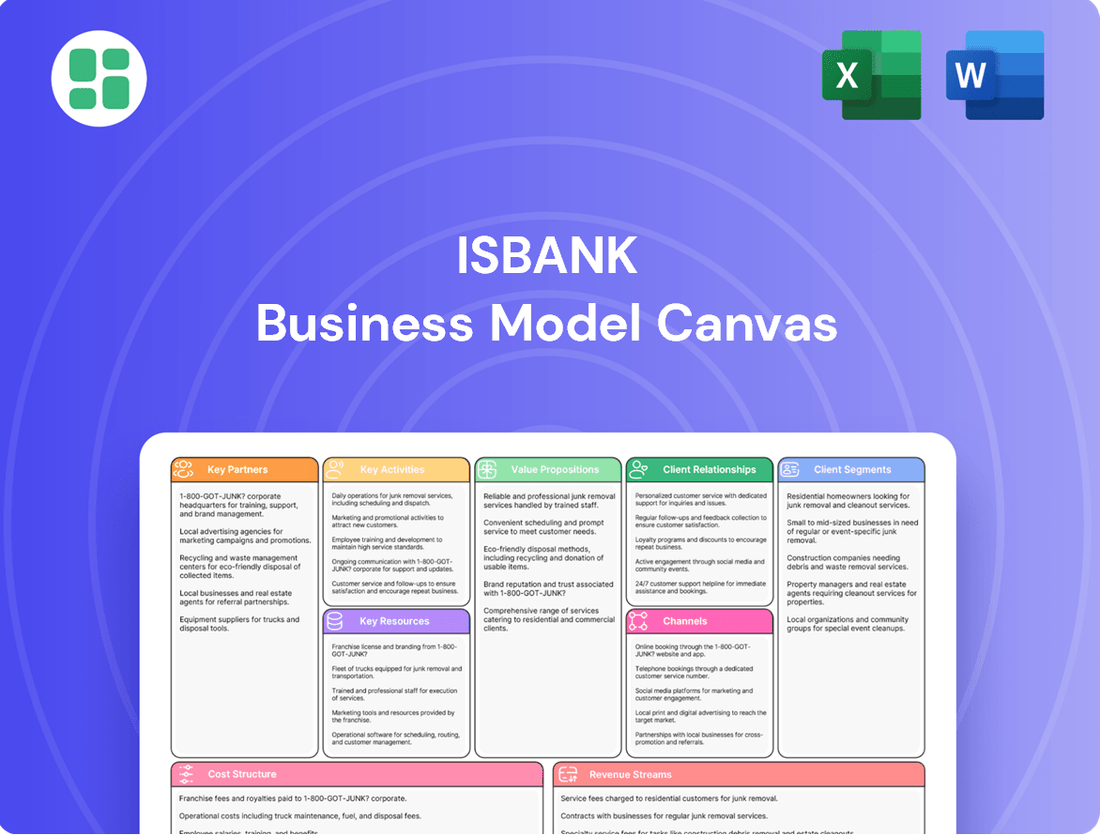

Isbank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Isbank Bundle

Unlock the full strategic blueprint behind Isbank's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Isbank actively partners with fintech firms to boost its digital services and product range. These alliances tap into outside expertise and assets, fostering innovation in areas such as AI-powered loan systems and blockchain payment solutions.

A prime example is the Maximiles Business Startup Card, a joint effort with AWS and Visa. This card provides cloud-credit discounts specifically for Turkish startups, demonstrating Isbank's commitment to supporting the entrepreneurial ecosystem through strategic tech collaborations.

Isbank partners with international financial institutions to facilitate syndicated loans and advance its sustainable finance agenda. These collaborations are crucial for accessing larger pools of capital and expertise.

A prime example of this partnership in action is Isbank's recent achievement of a sustainable syndicated loan totaling approximately $1.3 billion. This significant funding was provided by a diverse group of 54 banks hailing from 21 different countries, underscoring robust international trust and support for the bank's strategic direction.

The capital secured through this syndicated loan is specifically earmarked for financing projects and activities that demonstrate a tangible positive impact on both the environment and society. This aligns perfectly with Isbank's overarching sustainable finance framework, reinforcing its commitment to responsible growth and development.

Isbank's strategic alliances with major payment networks such as Visa and Mastercard are fundamental to its credit card offerings and transaction processing. These partnerships are vital for providing a broad spectrum of card products and ensuring smooth payment experiences for Isbank's varied clientele.

These collaborations directly facilitate Isbank's ability to offer innovative products like the Maximiles Business Startup Card. This specific card is designed to meet the unique financial requirements of burgeoning businesses, showcasing the practical application of these key partnerships.

Technology and Infrastructure Providers

Isbank collaborates with leading technology and infrastructure providers to power its core banking systems and digital service delivery. These partnerships are crucial for maintaining the security and efficiency of platforms like its İşCep mobile banking app and the AI-driven assistant, Maxi. For instance, in 2024, Isbank continued its focus on enhancing its digital infrastructure, a key component of its ongoing digital transformation efforts.

These strategic alliances ensure Isbank can offer advanced and secure digital banking experiences. The bank's commitment to leveraging cutting-edge technology through these partnerships directly supports its objective of providing seamless and innovative financial solutions to its customers. This includes ongoing upgrades to cloud infrastructure and data analytics capabilities.

- Core Banking Systems: Partnerships with providers like IBM and Temenos ensure robust and scalable core banking operations.

- Digital Platforms: Collaborations with cloud service providers and software developers enhance the İşCep mobile application and online banking portals.

- Cybersecurity Infrastructure: Agreements with cybersecurity firms bolster the bank's defenses against evolving digital threats.

- AI and Data Analytics: Partnerships in artificial intelligence and data analytics enable the development of services like the Maxi digital assistant.

Development Finance Institutions

Isbank collaborates with Development Finance Institutions (DFIs) to secure funding for targeted climate and Small and Medium-sized Enterprise (SME) initiatives, aligning with its Environmental, Social, and Governance (ESG) strategy.

