Iveco Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Iveco Group Bundle

Navigate the complex external forces shaping Iveco Group's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the company. This expertly crafted report provides the actionable intelligence you need to anticipate market changes and refine your own strategic approach. Download the full version now and gain a critical competitive edge.

Political factors

Government regulations significantly shape Iveco Group's operations. Stricter emissions standards, like Euro 7, necessitate substantial investment in cleaner powertrain technologies, impacting manufacturing costs and product development timelines. For instance, in 2024, the European Union continued to refine its automotive regulations, pushing manufacturers towards electrification and alternative fuels.

Trade policies and tariffs also play a crucial role. In 2024, ongoing geopolitical tensions and evolving trade agreements between major economic blocs could affect Iveco's global supply chain efficiency and the cost of imported components, potentially influencing pricing strategies in various markets.

Political stability in key operating regions is paramount for Iveco's strategic planning. For example, in 2024, regions experiencing political uncertainty might see delayed investment decisions or increased operational risks, prompting Iveco to diversify its manufacturing footprint and market presence to mitigate these impacts.

Geopolitical instability, including ongoing conflicts and the imposition of sanctions, directly impacts Iveco Group by creating significant supply chain vulnerabilities. Disruptions in the sourcing of essential raw materials and components, particularly from regions experiencing conflict, can lead to production delays and increased costs. For instance, the ongoing conflict in Eastern Europe has affected global logistics and the availability of certain industrial inputs, potentially impacting Iveco's manufacturing processes.

Political relations between key operating and sales markets for Iveco Group present both opportunities and risks. Favorable trade agreements and stable political climates in regions like Europe and South America can bolster demand for Iveco's commercial vehicles and defense products. Conversely, escalating trade tensions or political friction between major economic blocs could lead to tariffs or market access restrictions, negatively affecting Iveco's international sales performance.

Regional conflicts often drive demand for specialized vehicles, creating a potential market opportunity for Iveco Group's defense sector. Countries involved in or anticipating conflict may increase their procurement of armored personnel carriers, tactical trucks, and other military-grade equipment. For example, increased defense spending by NATO members in response to heightened geopolitical tensions in 2024 and 2025 could translate into higher orders for Iveco's defense solutions.

Government industrial policies significantly shape Iveco Group's operational landscape. Subsidies for electric vehicle adoption, like those seen in the European Union's push for decarbonization, directly encourage Iveco's transition to electric trucks and buses. For instance, Germany's €2.7 billion electric mobility funding program in 2023 incentivizes fleet operators to purchase cleaner vehicles. Support for manufacturing industries, including tax breaks for new factory investments, can bolster Iveco's production capabilities.

National economic policies also play a crucial role. Interest rate decisions by central banks, such as the European Central Bank's monetary policy adjustments in 2024, influence the cost of capital for Iveco's investments and affect the affordability of commercial vehicles for customers through financing. Taxation policies, including corporate tax rates and VAT on vehicle purchases, directly impact Iveco's profitability and consumer purchasing power. For example, changes in VAT in Italy could alter demand for Iveco's product lines.

Furthermore, policies promoting local production or international partnerships create strategic opportunities. Government initiatives encouraging domestic manufacturing can lead Iveco to expand its production facilities within specific regions, potentially creating local jobs and supply chains. Conversely, policies facilitating international collaborations can open doors for joint ventures or technology sharing, enhancing Iveco's competitive edge in global markets.

Public Procurement and Defense Spending

Government spending on public transport infrastructure and municipal services significantly influences Iveco Group's sales, particularly for its bus and specialized vehicle segments. For instance, the European Union's recovery funds, like the NextGenerationEU initiative, are channeling substantial investments into sustainable mobility and public transport upgrades across member states, presenting a direct opportunity for Iveco's bus division. In 2024, many European countries are expected to continue prioritizing these infrastructure projects, boosting demand for Iveco's offerings.

Changes in national defense budgets and public sector investment plans directly affect Iveco's order backlog and revenue streams, especially for its defense products. For example, increased defense spending by NATO members, a trend observed through 2023 and projected into 2024-2025, can lead to more substantial orders for Iveco's military vehicles. The company's ability to secure these government contracts is crucial, as they often represent long-term, high-value revenue. The competitive landscape for these contracts is intense, with Iveco vying against established global defense manufacturers.

- Public Procurement Impact: Government investments in public transport infrastructure, such as bus rapid transit systems and fleet renewals, directly boost Iveco's bus and coach sales.

- Defense Spending Influence: Fluctuations in national defense budgets, particularly in key European markets and North America, can significantly alter Iveco's defense vehicle order backlog.

- Contract Competition: Iveco faces stiff competition from both global and regional players when bidding for lucrative public sector and defense contracts, impacting its market share and pricing power.

- Investment Plan Alignment: The company's success is tied to aligning its product development with government investment plans, such as those focused on green mobility and national security.

Political Stability and Corruption Levels

Iveco Group's operations are significantly influenced by political stability. For instance, in 2024, countries like Italy, where Iveco has major manufacturing hubs, are navigating evolving political landscapes. Instability can disrupt supply chains and impact consumer confidence, directly affecting sales.

Corruption levels present another critical challenge. Transparency International's 2023 Corruption Perception Index highlights that countries with high corruption can impose significant compliance costs and deter investment. For Iveco, operating in regions with strong governance, such as Germany, offers a more predictable and secure business environment compared to those with weaker institutions.

