Isbank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isbank Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Isbank's trajectory. Our meticulously researched PESTLE analysis provides the strategic foresight you need to navigate complex market dynamics. Invest in actionable intelligence and gain a competitive advantage by downloading the full report today.

Political factors

The Turkish government's shift towards more orthodox macroeconomic policies, marked by tighter monetary policy and a focus on disinflation, significantly shapes Isbank's operational landscape. For instance, the Central Bank of the Republic of Turkey (CBRT) raised its policy rate to 45% by early 2024, a move intended to curb inflation, which had reached over 60% in 2023. This tightening directly impacts credit availability and borrowing costs for customers, potentially constraining loan growth and affecting net interest margins for banks like Isbank.

The Banking Regulation and Supervision Agency (BRSA) and the Central Bank of the Republic of Turkey (CBRT) provide a robust oversight framework for Turkish banks, including Isbank. These bodies enforce international standards such as Basel III, ensuring capital adequacy and liquidity. For instance, as of Q1 2024, the Turkish banking sector's capital adequacy ratio stood at a healthy 17.5%, well above the regulatory minimum.

Regulatory stability is paramount for Isbank's long-term strategic planning and effective risk management. Any shifts in capital requirements, liquidity rules, or credit growth limits directly influence the bank's operational capacity and profitability. For example, a tightening of liquidity rules could necessitate adjustments in Isbank's asset-liability management strategies to maintain compliance.

Turkey's strategic location places it at the crossroads of complex geopolitical dynamics, creating inherent risks for financial institutions like Isbank. Regional instability, such as ongoing conflicts or political tensions in neighboring countries, can directly impact investor confidence and lead to market volatility. For instance, heightened tensions in the Eastern Mediterranean in 2023 led to increased perceived risk for Turkish assets, affecting foreign capital inflows.

These geopolitical shifts can significantly influence Isbank's international operations and trade finance activities. A downturn in regional stability can disrupt trade routes and increase the cost of doing business, potentially impacting the bank's loan portfolio and fee income. In 2024, continued global economic uncertainty, coupled with regional flashpoints, presents ongoing challenges for managing cross-border financial exposures.

To navigate these challenges, Isbank must maintain a robust risk management framework. This includes diversifying its international presence and developing contingency plans to mitigate the impact of sudden geopolitical events. Proactive monitoring of regional developments and their potential economic repercussions is crucial for safeguarding the bank's financial health and ensuring business continuity.

Government Support for the Banking Sector

Government policies significantly shape the banking sector's operational environment. In Turkey, for example, the government has historically provided support to absorb economic shocks and steer lending towards strategic sectors. This support can manifest through various mechanisms, influencing how banks like Isbank operate and strategize.

Regulatory forbearance, such as temporary easing of capital requirements or loan classification rules, can offer banks breathing room during downturns. Furthermore, incentives for lending to Small and Medium-sized Enterprises (SMEs) and exporters are common, aiming to stimulate economic growth and employment. For instance, the Turkish government has utilized credit guarantee funds and interest rate subsidies to encourage lending to these vital economic segments, impacting the risk and return profiles for banks.

- Government intervention in the banking sector can include measures like regulatory forbearance to mitigate economic shocks.

- Incentives for lending to SMEs and export-oriented businesses are a key tool governments use to guide bank strategies.

- Such support mechanisms are designed to align bank operations with broader national economic objectives.

Political Volatility and Elections

Domestic political events, such as the upcoming general elections in Turkey, can create temporary market turbulence and currency fluctuations. For instance, the Turkish Lira experienced significant volatility in the lead-up to and following the 2023 general elections, impacting the broader economic landscape.

While the Turkish economy has demonstrated a degree of resilience, these political developments can influence investor sentiment and consumer confidence. This, in turn, may affect deposit growth and lending activity for institutions like Isbank. For example, periods of political uncertainty have historically correlated with shifts in foreign direct investment flows into Turkey.

Isbank needs to closely monitor these political dynamics to effectively adapt its strategies and ensure stability. This includes understanding how potential policy changes or shifts in government could impact the banking sector's regulatory environment and operational framework.

- Political Uncertainty Impact: Periods of political instability in Turkey have historically led to increased volatility in the Turkish Lira, with significant depreciations observed around key election cycles.

- Investor Sentiment: Foreign investor confidence can be sensitive to domestic political developments, potentially affecting capital inflows and the overall investment climate for Turkish financial institutions.

- Consumer Confidence: Political events can influence consumer spending and saving habits, which directly impacts deposit levels and demand for credit services at banks like Isbank.