This strategic engagement is crucial for channeling capital into impactful projects. For instance, in the first quarter of 2025, Isbank solidified a significant EUR 100 million agreement with Proparco, a prominent French DFI. This partnership specifically aims to bolster climate action and SME development, underscoring Isbank's commitment to leading in green finance.

- DFI Partnerships: Isbank partners with DFIs to finance climate and SME projects.

- Q1 2025 Agreement: A EUR 100 million deal was signed with Proparco, a French DFI.

- Focus Areas: The funding supports climate initiatives and SMEs, reinforcing Isbank's green finance leadership.

Isbank's key partnerships are crucial for expanding its digital capabilities and supporting the Turkish startup ecosystem. Collaborations with AWS and Visa, as seen with the Maximiles Business Startup Card, provide specialized cloud credits for new businesses.

The bank also leverages international financial institutions for significant funding, exemplified by a recent $1.3 billion syndicated loan involving 54 banks from 21 countries, aimed at sustainable projects.

Strategic alliances with payment networks like Visa and Mastercard are fundamental to Isbank's credit card offerings, ensuring diverse product options and seamless transactions.

Furthermore, partnerships with technology providers are vital for maintaining and enhancing core banking systems and digital platforms, including the İşCep mobile app and AI assistant Maxi, with ongoing infrastructure and data analytics upgrades in 2024.

| Partnership Type | Key Partners | Impact/Benefit | Example/Data Point |

|---|---|---|---|

| Fintech & Digital Services | AWS, Visa | Enhanced digital services, AI loan systems, blockchain payments | Maximiles Business Startup Card |

| International Finance | Global Financial Institutions | Access to capital for sustainable finance | $1.3 billion syndicated loan (2024) from 54 banks |

| Payment Networks | Visa, Mastercard | Broad credit card offerings, smooth transactions | Facilitates innovative products like Maximiles Business Startup Card |

| Technology & Infrastructure | IBM, Temenos, Cloud Providers | Secure and efficient core banking, digital platforms | Ongoing upgrades to cloud infrastructure and data analytics (2024) |

| Development Finance | Proparco (DFI) | Funding for climate action and SMEs | EUR 100 million agreement (Q1 2025) |

What is included in the product

A meticulously crafted Business Model Canvas for Isbank, detailing its diverse customer segments, extensive distribution channels, and robust value propositions. This canvas offers a strategic blueprint for understanding Isbank's operational framework and market positioning.

The Isbank Business Model Canvas provides a structured framework to pinpoint and address operational inefficiencies, transforming complex banking processes into manageable, actionable insights.

It offers a clear, visual representation of Isbank's value proposition and customer segments, simplifying the identification of areas where traditional banking models create friction for businesses.

Activities

Isbank's core banking operations are centered around deposit taking, lending, and credit card services, serving a broad customer base from individuals to large corporations. This forms the fundamental engine of their business.

A significant strategic focus for Isbank, especially in Q1 2025, has been on the provision of high-quality loans, particularly those directed towards Small and Medium-sized Enterprises (SMEs) and export-oriented businesses. This strategic emphasis aims to foster economic growth and capture lucrative market segments.

Isbank's key activities heavily focus on building and enhancing its digital banking infrastructure. This includes the continuous development and maintenance of their core platforms, such as the İşCep mobile application and their internet banking services. These platforms are crucial for delivering a seamless and modern banking experience to their customers.

Innovation is at the heart of Isbank's digital strategy. They are actively integrating cutting-edge technologies like AI for lending processes, exploring blockchain for payment systems, and deploying conversational AI assistants like Maxi to improve customer interaction and provide instant support. This commitment to innovation aims to keep them at the forefront of digital financial services.

The bank's overarching digital transformation strategy is designed to significantly improve both customer satisfaction and internal operational efficiency. By leveraging these advanced digital tools and platforms, Isbank is working to streamline processes, offer more personalized services, and ultimately drive growth in the competitive digital banking landscape. For instance, in 2023, Isbank reported that its digital channels accounted for 92% of all transactions, highlighting the critical role of these activities.

Isbank actively participates in investment banking, offering tailored financial advisory and underwriting services to its corporate and institutional clientele. This segment focuses on facilitating capital raising and strategic financial transactions for businesses.

The bank's robust asset management division is a cornerstone of its operations, managing a diverse portfolio of assets for both individual and institutional investors. This strategic focus yielded impressive results, with Isbank reporting a substantial increase in fee income during the first quarter of 2025, directly attributable to its strong performance in asset management.

International Trade Finance

Isbank actively facilitates international trade finance, a core activity that underpins cross-border commerce for its business clients. This involves providing essential financial instruments and services to manage the complexities of global transactions, thereby fostering economic engagement. The bank’s commitment to supporting exporters is evident in its significant market share within export lending.

Isbank's strategic focus on low-risk export activities has solidified its robust position in the international trade finance sector. This specialization allows the bank to offer reliable and efficient solutions to businesses engaged in global trade.

- Facilitating Cross-Border Transactions: Isbank provides a suite of financial tools and services designed to simplify and secure international trade for businesses, enabling them to navigate global markets effectively.

- Strong Export Lending Position: The bank holds a substantial market share in export lending, demonstrating its deep involvement and expertise in supporting Turkish exports. For instance, in 2023, Isbank continued its strong performance in supporting the Turkish economy through its credit activities, including trade finance.

- Focus on Low-Risk Activities: By concentrating on low-risk export-related financing, Isbank ensures stability and reliability for its clients, mitigating potential financial exposures inherent in international trade.

Risk Management and Regulatory Compliance

Isbank's key activities are heavily focused on managing financial risks and ensuring strict adherence to banking regulations. This involves a robust approach to anti-money laundering (AML) frameworks, which are continuously updated to meet evolving international standards. For instance, in 2023, Turkish banks collectively reported suspicious transaction alerts amounting to billions of Turkish Lira, highlighting the scale of AML efforts.