The company must actively manage risks associated with politically volatile regions. This includes diversifying manufacturing and supply chain partners to mitigate the impact of geopolitical events. For example, geopolitical tensions in Eastern Europe in early 2024 have underscored the need for agile operational strategies.

- Political Stability: Iveco Group's key markets, including Europe and South America, exhibit varying degrees of political stability, impacting operational continuity.

- Corruption Impact: High corruption levels in certain operating regions can increase operational costs through bribery demands and regulatory hurdles.

- Governance Quality: Strong governance frameworks in countries like Germany and France provide a more secure environment for Iveco's investments and supply chain management.

- Risk Management: Proactive risk mitigation strategies are essential to counter potential disruptions from political instability in emerging markets where Iveco operates.

Government regulations, particularly emissions standards like Euro 7, continue to drive Iveco's investment in cleaner technologies, with the EU refining these rules throughout 2024. Trade policies and geopolitical tensions in 2024 also pose risks to Iveco's global supply chain and component costs. Political stability in key markets remains crucial, as instability can delay investments and increase operational risks, prompting diversification efforts.

Geopolitical instability, such as conflicts in Eastern Europe, creates supply chain vulnerabilities for Iveco, impacting raw material sourcing and production costs. Political relations between Iveco's markets can either boost demand through favorable agreements or hinder sales via tariffs and restrictions. Regional conflicts can also spur demand for Iveco's defense vehicles, with increased NATO spending in 2024-2025 potentially leading to higher orders.

Government industrial policies, including subsidies for electric vehicles and manufacturing investments, significantly shape Iveco's operational landscape. National economic policies, like central bank interest rate decisions in 2024, affect capital costs and vehicle affordability. Taxation policies also directly impact Iveco's profitability and consumer purchasing power.

Government spending on public transport infrastructure, such as EU recovery funds in 2024, directly benefits Iveco's bus sales. Similarly, changes in national defense budgets, with increased NATO spending projected for 2024-2025, boost Iveco's defense vehicle revenue. Competition for these public sector and defense contracts is intense.

What is included in the product

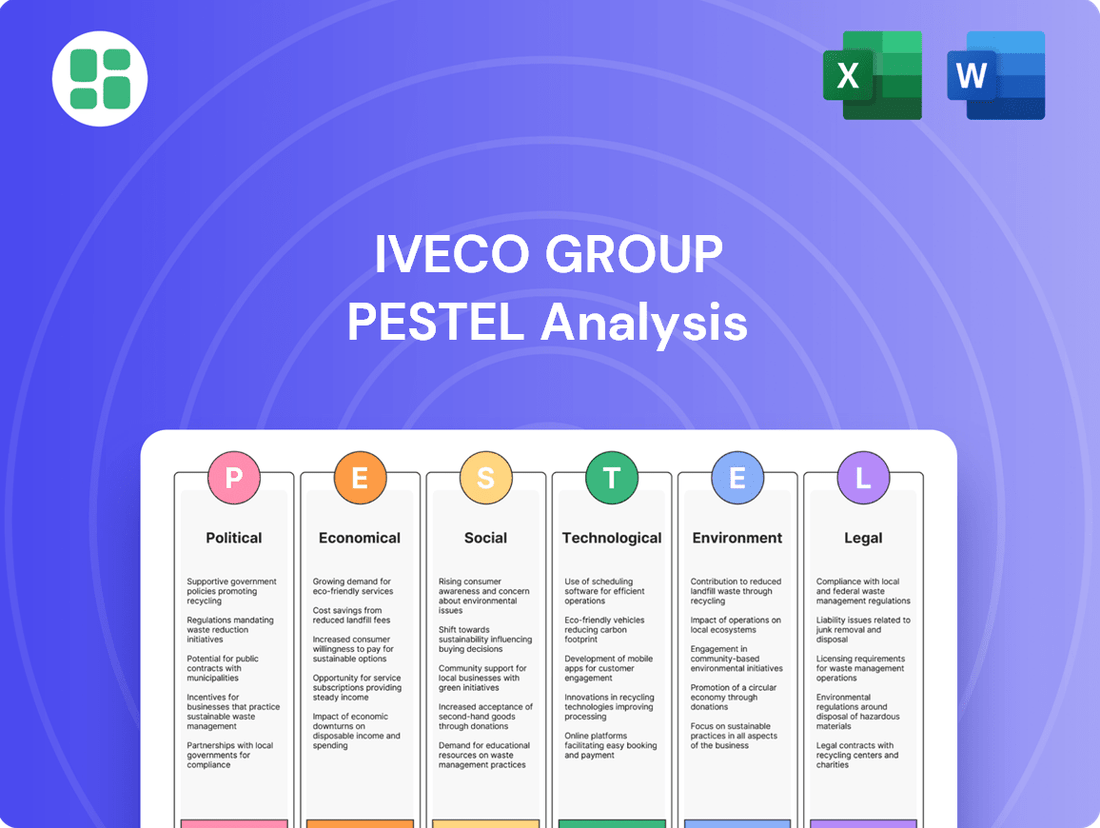

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the Iveco Group, covering political, economic, social, technological, environmental, and legal factors.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify opportunities and threats within the global commercial vehicle and services sector.

