Iveco Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iveco Group Bundle

The Iveco Group operates within a competitive landscape shaped by powerful buyer bargaining, intense rivalry, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate this sector effectively.

The complete report reveals the real forces shaping Iveco Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Iveco Group depends on suppliers for specialized parts like advanced engines and complex electronic systems. When these components are unique, have limited substitutes, or involve high research and development costs, suppliers gain significant leverage. This makes it costly and time-consuming for Iveco to switch to alternative suppliers.

For instance, Iveco's collaboration with Hyundai to develop electric and fuel cell powertrains for heavy-duty trucks highlights a proactive approach. By co-developing these critical technologies, Iveco aims to strengthen its supply chain and reduce the bargaining power of individual technology providers.

The prices and availability of essential raw materials such as steel, aluminum, and specialized metals are critical determinants of Iveco Group's manufacturing expenses. In 2024, the automotive sector experienced significant price fluctuations for these commodities, directly impacting production budgets.

Global supply chain disruptions and geopolitical tensions in 2024 have amplified supplier bargaining power by creating material shortages and price volatility. This environment necessitates robust supplier relationship management for Iveco.

Iveco Group's strategic initiatives, including enhanced supply chain oversight and operational optimization, aim to mitigate the impact of escalating raw material costs and bolster resilience against market uncertainties.

The bargaining power of suppliers, particularly concerning labor and talent, is a significant factor for Iveco Group. Specialized labor, especially in cutting-edge fields like AI and autonomous driving software development, can command premium wages due to scarcity. In 2024, the demand for such specialized engineers remained exceptionally high across the automotive sector.

Iveco's strategic focus on Artificial Intelligence and Software Defined Vehicles means its reliance on skilled engineers and developers, both internally and from its supply chain, is increasing. The cost and availability of this talent directly influence the pace of innovation and ultimately, Iveco's profitability. For instance, a shortage of AI specialists could delay crucial software updates or new feature rollouts.

Tiered Supply Chain Structure

The commercial vehicle industry, including Iveco Group, typically operates with a multi-tiered supply chain. Tier 1 suppliers are crucial, as they assemble major systems like engines and transmissions, often sourcing parts from Tier 2 and Tier 3 suppliers. This structure means Iveco relies heavily on these Tier 1 partners for critical components.

Iveco's direct engagement with Tier 1 suppliers for complex systems, such as powertrain or chassis modules, often places these suppliers in a strong bargaining position. Their specialized knowledge and significant production volumes allow them to exert considerable influence over pricing and terms. For instance, a major engine supplier to Iveco might also supply other large automotive manufacturers, increasing their leverage.

However, Iveco's strategic emphasis on modular design and common platforms across its diverse vehicle range can mitigate supplier power. By standardizing certain components and sub-assemblies, Iveco can create a larger, more unified demand for these parts. This approach can foster competition among suppliers for these standardized elements, thereby reducing the bargaining power of any single supplier.

- Supplier Concentration: The commercial vehicle sector often sees consolidation among key component suppliers, leading to fewer but larger players with enhanced bargaining power.

- Component Criticality: Suppliers of highly specialized or proprietary components essential for vehicle performance, such as advanced braking systems or unique transmission technologies, typically hold greater leverage.

- Switching Costs: High costs associated with re-tooling, qualifying new suppliers, and redesigning vehicles can make it difficult for Iveco to switch suppliers, thus strengthening existing suppliers' positions.

- Iveco's Scale: Iveco's substantial order volumes, especially for its core vehicle platforms, provide some counter-leverage against suppliers, particularly for more commoditized components.

Supplier Concentration and Switching Costs

When only a handful of suppliers provide essential parts for Iveco Group vehicles, their ability to dictate terms significantly rises. The automotive sector's intricate supply chains mean that switching providers for critical components like engines or advanced electronics is not a simple task. These transitions often necessitate substantial investments in re-tooling manufacturing lines, rigorous testing protocols, and obtaining necessary certifications, making it economically prohibitive to change suppliers frequently. This situation solidifies the leverage of established suppliers, allowing them greater influence over pricing and contract conditions.

