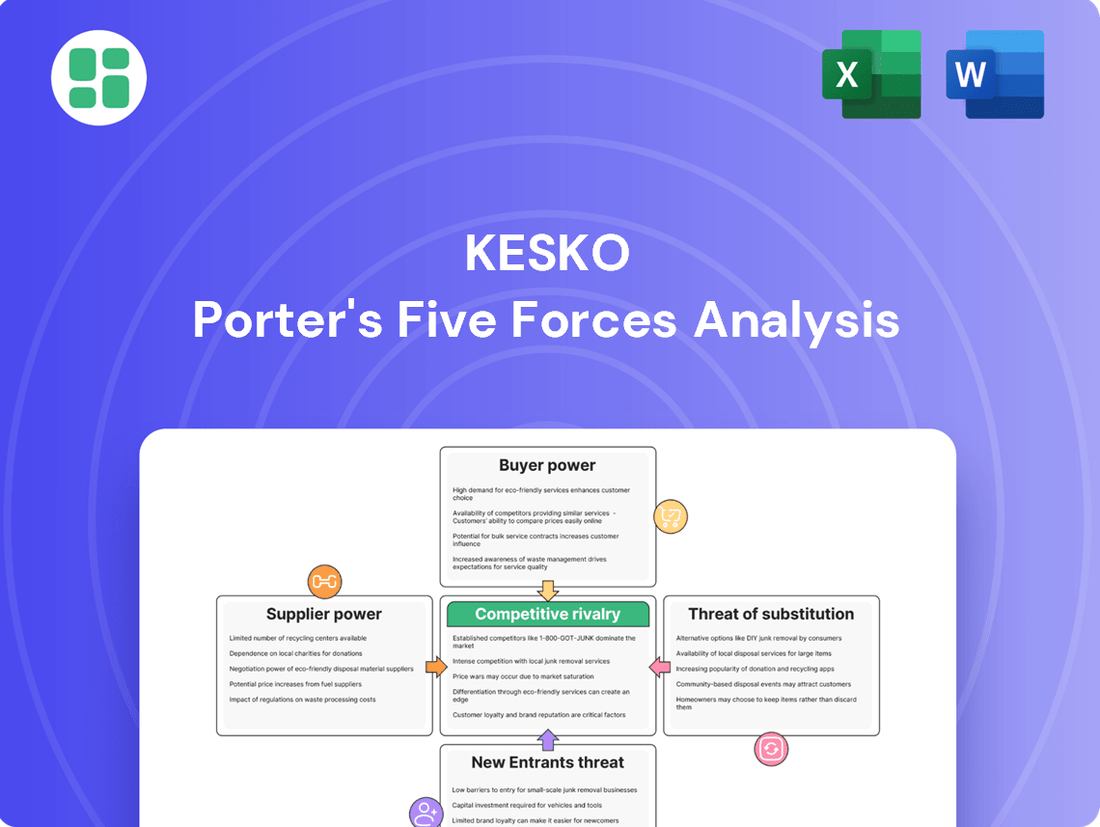

Kesko Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kesko Bundle

Kesko navigates a retail landscape shaped by intense rivalry, significant buyer power, and the ever-present threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp Kesko's strategic positioning and future prospects.

The complete report reveals the real forces shaping Kesko’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Kesko's supplier power is a mixed bag, shifting with each sector it operates in. In the grocery business, while essential food items have consistent demand, a wide array of producers often keeps individual supplier leverage in check. However, this can change if a single dominant producer emerges for a key product.

The automotive sector presents a stark contrast. Kesko's dealerships face significant supplier power from the limited number of major global car manufacturers. These manufacturers dictate terms, pricing, and model availability, giving them considerable leverage over Kesko's car sales operations.

Specialized building materials also represent a different dynamic. Suppliers of unique or high-performance materials can command greater power than those offering more common, easily substitutable hardware. This is especially true if Kesko's construction projects rely on these specific, less commoditized inputs.