A concise, PESTLE-structured overview of the Iveco Group's external environment, designed to proactively identify and mitigate potential market disruptions, thereby easing strategic planning burdens.

Economic factors

The global economic climate significantly impacts Iveco Group's performance. Slowing GDP growth, projected at 2.6% for 2024 by the IMF, and the lingering threat of recession in key markets can dampen demand for commercial vehicles. Economic downturns often lead logistics firms and public transport operators to postpone fleet expansions or replacements, directly affecting Iveco's sales volumes.

Demand for Iveco's products, such as trucks and buses, tends to be cyclical and somewhat elastic. During periods of economic expansion, increased trade and passenger mobility boost demand. Conversely, recessions typically see a contraction in these sectors, leading to reduced orders for new vehicles, as seen in the 2020 downturn where global commercial vehicle sales experienced a notable dip.

Rising inflation in 2024 and into 2025 is directly impacting Iveco Group's production costs. Expect increases in prices for essential raw materials like steel and aluminum, alongside higher energy expenses for manufacturing facilities. Labor costs are also likely to climb as wage demands keep pace with the cost of living.

Fluctuating interest rates present a dual challenge for Iveco. Higher borrowing costs will increase the expense of financing the company's operational needs and investments. Simultaneously, elevated interest rates make it more expensive for customers to finance vehicle purchases through Iveco's financial services, potentially dampening demand for new trucks and buses.

Central bank monetary policies aimed at controlling inflation, such as interest rate hikes, can significantly influence consumer and business confidence. If these policies lead to economic slowdown fears, both fleet operators and individual buyers may postpone large capital expenditures like vehicle acquisitions, impacting Iveco's sales volumes throughout 2024 and 2025.

Exchange rate fluctuations significantly impact Iveco Group's global financial performance. For instance, a stronger Euro can reduce the value of revenues earned in foreign currencies when translated back, while also making imported components more affordable. Conversely, a weaker Euro can boost the competitiveness of Iveco's exports by making their vehicles cheaper for international buyers, but it simultaneously increases the cost of parts sourced from countries with stronger currencies. In 2023, Iveco Group reported that currency headwinds, particularly from foreign exchange, had a notable impact on its financial results, highlighting the need for robust hedging strategies to mitigate these risks and ensure stable profitability across its diverse international markets.

Raw Material and Energy Costs

Raw material and energy costs significantly impact Iveco Group's profitability. Fluctuations in the prices of steel, aluminum, and essential rare earth minerals directly affect manufacturing expenses. For instance, the London Metal Exchange (LME) data shows that aluminum prices experienced considerable volatility throughout 2024, impacting the cost of vehicle components.

Global energy prices also play a crucial role in Iveco's operational expenditures. This includes the cost of fuel for vehicle testing and logistics, as well as the price of electricity powering its production facilities. In 2024, the Brent crude oil benchmark saw an average price of approximately $83 per barrel, influencing transportation and energy-related overheads.

Iveco Group's ability to pass these increased costs onto its customers is a key factor in maintaining margins. The competitive landscape of the commercial vehicle market, however, can limit pricing power.

- Steel Prices: Volatility in steel prices, a primary component in truck manufacturing, directly increases Iveco's production costs.

- Aluminum Costs: Fluctuations in aluminum prices impact the weight and efficiency of vehicles, affecting both production and the final product's value proposition.

- Energy Price Impact: Rising global energy prices in 2024, with oil benchmarks trading around $83 per barrel, elevate fuel and electricity expenses for Iveco's operations.

- Cost Pass-Through: Iveco's capacity to transfer these rising raw material and energy costs to customers is constrained by market competition.

Consumer and Business Spending Confidence

Consumer and business spending confidence significantly shapes Iveco Group's market. When businesses in logistics, construction, and public transport feel optimistic about the economy, they are more likely to invest in new fleets or upgrade older vehicles. For instance, a strong construction sector outlook in 2024, with projected growth in infrastructure spending in several European countries, encourages fleet expansion. Conversely, a dip in confidence can lead to postponed capital expenditures, directly impacting demand for Iveco's trucks and buses.

Consumer confidence acts as an indirect driver. Higher consumer confidence often translates to increased retail sales and demand for goods, which in turn necessitates more robust logistics operations and, consequently, more commercial vehicles. In 2024, consumer sentiment in key Iveco markets showed a gradual recovery, though inflation remained a concern. This recovery, albeit cautious, supports a baseline demand for goods movement, benefiting Iveco's commercial vehicle segment.

Government stimulus packages can provide a crucial boost. Initiatives aimed at greening transport fleets or supporting infrastructure development can directly incentivize purchases of new vehicles. For example, subsidies for electric trucks or support for public transport upgrades, as seen in various EU recovery plans extending into 2024-2025, can significantly influence fleet renewal decisions and positively impact Iveco's order books.

Key influencing factors include:

- Business Investment Decisions: High confidence in sectors like construction and logistics leads to increased fleet orders for Iveco.

- Consumer Demand Impact: Positive consumer sentiment fuels retail, boosting demand for goods transport and commercial vehicles.

- Government Support: Stimulus packages, particularly for green transport, can accelerate fleet upgrades and new vehicle purchases.

- Economic Outlook: Overall economic stability and growth projections are critical for both business and consumer spending confidence.

