Isbank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isbank Bundle

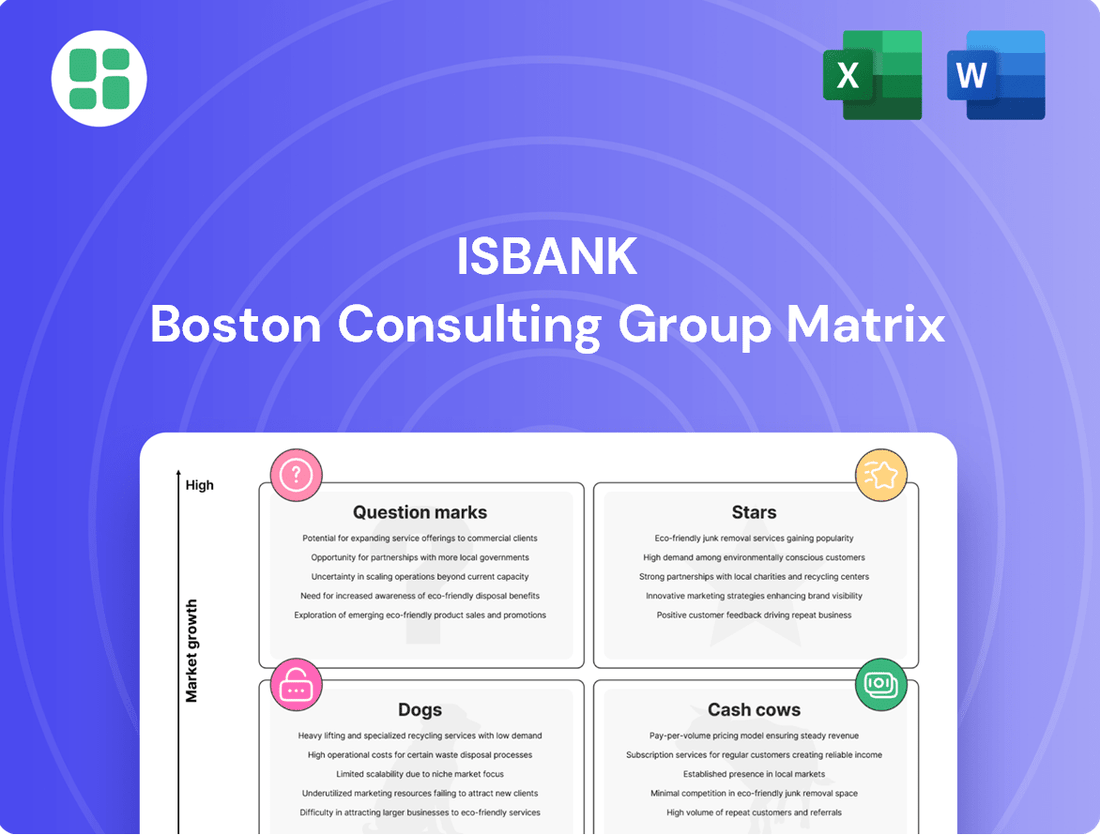

Isbank's BCG Matrix offers a crucial snapshot of its product portfolio, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is key to navigating the competitive banking landscape. Purchase the full BCG Matrix to unlock detailed quadrant analysis and actionable strategies for optimizing Isbank's market position and future investments.

Stars

İşCep, İşbank's mobile banking platform, shines as a Star in the BCG matrix. It was recognized as CEE's best digital bank in 2025 by Euromoney and the World's Best Mobile Banking Application by Global Finance. This signifies its strong competitive position in a high-growth market.

By 2025, İşCep served 15.4 million customers, offering over 800 functions. This extensive reach and functionality contribute to its high market share. The platform is experiencing rapid growth in both user adoption and transaction volume, reinforcing its Star status.

The dominance of İşCep is evident as four out of every five of the bank's transactions are now conducted via mobile. This trend underscores the platform's critical role in a rapidly expanding digital banking landscape, demonstrating its continued strong performance and future potential.

Isbank's Small and Medium-sized Enterprise (SME) lending is a clear Star within its portfolio. The bank saw a substantial 14% growth in SME loans during the first quarter of 2025, which is considerably higher than the overall banking sector's 7.4% expansion. This robust growth in a key segment highlights Isbank's strategic advantage.

With a commanding 22% market share in SME lending among private banks, Isbank demonstrates significant strength in this high-growth area. This strong position allows the bank to effectively capitalize on the expanding SME market, contributing to a balanced growth profile and improved asset quality.