The Turkish government's macroeconomic policies, including a recent shift towards tighter monetary conditions with the policy rate at 45% by early 2024 to combat inflation exceeding 60% in 2023, directly influence Isbank's lending and profitability. Regulatory bodies like the BRSA and CBRT enforce standards such as Basel III, with the banking sector maintaining a strong capital adequacy ratio of 17.5% as of Q1 2024, ensuring stability.

Geopolitical positioning creates risks, as regional instability can affect investor confidence and market volatility, impacting Isbank's international operations and trade finance. Domestic political events, such as election cycles, have historically caused Turkish Lira volatility and influenced investor sentiment, necessitating adaptive strategies from Isbank to manage these shifts.

Government intervention, including support for SMEs and exporters through credit guarantee funds and subsidies, shapes Isbank's strategic lending focus. These policies aim to align bank operations with national economic goals, influencing the risk-return profiles of their loan portfolios.

What is included in the product

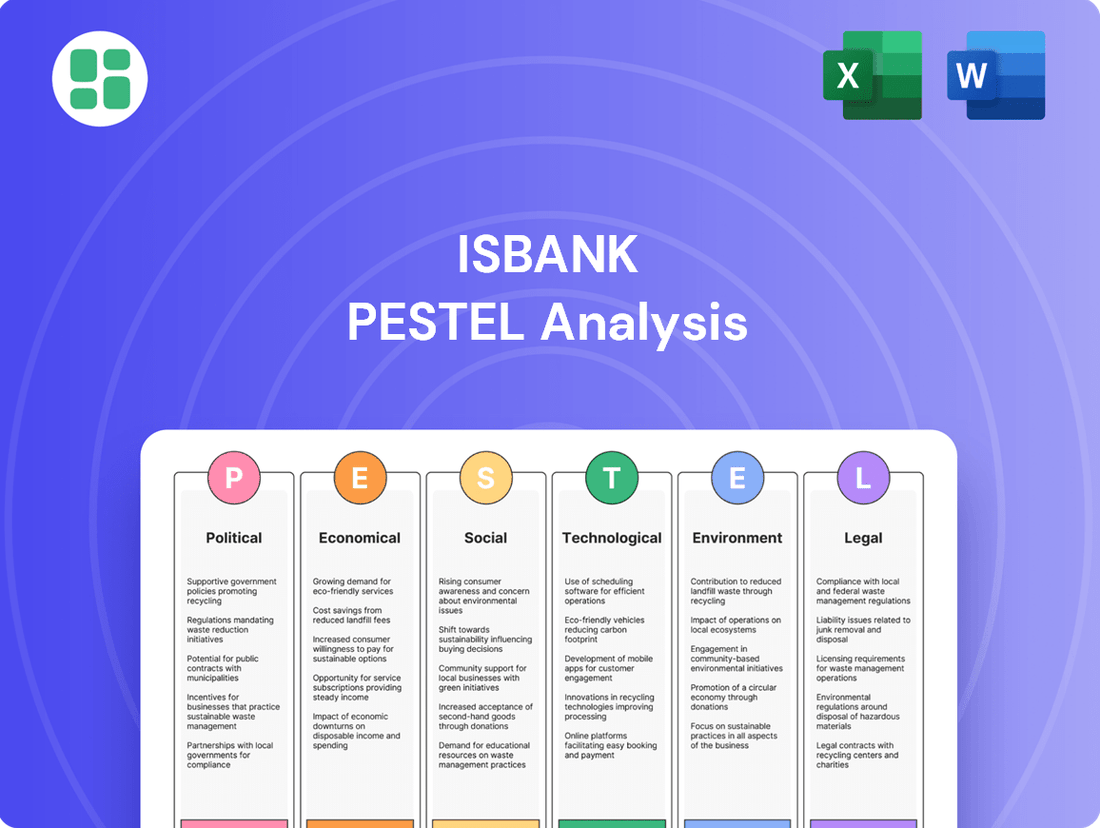

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Isbank across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify opportunities within Isbank's operating landscape.

Offers a clear, actionable roadmap by translating complex external factors identified in the Isbank PESTLE analysis into manageable strategic insights, thereby alleviating the burden of navigating uncertainty.

Economic factors

Türkiye has been grappling with elevated inflation, prompting the Central Bank of the Republic of Turkey (CBRT) to enact substantial policy rate increases. For instance, the policy rate stood at 45% as of April 2024, a significant jump from previous periods.

Isbank's General Manager has forecasted inflation to moderate to 22% and interest rates to decline to 25% by the close of 2025. This aligns with the CBRT's own target of bringing inflation down to 21% by the end of the same year.

This persistently high and fluctuating interest rate landscape directly affects Isbank's financial performance, influencing its net interest margins, the appetite for borrowing among customers, and overall profitability.

