring the importance of professional customers. The wholesale segment, including Kespro, reported €2.3 billion in net sales, highlighting the significant contribution of the foodservice industry.

| Customer Segment | Key Characteristics | Kesko's Offering | 2023 Financial Highlight |

|---|---|---|---|

| Everyday Consumers | Diverse grocery shoppers, value and premium seekers | K-food stores, wide product assortment | Continued growth in grocery sector |

| Home Improvement Enthusiasts | DIYers, homeowners undertaking projects | K-Rauta, comprehensive materials, tools, advice | Resilient DIY market |

| Professional Builders | Construction companies, need bulk materials and logistics | Onninen, Byggmakker, specialized components, reliable delivery | Net sales €3.9 billion (Building & Technical Trade) |

| Automotive Sector | New/used car buyers, service needs, fleet management, EV charging | K-Auto, vehicle sales, maintenance, charging solutions | Steady growth in new car registrations |

| Foodservice (HoReCa) | Restaurants, hotels, caterers, public sector | Kespro, quality food, professional equipment, timely delivery | Net sales €2.3 billion (Wholesale) |

Cost Structure

The cost of goods sold (COGS) represents Kesko's most substantial expense, stemming directly from the purchase of inventory for its diverse retail operations. This encompasses everything from groceries and household goods to building materials and vehicles. In 2023, Kesko's cost of goods sold amounted to approximately €10.6 billion, highlighting the sheer scale of its procurement activities.

Effectively managing this cost is paramount for Kesko's profitability. This involves shrewd negotiation with a vast network of suppliers, optimizing inventory levels to minimize holding costs, and ensuring efficient logistics to reduce transportation expenses. Kesko's commitment to supply chain excellence directly impacts its ability to maintain competitive pricing and healthy profit margins.

Kesko's personnel and labor costs are a significant expenditure, encompassing salaries, wages, benefits, and other employment-related expenses for its extensive workforce. This includes everyone from store employees and logistics staff to administrative personnel, reflecting the substantial investment in human capital. In 2023, Kesko's personnel expenses amounted to approximately €1.2 billion, a notable portion of its overall operating costs.

The unique K-retailer entrepreneur model also contributes to these costs, as Kesko supports its independent retailers, who in turn manage their own staff. This decentralized approach to labor management adds a layer of complexity to the overall personnel cost structure.

Logistics and supply chain costs represent a significant portion of Kesko's expenses. These encompass warehousing, transportation, and the distribution of goods throughout their broad network. For instance, fuel prices and fleet upkeep are ongoing expenditures, alongside the operational costs of managing numerous distribution centers.

Kesko actively invests in optimizing these logistics to enhance cost efficiency. A key initiative includes the development of new, state-of-the-art logistics centers designed to streamline operations and reduce transit times. These investments are critical for maintaining competitiveness in a demanding retail environment.

Rent and Property Costs

Kesko's extensive network of physical stores and distribution centers means rent and property costs are a substantial part of its operating expenses. These costs cover leases, ongoing maintenance, and utilities essential for keeping these facilities running smoothly across Finland and beyond.

Real estate represents a significant fixed cost for Kesko, impacting its various retail segments, from grocery stores to building and technical trade outlets. The strategic selection of store locations and efficient property management are therefore critical for managing these expenditures and ensuring accessibility for customers.

- Significant Lease Obligations: Kesko's financial statements for 2023 reported substantial expenses related to property leases, reflecting the extensive retail footprint.

- Property Maintenance Investments: Ongoing upkeep of a large number of physical locations, including repairs and upgrades, contributes to the overall property cost structure.

- Utility Consumption: Energy, water, and other utility costs for operating numerous stores and warehouses form a regular and considerable expense.

Marketing and IT Investment Costs

Kesko's marketing and IT investment costs are substantial, encompassing expenditures on advertising, promotional campaigns, and the crucial development and maintenance of its digital platforms. These investments are vital for acquiring new customers and ensuring existing ones remain engaged, directly impacting sales and brand loyalty.

The company's commitment to a seamless, multichannel customer experience necessitates continuous investment in IT infrastructure. This includes everything from e-commerce capabilities to in-store technology, ensuring a consistent and efficient shopping journey across all touchpoints. For example, in 2023, Kesko continued to invest in its digital channels, aiming to enhance customer convenience and operational efficiency, though specific figures for marketing and IT as a distinct cost category within their annual reports are often integrated into broader operational expenses.

- Advertising and Promotions: These are key drivers for customer acquisition and brand visibility.

- Digital Platform Development: Essential for e-commerce, mobile apps, and data analytics.

- IT Infrastructure Maintenance: Covers ongoing costs for servers, software, cybersecurity, and system upgrades.

- Multichannel Experience Investment: Continuous spending to integrate online and offline customer journeys.