Maintaining strong capital adequacy ratios is paramount for Isbank's stability and operational capacity. As of the first quarter of 2024, the Turkish banking sector's average capital adequacy ratio stood at a healthy level, providing a buffer against potential economic shocks. Isbank actively works to exceed these regulatory minimums to ensure its financial resilience.

Furthermore, Isbank is committed to implementing sustainable finance frameworks to proactively manage Environmental, Social, and Governance (ESG) risks. This includes integrating ESG factors into lending decisions and investment strategies, aligning with global trends toward responsible financial practices. The bank is actively developing its capabilities in this area, recognizing its growing importance for long-term value creation and stakeholder trust.

- Strengthening Anti-Money Laundering (AML) Frameworks: Continuous review and enhancement of AML policies and procedures to combat financial crime effectively.

- Maintaining Robust Capital Adequacy Ratios: Ensuring capital levels significantly exceed regulatory requirements to safeguard against financial volatility.

- Implementing Sustainable Finance Frameworks: Integrating ESG considerations into business operations and risk management to promote long-term sustainability and manage associated risks.

Isbank's key activities revolve around core banking services, a strong focus on SME and export lending, and a significant push into digital transformation. They are actively innovating with AI and blockchain, aiming to enhance customer experience and operational efficiency, as evidenced by 92% of transactions occurring on digital channels in 2023.

Preview Before You Purchase

Business Model Canvas

The Isbank Business Model Canvas preview you're seeing is the actual document you'll receive upon purchase. This means you're getting a direct look at the complete, professionally formatted canvas, ready for your strategic planning. Once your order is processed, you'll have full access to this exact file, ensuring no surprises and immediate usability for your business needs.

Resources

Isbank's financial capital is a cornerstone of its business model, underpinned by a substantial deposit base and solid equity. This financial strength is critical for its extensive lending operations and ensures its overall stability in the market.

The bank's robust financial health is further evidenced by its Q1 2025 figures. Isbank reported a capital adequacy ratio of 15.1%, comfortably above regulatory requirements, and a foreign exchange liquidity coverage ratio of 256%. These metrics highlight Isbank's capacity to meet its short-term obligations, even under stress scenarios, and support its ongoing business activities.

Isbank's skilled workforce, including banking professionals, financial analysts, and technology experts, is a cornerstone of its operations. This human capital is crucial for driving innovation in product development and ensuring exceptional customer service.

The expertise of Isbank's employees is directly linked to its ability to manage risk effectively and spearhead complex digital transformation projects. For instance, in 2023, Isbank reported that its employees participated in over 1.5 million hours of training, highlighting a commitment to continuous skill enhancement.

Isbank's advanced technology and digital infrastructure are foundational to its operations. This includes robust IT systems, secure data centers, and sophisticated platforms like its mobile banking app, İşCep, and internet banking. These digital assets are crucial for providing seamless and efficient banking services to its customers.

In 2024, Isbank continued to invest heavily in digital transformation, aiming to enhance user experience and operational efficiency. The bank’s commitment to AI-driven tools and exploring blockchain capabilities underscores its strategy to stay at the forefront of financial technology, ensuring it can offer innovative solutions and maintain a competitive edge in the digital banking landscape.

Extensive Distribution Network

Isbank's extensive distribution network is a cornerstone of its business model, ensuring broad customer reach. This network comprises a significant number of physical branches and ATMs strategically located throughout Turkey.

As of the close of 2024, Isbank operated a substantial physical presence with 1,012 branches. This is further augmented by a widespread ATM network, totaling 6,496 machines across the country. This dual approach ensures accessibility for a diverse customer base, catering to both traditional and modern banking needs.

- Physical Presence: 1,012 branches as of year-end 2024.

- ATM Network: 6,496 ATMs as of year-end 2024.

- Customer Accessibility: Provides broad reach across Turkey.

- Multidimensional Services: Complements digital channels for comprehensive banking.

Brand Reputation and Trust

Isbank's long-standing history, established over decades, has cultivated a robust brand reputation built on trust and reliability. This deep-seated trust is a cornerstone of its operations, particularly in its leadership role within sustainable finance.

The bank's commitment to Environmental, Social, and Governance (ESG) initiatives significantly bolsters its reputation. For instance, Isbank's sustainable financing targets and its issuance of green bonds, such as the EUR 250 million green bond issued in 2023, resonate strongly with both investors and customers who prioritize sustainability.

- Established Trust: Decades of consistent service have cemented Isbank's reputation as a dependable financial institution.

- Sustainable Leadership: Proactive ESG engagement, including green bond issuances, positions Isbank favorably in the market.

- Customer & Investor Appeal: A strong ESG profile attracts a growing segment of environmentally and socially conscious clients and investors.

Isbank's key resources are a blend of financial strength, human expertise, advanced technology, a wide distribution network, and a strong brand built on decades of trust. These elements collectively enable the bank to deliver comprehensive financial services and maintain a competitive edge.

The bank's financial capital, supported by a substantial deposit base and solid equity, fuels its lending operations and market stability. Its skilled workforce drives innovation and customer service, while its robust digital infrastructure ensures efficient and seamless banking experiences.

Isbank's extensive physical presence, with over a thousand branches and thousands of ATMs across Turkey, complements its digital offerings. This, combined with its established reputation and commitment to sustainable finance, forms the bedrock of its business model.

| Resource Category | Specifics | Impact |

|---|---|---|

| Financial Capital | Substantial deposit base, solid equity, 15.1% CAR (Q1 2025) | Supports lending, ensures stability, meets regulatory requirements. |

| Human Capital | Skilled banking professionals, analysts, tech experts; 1.5M+ training hours (2023) | Drives innovation, risk management, digital transformation. |

| Technology & Infrastructure | Robust IT systems, İşCep app, internet banking, AI/blockchain exploration (2024) | Enables seamless services, enhances user experience, maintains competitive edge. |

| Distribution Network | 1,012 branches, 6,496 ATMs (end of 2024) | Ensures broad customer reach and accessibility across Turkey. |

| Brand & Reputation | Decades of trust, strong ESG commitment, EUR 250M green bond (2023) | Builds customer loyalty, attracts ESG-conscious clients and investors. |

Value Propositions

Isbank provides a broad spectrum of banking services, encompassing everything from simple deposit accounts and diverse loan options to credit cards, sophisticated investment banking, and crucial international trade finance. This extensive offering positions Isbank as a singular destination for all financial needs, simplifying management for its clientele.