Global economic growth directly influences demand for Iveco's commercial vehicles. The IMF projected global GDP growth at 2.6% for 2024, a figure that, while positive, indicates a moderation from previous years. This slower growth, coupled with potential recessions in key markets, could lead fleet operators to delay vehicle acquisitions, impacting Iveco's sales volumes.

Inflationary pressures in 2024 and 2025 are increasing Iveco's production costs. Higher prices for raw materials like steel and aluminum, alongside rising energy expenses, directly affect manufacturing overheads. For example, aluminum prices on the LME experienced significant volatility in 2024, impacting component costs.

Interest rate policies by central banks, aimed at curbing inflation, create a challenging financial environment. Increased borrowing costs for Iveco and higher financing costs for its customers can dampen demand for new vehicles, especially for large capital expenditures like fleet upgrades.

| Economic Factor | Impact on Iveco Group | Supporting Data/Trend (2024/2025) |

| Global GDP Growth | Influences overall demand for commercial vehicles. | IMF projected 2.6% global GDP growth for 2024, indicating a moderate economic environment. |

| Inflation | Increases production costs for raw materials and energy. | Volatile aluminum prices on LME in 2024; Brent crude oil averaged ~$83/barrel in 2024, impacting energy costs. |

| Interest Rates | Affects financing costs for both Iveco and its customers. | Central banks continued to manage interest rates to control inflation throughout 2024. |

| Exchange Rates | Impacts financial results and competitiveness of exports. | In 2023, currency headwinds notably affected Iveco's financial results, highlighting ongoing sensitivity. |

Preview the Actual Deliverable

Iveco Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Iveco Group, providing critical insights for strategic decision-making. Gain a deep understanding of the external forces shaping Iveco's market landscape and competitive positioning.

Sociological factors

Global demographic trends, like a growing and aging population, directly impact vehicle demand. For instance, the increasing number of older adults in developed nations, such as Europe where Iveco has a strong presence, may drive demand for more accessible and specialized transport solutions.

Urbanization presents significant challenges and opportunities. With over 57% of the world's population living in urban areas in 2023, according to the UN, city congestion is a major concern. This trend fuels the need for efficient public transport like Iveco's buses and innovative last-mile delivery vehicles, pushing for smaller, cleaner, and more agile solutions.

These demographic shifts create clear avenues for Iveco. The company can capitalize on the growing need for sustainable public transportation systems in rapidly expanding cities and develop specialized urban vehicles designed to navigate congestion and meet the evolving needs of city dwellers and businesses.

Societal shifts are profoundly reshaping the automotive landscape for Iveco Group. Growing environmental consciousness is driving a significant demand for electric vehicles (EVs) and alternative fuel options; for instance, the global EV market is projected to reach over $1.5 trillion by 2030, indicating a strong consumer pull towards sustainable transport.

Evolving work patterns, particularly the rise of remote and hybrid models, are altering commuting habits. This can lead to reduced demand for traditional commercial vehicle usage for daily commutes but may increase the need for efficient last-mile delivery solutions and flexible fleet management, impacting Iveco's commercial vehicle segment.

Consumers increasingly expect vehicles to offer advanced connectivity and autonomous driving features. Iveco's ability to integrate these technologies into its product line, from advanced driver-assistance systems to potential future autonomous capabilities, will be crucial for meeting these evolving lifestyle expectations and maintaining market relevance.

Iveco Group faces challenges from evolving workforce dynamics, including persistent skill shortages in advanced manufacturing and digital technologies critical for its commercial vehicle and powertrain operations. Labor availability directly impacts production capacity, and in 2024, the automotive sector globally continued to grapple with filling specialized roles, affecting output efficiency. Strong labor union relations are crucial for maintaining stable operations; for instance, ongoing negotiations in key European markets in late 2024 could influence wage structures and working conditions, thereby impacting employment costs.

Talent attraction and retention are paramount for Iveco Group in the highly competitive global automotive market, especially as the industry pivots towards electrification and autonomous driving technologies. Companies are increasingly investing in upskilling their existing workforce and offering competitive compensation packages to secure specialized engineering and software development talent. The implications of changing labor laws and social welfare policies, such as those debated in 2025 concerning flexible work arrangements or enhanced employee benefits, could further elevate employment costs for Iveco Group, necessitating strategic adjustments in its human resource management and operational planning.

Health and Safety Standards Awareness

Societal expectations for robust health and safety standards in vehicle design, manufacturing, and operation are escalating. This heightened awareness directly influences consumer demand for vehicles equipped with advanced safety features, impacting manufacturers like Iveco Group. For instance, in 2024, European Union regulations like GSR2 (General Safety Regulation 2) mandate an array of advanced driver-assistance systems (ADAS) in new vehicles, reflecting this societal push.

Public consciousness regarding road safety and occupational health significantly shapes the demand for vehicles incorporating cutting-edge safety technologies. Consumers are increasingly prioritizing vehicles that offer features such as automatic emergency braking and lane-keeping assist. This trend is evident in market data, where vehicles with higher safety ratings consistently outperform those with lower ratings.

Iveco Group’s reputation and potential liability are intrinsically linked to its vehicle safety performance. A strong safety record enhances brand trust, while any failures can lead to significant reputational damage and costly recalls. For example, the European Transport Safety Council reported in 2023 that while road fatalities are decreasing, accidents involving heavy-duty vehicles still represent a significant concern, underscoring the critical importance of safety for commercial vehicle manufacturers.