Export Lending is a Star for Isbank within the BCG Matrix framework. Isbank holds a significant 30% market share in this crucial sector, reflecting its strong presence in a vital part of the Turkish economy. This segment is characterized by growth and strategic importance, making it a key area for the bank.

The resilience of export lending is further underscored by the fact that 40% of its foreign exchange loans are linked to low-risk export activities. This stability, combined with the segment's growth potential, solidifies its Star status. Isbank's focus on export-oriented businesses directly supports national economic goals and generates consistent, high-growth revenue.

Sustainable Finance Initiatives

Isbank's sustainable finance initiatives are positioned as a Star within its BCG Matrix, reflecting a high-growth, high-market-share segment. The bank has set an ambitious target of 300 billion TL, approximately $8.3 billion, for sustainable financing by 2026. This aggressive expansion is further evidenced by the bank's successful issuance of a $500 million green bond in the first quarter of 2025, which saw an oversubscription of threefold, indicating strong investor demand.

Isbank's leadership in Environmental, Social, and Governance (ESG) practices, bolstered by strategic partnerships and significant financial commitments, solidifies its Star status. This segment is experiencing rapid expansion in the financial market, driven by increasing investor focus on sustainability. The bank's strong performance here not only contributes to its growth but also enhances its brand reputation and appeal to environmentally and socially conscious investors.

- Sustainable Financing Target: 300 billion TL by 2026.

- Green Bond Issuance (Q1 2025): $500 million, oversubscribed threefold.

- Market Position: Leadership in ESG and green finance.

- Investor Appeal: Attracts ESG-focused investors and enhances brand value.

AI-Powered Conversational Banking (Maxi)

Maxi, Isbank's AI-powered conversational banking assistant, is a prime example of a Star in the BCG matrix. In 2024, it served 11.5 million customers, facilitating 103 million dialogues. This extensive usage highlights its strong market penetration and customer engagement.

The recent integration of generative AI for investment and credit services further solidifies Maxi's position as a high-growth product. This expansion into more sophisticated AI applications within banking positions Isbank at the forefront of technological innovation.

- Customer Reach: 11.5 million customers in 2024.

- Dialogue Volume: 103 million dialogues in 2024.

- Growth Driver: Extension with generative AI for investment and credit.

- Market Position: Leading in the emerging AI in banking sector.

Isbank's digital banking platform, İşCep, is a standout Star. Recognized as CEE's best digital bank in 2025 by Euromoney, it served 15.4 million customers by 2025, with over 80% of the bank's transactions occurring via mobile. This dominance in a high-growth digital market clearly marks it as a Star.

Maxi, the AI-powered conversational assistant, is another Star. In 2024, Maxi engaged with 11.5 million customers through 103 million dialogues, with its capabilities expanding into generative AI for investment and credit services, positioning it for continued high growth.

SME lending and export financing are also Stars for Isbank. SME loans grew 14% in Q1 2025, with Isbank holding a 22% market share among private banks. For export lending, Isbank commands a 30% market share, with 40% of its foreign exchange loans linked to low-risk export activities, indicating strong performance in growing sectors.

Sustainable finance is a key Star, with a target of 300 billion TL by 2026. The successful Q1 2025 issuance of a $500 million green bond, oversubscribed threefold, highlights strong market demand and Isbank's leadership in ESG initiatives.

| Product/Service | BCG Category | Key Metrics (2024-2025) | Market Position | Growth Indicator |

| İşCep (Mobile Banking) | Star | 15.4M Customers (2025); 80%+ of transactions mobile | CEE's Best Digital Bank (2025) | High user adoption & transaction volume |

| Maxi (AI Assistant) | Star | 11.5M Customers (2024); 103M Dialogues (2024) | Leading AI in Banking | Generative AI integration |

| SME Lending | Star | 14% loan growth (Q1 2025); 22% market share (private banks) | Strong market share | High growth in key segment |

| Export Financing | Star | 30% market share; 40% FX loans linked to exports | Significant sector presence | Stable, growth-oriented segment |

| Sustainable Finance | Star | 300B TL target (2026); $500M Green Bond (Q1 2025, 3x oversubscribed) | ESG Leadership | Rapid market expansion |

What is included in the product

The Isbank BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

It guides investment decisions, highlighting which units to invest in, hold, or divest based on market growth and share.

