Iveco Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iveco Group Bundle

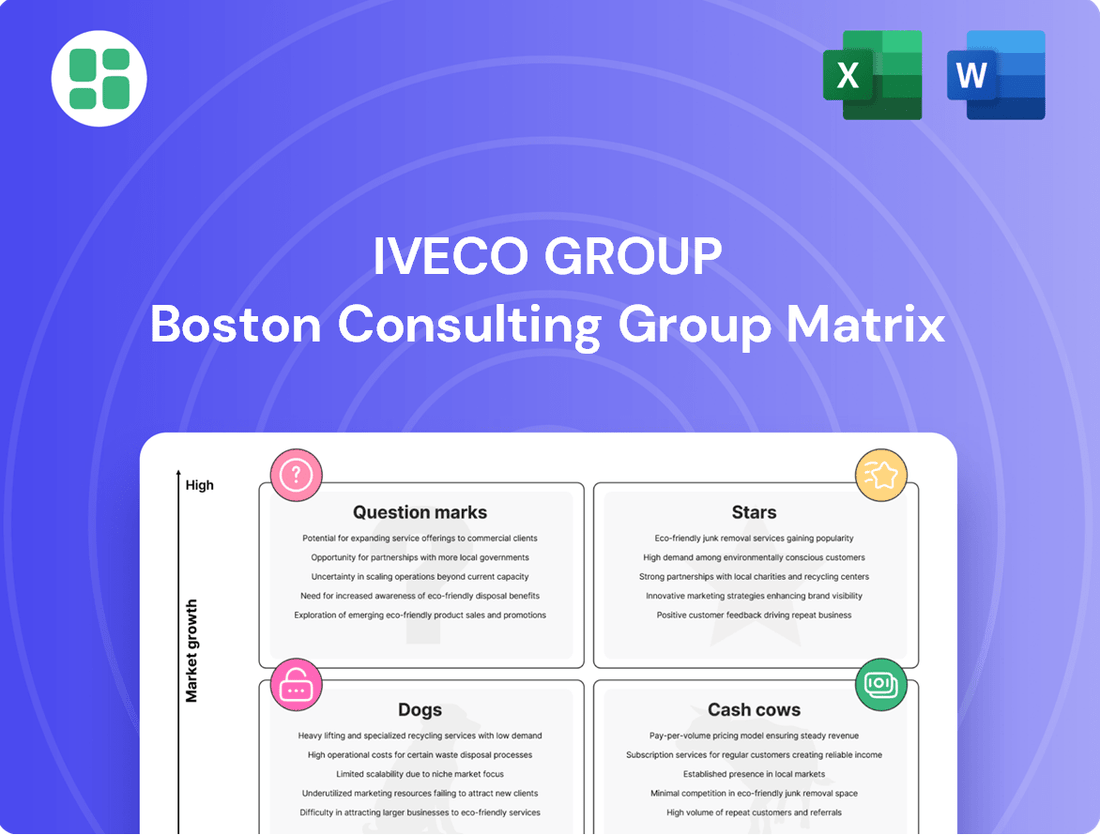

Curious about Iveco Group's strategic product portfolio? Our preview offers a glimpse into their market positioning, hinting at potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the complete picture; purchase the full BCG Matrix for a deep dive into each product's performance and actionable strategies to optimize your investments.

This initial look at Iveco Group's BCG Matrix is just the beginning of unlocking their competitive advantage. Gain a comprehensive understanding of where their products stand in the market and receive data-driven recommendations by securing the full report. It's your essential guide to making informed decisions and driving future growth.

Discover the full strategic blueprint of Iveco Group's product lineup with our complete BCG Matrix. Beyond this snapshot, you'll find detailed quadrant analysis and tailored insights to navigate the evolving automotive landscape. Invest in clarity and purchase the full version to empower your strategic planning.

Stars

Iveco Bus electric city buses are a clear Star for Iveco Group, dominating the European market. In 2024, the company secured the second spot in the European electric urban bus sector, capturing a significant 14.2% market share. This impressive growth, an increase of 6.5 percentage points, is happening in a market that itself is booming, with a 21.1% expansion in 2023.