The costs Kesko faces when changing suppliers significantly impact supplier power. For everyday grocery items and basic hardware, these switching costs are generally low, giving Kesko considerable flexibility in choosing its partners.

However, this dynamic shifts for exclusive or proprietary products. For instance, if Kesko partners with a specific car manufacturer for its automotive division or uses branded building solutions with integrated supply chains, the costs to switch suppliers can become substantial, thereby increasing the leverage of those particular suppliers.

The threat of suppliers integrating forward into retail operations, effectively becoming competitors, is a potential concern for retailers like Kesko. While less common for broad-line retailers, it's a possibility. For instance, a major food producer could decide to open its own branded stores or develop robust direct-to-consumer online sales, bypassing the traditional retail channels. Similarly, in sectors like automotive, manufacturers have increasingly explored direct sales models, reducing reliance on dealerships.

However, the significant investment in infrastructure, logistics, and brand recognition required to compete with an established retailer like Kesko presents a substantial barrier for most suppliers. Kesko's extensive network of stores and its established customer base make it a formidable competitor. For example, in 2024, Kesko continued to invest in its omnichannel strategy, enhancing its online presence and in-store experience, further solidifying its market position against potential supplier encroachment.

Importance of Kesko to Suppliers

Kesko's substantial market presence in Finland's grocery and building sectors significantly curtails supplier bargaining power. Many suppliers rely heavily on Kesko for a considerable portion of their revenue, granting Kesko considerable leverage in negotiating prices and supply agreements. For example, in 2023, Kesko reported net sales of €11.7 billion, highlighting its immense purchasing volume.

This customer dependence allows Kesko to dictate terms more effectively. However, the power dynamic can shift for suppliers offering globally recognized brands or highly specialized products, where Kesko's reliance might be less pronounced.

- Kesko's significant market share in Finland’s retail landscape (e.g., grocery and building trade) makes it a crucial customer for many suppliers.

- High supplier dependence on Kesko for sales volumes translates into Kesko's leverage in price and terms negotiations.

- Global brands or unique products may possess stronger bargaining power, as Kesko's dependence on them is relatively lower.

Availability of Substitute Inputs

The presence of substitute inputs significantly curtails supplier bargaining power. For Kesko, particularly in its grocery segment, the ability to source comparable products from multiple manufacturers, especially for its private label brands, diminishes dependence on any single supplier. This diversification is a key strategy to maintain competitive pricing and product availability.

In the building materials sector, generic alternatives are often readily available, allowing Kesko to switch suppliers if pricing or terms become unfavorable. However, the automotive trade presents a different scenario. Here, components are often brand and model-specific, meaning there are virtually no direct substitutes. This lack of alternatives grants car manufacturers considerable leverage over Kesko's automotive division.

For instance, in 2024, the automotive industry continued to grapple with supply chain disruptions, particularly for semiconductors and specialized parts. This scarcity amplified the bargaining power of original equipment manufacturers (OEMs) and their key component suppliers. Kesko's automotive unit, therefore, faced higher costs and less flexibility in sourcing essential parts for its dealerships.

- Grocery Sector: High availability of substitute inputs for private label goods, reducing reliance on single suppliers.

- Building Materials: Availability of generic alternatives provides flexibility and limits supplier power.

- Automotive Sector: Brand and model-specific components have virtually no substitutes, granting car manufacturers significant control.

- Impact of Scarcity: In 2024, supply chain issues, especially for semiconductors, increased the bargaining power of automotive suppliers and manufacturers.

Kesko's bargaining power with suppliers is substantial due to its significant market presence, particularly in the grocery and building sectors. This scale allows Kesko to negotiate favorable terms, as many suppliers depend on its large order volumes. For example, Kesko's net sales reached €11.7 billion in 2023, showcasing its immense purchasing power.

However, this power is moderated by the availability of substitutes and the nature of the products. While generic goods offer flexibility, specialized or globally recognized brands can retain stronger leverage. The automotive sector exemplifies this, where brand-specific parts limit Kesko's options and strengthen manufacturer power.