Iveco Group's proactive approach involves forging strategic alliances and long-term supply agreements. This strategy aims to mitigate the bargaining power of suppliers by ensuring a stable and predictable supply of components, while also fostering collaborative development of new technologies. For instance, in 2024, Iveco announced a significant partnership with a leading battery supplier to secure advanced power units for its electric vehicle range, underscoring the importance of these relationships in managing supplier influence.

- Limited Supplier Alternatives: A concentrated supplier base for critical automotive components inherently grants those suppliers increased bargaining power.

- High Switching Costs: The automotive industry faces substantial costs and complexities in changing suppliers, including re-tooling, testing, and certification, which reinforces supplier leverage.

- Strategic Partnerships: Iveco Group actively pursues long-term supply and co-development partnerships to secure critical components and manage supplier power.

- Securing Future Supply: By collaborating on new technologies, Iveco aims to ensure access to next-generation components, like advanced batteries for EVs, and gain a competitive edge.

Suppliers of specialized components, such as advanced engines and critical electronic systems, hold significant leverage over Iveco Group. This power stems from limited substitutes, high R&D costs, and the substantial expense and time involved in switching to new providers. In 2024, the automotive industry faced heightened supplier power due to global supply chain disruptions and geopolitical factors, leading to material shortages and price volatility.

Iveco's reliance on Tier 1 suppliers for complex systems like powertrains and chassis modules places these partners in a strong bargaining position. Their specialized knowledge and production scale allow them to influence pricing and contract terms. For instance, a major engine supplier might also serve other large manufacturers, increasing their leverage.

The bargaining power of suppliers is further amplified when there are few alternatives for essential parts. The complexity of the automotive supply chain means switching providers involves considerable investment in re-tooling, testing, and certifications, reinforcing the leverage of established suppliers over pricing and contract conditions.

To counter this, Iveco Group engages in strategic alliances and long-term agreements, securing component supply and fostering collaborative technology development. A notable example from 2024 is Iveco's partnership with a leading battery supplier to ensure access to advanced power units for its electric vehicle range.

| Factor | Impact on Iveco Group | 2024 Context |

|---|---|---|

| Supplier Concentration | Fewer suppliers for critical components increase their bargaining power. | Consolidation in the commercial vehicle sector means fewer, larger key component suppliers. |

| Component Criticality | Suppliers of specialized, essential parts have greater leverage. | Advanced braking systems and unique transmission technologies are examples of critical components. |

| Switching Costs | High costs for re-tooling, qualification, and redesign make switching difficult. | These costs reinforce the leverage of existing suppliers over pricing and terms. |

| Iveco's Scale | Large order volumes offer some counter-leverage for commoditized components. | Iveco's substantial orders for core platforms provide some negotiation power. |