The strength of Iveco Bus's electric city bus offering is further underscored by its exceptional performance in key European markets. For instance, in Italy, Iveco Bus holds a commanding 35% market share, while in France, it boasts an even more remarkable 56%. These figures highlight a strong market position within a high-growth and strategically important segment for the automotive industry.

The Iveco S-Way heavy-duty trucks in Australia are a prime example of a Star in the BCG matrix. Iveco achieved its best heavy-duty truck sales figures in Australia since 2019. This strong performance was bolstered by a significant 20.8% volume increase in 2024, fueled by robust demand across diverse customer sectors.

Anticipating continued success, Iveco plans to introduce further S-Way model variants in 2025. This strategic move signals ongoing investment and a clear expectation of sustained growth for this high-performing product line within the Australian market.

The Iveco Daily light commercial vehicle, particularly its cab chassis variant, is a standout performer in the Australian market. In 2024, it captured a significant 9.38% of the light truck segment, demonstrating robust sales growth and solidifying its status as the leading European-manufactured light truck Down Under. This strong market penetration, driven by its versatility and performance, clearly marks the Iveco Daily as a Star in the BCG matrix.

FPT Industrial's ePowertrain Solutions

FPT Industrial, a key player within the Iveco Group, is making substantial investments in its ePowertrain solutions. This includes the development of electric drivelines, advanced battery packs, and sophisticated battery management systems. The company’s focus on this area is a clear indicator of its commitment to a net-zero emissions future in mobility, positioning itself within a rapidly expanding market for vehicle electrification.

While precise market share figures for these emerging ePowertrain solutions are not yet widely publicized, FPT Industrial's strategic focus and ongoing development efforts signal a strong potential for market leadership. As the electric vehicle sector continues its rapid growth, the company is well-positioned to capitalize on this trend.

- Strategic Investment: FPT Industrial is channeling significant resources into ePowertrain technology, covering electric drivelines, battery packs, and management systems.

- Market Position: The brand is actively pursuing a leadership role in the high-growth market for vehicle electrification, aiming for net-zero emissions mobility.

- Growth Potential: Despite limited current market share data for these nascent solutions, FPT Industrial's development trajectory suggests strong future market penetration.

Iveco Bus City Bus Segment (Europe Overall)

Iveco Bus's city bus segment in Europe is experiencing robust expansion, securing the second spot in the market during 2024. This strong performance is underscored by a significant market share of 19.6%, a notable jump of 6.9 percentage points compared to 2023.

This upward trajectory highlights Iveco Bus's increasing influence in the urban transport sector. The company's ability to capture a larger piece of the market, reaching 19.6% in 2024, points to effective strategies in product development and market engagement.

- Market Share Growth: Iveco Bus's European city bus market share grew to 19.6% in 2024.

- Year-over-Year Gain: This represents a substantial increase of 6.9 percentage points from 2023.

- Competitive Positioning: The company now holds the second position in the overall European city bus market.

- Market Dynamics: This performance indicates strong penetration in a dynamic urban transport market.

Iveco Bus's electric city buses are a clear Star, holding the second position in the European market with a 14.2% share in 2024. This growth is occurring in a booming market, which expanded by 21.1% in 2023. Iveco Bus also shows strong performance in specific markets, with a 35% share in Italy and 56% in France.

The Iveco S-Way heavy-duty trucks in Australia are performing exceptionally well, achieving their best sales figures since 2019. In 2024, these trucks saw a significant 20.8% volume increase, driven by strong demand across various sectors. Further model variants are planned for 2025, indicating continued investment and expected growth.