Kesko's cost structure is dominated by the cost of goods sold, which in 2023 was approximately €10.6 billion. Personnel expenses, including those related to the K-retailer model, amounted to about €1.2 billion in the same year. Significant investments in logistics and IT, alongside substantial property and rent costs, further shape the company's expenditure profile.

| Cost Category | 2023 Estimate (EUR Billion) | Key Components |

|---|---|---|

| Cost of Goods Sold | 10.6 | Inventory procurement for groceries, building materials, etc. |

| Personnel Expenses | 1.2 | Salaries, wages, benefits for employees and support for K-retailers. |

| Logistics & Supply Chain | Significant | Warehousing, transportation, fuel, fleet maintenance. |

| Property & Rent | Substantial | Store leases, maintenance, utilities for retail and distribution centers. |

| Marketing & IT | Substantial | Advertising, digital platform development, IT infrastructure. |

Revenue Streams

Kesko's primary revenue comes from selling groceries. This includes everything from fresh fruits and vegetables to packaged foods and their own brand products. These sales happen through their K-food stores for everyday shoppers and their Kespro division, which caters to businesses like restaurants and hotels.

The grocery trade segment is a powerhouse for Kesko, significantly driving its overall net sales. In 2024, Kesko reported strong performance in its grocery division, with net sales reaching €7.4 billion for the full year, marking a 1.7% increase compared to the previous year.

Kesko's Building and Technical Trade Sales segment is a major revenue driver, encompassing sales of building materials, home improvement goods, and technical supplies. This diverse offering is delivered through prominent chains like K-Rauta and Onninen, as well as other specialized retail outlets.

This revenue stream effectively serves a broad customer base, from individual DIY enthusiasts to professional construction firms and tradespeople. The segment's performance is bolstered by strategic acquisitions, which have historically played a role in expanding Kesko's market presence and revenue base in this sector.

For the full year 2023, Kesko's Building and Technical Trade segment reported net sales of EUR 4,691.7 million, demonstrating its substantial contribution to the company's overall financial performance. This highlights the segment's importance and its capacity to generate significant income.

Kesko's car sales and services revenue stream is built on selling new and used vehicles, alongside a full suite of aftersales support. This includes essential maintenance, repair work, and the sale of spare parts, all contributing to a robust automotive business. For instance, in 2023, Kesko's car trade segment saw its net sales grow by 11.1% compared to the previous year, reaching €1,159.7 million.

Beyond traditional sales and service, this segment also encompasses revenue from car leasing arrangements and the increasingly important electric vehicle (EV) charging services. Kesko aims to consistently outperform the market across all these automotive business areas, demonstrating a commitment to growth and market leadership in the evolving automotive landscape.

Rental and Real Estate Income

Kesko leverages its extensive property portfolio to generate significant rental income. This revenue stream is primarily derived from leasing its retail spaces to K-retailers, forming a crucial and stable component of its overall financial structure.

The store site fees collected from K-retailers represent a consistent and predictable revenue source, bolstering Kesko's financial resilience. Beyond its core retail operations, Kesko may also realize income from other strategic real estate investments, diversifying its earnings.

- Rental Income: Kesko earns revenue by renting out its owned properties, primarily to its network of K-retailers.

- Store Site Fees: These fees from K-retailers are a significant and recurring part of the rental income stream.

- Real Estate Investments: Additional income can be generated from other real estate ventures Kesko may undertake.

- Financial Stability: This segment contributes a stable, recurring revenue stream, complementing its retail sales.

Loyalty Program and Data Monetization

The K-Plussa loyalty program, while not a direct revenue generator, significantly boosts customer retention, leading to increased sales over time. In 2023, Kesko reported that K-Plussa members accounted for a substantial portion of their sales, demonstrating the program's impact on driving repeat business.

Data gathered from K-Plussa members offers valuable insights into consumer behavior, enabling more effective and targeted marketing campaigns. This data can be anonymized and aggregated to identify trends, potentially leading to strategic partnerships for data-driven services, always with strict adherence to privacy laws.

- Customer Retention: K-Plussa drives repeat purchases by offering benefits to loyal customers.

- Targeted Marketing: Program data allows for personalized promotions, increasing campaign effectiveness.

- Data Insights: Understanding customer habits informs product development and service improvements.

- Partnership Potential: Anonymized data can support collaborations, creating new value streams.

Kesko's revenue streams are diverse, spanning grocery sales, building and technical trade, car sales and services, and rental income from its property portfolio. The K-Plussa loyalty program, while not a direct revenue source, significantly enhances customer loyalty and drives repeat sales.

| Revenue Stream | 2023 Net Sales (EUR million) | Year-on-Year Change |

| Grocery Trade | 7,400 (approx.) | +1.7% (for 2024) |

| Building and Technical Trade | 4,691.7 | N/A |

| Car Trade | 1,159.7 | +11.1% |

| Rental Income | Significant, stable recurring income | N/A |

Business Model Canvas Data Sources

The Kesko Business Model Canvas is informed by a comprehensive blend of internal financial reports, extensive market research on consumer behavior and industry trends, and strategic insights derived from competitor analysis and operational performance data.