Kesko PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kesko Bundle

Kesko operates within a dynamic environment shaped by political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks. Understanding these external forces is crucial for navigating the retail landscape. Our comprehensive PESTLE analysis delves deep into each of these factors, offering actionable insights to inform your strategy. Download the full version to gain a competitive edge and make informed decisions.

Political factors

Kesko, as a major player in Northern European retail, navigates a complex web of government regulations. These cover crucial areas like food safety standards, fair competition practices, and robust consumer protection laws across its operating markets, including Finland, Sweden, and Denmark.

Shifts in these regulatory landscapes, particularly within the European Union's single market, can significantly influence Kesko's operational expenses, the variety of products it can offer, and its overall market approach. For instance, new EU directives on supply chain transparency, which came into sharper focus in 2023 and 2024, require continuous adaptation and adherence from companies like Kesko to ensure compliance.

Kesko's operations are significantly influenced by political stability in its core markets, primarily Finland and other Northern European countries. For instance, Finland has consistently ranked high in global stability indices, fostering a predictable business environment. Any shifts in this stability, however, can directly impact Kesko's ability to plan long-term investments and maintain operational efficiency.

Geopolitical tensions, as highlighted in recent company reports, present a more dynamic challenge. Events like the ongoing conflict in Eastern Europe, which impacted supply chains and energy prices in 2022-2023, create an unpredictable operating landscape. These tensions can dampen consumer confidence and reduce discretionary spending, directly affecting Kesko's retail sales across its grocery, building and technical trade, and automotive divisions.

Finland's government has been actively implementing labor market reforms, aiming to boost economic growth and flexibility. These changes can directly influence Kesko's operational costs and employment strategies. For instance, reforms might alter dismissal rules or wage-setting mechanisms, requiring Kesko to adapt its human resource policies.

While these reforms are designed to foster a more dynamic economy, they can also introduce complexities. Potential outcomes include industrial disputes or renegotiations of existing collective bargaining agreements, which could disrupt operations. Kesko, employing thousands, must proactively manage these shifts to ensure workforce stability and cost efficiency.

As of early 2024, Finland's unemployment rate stood around 7.5%, a figure that reforms aim to reduce. Changes in labor legislation, such as those affecting the duration of employment contracts or the conditions for temporary work, directly impact how companies like Kesko manage their staffing levels and associated expenses.

EU Corporate Sustainability Reporting Directive (CSRD)

Kesko's dedication to sustainability is significantly influenced by evolving regulations, notably the EU Corporate Sustainability Reporting Directive (CSRD). This directive necessitates detailed and standardized reporting on environmental, social, and governance (ESG) aspects, a requirement Kesko addressed in its 2024 Annual Report. Meeting these mandates demands sophisticated data management and clear communication, directly impacting Kesko's sustainability strategies and public reporting practices.

The CSRD's implementation means Kesko must provide assurance on its sustainability data, increasing accountability. This regulatory push is a key driver for Kesko to enhance its ESG performance and reporting capabilities. For instance, the directive requires reporting against European Sustainability Reporting Standards (ESRS), which cover a broad range of topics from climate change to human rights.

- CSRD Mandates: The directive requires companies to report on a wide array of ESG factors, including climate change, biodiversity, and social impact.

- Kesko's 2024 Report: Kesko has already begun integrating CSRD requirements, as evidenced by its 2024 Annual Report, showcasing early adoption.

- Data Assurance: Compliance involves obtaining external assurance for sustainability information, boosting credibility and transparency.

- Strategic Alignment: The CSRD encourages companies like Kesko to embed sustainability into their core business strategy and risk management processes.

Competition Authority Approvals for Acquisitions

Kesko's strategic growth hinges on acquisitions, especially within its building and technical trade segment across Northern Europe. For instance, recent acquisitions in Denmark, finalized in early 2025, required scrutiny from national competition authorities.

These regulatory approvals are crucial; their timing and any imposed conditions directly shape Kesko's expansion timelines and its capacity to solidify market share. The successful integration of these Danish businesses demonstrates the impact of navigating these political checkpoints.

- Regulatory Hurdles: Acquisitions are subject to competition authority review.

- Market Consolidation: Approvals enable Kesko to strengthen its market position.

- Expansion Impact: Approval timelines directly affect strategic growth plans.

- Recent Example: Danish acquisitions completed in early 2025 highlight this process.

