Iveco Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iveco Group Bundle

Iveco Group, a major player in commercial vehicles, boasts strong brand recognition and a diverse product portfolio, but faces intense competition and evolving regulatory landscapes. Understanding these internal capabilities and external pressures is crucial for navigating the future of mobility.

Want the full story behind Iveco Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Iveco Group boasts a robust and diverse product portfolio, encompassing commercial and specialty vehicles like trucks, buses, and defense vehicles, alongside advanced powertrain solutions. This comprehensive offering allows the company to serve a broad spectrum of industries, from logistics and public transportation to defense applications, demonstrating significant market penetration. For instance, in the first quarter of 2024, Iveco Group reported net revenues of €3.7 billion, highlighting the scale of its operations across these varied segments.

FPT Industrial, Iveco Group's powertrain powerhouse, stands as a leading independent engine manufacturer worldwide, a significant strength in the group's portfolio. Its dedication to pioneering multi-energy solutions, encompassing HVO, natural gas, bio-methane, electric, and hydrogen powertrains, positions it advantageously in the rapidly shifting automotive market.

Iveco Group is demonstrating a strong commitment to innovation, planning to invest over €5.5 billion between 2024 and 2028. This significant capital allocation is directed towards crucial areas like the energy transition, artificial intelligence, software-defined vehicles, and autonomous driving technologies, positioning the company at the forefront of automotive advancements.

The company's proactive stance is further evidenced by concrete initiatives such as the establishment of its Software & Analytics Lab. Furthermore, Iveco Group is actively engaged in real-world testing of autonomous driving capabilities on public roads, underscoring its dedication to bringing cutting-edge technologies to market.

Strategic Partnerships and Collaborations

Iveco Group leverages strategic partnerships to drive innovation and broaden its market presence. These alliances are crucial for sharing development costs and accessing specialized technologies, thereby accelerating the introduction of new products.

Key collaborations highlight this strategy. For instance, the partnership with Hyundai focuses on developing electric heavy-duty trucks and light commercial vehicles, tapping into Hyundai's expertise in electrification. Furthermore, an agreement with Plus aims to integrate advanced autonomous driving technology into Iveco's commercial vehicle offerings.

These collaborations allow Iveco Group to mitigate the significant investment risks associated with cutting-edge technology development. By partnering with industry leaders like Ford Otosan for heavy-duty truck cabin structures, Iveco can efficiently incorporate 'best-of-breed' solutions, ensuring they bring advanced products to market more rapidly and competitively.

- Partnership with Hyundai: Accelerating electric vehicle development for heavy-duty and light commercial segments.

- Collaboration with Plus: Integrating autonomous driving technology into Iveco's product line.

- Alliance with Ford Otosan: Securing advanced cabin structures for heavy-duty trucks.

- Risk Mitigation: Strategic alliances reduce R&D investment burdens and speed up time-to-market for new technologies.

Solid Financial Performance and Efficiency Programs

Iveco Group has showcased impressive financial discipline, achieving its 2026 financial targets ahead of schedule by the close of 2023. This strong performance is underpinned by a clear commitment to operational efficiencies, with a goal of €1 billion by 2028, including a significant €600 million target by 2026.

The company's strategic focus on cost optimization and enhancing profitability, especially within its Bus and Defence divisions, creates a robust financial foundation. This dedication to efficiency and financial health positions Iveco Group favorably for sustained growth and resilience in the market.

- Financial Target Achievement: Met 2026 financial targets by end of 2023.

- Efficiency Program: Aiming for €1 billion in operational efficiencies by 2028.

- Mid-Term Efficiency Goal: €600 million targeted for achievement by 2026.

- Segment Profitability Focus: Enhanced profitability in Bus and Defence segments.

Iveco Group's diverse product range, from trucks to defense vehicles, coupled with FPT Industrial's advanced multi-energy powertrains, provides significant market reach and technological leadership. The company's substantial investment plan of over €5.5 billion between 2024 and 2028 in areas like AI and electric mobility signals a strong commitment to future innovation.