The Iveco Daily light commercial vehicle, especially its cab chassis variant, is a leading performer in Australia. It captured 9.38% of the light truck segment in 2024, solidifying its position as the top European-manufactured light truck there.

| Product/Segment | Market | 2024 Market Share | Growth Indicator | Key Markets |

| Iveco Bus Electric City Buses | European Urban Bus | 14.2% (2nd place) | +6.5 pp vs 2023 | Italy (35%), France (56%) |

| Iveco S-Way Heavy-Duty Trucks | Australia | N/A (Best sales since 2019) | +20.8% volume | Australia |

| Iveco Daily Light Commercial Vehicle (Cab Chassis) | Australia (Light Truck Segment) | 9.38% | Strong growth | Australia |

What is included in the product

The Iveco Group BCG Matrix analyzes its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

The Iveco Group BCG Matrix offers a clear, one-page overview that simplifies complex business unit performance, relieving the pain of strategic confusion.

Cash Cows

Iveco Bus commands a formidable presence in Europe's intercity bus market, securing an impressive 50.5% market share in 2024. This leadership position in a mature, stable demand environment translates directly into a reliable source of cash flow for Iveco Group.

The intercity segment functions as a cash cow for Iveco, benefiting from its established competitive advantages and consistent demand. Resources are strategically allocated to preserve this market dominance and enhance operational efficiencies.

FPT Industrial's traditional diesel powertrains represent a significant cash cow for the Iveco Group. The company's consistent production of approximately 500,000 internal combustion engines annually, with a substantial 65% sold to external clients, underscores its market dominance.

Despite the maturity of the diesel engine market, FPT Industrial leverages its robust market share, broad customer network, and stringent cost control measures to maintain high profit margins. This operational efficiency translates into substantial cash flow generation, providing a stable financial foundation for the Iveco Group's strategic investments and growth endeavors.

Iveco Group's Financial Services, known as Iveco Capital, acts as the dedicated financing arm for the group's vehicle sales. This division generates a reliable income stream through financing agreements with both dealers and end customers, effectively acting as a cash cow.

Within the mature automotive financing sector, Iveco Capital benefits from a strong market share directly tied to Iveco Group's vehicle sales volume. This correlation ensures consistent cash flow generation, even with limited growth potential in the overall market.

For the fiscal year 2023, Iveco Group reported total revenue of €15.6 billion. While specific figures for Iveco Capital are not broken out separately in all public reports, its function as a sales enabler and liquidity provider is critical to the group's overall financial health and stability, contributing significantly to its cash generation capabilities.

Iveco Natural Gas Buses (Europe)

Iveco Bus commands a commanding position in the European natural gas bus market, a testament to its strategic focus on this established alternative fuel. In 2024, an impressive 65% of Iveco's bus registrations in Europe were natural gas models, highlighting a significant market share in a mature segment.

This strong foothold in natural gas buses, while not in a hyper-growth phase like electric vehicles, translates into a reliable cash flow generator for Iveco Group. The existing infrastructure and Iveco's established leadership ensure consistent revenue streams from this segment.

- European Leadership: Iveco Bus is the undisputed leader in natural gas buses across Europe.

- Market Dominance: 65% of Iveco's 2024 European bus registrations were natural gas vehicles.

- Cash Generation: The strong market position and existing infrastructure ensure consistent cash flow.

- Established Niche: This segment represents a well-established alternative energy solution within the bus industry.

Core Heavy-Duty Truck Business (European Mature Segments)

Despite a slight slowdown in the European heavy-duty truck market during the first quarter of 2025, Iveco's core business in this segment remains a robust cash generator. The introduction of the Model Year 2024 lineup has been well-received, reinforcing the company's position in a mature but stable market.

Iveco's pricing discipline is a key factor in its ability to extract significant cash flow from its established European market share. This strategy, combined with a strong brand presence, ensures consistent returns from its heavy-duty truck operations.

- Market Position: Iveco holds a significant share in the mature European heavy-duty truck market.

- Cash Generation: Strong pricing discipline supports substantial cash flow from existing operations.

- Product Line: The Model Year 2024 lineup contributes to maintaining market presence and sales.

- Market Outlook: The European heavy-duty truck market is forecast to stabilize in 2025, indicating a predictable cash generation environment.

Iveco Group's established presence in the natural gas bus market in Europe, where it held 65% of its bus registrations in 2024, serves as a prime example of a cash cow. This segment benefits from a mature market with consistent demand, bolstered by existing infrastructure and Iveco's leadership.