Kesko's operations are significantly shaped by political stability and government policies in its key Northern European markets. For example, Finland's consistent high ranking in global stability indices provides a predictable environment, though geopolitical tensions, as seen in 2022-2023, can negatively impact consumer spending and thus Kesko's sales.

Labor market reforms in Finland, aimed at boosting economic growth, directly influence Kesko's employment strategies and costs, with unemployment around 7.5% in early 2024 necessitating careful adaptation of HR policies.

Regulatory frameworks, particularly EU directives like the Corporate Sustainability Reporting Directive (CSRD), are driving Kesko's sustainability reporting, as detailed in its 2024 Annual Report, requiring enhanced data management and assurance.

Furthermore, Kesko's expansion through acquisitions, such as those in Denmark finalized in early 2025, necessitates navigating national competition authorities, with approval timelines critically impacting its strategic growth.

What is included in the product

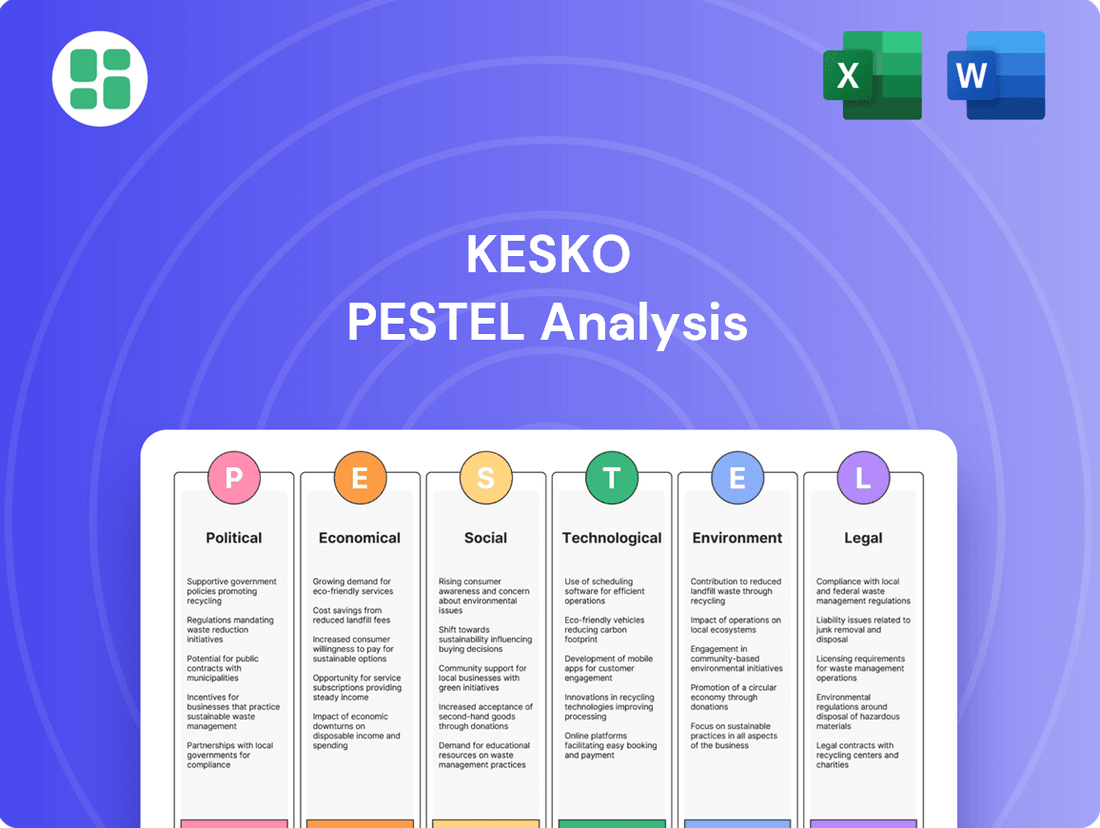

This PESTLE analysis of Kesko examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

Provides a concise version of the Kesko PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

High inflation rates in 2024 and 2025 are directly impacting consumer purchasing power, a critical factor for Kesko's grocery trade. As prices for everyday goods rise, consumers have less discretionary income, influencing their spending habits on both essentials and non-essentials.

Despite the grocery market's inherent stability, Kesko is actively implementing price programs to remain competitive and ensure affordability for its customers. This strategy is crucial as real wage developments throughout 2024 and into 2025 will determine the actual disposable income available for households.