What is included in the product

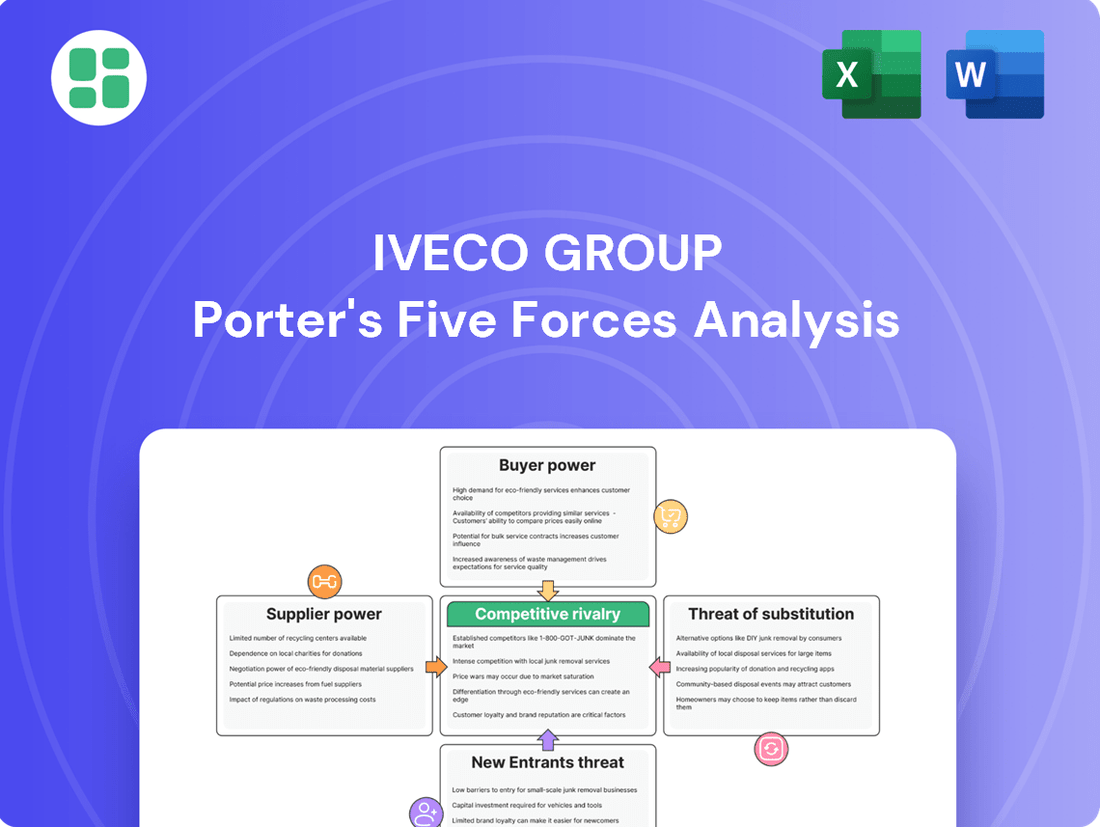

This analysis dissects the competitive forces impacting Iveco Group, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its commercial vehicle and specialized vehicle markets.

Instantly understand strategic pressure with a powerful spider/radar chart that visualizes Iveco Group's competitive landscape across all five forces.

Customers Bargaining Power

Iveco Group's large fleet operators, such as major logistics firms and public transport authorities, wield considerable bargaining power. These entities purchase vehicles in substantial volumes, giving them leverage to demand lower prices and tailored specifications. For instance, in 2024, a significant portion of Iveco's revenue is derived from these bulk orders, making their satisfaction crucial.

Customers in the commercial vehicle sector are acutely aware of the total cost of ownership (TCO). This means they look beyond the initial purchase price to consider fuel efficiency, ongoing maintenance expenses, and the potential cost of vehicle downtime. For Iveco, this translates into a significant pressure to deliver vehicles that are not only competitively priced upfront but also economical to run over their lifespan.

The economic climate heavily influences this price sensitivity. During periods of economic slowdown or when operational costs like fuel and interest rates are climbing, customers become even more focused on minimizing their TCO. For instance, in 2024, many fleet operators are grappling with elevated diesel prices, making fuel efficiency a paramount concern when selecting a new vehicle, directly impacting Iveco's pricing and product development strategies.

While Iveco Group offers a broad spectrum of commercial and specialty vehicles, the extent to which these products are differentiated significantly impacts customer bargaining power. If Iveco's vehicles are perceived as largely interchangeable commodities, customers can readily compare pricing across manufacturers and switch suppliers with minimal friction, thereby increasing their leverage.

However, Iveco's strategic focus on providing highly customized solutions for niche markets, such as specialized vehicles for defense applications or bespoke configurations for public transport, can effectively mitigate this customer power. This customization creates unique value propositions that are harder for customers to replicate or find elsewhere, fostering loyalty and reducing their ability to demand lower prices or more favorable terms.

Availability of Financing Options

Iveco Group's provision of in-house financing options, alongside collaborations with entities like DLL, significantly influences customer bargaining power. These financial services can lock in customers by offering attractive payment terms and making Iveco's commercial vehicles more attainable, particularly for small to medium-sized enterprises with tighter budgets. For instance, in 2024, Iveco Capital reported a substantial portfolio, demonstrating the strategic importance of these financing solutions in customer retention and mitigating price sensitivity.

The availability of diverse financing choices directly impacts a customer's ability to negotiate better terms. When Iveco Group can offer competitive rates and flexible repayment schedules, it reduces the customer's reliance on external lenders and strengthens Iveco's position. This strategy is crucial in a market where capital expenditure for commercial fleets is a major consideration for buyers.

- Iveco Capital's Role: Offers tailored financial solutions to support vehicle purchases.

- Partnerships: Collaborations with financial institutions like DLL broaden financing accessibility.

- Customer Retention: Competitive financing acts as a key tool to secure customer loyalty.