Supply chain disruptions, as seen in 2024 with semiconductor shortages, can also temporarily shift power towards suppliers, especially in industries with few alternative sources for critical components.

| Factor | Impact on Kesko's Supplier Bargaining Power | Notes |

| Market Share & Sales Volume | Reduces Supplier Power | Kesko's €11.7 billion net sales in 2023 indicates significant purchasing leverage. |

| Availability of Substitutes | Reduces Supplier Power | High in groceries and building materials; low in automotive. |

| Supplier Dependence | Reduces Supplier Power | Many suppliers rely on Kesko for a large portion of their revenue. |

| Product Specialization/Brand Strength | Increases Supplier Power | Globally recognized brands or unique, non-substitutable products. |

| Switching Costs | Can Increase Supplier Power | High for proprietary items or integrated supply chains. |

What is included in the product

Kesko's Porter's Five Forces Analysis reveals the intensity of competition, buyer and supplier power, threat of new entrants, and the impact of substitutes on its grocery and building and technical trade sectors.

Effortlessly identify and address competitive threats, empowering strategic adjustments for Kesko's market position.

Customers Bargaining Power

Kesko's customers, particularly in the grocery sector, exhibit significant price sensitivity. This sensitivity was amplified in 2024 due to a general weakening of consumer purchasing power and heightened price competition among major retailers like S Group and Lidl.

The widespread availability of online price comparison tools empowers customers, making it easier than ever to scrutinize prices across various chains. This transparency directly translates into increased bargaining power for consumers, compelling Kesko to actively manage its pricing strategies to remain competitive.

For instance, Kesko implemented price reductions on more than 1,200 essential grocery items in early 2025, a clear response to this dynamic market. This move underscores the pressure Kesko faces to maintain attractive price points to retain its customer base in a highly competitive environment.

The bargaining power of customers is significantly amplified by the wide availability of substitute products and services. For Kesko, this is evident across its core business segments. Consumers have numerous choices for groceries, hardware, and automotive needs, with both brick-and-mortar and online retailers offering alternatives.

In 2024, the competitive pressure remained high. For instance, S Group and Lidl continued to expand their market presence, offering competitive pricing and product selections. Online grocery platforms also saw sustained growth, providing consumers with convenient alternatives to traditional supermarkets, further strengthening customer leverage.

This ease of switching compels Kesko to continuously enhance its customer value proposition. Focusing on superior customer experience, exceptional service quality, and a broad, appealing product assortment are crucial strategies for retaining loyalty in such a dynamic market. Kesko's ability to differentiate itself in these areas directly impacts its ability to mitigate customer bargaining power.

Kesko benefits from a highly fragmented customer base, with millions of individual consumers and numerous businesses across its various segments. This broad reach significantly dilutes the bargaining power of any single customer or small group. For instance, in its grocery division, individual shoppers have virtually no leverage.

While the majority of Kesko's customers have minimal individual power, certain B2B segments present a different dynamic. Large corporate clients in the building and technical trade, or significant fleet buyers in the automotive sector, can exert more influence due to the substantial volume of their purchases. For example, a major construction company purchasing significant quantities of building materials could negotiate more favorable terms.

Switching Costs for Customers

Switching costs for customers within Kesko's core grocery and building and technical trade segments are typically low. For instance, a consumer can easily switch between different grocery chains with little to no financial or effort-related barriers. This ease of transition means customers can readily move to a competitor if they find better prices or a more convenient shopping experience.

While Kesko's K-Plussa loyalty program is designed to foster customer loyalty and increase switching costs by offering benefits, its impact can be somewhat diluted. Competitors frequently counter loyalty programs with aggressive pricing strategies or by offering similar perks, which can still incentivize customers to switch. For example, in 2023, Finnish grocery market saw intense price competition, with major players like S Group and Lidl actively promoting discounts and value offers, directly challenging the lock-in effect of loyalty schemes.