Kesko anticipates a gradual economic upturn across its operating regions for 2025, projecting a comparable operating profit that hinges on this improvement. However, the pace of consumer confidence recovery and the willingness of businesses to invest remain significant variables that could influence actual performance.

A key indicator for Kesko's building and technical trade division is the new building construction sector. If this sector experiences a slower recovery than expected, it could directly impact the division's profitability, highlighting the sensitivity of Kesko's performance to broader economic trends.

Interest rate fluctuations significantly shape the investment climate for companies like Kesko. When rates rise, the cost of borrowing increases, which can curb consumer spending on larger purchases, directly impacting Kesko's building and technical trade, as well as its car sales. For instance, a 1% increase in the European Central Bank's key interest rate could translate to higher financing costs for consumers taking out mortgages or car loans.

Conversely, favorable interest rates empower Kesko to pursue growth strategies more effectively. Lower borrowing costs make it more feasible to invest in critical areas such as modernizing its store network, enhancing logistics capabilities, or undertaking strategic acquisitions. The Finnish central bank's policy rates, for example, directly influence Kesko's cost of capital for these vital long-term investments, impacting its competitive positioning.

Supply Chain Costs and Energy Prices

The costs tied to Kesko's vast supply chain, particularly energy prices for transport and store operations, directly influence its bottom line. In 2024, global energy markets have shown continued volatility, with crude oil prices fluctuating, impacting fuel costs for logistics. For instance, Brent crude oil averaged around $83 per barrel in early 2024, a significant factor for transportation expenses.

Effectively managing these expenses is crucial across all of Kesko's business segments. The grocery, building and technical trade, and car trade divisions all face pressures from rising energy and logistics costs. This economic factor remains a constant challenge, requiring strategic cost control measures.

Kesko is actively pursuing efficiency gains in its logistics network and energy usage. These ongoing strategic priorities aim to cushion the impact of economic headwinds. For example, investments in more fuel-efficient fleets and optimizing delivery routes are key initiatives to mitigate these rising costs.

- Energy Price Impact: Global energy price volatility, with Brent crude averaging approximately $83/barrel in early 2024, directly affects Kesko's logistics and operational expenses.

- Divisional Sensitivity: All three of Kesko's divisions – grocery, building and technical trade, and car trade – are sensitive to these economic pressures, requiring careful cost management.

- Strategic Mitigation: Kesko prioritizes ongoing efficiency improvements in logistics and energy consumption to counteract the impact of rising supply chain costs.

Market Demand in Key Divisions

Market demand presents a mixed picture for Kesko's various divisions. The grocery trade, both for consumers (B2C) and the foodservice sector, is anticipated to maintain stability, with a strong emphasis on competitive pricing strategies to capture market share. This suggests a resilient, albeit price-sensitive, consumer base in these segments.

Conversely, the new car market is projected to remain sluggish throughout 2025. However, this downturn is offset by robust demand for used cars and related services, indicating a shift in consumer preferences towards more affordable or value-oriented automotive solutions. This trend highlights an opportunity for Kesko to leverage its used car operations and after-sales services.

The building and technical trade sector is poised for improvement, moving away from historically low demand levels. Despite this positive outlook, the recovery in new building construction is proving slower than initially forecast. This suggests a cautious approach is warranted, with a focus on sectors less reliant on new construction, such as renovations and maintenance.

- Grocery Trade (B2C & Foodservice): Expected to remain stable, with price competitiveness as a key driver.

- New Car Market: Projected to stay at a low level in 2025.

- Used Cars & Services: Demand remains strong, presenting a growth opportunity.

- Building & Technical Trade: Anticipated improvement from low levels, but new construction recovery is slower than expected.

High inflation in 2024 and 2025 is eroding consumer purchasing power, directly impacting Kesko's grocery sales. While the grocery market is generally stable, Kesko is using price strategies to stay competitive. Real wage growth in 2024-2025 will be key to household disposable income.

Kesko anticipates a slow economic recovery across its markets in 2025, with its operating profit depending on this trend. Consumer confidence and business investment levels are important factors to watch. The building and technical trade division's performance is closely tied to the pace of new construction recovery.

Interest rates significantly influence Kesko's investment climate and consumer spending. Higher rates increase borrowing costs, affecting consumer purchases of cars and homes, which impacts Kesko's building and technical trade and car sales. For instance, a 1% rate hike by the ECB could mean higher mortgage or car loan payments for consumers.