Strategic partnerships with firms like Hyundai and Plus are accelerating the development and integration of crucial technologies such as electric powertrains and autonomous driving. Furthermore, Iveco Group's proactive financial management, evidenced by achieving its 2026 targets ahead of schedule by the end of 2023 and its ongoing efficiency programs, creates a solid foundation for growth.

| Metric | Value | Period |

|---|---|---|

| Net Revenues | €3.7 billion | Q1 2024 |

| Investment in Innovation | Over €5.5 billion | 2024-2028 |

| Operational Efficiencies Target | €1 billion | By 2028 |

| Mid-Term Efficiency Goal | €600 million | By 2026 |

What is included in the product

Analyzes Iveco Group’s competitive position through key internal and external factors, highlighting its strengths in commercial vehicles and opportunities in new energy solutions, while acknowledging weaknesses in brand perception and threats from intense market competition.

Offers a clear, actionable framework to address Iveco Group's competitive challenges and capitalize on emerging market opportunities.

Weaknesses

Iveco Group is facing headwinds with declining revenues in its crucial Truck and Powertrain divisions. In the second quarter of 2025, the company saw a year-over-year drop in consolidated net revenues, largely due to reduced sales volumes in these core areas. This signals a tougher market for their primary products.

Looking ahead, the outlook for Iveco Group's industrial net revenues remains subdued. Projections indicate an expected decline of 3% to 5% for the full year 2025 when compared to 2024 figures, underscoring the ongoing challenges in key segments.

Iveco Group experienced a dip in profitability during the second quarter of 2025, with both adjusted EBIT and net income showing a decline when compared to the same period in 2024. This contraction in earnings was primarily driven by a combination of factors, including reduced sales volumes and less favorable pricing conditions.

Furthermore, an increase in product costs put additional pressure on the company's margins, even as they worked to control expenses. This trend of lower profitability could potentially affect how investors perceive the company's financial health and future prospects.

The European truck market is experiencing a notable slowdown. Projections indicate a decline in light commercial vehicle volumes by 10-15% and medium & heavy trucks by 5-10% in 2025, relative to 2024 figures. This widespread market contraction presents a significant challenge for Iveco Group's sales performance in its key European markets.

Impact of Recent Divestitures

The disposal of the Magirus fire-fighting equipment division in January 2025, alongside the anticipated sale of the Defence business to Leonardo, will inevitably shrink Iveco Group's overall revenue. This strategic pivot, while aimed at sharpening focus on core segments, means a narrower product portfolio and potentially reduced market presence in formerly occupied niches.

This transition period presents a significant challenge. Iveco Group will need to navigate operational realignments and manage market perceptions as it reshapes its business structure. For instance, the Magirus divestiture alone represented a notable portion of the group's specialized vehicle segment revenue prior to its completion.

- Reduced Revenue Streams: The exit from Magirus and the planned sale of Defence will directly impact top-line figures, necessitating growth from remaining core businesses.

- Portfolio Simplification: While streamlining, this also means a loss of diversification and potential revenue from specialized markets.

- Operational Adjustments: Integrating or separating these divisions requires careful management to avoid disruption to ongoing operations and employee morale.

- Market Perception: Investors and analysts will be closely watching how Iveco Group maintains its competitive edge and growth trajectory post-divestiture.

Vulnerability to Supply Chain and Macroeconomic Uncertainties

Iveco Group faces significant headwinds from potential supply chain disruptions. For instance, the ongoing semiconductor shortage, which heavily impacted automotive production throughout 2023 and into early 2024, continues to pose a risk to Iveco's manufacturing output and delivery schedules.

Global logistic constraints also present a weakness, as seen in the elevated shipping costs and port congestion experienced in late 2023 and projected to persist into 2024. These factors directly increase operational expenses and can delay the timely delivery of components and finished vehicles.