In the automotive sector, where Kesko operates through its subsidiaries, switching costs can be perceived as higher. Customers may consider factors like familiarity with a particular car brand, established relationships with servicing dealerships, and concerns about resale value when considering a change. However, the Finnish car market is highly competitive, offering a wide array of brands and models, which ultimately limits the power of any single dealer or brand to significantly raise switching costs.

- Low Switching Costs in Grocery: Customers face minimal barriers when changing grocery stores, impacting Kesko's ability to retain them solely through convenience or product range.

- Loyalty Program Mitigation: Kesko's K-Plussa program aims to increase loyalty, but its effectiveness is challenged by competitors' pricing initiatives and comparable loyalty offerings.

- Perceived Higher Costs in Auto Trade: While brand familiarity and servicing contribute to higher perceived switching costs in car sales, the broad availability of alternatives limits this power.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they start producing the goods Kesko sells themselves, is quite low for Kesko. For instance, individual shoppers buying groceries simply don't have the capacity to produce their own food on a scale that would affect a major retailer like Kesko.

While some larger business clients, perhaps in construction, might source certain materials directly from manufacturers for specific, large-scale projects, this doesn't pose a widespread threat to Kesko's overall market presence. These instances are usually exceptions rather than the norm, and they don't fundamentally undermine Kesko's position as a primary supplier for the majority of its customer base.

The sheer convenience and the vast selection of products that Kesko provides through its established retail network are incredibly difficult for individual customers or even most businesses to replicate on their own. This makes backward integration by customers a minimal concern.

- Low Likelihood of Consumer Backward Integration: Individual consumers lack the scale and resources to produce goods Kesko sells, like groceries or building supplies, impacting Kesko's market.

- Limited Business-to-Manufacturer Sourcing: While some large businesses might bypass retailers for specific bulk purchases directly from manufacturers, this is niche and doesn't broadly erode Kesko's market share.

- Kesko's Competitive Advantages: The convenience, extensive product range, and established logistics of Kesko's retail model present significant barriers for customers attempting to self-supply.

Kesko's customers possess considerable bargaining power, primarily driven by price sensitivity and the ease of switching between retailers. In 2024, this was exacerbated by economic pressures and intense competition, such as S Group and Lidl's aggressive pricing. The proliferation of online price comparison tools further empowers consumers, forcing Kesko to maintain competitive pricing, as seen with their early 2025 price reductions on over 1,200 grocery items.

While Kesko benefits from a vast, fragmented customer base that limits individual leverage, larger B2B clients in sectors like building and automotive can negotiate more favorable terms due to purchase volume. However, low switching costs across most segments, particularly groceries, mean customers can easily opt for competitors offering better prices or experiences, a trend intensified by rival loyalty programs and promotions in 2023.

The threat of backward integration by customers is minimal for Kesko. Individual consumers lack the scale to produce their own goods, and while some large businesses might source directly from manufacturers for specific projects, this remains an exception rather than a widespread challenge to Kesko's dominant retail model.

Same Document Delivered

Kesko Porter's Five Forces Analysis

This preview shows the exact Kesko Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape affecting Kesko, including buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. This professionally formatted document is ready for your strategic planning and decision-making needs.

Rivalry Among Competitors

Kesko operates in highly competitive markets, particularly in Northern Europe. In the grocery sector, it contends with powerful rivals like S Group, which reported strong sales growth in the first half of 2025, and the rapidly expanding Lidl. This intense competition necessitates continuous innovation and efficiency to maintain market share.

The building and technical trade segment is characterized by a broad mix of competitors, encompassing both established local businesses and international corporations. This diverse landscape means Kesko must differentiate itself through specialized offerings and strong customer relationships to stand out.

Furthermore, the automotive sector presents its own set of challenges. Kesko's car trade division faces significant pressure not only from other large dealership groups but also from car manufacturers increasingly adopting direct-to-consumer sales models. This evolving dynamic requires strategic adaptation to remain competitive.

The growth rate within Kesko's operating sectors significantly impacts competitive rivalry. For instance, the Finnish grocery retail market saw a modest 2.0% growth in 2024, but this period was marked by heightened price competition among players.