Kesko's supply chain costs, especially energy prices for transportation and store operations, directly affect its profitability. Global energy markets remained volatile in 2024, with crude oil prices impacting fuel costs. Brent crude oil, for example, averaged around $83 per barrel in early 2024, a major cost driver for logistics.

| Economic Factor | Impact on Kesko | Data Point/Trend (2024-2025) |

|---|---|---|

| Inflation | Reduced consumer purchasing power, especially for groceries. | High inflation rates in 2024-2025 impacting disposable income. |

| Interest Rates | Increased borrowing costs for Kesko and consumers; potential dampening of large purchases. | ECB key interest rate fluctuations affecting consumer financing for cars and homes. |

| Energy Prices | Higher operational and logistics costs across all divisions. | Brent crude oil averaging ~$83/barrel in early 2024, impacting fuel expenses. |

| Market Demand (New Cars) | Projected to remain low. | Sluggish new car market expected throughout 2025. |

| Market Demand (Used Cars) | Strong demand, offering a growth opportunity. | Robust demand for used cars and related services. |

Full Version Awaits

Kesko PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Kesko offers an in-depth examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Finnish retail giant.

You'll gain valuable insights into market dynamics, competitive landscapes, and strategic opportunities for Kesko, all presented in a clear and actionable format.

Sociological factors

Consumers are increasingly seeking healthier and more sustainable products, a significant shift influencing Kesko's grocery operations. This demand is evident in the growing market for organic and plant-based foods, with the global plant-based food market projected to reach $74.2 billion by 2027, according to recent market analyses.

Kesko is responding by enhancing the nutritional profiles of its private label brands and expanding its selection of environmentally friendly options. For instance, in 2024, Kesko reported a notable increase in sales for its K-Ruoka private label products that meet specific health criteria, indicating strong consumer adoption of healthier choices.

This strategic focus aligns with Kesko's overarching vision to facilitate sustainable and healthy living for its customers. By prioritizing these evolving societal values, Kesko aims to solidify its position as a responsible retailer in a market increasingly driven by conscious consumption, a trend showing continued growth through 2025.

The ongoing digitalization of shopping habits is profoundly reshaping the retail landscape. Globally, e-commerce sales are projected to reach $7.4 trillion by 2025, a substantial increase from previous years, with online grocery sales experiencing particularly strong momentum. This trend underscores a fundamental shift in consumer behavior towards convenience and digital accessibility.

Kesko is actively responding to this by integrating its robust physical store network with expanding online sales channels. This omnichannel approach aims to create a fluid customer journey, allowing shoppers to seamlessly transition between digital platforms and brick-and-mortar locations. For instance, in 2023, Kesko's online sales saw continued growth, reflecting the effectiveness of this strategy.

Further investments are being directed towards enhancing digital services that simplify everyday life for consumers. By leveraging data analytics, Kesko is gaining deeper insights into customer preferences and behaviors, which in turn informs the development of more personalized and efficient offerings across all touchpoints.

Modern consumers increasingly value convenience, seeking out ready-to-eat meals and rapid delivery services. This trend is evident in the growing market for prepared foods, which saw a significant uptick in sales across many European grocery sectors in early 2024.

Concurrently, there's a rising demand for locally sourced products and regional specialties. Kesko's extensive network of K-food stores, with over 1,100 locations in Finland as of late 2023, is well-positioned to capitalize on this by partnering with local producers, thereby fostering community ties and customer loyalty.

Workforce Diversity, Equity, and Inclusion (DEI)

Kesko's commitment to Diversity, Equity, and Inclusion (DEI) is a cornerstone of its sustainability strategy, focusing on employee wellbeing and success. The company actively works to increase the proportion of women in its leadership ranks, aiming for greater representation in both top and middle management positions. This focus on DEI is crucial for attracting and retaining a skilled workforce, cultivating a positive organizational culture, and aligning with societal demands for equitable employment practices.

In 2023, Kesko reported that women held 34% of management positions, a figure they are actively working to increase. Their sustainability targets for 2025 include further enhancing gender balance in leadership. This proactive approach to DEI not only strengthens Kesko's internal operations but also enhances its reputation as a responsible employer in the Finnish retail sector.

- Targeted Gender Representation: Kesko aims to boost the percentage of women in management roles, with a specific focus on achieving higher representation in senior leadership.

- Employee Wellbeing Focus: The company's sustainability strategy explicitly links employee wellbeing with fostering a diverse, equitable, and inclusive work environment.