Broader macroeconomic and geopolitical uncertainties, including inflation and regional conflicts, further exacerbate these vulnerabilities. For example, rising energy prices in Europe, a key market for Iveco, can dampen consumer confidence and reduce demand for commercial vehicles and capital goods throughout 2024 and into 2025.

- Supply Chain Fragility: Continued reliance on globalized supply chains leaves Iveco susceptible to disruptions, impacting production volumes.

- Logistical Bottlenecks: Elevated shipping costs and port inefficiencies in 2023-2024 directly inflate operational expenditures.

- Macroeconomic Sensitivity: Inflationary pressures and geopolitical instability in key markets like Europe can significantly curb demand for Iveco's products.

Iveco Group's profitability is under pressure, with adjusted EBIT and net income declining in Q2 2025 compared to the previous year. This downturn is attributed to lower sales volumes and less favorable pricing, compounded by rising product costs. These factors combined are squeezing margins, potentially impacting investor confidence in the company's financial performance and future outlook.

The European truck market is experiencing a significant slowdown. Projections for 2025 indicate a 10-15% decrease in light commercial vehicle volumes and a 5-10% drop in medium and heavy trucks compared to 2024. This contraction directly challenges Iveco Group's sales performance in its primary European markets.

The divestment of the Magirus fire-fighting division in early 2025 and the planned sale of the Defence business will shrink Iveco Group's overall revenue. While this aims to sharpen focus on core segments, it reduces diversification and market presence in specialized areas, requiring growth from remaining businesses to compensate.

Supply chain fragility remains a key weakness, with continued reliance on global networks leaving Iveco susceptible to disruptions that impact production. Additionally, logistical bottlenecks, evidenced by elevated shipping costs and port inefficiencies in 2023-2024, directly increase operational expenditures and can delay deliveries.