- Market Impact: Enhances vehicle affordability, especially for smaller businesses.

Regulatory and Environmental Demands

Increasingly stringent environmental regulations and zero-emission targets are significantly influencing customer purchasing decisions within the automotive sector, including for commercial vehicles like those produced by Iveco Group. This shift is directly driving demand for electric and hydrogen-powered vehicles, as customers increasingly prioritize sustainability.

Customers who value environmental compliance can leverage this trend to demand specific technologies or adherence to evolving standards. This can empower them, as they have a growing array of compliant vehicles to choose from. For instance, by 2024, many European countries have introduced or strengthened CO2 emission standards for heavy-duty vehicles, directly impacting fleet purchasing strategies.

- Growing demand for zero-emission vehicles: Customer preference for electric and hydrogen powertrains is escalating, influenced by regulatory pressures and corporate sustainability goals.

- Impact on purchasing power: Customers prioritizing eco-friendly options gain leverage by selecting manufacturers capable of meeting these stringent environmental demands.

- Regulatory influence by 2024: Many jurisdictions have implemented stricter CO2 emission targets for commercial vehicles, compelling buyers to consider cleaner alternatives.

Iveco Group faces significant customer bargaining power, particularly from large fleet operators who purchase in high volumes, demanding lower prices and customized specifications. In 2024, these bulk orders represent a substantial portion of Iveco's revenue, making customer satisfaction paramount.

Customers are increasingly focused on the total cost of ownership (TCO), scrutinizing fuel efficiency and maintenance to minimize operational expenses. This pressure is amplified in 2024 by rising fuel costs, forcing Iveco to emphasize economical vehicle performance.

The bargaining power of customers is also shaped by product differentiation and the availability of financing. While customization can reduce this power, Iveco's financing solutions, like those offered through Iveco Capital in 2024, aim to enhance affordability and customer loyalty.

Environmental regulations are a growing factor, with customers prioritizing zero-emission vehicles and leveraging this demand to negotiate terms. By 2024, stricter CO2 standards are compelling buyers to consider cleaner alternatives, giving those with compliant offerings an advantage.

| Customer Segment | Bargaining Power Drivers | Iveco's Mitigation Strategies |

|---|---|---|

| Large Fleet Operators | High volume purchases, price sensitivity | Customized solutions, financing options, focus on TCO |

| Environmentally Conscious Buyers | Demand for zero-emission vehicles, regulatory compliance | Development of electric and hydrogen powertrains, adherence to standards |

| SMEs | Budget constraints, need for accessible financing | Attractive financing packages via Iveco Capital, flexible payment terms |

Full Version Awaits

Iveco Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Iveco Group's Porter's Five Forces Analysis meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the commercial vehicle sector. This comprehensive report provides actionable insights into the strategic positioning and future outlook for Iveco Group.

Rivalry Among Competitors

The commercial vehicle landscape is fiercely competitive, with global giants like Daimler Truck, Volvo Group, and PACCAR setting a high bar. Iveco Group also contends with strong regional players and rapidly growing electric vehicle manufacturers, particularly in key markets. For instance, in 2024, the global commercial vehicle market is projected to see continued growth, with established players investing heavily in electrification and autonomous driving technologies.

Iveco Group's competitive rivalry spans its entire product portfolio, from light commercial vehicles to heavy-duty trucks and buses. This broad exposure means facing intense competition across multiple segments. The push towards sustainability is a major driver, with companies like BYD making significant inroads in electric bus markets, directly impacting Iveco's bus division.

While the global commercial vehicle market is expected to expand, certain mature markets, particularly in Europe, are facing a downturn in truck sales. This decline, driven by sluggish demand and market saturation, naturally escalates the competitive intensity among established manufacturers.

Iveco Group's performance in 2024 reflected this dynamic, with robust growth in Latin America helping to counterbalance a contraction in European sales. This regional divergence underscores the critical need for flexible and responsive market strategies to navigate varying economic conditions and competitive pressures.

The commercial vehicle sector, including Iveco Group, faces intense rivalry partly due to substantial fixed costs. These costs, covering research and development, extensive manufacturing facilities, and broad distribution systems, necessitate high production volumes to spread the expense. For instance, in 2024, major players continue to invest billions in electrification and autonomous driving technologies, further escalating these initial outlays.