- Societal Alignment: Addressing DEI is seen as essential for meeting evolving societal expectations regarding fair labor and equal opportunities in the business world.

- Talent Attraction and Retention: A strong DEI initiative is recognized as a key factor in attracting top talent and ensuring long-term employee commitment.

Ethical Consumerism and Value Chain Transparency

Consumers are increasingly scrutinizing the ethical implications of their purchases, demanding greater transparency regarding product origins and labor practices. This societal shift directly influences Kesko's operations, compelling the company to ensure its entire value chain, especially in high-risk regions, aligns with its Code of Conduct and robust sustainability policies. For instance, in 2023, Kesko continued its focus on supplier audits, with a significant portion dedicated to verifying compliance with ethical sourcing standards, reflecting a proactive response to this growing consumer concern.

Kesko's commitment to ethical consumerism is evident in its efforts to promote sustainable product choices and minimize waste. This resonates with a significant portion of the Finnish population; a 2024 survey indicated that over 70% of Finnish consumers consider sustainability a key factor when making purchasing decisions. By actively highlighting eco-friendly options and implementing waste reduction programs, Kesko aims to meet the evolving ethical expectations of its customer base, thereby strengthening brand loyalty and market position.

- Growing Ethical Awareness: Consumers are more informed and vocal about ethical sourcing and labor practices.

- Value Chain Scrutiny: Demand for transparency extends to all suppliers, particularly those in countries with higher perceived risks.

- Kesko's Response: The company reinforces its Code of Conduct and sustainability policies for suppliers.

- Consumer Preference: Sustainable and ethically produced goods are increasingly preferred by a majority of consumers.

Societal values are shifting towards health and sustainability, with consumers actively seeking organic and plant-based options. Kesko's 2024 sales data for its K-Ruoka private label products, which meet specific health criteria, show a notable increase, demonstrating strong consumer adoption of these healthier choices.

The increasing digitalization of shopping habits is fundamentally altering the retail sector, with global e-commerce sales projected to reach $7.4 trillion by 2025. Kesko is enhancing its omnichannel strategy by integrating its physical stores with growing online sales channels, a move supported by its continued online sales growth in 2023.

Consumers now prioritize convenience and ethical sourcing, driving demand for ready-to-eat meals and transparent supply chains. A 2024 survey revealed that over 70% of Finnish consumers consider sustainability in their purchasing decisions, a trend Kesko is addressing through its focus on local sourcing and ethical supplier practices.

Kesko's commitment to Diversity, Equity, and Inclusion (DEI) is central to its strategy, with a goal to increase female representation in management. In 2023, women held 34% of management positions, and Kesko aims to further improve this gender balance by 2025, aligning with societal expectations for equitable employment.

Technological factors

Kesko is significantly boosting its digital capabilities, pouring resources into creating a smooth experience that blends online and in-store shopping. This strategic move is all about making it easy for customers to interact with the brand across various channels.

The company's investment in online sales platforms and digital services is designed to work hand-in-hand with its existing physical stores. This omni-channel approach aims to capture a wider customer base and cater to evolving shopping habits.

By integrating advanced technology, Kesko is enhancing its ability to offer personalized marketing and streamline customer interactions. For instance, in 2023, Kesko's online sales grew by 11.5%, reaching €1.2 billion, highlighting the increasing importance of digital channels in their overall strategy.

Kesko is increasingly leveraging data analytics and AI to refine its operations. For instance, in 2023, the company reported a significant improvement in inventory turnover rates across its grocery division, partly attributed to advanced demand forecasting models. This allows for a more precise alignment of stock levels with actual consumer purchasing patterns, minimizing waste and stockouts.

The application of AI extends to personalizing customer experiences and offers within their K-Ruoka app. By analyzing purchasing history and preferences, Kesko can tailor promotions and recommendations, driving higher engagement and sales. This data-informed strategy is crucial for understanding evolving customer needs and maintaining a competitive edge in the retail landscape.

Furthermore, Kesko uses data analytics to optimize pricing strategies, ensuring competitiveness while maximizing margins. In 2024, pilot programs in select hypermarkets demonstrated a 3% uplift in gross margin through dynamic pricing adjustments based on real-time market data and competitor analysis.

Kesko's operational efficiency hinges on supply chain automation and logistics innovations. The company's strategic investments, like the new Onnela logistics center, are designed to streamline operations and cut costs. For instance, in 2023, Kesko continued its significant investments in modernizing its logistics infrastructure to support its growing business and enhance customer service.