| Metric | Q2 2025 (vs Q2 2024) | Full Year 2025 Projection (vs 2024) |

| Consolidated Net Revenues | Declined | Industrial Net Revenues: -3% to -5% |

| Adjusted EBIT | Declined | N/A |

| Net Income | Declined | N/A |

| European LCV Volumes | N/A | Projected -10% to -15% |

| European M&H Truck Volumes | N/A | Projected -5% to -10% |

Preview the Actual Deliverable

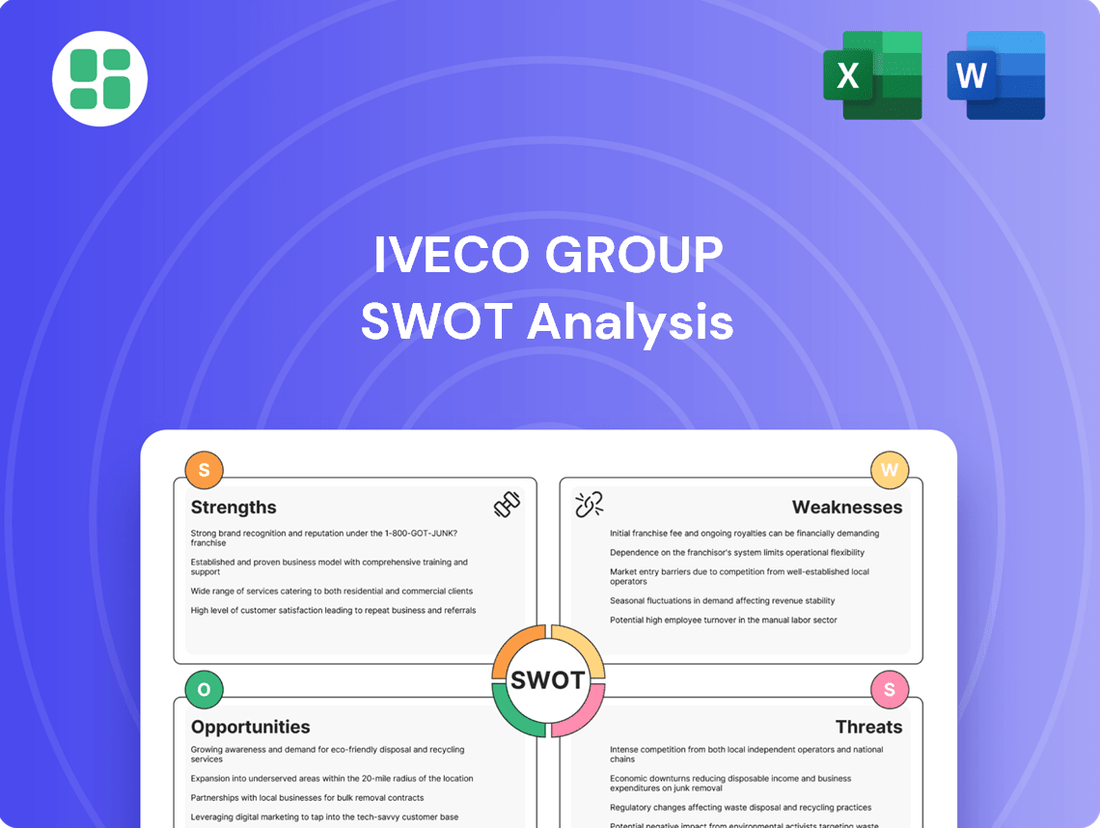

Iveco Group SWOT Analysis

The preview you see is the actual Iveco Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report outlines the company's Strengths, Weaknesses, Opportunities, and Threats, providing valuable insights for strategic decision-making.

Opportunities

Iveco Group is strategically positioned to benefit from the accelerating global trend towards electrification and hydrogen-powered mobility. The company's substantial investments in developing a comprehensive range of zero-emission vehicles, covering both battery-electric and hydrogen fuel cell technologies, directly addresses growing market demand for sustainable transportation solutions.

This multi-energy approach is a key strength. For instance, Iveco Group reported a robust order backlog for its electric buses, demonstrating early market traction. Furthermore, the recent launch of new electric heavy-duty trucks, such as the S-eWay, allows Iveco to capture market share as regulations and consumer preferences increasingly favor clean energy alternatives.

Iveco Group's investment in autonomous driving and AI integration, targeting Level 2++ and higher, positions them for future growth. By embedding AI into their software-defined vehicles, they aim to enhance safety and efficiency, opening doors for new service-based revenue streams.

The potential acquisition of Iveco Group's commercial vehicle division by Tata Motors presents a significant opportunity for strategic expansion. This move could forge a formidable global player in the commercial vehicle sector, combining Iveco's European market presence with Tata's strong foothold in emerging economies.

Such a merger would likely broaden Iveco's market access, especially in rapidly growing Asian and African markets, where Tata Motors has established distribution networks. This expanded reach is crucial for long-term growth in the competitive commercial vehicle landscape.

Furthermore, the combination could lead to a more robust product portfolio, integrating Iveco's specialized offerings with Tata's diverse range. In 2023, Tata Motors reported a consolidated revenue of approximately $36.7 billion, highlighting its substantial market capacity to absorb and integrate Iveco's operations effectively.

Growth Potential in Bus and Defence Segments

Iveco Group is seeing notable opportunities in its Bus and Defence segments, even amidst a softer truck market. The bus division, especially with its focus on electric-born architectures, is demonstrating consistent growth and improved margins, signaling a promising future in sustainable transport solutions.

The defence business has also performed strongly, contributing positively to the group's financial health prior to its anticipated sale. These specialized areas highlight Iveco's capacity for robust organic growth driven by strategic investments and market demand.

- Bus Division Growth: Iveco's bus unit has experienced consistent growth and margin expansion, a testament to strategic investments in areas like electric-born architectures.