- Growing demand for ADAS: By 2025, it's projected that over 80% of new passenger cars sold in major markets will feature at least one ADAS function.

- Regulatory impact: EU's GSR2, implemented from July 2022 for new types and July 2024 for all new vehicles, mandates features like intelligent speed assistance and emergency lane keeping.

- Brand perception: A vehicle safety recall can cost manufacturers millions in remediation and significantly damage consumer confidence, as seen in past incidents across the automotive industry.

- Occupational safety focus: Stricter workplace safety regulations in manufacturing plants also necessitate investments in advanced safety protocols and equipment for employees.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for Corporate Social Responsibility (CSR) are intensifying, pushing companies like Iveco Group to prioritize ethical sourcing, fair labor, and community involvement. Consumers and stakeholders increasingly demand accountability, impacting brand perception and market share.

Iveco Group's sustainability efforts, such as its commitment to reducing CO2 emissions in its vehicle production and operations, directly shape its brand image and foster customer loyalty. For instance, Iveco's 2023 sustainability report highlighted a 15% reduction in Scope 1 and 2 emissions compared to 2022, a figure that resonates with environmentally conscious buyers and investors.

Transparent reporting on Environmental, Social, and Governance (ESG) metrics is crucial for maintaining investor confidence and attracting socially responsible investment. Iveco Group's proactive engagement in ESG reporting, including detailed data on its supply chain labor standards and community investment programs, strengthens its reputation as a responsible corporate citizen.

- Growing consumer demand for ethical products: Surveys in 2024 indicated that over 60% of European consumers consider a company's CSR practices when making purchasing decisions.

- Investor focus on ESG: Global ESG assets under management were projected to reach $50 trillion by the end of 2025, underscoring the financial importance of strong CSR performance.

- Iveco's sustainability targets: The company aims for carbon neutrality in its operations by 2040, aligning with global climate goals and stakeholder expectations.

- Community engagement initiatives: Iveco Group's partnerships with local communities, such as its support for vocational training programs, enhance its social license to operate.

Societal expectations for advanced safety features are increasingly influencing vehicle design and consumer choice. By 2025, over 80% of new passenger cars in major markets are expected to feature at least one Advanced Driver-Assistance System (ADAS). The EU's General Safety Regulation 2 (GSR2), fully implemented for all new vehicles by July 2024, mandates features like intelligent speed assistance, underscoring this trend.

Consumer demand for ethical products and corporate social responsibility (CSR) is growing, with surveys in 2024 showing over 60% of European consumers consider CSR practices in their purchasing decisions. Iveco Group's commitment to sustainability, including a target for operational carbon neutrality by 2040, aligns with these evolving societal values and investor focus on ESG assets, projected to reach $50 trillion by the end of 2025.

| Societal Factor | Impact on Iveco Group | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Safety Expectations | Drives demand for ADAS and enhanced vehicle safety features. | 80% of new passenger cars in major markets projected to have ADAS by 2025. EU GSR2 mandates features from July 2024. |

| CSR & Sustainability | Influences brand perception, customer loyalty, and investor attraction. | 60%+ European consumers consider CSR in purchasing (2024). ESG assets projected to reach $50T by end of 2025. |

| Workforce Dynamics | Impacts production capacity and operational costs due to skill shortages and labor relations. | Automotive sector globally grappled with filling specialized roles in 2024. Labor union negotiations in Europe in late 2024 could affect employment costs. |

Technological factors

The automotive industry's swift embrace of electrification and alternative powertrains, including hydrogen fuel cells, significantly shapes Iveco Group's future product development. This technological shift necessitates substantial investment in research and development for new powertrains and battery technologies, alongside retooling manufacturing facilities. Iveco Group's commitment to this transition is evident in its strategic partnerships and its stated goal to have zero-emission vehicles represent a significant portion of its portfolio by 2030.

Iveco Group is closely monitoring the rapid advancements in autonomous driving and vehicle connectivity, crucial for enhancing commercial vehicle operations. These technologies promise significant improvements in safety by reducing human error, a major cause of accidents, and boosting efficiency through optimized routing and platooning. For instance, by 2024, the global market for autonomous trucks is projected to reach $1.5 billion, highlighting the growing investment and potential.

The integration of advanced connectivity allows for real-time data sharing, enabling predictive maintenance and more streamlined logistics management. This means fewer breakdowns and better utilization of fleets. Iveco's focus on connected services aims to provide customers with enhanced visibility and control over their operations, anticipating a future where trucks communicate seamlessly with infrastructure and other vehicles.

However, the widespread adoption of autonomous driving faces hurdles. Evolving regulatory landscapes across different regions present a challenge, as do the critical needs for robust cybersecurity to protect connected vehicles from threats. Public perception and trust in autonomous technology also remain key factors that Iveco, like other industry players, must address to ensure successful market integration.

Iveco Group is actively integrating Industry 4.0 technologies like automation, robotics, and AI into its production lines. This strategic adoption aims to significantly boost manufacturing efficiency and lower operational costs.

The implementation of advanced analytics and big data is expected to refine Iveco's quality control, leading to more reliable vehicles. Furthermore, these digital transformations are paving the way for more agile and responsive production capabilities.