Similarly, FPT Industrial's traditional diesel powertrains are a significant cash generator, with approximately 500,000 engines produced annually, 65% of which are sold externally. This highlights a strong market position and consistent revenue from a well-established product line.

Iveco Capital, the group's financing arm, also functions as a cash cow by providing financing for vehicle sales to both dealers and end customers. Its income stream is directly tied to Iveco Group's vehicle sales volume, ensuring stable cash flow within the mature automotive financing sector.

The European heavy-duty truck market, despite a slight Q1 2025 slowdown, remains a robust cash generator due to Iveco's pricing discipline and strong brand presence. The Model Year 2024 lineup reinforces its position in this stable market.

| Business Segment | Market Position | Cash Flow Contribution | Key Data Point (2024/2025) |

|---|---|---|---|

| Iveco Bus (Intercity) | European Leader | Strong & Stable | 50.5% European Market Share |

| FPT Industrial (Diesel Powertrains) | Dominant | Consistent & High | 65% External Sales |

| Iveco Capital (Financial Services) | Integral to Sales | Reliable Income Stream | Enables Vehicle Sales |

| Iveco Trucks (Heavy-Duty) | Significant Share | Robust Generator | Model Year 2024 Reception |

| Iveco Bus (Natural Gas) | European Leader | Consistent Revenue | 65% of 2024 Registrations |

Delivered as Shown

Iveco Group BCG Matrix

The Iveco Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means you're getting direct access to a comprehensive strategic analysis without any watermarks or placeholder content. The report is designed for immediate professional use, allowing you to integrate its insights into your business planning and decision-making processes without delay.

Dogs

The firefighting business, operating under the Magirus brand, was classified as discontinued operations by Iveco Group. Its ownership was transferred in early 2025.

This divestment clearly signals that Magirus was considered a low-growth, low-market share asset. It was likely consuming resources without generating sufficient returns or aligning with Iveco Group's evolving strategic priorities.

The decision to sell Magirus reflects its position as a 'Dog' in the BCG matrix, indicating a business unit with poor prospects that no longer fit the parent company's core strategy.

Iveco Group's older model year trucks, often being phased out, fall into the 'Dogs' category of the BCG Matrix. These vehicles typically experience declining demand and lower market share as newer, more technologically advanced models become available. The company proactively adjusted production and inventories in Q1 2025 to manage this transition.

Underperforming regional truck markets for Iveco Group, while not explicitly detailed in public BCG analyses, would represent its Dogs. These are markets where Iveco has a low share and the overall market is shrinking or not growing. For example, if Iveco's market share in a specific, mature European region was consistently below 5% and the total regional truck sales for that segment declined by 2% year-over-year in 2024, this would characterize a Dog.

Legacy Powertrain Technologies (FPT Industrial)

Legacy Powertrain Technologies within FPT Industrial, part of the Iveco Group, represent older, less efficient engine and powertrain solutions. These are being phased out as the company invests heavily in electrification and alternative fuels. For instance, in 2024, FPT Industrial continued its transition, with a significant portion of its R&D budget allocated to developing advanced, low-emission powertrains, impacting the market presence of its legacy offerings.

These legacy products are experiencing declining demand as regulatory pressures and customer preferences shift towards more sustainable options. Consequently, they are likely to generate minimal profits or could even incur losses due to reduced sales volumes and the ongoing costs associated with supporting older technologies. In 2023, FPT Industrial reported that its traditional diesel engine sales saw a slight decrease compared to previous years, reflecting this market trend.

- Declining Market Share: Legacy powertrains are losing ground to newer, more environmentally friendly alternatives.

- Profitability Concerns: Reduced demand and increased support costs put pressure on the profitability of these older technologies.

- Strategic Divestment Potential: Iveco Group may consider divesting or phasing out these legacy segments to focus resources on future growth areas.

- Investment Shift: Capital is being redirected from legacy technologies to support the development and production of electric and hydrogen-based powertrains.