Turkey's economic growth significantly impacts demand for banking services. The economy expanded by 3.2% in 2024, indicating a degree of recovery.

However, Isbank's projections for 2025 suggest ongoing economic hurdles for the banking sector, with a target for stabilization by 2026. A robust and sustained economic rebound is essential for boosting both consumer and corporate loan volumes, directly benefiting Isbank's core business.

The Turkish banking sector has navigated a complex environment characterized by credit growth limitations and an uptick in non-performing loans (NPLs), especially within the retail and small and medium-sized enterprise (SME) segments. Despite these pressures, the sector's capital adequacy ratios remained robust as of the first quarter of 2024, with the overall NPL ratio standing at approximately 1.55% by April 2024, a slight increase from the previous year.

Looking ahead, the cost of risk is projected to escalate, reflecting the ongoing tight monetary policy and its impact on borrowers' repayment capacities. This challenging backdrop necessitates a strategic focus on asset quality for institutions like Isbank.

Isbank's proactive approach has centered on bolstering asset quality by prioritizing lending to high-quality SMEs and export-oriented businesses. This strategy aims to mitigate risks associated with tighter monetary conditions and ensure a more resilient loan portfolio, a crucial move given the economic landscape of 2024 and into 2025.

Exchange Rate Volatility

Exchange rate volatility significantly impacts Isbank's financial health. Fluctuations in the Turkish Lira (TRY) against major currencies directly affect the value of the bank's foreign currency-denominated assets and liabilities, thereby influencing its profitability and capital adequacy ratios. For instance, a weakening lira can increase the cost of foreign currency liabilities and reduce the value of foreign currency assets when translated back into lira.

The Central Bank of the Republic of Turkey (CBRT) is actively implementing policies aimed at discouraging dollarization and stabilizing the lira. These initiatives, such as reserve requirement adjustments and interest rate policies, have a direct bearing on Isbank's deposit structures and its ability to engage in foreign currency lending. For example, in early 2024, the CBRT maintained a tight monetary policy stance, with the policy rate at 45%, to combat inflation and support lira stability, which in turn influences the cost of funds for banks like Isbank.

Isbank must therefore adopt robust strategies to manage its foreign exchange exposure. This involves careful monitoring of currency markets, hedging strategies, and aligning its asset and liability maturities in different currencies. The bank's ability to navigate these exchange rate fluctuations is crucial for maintaining its competitive position and ensuring long-term financial stability in a dynamic economic environment.

- TRY/USD Performance: The Turkish Lira experienced significant depreciation against the US Dollar throughout 2023 and into early 2024, trading in the range of 30-32 TRY per USD, highlighting the ongoing challenge of currency stability.

- CBRT Policy Impact: The CBRT's continued high policy rate, maintained at 45% as of early 2024, aims to curb inflation and support the lira, impacting deposit rates and lending costs for banks.

- Foreign Currency Deposits: While efforts to de-dollarize are underway, foreign currency deposit holdings remain a significant factor for Turkish banks, requiring careful management of FX risk.

Consumer Spending and Investment Climate

Consumer confidence and spending are pivotal for retail banking. In early 2024, Turkey's consumer confidence index showed fluctuations, with inflation and interest rate hikes impacting discretionary spending, directly affecting demand for credit cards and personal loans. For instance, a persistent high inflation rate, hovering around 60% year-on-year in Q1 2024, can dampen consumer enthusiasm for large purchases financed by credit.

The business investment climate, shaped by economic stability and access to credit, dictates corporate and investment banking volumes. As of mid-2024, while global economic uncertainty persists, domestic economic policies aimed at stabilizing inflation and supporting growth are crucial. Isbank's strategic focus on sectors like tourism, which saw a significant rebound in 2023 with tourist arrivals exceeding 55 million, and Small and Medium-sized Enterprises (SMEs), which form the backbone of the Turkish economy, positions it to capitalize on recovery and growth trends.

- Consumer Confidence: Fluctuations in consumer confidence in early 2024, driven by inflation, impact demand for retail credit products.

- Inflation Impact: High inflation rates, persisting around 60% year-on-year in Q1 2024, affect consumer spending on non-essential goods.

- Investment Climate: Economic stability and credit availability are key drivers for corporate and investment banking activities.

- Sectoral Focus: Isbank's support for tourism, which welcomed over 55 million visitors in 2023, and SMEs is vital for navigating economic dynamics.

Turkey's economic trajectory in 2024 and 2025 is heavily influenced by inflation and interest rate policies. The Central Bank of the Republic of Turkey (CBRT) maintained a policy rate of 45% in April 2024, aiming to curb inflation, which Isbank's management forecasts to decrease to 22% by year-end 2025, aligning with the CBRT's target of 21% for the same period.