Investments in smart factories are a cornerstone of Iveco's digital transformation strategy, with significant capital allocated to upgrade existing facilities and build new, technologically advanced plants. For instance, the company's investment in its Valladolid plant in Spain exemplifies this, focusing on advanced automation and digital integration for its Daily van production.

Digitalization and Data Analytics

Iveco Group is increasingly leveraging digitalization across its entire value chain. This digital transformation impacts everything from the initial design and engineering phases to how vehicles are sold and serviced after purchase. For instance, Iveco's connected services aim to enhance efficiency and customer experience throughout the vehicle lifecycle.

Data analytics plays a crucial role in Iveco's operations. The company utilizes this technology for predictive maintenance, helping to anticipate potential issues before they cause downtime. Furthermore, data analytics aids in optimizing fleet management for customers and provides deeper insights into customer behavior, enabling more tailored offerings.

- Digitalization of Operations: Iveco's focus on digital tools streamlines R&D, manufacturing, and customer interactions.

- Data-Driven Services: Predictive maintenance and fleet management solutions are powered by advanced data analytics.

- Customer Insights: Understanding customer needs and usage patterns through data allows for personalized services and product development.

- Data Security Focus: Protecting sensitive customer and operational data is paramount in Iveco's connected ecosystem.

Materials Science and Lightweighting

Advancements in materials science, particularly lightweight composites and advanced alloys, are significantly impacting vehicle design. These materials enable manufacturers like Iveco Group to create lighter vehicles, directly improving fuel efficiency and increasing payload capacity. For instance, the use of carbon fiber reinforced polymers (CFRPs) and high-strength steel alloys can reduce vehicle weight by up to 20-30%, leading to substantial operational cost savings for fleet operators.

Sourcing and manufacturing with these novel materials present both challenges and opportunities. While they offer superior performance characteristics, the initial investment in new manufacturing processes and the cost of raw materials can be higher. However, the long-term benefits in terms of reduced fuel consumption and enhanced durability often outweigh these upfront costs. By 2024, the global market for advanced composites in automotive applications was projected to reach over $25 billion, highlighting the growing adoption.

The impact on vehicle performance, durability, and cost is multifaceted. Lightweighting improves acceleration, braking, and overall handling. Furthermore, advanced materials often exhibit greater resistance to corrosion and fatigue, extending vehicle lifespan. For example, Iveco's S-Way truck range incorporates lightweight materials to optimize aerodynamics and reduce the overall curb weight, contributing to a more sustainable and cost-effective transportation solution. These innovations are crucial for meeting evolving emissions standards and customer demands for efficiency.

- Material Innovation: Increased use of composites and alloys to reduce vehicle weight.

- Efficiency Gains: Improved fuel economy and higher payload capacity for commercial vehicles.

- Manufacturing Challenges: Higher initial costs and need for specialized production techniques.

- Performance Benefits: Enhanced durability, handling, and extended vehicle lifespan.

Technological advancements in electrification and alternative fuels are reshaping Iveco Group's product strategy, driving significant R&D investment into new powertrains and battery tech. The company aims for zero-emission vehicles to be a substantial part of its portfolio by 2030, reflecting a commitment to sustainable mobility solutions. This transition also involves retooling manufacturing facilities to accommodate these new technologies.

The increasing sophistication of autonomous driving and vehicle connectivity is a key focus for Iveco, promising enhanced safety and operational efficiency in commercial transport. By 2024, the global autonomous truck market is projected to hit $1.5 billion, underscoring the rapid growth in this sector and its potential impact on logistics. These advancements facilitate real-time data sharing for predictive maintenance and optimized fleet management.

Iveco Group is actively integrating Industry 4.0 technologies, such as automation and AI, into its manufacturing processes to boost efficiency and reduce costs. Investments in smart factories, like the Valladolid plant upgrade, exemplify this strategy. Digitalization across the value chain, from design to after-sales service, is also a priority, supported by data analytics for predictive maintenance and customer insights.

Materials science innovations, particularly lightweight composites and advanced alloys, are enabling Iveco to design more fuel-efficient vehicles with increased payload capacity. The use of materials like CFRPs can reduce vehicle weight by up to 30%, leading to significant operational cost savings for fleet operators. By 2024, the advanced composites market in automotive applications was expected to exceed $25 billion, indicating widespread adoption.

Legal factors

The Iveco Group operates under increasingly stringent global vehicle emissions regulations, such as the upcoming Euro 7 standards in Europe and evolving EPA standards in the United States. These legal frameworks directly influence product development, necessitating significant investment in cleaner technologies and potentially increasing compliance costs. For instance, the transition to Euro 7, expected to be fully implemented by 2027, will impose stricter limits on pollutants, requiring advanced exhaust after-treatment systems for both internal combustion engines and new powertrain technologies.

Non-compliance with these environmental laws can result in substantial financial penalties, as demonstrated by past cases where automotive manufacturers faced millions in fines for exceeding emission limits. This regulatory pressure compels Iveco to prioritize innovation in areas like electric powertrains and hydrogen fuel cell technology to meet future standards and maintain market access. Regional variations in environmental laws, such as differing timelines for adoption or specific pollutant targets, also require Iveco to tailor its product strategies and compliance efforts across diverse geographical markets.