Non-Strategic Niche Commercial Vehicles

Non-strategic niche commercial vehicles within Iveco Group's portfolio represent specialized product lines that don't fit into the company's primary growth strategies. These vehicles typically operate in small, stagnant, or even shrinking market segments, meaning they have a low market share and limited potential for significant expansion.

These "Dogs" in the BCG matrix receive minimal strategic focus and investment. Iveco Group might continue production to fulfill existing demand or for legacy reasons, but the emphasis is on eventual rationalization or divestment. For instance, if a specific type of industrial vehicle catering to a very narrow sector saw its market shrink by 5% annually and Iveco held less than 2% market share, it would likely be classified here.

- Low Market Share: These vehicles often command less than 5% of their respective niche markets.

- Stagnant or Declining Markets: The overall demand for these specialized vehicles is not growing, or is actively decreasing.

- Minimal Investment: Future capital allocation is severely limited, focusing on maintaining existing operations rather than expansion.

- Rationalization Potential: These product lines are candidates for discontinuation or sale to optimize resource allocation.

Iveco Group's "Dogs" represent business segments with low market share and low growth prospects. These are often older product lines or those in niche markets that are not strategically prioritized. The company actively manages these by phasing out or divesting them to focus resources on growth areas.

The divestment of Magirus, a firefighting equipment business, exemplifies a "Dog" being removed from the portfolio. This move, completed in early 2025, signals a strategic shift away from low-return assets. Similarly, older truck models and legacy powertrain technologies within FPT Industrial are being managed as "Dogs" through production adjustments and R&D reallocation.

These segments are characterized by declining demand and profitability concerns, often due to evolving market preferences and stricter regulations. Iveco Group's strategy involves rationalizing these "Dogs" to improve overall portfolio performance and financial health.

For instance, in 2024, Iveco Group reported a slight decrease in sales for its traditional diesel engines, a clear indicator of legacy powertrain products fitting the "Dog" profile. The company's focus on electric and alternative fuel powertrains highlights the strategic shift away from these older technologies.

Question Marks

Iveco Group is making substantial investments in hydrogen fuel cell technology, exemplified by their S-eWay Fuel Cell trucks. These vehicles are being deployed in key projects like H2Haul and are supported by expanding collaborations with Hyundai for hydrogen-powered transportation solutions. This positions Iveco at the forefront of a burgeoning market with considerable long-term prospects for reducing emissions in heavy-duty logistics.

The hydrogen fuel cell truck segment represents a high-growth opportunity, driven by the urgent need to decarbonize heavy-duty transport. However, the market is still in its nascent stages, characterized by limited current market share due to underdeveloped infrastructure and slow initial adoption rates. Iveco's commitment here is a strategic bet on future market dominance.

These forward-looking initiatives necessitate significant research and development expenditure for Iveco Group. While these investments consume substantial R&D cash, they hold the promise of significant, albeit uncertain, future returns as the hydrogen economy matures and infrastructure becomes more widespread. The long-term potential for decarbonization makes this a critical area of focus.

Iveco is expanding its battery electric vehicle (BEV) portfolio with models like the S-eWay Rigid and eMoovy, signaling a strategic push into the heavy-duty electric truck market. This segment is experiencing rapid growth, fueled by stringent emissions regulations and corporate sustainability mandates. For instance, the global electric heavy-duty truck market was valued at approximately $1.5 billion in 2023 and is projected to reach over $20 billion by 2030, demonstrating a compound annual growth rate (CAGR) of over 35%.

Despite this promising market trajectory, Iveco is in the early stages of establishing its presence in this high-growth, but nascent, electric heavy-duty truck sector. Significant investments are necessary to ramp up production capabilities, develop charging infrastructure partnerships, and build brand recognition to compete effectively. This positions these new BEV offerings as potential Stars in the BCG matrix, requiring substantial capital to maintain their growth trajectory and capture market share against established and emerging competitors.