Economic growth, recorded at 3.2% in 2024, is crucial for banking demand, though Isbank anticipates stabilization by 2026, highlighting the need for sustained recovery to boost loan volumes.

The banking sector faces challenges such as credit growth limitations and rising non-performing loans (NPLs), with the overall NPL ratio at approximately 1.55% in April 2024, though capital adequacy remains robust.

Exchange rate volatility, particularly the Turkish Lira's depreciation against the USD (trading around 30-32 TRY/USD in early 2024), directly impacts Isbank's foreign currency assets and liabilities, necessitating careful FX risk management.

| Economic Indicator | Value/Status (Early-Mid 2024) | Outlook (2025) |

|---|---|---|

| Policy Rate (CBRT) | 45% (April 2024) | Projected to decline to 25% |

| Inflation Forecast (Isbank) | ~60% (Q1 2024) | Moderation to 22% |

| GDP Growth | 3.2% (2024) | Target for stabilization by 2026 |

| NPL Ratio (Banking Sector) | ~1.55% (April 2024) | Potential escalation of cost of risk |

| TRY/USD Exchange Rate | 30-32 TRY/USD | Ongoing volatility |

Preview Before You Purchase

Isbank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Isbank provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the bank's operations. You can confidently purchase knowing you are acquiring a complete and professionally structured report.

Sociological factors

Turkish consumers are rapidly embracing digital banking, with mobile banking usage seeing significant growth. For instance, data from early 2024 indicates a substantial portion of banking transactions are now conducted via mobile apps, a trend that continues to accelerate. This shift means Isbank must prioritize its digital infrastructure to meet evolving customer expectations for convenience and personalized online experiences.

The financial literacy of a nation's population directly influences its engagement with sophisticated financial products and investment opportunities. In Turkey, for instance, while efforts are underway to boost financial understanding, a significant portion of the populace still requires enhanced education to fully leverage financial services.

As digital banking solutions become more prevalent, expanding financial inclusion, especially for those previously unbanked, is a key societal objective. Isbank, by offering user-friendly digital platforms and educational resources, can play a crucial role in bridging this gap. By mid-2024, Turkey's banking sector saw a notable increase in digital transaction volumes, highlighting the growing reliance on and acceptance of these accessible channels.

Turkey's demographic profile, characterized by a significantly young population, presents a dynamic market for banking services. This youth bulge, coupled with a strong trend towards urbanization, directly impacts demand for specific financial products. For instance, there's a growing need for youth-oriented accounts, digital banking solutions that appeal to tech-savvy younger generations, and accessible housing loans concentrated in expanding urban centers.

Isbank must strategically adapt its product portfolio and distribution channels to effectively serve these evolving demographic needs and population concentrations. By understanding that a substantial portion of Turkey's population is under 30, the bank can prioritize digital transformation and tailor offerings to attract and retain younger customers, who are increasingly driving economic activity and financial innovation.

Social Responsibility and Ethical Banking

Customers and stakeholders increasingly expect financial institutions like Isbank to operate with a strong sense of social responsibility. This includes ethical lending, transparent dealings, and active community involvement. For instance, in 2024, consumer surveys indicated that over 70% of banking customers consider a bank's ethical practices when choosing where to deposit their money.

Isbank, as a major player in the financial sector, faces pressure to not only meet regulatory requirements but also to proactively contribute to societal well-being. This extends beyond traditional financial services to areas like environmental sustainability and fair labor practices. Reports from 2024 highlighted a significant rise in corporate social responsibility (CSR) reporting by major banks, with an average increase of 15% in dedicated CSR sections compared to the previous year.

- Growing Consumer Demand: A significant majority of consumers, often upwards of 70% in recent studies, now prioritize ethical practices when selecting a bank.

- Enhanced CSR Reporting: Banks are increasingly dedicating more resources and space to detailing their corporate social responsibility initiatives, with a noticeable year-on-year increase in transparency.

- Community Investment: Expectations are high for banks to invest in and support local communities through various programs and initiatives, fostering goodwill and social impact.

- Ethical Lending Focus: Practices such as fair interest rates, responsible debt collection, and avoiding predatory lending are becoming non-negotiable expectations for reputable banks.

Workforce Demographics and Talent Management

The demographic shifts in Turkey's workforce, characterized by a growing proportion of younger, digitally adept individuals, directly influence Isbank's approach to human capital. This evolving talent pool expects modern work environments and continuous learning opportunities.

Isbank faces the critical challenge of attracting and retaining specialized talent, particularly in high-demand fields like artificial intelligence, cloud computing, and cybersecurity. For instance, by the end of 2024, the demand for AI specialists in Turkey was projected to grow by over 30%, a trend Isbank must navigate.