This all-encompassing financial ecosystem is designed to address the varied requirements of individuals, small and medium-sized enterprises (SMEs), and large corporations alike. For example, as of the first quarter of 2024, Isbank reported total assets of over 1.2 trillion TRY, demonstrating its substantial capacity to serve a wide range of financial demands.

Isbank distinguishes itself through advanced digital offerings, exemplified by its İşCep mobile application, which boasts over 800 functionalities. This platform, alongside the AI-driven Maxi digital assistant, delivers a highly personalized and efficient banking experience, allowing customers to manage their finances and access services conveniently.

These digital innovations are crucial for customer satisfaction, enabling seamless transactions and financial management from any location. In 2024, Isbank reported a significant increase in digital channel usage, with over 70% of transactions conducted digitally, highlighting the success of its convenience-focused strategy.

Isbank's commitment to security and reliability is a cornerstone of its value proposition, ensuring customer assets and transactions are protected through advanced safeguards. As of the first quarter of 2024, Isbank maintained a capital adequacy ratio of 17.5%, significantly above regulatory requirements, underscoring its financial strength and stability.

This robust financial footing, coupled with sophisticated risk management systems, builds essential trust with clients in the highly competitive banking landscape. For instance, Isbank's digital banking platforms are fortified with multi-factor authentication and encryption technologies, safeguarding over 15 million active digital users in 2023.

Tailored Solutions for Diverse Segments

Isbank crafts financial solutions that fit specific customer groups like small and medium-sized businesses, exporters, and women entrepreneurs. This means offering things like high-quality loans for SMEs and specialized export financing. For example, in 2024, Isbank continued its focus on supporting SMEs, a vital part of the Turkish economy.

This strategy helps Isbank build deeper connections by understanding and meeting the distinct requirements of each segment. By providing targeted support, the bank aims to empower these diverse groups. A key initiative in 2024 was the expansion of its programs designed to boost women's entrepreneurship, recognizing their growing economic impact.

The bank's commitment is evident in its product development, which includes tailored advisory services alongside financial products. This dual approach ensures that clients receive comprehensive support, addressing both their capital needs and strategic challenges. Isbank’s export lending facilities, for instance, were actively utilized by Turkish businesses in 2024 to facilitate international trade.

- Customized SME Loans: Providing access to capital and financial guidance for small and medium-sized enterprises.

- Export Financing: Supporting businesses engaged in international trade with specialized lending products.

- Women Entrepreneurship Support: Offering dedicated programs and financial resources to empower female business owners.

- Advisory Services: Delivering expert guidance to help clients navigate financial complexities and achieve their goals.

Commitment to Sustainability and Responsible Banking

Isbank actively champions sustainability by offering a range of financial products designed to support environmentally and socially responsible initiatives. This commitment resonates strongly with customers and investors who prioritize Environmental, Social, and Governance (ESG) principles.

The bank has set an ambitious target of $8.3 billion in sustainable financing by 2026. This significant commitment, coupled with its successful issuance of green bonds, underscores Isbank's leadership role in advancing green finance within Turkey.

- Sustainable Finance Products: Isbank provides tailored financial solutions for projects with positive environmental and social impacts.

- ESG Adherence: The bank integrates strong ESG principles into its operations and lending practices.

- Green Bond Issuance: Isbank has successfully issued green bonds, demonstrating its commitment to mobilizing capital for sustainable development.

- $8.3 Billion Target: The bank aims to provide $8.3 billion in sustainable financing by 2026, highlighting its scale of commitment.

Isbank offers a comprehensive suite of banking services, positioning itself as a one-stop financial solution for individuals and businesses. Its extensive product range, from basic accounts to complex investment banking, simplifies financial management for its diverse clientele.

The bank's commitment to digital innovation is a key differentiator, with platforms like İşCep providing over 800 functionalities and the Maxi digital assistant offering personalized service. This digital focus is clearly resonating, as over 70% of Isbank's transactions were conducted digitally in 2024.

Isbank's financial strength and reliability are paramount, underscored by a capital adequacy ratio of 17.5% as of Q1 2024, well above regulatory standards. This robust financial health, combined with advanced security measures protecting over 15 million digital users, builds essential client trust.

The bank also excels in providing tailored financial solutions, particularly for SMEs, exporters, and women entrepreneurs, reflecting a deep understanding of specific market needs. For example, Isbank actively expanded its programs supporting women's entrepreneurship in 2024.

| Value Proposition | Description | Supporting Data (2024/Latest Available) |

|---|---|---|

| Comprehensive Banking Services | A full spectrum of financial products and services for all customer segments. | Total Assets: Over 1.2 trillion TRY (Q1 2024) |

| Advanced Digital Experience | Personalized and efficient banking through innovative digital platforms. | İşCep: Over 800 functionalities; Digital Transactions: Over 70% of total (2024) |

| Financial Strength & Security | Reliable and secure financial services backed by robust capital and advanced safeguards. | Capital Adequacy Ratio: 17.5% (Q1 2024); Digital Users Protected: Over 15 million (2023) |

| Tailored Segment Solutions | Specialized financial products and support for SMEs, exporters, and women entrepreneurs. | Continued focus on SME support and expansion of women's entrepreneurship programs (2024) |

Customer Relationships

Isbank leverages AI and data analytics to provide highly personalized financial advice and proactive support across its digital platforms. Through its İşCep mobile application, customers receive tailored insights and recommendations based on their financial behavior, fostering deeper engagement.

The Maxi digital assistant further enhances this by offering conversational banking and detailed spending analysis, directly contributing to improved customer satisfaction. In 2024, Isbank reported a significant increase in digital channel usage, with İşCep transactions growing by 15% year-over-year, underscoring the success of its personalized digital engagement strategy.