The Isbank BCG Matrix offers a clear, one-page overview, instantly relieving the pain of deciphering complex business unit performance.

Cash Cows

Isbank's traditional retail deposit base is a prime example of a Cash Cow within its business portfolio. By the close of 2024, these stable accounts held over TL 2.1 trillion in deposits, highlighting a substantial and loyal customer foundation.

This extensive base offers Isbank a consistent and cost-effective funding stream, reliably generating interest income. Despite the mature and slow-growth nature of the traditional deposit market, Isbank's strong market position ensures a predictable and significant inflow of cash.

Isbank's large corporate lending segment, as the largest private bank in Turkey by total loans, represents a significant cash cow. This area, characterized by established client relationships and generally lower risk, provides a stable and substantial source of interest income. For instance, in 2024, Isbank's corporate and commercial loan portfolio continued to be a cornerstone of its profitability, contributing a significant portion of its net interest income.

Isbank's conventional credit card portfolios represent a significant Cash Cow. This established business, though in a mature market, consistently delivers substantial fee and interest income from a broad customer base. In 2024, Turkish credit card spending saw a notable increase, with total transaction volumes reaching trillions of Turkish Lira, underscoring the scale of this segment for Isbank.

Extensive Branch Network

Isbank's extensive branch network in Turkey acts as a significant Cash Cow. This vast physical presence continues to attract and serve a substantial portion of its customer base, particularly for traditional banking needs. Even with the rise of digital platforms, these branches offer a crucial touchpoint for customer acquisition and handling specific transactions, solidifying Isbank's large market share.

The network's primary contribution is generating consistent, though modest, fee and service income. In 2024, Isbank reported that its physical branches, despite the digital shift, still played a vital role in customer engagement and transaction volume. For instance, while digital transactions surged, a notable percentage of new account openings and loan applications still originated or were finalized through branch interactions.

- Steady Income Generation: The extensive branch network consistently generates reliable fee and service income for Isbank, a hallmark of a Cash Cow.

- Foundational Customer Presence: Physical branches provide a stable base for customer acquisition and retention, especially for those preferring traditional banking methods.

- Market Share Support: The network reinforces Isbank's significant market share in Turkey by catering to diverse customer needs and preferences.

- Low Growth, High Stability: While not a high-growth area, the branches offer predictable revenue streams, contributing to the bank's overall financial stability.

Core Payment Systems and Transaction Banking

Isbank's core payment systems, encompassing money transfers and a diverse array of payment services, are robustly handling a substantial volume of transactions. This consistent activity is a significant driver of fee income for the bank, reflecting their established position in the market.

These fundamental banking services are crucial in a mature market, affording Isbank a high market share and ensuring stable, predictable revenue streams. The low requirement for extensive promotional investment in these established areas further bolsters their profitability.

The bank's operational efficiency in managing these payment systems directly contributes to its overall financial health. For instance, in 2024, Isbank reported a notable increase in transaction volumes across its digital payment channels, underscoring the continued reliance on these core services.

- High Transaction Volume: Core payment systems facilitate a large number of daily transactions.

- Consistent Fee Income: These services generate reliable revenue through fees.

- Mature Market Dominance: Isbank enjoys a strong market share in established payment services.

- Profitability Driver: Efficient operations in this segment significantly boost overall bank profitability.

Isbank's traditional retail deposit base is a prime example of a Cash Cow within its business portfolio. By the close of 2024, these stable accounts held over TL 2.1 trillion in deposits, highlighting a substantial and loyal customer foundation.

This extensive base offers Isbank a consistent and cost-effective funding stream, reliably generating interest income. Despite the mature and slow-growth nature of the traditional deposit market, Isbank's strong market position ensures a predictable and significant inflow of cash.

Isbank's large corporate lending segment, as the largest private bank in Turkey by total loans, represents a significant cash cow. This area, characterized by established client relationships and generally lower risk, provides a stable and substantial source of interest income. For instance, in 2024, Isbank's corporate and commercial loan portfolio continued to be a cornerstone of its profitability, contributing a significant portion of its net interest income.

Isbank's conventional credit card portfolios represent a significant Cash Cow. This established business, though in a mature market, consistently delivers substantial fee and interest income from a broad customer base. In 2024, Turkish credit card spending saw a notable increase, with total transaction volumes reaching trillions of Turkish Lira, underscoring the scale of this segment for Isbank.