- Younger Workforce: A significant portion of Turkey's population is under 30, representing a digitally native segment entering the job market.

- Skills Gap: There's a pronounced need for advanced digital skills, with banks like Isbank competing for talent in areas such as data science and cybersecurity.

- Talent Retention: Investing in competitive compensation, career development programs, and a positive work culture is essential to retain skilled employees amidst high demand.

- Digital Transformation: Isbank's success in its digital transformation hinges on its ability to build and maintain a workforce proficient in cutting-edge technologies.

Societal expectations are increasingly shaping the banking landscape, with a strong emphasis on corporate social responsibility and ethical conduct. By mid-2024, consumer surveys consistently showed that over 70% of individuals consider a bank's social and ethical practices when making financial decisions, influencing brand loyalty and customer acquisition.

Technological factors

Isbank is actively engaged in a comprehensive digital transformation, a crucial move to stay ahead in the competitive financial sector and cater to changing customer needs. This initiative focuses on modernizing every aspect of service, from the ease of opening an account to the efficiency of loan processing, by adopting cutting-edge technologies.

The bank is investing heavily in digital channels, aiming to enhance user experience and operational efficiency. For instance, by the end of 2024, Isbank reported a significant increase in digital transaction volumes, with mobile banking usage growing by 15% year-over-year, reflecting a strong customer shift towards digital platforms.

Successfully integrating these innovative digital solutions with stringent risk management protocols is paramount for Isbank's sustained growth and stability in the rapidly evolving digital financial ecosystem. This careful balance ensures that technological advancements do not compromise security or regulatory compliance.

Cybersecurity is a critical concern for Isbank, especially with the growing digital landscape. In 2024, global cybercrime costs were projected to reach $10.5 trillion annually, a stark reminder of the financial and reputational risks. Protecting sensitive customer data and maintaining the integrity of digital banking platforms against evolving threats like ransomware and phishing attacks are therefore top priorities for the bank.

Isbank's commitment to robust cybersecurity is essential for maintaining customer trust and operational continuity. The bank is likely investing in advanced security measures, potentially including AI-powered threat detection systems, to proactively identify and mitigate cyber risks. This focus on digital resilience is vital in an era where data breaches can have severe consequences.

The banking sector, including Isbank, faces intensified competition from agile fintech firms. These companies are rapidly innovating in areas like digital payments, lending, and wealth management, often offering more user-friendly experiences. For instance, by the end of 2024, fintech investment globally was projected to reach over $150 billion, highlighting the sector's dynamism.

However, this competition also presents opportunities for collaboration. Isbank can leverage partnerships with fintechs to integrate new technologies, improve operational efficiency, and expand its service portfolio. By collaborating on areas like blockchain-based payment solutions or AI-driven personalized financial advice, Isbank can enhance its digital offerings and better cater to evolving customer expectations, potentially capturing a larger share of the digital financial services market.

Adoption of AI and Big Data Analytics

Isbank's strategic advantage hinges on its ability to harness AI and big data. By leveraging these technologies, the bank can gain deeper insights into customer preferences, allowing for hyper-personalized product offerings and service delivery. This data-driven approach also streamlines operations, from automating compliance checks to enhancing fraud detection systems, ultimately boosting efficiency and reducing risk.

The adoption of AI and big data analytics is crucial for Isbank's competitive edge in the evolving financial landscape. For instance, AI-powered credit scoring models can improve loan portfolio quality, a critical factor in the current economic climate. Furthermore, the bank can utilize predictive analytics to anticipate market trends and customer needs, enabling proactive service development. In 2024, the global AI market in financial services was projected to reach over $30 billion, highlighting the significant investment and potential in this area.

- Customer Insight: AI analyzes vast datasets to understand individual customer behavior, leading to tailored product recommendations and improved customer satisfaction.

- Operational Efficiency: Automation of routine tasks, such as compliance monitoring and data entry, frees up human resources for more strategic functions.

- Risk Management: Predictive analytics powered by big data enhances credit risk assessment and strengthens fraud detection capabilities.

- Personalized Services: AI enables the creation of customized banking experiences, from personalized investment advice to tailored loan packages.

Mobile Banking and Payment Systems Evolution

The banking sector is witnessing a significant shift with the accelerated adoption of mobile banking and the rapid evolution of payment systems. By the end of 2024, it's projected that over 85% of global banking customers will be using mobile banking services, a substantial increase from just a few years prior. This trend necessitates that Isbank continues to prioritize investments in intuitive and highly secure mobile applications. Furthermore, integrating with emerging payment infrastructures is crucial for staying competitive.