This drive for economies of scale fuels aggressive pricing strategies, especially when market demand softens. Companies are compelled to keep assembly lines running at high capacity utilization to avoid significant per-unit cost increases. This pressure intensifies competition, as firms strive to capture market share and cover their substantial overheads, leading to price wars during economic downturns.

Product Innovation and Technology Race

The competitive rivalry within the commercial vehicle sector is intensified by a relentless pursuit of product innovation and a technology race, particularly in areas like electrification and autonomous driving. Manufacturers are pouring significant resources into developing advanced powertrain technologies, including battery electric vehicles (BEVs), hydrogen fuel cell systems, and hydrogen internal combustion engines (ICE). This drive necessitates substantial research and development (R&D) investments to maintain a competitive edge.

- Electrification and Autonomous Driving: These technologies are reshaping the industry, forcing companies to invest heavily in R&D to remain competitive.

- Powertrain Advancements: The focus is on BEVs, hydrogen fuel cells, and hydrogen ICE, requiring substantial capital outlays for new technology development.

- Software-Defined Vehicles: The increasing importance of software in vehicle functionality adds another layer of complexity and investment.

- Iveco's Innovation Investment: Iveco Group's commitment of €5.5 billion to innovation between 2024 and 2028 underscores the critical nature of R&D in this highly competitive landscape.

Mergers, Acquisitions, and Strategic Alliances

Competitive rivalry within the commercial vehicle sector is intensified by frequent mergers, acquisitions, and strategic alliances. Companies actively pursue these avenues to bolster market presence, acquire advanced technologies, and realize cost efficiencies through scale. For instance, Iveco Group has been actively forging partnerships, notably with Hyundai for electric truck development and with Ford Otosan to secure heavy-duty truck cabin structures, highlighting a proactive approach to industry dynamics.

The sector's dynamism is further underscored by significant corporate actions, such as the acquisition offer made by Tata Motors for Iveco Group, which, though not finalized, signals the substantial consolidation pressures at play. These moves are critical for players aiming to navigate evolving market demands and technological shifts, such as the rapid transition to electric and autonomous powertrains.

- Consolidation Drive: The commercial vehicle industry is characterized by ongoing consolidation as firms seek to achieve economies of scale and enhance their competitive positioning.

- Strategic Partnerships: Iveco Group's collaborations, such as with Hyundai for electric trucks, exemplify the trend of strategic alliances to access new technologies and markets.

- Acquisition Interest: The acquisition offer from Tata Motors for Iveco Group in 2024 illustrates the high level of M&A activity and strategic interest within the sector.

- Market Share Gains: These mergers, acquisitions, and alliances are primarily driven by the imperative to gain market share and strengthen competitive advantages in a rapidly evolving landscape.

Competitive rivalry within the commercial vehicle sector is intense, driven by global players like Daimler Truck and Volvo Group, alongside regional competitors and emerging EV manufacturers. Iveco Group faces this pressure across its product lines, from light commercial vehicles to heavy-duty trucks and buses. The industry's push towards electrification and autonomous technologies, with significant R&D investments by major players in 2024, further escalates this rivalry.

High fixed costs associated with manufacturing and technology development necessitate high production volumes, leading to aggressive pricing strategies, especially during market downturns. This pressure to maintain capacity utilization fuels competition as firms strive to cover substantial overheads. Iveco's 2024 performance, showing growth in Latin America offsetting European contraction, highlights the need for agile strategies to manage these varied competitive pressures.

The sector is also marked by a relentless pursuit of innovation, particularly in powertrain advancements like battery electric vehicles (BEVs) and hydrogen fuel cells. Iveco Group's commitment of €5.5 billion to innovation between 2024 and 2028 demonstrates the crucial role of R&D. Furthermore, frequent mergers, acquisitions, and strategic alliances, such as Iveco's partnerships with Hyundai and Ford Otosan, are key to gaining market share and technological access in this dynamic environment.

| Key Competitors | 2024 Market Focus | Strategic Initiatives |

|---|---|---|

| Daimler Truck | Electrification, Autonomous Driving | Heavy investment in R&D, expanding BEV truck portfolio |

| Volvo Group | Sustainability, Digitalization | Partnerships for charging infrastructure, development of hydrogen solutions |

| PACCAR | Alternative Fuels, Connectivity | Focus on battery electric and hydrogen fuel cell trucks, advanced telematics |

| Iveco Group | Electrification, Regional Growth | €5.5B innovation investment (2024-2028), partnerships (Hyundai, Ford Otosan) |

| BYD | Electric Buses, Commercial Vehicles | Rapid expansion in EV markets, particularly buses |