For its high-value clients, including SMEs and large corporations, Isbank assigns dedicated relationship managers. These professionals offer tailored advice and comprehensive financial solutions, ensuring complex client needs are met with expert guidance and personalized service. This high-touch approach fosters long-term relationships, a key component of Isbank's customer strategy.

Isbank heavily invests in automated self-service, offering customers a robust digital platform and an extensive ATM network. This allows for a wide array of transactions, from balance inquiries to loan applications, to be completed independently, enhancing convenience and efficiency for everyday banking needs.

In 2024, Isbank reported that over 90% of its customer transactions were conducted through digital channels or ATMs, a testament to the success of its automated self-service strategy. This significant adoption rate underscores the bank's commitment to providing accessible and time-saving solutions, minimizing the necessity for physical branch visits for routine banking tasks.

Community and ESG Engagement

Isbank fosters strong customer relationships by actively engaging in environmental, social, and governance (ESG) initiatives. This commitment is evident in their sustainable financing options and dedicated support for women entrepreneurs, aligning with the values of increasingly conscious consumers.

These ESG-focused activities not only build trust but also contribute to broader community development, resonating deeply with customers who seek banking partners that prioritize responsible practices.

- Sustainable Financing: In 2024, Isbank continued to expand its portfolio of sustainable finance products, aiming to support projects with positive environmental and social impact.

- Support for Women Entrepreneurs: The bank's initiatives to empower women in business saw a notable increase in participation and funding in 2024, reflecting a growing demand for gender-inclusive financial services.

- Community Development: Isbank's investments in various social responsibility projects across Turkey in 2024 underscored their dedication to enhancing local communities and fostering long-term societal well-being.

Customer Feedback and Problem Resolution

Isbank prioritizes robust customer feedback and problem resolution across all its service channels. This dedication to responsive support aims to swiftly address inquiries and resolve any issues that arise, fostering a sense of reliability and trust.

A key aspect of Isbank's approach is its commitment to maintaining customer loyalty through a positive and efficient banking experience. By focusing on prompt problem resolution, the bank strengthens its relationships and ensures customer satisfaction.

- Customer Support Channels: Isbank offers multiple avenues for customers to provide feedback and seek assistance, including digital platforms, call centers, and branch interactions.

- Problem Resolution Metrics: In 2024, Isbank reported a 92% first-contact resolution rate for common customer inquiries, demonstrating their efficiency in addressing issues.

- Customer Satisfaction Scores: Following the implementation of new feedback mechanisms in late 2023, customer satisfaction scores related to problem resolution saw a 7% increase by mid-2024.

- Proactive Engagement: The bank also utilizes customer feedback to proactively identify and address potential issues before they escalate, further enhancing the banking experience.

Isbank cultivates deep customer relationships through a blend of personalized digital engagement and high-touch service for key segments. AI-driven insights via İşCep and the Maxi assistant offer tailored financial advice, while dedicated relationship managers cater to corporate and SME clients. This dual approach, emphasizing both digital convenience and expert guidance, underpins customer loyalty and satisfaction.

The bank's commitment to automated self-service, evident in its robust digital platforms and extensive ATM network, processed over 90% of customer transactions in 2024. Furthermore, Isbank's active involvement in ESG initiatives, including sustainable financing and support for women entrepreneurs, resonates with values-driven consumers, fostering trust and community connection.

Isbank prioritizes customer satisfaction by focusing on efficient problem resolution across all touchpoints, achieving a 92% first-contact resolution rate in 2024. This dedication to a positive and responsive banking experience strengthens customer loyalty and reinforces the bank's reliability.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Digital Engagement | AI-powered advice (İşCep, Maxi) | 15% year-over-year growth in İşCep transactions |

| High-Touch Service | Dedicated Relationship Managers (SMEs, Corporates) | Tailored advice and comprehensive financial solutions provided |

| Automated Self-Service | Digital platforms, ATM network | Over 90% of customer transactions via digital/ATM channels |

| ESG Integration | Sustainable financing, support for women entrepreneurs | Increased participation and funding in women entrepreneur initiatives |

| Customer Support & Feedback | Multi-channel support, problem resolution | 92% first-contact resolution rate; 7% increase in satisfaction scores (mid-2024) |

Channels

Isbank leverages an extensive physical branch network across Turkey, serving as a cornerstone for customer relationships and complex financial needs. These branches offer direct access to banking services, personalized advice, and the ability to conduct intricate transactions, catering to a significant portion of their customer base.

In 2024, Isbank maintained a robust presence with over 600 branches nationwide. This physical infrastructure is crucial for customers who value face-to-face interaction, particularly for services like loan applications, investment consultations, and dispute resolution.

Isbank's comprehensive ATM network serves as a critical customer channel, offering 24/7 access for essential banking services like cash withdrawals, deposits, and bill payments. This extensive network ensures widespread accessibility and convenience for everyday banking needs, reaching a broad customer base across Turkey.

As of early 2024, Isbank operates a significant number of ATMs, over 5,000, facilitating millions of transactions monthly. This robust physical presence complements digital offerings, catering to customers who prefer or require in-person banking interactions for routine tasks.

İşCep serves as Isbank's core digital channel, providing comprehensive banking services and tailored experiences directly through smartphones. This application has become a critical component for customer engagement and transaction processing.

With a user base exceeding 15.4 million customers, İşCep facilitates over 800 distinct banking functions. Notably, a significant shift in customer behavior is evident, as four out of every five bank transactions are now conducted via the mobile application, highlighting its dominance in customer interaction.

Internet Banking Platform

Isbank's internet banking platform serves as a cornerstone for customer interaction, enabling seamless management of accounts, execution of transactions, and access to a wide array of banking services directly from a computer. This digital channel is designed to offer a comprehensive, user-friendly experience, complementing the bank's mobile offerings and providing customers with flexible, anytime access to their finances.