Isbank's extensive branch network in Turkey acts as a significant Cash Cow. This vast physical presence continues to attract and serve a substantial portion of its customer base, particularly for traditional banking needs. Even with the rise of digital platforms, these branches offer a crucial touchpoint for customer acquisition and handling specific transactions, solidifying Isbank's large market share.

The network's primary contribution is generating consistent, though modest, fee and service income. In 2024, Isbank reported that its physical branches, despite the digital shift, still played a vital role in customer engagement and transaction volume. For instance, while digital transactions surged, a notable percentage of new account openings and loan applications still originated or were finalized through branch interactions.

- Steady Income Generation: The extensive branch network consistently generates reliable fee and service income for Isbank, a hallmark of a Cash Cow.

- Foundational Customer Presence: Physical branches provide a stable base for customer acquisition and retention, especially for those preferring traditional banking methods.

- Market Share Support: The network reinforces Isbank's significant market share in Turkey by catering to diverse customer needs and preferences.

- Low Growth, High Stability: While not a high-growth area, the branches offer predictable revenue streams, contributing to the bank's overall financial stability.

Isbank's core payment systems, encompassing money transfers and a diverse array of payment services, are robustly handling a substantial volume of transactions. This consistent activity is a significant driver of fee income for the bank, reflecting their established position in the market.

These fundamental banking services are crucial in a mature market, affording Isbank a high market share and ensuring stable, predictable revenue streams. The low requirement for extensive promotional investment in these established areas further bolsters their profitability.

The bank's operational efficiency in managing these payment systems directly contributes to its overall financial health. For instance, in 2024, Isbank reported a notable increase in transaction volumes across its digital payment channels, underscoring the continued reliance on these core services.

- High Transaction Volume: Core payment systems facilitate a large number of daily transactions.

- Consistent Fee Income: These services generate reliable revenue through fees.

- Mature Market Dominance: Isbank enjoys a strong market share in established payment services.

- Profitability Driver: Efficient operations in this segment significantly boost overall bank profitability.

| Business Segment | BCG Matrix Category | 2024 Data Insight | Contribution to Profitability | Market Dynamics |

|---|---|---|---|---|

| Retail Deposit Base | Cash Cow | Over TL 2.1 trillion in deposits | Consistent interest income, cost-effective funding | Mature, slow-growth market |

| Corporate Lending | Cash Cow | Largest private bank by total loans in Turkey | Stable, substantial interest income | Established client relationships, lower risk |

| Credit Card Portfolios | Cash Cow | Trillions of TL in transaction volumes | Substantial fee and interest income | Mature market with increasing spending |

| Branch Network | Cash Cow | Vital for customer engagement and transaction volume | Consistent fee and service income | Reinforces market share, caters to traditional banking |

| Core Payment Systems | Cash Cow | Notable increase in digital transaction volumes | Significant fee income, operational efficiency | High transaction volume, mature market dominance |

Full Transparency, Always

Isbank BCG Matrix

The Isbank BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content—just the comprehensive, professionally formatted analysis ready for your strategic decision-making. You can be confident that the insights and structure you see here are precisely what you'll be working with to understand Isbank's business units and their market positions.

Dogs

Certain Isbank physical branches, particularly those in areas experiencing population decline or demographic shifts, could be classified as Dogs. For instance, as of early 2024, Isbank, like many traditional banks, has seen a significant portion of customer transactions move to digital platforms. Branches with consistently low customer traffic and transaction volumes are prime candidates for this category.

These underperforming locations often represent a drain on resources, consuming funds for rent, staffing, and maintenance without generating proportional revenue. They operate within a low-growth market for traditional branch services, and their individual market share within that niche is likely minimal, reflecting their Dog status in the BCG Matrix.

Outdated manual banking processes are a clear example of Dogs in the Isbank BCG Matrix. These are the banking operations that still rely heavily on paper, require extensive manual input for routine tasks, and demand significant human involvement. In today's fast-paced digital world, these methods are inherently inefficient, prone to mistakes, and drive up operational expenses.

Such processes contribute minimally to Isbank's overall market share and consume valuable resources without offering any competitive edge or substantial returns. For instance, while digital transactions are soaring, a significant portion of legacy account opening or loan processing might still involve paper forms, slowing down customer service and increasing error rates.

Niche, Low-Demand Traditional Products in Isbank's portfolio, like physical passbook savings accounts, represent offerings with a small market share in a shrinking sector. For instance, while digital banking transactions surged by over 40% in Turkey during 2023, the usage of traditional passbook services continued its downward trend.