In contrast, the building and technical trade faced considerable headwinds, experiencing historically low activity. A truly robust recovery for this segment is not anticipated until 2025, suggesting continued pressure on margins and intense competition for any available business.

The automotive sector, especially new car sales, is also projected to remain sluggish through the first half of 2025. This forecast of declining overall sales naturally escalates the battle for market share, forcing companies to compete more aggressively on price and incentives.

In grocery and hardware retail, product differentiation is typically minimal, forcing companies like Kesko to compete heavily on price, location, and service quality. Kesko aims to stand out by developing unique store concepts, enhancing its digital offerings, and leveraging its K-Plussa loyalty program to build customer relationships and encourage repeat business.

The automotive sector presents a different landscape where differentiation is more pronounced, stemming from distinct brand reputations and the quality of after-sales service. However, across most of Kesko's operating segments, customers face low switching costs. This lack of friction means Kesko must constantly invest in improving the customer experience and maintaining competitive pricing to retain its market share against rivals.

Exit Barriers

Kesko faces significant competitive rivalry due to high exit barriers. The company's substantial investment in physical retail locations, extensive logistics networks, and specialized supply chains for its diverse product categories represent substantial fixed assets. These assets are not easily repurposed or sold, making it financially challenging and time-consuming for Kesko to withdraw from any particular market segment or geography.

These exit barriers mean that even when market conditions are unfavorable or profitability declines, Kesko and its competitors are often compelled to remain active. This forced continuation of operations fuels sustained competition, as companies strive to maintain market share and leverage economies of scale to offset their fixed costs. For instance, in 2024, the retail sector continued to see intense price competition, partly driven by the need for large players to keep their extensive store networks operational.

The presence of a large, trained employee base also contributes to exit barriers. The costs associated with workforce reductions, severance packages, and the potential reputational damage of mass layoffs can deter companies from exiting markets. This sticky labor situation further entrenches existing players, intensifying the rivalry as each company works to optimize its operations within the existing competitive landscape.

- High Fixed Asset Investment: Kesko operates numerous physical stores and advanced logistics centers, representing significant capital tied up in tangible assets that are difficult to divest.

- Specialized Supply Chains: The company's supply chain infrastructure is tailored to its specific retail sectors, such as groceries and building materials, limiting its flexibility for quick market exits.

- Employee Base: A large workforce across its operations presents substantial human capital costs and complexities that act as a disincentive for rapid withdrawal from markets.

- Economies of Scale: Maintaining a broad market presence is crucial for Kesko to achieve cost efficiencies through scale, creating a barrier to exiting markets where such scale is vital for competitiveness.

Strategic Objectives of Competitors

Competitors like S Group are aggressively pursuing strategic objectives, notably a focus on affordability and extensive product ranges, alongside a robust push into online sales. This directly influences Kesko's strategic planning, as these competitor actions create significant market pressures.

Many retailers are channeling substantial investments into expanding their physical store footprints and enhancing their digital infrastructure. This trend intensifies competition for market share, compelling Kesko to respond proactively to maintain its standing.

- S Group's Strategic Focus: Emphasis on value and breadth of offering, coupled with significant investment in e-commerce capabilities.

- Industry Investment Trend: Widespread capital allocation towards larger store formats and advanced online sales platforms by numerous retailers.

- Kesko's Counter-Strategy: Necessity for Kesko to invest in modernizing its store network, implementing competitive pricing strategies, and bolstering digital services to defend its market position.