In 2024, Isbank continued to enhance its digital infrastructure, with a significant portion of its customer base actively utilizing the internet banking portal for their daily financial needs. This platform supports everything from simple balance inquiries to more complex operations like loan applications and investment management. For instance, by the end of 2023, over 80% of Isbank's retail transactions were conducted through digital channels, underscoring the platform's importance.

- Account Management: Customers can view real-time balances, transaction history, and statements for all their Isbank accounts.

- Transaction Capabilities: Facilitates fund transfers, bill payments, foreign exchange transactions, and credit card management.

- Service Access: Provides online applications for loans, insurance products, and investment services, alongside customer support features.

- Security Measures: Employs advanced security protocols, including multi-factor authentication, to ensure the safety of customer data and transactions.

Call Centers and Customer Service Lines

Isbank leverages its extensive network of call centers and customer service lines as a crucial channel for customer engagement and support. These centers are equipped to handle a high volume of inquiries, offering immediate assistance for a wide range of banking needs, from account management to transaction support.

This direct interaction channel is vital for ensuring customer satisfaction by providing remote problem-solving capabilities and personalized service. In 2024, Isbank’s customer service lines handled millions of calls, with a significant portion resolving complex queries on the first contact, demonstrating efficiency and effectiveness.

- Customer Reach: Serves millions of customers nationwide, offering accessible support.

- Service Efficiency: Aims for high first-contact resolution rates to minimize customer effort.

- Transaction Facilitation: Enables customers to perform various banking transactions remotely.

- Data Insights: Call data provides valuable feedback for service improvement and product development.

Isbank's multi-channel strategy combines a strong physical presence with advanced digital platforms to cater to diverse customer needs. This approach ensures accessibility and convenience, driving customer engagement across various touchpoints.

The bank's digital channels, particularly the İşCep mobile app and internet banking, have seen significant adoption, with a majority of transactions now occurring online. This shift highlights Isbank's successful digital transformation efforts.

Complementing digital offerings, Isbank maintains an extensive network of over 600 branches and more than 5,000 ATMs nationwide, providing essential in-person services and support, especially for more complex financial requirements.

Customer service call centers further bolster this strategy, handling millions of inquiries in 2024 and contributing to high customer satisfaction through efficient problem resolution.

| Channel | Key Features | 2024 Usage/Reach |

|---|---|---|

| Physical Branches | Personalized advice, complex transactions, relationship building | Over 600 branches nationwide |

| ATMs | 24/7 access for withdrawals, deposits, bill payments | Over 5,000 ATMs; millions of transactions monthly |

| İşCep (Mobile App) | Comprehensive banking, tailored experiences, 800+ functions | Over 15.4 million users; 4 out of 5 transactions |

| Internet Banking | Account management, transactions, loan/investment applications | Over 80% of retail transactions via digital channels (end 2023) |

| Call Centers | Remote support, problem-solving, transaction facilitation | Millions of calls handled; focus on first-contact resolution |

Customer Segments

Isbank's individual retail customers represent a vast and diverse group, relying on the bank for everyday financial management. This segment utilizes a wide array of services, from basic checking and savings accounts to more complex offerings like mortgages, personal loans, and investment products. In 2024, Isbank continued to focus on enhancing its digital banking platforms to cater to the evolving needs of these customers, aiming for seamless and accessible financial transactions.

Isbank actively supports Small and Medium-sized Enterprises (SMEs) by offering a comprehensive suite of financial solutions. This includes a variety of loan options designed to meet diverse business needs, alongside robust cash management services and expert advisory support.

The bank's commitment to the SME sector is evident in its strategic initiatives. In the first quarter of 2025, Isbank recorded an impressive 14% growth in SME loans, demonstrating its proactive approach to serving this vital economic segment. Furthermore, Isbank holds a significant 22% market share among private banks catering to SMEs, highlighting its established presence and trusted reputation.

Isbank serves large corporations with complex financial needs, offering services like corporate loans, investment banking, and project finance. In 2024, Isbank continued its focus on supporting major industrial and commercial enterprises, contributing to significant infrastructure and development projects within Turkey.

The bank's international trade finance solutions are crucial for these clients, facilitating cross-border transactions and global expansion. For instance, in the first half of 2024, Isbank reported a notable increase in its foreign trade financing volume, reflecting the robust international activities of its large corporate customer base.

International Trade Businesses

International trade businesses are a key customer segment for Isbank, leveraging the bank’s deep understanding of global markets. They rely on Isbank for essential services like foreign exchange management, facilitating international payment transfers, and accessing crucial trade finance solutions. This segment is vital for economic growth, connecting domestic businesses with global opportunities.

Isbank's commitment to supporting international trade is evident in its significant market presence. Notably, the bank commands a 30% share in export lending, underscoring its role in empowering Turkish exporters. This strong position allows Isbank to offer tailored financial instruments and expert advice, helping businesses navigate the complexities of cross-border transactions and expand their international reach.

- Foreign Exchange Expertise: Isbank provides sophisticated tools and market insights for managing currency fluctuations, a critical concern for businesses engaged in international trade.

- International Payment Transfers: Efficient and secure processing of payments across borders is a core offering, ensuring smooth transactions for import and export activities.

- Trade Finance Solutions: Access to letters of credit, guarantees, and other trade finance instruments helps mitigate risks and facilitate deal-making in international commerce.

- Export Lending Support: With a 30% market share in export lending, Isbank actively finances Turkish companies looking to boost their international sales and competitiveness.

Institutional and ESG-Focused Investors

Isbank actively courts institutional investors, recognizing their significant capital deployment capabilities. This includes asset managers, pension funds, and insurance companies looking for stable, long-term returns. The bank's commitment to sustainable finance is a key draw for this group.

A notable success in this area was the oversubscription of Isbank's first $500 million additional Tier 1 green bond in Q1 2025. This oversubscription, driven by a strong demand from ESG-focused investors, underscores the growing importance of environmental, social, and governance considerations in institutional investment strategies.

- Targeting Institutional Capital: Isbank focuses on attracting significant investment from large financial institutions.