These products are characterized by their low growth potential and often require continued maintenance, tying up valuable bank resources. The operational costs associated with these legacy services, even for a small customer base, can outweigh the minimal revenue they generate, making them candidates for strategic review.

Divested International Operations (e.g., Kosovo)

Isbank's decision to cease banking operations in Kosovo, effective July 2025, firmly places these international operations in the Dogs category of the BCG Matrix. This strategic move suggests that the Kosovo branch held a minimal market share within a low-growth or stagnant market, failing to generate sufficient returns to justify continued investment.

The divestiture underscores the operational drain these units represented, consuming valuable resources without aligning with Isbank's broader financial performance goals or strategic growth initiatives. Such actions are typical for businesses identifying underperforming assets that are no longer strategically viable.

- Low Market Share: Isbank's Kosovo operations likely struggled to capture a significant portion of the local banking market.

- Low Market Growth: The Kosovo banking sector may have offered limited opportunities for expansion and profitability.

- Resource Drain: Continued operation was likely consuming capital and management attention without commensurate returns.

- Divestment Strategy: Exiting the market signals a focus on optimizing the bank's overall portfolio by shedding unprofitable ventures.

Legacy IT Systems Requiring High Maintenance

Legacy IT systems at Isbank, characterized by their age and lack of integration, demand significant maintenance and human intervention. These systems, while still functional for core operations, offer limited modern capabilities and scalability, placing them in a low-growth technological area with high operational costs. For instance, in 2024, the cost of maintaining such legacy systems can consume a substantial portion of an IT budget, diverting funds from crucial digital transformation projects that promise higher returns.

These systems often require constant patching and updates to remain operational, representing a drain on resources. Their inability to seamlessly integrate with newer platforms hinders agility and innovation. By 2024, many financial institutions, including Isbank, are grappling with the challenge of modernizing these critical but costly infrastructures.

- High Maintenance Costs: Legacy systems often incur disproportionately high costs for upkeep, patches, and specialized personnel.

- Limited Scalability: These systems struggle to adapt to increasing data volumes and user demands, hindering business growth.

- Integration Challenges: Lack of modern APIs and interoperability makes integrating legacy systems with new technologies difficult and expensive.

- Security Vulnerabilities: Older systems may have unpatched security flaws, posing significant risks in the current threat landscape.

Isbank's underperforming physical branches, especially those in declining areas, are prime examples of Dogs. These branches often see low customer footfall and transaction volumes, indicating a shrinking market for traditional banking services. As of early 2024, the shift to digital channels has further reduced the reliance on brick-and-mortar locations.

These branches consume resources like rent and staffing without generating substantial returns, fitting the profile of low market share in a low-growth sector. The bank's strategic decision to exit certain international markets, such as Kosovo by July 2025, also highlights the classification of these operations as Dogs due to their minimal market share and limited growth prospects.

Legacy IT systems and outdated manual banking processes also fall into the Dog category. These systems are costly to maintain, offer limited scalability, and hinder innovation, diverting resources from more profitable ventures. For instance, in 2024, the high cost of maintaining legacy systems often consumes a significant portion of IT budgets, impacting digital transformation initiatives.

| Isbank Business Unit/Product | BCG Category | Rationale |

|---|---|---|

| Underperforming Physical Branches | Dogs | Low customer traffic, declining market for traditional services, high operational costs. |

| Kosovo Operations (Exiting July 2025) | Dogs | Minimal market share, low growth market, resource drain, divestment strategy. |

| Legacy IT Systems | Dogs | High maintenance costs, limited scalability, integration challenges, security vulnerabilities. |

| Outdated Manual Banking Processes | Dogs | Inefficient, error-prone, high operational expenses, low competitive edge. |

| Niche, Low-Demand Traditional Products (e.g., Passbook Savings) | Dogs | Small market share in a shrinking sector, low growth potential, minimal revenue generation. |

Question Marks

Isbank's engagement in new fintech partnerships and open banking initiatives positions it within a high-growth market, leveraging innovation. These ventures, while promising, are still developing their market share and profitability, reflecting their nascent stage. For example, Isbank has been actively exploring collaborations in areas like digital payments and embedded finance, aiming to tap into the burgeoning fintech ecosystem.