Kesko faces intense rivalry across its diverse business segments, driven by established players and aggressive newcomers. The grocery sector sees strong competition from S Group and Lidl, while building and technical trade includes both local and international firms. The automotive division contends with other large groups and manufacturers moving towards direct sales, all amplified by low customer switching costs and the need to maintain scale.

| Competitor | Sector | Key Competitive Factor | 2024 Market Dynamic Impact |

| S Group | Grocery | Affordability, product range, online sales | Heightened price competition, market share pressure |

| Lidl | Grocery | Aggressive expansion, value pricing | Increased competition for price-sensitive consumers |

| Local & International Firms | Building & Technical Trade | Specialized offerings, customer relationships | Intensified competition for market share in a low-activity market |

| Automotive Manufacturers | Automotive | Direct-to-consumer sales models | Pressure on traditional dealership models, need for differentiation |

SSubstitutes Threaten

In the grocery sector, online grocery delivery services represent a significant threat, with the global online grocery market projected to reach over $1.5 trillion by 2025. Local farmers' markets and specialized food producers also offer alternatives, catering to consumers seeking unique or locally sourced products.

For Kesko's hardware segment, K-Rauta faces competition from online DIY retailers and professional installation services. The e-commerce boom has made it easier for consumers to purchase home improvement supplies online, while opting for professional services bypasses the need to buy materials altogether.

In the automotive trade, ride-sharing platforms and expanding public transportation networks offer viable substitutes for private car ownership, particularly in urban centers. These alternatives are gaining traction as consumers re-evaluate the costs and conveniences associated with traditional car ownership, impacting new car sales.

The price competitiveness of substitutes is a major factor in their threat. For instance, while online grocery services provide convenience, sometimes at a slightly higher price point, discount chains like Lidl directly compete on price, attracting a different customer segment. This price sensitivity among consumers directly influences how readily they might switch from traditional grocery shopping.

In the building and technical trade sector, the threat of substitutes isn't solely about price but also about value. Professional services, though carrying a higher initial cost, often provide a comprehensive solution that saves customers significant time and effort, especially those lacking specialized knowledge or tools. This bundle of convenience and expertise can outweigh a direct price comparison.

The escalating costs associated with car ownership, including fuel, insurance, and maintenance, are making alternative transportation methods more appealing. In 2024, with inflation impacting many household budgets, shared mobility solutions, whether ride-sharing or car-sharing services, present a cost-effective substitute for many individuals, potentially reducing demand for traditional car purchases and usage.

Switching costs for consumers to alternative retail options, like trying a different grocery store or ordering online, are generally quite low. This means Kesko faces constant pressure to provide excellent value and convenience to keep customers. For instance, in 2023, the Finnish grocery market saw intense competition, with discounters gaining market share, highlighting how easily consumers can shift their spending.

Buyer Propensity to Substitute

Consumers are increasingly open to switching between different product categories and brands, driven by changing lifestyles and economic realities. For instance, the growing demand for convenience, exemplified by the rise of online grocery shopping, directly challenges traditional brick-and-mortar food retailers. In 2024, online grocery sales in Finland, Kesko's primary market, continued to see robust growth, with estimates suggesting it could reach over 10% of total grocery sales, a significant jump from previous years.

Environmental consciousness and cost-effectiveness are also powerful drivers of substitution. Consumers are actively seeking out sustainable options, such as locally sourced food or energy-efficient appliances, while economic pressures push them towards budget-friendly alternatives like discount retailers or public transportation over private car ownership. This trend is evident in the increasing popularity of electric vehicles, which offer long-term cost savings despite higher initial purchase prices, impacting the automotive sector and related services.

Kesko is actively responding to these substitution threats by strategically enhancing its omnichannel capabilities, making it easier for customers to shop across various platforms. Furthermore, the company's commitment to offering sustainable choices, from responsibly sourced food products to energy-efficient home solutions, aims to align with consumer preferences and reduce the appeal of substitute offerings.

- Consumer Propensity to Substitute: Driven by convenience, sustainability, and cost-effectiveness.

- Key Substitution Drivers: Online grocery shopping, locally sourced food, electric vehicles, budget retailers, public transport.

- Market Trend Example: Online grocery sales in Finland projected to exceed 10% of total sales in 2024.

- Kesko's Strategy: Focus on omnichannel experiences and sustainable product offerings.