Innovations like QR code payments and real-time payment systems, such as Turkey's own FAST (Financial Interbank Payment System), are fundamentally changing customer-bank interactions. FAST transactions, for instance, saw a significant surge in volume during 2024, handling billions of lira daily. Isbank's strategic imperative is to seamlessly integrate with these modern payment infrastructures to enhance customer experience and maintain its market leadership.

- Mobile banking adoption is projected to exceed 85% globally by the end of 2024.

- Real-time payment systems like FAST are experiencing exponential growth in transaction volumes.

- Isbank must focus on user experience and security in its mobile banking offerings.

- Integration with modern payment infrastructures is key to Isbank's competitive strategy.

Isbank is prioritizing digital transformation, evident in its substantial investment in modernizing services and enhancing digital channels. By the close of 2024, mobile banking usage saw a 15% year-over-year increase, underscoring a strong customer shift.

Cybersecurity is paramount, with global cybercrime costs projected to reach $10.5 trillion annually in 2024. Isbank is likely implementing advanced measures, such as AI-powered threat detection, to safeguard customer data and maintain platform integrity.

The bank leverages AI and big data for deeper customer insights and operational efficiency. The global AI market in financial services was expected to exceed $30 billion in 2024, highlighting the sector's focus on these technologies for improved credit scoring and predictive analytics.

Isbank must integrate with emerging payment systems, as mobile banking is projected to be used by over 85% of global customers by the end of 2024. Innovations like Turkey's FAST system are transforming interactions, with billions of lira processed daily in 2024.

| Technology Focus | 2024 Projection/Data | Impact on Isbank |

|---|---|---|

| Digital Transformation Investment | Significant | Modernization of services, enhanced user experience |

| Mobile Banking Growth | 15% YoY increase in usage (end of 2024) | Need for intuitive and secure mobile applications |

| Cybersecurity Threats | Global costs projected at $10.5 trillion annually (2024) | Proactive investment in advanced security measures |

| AI in Financial Services Market | Projected over $30 billion (2024) | Enhanced customer insight, operational efficiency, risk management |

| Real-time Payment Systems (e.g., FAST) | Billions of lira processed daily (2024) | Integration for competitive advantage and customer experience |

Legal factors

Isbank operates within the framework of the Turkish Banking Law, a critical legal structure that governs all banking activities in the country. This law mandates adherence to stringent operational and financial standards, ensuring stability and consumer protection within the financial sector.

Furthermore, Isbank, like other major global financial institutions, must comply with Basel III international regulatory standards. These regulations are designed to strengthen bank capital requirements, improve risk management, and increase transparency, with a key requirement being a minimum capital adequacy ratio of 12% for Turkish banks.

Compliance with Basel III ensures that Isbank maintains sufficient capital reserves to absorb unexpected losses and manage liquidity risks effectively. This adherence is vital for Isbank's financial resilience, especially in the face of evolving global economic conditions and potential financial market volatility.

Turkey's data protection landscape, significantly shaped by amendments effective June 2024 and projected for February 2025, places stringent demands on how personal and sensitive financial information is handled and moved across borders. Isbank must rigorously adhere to these evolving regulations, which include specific data residency mandates for financial data, ensuring all operations align with these legal requirements.

Turkey's Financial Crimes Investigation Board (MASAK) is enhancing Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, with new rules targeting crypto-asset service providers and electronic money institutions set to take effect in late 2024 and early 2025. This tightening of oversight is a global trend, with FATF recommendations continuing to shape national frameworks.

Isbank, like all financial institutions, must rigorously implement customer due diligence, including robust identity verification and ongoing transaction monitoring. The bank is also obligated to report any suspicious activities promptly to MASAK, ensuring compliance with evolving legal mandates designed to prevent financial crime.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for Isbank. Laws like Turkey's Law No. 6502 on Consumer Protection are designed to ensure banks treat their customers fairly and transparently. This legislation mandates clear disclosure of terms for financial products such as loans and credit cards, and establishes processes for handling customer complaints and resolving disputes.

Isbank must diligently adhere to these regulations to safeguard consumer rights. This includes providing accurate information about interest rates, fees, and repayment schedules for all its offerings. Compliance ensures that customers understand the financial products they are engaging with, fostering trust and preventing potential legal challenges.

- Transparency Mandates: Isbank must ensure all financial product terms, including those for loans and credit cards, are presented clearly and understandably to consumers, as per Law No. 6502.

- Fair Practice Enforcement: The bank's operational procedures must align with regulations that prevent unfair or deceptive practices in its dealings with customers.

- Dispute Resolution Framework: Isbank needs robust internal mechanisms to address customer grievances effectively, in line with established legal dispute resolution pathways.