Iveco Group faces stringent legal requirements concerning vehicle safety, encompassing design standards, robust recall procedures, and comprehensive consumer protection laws. Failure to meet these mandates can result in significant liabilities. For instance, in 2023, the automotive industry saw numerous recalls affecting millions of vehicles globally, highlighting the critical nature of compliance.

Product defects and subsequent accidents directly impact Iveco Group's legal exposure and brand reputation. The financial repercussions can be substantial, including hefty fines, compensation payouts, and increased insurance premiums. A damaged reputation can deter future customers and investors, as seen with past incidents involving major automotive manufacturers that experienced prolonged recovery periods.

Continuous adherence to international safety certifications, such as ECE regulations and FMVSS standards, is paramount. Iveco Group must ensure its vehicles meet these evolving global benchmarks to maintain market access and consumer trust. The increasing complexity of vehicle technology, including advanced driver-assistance systems, adds layers to these certification requirements.

Iveco Group faces growing challenges from data privacy and cybersecurity laws like GDPR and CCPA, especially with its connected vehicle technologies and digital services. These regulations demand stringent customer data protection, safeguarding intellectual property, and robust network security measures.

Failure to comply can lead to significant legal penalties; for instance, GDPR violations can result in fines of up to 4% of global annual turnover or €20 million, whichever is higher, as seen in various high-profile cases impacting automotive suppliers in recent years.

International Trade Laws and Sanctions

International trade laws, including tariffs and quotas, significantly impact Iveco Group's global supply chain and export operations. For instance, the European Union's trade policies and potential retaliatory tariffs from other nations can increase the cost of imported components and affect the competitiveness of Iveco vehicles in various markets. Geopolitical tensions, such as those seen in Eastern Europe in recent years, have led to sanctions that can disrupt established trade routes and necessitate costly adjustments to sourcing and distribution strategies.

Changes in trade agreements, like the ongoing evolution of EU-UK trade relations post-Brexit, can introduce new customs procedures and regulatory hurdles. These shifts can directly affect Iveco's ability to freely move vehicles and parts across borders, potentially impacting delivery times and overall profitability. Iveco's reliance on a complex international network means that navigating these evolving legal landscapes is crucial for maintaining operational efficiency and market access.

- Tariff Impact: Increased tariffs on steel or other raw materials could raise production costs for Iveco, potentially affecting vehicle pricing and demand.

- Sanctions Risk: Economic sanctions imposed on specific countries can limit Iveco's ability to sell vehicles or source components, forcing market diversification.

- Trade Agreement Shifts: Evolving trade deals may introduce new compliance requirements for emissions standards or vehicle safety, necessitating costly product adaptations.

- Supply Chain Disruption: Geopolitical instability and trade disputes can lead to delays and increased costs in Iveco's global logistics network.

Labor and Employment Laws

Iveco Group navigates a complex web of labor and employment laws across its global operations, impacting everything from minimum wages and working hours to collective bargaining rights and employee protections. For instance, in 2024, many European countries continued to see discussions around stricter regulations on gig economy workers, which could affect Iveco's supply chain and service networks. Changes in these legal frameworks can directly influence labor costs, necessitate adjustments in human resource strategies, and potentially lead to industrial disputes if not managed proactively.

The company must remain vigilant regarding evolving legislation concerning workplace safety, discrimination, and the right to organize. For example, ongoing debates in the United States and Canada regarding enhanced protections for unionized workers in the automotive sector could present new challenges or opportunities for Iveco. Adherence to ethical labor practices is not just a legal requirement but also crucial for maintaining brand reputation and attracting skilled talent.

- Jurisdictional Diversity: Iveco Group operates in over 100 countries, each with unique labor laws governing wages, benefits, and working conditions.

- Regulatory Impact: Changes in employment laws, such as those proposed in 2024 regarding mandatory paid sick leave in some US states, can directly increase operational expenses.

- Collective Bargaining: Strong union presence in key markets like Italy and Germany necessitates robust engagement with employee representative bodies.

- Ethical Labor: Maintaining fair wages and safe working environments is paramount, particularly as global scrutiny on corporate social responsibility intensifies.

Iveco Group must navigate evolving intellectual property laws, especially concerning its advanced vehicle technologies and digital platforms. Protecting patents for innovations in electric powertrains and autonomous driving systems is critical, as infringement can lead to significant financial losses and competitive disadvantage. The company also faces legal scrutiny regarding anti-trust regulations and fair competition practices in its key markets, requiring careful adherence to prevent regulatory action.

Environmental factors

Iveco Group faces mounting pressure from regulators, investors, and customers to significantly reduce its carbon footprint. This includes emissions generated during vehicle manufacturing and the operational emissions of the vehicles themselves. For instance, the European Union's stringent CO2 emission standards for heavy-duty vehicles are driving innovation in cleaner technologies.

The company is actively pursuing strategies for carbon neutrality, aligning with global commitments such as the Paris Agreement. Iveco Group has set targets to reduce its environmental impact, investing in electric and alternative fuel vehicle technologies. Their 2023 sustainability report highlighted progress in reducing Scope 1 and 2 emissions by 10.4% compared to 2022.

Climate change also presents operational risks for Iveco Group. Extreme weather events can disrupt supply chains, impact manufacturing facilities, and affect the availability of raw materials. The company is working to build resilience into its operations to mitigate these potential disruptions.