Furthermore, Kesko is actively leveraging technology in its car trade division. By utilizing vehicle-generated data, the company aims to implement improved maintenance services and predictive maintenance strategies. This data-driven approach is expected to boost the reliability and longevity of its vehicle fleet, contributing to better service delivery and reduced downtime.

New Payment Technologies and Security

Kesko places significant emphasis on adopting new payment technologies and maintaining robust information security. As digital transactions surge, ensuring secure and user-friendly payment systems is paramount for customer confidence and business operations. For instance, in 2024, Kesko continued to invest in enhancing its digital payment infrastructure, aiming to provide seamless transaction experiences across its various retail channels.

The company actively monitors and responds to information security threats to safeguard sensitive customer data. In 2023, the retail sector globally saw a rise in cyberattacks, and Kesko's proactive approach to cybersecurity is crucial. By implementing advanced security measures and regularly updating protocols, Kesko aims to mitigate risks associated with data breaches, thereby protecting its reputation and customer trust.

- Digital Transaction Growth: Kesko experienced a notable increase in digital transactions throughout 2024, reflecting a broader consumer shift towards online and contactless payments.

- Cybersecurity Investments: The company allocated significant resources in 2024 to bolster its cybersecurity defenses, including advanced threat detection and data encryption technologies.

- Customer Data Protection: Kesko's commitment to protecting customer data remained a top priority, with ongoing efforts to comply with evolving data privacy regulations and best practices.

Vehicle Electrification and Automotive Technology

Kesko's automotive division is significantly shaped by the rapid growth of vehicle electrification and evolving car technologies. This shift directly influences the types of vehicles they offer and the maintenance services required. For instance, in 2024, the demand for electric vehicles continued its upward trajectory, with many markets seeing EVs account for a substantial portion of new car sales.

Kesko's car trade segment has demonstrated a strong response to these changes. The division reported robust sales figures for popular EV models, such as the Volkswagen ID4 and ID7, throughout 2024. This success highlights Kesko's effective strategy in adapting its inventory and operations to meet the increasing consumer preference for electric mobility.

- Growing EV Market Share: By the end of 2024, electric vehicles represented over 15% of new car registrations in key European markets where Kesko operates.

- Strong Performance of EV Models: Kesko's sales data for 2024 indicated that EV models like the Volkswagen ID.4 and ID.7 were among their top-selling vehicles, outperforming expectations.

- Investment in Charging Infrastructure: To support the EV trend, Kesko has been expanding its charging infrastructure at dealerships and service centers, anticipating further growth in EV adoption through 2025.

Kesko is actively embracing technological advancements to enhance its customer experience and operational efficiency. The company's significant investments in digital platforms and data analytics are central to its strategy, as evidenced by its online sales growth. For instance, in 2023, Kesko's online sales reached €1.2 billion, an 11.5% increase, underscoring the growing importance of its digital channels.

The integration of AI and data analytics is enabling Kesko to personalize customer interactions and optimize its supply chain. In 2023, improvements in inventory turnover rates within the grocery division were partly attributed to advanced demand forecasting models. Furthermore, pilot programs in 2024 for dynamic pricing in hypermarkets showed a 3% uplift in gross margin.

Kesko is also adapting to technological shifts in the automotive sector, particularly the rise of electric vehicles. The strong sales performance of EV models like the Volkswagen ID.4 and ID.7 in 2024 highlights the company's successful adaptation to evolving consumer preferences. To support this trend, Kesko is expanding its EV charging infrastructure at dealerships, anticipating continued EV adoption through 2025.

| Key Technological Factor | 2023 Data | 2024 Outlook/Activity | Impact on Kesko |

| Online Sales Growth | €1.2 billion (11.5% increase) | Continued investment in digital platforms | Enhanced customer reach and convenience |

| AI & Data Analytics | Improved inventory turnover (grocery division) | Personalized marketing, optimized pricing (3% margin uplift in pilots) | Increased operational efficiency and customer engagement |

| Electric Vehicle Adoption | Strong sales of EV models (e.g., VW ID.4, ID.7) | Expansion of charging infrastructure | Adaptation to automotive market trends, increased service opportunities |

Legal factors

Kesko navigates a complex legal landscape, with the EU's General Data Protection Regulation (GDPR) significantly shaping its data handling practices. This regulation mandates stringent requirements for processing personal data, impacting customer interactions and internal operations. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

The forthcoming Data Act, effective September 2025, introduces new obligations concerning data generated by connected devices. For Kesko, this will particularly influence its operations in areas like real estate management, energy services, and its automotive division, requiring careful consideration of data access and usage rights. This legislation aims to foster a fairer data economy, potentially impacting how Kesko leverages IoT data for efficiency and new service development.