Fintech-Specific Regulations

Turkey's fintech sector is a dynamic area, with regulators actively shaping its growth. New rules govern electronic money, payment services, and even crypto-assets, reflecting the evolving digital financial landscape. For instance, by the end of 2023, the number of licensed payment institutions in Turkey had grown significantly, indicating increased regulatory activity and market participation.

While cryptocurrency trading isn't banned, the Central Bank of the Republic of Turkey (CBRT) has imposed notable restrictions on using crypto-assets for payments. This means institutions like Isbank must carefully consider these limitations when exploring or implementing fintech innovations. Understanding these specific legal frameworks is crucial for compliance and successful fintech integration.

- Evolving Fintech Regulations: Turkey has introduced specific laws for electronic money, payment services, and crypto-assets, impacting financial innovation.

- Crypto Payment Restrictions: The CBRT has placed significant limitations on the use of cryptocurrencies for payments, requiring careful navigation by financial institutions.

- Navigating Compliance: Isbank must stay abreast of these fintech-specific regulations to ensure its digital financial solutions are compliant and effective.

Isbank operates under a comprehensive legal framework, including the Turkish Banking Law and international Basel III standards, which mandate strong capital adequacy, with Turkish banks needing a minimum 12% capital adequacy ratio. New data protection amendments, effective mid-2024 and early 2025, impose strict rules on handling financial data, including residency requirements.

The bank must also comply with enhanced Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations from MASAK, which are increasingly targeting digital assets and requiring robust customer due diligence and suspicious activity reporting. Consumer protection laws, such as Law No. 6502, ensure fair practices and transparent disclosure for all financial products, with a focus on clear terms for loans and credit cards and effective dispute resolution mechanisms.

Turkey's dynamic fintech sector is governed by specific regulations for electronic money and payment services, alongside restrictions on cryptocurrency use for payments by the Central Bank of the Republic of Turkey (CBRT). Isbank must navigate these evolving rules, particularly concerning crypto-asset service providers, to ensure compliance and successful integration of digital financial solutions.

| Legal Area | Key Regulations/Requirements | Impact on Isbank |

|---|---|---|

| Banking Law | Adherence to operational and financial standards | Ensures stability and consumer protection |

| International Standards | Basel III (min. 12% capital adequacy ratio) | Strengthens capital, risk management, and transparency |

| Data Protection | Amendments effective mid-2024/early 2025 (data residency) | Requires rigorous adherence to personal data handling rules |

| AML/CTF | MASAK regulations, FATF recommendations | Mandates strict customer due diligence and suspicious activity reporting |

| Consumer Protection | Law No. 6502 (transparency, fair practice, dispute resolution) | Ensures clear product terms and effective grievance handling |

| Fintech & Crypto | CBRT payment restrictions, specific fintech regulations | Requires careful navigation of digital asset use and innovation compliance |

Environmental factors

Isbank is actively integrating Environmental, Social, and Governance (ESG) principles into its operations, evidenced by its issuance of sustainable finance allocation reports and green bonds. This strategic shift aligns with a broader global movement towards responsible investment practices.

The bank has set ambitious targets for sustainable finance, aiming to allocate significant capital towards environmentally and socially beneficial projects. For instance, Isbank's 2023 sustainability report highlighted a substantial increase in its green financing portfolio, demonstrating tangible progress towards its ESG leadership aspirations.

These initiatives are bolstered by strategic partnerships with international organizations focused on sustainable development. This commitment reflects Isbank's understanding that ESG performance is increasingly crucial for long-term financial health and stakeholder trust in the evolving financial landscape.

Isbank faces significant climate change impacts, with physical risks like extreme weather events potentially affecting borrowers in agriculture and tourism, sectors crucial to Turkey's economy. For instance, a severe drought in 2024 could directly impact the repayment capacity of agricultural loans, a key segment for Turkish banks.

Transition risks, stemming from new carbon regulations and a shift towards greener industries, also pose a challenge. Isbank must evaluate how its loan portfolio, particularly in energy-intensive sectors, aligns with Turkey's evolving climate commitments, such as those under the Paris Agreement.

Managing these climate-related financial risks is paramount. By 2025, Isbank could proactively adjust its lending strategies, favoring sectors aligned with sustainability goals and potentially offering green financing options to mitigate exposure and capitalize on emerging opportunities in renewable energy projects.

There's a clear surge in demand for green finance products, like green loans and bonds, designed to back eco-conscious projects and companies. Isbank is actively engaging in this area, using its strong financial foundation to fund green initiatives and digital advancements, often in line with recommendations from organizations such as the EBRD.