SSubstitutes Threaten

While trucks are crucial for road freight, alternative transportation modes like rail, sea, and air freight offer significant substitution potential, particularly for long-haul and international shipments of bulk goods. For instance, in 2024, rail freight continued to be a cost-effective option for heavy cargo, with many European countries investing in expanding their rail networks to reduce road congestion and emissions.

For passenger transport, Iveco's commercial buses face competition from trains, which are often faster and more environmentally friendly for intercity travel. Ridesharing services and the continued prevalence of private vehicles also present substitutes, especially in urban areas. The attractiveness of these alternatives is heavily influenced by factors such as cost efficiency, transit times, the nature of the cargo or passengers, and the existing infrastructure.

Technological advancements in existing internal combustion engine (ICE) vehicles present a significant threat of substitution for Iveco Group. Improvements in fuel efficiency, for instance, directly counter the appeal of alternative powertrains. In 2024, the average fuel efficiency for new heavy-duty trucks in Europe continued to improve, with some models achieving over 10 miles per gallon, making the total cost of ownership for traditional vehicles more competitive.

Enhanced payload capacity and extended longevity of current ICE trucks also diminish the immediate need for fleet operators to invest in entirely new technologies. This means that rather than adopting electric or hydrogen solutions, businesses might opt to upgrade their existing fleets or purchase newer, more capable ICE models, effectively substituting the perceived benefits of alternative propulsion.

The threat of substitutes is significant in the commercial vehicle sector due to the evolving powertrain landscape. Battery electric vehicles (BEVs) and hydrogen fuel cell electric vehicles (FCEVs) are increasingly viable alternatives to traditional diesel engines, propelled by stricter emissions standards and a global push for sustainability. For instance, by the end of 2024, Iveco Group has been actively expanding its e-Daily range, showcasing its commitment to BEV technology as a direct substitute for internal combustion engine vehicles in the light commercial segment.

Digital Solutions and Fleet Optimization Software

The increasing sophistication of digital solutions, particularly advanced telematics and fleet management software, presents a significant threat of substitutes for Iveco Group. These platforms allow businesses to optimize the usage and maintenance of their existing vehicle fleets, thereby reducing the immediate need to purchase new trucks or vans. For instance, by improving route planning and fuel efficiency, these digital tools can directly impact a company's bottom line, making them a compelling alternative to capital expenditure on new vehicles.

The ability of these digital solutions to extend vehicle lifecycles and reduce operational costs is a key factor in their substitutive power. Companies can leverage software to monitor vehicle health, schedule proactive maintenance, and identify underutilized assets. This focus on efficiency can delay new vehicle acquisition cycles, impacting Iveco's sales volume. In 2024, the global fleet management software market was projected to reach over $40 billion, indicating substantial investment and adoption by businesses seeking operational gains.

- Digitalization of Fleet Operations: Advanced telematics and logistics optimization platforms enhance the efficiency and utilization of existing vehicle fleets.

- Cost Reduction and Lifecycle Extension: These digital tools enable customers to lower operational expenses and prolong the useful life of their vehicles.

- Delayed New Vehicle Purchases: By optimizing existing assets, businesses may postpone or reduce the frequency of new vehicle acquisitions.

- Market Growth: The fleet management software market's significant growth in 2024 underscores the increasing adoption of these digital substitutes.

Shift Towards Service-Based Mobility Models

Emerging service-based mobility models, like transportation-as-a-service or extensive rental agreements, directly challenge the traditional model of outright vehicle ownership. This shift can significantly impact the demand for new vehicle sales, potentially redirecting revenue streams from manufacturing to service provision. For instance, the growing popularity of subscription services for commercial vehicles offers an alternative to direct purchase, potentially reducing the volume of new truck and van sales.