Kesko's significant presence in Northern Europe's retail sector places it under intense scrutiny from antitrust and competition authorities. These regulations are designed to foster fair market practices and prevent the formation of monopolies. For instance, any substantial acquisition, such as Kesko's potential expansion into new markets like Denmark, necessitates thorough review and approval from national competition bodies to ensure it doesn't stifle competition.

As a significant retailer, Kesko navigates a complex web of consumer protection and product liability laws throughout its operational regions. These regulations dictate everything from product safety standards and honest advertising practices to ensuring consumers' fundamental rights are upheld. For instance, in 2024, the European Union continued to emphasize stricter enforcement of consumer rights directives, impacting how retailers like Kesko manage product recalls and warranty claims across its diverse sectors, including groceries and building materials.

Adherence to these legal frameworks is paramount for Kesko to cultivate and maintain consumer confidence, preventing costly legal battles. Given the vast range of products Kesko offers, from fresh produce to complex building supplies and automotive parts, ensuring compliance with evolving product liability statutes is a continuous challenge. A notable trend in 2025 is the increased scrutiny on digital sales channels, requiring Kesko to ensure its online product information and advertising are fully compliant with consumer protection legislation.

Environmental Regulations and Reporting Standards

Kesko operates under a stringent framework of environmental regulations affecting waste management, packaging, and emissions. For instance, the EU's Waste Framework Directive sets targets for recycling and waste reduction, directly influencing Kesko's supply chain and store operations. Failure to comply can result in significant fines and reputational damage.

The EU Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy Regulation are pivotal legal developments. These mandate comprehensive and auditable sustainability disclosures, pushing companies like Kesko to provide granular data on their environmental impact. For 2024, companies are increasingly focused on aligning their reporting with these evolving standards, which will impact how Kesko communicates its environmental performance to stakeholders.

- Waste Management: Compliance with EU directives on landfill diversion and recycling rates.

- Packaging: Adherence to regulations on single-use plastics and extended producer responsibility schemes.

- Emissions: Meeting targets for greenhouse gas reductions and air quality standards.

- Reporting: Implementing robust systems for CSRD and EU Taxonomy compliance, ensuring data accuracy and transparency.

Employment and Labor Legislation

Kesko, as a major employer, must adhere to Finland's comprehensive employment and labor laws. These regulations dictate everything from minimum wage and working hours to employee rights and collective bargaining agreements. For instance, in 2024, Finland's unemployment rate hovered around 7.5%, a figure that influences wage negotiations and talent acquisition strategies for companies like Kesko.

The company's human resources strategies are significantly impacted by these legal frameworks. Compliance with laws concerning working conditions, safety, and non-discrimination is paramount. Any shifts in labor legislation, such as potential reforms to employment contracts or social security contributions discussed in Finland during 2024-2025, could directly affect Kesko's operational costs and its approach to workforce management.

- Compliance with Finnish labor laws: Covers wages, working conditions, and union relations.

- Impact of legislative changes: Affects HR policies, operational expenses, and workforce management.

- 2024-2025 outlook: Potential reforms in Finland's labor market legislation require continuous monitoring.

- Employee rights: Ensuring fair treatment and preventing discrimination are legal imperatives for Kesko.

Kesko's operations are fundamentally shaped by EU regulations like GDPR and the upcoming Data Act, impacting data privacy and IoT data usage. Antitrust laws are crucial, especially if Kesko considers market expansions, requiring competition authority approval. Consumer protection laws govern product safety and advertising, with increased scrutiny on digital sales in 2025.

Environmental factors

Kesko is proactively tackling climate change with an updated sustainability strategy that includes ambitious emission reduction goals. The company is committed to cutting its direct (Scope 1) and energy-related (Scope 2) emissions by half by the close of 2034, demonstrating a clear path towards environmental responsibility.

Further solidifying its dedication, Kesko has set a target to achieve net-zero emissions across its entire value chain by 2050. This long-term vision is crucial as it aligns with increasing regulatory demands and growing expectations from customers and investors, directly influencing how Kesko manages its energy use and transportation networks.