- Defence Segment Strength: The defence business has shown strong performance, contributing to the group's financial results before its planned divestment.

- Strategic Focus: These segments represent key areas where Iveco Group can leverage focused investments to drive further organic growth and profitability.

Enhanced Connectivity and Financial Services Offerings

Iveco Group can leverage enhanced connectivity and expanded financial services to foster deeper customer relationships and create new income avenues. By integrating advanced infotainment systems, real-time driver data, and AI-driven predictive diagnostics, the company can significantly elevate the user experience. IVECO CAPITAL's comprehensive financial offerings further complement these technological advancements, supporting vehicle sales and improving customer loyalty.

This strategic focus on value-added services is crucial for differentiation in the competitive commercial vehicle market. For instance, in 2024, Iveco Group reported that its financial services segment, IVECO CAPITAL, played a significant role in supporting sales, with financing solutions being a key enabler for fleet operators. The expansion of these digital and financial services is projected to contribute to a more robust customer ecosystem, driving repeat business and increasing the lifetime value of each customer.

- Advanced Infotainment and Diagnostics: Offering cutting-edge systems that provide drivers with real-time information and AI-powered predictive maintenance can reduce downtime and improve operational efficiency.

- AI-Powered Predictive Diagnostics: Implementing AI to anticipate potential vehicle issues before they occur allows for proactive maintenance, minimizing unexpected repair costs and maximizing vehicle availability.

- Comprehensive Financial Services: IVECO CAPITAL's tailored financing and leasing options can make Iveco vehicles more accessible and attractive to a wider range of customers, directly supporting sales volume.

- Deepened Customer Engagement: By providing a suite of integrated digital and financial services, Iveco Group can build stronger, more enduring relationships with its customer base, leading to increased retention and satisfaction.

Iveco Group's strategic focus on zero-emission vehicles, particularly its electric and hydrogen offerings, positions it to capitalize on the growing demand for sustainable transport. The company's multi-energy approach, evident in its robust order backlog for electric buses and the launch of new electric heavy-duty trucks like the S-eWay, demonstrates early market traction and a clear response to evolving regulatory landscapes and consumer preferences.

The potential strategic expansion through a merger with Tata Motors' commercial vehicle division presents a significant opportunity. This collaboration could create a global powerhouse by combining Iveco's European presence with Tata's established networks in emerging markets, thereby broadening market access and potentially leading to a more competitive product portfolio. Tata Motors' substantial revenue, reported around $36.7 billion in 2023, underscores its capacity for such integration.

Furthermore, Iveco Group can leverage enhanced connectivity and expanded financial services, such as those offered by IVECO CAPITAL, to deepen customer relationships and generate new revenue streams. Integrating advanced infotainment, AI-driven diagnostics, and tailored financial solutions can significantly improve the customer experience and drive loyalty, as evidenced by the role of IVECO CAPITAL in supporting sales in 2024.

Threats

Iveco Group faces fierce competition from established global manufacturers like Daimler Truck, Volvo Group, and PACCAR, as well as emerging players from China. This crowded landscape means constant pressure on pricing and market share, forcing significant investments in research and development to stay ahead. For instance, the commercial vehicle market is projected to reach $1.4 trillion by 2027, highlighting the sheer scale and intensity of the competition Iveco must navigate.

Macroeconomic uncertainties, such as the specter of recessions, persistent high inflation, and fluctuating interest rates, present a significant hurdle for Iveco Group by potentially reducing demand for its commercial vehicles. These factors create a challenging environment for sales and revenue generation.

The European truck market is projected to experience a downturn in 2025, a trend that, coupled with wider economic instability, directly threatens Iveco Group's ability to meet its revenue and profitability objectives. This forecast highlights the vulnerability of the company to broader economic headwinds.