Iveco Group is actively addressing this trend through initiatives like its GATE (Green & Advanced Transport Ecosystem). This pay-per-use model for zero-emission vehicles directly engages with the service-based mobility paradigm. In 2024, the commercial vehicle leasing market continued its expansion, with rental and leasing companies playing an increasingly vital role in fleet management, indicating a growing customer preference for flexible, service-oriented solutions over capital expenditure.

- Service-based mobility models offer alternatives to vehicle ownership.

- This can reduce demand for new vehicle sales, impacting manufacturer revenue.

- Iveco Group's GATE initiative is a direct response to this trend.

- The commercial vehicle leasing market saw continued growth in 2024.

The threat of substitutes for Iveco Group is substantial, encompassing alternative transport modes and evolving vehicle technologies. Rail and sea freight remain strong alternatives for bulk goods, especially for long distances, with continued investment in rail infrastructure in Europe during 2024 enhancing its competitiveness. Furthermore, advancements in traditional internal combustion engine (ICE) vehicles, particularly in fuel efficiency, directly challenge the adoption of newer, alternative powertrains.

Digital solutions are also emerging as key substitutes. Advanced telematics and fleet management software allow companies to optimize existing fleets, reducing the immediate need for new vehicle purchases. The global fleet management software market's projected growth past $40 billion in 2024 highlights the significant adoption of these efficiency-boosting digital tools. These platforms can extend vehicle lifecycles and lower operational costs, making them a compelling alternative to capital expenditure on new vehicles.

Service-based mobility models, such as transportation-as-a-service and extensive rental agreements, also pose a threat by shifting focus from ownership to usage. Iveco's GATE initiative, a pay-per-use model for zero-emission vehicles, directly addresses this trend. The commercial vehicle leasing market's continued expansion in 2024 further underscores a growing customer preference for flexible, service-oriented solutions over outright purchase.

| Substitute Category | Key Characteristics | Impact on Iveco Group | 2024 Data/Trend |

|---|---|---|---|

| Alternative Transport Modes | Rail, Sea, Air Freight | Reduces demand for road freight, especially for bulk/long-haul | Continued investment in European rail networks for efficiency and emissions reduction. |

| Technological Advancements (ICE) | Improved Fuel Efficiency, Payload, Longevity | Delays new vehicle purchases by making existing technology more competitive | Average fuel efficiency for new heavy-duty trucks in Europe improving, some exceeding 10 mpg. |

| Digital Fleet Management | Telematics, Route Optimization, Predictive Maintenance | Optimizes existing fleets, reducing need for new acquisitions | Global fleet management software market projected to exceed $40 billion. |

| Service-Based Mobility | Leasing, Rental, Pay-per-use | Shifts revenue from sales to services, impacts ownership models | Continued expansion of commercial vehicle leasing market. |

Entrants Threaten

The commercial vehicle manufacturing sector, where Iveco Group operates, presents a formidable barrier to entry due to exceptionally high capital investment requirements. Developing new truck and bus models necessitates substantial outlays in research and development, advanced engineering, and sophisticated design.

Establishing state-of-the-art manufacturing facilities, complete with specialized tooling and assembly lines, represents another significant cost. For instance, setting up a new automotive plant can easily run into hundreds of millions, if not billions, of dollars.

Furthermore, building a robust and widespread distribution network for sales and a comprehensive after-sales service infrastructure, including parts supply and maintenance centers, demands considerable financial commitment. This extensive network is crucial for customer support and brand loyalty, making it a costly but essential component for any new entrant aiming to compete effectively against established players like Iveco Group.

Iveco Group benefits from substantial brand loyalty and deeply entrenched customer relationships. Established players like Iveco have cultivated reputations for dependability and have fostered long-term partnerships with critical sectors such as fleet operators and government entities. This makes it challenging for newcomers to gain traction.

New entrants must invest heavily in marketing and demonstrate proven performance to build trust and compete effectively against incumbent suppliers. For instance, in 2024, the commercial vehicle market continues to see significant brand loyalty, with major manufacturers reporting high retention rates among their existing customer bases, often exceeding 70% for fleet renewals.

The commercial vehicle sector faces substantial regulatory challenges that act as a significant barrier to new entrants. For instance, in 2024, meeting Euro 7 emissions standards in Europe requires substantial investment in advanced exhaust aftertreatment systems, adding millions to development costs for new models.