Growing concerns over resource depletion, especially for critical raw materials like rare earth elements essential for electric vehicle components, are pushing manufacturers towards circular economy models. Iveco Group is actively exploring these principles, focusing on enhancing the recyclability of its vehicles and increasing the use of recycled content in new models. This shift is crucial for supply chain resilience and effective waste management in the automotive sector.

Iveco Group faces increasing legal and societal pressure to minimize pollution from its manufacturing plants and vehicle emissions, with stricter regulations on air quality, water discharge, and soil contamination becoming standard across its operating regions.

The company is actively engaged in waste reduction initiatives, including the proper disposal of hazardous materials and ensuring strict adherence to environmental permits, a crucial aspect for maintaining operational licenses and corporate reputation.

Furthermore, Iveco Group acknowledges its extended producer responsibility for the end-of-life management of its vehicles, focusing on sustainable recycling and material recovery processes to lessen environmental impact.

Biodiversity and Ecosystem Impact

Iveco Group's extensive manufacturing footprint and global supply chain present potential risks to biodiversity and local ecosystems. The company's operations, including vehicle assembly plants and research facilities, require significant land, which can lead to habitat fragmentation. Furthermore, the sourcing of raw materials like steel, aluminum, and rubber can contribute to deforestation and ecosystem degradation if not managed responsibly. Environmental impact assessments are crucial for identifying and mitigating these risks.

Iveco Group is committed to minimizing its ecological footprint through various sustainability initiatives. This includes efforts to reduce waste, conserve water, and lower greenhouse gas emissions across its operations. The company is also exploring the use of more sustainable materials in its vehicles and supply chain. For instance, by 2023, Iveco Group reported a 12% reduction in CO2 emissions from its manufacturing activities compared to 2019 levels, demonstrating progress in operational efficiency.

- Land Use: Iveco Group operates numerous manufacturing sites globally, necessitating careful land management to avoid significant habitat disruption.

- Raw Material Sourcing: The extraction and processing of materials for vehicle production, such as metals and plastics, can have substantial environmental consequences on biodiversity.

- Sustainable Practices: The company is investing in cleaner production technologies and exploring circular economy principles to reduce its impact.

- Environmental Reporting: Iveco Group's sustainability reports, such as those released in 2024 covering 2023 data, detail their progress in environmental stewardship and impact reduction.

Energy Consumption and Renewable Energy Adoption

Iveco Group is actively assessing its energy consumption across its global manufacturing and operational sites, with a clear strategic focus on increasing the adoption of renewable energy sources. This transition is driven by both environmental stewardship and the pursuit of long-term cost efficiencies. The company is exploring investments in on-site solar power generation and has indicated interest in power purchase agreements for wind energy to reduce its reliance on fossil fuels.

The financial benefits are becoming increasingly apparent as energy markets fluctuate. For instance, by reducing dependence on volatile fossil fuel prices, Iveco Group can achieve more predictable operating expenses. Environmentally, this shift directly contributes to lowering its carbon footprint, aligning with stringent regulatory requirements and growing stakeholder expectations for sustainability. The company's 2023 sustainability report highlighted initial pilot projects for solar installations at select European facilities, aiming for a measurable reduction in grid electricity purchases.

- Energy Consumption Assessment: Ongoing evaluation of energy use across Iveco Group's production facilities.

- Renewable Energy Investments: Exploration and potential investment in solar, wind, and other clean energy technologies.

- Financial Advantages: Reducing operational costs and mitigating risks associated with fossil fuel price volatility.

- Environmental Impact: Lowering carbon emissions and enhancing overall sustainability performance.

Environmental regulations are a significant driver for Iveco Group, pushing for cleaner vehicle technologies and reduced manufacturing emissions. For example, the EU's stringent CO2 standards for heavy-duty vehicles are compelling innovation. The company's 2023 sustainability report noted a 10.4% reduction in Scope 1 and 2 emissions compared to 2022, demonstrating progress in this area.

Climate change poses operational risks, such as supply chain disruptions from extreme weather. Iveco Group is also addressing resource depletion by exploring circular economy principles, aiming for greater vehicle recyclability and increased use of recycled materials. By 2023, manufacturing CO2 emissions were down 12% from 2019 levels.

Iveco Group is actively assessing its energy consumption and increasing renewable energy adoption, with pilot solar projects underway at European facilities. This strategy not only lowers its carbon footprint but also offers financial benefits through more predictable operating expenses, mitigating fossil fuel price volatility.

| Environmental Factor | Iveco Group's Response/Impact | Relevant Data (as of 2023/2024) |

| Emissions Reduction | Adherence to EU CO2 standards, investment in electric/alternative fuels. | 10.4% reduction in Scope 1 & 2 emissions (vs. 2022), 12% reduction in manufacturing CO2 (vs. 2019). |

| Climate Change Risks | Building operational resilience against extreme weather. | Focus on supply chain robustness. |

| Resource Management | Exploration of circular economy models, increased recyclability. | Focus on recycled content in new models. |

| Energy Transition | Increasing renewable energy use, investing in solar/wind. | Pilot solar installations at European sites. |

PESTLE Analysis Data Sources

Our Iveco Group PESTLE Analysis is constructed using a diverse range of data sources, including reports from the International Monetary Fund (IMF), World Bank, and European Union agencies, alongside industry-specific publications and market research firms.