Global emission regulations are tightening significantly, pushing companies like Iveco Group towards decarbonization. This shift demands heavy investment in new technologies and manufacturing methods. For instance, the Euro 7 emission standards, expected to be fully implemented in Europe by 2027, will impose stricter limits on pollutants from vehicles, requiring advanced engine and exhaust aftertreatment systems.

Failing to keep pace with these evolving standards poses serious risks, including hefty fines and restricted access to key markets. Iveco Group, like other heavy vehicle manufacturers, must navigate these challenges to maintain its competitive edge and ensure the long-term viability of its product portfolio, especially concerning traditional internal combustion engine vehicles.

Integration and Transition Risks from Major Transactions

Iveco Group faces significant integration and transition risks from its major ongoing and planned transactions. The proposed acquisition by Tata Motors, for instance, requires careful navigation of regulatory approvals and operational alignment, with potential disruptions to its existing business model.

The sale of its Defence business to Leonardo also presents challenges. Successfully integrating or divesting these units requires meticulous planning to avoid operational disruptions, cultural clashes, and ensure the seamless continuity of supply chains and customer relationships. For example, the integration of acquired entities often leads to temporary dips in productivity as new systems and processes are implemented.

- Operational Disruption: Merging or separating business units can lead to temporary setbacks in production, logistics, and customer service, impacting revenue and market share.

- Cultural Integration: Aligning diverse organizational cultures is crucial for employee morale and productivity, but often proves difficult, potentially leading to talent attrition.

- Supply Chain Continuity: Ensuring uninterrupted supply chains during and after major transactions is vital to maintain customer trust and operational efficiency.

Persistent Supply Chain Disruptions and Cost Pressures

Iveco Group, like many in the commercial vehicle sector, continues to grapple with ongoing supply chain disruptions. These challenges manifest as shortages of critical components, difficulties in securing raw materials, and unpredictable price fluctuations. For instance, the semiconductor shortage, while easing, still impacts vehicle production timelines in 2024.

These persistent issues directly translate into increased manufacturing costs for Iveco. The need to source components from alternative, often more expensive, suppliers or to absorb higher material prices erodes profit margins. This cost pressure is a significant headwind for the company's financial performance.

The direct consequence of these supply chain vulnerabilities is the potential for production delays and a negative impact on delivery schedules. For Iveco, this means struggling to meet customer demand promptly, which can damage customer relationships and lead to lost sales opportunities. The industry saw average lead times for certain heavy-duty truck components extend by over 20% in late 2023, a trend that has continued into early 2024.

- Component Shortages: Continued scarcity of key parts, particularly electronics and specialized materials, remains a challenge.

- Material Price Volatility: Fluctuations in the cost of steel, aluminum, and rare earth minerals directly impact production expenses.

- Logistical Bottlenecks: Port congestion and transportation capacity limitations can still cause delays in receiving necessary parts.

- Increased Manufacturing Costs: Higher raw material prices and the expense of alternative sourcing methods are compressing margins.

Iveco Group faces intense competition from established global players and emerging manufacturers, necessitating continuous investment in R&D to maintain market share. The commercial vehicle market's projected growth to $1.4 trillion by 2027 underscores the fierce competitive landscape.

Economic instability, including potential recessions and high inflation, threatens demand for Iveco's vehicles, impacting sales and revenue. The European truck market's anticipated downturn in 2025 further compounds these economic challenges.

Stringent emission regulations, such as the Euro 7 standards by 2027, require substantial investment in new technologies, posing risks of fines and market access limitations if not met.

Ongoing transactions, like the potential Tata Motors acquisition and the sale of its Defence business, introduce integration and transition risks, potentially disrupting operations and supply chains.

Persistent supply chain disruptions, including component shortages and material price volatility, continue to increase manufacturing costs and delay production, impacting customer delivery schedules and profitability.

SWOT Analysis Data Sources

This Iveco Group SWOT analysis is built upon robust data from financial reports, comprehensive market research, and expert industry analyses to provide a well-informed strategic overview.