Isbank's foray into blockchain-based financial solutions places it squarely in the Question Mark category of the BCG matrix. The bank is investing in a high-growth technology with significant potential to revolutionize financial transactions through enhanced security and transparency. However, the practical application and widespread market acceptance of these solutions within the banking sector are still developing.

While the global blockchain in banking market was valued at approximately USD 1.5 billion in 2023 and is projected to grow substantially, Isbank's specific projects are in an early stage. Success will depend on overcoming regulatory hurdles, achieving scalability, and demonstrating clear value propositions to customers and the broader financial ecosystem.

Isbank's ongoing development of hyper-personalized AI-driven financial advice within its İşCep platform signifies a strategic move into a high-growth sector. This initiative aims to provide proactive, data-driven guidance, enhancing customer engagement and loyalty.

While the potential for deepening customer relationships is significant, the direct revenue generation from these highly customized AI services is still in its nascent stages. Market penetration is currently limited, with success heavily reliant on user adoption and the demonstrable value proposition perceived by customers.

Specialized Digital-First Products for Niches (e.g., Startup Card)

The Maximiles Business Startup Card, a digital-first offering from Isbank, perfectly fits the Question Mark category within the BCG matrix. This product is designed for a rapidly expanding niche: startups, a segment with significant growth potential.

Launched with strategic partnerships with AWS and Visa, the card provides unique benefits like cloud-credit rebates, aiming to attract and retain young, innovative businesses. By late 2024, over 1,500 companies had adopted the Startup Card, indicating initial traction in this specialized market.

- High-Growth Potential: The startup ecosystem is characterized by rapid expansion and innovation, offering a fertile ground for specialized financial products.

- Uncertain Market Share: While adoption is growing, the Startup Card is still in the early stages of establishing its market dominance against potential competitors.

- Strategic Partnerships: Collaborations with AWS and Visa lend credibility and offer tangible value propositions, crucial for attracting early adopters in the tech-focused startup scene.

- Future Investment Required: The success of this product hinges on Isbank's ability to scale its user base and demonstrate a clear path to profitability and sustainable competitive advantage in this dynamic sector.

New International Market Explorations (if any specific ones beyond current presence)

Isbank could consider expanding into emerging markets in Asia or Africa, which often present high growth potential for financial services. These markets, while offering significant upside, typically require substantial initial investment and carry inherent risks due to regulatory complexities and competitive landscapes. For instance, a push into Southeast Asia, where digital banking adoption is rapidly increasing, could be a strategic move, though it would demand careful market analysis and localized strategies.

Such new international explorations would fall into the Stars category of the BCG Matrix, characterized by high growth and low current market share for Isbank. For example, exploring opportunities in the rapidly digitizing Indian financial sector, which saw its digital payments volume exceed $3 trillion in 2023, represents a high-growth, albeit competitive, arena. This would necessitate significant capital outlay for technology, regulatory compliance, and market penetration efforts.

- High Growth Potential Markets: Focusing on regions like Southeast Asia or Sub-Saharan Africa, where financial inclusion and digital banking are on the rise.

- Significant Investment Requirements: Allocating substantial capital for market entry, technology infrastructure, talent acquisition, and regulatory adherence.

- Uncertain Outcomes: Recognizing that these ventures are strategic bets with a possibility of high returns but also a risk of underperformance due to market volatility and competition.

- Diversification Strategy: Aiming to broaden Isbank's global revenue streams and reduce reliance on existing markets, thereby enhancing long-term resilience.

Isbank's ventures into areas like fintech partnerships, blockchain solutions, and AI-driven financial advice represent significant investments in high-growth potential sectors. These initiatives, while promising, are still in their early stages of development and market penetration, characteristic of Question Marks in the BCG matrix. The success of these ventures hinges on continued investment, innovation, and adapting to evolving market dynamics and customer adoption rates.

The Maximiles Business Startup Card exemplifies this category, targeting the rapidly expanding startup ecosystem with tailored benefits. Despite initial traction, its long-term market share and profitability remain uncertain, necessitating ongoing strategic support and product refinement to solidify its position.

Exploring new international markets, such as Southeast Asia or India, also places Isbank in a high-growth but uncertain position. These ventures require substantial investment and careful navigation of diverse regulatory and competitive landscapes, aligning with the strategic risks and potential rewards of Question Mark investments.

BCG Matrix Data Sources

Our Isbank BCG Matrix is constructed using comprehensive financial disclosures, extensive market analytics, and expert industry evaluations to provide a clear strategic overview.