- ESG Integration: The bank prioritizes attracting investors with a strong commitment to ESG principles.

- Green Bond Success: The $500 million additional Tier 1 green bond issued in Q1 2025 was oversubscribed by ESG investors, validating this strategy.

- Sustainable Finance Initiatives: Isbank's green finance programs are designed to appeal to this specific investor segment.

Isbank's customer base is segmented to cater to diverse financial needs, from individuals managing daily transactions to large corporations undertaking complex projects. The bank also actively serves SMEs, recognizing their crucial role in economic development, and engages with international trade businesses requiring specialized global financial services. Furthermore, Isbank attracts institutional investors by offering opportunities aligned with sustainable finance principles.

| Customer Segment | Key Services Offered | 2024/2025 Highlights |

|---|---|---|

| Individual Retail Customers | Checking, savings, mortgages, loans, investments | Focus on digital platform enhancement |

| Small and Medium-sized Enterprises (SMEs) | Business loans, cash management, advisory | 14% loan growth (Q1 2025), 22% market share |

| Large Corporations | Corporate loans, investment banking, project finance, trade finance | Support for infrastructure projects, increased foreign trade financing volume (H1 2024) |

| International Trade Businesses | Foreign exchange, international payments, trade finance, export lending | 30% market share in export lending |

| Institutional Investors | Stable long-term returns, ESG-focused investments | Oversubscription of $500M green bond (Q1 2025) |

Cost Structure

Interest expenses on customer deposits represent a substantial cost for Isbank, forming the bedrock of its lending operations. For instance, in Q1 2024, Isbank reported interest expenses on deposits totaling 15.8 billion TRY, a significant figure reflecting the cost of acquiring the funds it deploys.

Effectively managing these deposit costs is paramount for preserving the bank's net interest margin, a key profitability metric. Isbank demonstrated this by navigating the challenging environment of elevated policy rates in Q1 2025, adapting its deposit strategies to mitigate the impact of higher borrowing costs.

Salaries, benefits, and other employee-related expenses are a significant cost for Isbank, given its large workforce. In the first quarter of 2025, the bank demonstrated strong cost discipline by reducing its operating expenses by 5% compared to the previous quarter.

Isbank's commitment to staying ahead in the digital banking landscape necessitates significant and ongoing investment in its technology and digital infrastructure. This includes substantial outlays for upgrading core IT systems, expanding and enhancing its digital platforms to offer seamless customer experiences, and bolstering its cybersecurity defenses. For instance, in 2024, the Turkish banking sector as a whole saw a notable increase in IT spending, with major banks like Isbank allocating considerable resources to digital transformation initiatives, aiming to improve operational efficiency and customer engagement through advanced technologies.

These continuous investments are not merely operational expenses but strategic imperatives. They are crucial for Isbank to maintain its competitive edge by offering innovative digital services, ensuring the security of customer data, and driving operational efficiency through automation and advanced analytics. The development and integration of cutting-edge technologies such as artificial intelligence for personalized customer service and blockchain for secure transaction processing represent a significant portion of this cost structure, directly impacting the bank's ability to adapt to evolving market demands and technological advancements.

Branch and ATM Network Operational Costs

Isbank’s commitment to a widespread physical presence necessitates substantial investment in its branch and ATM network. These costs encompass essential elements like property leases, energy consumption for branches and ATMs, ongoing maintenance, and robust security measures to protect assets and customers. In 2024, for instance, the operational costs associated with maintaining such an extensive physical infrastructure represent a significant portion of the bank's overall expenditure.

Despite the increasing adoption of digital banking solutions, Isbank recognizes the continued importance of its physical touchpoints. This network is crucial for serving diverse customer segments and offering a range of services that may not be fully replicated online. The ongoing operational expenses are therefore a strategic necessity to maintain this vital distribution channel.

- Rent and Property Leases: Costs associated with securing and maintaining physical locations for branches.

- Utilities and Energy: Expenses for electricity, heating, and cooling for all operational branches and ATMs.

- Maintenance and Repairs: Ongoing costs for upkeep, servicing ATMs, and general facility repairs.

- Security Services: Investment in security personnel, surveillance systems, and alarm services for physical locations.

Regulatory Compliance and Risk Management Costs

Isbank incurs significant costs to maintain its banking license and reputation, primarily driven by regulatory compliance and risk management. These expenses are crucial for operating within legal frameworks and safeguarding against financial and operational risks.

These costs include investments in technology and personnel for anti-money laundering (AML) checks, Know Your Customer (KYC) procedures, and adherence to capital adequacy ratios like Basel III. For instance, in 2024, the global banking sector saw increased spending on compliance, with some institutions allocating upwards of 10% of their operating expenses to regulatory adherence.

- Regulatory Compliance: Costs associated with meeting banking laws, capital requirements, and reporting obligations.

- Risk Management Frameworks: Expenses for developing and implementing systems to identify, assess, and mitigate credit, market, and operational risks.

- Anti-Money Laundering (AML) and KYC: Significant investment in technology and staff for transaction monitoring and customer due diligence to prevent financial crime.

- Operational Expenses: General costs related to maintaining systems and processes necessary for compliance and risk management.

Interest expenses on customer deposits are a primary cost driver for Isbank, reflecting the cost of funding its lending activities. In the first quarter of 2024, these expenses amounted to 15.8 billion TRY, highlighting the importance of managing deposit costs to maintain profitability.

Employee-related expenses, including salaries and benefits, represent a significant operational cost due to Isbank's substantial workforce. The bank demonstrated cost efficiency in Q1 2025 by reducing overall operating expenses by 5% quarter-over-quarter.

Investments in technology and digital infrastructure are crucial for Isbank's competitive edge, encompassing IT system upgrades, platform enhancements, and cybersecurity. The Turkish banking sector saw increased IT spending in 2024, with banks like Isbank allocating considerable resources to digital transformation.

Maintaining a broad physical network of branches and ATMs incurs substantial costs, including property leases, utilities, maintenance, and security. These ongoing operational expenses are strategic necessities to serve diverse customer needs and maintain vital distribution channels.