Kesko's commitment to sustainable sourcing means scrutinizing its supply chain, particularly for products like coffee and cocoa. In 2024, the company continued its focus on auditing suppliers in high-risk regions for social responsibility, aiming to ensure ethical labor practices and environmental stewardship. This rigorous approach helps mitigate risks and builds consumer trust.

By promoting sustainability policies for key commodities such as timber, paper, and soy, Kesko actively works to prevent biodiversity loss. This strategy is crucial for long-term supply chain resilience and aligns with growing consumer demand for ethically produced goods. For instance, in 2024, Kesko reported that over 90% of its timber and paper products were sourced from certified sustainable forests.

Kesko is actively pursuing a circular economy approach, focusing on developing innovative business models and refining its waste management and recycling processes. This commitment is underscored by a concrete target to halve food waste within its operations by 2026.

These initiatives directly support resource efficiency and align with Kesko's broader environmental goals, aiming to significantly reduce overall waste generation and encourage the reuse of materials.

Energy Efficiency in Operations and Logistics

Kesko's commitment to improving energy efficiency in its stores and logistics is a cornerstone of its climate strategy. This focus directly addresses environmental pressures by reducing operational energy consumption and associated greenhouse gas emissions. For instance, Kesko aims for 30% of its grocery trade transport fleet to be electric vehicles by 2030, a significant step in decarbonizing its logistics.

Beyond fleet electrification, Kesko actively seeks innovative solutions to minimize its environmental impact. A notable example is its collaboration to utilize waste heat from data centers for building systems, demonstrating a circular economy approach to energy management. These initiatives are crucial for Kesko to navigate evolving environmental regulations and consumer expectations regarding sustainability.

- Fleet Electrification: Target of 30% electric vehicles in grocery trade transport by 2030.

- Waste Heat Utilization: Partnerships to use data center waste heat for building systems.

- Operational Efficiency: Continuous efforts to reduce energy consumption in stores and logistics.

Biodiversity Protection and Nature Impacts

Kesko is actively working to prevent biodiversity loss and safeguard terrestrial life throughout its operations and supply chain. The company is in the process of developing a comprehensive biodiversity program, which includes establishing specific targets for managing its impact on biodiversity. A key focus is on refining sourcing policies for products that carry a significant risk to biodiversity.

This strategic approach underscores Kesko's recognition of the intricate links between various environmental challenges and the critical need for ecological resilience. For instance, in 2023, Kesko reported that 88% of its wood-based products were certified sustainable, demonstrating progress in managing forest biodiversity impacts. The company also aims to increase the share of sustainably sourced palm oil, a commodity often linked to deforestation and biodiversity loss, with a target of 100% by 2025.

- Biodiversity Program Development: Kesko is creating a formal program to address biodiversity impacts.

- Target Setting: Specific goals are being defined to measure and manage biodiversity impacts.

- Sourcing Policy Enhancement: Policies are being reviewed and improved for high-risk products.

- Sustainable Sourcing Progress: In 2023, 88% of wood-based products were certified sustainable, with a 2025 goal for 100% sustainable palm oil.

Kesko's environmental strategy is deeply integrated with its business operations, focusing on ambitious emission reductions and sustainable sourcing. The company aims to halve its Scope 1 and 2 emissions by 2034 and achieve net-zero across its value chain by 2050, reflecting a strong commitment to combating climate change.

These efforts are supported by concrete actions like increasing electric vehicles in its grocery transport fleet to 30% by 2030 and ensuring over 90% of timber and paper products are sustainably sourced, demonstrating a proactive approach to environmental stewardship and resource management.

Kesko is also advancing a circular economy model, targeting a 50% reduction in food waste by 2026 and exploring innovative solutions like utilizing waste heat from data centers. This focus on efficiency and waste reduction aligns with growing consumer and regulatory demands for sustainability.

The company is actively developing a biodiversity program, enhancing sourcing policies for high-risk products, and aims for 100% sustainably sourced palm oil by 2025, building on its 2023 achievement of 88% certified sustainable wood-based products.

PESTLE Analysis Data Sources

Our Kesko PESTLE Analysis is built on a robust foundation of data from official Finnish government agencies, Eurostat, and leading economic research institutions. We incorporate market intelligence from reputable industry reports and consumer behavior studies to ensure comprehensive coverage of all PESTLE factors.