Technological Expertise and IP Protection

Developing advanced powertrain technologies, autonomous driving capabilities, and integrated digital systems requires deep technological expertise and significant intellectual property. New entrants would need to either invest heavily in their own R&D or acquire existing technologies, both of which are costly and time-consuming. This barrier protects incumbents like Iveco, who continue to invest in innovation and strategic partnerships to maintain their technological edge.

For instance, in 2024, the global automotive R&D spending was projected to reach over $200 billion, with a substantial portion dedicated to electrification and autonomous systems. Iveco Group, through its collaborations, such as its partnership with Plus for autonomous trucking solutions, demonstrates a commitment to staying at the forefront of these advancements. This ongoing investment makes it challenging for new players to compete without substantial capital and a robust patent portfolio.

- High R&D Investment: New entrants face substantial costs in developing proprietary technologies for advanced powertrains and autonomous driving systems.

- Intellectual Property Barriers: Existing patents and trade secrets held by incumbents like Iveco create significant hurdles for newcomers seeking to enter the market with comparable innovations.

- Acquisition Costs: Alternatively, acquiring existing technologies is expensive and time-consuming, further increasing the barrier to entry.

- Partnership Ecosystem: Incumbents leverage existing partnerships and ongoing innovation to continuously enhance their offerings, making it difficult for new entrants to catch up.

Access to Distribution Channels and Supply Chains

Building a comprehensive global distribution network, complete with dealerships, service centers, and readily available spare parts, is absolutely vital for success in the commercial vehicle market. This network underpins both sales and crucial after-sales support.

Newcomers face significant hurdles in replicating the extensive networks and securing dependable, cost-efficient supply chains that established companies like Iveco Group already possess. This creates a substantial barrier to entry, as developing these capabilities from scratch requires immense investment and time.

- Distribution Network Scale: Iveco Group operates in over 160 countries, demonstrating the breadth of its established distribution and service infrastructure.

- Supply Chain Integration: Securing reliable component suppliers and managing complex global supply chains is a major challenge for new entrants, impacting cost and delivery times.

- After-Sales Service Importance: The availability of parts and qualified service technicians is a key differentiator for fleet operators, an area where established players have a distinct advantage.

The threat of new entrants in the commercial vehicle sector, where Iveco Group operates, remains relatively low due to significant barriers. These include the immense capital required for R&D, manufacturing, and establishing extensive distribution and service networks. For instance, setting up a new automotive production facility can cost billions of dollars.

Incumbents like Iveco benefit from strong brand loyalty, with fleet operators often renewing contracts with established suppliers, a trend that continued in 2024 with high retention rates reported by major manufacturers. Furthermore, stringent regulatory requirements, such as emissions standards like Euro 7, necessitate substantial investment in new technologies, adding millions to development costs for any new model.

Technological expertise, particularly in areas like electrification and autonomous driving, is another critical barrier. Iveco's investment in partnerships, such as with Plus for autonomous trucking, highlights the need for significant R&D spending, projected to exceed $200 billion globally in 2024 for the automotive sector, to compete effectively.

The established global distribution and after-sales service networks of companies like Iveco, operating in over 160 countries, present a formidable challenge for newcomers to replicate. Securing reliable supply chains and ensuring widespread parts availability and qualified service technicians are crucial differentiators that are difficult and costly for new entrants to build from scratch.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and distribution. | Significant financial hurdle. | Setting up a new automotive plant can cost billions. |

| Brand Loyalty & Customer Relationships | Established trust and long-term partnerships. | Difficulty in acquiring customers. | Fleet renewal retention rates often exceed 70% for incumbents. |

| Regulatory Hurdles | Compliance with emissions and safety standards. | Increased development costs. | Euro 7 compliance adds millions to new model development. |

| Technological Expertise & IP | Need for advanced powertrain and autonomous driving tech. | Requires substantial R&D or acquisition costs. | Global automotive R&D spending projected over $200 billion in 2024. |

| Distribution & Service Networks | Extensive sales, service, and parts infrastructure. | Challenging and costly to replicate. | Iveco operates in over 160 countries. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Iveco Group is built upon a foundation of robust data, including Iveco's annual reports and investor presentations, alongside industry-specific market research from firms like IHS Markit and LMC Automotive. We also incorporate data from financial databases such as Bloomberg and S&P Capital IQ to capture macroeconomic trends and competitor financial performance.