Product-for-Product Substitution

Beyond direct competitors, consumers may switch to different product types that fulfill the same basic need. For instance, in the grocery sector, shoppers might replace fresh fruits and vegetables with frozen or canned alternatives, especially when price or immediate availability becomes a deciding factor. This flexibility in consumer choice highlights a significant threat, as it allows customers to bypass traditional offerings.

In the hardware market, the availability of less expensive, lower-quality products can draw customers away from premium brands, particularly when budget constraints are a primary concern. This dynamic means that even if Kesko offers high-quality goods, a readily available cheaper option can erode market share. For example, a DIY enthusiast might choose a basic, less durable tool for a single project if the cost savings are substantial.

The automotive industry provides a clear illustration of product-for-product substitution, with the accelerating adoption of electric vehicles (EVs) and hybrids directly challenging traditional internal combustion engine (ICE) vehicles. By July 2024, global EV sales were projected to reach over 16 million units, representing a substantial shift in consumer preference and a direct threat to established ICE vehicle sales channels. This trend forces companies like Kesko, which has automotive divisions, to adapt their strategies to accommodate evolving consumer demands and technological advancements.

- Consumer Choice: Customers can opt for frozen or canned produce over fresh, driven by price and availability, impacting grocery sales.

- Price Sensitivity: In hardware, cheaper, lower-quality alternatives attract budget-conscious buyers, posing a threat to higher-priced goods.

- Technological Shifts: The automotive sector sees EVs and hybrids substituting traditional ICE vehicles, a trend supported by projected global EV sales exceeding 16 million units by mid-2024.

- Adaptability: Companies must remain agile to address these product-for-product substitutions, ensuring their offerings remain competitive and aligned with market evolution.

The threat of substitutes for Kesko stems from various alternatives that fulfill similar customer needs. In groceries, online platforms and local producers offer convenience and unique products, respectively. For hardware, DIY enthusiasts may opt for online retailers or professional services, bypassing traditional purchases. The automotive sector sees ride-sharing and public transport as viable substitutes for car ownership, driven by rising ownership costs.

Price competitiveness is a key driver, with discount chains directly challenging Kesko's pricing. Convenience and expertise offered by professional services also present a value-based substitute. Escalating car ownership costs in 2024 make shared mobility a more attractive alternative, impacting new car sales.

Switching costs for consumers to alternatives are generally low, necessitating continuous value and convenience from Kesko. The Finnish grocery market in 2023 demonstrated this, with discounters gaining share due to consumer ease of switching.

Consumer preferences are shifting towards convenience and sustainability, with online grocery sales in Finland projected to exceed 10% of total sales in 2024. This trend, alongside the rise of EVs driven by cost-effectiveness and environmental consciousness, highlights the dynamic nature of substitution threats across Kesko's diverse segments.

Entrants Threaten

The retail sector, particularly in areas like grocery and large building supplies, demands significant upfront investment. Think about building and maintaining store networks, establishing efficient logistics, and stocking substantial inventory. This high capital requirement acts as a major hurdle for any new companies looking to enter the market.

Companies like Kesko already enjoy considerable advantages due to economies of scale. Their sheer size allows them to negotiate better prices on purchases, optimize distribution, and run more cost-effective marketing campaigns. This makes it tough for smaller, newer competitors to match their pricing and overall cost structure.

While traditional brick-and-mortar retail presents high barriers, the rise of online-only retail models offers a potential avenue for new entrants. These digital-first approaches can significantly lower the initial capital needed, bypassing some of the physical infrastructure costs that have historically protected established players.

Kesko's strong brand recognition across its K-food stores, K-Rauta, and K-Auto segments, coupled with the widely adopted K-Plussa loyalty program, cultivates significant customer loyalty. This established customer base presents a substantial hurdle for any new competitor aiming to gain market share.

While the cost of switching for a single purchase might be minimal, the accumulated benefits and ingrained shopping habits associated with Kesko's loyalty initiatives effectively raise switching costs for customers. New entrants must provide a demonstrably superior value proposition or a uniquely differentiated offering to entice customers away from their established routines.