Iveco Group's new all-electric light commercial vehicle (eLCV) for Europe, leveraging Hyundai's eLCV platform, is positioned as a Star in the BCG Matrix. This segment is experiencing robust growth, with the global electric LCV market projected to reach approximately $150 billion by 2030, up from around $30 billion in 2023. Iveco is entering this dynamic market with a fresh product, aiming to capture significant market share.

While the eLCV platform represents a high-growth opportunity, Iveco's current market share in this specific electric LCV category is nascent, placing it in the low market share quadrant relative to the high growth. This necessitates significant investment in marketing, sales, and distribution networks to build brand awareness and establish a strong customer base in a competitive landscape.

Advanced Autonomous Driving Technologies

Advanced autonomous driving technologies, as part of Iveco Group's strategy, are positioned as Stars or Question Marks in a BCG Matrix. The company's Strategic Plan to 2028 highlights significant investment in these areas, recognizing their transformative potential for the future of transportation.

These technologies are characterized by high growth potential but are currently in early development, lacking significant market share or immediate revenue. This necessitates substantial research and development expenditure with payoffs that are long-term and uncertain, fitting the profile of Question Marks.

- High R&D Investment: Iveco Group is channeling resources into developing advanced autonomous driving systems, a key component of its 2028 strategic roadmap.

- Early Development Stage: These technologies are not yet generating substantial revenue, placing them in the early phases of market penetration and adoption.

- Transformative Potential: Autonomous driving is viewed as a critical future growth driver for the transportation sector, promising significant long-term value.

- Uncertain Payoffs: The substantial upfront investment carries inherent risks due to the evolving regulatory landscape and consumer acceptance of autonomous vehicles.

Hydrogen Internal Combustion Engines (ICE) (FPT Industrial)

FPT Industrial is actively developing hydrogen internal combustion engines (ICE) as a promising alternative propulsion technology. Prototypes have been showcased, including at IAA 2024, signaling a strategic push into this emerging sector.

This innovation positions FPT Industrial to capitalize on a potentially high-growth niche within the evolving alternative fuels market. The company's exploration of hydrogen ICE aligns with broader industry trends towards decarbonization and diversified powertrain solutions.

Currently, hydrogen ICE technology exhibits minimal commercial adoption and a consequently low market share. This necessitates substantial investment in research, development, and market education to establish its long-term viability and widespread acceptance.

- Market Entry: FPT Industrial is in the early stages of market entry for hydrogen ICE, with prototypes being a key part of their strategy.

- Growth Potential: The technology targets a future high-growth niche, indicating a belief in its long-term market expansion.

- Current Status: Commercial adoption remains minimal, and market share is currently low, reflecting the nascent stage of this technology.

- Investment Needs: Significant investment is required for further development and to build market acceptance, crucial for proving its viability.

Iveco Group's investment in advanced autonomous driving technologies aligns with the characteristics of Question Marks in the BCG matrix. These initiatives require significant R&D funding with uncertain future returns, reflecting the early developmental stage and nascent market penetration. The company's strategic plan emphasizes these areas as crucial for future growth, acknowledging the long-term potential despite current market share limitations.

The company is actively investing in autonomous driving, recognizing its transformative impact on the transportation industry. While these technologies are still in their infancy, they represent a significant future growth avenue for Iveco Group. The substantial upfront investment is a strategic move to secure a competitive edge in a rapidly evolving market, even with the inherent risks associated with unproven technologies.

The focus on autonomous driving stems from its potential to revolutionize logistics and passenger transport, driving efficiency and safety. Iveco's commitment underscores a long-term vision to integrate these advanced capabilities into its product offerings. This strategic direction positions the company to capture future market opportunities as autonomous technology matures and gains wider acceptance.

The development of autonomous driving systems is a capital-intensive endeavor with a long gestation period. Iveco's allocation of resources to this area highlights its commitment to innovation and its belief in the eventual widespread adoption of self-driving vehicles. The success of these investments will depend on technological advancements, regulatory frameworks, and consumer acceptance.

BCG Matrix Data Sources

Our Iveco Group BCG Matrix leverages comprehensive data from financial statements, industry growth forecasts, and internal product performance metrics to provide strategic clarity.