Operational Environmental Footprint

Isbank faces increasing pressure to manage its operational environmental footprint, particularly concerning energy consumption, waste generation, and resource utilization across its wide network of branches and critical data centers. Stakeholders anticipate the bank will actively implement strategies to minimize its ecological impact and embed sustainability into its core operational practices.

In line with sustainability goals, Isbank has focused on reducing its carbon emissions. For instance, in 2023, the bank continued its efforts to decrease energy consumption in its branches and offices, aiming for a significant reduction in its overall carbon footprint by 2030. This includes investments in energy-efficient technologies and digital transformation initiatives to reduce paper usage.

- Energy Efficiency: Isbank is upgrading its branches and data centers with energy-saving lighting and HVAC systems.

- Waste Management: The bank is implementing enhanced recycling programs and reducing paper consumption through digitalization.

- Resource Conservation: Initiatives are in place to optimize water usage and promote responsible sourcing of materials.

- Renewable Energy: Exploration into the use of renewable energy sources for its facilities is an ongoing priority.

Compliance with Environmental Regulations

Compliance with environmental regulations, while not directly dictating banking operations, significantly influences Isbank's corporate clients. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023 and fully operational by 2026, imposes carbon costs on imports. This policy directly impacts Turkish exporters, potentially affecting their profitability and Isbank's loan portfolio. Isbank may need to proactively advise its clients on adopting greener technologies and sustainable operational practices to mitigate these indirect financial risks and ensure continued market access.

The growing global emphasis on climate action translates into stricter environmental standards that Isbank's clients must meet. Failure to adapt can lead to increased operational costs, reduced competitiveness, and potential credit downgrades for businesses. Consequently, Isbank's lending strategies will likely need to incorporate environmental risk assessments, encouraging clients to invest in energy efficiency and renewable energy sources. This shift supports a more resilient and sustainable economic ecosystem, aligning with international sustainability goals and potentially opening new avenues for green financing.

- CBAM Implementation: The EU's Carbon Border Adjustment Mechanism, phased in from October 2023, directly impacts Turkish exporters, influencing their financial health and Isbank's lending exposure.

- Climate Risk Integration: Isbank is increasingly expected to integrate climate-related risks into its credit assessment and portfolio management to ensure long-term stability.

- Green Finance Opportunities: The push for environmental compliance creates opportunities for Isbank to finance green projects and support clients in their transition to sustainable operations.

Environmental factors significantly shape Isbank's strategic direction, pushing it towards sustainable finance and robust climate risk management. The bank's proactive stance on green bonds and its increasing allocation to eco-friendly projects, as seen in its 2023 sustainability report, underscore this commitment. Isbank is actively working to reduce its operational footprint, implementing energy efficiency measures in its branches and offices, and exploring renewable energy options.

The bank must navigate transition risks arising from evolving climate regulations, such as the EU's Carbon Border Adjustment Mechanism (CBAM), which began its phased implementation in October 2023 and will be fully operational by 2026. This mechanism directly affects Turkish exporters, influencing their financial health and, consequently, Isbank's lending exposure. Isbank's lending strategies are increasingly incorporating environmental risk assessments, encouraging clients to invest in sustainable practices and green technologies.

| Environmental Factor | Impact on Isbank | Isbank's Response/Initiatives |

|---|---|---|

| Climate Change Impacts | Physical risks (e.g., extreme weather) affecting key sectors like agriculture and tourism, impacting loan portfolios. Transition risks from new carbon regulations and shifts to greener industries. | Proactive adjustment of lending strategies, favoring sustainable sectors, offering green financing options. Evaluating loan portfolio alignment with climate commitments. |

| Demand for Green Finance | Growing market for green loans and bonds, creating opportunities for funding eco-conscious projects. | Actively engaging in green finance, leveraging financial foundation to fund green initiatives and digital advancements. |

| Operational Environmental Footprint | Pressure to manage energy consumption, waste generation, and resource utilization across its network. | Implementing energy-saving lighting and HVAC systems, enhanced recycling programs, reducing paper consumption via digitalization, exploring renewable energy sources. |

| Environmental Regulations | Indirect influence on corporate clients through regulations like EU's CBAM, impacting their profitability and Isbank's loan portfolio. | Advising clients on adopting greener technologies and sustainable practices to mitigate indirect financial risks and ensure market access. Integrating climate risk into credit assessment and portfolio management. |

PESTLE Analysis Data Sources

Our Isbank PESTLE Analysis is built on data from the Central Bank of the Republic of Turkey, the Turkish Statistical Institute (TurkStat), and reputable international financial institutions like the IMF and World Bank. We also incorporate insights from industry-specific reports and reputable business news outlets.