For physical retail, securing prime locations and establishing efficient supply chains are critical hurdles for newcomers. Kesko's vast network, boasting over 1,700 stores across Finland as of early 2024, gives it a significant edge in physical market access.

While online channels lower entry barriers, building a reliable and cost-effective delivery infrastructure remains a substantial challenge for new entrants. This is particularly true in a market like Finland, where logistical complexities can arise.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants for companies like Kesko. Regulatory hurdles, such as zoning laws for retail spaces, stringent food safety standards, and evolving environmental regulations, can create substantial barriers. For example, in 2024, Finland's commitment to stricter environmental standards for building materials and operations could increase the capital expenditure required for new retail developments, making entry more challenging.

In sectors where Kesko operates, like the car trade, specific import regulations, dealership licensing requirements, and increasingly rigorous emissions standards act as deterrents. Navigating these complex legal frameworks demands considerable investment in compliance and expertise. While these regulations are not absolute barriers, they undoubtedly add layers of complexity and cost for any potential new competitor seeking to enter the market.

These governmental impositions can be viewed through several key aspects:

- Zoning and Land Use: Local government regulations can restrict where new retail outlets can be established, limiting prime locations for potential entrants.

- Industry-Specific Standards: Food safety, import quotas, and emissions standards necessitate significant upfront investment and ongoing compliance efforts.

- Licensing and Permits: Obtaining necessary business licenses and permits can be a time-consuming and costly process, especially in regulated industries.

- Environmental Compliance: Adherence to environmental protection laws, including waste management and energy efficiency, adds to operational costs for new businesses.

Expected Retaliation from Incumbents

New entrants must anticipate aggressive responses from established companies like Kesko. Kesko possesses significant financial strength and a substantial market footprint, enabling it to react forcefully to new competition.

Kesko's commitment to price competition, as evidenced by its investments in grocery trade price programs, highlights its readiness to protect its market share. These strategic moves can render market entry financially unviable or unsustainable for newer, less capitalized rivals.

- Kesko's Financial Capacity: As of the end of Q1 2024, Kesko reported net sales of €2,922.5 million, indicating substantial resources available for competitive actions.

- Market Share Defense: The company's active participation in price wars, particularly in the grocery sector, demonstrates a clear strategy to deter new entrants by making profitability challenging.

- Impact on New Entrants: The potential for retaliatory pricing and marketing campaigns by Kesko can significantly increase the cost and risk associated with entering the market.

The threat of new entrants for Kesko is generally moderate, influenced by high capital requirements, established brand loyalty, and significant economies of scale enjoyed by the company. While online retail lowers some barriers, physical retail requires substantial investment in infrastructure and logistics. For instance, Kesko's extensive network of over 1,700 stores across Finland as of early 2024 provides a considerable advantage in market access and distribution efficiency, making it difficult for newcomers to replicate this reach.

Regulatory environments and Kesko's strong brand recognition and loyalty programs further solidify its market position, acting as deterrents for potential new competitors. The company's financial strength, demonstrated by its Q1 2024 net sales of €2,922.5 million, also allows for aggressive responses to new competition, such as price wars, which can significantly impact the viability of new entrants.

| Factor | Impact on New Entrants | Kesko's Position |

|---|---|---|

| Capital Requirements | High (physical retail) | Established infrastructure, economies of scale |

| Brand Loyalty | Significant hurdle | Strong brand recognition, K-Plussa loyalty program |

| Economies of Scale | Challenging to match | Negotiating power, optimized logistics |

| Online Retail | Lowered barriers | Developing omnichannel strategies |

| Regulatory Environment | Adds complexity and cost | Navigated compliance, potential for new standards |

| Kesko's Retaliation | High risk | Financial capacity, price competition strategy |

Porter's Five Forces Analysis Data Sources

Our Kesko Porter's Five Forces analysis is built upon a foundation of robust data, including Kesko's official annual reports, investor presentations, and publicly available financial statements. We also leverage industry-specific market research reports and competitor analysis from reputable sources to provide a comprehensive view of the competitive landscape.