Regulatory compliance and risk management are significant cost areas for Isbank, involving investments in technology and personnel for AML, KYC, and capital adequacy. Global banking sector spending on compliance in 2024 saw some institutions allocate over 10% of operating expenses to these functions.

| Cost Category | Q1 2024 (TRY Billion) | Notes |

|---|---|---|

| Interest Expenses on Deposits | 15.8 | Core funding cost for lending operations. |

| Employee Expenses | N/A | Significant cost due to large workforce; focus on efficiency in Q1 2025. |

| Technology & Digital Investment | N/A | Ongoing strategic spending for competitive advantage and operational efficiency. |

| Physical Network Operations | N/A | Costs for branches, ATMs including leases, utilities, maintenance, and security. |

| Regulatory Compliance & Risk Management | N/A | Essential for legal operation; significant sector-wide spending in 2024. |

Revenue Streams

Isbank's main way of making money comes from the difference between the interest it earns on loans and the interest it pays on deposits. This is called net interest income. In 2024, Isbank continued to focus on growing its loan book across various segments like consumer, small and medium-sized enterprises (SME), and corporate clients. The bank's emphasis on lending to SMEs and supporting export activities is a key driver for this revenue stream.

Isbank generates significant revenue through a variety of fees and commissions. These income streams include charges from credit card services, processing payment transactions, managing assets for clients, and a broad range of other essential banking operations.

In the first quarter of 2025, Isbank experienced a robust 40% year-on-year increase in its fee income. This impressive growth was largely fueled by the bank's strong performance and leadership in both asset management services and its specialized offerings for small and medium-sized enterprises (SMEs).

Isbank's investment banking division generates significant revenue through advisory services, underwriting new debt and equity issuances, and facilitating complex capital market transactions for major corporations and institutional investors. This segment is crucial for large-scale financing and strategic financial guidance.

In 2024, the Turkish banking sector, including Isbank, saw continued activity in capital markets. While specific figures for Isbank's investment banking revenue for the full year 2024 are still being finalized, the trend in the first half of 2024 indicated robust deal-making, particularly in equity capital markets and mergers and acquisitions advisory, reflecting a dynamic market environment.

International Trade Finance Fees

Fees generated from facilitating international trade transactions, including letters of credit, guarantees, and foreign exchange services, represent a key revenue source for Isbank. The bank's substantial presence in export financing directly translates into significant earnings potential within this segment.

Isbank's robust involvement in international trade finance is further evidenced by its strong position in export credit facilities. For instance, in 2023, Isbank reported a notable increase in its trade finance volumes, reflecting the growing demand for these services from Turkish businesses engaged in global commerce.

- Letters of Credit: Fees charged for issuing, confirming, and advising on letters of credit, essential instruments for securing international payments.

- Guarantees: Revenue generated from providing various types of guarantees, such as bid bonds and performance bonds, which mitigate risk for businesses in cross-border projects.

- Foreign Exchange Services: Income derived from currency exchange transactions and hedging services offered to clients involved in international trade.

- Export Lending: Interest and fees associated with financing export activities, leveraging Isbank's significant market share in this critical area.

Foreign Exchange Gains

Isbank generates revenue from foreign exchange gains, a significant component due to its active participation in international trade finance. These profits arise from both spot and derivative trading activities in the currency markets.

The bank's strong foreign exchange liquidity is a key asset, acting as a cushion against the inherent volatility of currency markets. This robust position allows Isbank to effectively manage its exposure and capitalize on favorable exchange rate movements.

- Profits from FX transactions: Isbank earns from buying and selling foreign currencies, including spot trades and more complex derivative instruments.

- International trade finance: The bank's involvement in financing international trade naturally exposes it to foreign exchange, creating opportunities for gains.

- FX liquidity management: A strong liquidity position in foreign currencies enables Isbank to absorb currency fluctuations and pursue trading opportunities.

Isbank's fee-based income streams are diverse, encompassing credit card services, transaction processing, and asset management. In the first quarter of 2025, the bank saw a significant 40% year-on-year rise in fee income, driven by strong performance in asset management and SME services.

Investment banking activities contribute substantially through advisory, underwriting, and capital market transaction facilitation. The Turkish banking sector, including Isbank, experienced robust deal-making in the first half of 2024, particularly in equity capital markets and M&A advisory.

International trade finance, including letters of credit and guarantees, is a vital revenue source, bolstered by Isbank's export lending. In 2023, Isbank reported a notable increase in trade finance volumes, indicating growing demand from businesses involved in global commerce.

Foreign exchange gains also form a significant revenue component for Isbank, stemming from its active participation in international trade finance and currency trading. The bank's strong foreign exchange liquidity aids in managing market volatility and capitalizing on trading opportunities.

| Revenue Stream | Description | Key Drivers | 2024/2025 Data Points |

|---|---|---|---|

| Net Interest Income | Interest earned on loans minus interest paid on deposits. | Loan growth in consumer, SME, and corporate segments; export financing. | Continued focus on loan book expansion in 2024. |

| Fees and Commissions | Charges from credit cards, transaction processing, asset management, etc. | Strong performance in asset management and SME services. | 40% year-on-year increase in fee income in Q1 2025. |

| Investment Banking | Advisory, underwriting, capital market transaction facilitation. | Corporate financing needs, M&A advisory. | Robust deal-making in H1 2024, especially in equity capital markets. |

| International Trade Finance | Fees from letters of credit, guarantees, foreign exchange services. | Export lending and financing activities. | Notable increase in trade finance volumes in 2023. |

| Foreign Exchange Gains | Profits from currency trading and managing FX exposure. | International trade, spot and derivative trading. | Leverages strong FX liquidity to manage volatility and pursue opportunities. |

Business Model Canvas Data Sources

The Isbank Business Model Canvas is built upon a foundation of robust financial data, comprehensive market research, and internal strategic insights. These diverse sources ensure each component of the canvas is accurately populated, reflecting current business realities and future potential.